Preview text:

lOMoAR cPSD| 58097008 lOMoAR cPSD| 58097008

BS A1.1: Business Strategy Report Table of Contents I.

Introduction............................................................................3

II. Vinamilk External Environment Analysis...................................5

PESTEL framework..............................................................................5

Political..................................................................................................................................................................5

Economic...............................................................................................................................................................5

Social.....................................................................................................................................................................6

Technological........................................................................................................................................................6

Environmental.......................................................................................................................................................6

Legal Factors.........................................................................................................................................................7

Conclusion.............................................................................................................................................................7

Porter’s Five Forces............................................................................7 1.

Rivalry Among Existing Competitors.........................................................................................................7 2.

Threat of Substitutes (Thêm minh chứng)...................................................................................................8

Conclusion.............................................................................................................................................................9

III. Vinamilk internal Environment Analysis.................................9 IV. Vinamilk business

strategies...............................................10

V. Vinamilk strategic management plan......................................12

McKinsey 7S Framework....................................................................12

Vinamilk’s strategic management plan...............................................13

Strategic Objectives and Timeline......................................................................................................................13

Resource Allocation and Organisational Support...............................................................................................14

Risk Management................................................................................................................................................14 lOMoAR cPSD| 58097008 I. Introduction

Figure 1: Vinamilk Logo

Vinamilk (Vietnam Dairy Products Joint Stock Company) is the largest dairy company in Vietnam,

established in 1976. Over the years, it has expanded its operations and is now recognized as one

of the leading dairy brands in Southeast Asia. The company is committed to providing high-quality

dairy and nutritional products, aiming to become a globally recognized brand in the food and

beverage industry (Vinamilk, 2025).

Since it began, Vinamilk has gone through a number of important changes. The company changed

its name to Vinamilk in 1994. The business went public in 2003 and was one of the first in Vietnam

to list on the stock exchange in 2006. Vinamilk started to do business in other countries in 2007

and made smart investments and purchases in Cambodia, the Philippines, and New Zealand

(Vinamilk, 2025). These important events show how it has grown from a small business in one area to a global leader.

In 2024, Vinamilk is one of the 40 biggest dairy companies in the world by sales and one of the

10 most expensive dairy names in the world (Vinamilk, 2025). Furthermore, the company made

a total of VND 60,075 bil ion in sales and has 7,855 employees. Vinamilk are stil expanding its

worldwide presence while improving its leadership at home with more than 40 subsidiaries and

business divisions comprising both local and foreign activities (Vinamilk, 2025). lOMoAR cPSD| 58097008

The company offers a diverse range of dairy and beverage products, including liquid milk, yogurt,

powdered milk, sweetened condensed milk, and fruit juices. Some of its well-known brands

include Vinamilk Liquid Milk, Vinamilk Yogurt, Longevity Sweetened Condensed Milk, Dielac

Powdered Milk, and Vfresh Fruit Juice (Vinamilk, 2025). These products are widely available in

Vietnam and exported to over 50 countries, including the United States, Japan, South Korea,

China, and the Middle East. Vinamilk also invests in dairy farms and production sites in other

countries to boost its global footprint. It has businesses in the Philippines, Cambodia, and New Zealand (Vinamilk, 2025).

Vision for Vinamilk is one of a world-class brand in the food and beverage sector, trusted by

consumers for its health and nutrition benefits. Its mission is to provide essential nutrients to the

community while maintaining respect, love, and responsibility. Core values of the organization

include integrity, respect, fairness, ethics, and compliance, which direct its business practices and

corporate culture (Vinamilk, 2025).

Vinamilk’s business philosophy emphasizes quality and innovation as key drivers of success. The

company prioritizes a customer-centered approach, ensuring that its products meet the highest

safety and quality standards. It follows a strict quality policy, focusing on product diversification,

competitive pricing, food safety, and adherence to business ethics and legal regulations (Vinamilk, 2025).

Vinamilk’s long-term strategy focuses on three key goals. First, the company aims to become one

of the 30 largest dairy companies worldwide by investing in research and development and

launching innovative products that align with consumer preferences. Second, it seeks to

strengthen its leadership in Vietnam’s dairy industry by expanding distribution networks,

increasing market penetration in rural areas, and enhancing high-value product offerings. Third,

Vinamilk is working towards becoming the most valuable dairy company in Southeast Asia,

leveraging mergers and acquisitions and strategic collaborations to expand into new markets (Vinamilk, 2025). lOMoAR cPSD| 58097008

II. Vinamilk External Environment Analysis PESTEL framework

To analyze the impact and influence of the macro environment on Vinamilk and its business

strategies, we can apply the PESTEL framework, which looks at the Political, Economic, Social,

Technological, Environmental, and Legal factors that shape the company's operations (Akbalik & Çitilci, 2019).

Figure 2: PESTEL Framework Political

Vietnam's stable political situation significantly influences Vinamilk's business environment. The

political stability of the country fosters economic growth, which benefits businesses like Vinamilk

by creating job opportunities, increasing income levels, and enhancing social consumption

demand. The company's strategic decisions are also influenced by the government’s support for

domestic businesses, particularly through policies like tax reductions for foreign businesses and

the stabilization of milk prices (Kazimierz & Tan, 2024). Vietnam’s relations with other countries,

such as its diplomatic ties with 171 countries, open international markets for Vinamilk’s dairy

products (Kazimierz & Tan, 2024). Economic

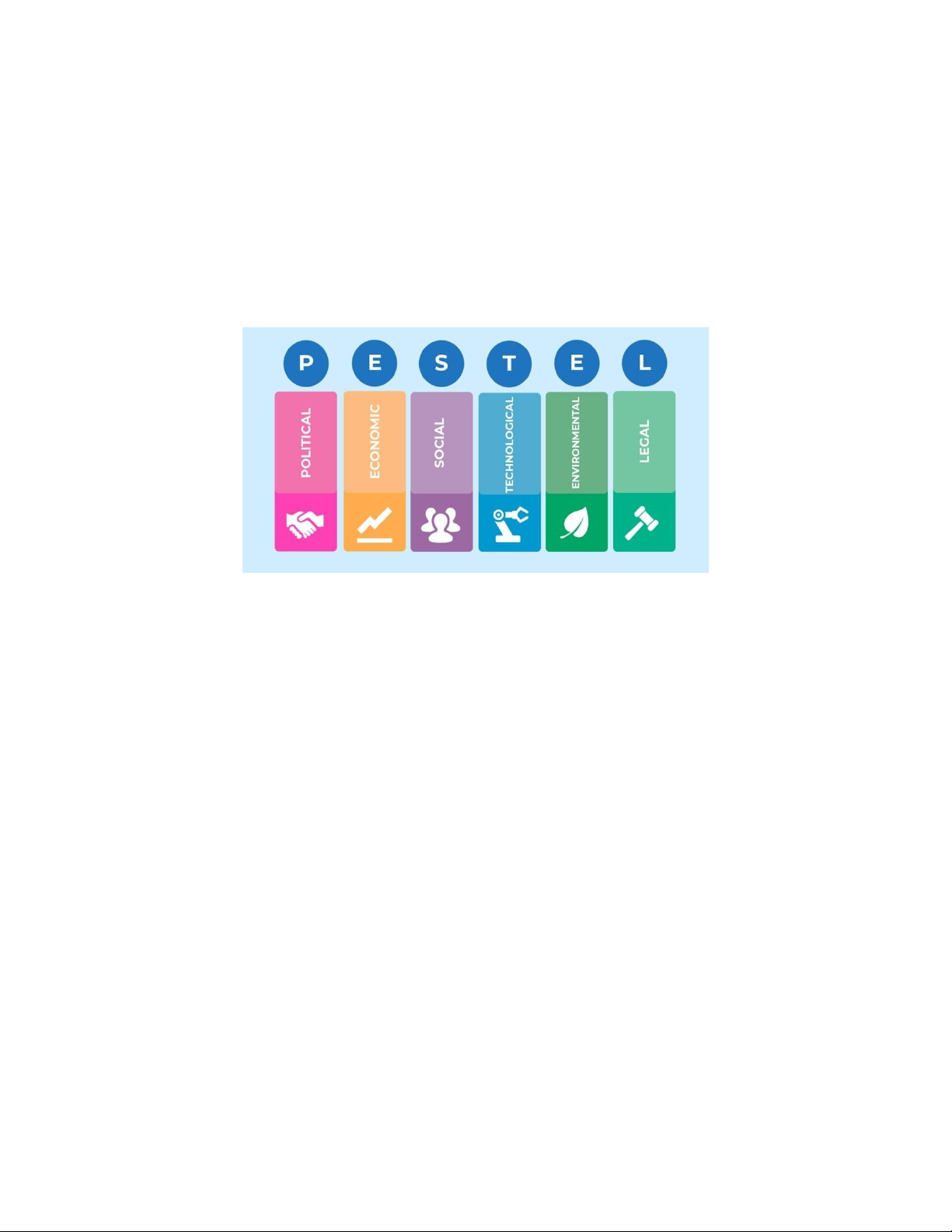

The economic environment in Vietnam is a crucial driver of Vinamilk’s strategy. In 2024, Vietnam’s

economy demonstrated resilience, with a strong GDP growth of 7.09%, reflecting its robust

recovery despite external chal enges and natural disasters like Typhoon Yagi (Nguyen Hanh Vu ,

2025). The economy saw gradual improvements throughout the year, from 5.98% in

Q1 to 7.55% in Q4, showing a consistent upward trajectory. In terms of income growth, lOMoAR cPSD| 58097008

Vietnam's per capita GDP rose to US$4,700, marking an increase of US$377 from the previous

year (Nguyen Hanh Vu , 2025). This increase in consumer income is significant for Vinamilk, as

higher income levels typically lead to increased demand for consumer goods, including dairy products.

The economic recovery in Vietnam was reflected in the performance of key sectors. The services

sector was the primary growth driver, contributing 49.46% to GDP growth, followed by the

industrial and construction sector, which contributed 45.17% (Nguyen Hanh Vu , 2025). These

sectors helped push Vietnam’s GDP to 476.3 bil ion dol ars in 2024 (Nguyen Hanh Vu , 2025),

strengthening the economic foundation for businesses like Vinamilk.

Figure 3: Vietnam's Annual GDP Growth Chart (Nguyen Hanh Vu , 2025)

Furthermore, inflation in Vietnam remained under control, with the Consumer Price Index rising

by 3.63%, in line with Vietnam National Assembly's target (Nguyen Hanh Vu , 2025). This inflation

rate is manageable, supporting economic stability and consumer purchasing power. Social

Vietnamese consumers are increasingly prioritizing health and wellness in their purchasing

decisions. A study by Nielsen revealed that 69% of consumers are willing to pay more for

highquality and safe products, significantly higher than the global average of 49% (VietnamPlus,

2020). This reflects a growing demand for nutritious and health-beneficial food and beverage options. lOMoAR cPSD| 58097008

There is also a strong inclination among Vietnamese consumers towards locally produced goods.

According to Nielsen, up to 76% of consumers prefer domestically made products, citing clear

product origins and a desire to support local producers as key reasons (VietnamPlus, 2020). This

trend benefits local companies but also presents barriers for foreign competitors seeking market share.

Environmental concerns are increasingly influencing consumer behavior. A survey conducted by

the Business Association of High Quality Vietnamese Products found that 69% of consumers

prefer products beneficial to their health or meeting quality standards, and 45% favor products

with traceable origins (Lan Do, 2024). Additionally, another study indicated that 24% of

Vietnamese consumers are focusing on sustainable lifestyles in their short-term plans, while 16%

have incorporated sustainable futures into their long-term priorities (Phuong Uyen, 2024). These

trends highlight a growing market demand for environmentally friendly and ethically produced food and beverage products. Technological

Globally, the dairy industry is undergoing a significant transformation driven by the Fourth

Industrial Revolution (Industry 4.0). Key technologies such as robotics, AI, Internet of Things ,

big data analytics, and 3D printing are being applied across the dairy value chain (Hassoun, et

al., 2023). For example, robotic milking systems are increasingly used to improve efficiency,

reduce reliance on manual labour, and enhance animal welfare. Similarly, big data tools are being

used to monitor and predict milk production and cow health, while IoT enables real-time tracking of livestock and logistics.

3D printing is emerging as an innovative method to produce customised dairy products using milk

proteins and whey. These technologies offer potential for improving productivity, traceability,

and sustainability in the global dairy sector (Hassoun, et al., 2023). However, chal enges remain,

including the high cost of technology adoption, the need for skil ed labour, and concerns about

the impact on milk quality (Hassoun, et al., 2023). As digital transformation becomes a key

competitive factor in the global dairy market, companies that can effectively leverage these

technologies may gain a significant strategic advantage. Environmental

Environmental factors play a significant role in the operational strategy of Vinamilk, particularly

given the company’s reliance on dairy farming. The climate in Vietnam is generally hot and humid,

which is suitable for dairy farming in certain regions like Tuyen Quang, Lam Dong or Ba Vi as this lOMoAR cPSD| 58097008

is ideal for high-quality grass growth and dairy cow raising (Kazimierz & Tan, 2024). Vinamilk’s

ability to produce raw materials local y gives it a cost advantage compared to relying on imported

milk. However, the country’s tropical climate presents chal enges in preserving and processing

milk, making it essential for Vinamilk to invest in advanced preservation technologies to maintain

product quality (Kazimierz & Tan, 2024). Legal Factors

Vietnamese law and regulation affect the dairy business, primarily through price control and

advertising restrictions. Milk producers, distributors, and retailers must register and justify price

adjustments under Circular 122/2010/TT-BTC, especially when price increases exceed input costs

(Pincus, 2010). Stabilization measures like price limits might result in fines or license revocation

for noncompliance. Once limited to state-owned enterprises, these regulations increasingly apply

to private and foreign firms, strengthening industry regulation.

Advertising and marketing expenses are capped at 10% of gross income in Vietnam's Corporate

Income Tax Code (Pincus, 2010). This prevents food and dairy industries from investing in brand-

building, which is crucial for consumer trust and product distinction. Due to resource constraints,

food safety rules are rarely enforced, raising customer concerns regarding product quality (Pincus,

2010). This drives demand for higher-priced or international products seen as safer, despite

Vietnam's competitive market. These rules protect consumers and maintain prices, but they may

hinder industrial competitiveness and innovation. Conclusion

The PESTEL analysis reveals a mix of opportunities and challenges that shape Vinamilk's strategic

environment. Vietnam’s stable political climate and strong international relations support business

growth and market expansion, while robust economic indicators—such as rising GDP, increasing

income levels, and controlled inflation—contribute to stronger consumer purchasing power and

higher demand for dairy products.

Shifting consumer behavior also opens new possibilities. As health awareness grows and local

products are increasingly favored, Vinamilk is well-positioned to meet these preferences. At the

same time, the rise in environmental consciousness encourages the company to strengthen its

commitment to sustainable practices, such as environmentally friendly packaging and cleaner production processes.

On the technology front, global advances in Industry 4.0 present opportunities for Vinamilk to

enhance productivity and product traceability by investing in smart technologies like robotics, IoT,

and big data analytics. However, the high cost and need for skilled expertise may limit the speed of adoption. lOMoAR cPSD| 58097008

Environmental conditions, particularly Vietnam’s warm and humid climate, offer advantages for

local dairy farming but also require advanced preservation methods to ensure product quality.

Legally, price controls, limits on advertising deductions, and weak food safety enforcement

increase regulatory pressures. Yet these also highlight the importance of transparency and trust—

areas where Vinamilk can further differentiate itself.

In summary, Vinamilk stands to benefit from rising consumer demand, favorable political and

economic trends, and technological innovation, but must strategically navigate legal constraints

and sustainability expectations to maintain its competitive edge. Porter’s Five Forces

Porter’s Five Forces is a framework used to analyze the level of competition in an industry. It helps

businesses understand the main factors that influence profitability and market attractiveness

(Bhaskar, et al., 2019). By applying this model, Vinamilk can assess its current competitive

environment and trends, therefore decide how to position itself for long-term success.

1. Rivalry Among Existing Competitors

Vinamilk faces strong competition from domestic and international firms such as

FrieslandCampina, TH True Milk, Nestlé, Nutifood, Abbott, Mộc Châu, Vinasoy, and Yakult

(Mar, 2024). These competitors have made significant investments in new product developments,

pricing policies, and marketing activities. For instance, TH True Milk, a recent arrival, captured

thirty percent of the urban retail fresh milk market by 2021. Another example is FrieslandCampina

from Holland, as one of the biggest milk company in the world, the firm operating businesses in

over 100 countries and made 11 billion dollars in sales in 2016 (Mar, 2024). Because of this,

competition is likely to stay high because customer tastes are changing, people are becoming more

health conscious, and brands are still coming up with new products. As time goes on, Vinamilk's

competitors will keep adding new goods and promoting their names hard, especially in urban areas.

2. Threat of Substitutes

Alternative beverage products are becoming a growing threat to Vinamilk as consumer preferences

shift towards healthier and functional drinks. Kombucha, a fermented tea known for its probiotic

and digestive health benefits, is rapidly gaining traction in Vietnam. Both local and international

players—such as Tan Hiep Phat Group, Vinut Beverage, and NutiFood—have entered this space,

offering a wide range of flavors to meet rising demand (6Wresearch, 2023). This growth is largely

fueled by younger, health-conscious consumers. In fact, 55% of

Vietnamese consumers aged 18–35 now regularly include probiotic beverages in their diet, with

40% of urban consumers consuming such drinks daily (Datamintelligence, 2024) lOMoAR cPSD| 58097008

More broadly, the functional beverage market—especially probiotic drinks—saw a growth rate of

8% in 2023 (Datamintelligence, 2024), and probiotics now make up a significant share of this

expansion. In addition, Vietnam’s government initiatives like Ministry of Health or Vietnam

Nutrition Association also promoted awareness around gut health, further boosting demand.

Despite these clear trends, Vinamilk currently lacks products in these fast-growing categories,

including kombucha and sparkling flavored waters. This leaves a strategic gap in its portfolio and

opens the door for competitors to capture market share, particularly among younger urban

consumers who are increasingly adopting wellness-focused lifestyles.

3. Bargaining Power of Suppliers

Twelve dairy farms with more than 130,000 cows are part of Vinamilk's vertically integrated

operations (Vinamilk, 2025). This lets the company control almost 1,000 tons of fresh milk every

day. These farms use modern technology to improve the quality of their products, the speed of

manufacturing, and their cost control (Vinamilk, 2025). Even though Vinamilk can make most of

its own ingredients, it still needs to buy animal feed and other specific ingredients from outside

sources. Costs and availability can sometimes be affected by problems in global supply lines that

are caused by things like inflation, geopolitical issues, or climate-related events. Therefore,

supplier power expected to stay low in the future as Vinamilk controls its own core raw materials.

However, changes in foreign markets could put short-term pressure on the firm cost structures and

the stability of inputs sources.

4. Bargaining Power of Buyers

Vietnamese are becoming more price aware and health-conscious. They also have easier access to

product data and a wider range of dairy and non-dairy options. As a result, they can compare prices,

products, and nutritional value between brands. Furthermore, big buyers like retailer, hospitals or

schools can deal for better terms because they buy in large quantities. As markets become more

open and competitive, buyer power is likely to rise. This trend could make it harder for Vinamilk

to make profit when keep its market position and retain customers. This force require them to be

diffrent from competitors through improve customer interaction, invent new ways to package and

formulate its products, and keep its prices reasonable.

5. Threat of New Entrants

Among the major challenges new competitors must overcome are high financial needs,

complicated logistics, and legal restrictions. Vinamilk's well-known brand, extensive distribution

system, and cost-effective policies provide strong challenges for entrants trying to match its size

or competitive pricing. Although consumer interest in sectors like organic and plant-based milk is

rising, Vinamilk is already somewhat well-known in these areas. These factors mean that the

entrance of new rivals is expected to remain limited but smaller firms may still enter niche markets

with innovative offerings such as kombucha, which appeal to health-conscious consumers and

could draw attention from specific customer segments of Vinamilk. lOMoAR cPSD| 58097008 Conclusion

Vinamilk operates in a competitive market where rivalry is high, with strong local and global

brands competing on health, innovation, and price. The threat of substitutes is increasing, driven

by rising demand for probiotic drinks and fermented beverages like kombucha— especially among

health-conscious youth, with 55% of 18–35-year-olds regularly consuming probiotics. The threat

of new entrants is low due to high barriers, but small firms may enter niche markets with

innovative products like alternative proteins. Buyer power is moderate, as consumers seek both

affordability and health benefits, while supplier power is limited thanks to Vinamilk’s vertical

integration. Overall, the key threats for Vinamilk lie in shifting consumer preferences and fast-

growing health-focused substitutes.

III. Vinamilk internal Environment Analysis

The VRIN framework is used to assess whether a firm’s internal resources and capabilities can

generate sustained competitive advantage. It evaluates resources based on four dimensions:

Valuable, Rare, Inimitable, and Non-substitutable (Barney et al., 2001). For Vinamilk, several

core strengths underpin its leadership in Vietnam’s dairy sector. Valuable

Vinamilk holds a dominant market share—37% of the total dairy market, including 85% in

condensed milk and 45% in liquid milk (Kazimierz, 2024) which gives it economies of scale,

pricing power, and strong brand recognition. Its nationwide distribution network and

longstanding brand reputation help build deep consumer trust. The company has also invested

significantly in modern infrastructure and advanced technology, enhancing productivity and

product innovation. Moreover, it benefits from a skilled R&D workforce and strong financial

flexibility, as seen in its low debt-to-asset ratio of 16.7%, allowing it to reinvest strategically without external constraints. Rare

Few domestic competitors match the combination of Vinamilk’s national distribution reach, brand

loyalty, and market scale. Similarly, its advanced infrastructure, internal R&D team, and access to

capital are not commonly found across the industry, making these resources rare within the Vietnamese dairy context. Inimitable

The scale of Vinamilk’s past investments—approximately 4,500 billion VND from 2005 to 2011

—has led to highly efficient and automated production facilities across multiple provinces

(Kazimierz, 2024). Combined with years of operational experience, proprietary processing

methods, and accumulated know-how, these are difficult for new or smaller competitors to imitate

without substantial time and capital. Non-substitutable lOMoAR cPSD| 58097008

Vinamilk’s financial strength provides strategic flexibility to fund R&D, improve its supply chain,

and expand into new markets. This internal funding capacity plays a unique role in sustaining

competitive advantage and cannot be easily replaced by other resources such as loans or

partnerships, making it non-substitutable.

However, certain weaknesses remain. Vinamilk depends on imported raw materials for 60% of

its inputs, exposing it to global price volatility and exchange rate risks (Kazimierz, 2024).

Additionally, it has a limited presence in the powdered milk segment, where foreign brands

dominate 65% of the market (Kazimierz, 2024), suggesting that its current resources do not secure

competitive advantage in every product line. SWOT framework

To understand Vinamilk’s core competences and competitive advantages, the SWOT framework

is used. It helps link internal factors from the VRIO analysis with external influences identified

through PESTEL and Porter’s Five Forces. This shows how Vinamilk’s strengths match market

opportunities and how it manages its weaknesses and threats to stay competitive. Strengths Weaknesses

Strong brand equity and customer trust with Dependence on imported raw materials (60%),

over 45% market share in liquid milk and 85% increasing vulnerability to global price

in condensed milk (Kazimierz, 2024).

volatility and exchange rate fluctuations.

Extensive national distribution network with Limited presence in powdered milk segment,

over 220 distributors and 125,000 points of where foreign brands dominate 65% of the

sale, creating market reach advantages. market (Kazimierz, 2024).

Advanced production infrastructure and Moderate supplier power, due to reliance on

automation systems, enabled by large past external input sources. investments.

Financial flexibility with low debt-to-asset

ratio (16.7%), allowing internal reinvestment in R&D and expansion.

In-house R&D capability to develop

innovative dairy products and adapt to health trends. Opportunities Threats lOMoAR cPSD| 58097008

Rising health awareness among Vietnamese High competition in some segments,

consumers, especially in urban areas especially powdered milk and infant formula, (Datamintelligence, 2024). dominated by multinationals.

Government support for domestic dairy Fluctuating input prices (farmgate milk prices,

industry and nutrition-focused policies.

global dairy costs) and currency risks due to import dependence.

Technology trends supporting smart farming

and automation (Birth of Dairy 4.0, 2024).

Changing regulatory environments in foreign

markets, especially for food safety and

International demand growth, particularly in labeling in export regions.

South America’s yogurt and cheese segments,

growing at 6% CAGR (Mordor Intelligence, Bargaining power of consumers increasing, 2025).

particularly in urban centers where alternative brands are available.

Relatively low threat of new entrants due to

high capital and infrastructure requirements in the dairy industry.

Overall, Vinamilk’s core competences—such as its strong brand, advanced production capabilities,

and financial flexibility—are well-aligned with market opportunities like rising health trends and

international demand. These capabilities give the company a sustained competitive advantage both

domestically and in emerging global markets.

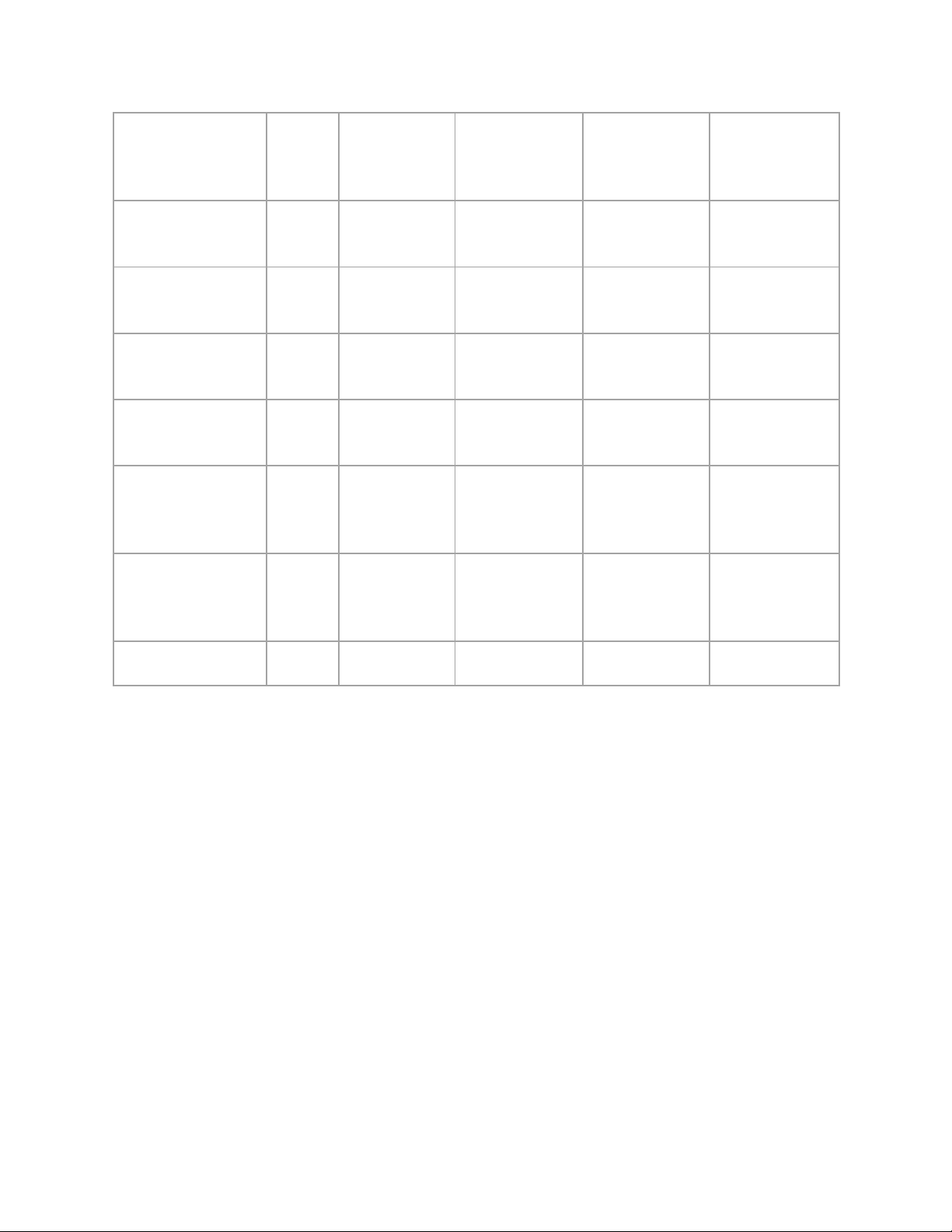

IV. Vinamilk business strategies Ansoff Matrix Model lOMoAR cPSD| 58097008

Figure 4: Ansoff Matrix (Awware, 2023)

To develop actionable strategies, the Ansoff Matrix was chosen for its clear focus on growth

through products and markets. It helps Vinamilk explore strategic options such as deepening

existing markets, launching new products, entering new markets, or diversifying. Its four growth

strategies—Market Penetration, Product Development, Market Development, and Diversification

(Oliveira & Marques, 2024), offer practical directions that align closely with Vinamilk’s recent

activities and long-term strategic goals.

In terms of market penetration, Vinamilk already holds a dominant position in Vietnam, with

over 220 distributors and 125,000 sales points nationwide (Vinamilk, 2025). It maintains an 85%

market share in the condensed milk segment and 45% in liquid milk (Kazimierz, 2024). To deepen

this reach, Vinamilk could expand further into rural areas, where only 40% of consumers regularly

access probiotic products compared to 75% in urban zones (Datamintelligence, 2024). The

company could also introduce loyalty programs and increase awareness campaigns targeting the

65% of urban consumers who now actively include functional health products in their daily diets (Datamintelligence, 2024).

For product development, Vinamilk has launched items like weight-loss milk powder,

fruitinfused milk, and calcium-rich flavored milk (Vinamilk, 2025). To build on this, Vinamilk

could enter the kombucha market—a fermented, functional beverage category growing at 7.15%

CAGR in Vietnam, reaching a value of US$501.23 million in 2023 (Datamintelligence, 2024).

Additionally, developing dairy-based probiotic drinks targeting the 55% of 18–35-year-olds who

already consume these products regularly (Datamintelligence, 2024) can help Vinamilk stay

competitive and relevant in the functional beverage segment.

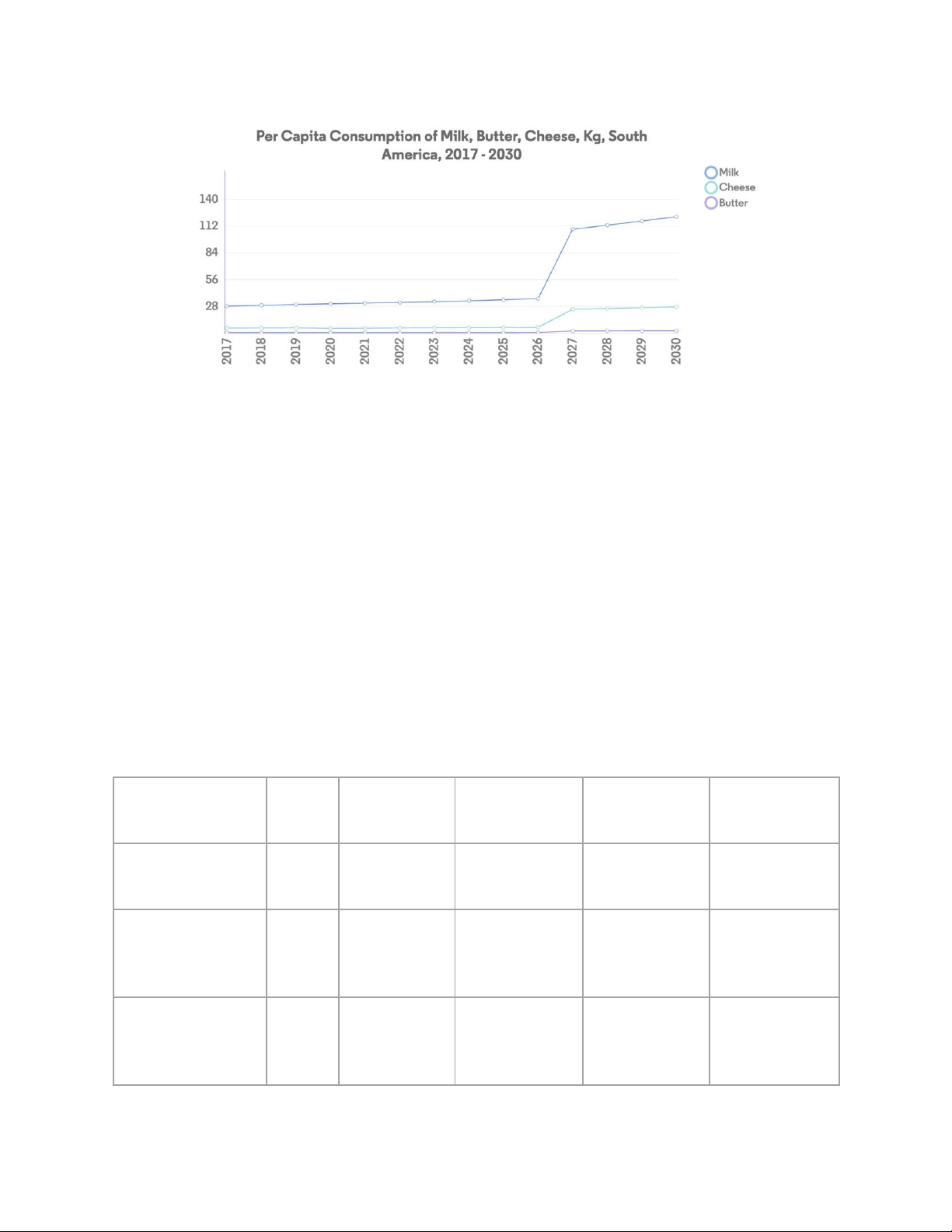

In terms of market development, South America presents a promising opportunity. The region’s

dairy market is projected to grow from USD 56.78 billion in 2025 to USD 74.79 billion by 2030

(Mordor Intelligence, 2025). Brazil alone holds 75% of the region’s dairy market and ranks third

globally in cattle herd size, while Argentina’s dairy market is projected to grow at a CAGR of 6%

from 2024 to 2029 (Mordor Intelligence, 2025). However, rising farmgate prices and high

production costs are limiting milk output, even as demand for products like cheese and yogurt

continues to grow—driven by health trends and the expanding foodservice sector. Cheese

consumption, for example, is increasing across restaurants and cafes, but Brazil’s per capita cheese

intake remains 30% below the global average, indicating room for growth. Yogurt is the fastest-

growing segment, expected to grow 6% annually, supported by demand for high-protein, probiotic-

rich products (Mordor Intelligence, 2025). lOMoAR cPSD| 58097008

Figure 5: South America Dairy Market Trends (Mordor Intelligence, 2025)

Given these trends, Vinamilk can enter the South American market by partnering with established

local distributors and foodservice providers to overcome initial logistical barriers. Targeting high-

growth segments like yogurt and cheese—where health-conscious demand is rising—allows

Vinamilk to offer functional, affordable products while addressing unmet consumer needs and

leveraging its experience in product innovation and scalable production. QSPM Matrix

To identify the most suitable strategies from the four options in the Ansoff Matrix, the QSPM is

used. This tool allows comparison of strategic options by assigning weights to key internal and

external factors and rating each strategy according to how well it addresses these factors (David,

et al., 2009). In the QSPM, each factor is assigned a weight (totaling 1.00) based on importance.

Strategies are rated from 1 (low attractiveness) to 4 (high) depending on how well they address

each factor. The weight is multiplied by the rating to get a score. Adding these scores shows which

strategies best fit Vinamilk’s situation.

Strategic Factor Weight Market Product Market Diversification

Penetration Development Development Strong brand and 0.10 4 (0.40) 3 (0.30) 2 (0.20) 1 (0.10) trust in Vietnam Rising domestic 0.10 4 (0.40) 4 (0.40) 2 (0.20) 2 (0.20) demand for health products Existing 0.08 4 (0.32) 3 (0.24) 2 (0.16) 1 (0.08) distribution network lOMoAR cPSD| 58097008 Innovation in 0.09 2 (0.18) 4 (0.36) 3 (0.27) 2 (0.18) functional dairy products Financial strength 0.08 3 (0.24) 3 (0.24) 4 (0.32) 3 (0.24) for expansion Growing demand 0.12 1 (0.12) 2 (0.24) 4 (0.48) 3 (0.36) in South America Logistic 0.10 4 (0.40) 3 (0.30) 2 (0.20) 1 (0.10) challenges abroad Threat from 0.09 3 (0.27) 3 (0.27) 3 (0.27) 2 (0.18) imported brands Opportunity in 0.08 2 (0.16) 4 (0.32) 2 (0.16) 2 (0.16) youth wellness market Experience in 0.06 2 (0.12) 3 (0.18) 4 (0.24) 3 (0.18) overseas partnerships Total 1.00 2.61 2.85 2.80 1.78

Conclusion: Based on the QSPM results, Product Development (2.85) ranks highest, followed

closely by Market Development (2.80). These two strategies best align with Vinamilk's core

strengths, market trends, and international opportunities. Therefore, Vinamilk should prioritize

developing new functional dairy beverages and expanding into South American markets as part of its growth strategy.

Appropriate Business Strategies Based on Analytical Outcomes

With Product Development and Market Development as the most suitable strategies for Vinamilk,

they will then be translated into appropriate business strategies at both the corporate and SBU levels. Corporate-Level Strategy

Vinamilk should pursue a concentric diversification strategy, combining Product Development

and Market Development. The company can innovate its health-focused dairy product line while

entering new markets such as Brazil and Argentina, where demand for dairy is rising (Mordor lOMoAR cPSD| 58097008

Intelligence, 2025). This approach leverages Vinamilk’s existing competencies while expanding

its geographic footprint and consumer base. SBU-Level Strategies

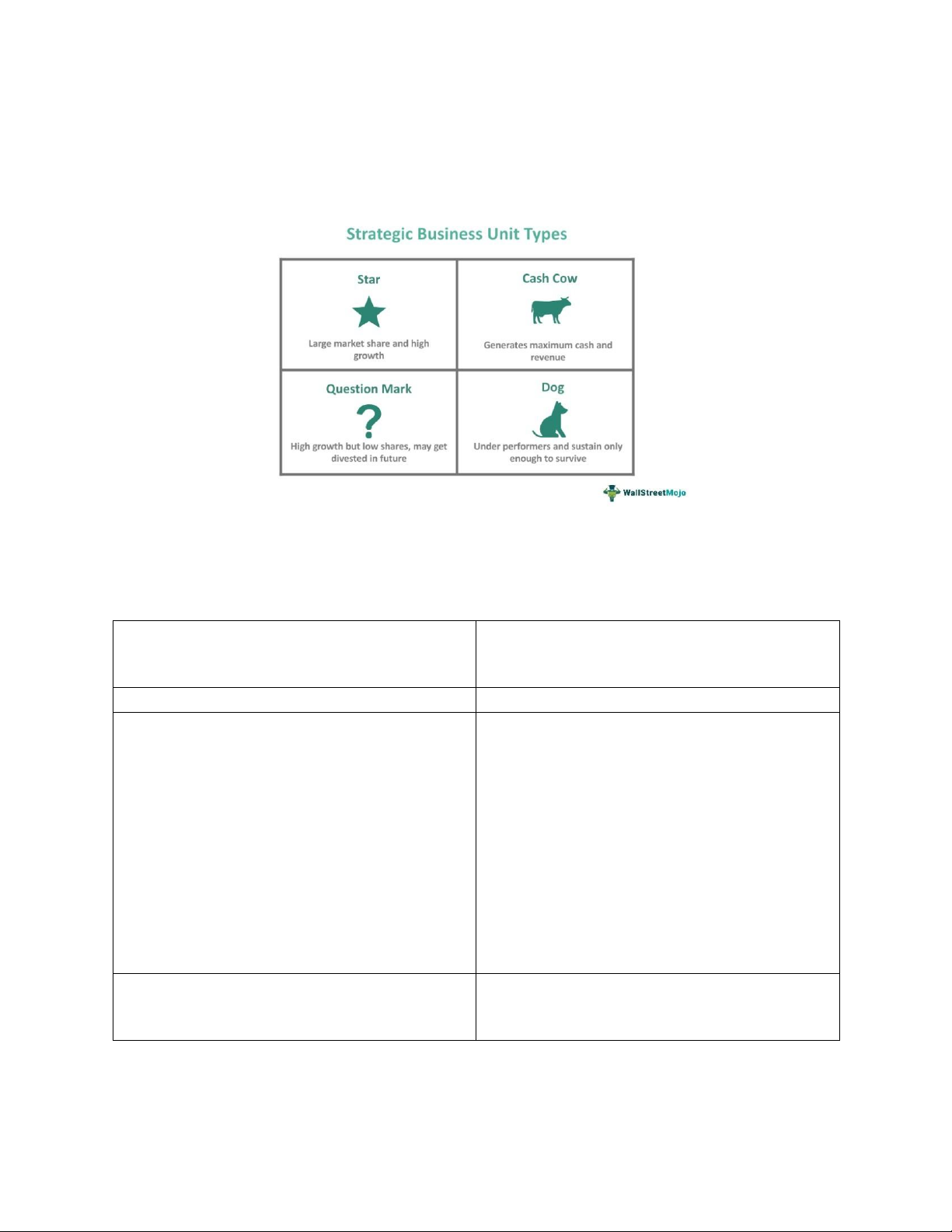

Figure 6: Strategic Business Unit Types (Gajendrakar, 2023)

Strategic Business Unit types will be used to classify Vinamilk’s product lines into four groups —

Stars, Cash Cows, Question Marks, and Dogs—based on market share and growth. This helps

Vinamilk develop effective SBU-level strategies. Star Cash Cow

Domestic Functional Dairy Products

Traditional Products SBU

This SBU operates in high-growth categories Vinamilk's traditional products, such as fresh

with increasing consumer demand such as milk and condensed milk, remain core

yogurt or milk. For instanse, Vietnam’s offerings in Vietnam, generating stable

yogurt market are expected to generte revenue. The company maintains a leading

US$32.12 million by 2029 (The-Shiv, 2024) position in the liquid milk segment, with a

or milk market projected to reach US$2.40 comprehensive portfolio that includes nearly

billion in 2025 (Statista, 2025). Given the 50 types of liquid milk products (Viet Nam

strong demand, Vinamilk should continue News, 2021). The strategy should be to

investing in probiotic yogurt, drinking maintain market share and use profits to fund

yogurts, and fortified milk, leveraging health innovation and international expansion for

trends and product innovation to sustain steady income.

growth and transition this SBU into a future "Cash Cow." Question Mark South Dog American Expansion

Low-performing or outdated product lines lOMoAR cPSD| 58097008

This SBU targets high-growth markets like Brazil and Argentina, where dairy consumption is increasing

(Mordor As consumers start to focus more on their

health and the ingredients of the products they

Intelligence, 2025) but Vinamilk’s brand consume, they are starting to look for options

presence remains low. Vinamilk should focus which have a lower sugar and fat content

on building local partnerships, adapting (Euromonitor International, 2022). Therefore,

products to regional tastes, and investing in Vinamilk has some underperforming products

brand awareness campaigns to capture market that left behind the trend like:

share and develop this SBU into a future "Star." •

High-sugar milk products •

Older condensed milk variants without reformulation •

Niche flavored milks with low uptake

Vinamilk should consider reformulating,

repositioning, or discontinuing these

products to redirect resources to more promising segments.

V. Vinamilk strategic management plan McKinsey 7S Framework

To ensure the successful implementation of Vinamilk’s strategic management plan, particularly the

growth strategies identified through the Ansoff Matrix—such as product development, market

development, and diversification—it is crucial to align internal elements using the McKinsey 7S

Framework. This framework, developed by Waterman, Peters, and Phillips

(1980), identifies seven interdependent factors—Structure, Strategy, Systems, Shared Values,

Style, Staff, and Skills—that must be aligned for successful organizational change and strategic execution.

First, strategy must be clearly defined and focused on delivering value through market

development in South America and product innovation in Vietnam. This strategy needs to align

with structure, ensuring that Vinamilk’s international expansion teams and domestic product

development units are clearly organized with decision-making authority. Systems—such as supply

chain logistics, R&D processes, and digital marketing platforms—must be capable of supporting

new market operations and rapid product launches. For example, building export capabilities and

forming partnerships with local distributors in South America will require agile coordination

systems. Meanwhile, shared values such as quality, innovation, and sustainability should be

consistently reinforced across the organization to unify teams around the strategic vision.

Leadership style also plays a critical role; Vinamilk’s leaders must communicate change

effectively, motivate staff during market expansion, and foster a culture of continuous

improvement. This requires skilled staff—particularly in areas like international business, lOMoAR cPSD| 58097008

marketing, and food technology—who are capable of adapting to new consumer trends and

regulatory environments. Lastly, developing the skills of employees through training in market

analysis, product innovation, and international logistics will be essential to build internal

capabilities that support long-term growth.

By ensuring all seven elements are aligned, Vinamilk will be better positioned to execute its

strategies successfully, maintain competitive advantage, and adapt to challenges during expansion and innovation efforts.

Vinamilk’s strategic management plan

To execute the SBU-Level Strategies effectively, Vinamilk will implement a detailed, department-

led management plan with clear tasks, KPIs, and deadlines. From 2025 to 2027, the R&D,

Marketing, and Sales departments will focus on strengthening high-growth domestic products

(Stars) by launching three new functional dairy products per year, such as yogurt drinks and

fortified milk. Marketing budgets for these products will be increased by 20% annually, with the

goal of achieving 15% revenue growth year-on-year and securing a 20% share in the yogurt drink

market by the end of 2027. The first new product launch is targeted for Q4/2025.

For the expansion into South America (Question Mark SBUs targeting Brazil and Argentina), the

International Business, Product Development, and Legal & Compliance teams will complete full

market research reports by Q3/2025, localize two to three dairy products for each country, and aim

to establish local partnerships by 2026. The KPIs for this project include reaching $5 million in

combined revenue from Brazil and Argentina by the end of 2027 and achieving a positive net

margin by 2028. The first product launches in both countries are scheduled for Q2/2026.

At the same time, Vinamilk will maintain its Cash Cow SBUs — traditional milk and condensed

milk products — through the Domestic Sales and Brand Management teams. These departments

will refresh branding campaigns by Q1/2026 and implement cost-optimization initiatives, aiming

to maintain at least a 40% market share in Vietnam and increase profit margins by 2% by 2027.

For low-performing or outdated product lines (Dogs), the Portfolio Management and Finance

departments will complete a full product portfolio review by Q2/2025, focusing on divesting or

discontinuing at least 50% of the underperforming products, such as outdated condensed milk

variants or low-demand flavored milks. This move is expected to reduce operational costs by 10% by 2026.

Cross-department support will be critical to success. Human Resources will launch talent

development programs focused on international marketing and R&D innovation by the end of

2025. The Strategy Office will conduct biannual performance reviews of all SBUs based on

financial and market KPIs, ensuring timely adjustments. Meanwhile, the IT and Digital

Transformation team will deploy data analytics systems by Q1/2026 to monitor product

performance across domestic and international markets. lOMoAR cPSD| 58097008

This integrated management plan will allow Vinamilk to allocate resources efficiently, drive

growth in promising areas, and optimize its overall business portfolio in line with its long-term strategic objectives.