Preview text:

Vingroup - Financial Analysis (FY2024) Created: 2025-09-22 11:57:08 1. Introduction

This report provides an analysis of Vingroup's consolidated financial statements for

FY2024. The analysis focuses on key balance sheet figures, income statement highlights, and

financial ratios. Charts are also included for visual representation of financial structure and performance.

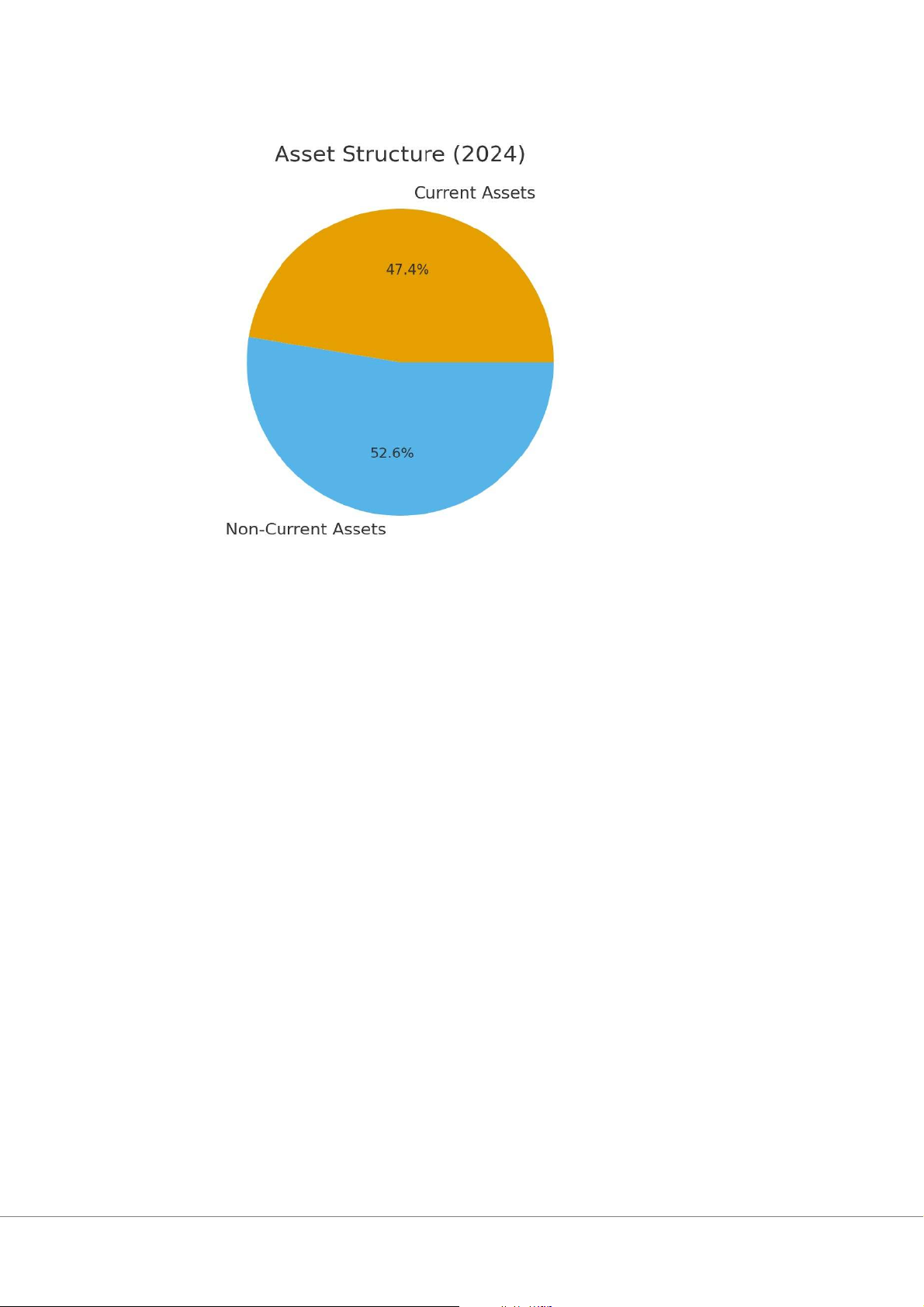

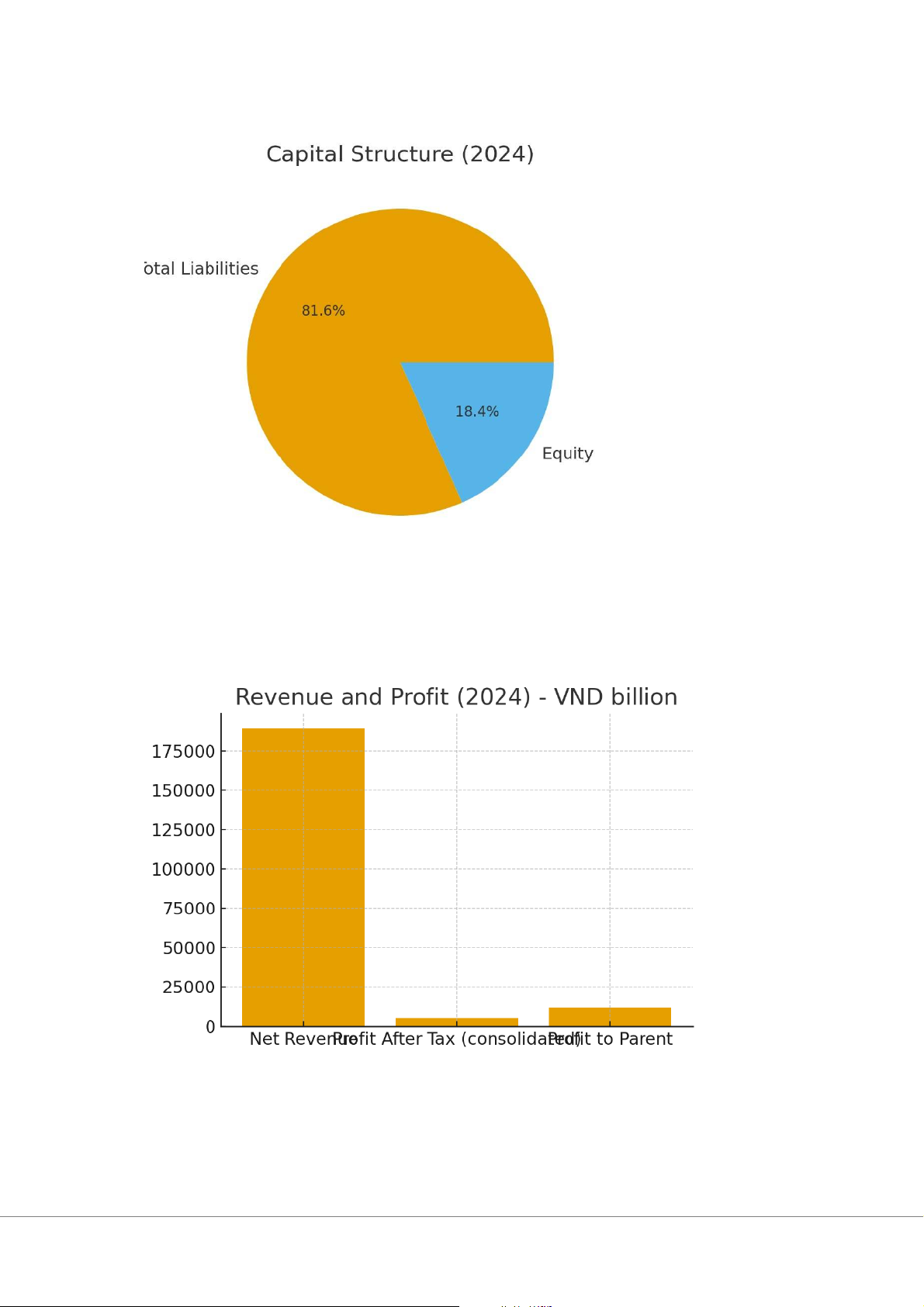

2. Key Financial Figures (VND billion) Item Value Total Assets (2024) 836,604 Current Assets (2024) 396,480 Non-Current Assets (2024) 440,124 Total Liabilities (2024) 682,769 Current Liabilities (2024) 506,624 Non-Current Liabilities (2024) 176,145 Owner's Equity (2024) 153,834 Net Revenue (2024) 189,068

Profit after tax - consolidated (2024) 5,276

Profit after tax attributable to parent 11,903 (2024) Total borrowings (2024) 227,920 3. Visual Charts

The following charts illustrate the financial structure and profitability of Vingroup in 2024: • Asset Structure: • Capital Structure:

• Revenue and Profit Comparison: 4. Financial Ratio Analysis Ratio Formula Value Current ratio (Current 396,480 / 506,624 0.78 assets / Current liabilities) Debt to assets (Total 682,769 / 836,604 81.61% liabilities / Total assets) Debt to equity (Total 682,769 / 153,834 443.83% liabilities / Owner's equity) Return on Assets - ROA 5,276 / 836,604 0.63% (Profit after tax consolidated / Total assets) Return on Equity - ROE 11,903 / 153,834 7.74% (Profit attributable to parent / Owner's equity) 5. Detailed Interpretation

- Liquidity: The current ratio is 0.78, indicating that short-term liabilities exceed short-term

assets. This suggests potential liquidity pressure and reliance on refinancing or external funding.

- Leverage: Debt accounts for nearly 82% of assets, and the debt-to-equity ratio is above

400%. This highlights Vingroup's high leverage strategy, typical for large-scale property and

manufacturing groups. Such a structure can magnify returns but also increases financial risk.

- Profitability: ROA is 0.63%, showing limited returns from assets. ROE at 7.74% is modest,

but better than ROA due to leverage. However, compared to industry peers, profitability remains on the low side.

- Revenue and profit: Net revenue reached VND 189 trillion in 2024. Profitability, however,

was relatively weak due to large financing costs, investment cycles, and the challenges faced by VinFast.

- Outlook: To improve financial health, Vingroup may focus on optimizing cash flows,

reducing debt, and improving profitability from new ventures. 6. Conclusion

Overall, Vingroup remains a large and diversified conglomerate with strong revenue

generation capacity. Nevertheless, high debt levels and low profitability indicators pose

financial risks. Sustainable growth will depend on deleveraging, efficient capital allocation,

and success in emerging sectors. 7. References

Vingroup Consolidated Financial Statements FY2024 (audited, published April 2025).

Annual General Meeting 2025 materials and investor relations publications.