Preview text:

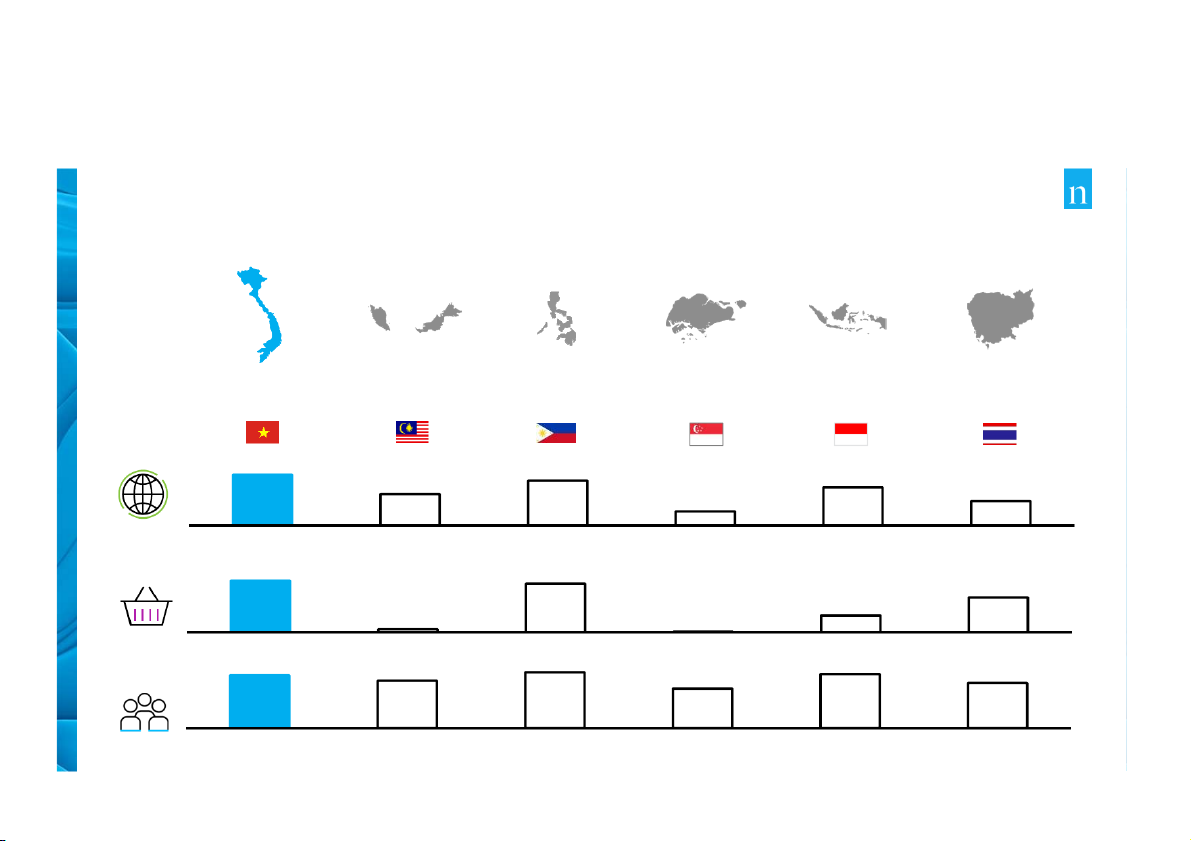

E-COMMERCE IN VIETNAM VIETNAM – A MARKET OF OPPORTUNITIES

Copyright © 2017 The Nielsen Company. Confidential and proprietary.

VIETNAM REMAINS ONE OF THE FASTEST GROWING IN SOUTHEAST ASIA !"# ""$ $ $ $ %$ & & ' ' ( ( " " ' !"# "$ $ "$ $ %$ &' ("' . ry ta rie *! * + + ! ! ( ( p ro p d n l a tia n ) ) ) ) e fid on . C y n a p m o C n e ls ie N e h !"# "$ $ "$ $ %$ & & ' ' ("' T 7 1 0 2 + + , + + - ' ' . . t © h rig y p o & & ' / C • %,.0 % 1

2. &"".3! " 4 # "

,5#, 5$ % % $ $ & & ' ' ("' 3 +1 + 4% 4 3 % ! 3 2 ! 7 2 7 + 1 + 4 1 *& * & 2 4 2 + 4 2 + 2 &4289 (1 ( 1 & 2 & ( 2 4 ( ! 2 ! % 2 2 % 2 &4 & + 4 72 7 2 % & % 4 & 4 +14 1 + 4 2 + 74 7 % 4 ) ) ) ) : : : : : : : : : : . . - - . 6 6 6 @A @ A $ $ B @A @ A $ $ B @A @ A $ $ B & 2 & (4 ( ! 2 ! % 2 2 % 2 ( 1 ( 1 % % 2 4 2 & 4 & 4 * ( * 2 ( 7 2 7 4 2 4 + 2 2% 2 % % & % ( & ) ) ) ) ) ) +< + &> <& > 7 2 7 4 2 4 ) ) ) ) ) ) ) <2 <2 > ( > < (

&4+72%&4?&>>% ) ) 2 2 3+ 3+ ( & ( 1 & 4 1 . ry ta % % rie p ro p 4 4 . " . " d n

67$'#$5.. l a tia < < " "' ' # # = = . . n e fid ) ) on 4 4 . . " " # # $ $ ' , ' . , . . C y ) n a p 11 1 < 1 < m 2> 2 2 > +( + 7 ( & 7 + & & + ( 7 & 7 +2 + 2 &4+ 4 7 + 2 2 % 2 % o C n e ) < < $ $ ls ie

2"..#$.,$"-'6 N e h T 7 1

!-#-5"# 0 2 t © h rig y p o C ;) ; ; ) ;) ; ; ; ; ; ; ; ;

67$'##""$' -.

+, +-'.&'/0.$-"."C5$$.D.$--$"-./ D.$-'=5' -$$"5,##''/ %,.04" 4

"5"%,#+, +-'.%.

VIETNAM HAS A YOUNG POPULATION WITH MILLENNIALS DOMINANT &

GEN Z ARE CONSUMERS OF FUTURE 2015 2025 SHARE OF POPULATION MILLENNIALS GEN Z (20-49 y.o) BABY BOOMER (15-19 y.o) (50-64 y.o) 7% 18% 7% 14% 43% 48% . ry ta rie p ro p d n l a tia n e fid on . C y n a p m o C n e ls ie N e h T 7 1

• Super connected with synergy 0 •

Seek for delivery services 2 t © h rig

between Online & Offline activities y •

Willing to try Health supplement p o C •

Seek for greater convenience

• Care about society issues (social products • More going out

responsibility, gender equality, LGBTQ) • Open to new things

• Strong POV & KOL influence •

Go premium but value for money 5

FAST CHANGING PACE OF MODERN “CASH-RICH TIME-POOR”

LIFESTYLE LEADING TO THE BOOMING OF CONVENIENCE SOLUTIONS , , " ' " ' E E F F

J# 6 )

$#/-K

<,"'E @;$B

G$ @;3%B !( ! M M - - N! ! )D ) D L L A A 6 6 2 . ry ta rie p ro

($ $5,-$$ p d n l a tia n > >

H, $,

%,$ H=+%=!: e fid on . C

,=HI ,='# y n a p m o C n e ls ie N e h T 7

+

+ 1 0 2 t © ) ) 6 : * * "

"5-.$.$< h

2#-'&'

"#"5".H rig y p o C

+@-6B

%,.02&3+2&+(. &">51E-

%,.04"$$'): 6

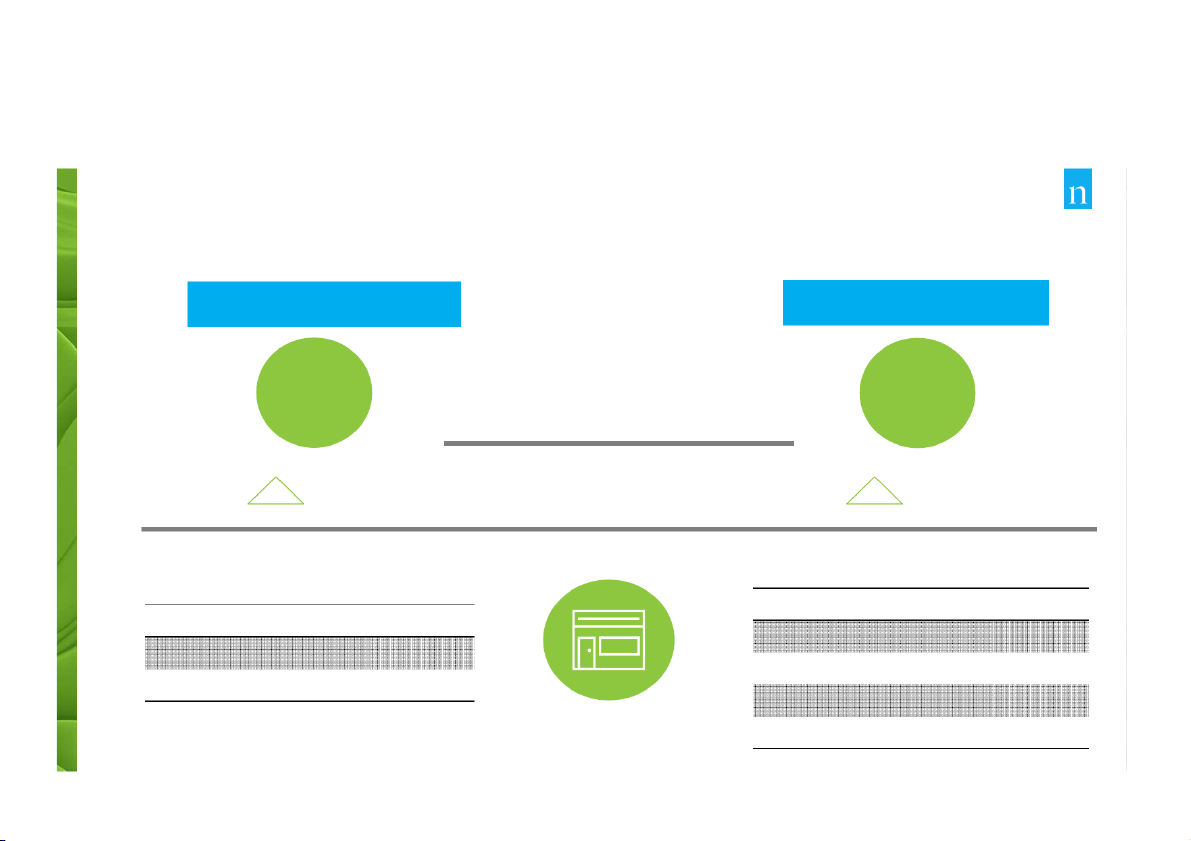

MODERN TRADE IS BOOMING RAPIDLY ACROSS STORE TYPES & DRIVING THE GROWTH OF FMCG TRADITIONAL TRADE MODERN TRADE

Value % contribution – Total Vietnam OFF+ON Premises in 87% 13% MAT Jul’19 5% Growth % vs. YA 19% . Updated: Jul’19 ry

Updated: Universe Update H1’18 ta rie p ro p d 7,968 STORES n (+14% vs Oct’18) l a

~ 1.5 MIL STORES (+0.2% vs. YA) tia n e fid on . C y Hyper/ Supermarket* 717 n a p m o Market Stall 65,248 C n e ls ie Minimart & Food Store* 5,301 N e h T 7 1 ON Premise 675,469 0 2 t © h Convenience Store 889 rig y p o C OFF Premise 811,032 Modern Drug Store** 434 Mom & Kid Store 627

Source: Nielsen Retail Measurement, Nielsen Universe Update, * including independent stores, ** including Health & Beauty store 8

MAT : Moving Annual Total, FMCG includes 37 categories without Cigarette

SMALL FORMAT CONTINUES GAINING IN “PENETRATION”, “FREQUENCY” AND “MOST SPENDING” Wet Markets Traditional Supermarkets Department Health & Convenience Minimarts Grocery Store Beauty Stores Drugstore PENETRATION 86 81 97 14 32 46 51 . ry ta rie p ro p d FREQUENCY 18.7 7.0 2.3 0.7 1.2 4.2 3.7 n l a tia n e fid on . C y n a p m o SPEND MOST AT 36 7 45 0 1 3 2 C n e ls ie N e h T 7 1 0 2 t © h rig y p o C

Base: 2018 (n=1500), 2019 (n=1702)

Ref: Q7a Which of these types of stores have you visited in the past 7 days?

Ref: Q8 On average, how often would you shop at the following type of store? 9

Ref: Q7d Which of these types of stores would be the one where you normally buy most of your food and grocery items?