Preview text:

lOMoAR cPSD| 58540065 8/8/2024 BUSINESS ECONOMICS

CHAPTER 1: INTRODUCTION TO BUSINESS ECONOMICS

1. Objectives and methodology

- Objectives → find optimal solutions for decisions

- Methodology: Fundamental economic theories + Empirical models 2. Overview of a company

Firms are major economic institutions in market economies a) Types

Unincorporated businesses

Incorporated businesses (private and

(sole traders and partnerships) public limited companies)

→ không có tính chất pháp nhấn –

They have no separate legal –

They have a separate identity from

identity. It is the owner who makes contracts the owner and consequently can sue and be

on behalf of the business and it is the owner, sued in their own right (i.e. under the name of

not the business, that is liable for the debts of the company). the company. –

There is unlimited liability for –

There is limited liability for business

business debts, which means that the owner debts, which means that the owners are liable

or owners can be declared bankrupt and any only up to the amount they have themselves

personal possessions may be taken and sold invested in the business. For example, if a

to pay off the debts of the business.

company becomes insolvent, and a

shareholder owns £1,000 of shares in the

company, then he or she will only lose the £1,000 invested. –

There are few formalities (thủ tục) –

There are many formalities required

when it comes to setting up the business. to establish a company.

5 types of companies in Vietnam

- Sole trader (Doanh nghiệp tư nhân)

- Partnership (Công ty hợp danh)

- Single-member limited liability company (LLC, LTD) (Công ty TNHH một thành viên)

- Limited liability with 2 or more members (Công ty TNHH nhiều thành viên)

- Joint stock company (JSC) (Công ty cổ phần)

The most popular in VN are limited liability companies. Ex: Sam Sung -> LTD Vinfast -> JSC

CPA VN -> Partnership or Limited Liability Company

Pham Associates and Partners -> Partnership lOMoAR cPSD| 58540065

b) Common characteristics - Owners - Managers - Objectives - Resources

- Organization structures - Performance assessment

c) Ownership structure -

Monistics – where the company serves a single interest group, normally shareholders (UK & USA) -

Dualistic – where the company serves 2 interest groups. Shareholders are the primary

group but employees’ interests are also served. (France + Germany) -

Pluralistic - where the company serves the interests of stakeholders in the companies

and not just shareholders. (Japan)

3. Ownership vs Managerial control

a) Definition -

Owner control occurs where the equity holders of a firm maintain sufficient

control over the board of directors to have a measurable influence on policy either by

direct control of votes on the board of directors, or indirectly through a sufficiently

large share of the voting stock. + Advantages:

▪ More productive and accountable to the owner’s wishes

▪ Align the interests of the owner and the manager

▪ Help retain the ability of the owner to control the future direction

▪ Avoid the problem of agency -

Manager control exists in a firm where the shareholders fail to achieve sufficient

board representation or voting stock control allowing managers to exercise more

judgment than would be possible under the OC regime. + Advantages:

▪ Suitable for the complexity, scale and scope of a company’s operation expansion

▪ Protect minority stakeholders

▪ Possess specific knowledge that effective management

b) Criteria for classification - A threshold/ a cut-off point + Berle and Means (1932): 20%

+ Radice (1971): 15% for the largest shareholding; <5% MC

Berle and Means (1932), who first identified the divorce between ownership and control,

argued that a stake of more than 20% would be sufficient for that shareholder to control a

company but less than 20% would be insufficient and the company would be management controlled.

Radice (1971) used a largest shareholding of 15% to classify a firm as owner controlled.

- A probabilistic voting model: (Cubbin and Leech) lOMoAR cPSD| 58540065

+ Degree of control (probability of the controlling shareholders securing majority support in a contest vote)

+ Control (95% chance of winning a vote) Control = f(X) - X: Size of largest holding

- Size and distribution of the remaining shares

- Willingness of other shareholders to form a voting block

- Willingness of other shareholders to be active and to vote against the controlling group

Case Study 1.1 Manchester United – owner or managerially controlled?

The control mechanism of Manchester United has evolved significantly over the years,

reflecting the club's transition from a primarily managerially controlled entity to one influenced by owner control.

- Initially, Manchester United did not have any single shareholder with overall control. The

club was managed by a board of directors, and the influence of the manager (e.g., Matt Busby) was paramount.

- By 1964, MU had been owner controlled when Louis Edwards had acquired a majorityand

controlling interest in the club. After that, MU was owner controlled by Martin Edwards, the son of Louis Edwards.

- The takeover bid by BSkyB in 1998 highlighted the club's vulnerability to external

ownership influences, but finally it was managerially controlled as BSkyB (the largest

shareholder) owned only 9.99% of the share capital.

- In September and early October 2003 there was significant trading, MU was owner

controlled by Cubic Expression Ltd with 23.2% of share.

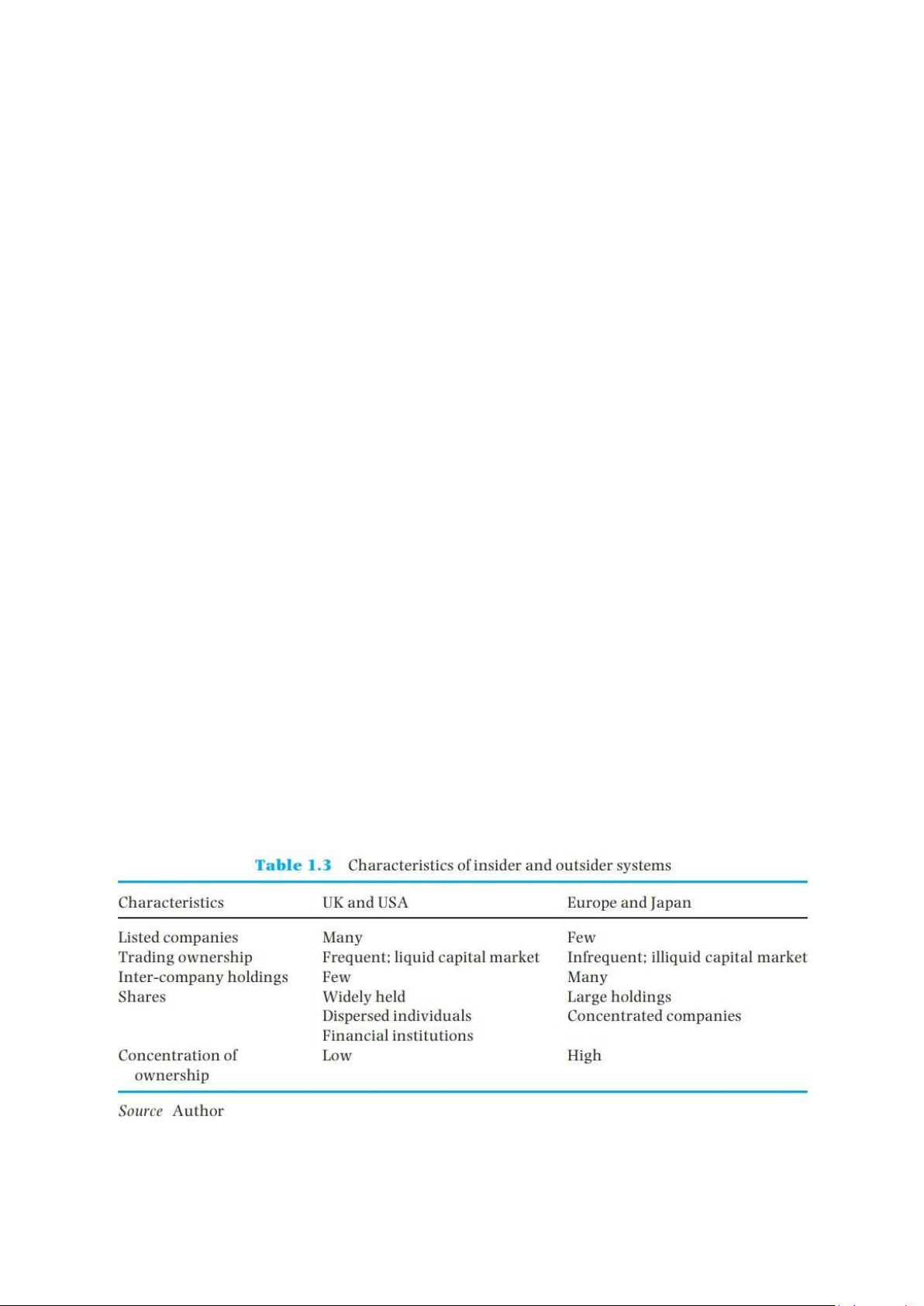

4. Insider Vs Outsider system of corporate control

a) Corporate governance

Griffiths and Wall: “Corporate governance refers to the various arrangements within

companies which provide both authority and accountability in its operations. In other

words, the various rules and procedures which are in place to direct and control the running of the company”

b) Corporate control

- Insider systems: are characterized by relatively few quoted companies, concentrated

ownership, dominance of corporate and/or institutional shareholders and reciprocal

shareholding. Shares are infrequently traded, but when they are they often involve large

blocks. Takeover activity is largely absent, and where mergers take place they are largely done by agreement. + Ownership: concentrated

+ Trading shares: large blocks

+ Relationship between management and shareholders: close and stable

+ Board of directors or other senior managerial positions:

shareholders + Priority to stakeholder ➔ More active owner participation lOMoAR cPSD| 58540065 Example:

Germany: example of insider corporate system

- 800 quoted companies (vs. 3000 in the UK) (2001)

- 85% of the largest quoted companies having a single shareholder owning more than 25% of the voting shares

- Large ownership stakes: families or companies with interconnected holdings

Example: BMW: The largest shareholder is the Quandt family (46% of the voting equity)

+ Stefant Quandt is deputy chairman, his sister Susanne is a member of the supervisory board

+ Head of the family is Joanna Quandt: Majority owner of Altana-pharmaceutical manufacturer

+ The Quandt family controllers of 2/30 top companies in Germany

- Outsider system: Are characterized by dispersed share ownership, with the dominant

owners being nonbank financial institutions and private individuals. Owners and other

stakeholders are not represented on the boards of companies. Shareholders are seen as

passive investors who only rarely question the way in which a company is being operated.

Shares are easily sold and tend to be held for investment purposes, as part of a diversified

portfolio, rather than for control purposes; this discourages active participation in company

a¡airs since shares are easily traded. Thus, dissatisfaction with the performance of a

company leads the shareholder to sell shares, rather than initiate moves to change the

management or even company policies.

+ Ownership: dispersed → managerial control

+ Trading shares: easy (for investment)

+ Relationship between management and shareholders: not close

+ Board of directors or other senior managerial positions: NOT owners and stakeholders

+ Priority to market regulations

➔ More active market for corporate control

-> Managers, regulators and chairman (head of owners) have the voice

UK and USA: outsider; Europe and Japan: insider

5. External and Internal constraints

Constraints to managerial discretion lOMoAR cPSD| 58540065 -

External constraints: Arise from the active market in company shares (i.e. holder of

large blocks of shares, acquirer of blocks of shares, bidders in the takeover process,

debtors/investors, external regulator and auditor...) -

Internal constraints: Arise from the role of non - executive board members and

stakeholders (i.e. non-executive directors, owners/shareholders, stakeholders within the

company: employee, customers, suppliers, lenders, local community)

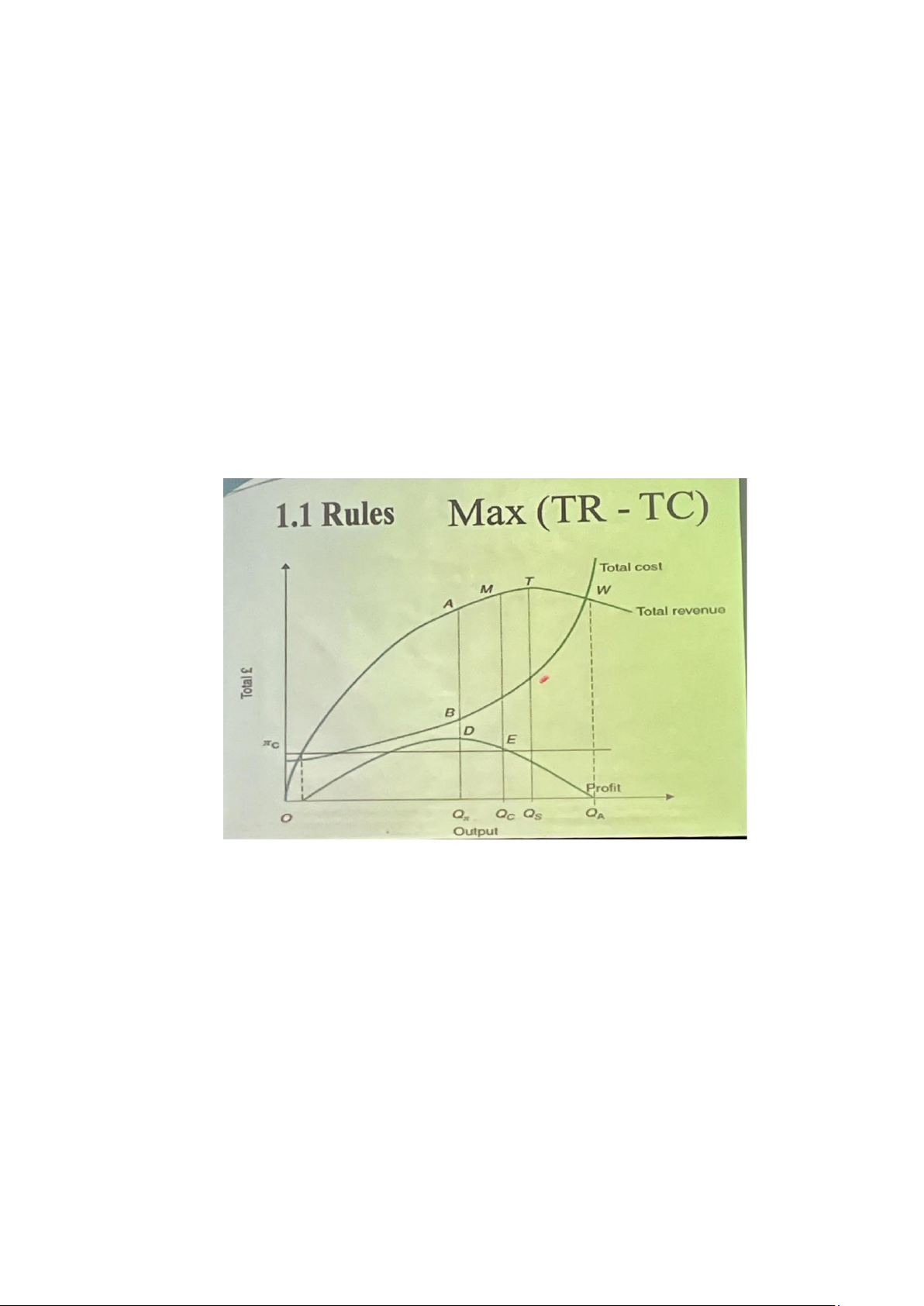

CHAPTER 2: BUSINESS OBJECTIVES & THEORIES OF FIRMS 1. Profit maximization

1.1. Assumptions / Rules - Perfect information - Rational decision maker - Marginal analysis lOMoAR cPSD| 58540065

TR - TC max ⇔ (TR - TC)’ = 0 ⇔ MR - MC = 0 ⇔ MR = MC

=> Profit maximization: MR=MC 1.2. Criticism - Theoretical perspectives:

+ Imperfect and uncertain information → Make the calculation of MR and MC quite difficult

+ Profit relates to time (short-run and long-run profit) → a firm may trade-off lower profits

in the short run for greater long-run profit, which is in the long-term interests of the firm.

+ A set of objectives for modern org -> The firm may adopt a mixture of goals and not

necessarily maximize any single goal

- Main empirical perspectives: Shipley (1981): 15% are true profit maximizers;

Hornby (1995): range of goals (> single one) + Profit maximization is a poor

description of what many firms actually try to achieve.

+ Other objectives may be more important, such as increasing sales in the short run

+ No single objective may be maximized

+ Marginalism is a poor description of the processes used by businesses to decide output and price

+ Profit is a residual and its outcome is uncertain lOMoAR cPSD| 58540065

Defence of Profit maximization

- MR and MC are subjective concepts → managers do in an automatic way based on their experience

- Firms are constrained by its choice of objectives by the actions of their rivals, when

significant degree of competition Profit maximization is the only goal for survival

- Essential proof to raise future capital

- Important objective that allows Precise and predictive analysis of decisions 2. Sales revenue max

- Baumol (1959): managers have discretion (sự tự định đoạt) in setting goals and that

salesrevenue maximization was a more likely short-run objective than profit maximization

in firms operating in oligopolistic (độc quyền nhóm bán) markets. - Reasons:

+ Sales revenue is a more useful short-term goal for the firm than profit. Sales are

measurable and can be used as a specific target to motivate staff, whereas profits, which are a residual

+ Rewards for senior managers are often tied to sales revenue rather than profit

+ Increase in sale revenue -> increase in profit used to measure the increasing size of

the firm -> seen by shareholders for SR profit increase

+ Increasing sales (size of firm) -> easier to manage (believe in success of firm)

2.1 The static single-period max a) Assumption -

The firm produces a single product and has non-linear total cost and revenue

functions - The firm makes its price/output decision without taking account of the actions of other firms -

The firm’s objective is to choose a level of sales or output that maximizes sales

revenue (TR) subject to a minimum profit constraint set by shareholders

b) Determinations of πc lOMoAR cPSD| 58540065

c) Linear TR and TC Exercise: lOMoAR cPSD| 58540065

a) Total profit is maximized at output Q2. The value of total profit at this output is the

difference between (X) and Q2.

b) Total revenue is maximized at output Q3. The value of total revenue at this output (C)

can also be found on the graph where the total revenue curve peaks.

c) At both Q1 and Q4, there are break-even. However,

- At output Q1 , the firm is likely to experience a gain, as total costs are declining while

total revenue continues to rise.

- At output Q4 , the firm may be operating at a loss, as total revenue is declining while total costs continue to rise.

d) To maximize sales revenue subject to the minimum profit constraint (1), the firm should produce at output Q3.

To maximize sales revenue subject to the minimum profit constraint (2), the firm

should produce at output Q2’

3. Managerial utility model a)

Williamson (1963) sought to explain firm behavior by assuming senior management seeks to

maximize their managerial utility function rather than that of the owners.

B = Salary + Non-pecuniary benefits

Non-pecuniary (phi tiền bạc) benefits are related to expenditures= S + M + Id

- (S): Staff expenditure

- (M): Managerial fringe benefits (luxurious cars, expensive holidays,..are paid for by the firm)

- (Id): Discretionary investment, which allows managers to pursue their own favoured

projects (chi tiêu tự do theo ý muốn)

b) Profits of firms - Actual profit: πA - Reported profit (=πA - M) - Minimum profit: πM

→ Necessary to keep shareholders happy and willing to hold their stock

→ Reported profit = πA - M >= πM

- Discretionary profit (πD = πA - πM)

- Managerial fringe benefits (M)

- Discretionary investment (Id)

→ Discretionary profit πD = Id + M

→ Discretionary expenditure = S + M + Id → Um = F(S, M, Id) lOMoAR cPSD| 58540065

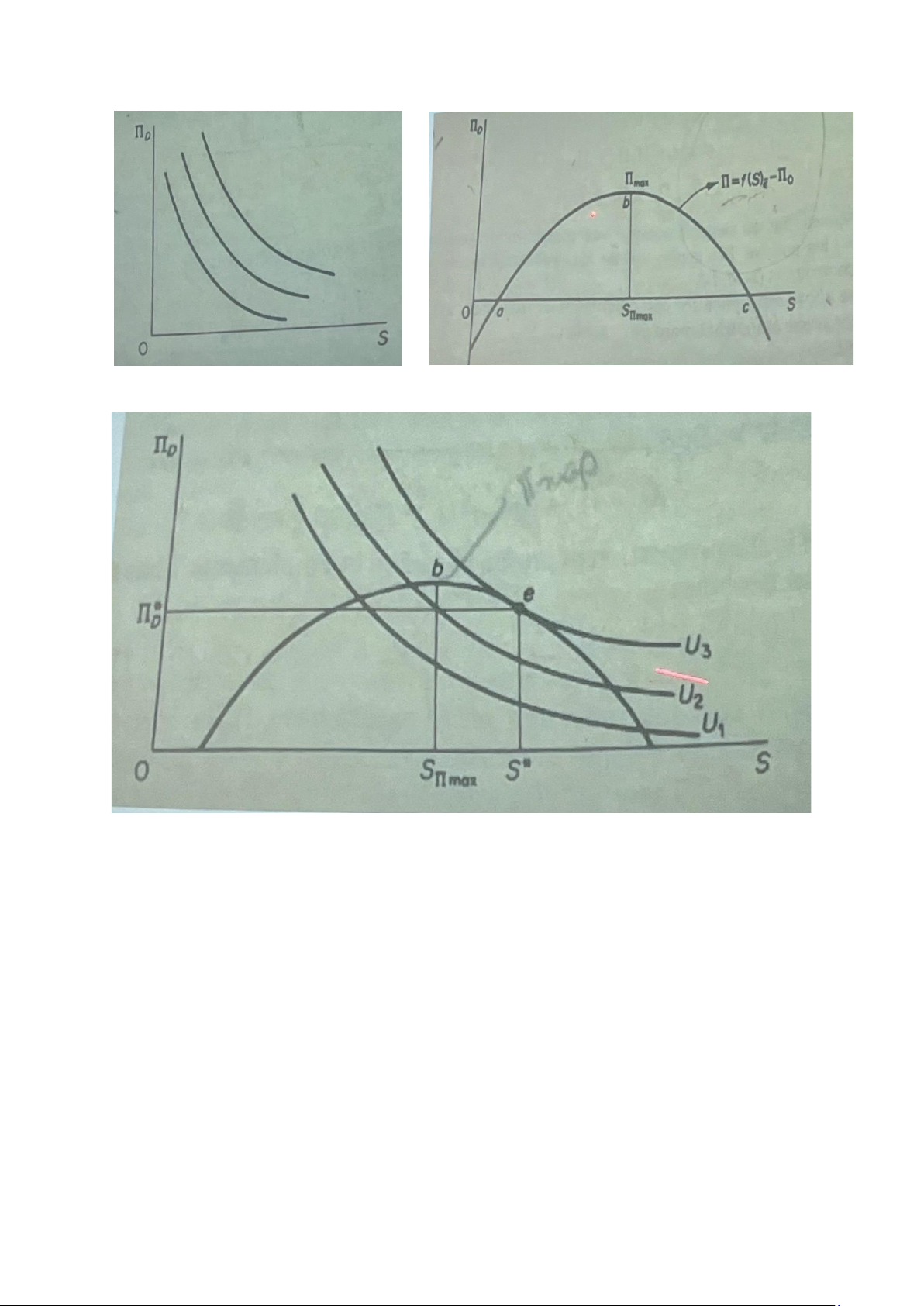

Managerial utility model

Profits of firms

Maximize utility at point E, which represents a point of tangency between the highest

achievable indifference curve and the discretionary profit curve. -

Profit maximization: no discretionary spending/ expenditure - Managerial

utility maximization: respond to changes by increasing or decreasing discretionary expenditure. +

Increase in demand → increase actual profits + increase discretionary expenditure

+ Decrease in demand → reduce actual profits but may not reduce reported profits -

Williamson (1964): firms were able to make cost reductions in times of

declining profit opportunities without hindering the operations of the firm. 4. Behavioral models

Firms decide on multiple objectives

a) Simon (1959): ….. lOMoAR cPSD| 58540065

5. Corporate social responsibility

- Corporate social responsibility (CSR): the extent to which individual firms serve social

needs other than those of the owners and managers, even if this conflicts with the

maximization of profits (Moir 2001) - Why to be needed?

+ Long-run self-interest of the firm: socially responsible behavior generates

additional revenue and profits in the long run

+ Stakeholders: it is beneficial to the firm to keep in line with ethical, social and cultural

norms, because this keeps workers, customers and suppliers happy and minimizes the

risks to the reputation and profitability of the firm.

+ Regulation: bad corporate behavior may lead to the imposition of an expensive and

inflexible regulatory regime to curb antisocial behavior, - CSR and Profit?

+ No statistically significant relationship between social spending and market price (share price)

+ Varies at different times and from countries to countries + Increasingly important - ESG

+ Environmental: environmental protection and management to environmental risks

+ Social: social relationship with employees, suppliers, customers and communities

+ Governance: org’s leadership, executive pay, audits, internal controls and shareholder rights

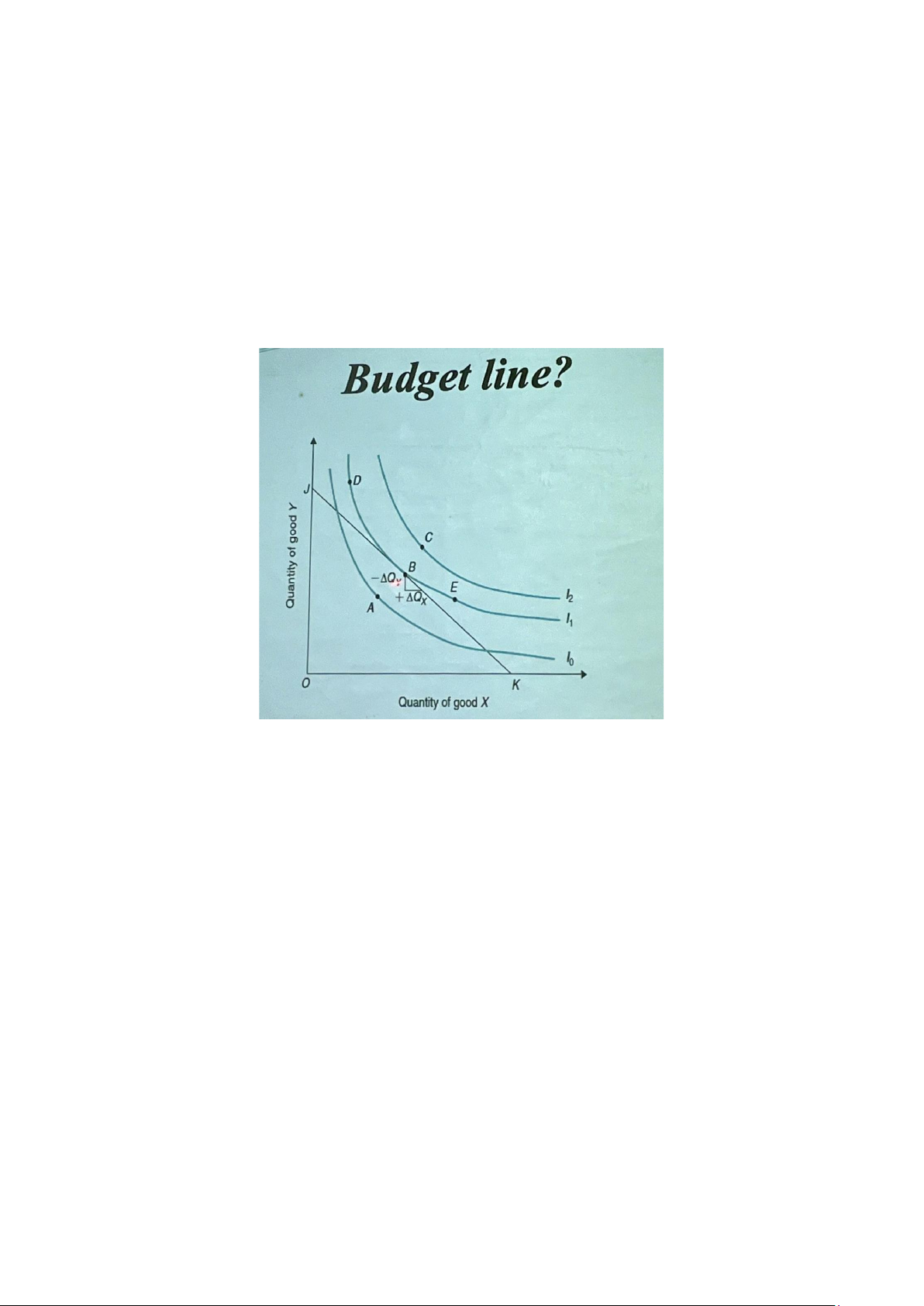

CHAPTER 3: DEMAND AND CONSUMER BEHAVIOR 1. Consumer behaviour 1.1. Maximize utility

Indifference curve: same level of utility/satisfaction over different bundle of goods

Assumptions: 2 substitutes, the more is better and no durable characteristics - Convex to the origin - Downward sloping

a) Marginal Rate of Substitution (MRS)?

- Measures how much of one good a consumer requires in order to be compensated for a

oneunit reduction in consumption of another good.

- MRS between 2 goods depends on their marginal utility

- Example: marginal utility of good X is twice the marginal utility of good Y, then a

personwould need 2 units of good Y to compensate for losing 1 unit of good X, and the

marginal rate of substitution equals 2. MRSxy = MUx/MUy - MRS and IC? MUx = Delta TUx/Delta Qx lOMoAR cPSD| 58540065 MUy = Delta TUy/Delta Qy

→ Delta TUx = MUx * Delta Qx

Delta TUy = MUy* Delta Qy Delta TUx + Delta TUy = 0

→ - MUx * Delta Qx = MUy* Delta Qy

→ Delta Qy/Delta Qx = - MUx/ MUy

=> Slope of Indifference Curve = MRS lOMoAR cPSD| 58540065

b) Criticism of indifference curve: -

How to set/change preferences?

- Static theory: not determine the path of change- Imperfect Information to make decisions?

- Ordering of preferences is NOT just based on utility, BUT moral preference/hierarchy of needs

- No interactions among individuals

- Only deal with private goods, consumed

1.2. Characteristic approach Lancaster (1966):

Consumers make choices not only between distinct goods but also similar goods but with dif.

combinations of characteristics

(ex: same 4 wheels of car, but many dif. body shapes and other features)

- Consumers want goods for their inherent characteristics

- Characteristic is a property of goods that generates utility

- The utility = function of the characteristics that the goodencompasses

- Consumer seeks to maximize utility, under the income coóntraint- Assumptions:

+ Each product will have more than one characteristic.

+ Each product will have a mix of characteristics that will vary by brand.

+ Characteristics are measurable objectively.

+ Products are divisible and do not have to be purchased in whole units.

+ Products (or brands) are substitutes for each other despite containing differing combinations of characteristics. lOMoAR cPSD| 58540065

1.3. Behavioral approach

Behavioral economic theory

- Consumers are not perfect and fully rational decision maker

- Consumers utilize rules of thumb and decision routines to overcome limited abilities and partial information → NOT

Maximize but Satisfy their utilities

- Consumption = Previous experience + purchase position in budget Decision-making cycle

- Recognition of the need to make a choice.

- Search for possible solutions to the problem.

- Evaluation of rival alternative courses of action.

- Choice by ranking alternatives in order of preference.

- Implementation of a chosen course of action.

- Hindsight by examining the outcome to see whether the outcome matched perception. Procedures for Making Choices

- Information-processing tasks can be viewed as constructing a choice matrix with

rivalproducts on one axis and relevant characteristics on the other

- The rules used by consumers to evaluate the information are grouped under two headings: +

Compensatory rules that compare positive and negative features

+ Non-compensatory procedures that eliminate products on a single criterion or absolute level of performance 2. Demand analysis

2.1. Market demand Function of:

Qx = f (Px, Py, Ax, Y, T, O)

Qx: quantity demanded of good X Px: price of good X Py: price of another good Y

A: advertising expenditure on good X

Y: real disposable income of consumers in the market T: consumer tastes O: other factors For simplicity: Qx = f (Px)

(inverse demand function)

Linear demand function: Qx = a + bPx -> a linear MR curve

-> a MR curve: slope is twice that of the demand curve

-> TR is maximized where MR = 0

Qx = a + bPx => Px = (Qx - a) / b

TR = Px.Qx = Qx . (Qx - a) / b = (Qx)^2/b - a.Qx/b MR = TR’ = 2Qx/b - a/b a) Formula