Preview text:

Corporate Finance - Final Exam Review Duration: 90 minutes Structure: 2 parts: -

Part 1: MC = 10 sentences - Part 2: Problems = 3 - Opened book exam Part A: Multiple Choice

Some important points should be noted:

a. Lecture 6: Capital Budgeting

● Incremental cash flow (those cash flows that will only occur if the

project is accepted) should include:

○ the Investment in Working Capital ○ Shutdown Cash Flows ○ Allocated Overhead Costs

○ opportunity cost (cost of giving up the second best use of resources)

○ Indirect Effects (side effects):

■ Erosion (new project reduces sales and cash flows of existing projects)

■ Synergy (new project increases sales and cash flows of existing projects)

● Incremental cash flow should exclude:

○ sunk cost (a cost that has already occurred regardless of whether the project is accepted).

● Cash flows # profits & losses

● Net cash flow = Cash Inflow - Cash Outflow

b. Lecture 7: Risk - Return ● The risk - free security:

○ Beta - β (a measure of the volatility or systematic risk of a security

or portfolio compared to the market as a whole) = 0, ○ no systematic risk

● There are two types of risk: unsystematic risk and systematic risk - example ● CAPM model:

𝑅 = 𝑅 + (𝑅 − 𝑅 ) * β 𝑒 𝑓 𝑀 𝑓 Ms. Tran Thi Hoang Vi Corporate Finance Class In which:

𝑅 : expected rate of return of stock 𝑒

𝑅 : rate of return of risk - free security 𝑓

𝑅 : expected rate of return of market 𝑀

(𝑅 − 𝑅 : market risk premium ) 𝑀 𝑓 Beta - β

● A weighted average of returns on debt and equity is cost of capital - WACC ● Variance formula ● Capital structure

c. Lecture 5: investment criteria -

advantage and disadvantage of NPV method, IRR, payback period method - Decision rules of NPV

d. Lecture 4: Stock valuation

● Stock valuation: recall that the price of any asset is the present value of the

cash flows generated by that asset in the future. In the case of stock, the

future cash flows generated are the dividends and/or the price of that stock

sold in the future. Or the price of the house is the present value of cash

flows like rent generated by that house every year and the selling price of the house at the end.

● stock represents ownership interest in a corporation. ● shareholder’s right: - to share in the profits. -

to share in assets upon liquidation. - to elect a board of directors.

● the primary and secondary market ● formula of dividend yield

○ 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝑦𝑖𝑒𝑙𝑑 = 𝑒𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝑜𝑓 𝑡ℎ𝑒 𝑛𝑒𝑥𝑡 𝑝𝑒𝑟𝑖𝑜𝑑

𝑐𝑢𝑟𝑟𝑒𝑛𝑡 𝑠𝑡𝑜𝑐𝑘 𝑝𝑟𝑖𝑐𝑒

1. This type of risk is avoidable through proper diversification. A. portfolio risk B. systematic risk C. unsystematic risk D. total risk Ms. Tran Thi Hoang Vi Corporate Finance Class

2. A statistical measure of the degree to which two variables (e.g., securities’ returns) move together: A. coefficient of variation B. Variance C. Covariance D. certainty equivalent

3. An “aggressive” common stock would have a “beta” A. equal to zero B. greater than one C. equal to one D. less than one.

4. The span of time within which the investment made for the project will be recovered

by the net returns of the project is known as A. Period of return B. Payback period C. Span of return D. None of the above

5. Projects with __________ are preferred A. Lower payback period B. Normal payback period C. Higher payback period D. Any of the above

6. Which of the following statements concerning the NPV is not true?

a. The NPV technique takes account of the time value of money.

b. The NPV of a project is the sum of all the discounted cash flows associated with a project.

c. The NPV technique takes account of all the cash flows associated with a project.

d. If two competing projects are being considered, the one expected to yield

the lowest NPV should be selected.

7. Which of the following would be the best example of systematic risk?

a. An error in the company’s computer system miscalculates the amount of

inventory that Monique’s Boutique is holding.

b. BlueJay Air has a reduction in new reservations following a crash of one of its jets.

c. The spokesperson for Serena’s Sports Shoes is involved in an ethical scandal. Ms. Tran Thi Hoang Vi Corporate Finance Class

d. InterestratesriseaftertheFederalReserveannouncesitwillslow

downtherateofgrowthofthemoneysupply.

8. Whichofthefollowingisthebestexampleoffirm-specificrisk?

a. A global pandemic causes major disruptions in the economy.

b. The Federal Reserve increases the money supply dramatically, leading to massive inflation.

c. AAAPharmaceuticalswithdrawsamedicationasitstudieswhether

strokesfivepeoplesufferedaftertakingthemedicationwererelated tothemedication.

d. As an arctic blast descends on North America, most of the United States is blanketed in snow or ice.

9. Betaisameasureof_______________. a. systematicrisk b. firm-specific risk c. a firm’s profitability d. a stock’s dividend yield

10. The gap between cash inflow and cash outflow a. Capital structure b. Free cash flow c. Cost of capital d. Net present value

11. The internal Rate of Return (IRR) criterion for project acceptance, under

theoretically infinite funds is: accept all projects which have

A. IRR equal to the cost of capital

B. IRR greater than the cost of capital

C. IRR less than the cost of capital D. None of the above

Problem 1: Capital Budgeting

1. A project generates revenues of $600, expenses of $300, and depreciation charges of

$200 in a particular year. The firm’s tax bracket is 35%. Find the operating cash flow of the project. Answer:

The tax rate is T = 35%. Taxes paid will be

𝑇 * (𝑟𝑒𝑣𝑒𝑛𝑢𝑒 − 𝑒𝑥𝑝𝑒𝑛𝑠𝑒𝑠 − 𝑑𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛) = 35% * (600 − 300 − 200) = $35 Ms. Tran Thi Hoang Vi Corporate Finance Class

Operating cash flow can be calculated as follows.

a. (𝑅𝑒𝑣𝑒𝑛𝑢𝑒 − 𝑒𝑥𝑝𝑒𝑛𝑠𝑒𝑠 − 𝑡𝑎𝑥𝑒𝑠) = 600 − 300 − 35 = $265

b. 𝑁𝑒𝑡 𝑝𝑟𝑜𝑓𝑖𝑡 + 𝑑𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛 = (600 − 300 − 200 − 35) + 200 = $265 c.

(𝑅𝑒𝑣𝑒𝑛𝑢𝑒𝑠 − 𝑐𝑎𝑠ℎ 𝑒𝑥𝑝𝑒𝑛𝑠𝑒𝑠) * (1 − 𝑡𝑎𝑥 𝑟𝑎𝑡𝑒) + (𝑑𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛 * 𝑡𝑎𝑥 𝑟𝑎𝑡𝑒)

= (600 − 300) * (1 − 35%) + (200 * 35%) = 265

2. A regional supermarket chain is deciding whether to install a Tewgit machine in each of

its stores. Each machine costs $750,000, depreciated $150,000 each year .

Company supposes to use the machine for 5 years then sell it at the end of year 5 for 800,000 dollars.

This 5 year project has annual sales of $500,000 and operating cash expenses of

$200,000. The required rate of return is 15%, and the tax rate is 20%. Required:

Evaluate the project using NPV, IRR. Answer:

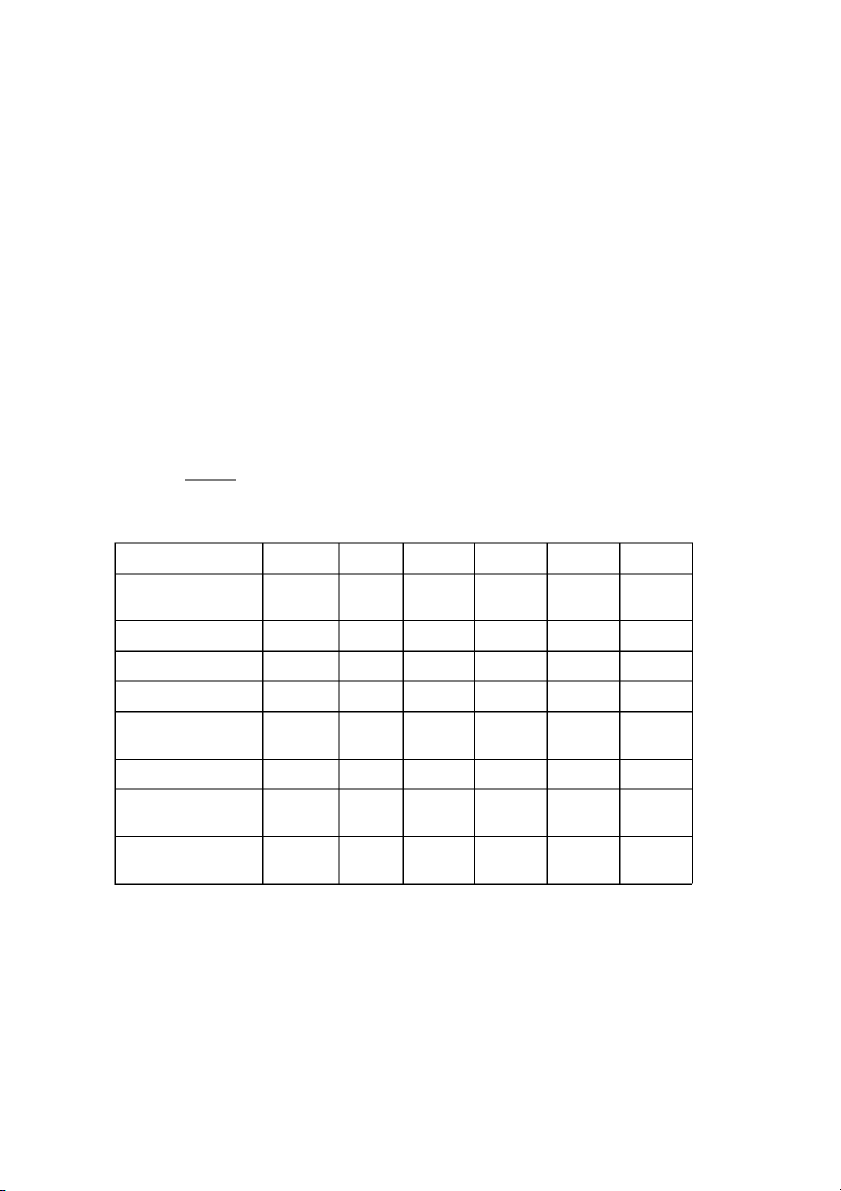

Remember, discount cash flows, not profits. Year 0 1 2 3 4 5 Investment cash flow -750,000 (outflow) (A) Sales (1) 500,000 500,000 500,000 500,000 300,000 Operating expenses (2) 200,000 200,000 200,000 200,000 200,000 Depreciation (3) 150,000 150,000 150,000 150,000 150,000 Profit before tax (4) = 150,000 150,000 150,000 150,000 150,000 (1) - (2) - (3) Taxes (5) = (4)*20% 0 30,000 30,000 30,000 30,000 30,000 Net profit (6) = (4) - 0 120,000 120,000 120,000 120,000 120,000 (5) Operating Cash flow 0 270,000 270,000 270,000 270,000 270,000 (B) = (6) + (3) Ms. Tran Thi Hoang Vi Corporate Finance Class Salvage value 800,000 Terminal Cash flow 800,000 (C) Total project free cash -750,000 270,000 270,000 270,000 270,000 1,070,000 flow = A + B + C NPV 𝑁𝑃𝑉 = 270,000

1+15% + 270,000 + 270,000 + 270,000 + 1,070,000 − 750, 000 = (1+15%)2 (1+15%)3 (1+15%)4 (1+15%)5 𝑁𝑃𝑉 = 0 = 270,000

1+𝐼𝑅𝑅 + 270,000 + 270,000 + 270,000 + 1,070,000 − 750, 000 (1+𝐼𝑅𝑅)2 (1+𝐼𝑅𝑅)3 (1+𝐼𝑅𝑅)4 (1+𝐼𝑅𝑅)5 => 𝐼𝑅𝑅 =

Problem 2 (Stock Valuation):

1. ABC Corp. has just paid an annual dividend of $0.75 per share. Dividends are expected

to grow at 15% for each of the next 3 years, at 10% for year 4 and year 5, and at 3% from

year 6 onwards. Given the appropriate discount rate of 10%. Required:

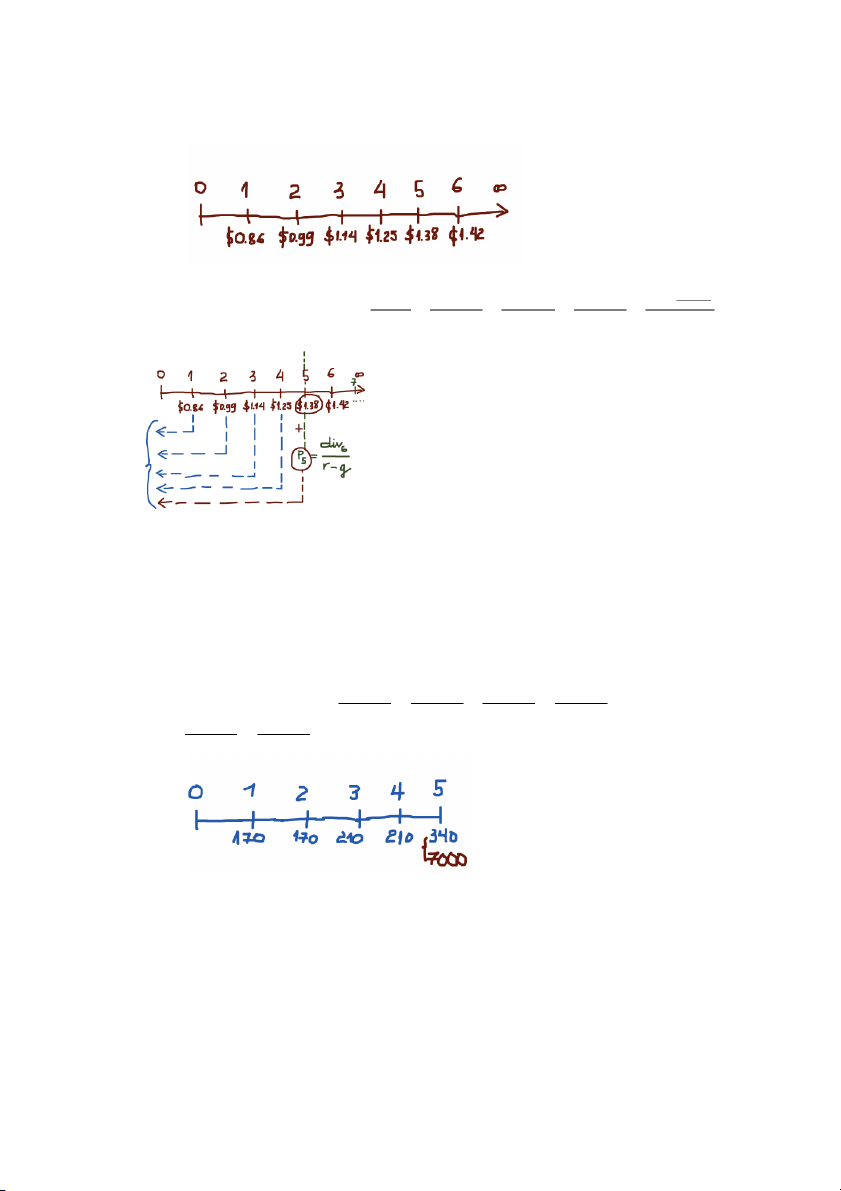

a. Draw a timeline to show the expected dividend from year 1 to year 6.

b. What is the price of the stock today? If the current price of ABC Corp. shares in the stock

market is $14.3, should the investor purchase the shares? Answer:

a. 𝑒𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝑎𝑡 𝑦𝑒𝑎𝑟 1 = 𝑑𝑖𝑣 = 𝑑𝑖𝑣 * (1 + 15%) = $0. 86 1 0

𝑒𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝑎𝑡 𝑦𝑒𝑎𝑟 2 = 𝑑𝑖𝑣 = 𝑑𝑖𝑣 * (1 + 15%) = $0. 99 2 1

𝑒𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝑎𝑡 𝑦𝑒𝑎𝑟 3 = 𝑑𝑖𝑣 = 𝑑𝑖𝑣 * (1 + 15%) = $1. 14 3 2

𝑒𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝑎𝑡 𝑦𝑒𝑎𝑟 4 = 𝑑𝑖𝑣 = 𝑑𝑖𝑣 * (1 + 10%) = $1. 25 4 3

𝑒𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝑎𝑡 𝑦𝑒𝑎𝑟 5 = 𝑑𝑖𝑣 = 𝑑𝑖𝑣 * (1 + 10%) = $1. 38 5 4

𝑒𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝑎𝑡 𝑦𝑒𝑎𝑟 6 = 𝑑𝑖𝑣 = 𝑑𝑖𝑣 * (1 + 3%) = $1. 42 6 5 Ms. Tran Thi Hoang Vi Corporate Finance Class b. Price of stock today:

𝑃 = 𝑝𝑟𝑖𝑐𝑒 𝑜𝑓 𝑠𝑡𝑜𝑐𝑘 𝑡𝑜𝑑𝑎𝑦 = 0.86 + 1.14 + 1.25 + 1.38+ 1.42 10%−3% 0 1+10% + 0.99 (1+10%)2 (1+10%)3 (1+10%)4 (1+10%)5 = $16. 78

At a current market price of $14.30 the investor should consider buying the shares.

2. You are going to buy a batch of stock. You expect to be paid $170/year in dividend for the first

two years, $210/year in year 3 and 4, and $340/year for the final year. At the end of year 5 you

anticipate selling the stocks for $7,000. Assume a 10% expected rate of return. Required:

a. What is the price of the stock?

b. Compute NPV, IRR if you spent $5,000 for the batch of stock. What is your decision? Answer: a. Price of the stock:

𝑃𝑟𝑖𝑐𝑒 𝑜𝑓 𝑠𝑡𝑜𝑐𝑘 = 𝑃𝑉 = 170 + 170 + 210 + 210 + (1+10%)1 (1+10%)2 (1+10%)3 (1+10%)4 340 + 7,000 = $5, 153. 81 (1+10%)5 (1+10%)5 b. NPV Ms. Tran Thi Hoang Vi Corporate Finance Class 𝑁𝑃𝑉 = 170 + 170 + 210 + 210 + 340 (1+10%)1 (1+10%)2 (1+10%)3 (1+10%)4 (1+10%)5

+ 7,000 − 5, 000 = 𝑃𝑟𝑖𝑐𝑒 𝑜𝑓 𝑠𝑡𝑜𝑐𝑘 − 𝑦𝑜𝑢 𝑠𝑝𝑒𝑛𝑡 𝑓𝑜𝑟 𝑡ℎ𝑒 𝑠𝑡𝑜𝑐𝑘𝑠 (1+10%)5 = 153. 81 > 0 IRR = 10.71%

Problem 3: Risk and Return

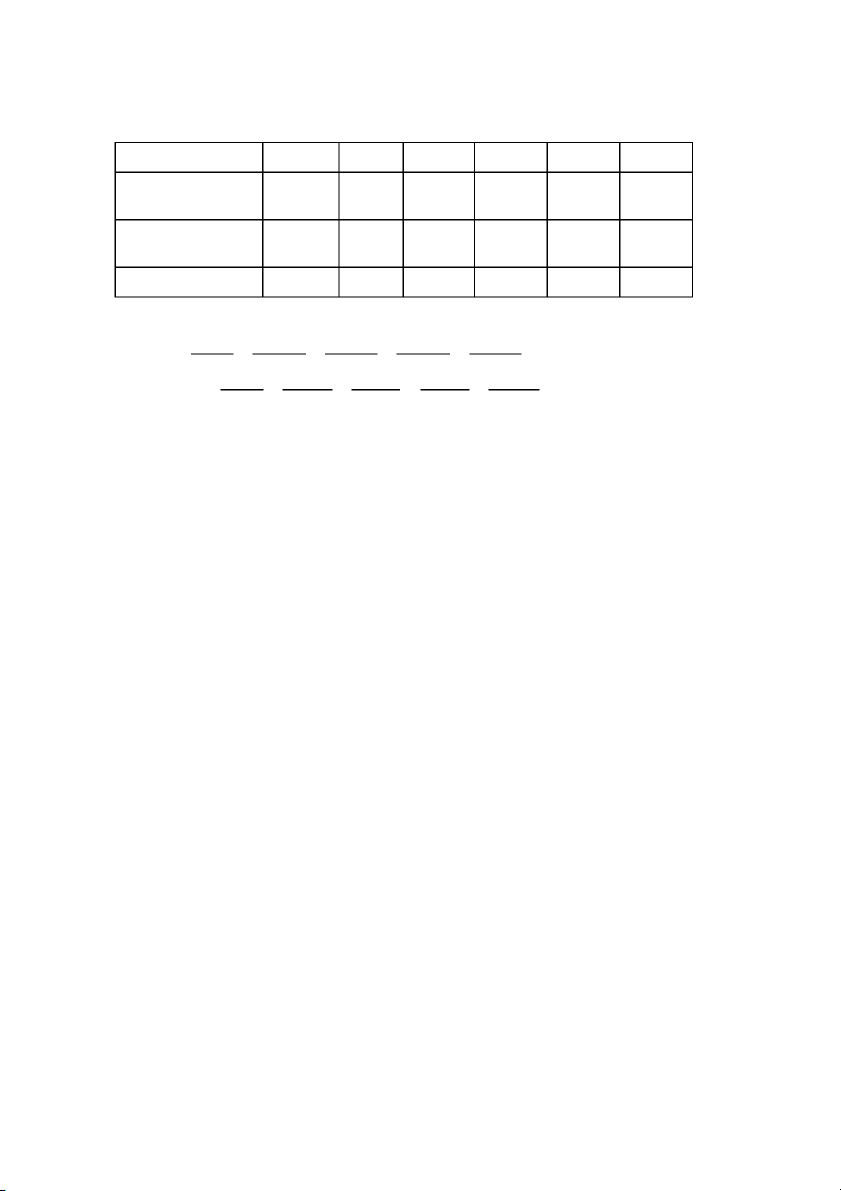

1. Stock A and B got the rate of return as follow: Year

Rate of return of stock A

Rate of return of stock B 1 -10.00% -3.00% 2 18.50% 21.29% 3 38.67% 44.25% 4 14.33% 3.67% 5 33.00% 28.30%

a. Calculate expected rate of return of each stock.

b. Assume you have a portfolio including 50% of stock A and 50% of stock B, calculate the

expected return of your portfolio.

c. What is the Variance and standard deviation of the portfolio in sentence b? 𝑛=5

𝐶𝑜𝑣𝑎𝑟𝑖𝑎𝑛𝑐𝑒 𝑏𝑒𝑡𝑤𝑒𝑒𝑛 𝐴 𝑎𝑛𝑑 𝐵 = σ = ∑ 𝑃 𝑅

[ − 𝐸(𝑅 )][𝑅 − 𝐸(𝑅 )] 𝐴,𝐵 𝑖=1 𝑖 𝑖𝐴 𝐴 𝑖𝐵 𝐵

= [− 10% − 18. 9%][− 3% − 18. 9%]

+ [18. 5% − 18. 9%][21. 29% − 18. 9%]

+ [38. 67% − 18. 9%][44. 25% − 18. 9%]

+ [14. 33% − 18. 9%][3. 67% − 18. 9%]

+ [33% − 18. 9%][28. 30% − 18. 9%] = 0. 1335 Ms. Tran Thi Hoang Vi Corporate Finance Class 𝑛=5 σ = σ2 = ∑ 𝑅 [ − 𝐸(𝑅 )]2 * 𝑃 𝐴 𝐴 𝑖𝐴 𝐴 𝐼=1 𝑖

= [− 10% − 18. 9%]2 * 15 + [18. 5% − 18. 9%]2 * 15 + [38. 67% − 18. 9%]2 * 15 + [14. 33% − 18. 9%]2 * 15 + [33% − 18. 9%]2 * 15 =17% 𝑛=5 σ = σ2 = ∑ 𝑅 [ − 𝐸(𝑅 )]2 * 𝑃 𝐵 𝐵 𝐼=1 𝑖𝐵 𝐵 𝑖

= [− 3% − 18. 9%]2 * 15 + [21. 29% − 18. 9%]2 * 15 + [44. 25% − 18. 9%]2 * 15 + [3. 67% − 18. 9%]2 * 15 + [28. 3% − 18. 9%]2 * 15 =17%

σ = σ2 = (𝑤2σ2 + 𝑤2σ2 + 2𝑤 𝑤 σ 𝑃 𝑃 𝐴 𝐴 𝐵 𝐵 𝐴 𝐵 𝐴,𝐵

= (0. 5)2(17%)2 + (0. 5)2(17%)2 + 2 * 0. 5 * 0. 5 * 0. 1335 = 29. 74%

2. What is the expected return for stock VNM if it has a beta of 0.8, the expected market return is

15 percent and the expected risk – free rate is 2 percent? Answer:

Using CAPM model as the following to answer:

𝑅 = 𝑅 + (𝑅 − 𝑅 ) * β 𝑒 𝑓 𝑀 𝑓 In which:

𝑅 : expected rate of return of stock = ? 𝑒

𝑅 : rate of return of risk - free security = 2% 𝑓

𝑅 : expected rate of return of market = 15% 𝑀

(𝑅 − 𝑅 : market risk premium = 15% - 2% = 13% ) 𝑀 𝑓 Beta - β = 0.8 =>

𝑅 = 𝑅 + (𝑅 − 𝑅 ) * β = 2% + 13% * 0. 8 = 12. 4% 𝑒 𝑓 𝑀 𝑓

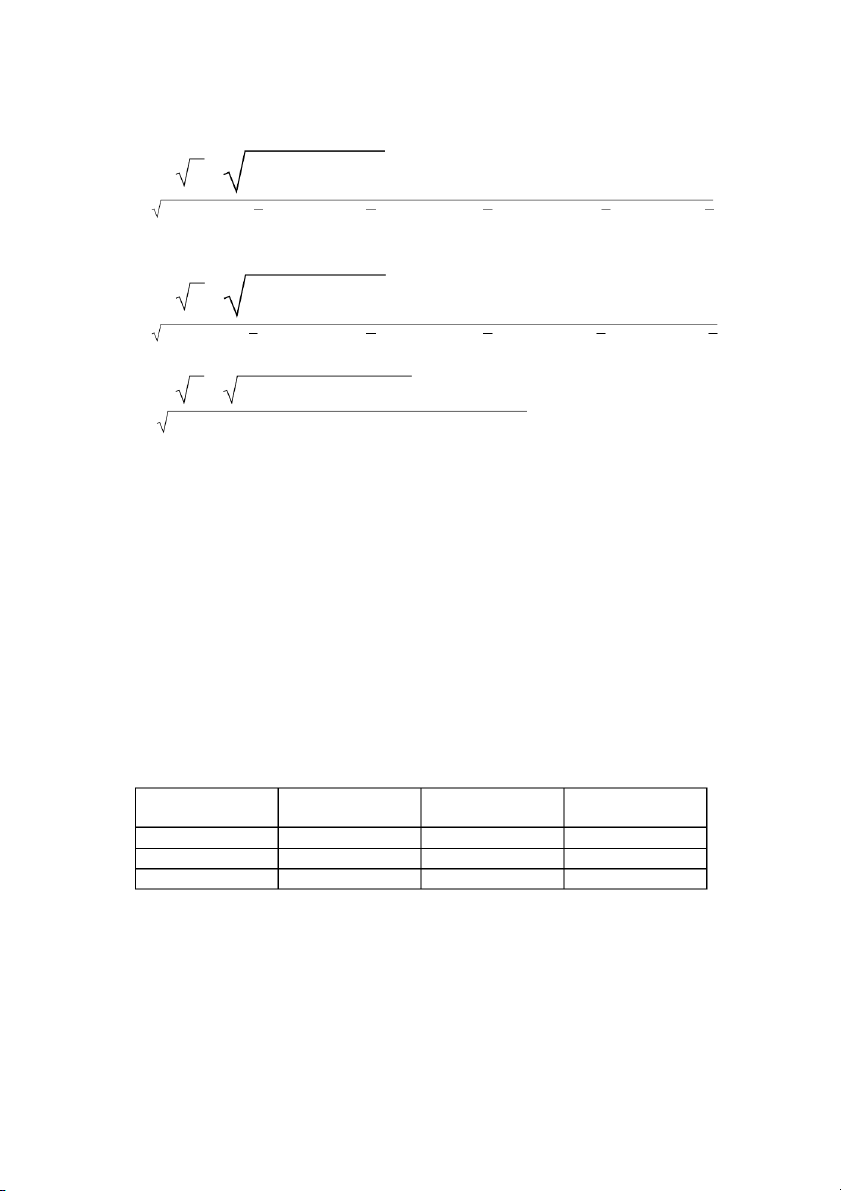

3. Assume you collect the following information of return of stock X and bond Y according

to the situation of the economy: Scenario Rate of return of Rate of return of Probability stock X Bond Y Recession 0.25 -8.2% 5.3% Normal 0.50 12.3% 6.8% Expansion 0.25 25.8% 7.9% Ms. Tran Thi Hoang Vi Corporate Finance Class

a. Expected return of stock X and bond Y. Answer: 𝑛=3

𝐸(𝑅 ) = ∑ 𝑃 * 𝑅 = 𝑃 * 𝑅 + 𝑃 * 𝑅 + 𝑃 * 𝑅 𝑋 𝑖=1 𝑖 𝑋𝑖

𝑅𝑒𝑐𝑒𝑠𝑠𝑖𝑜𝑛

𝑋,𝑅𝑒𝑐𝑒𝑠𝑠𝑖𝑜𝑛 𝑁𝑜𝑟𝑚𝑎𝑙 𝑋,𝑁𝑜𝑟𝑚𝑎𝑙

𝐸𝑥𝑝𝑎𝑛𝑠𝑖𝑜𝑛

𝑋,𝐸𝑥𝑝𝑎𝑛𝑠𝑖𝑜𝑛

= 0. 25 * (− 8. 2%) + 0. 5 * 12. 3% + 0. 25 * 25. 8% = 0. 1055 𝑛=3

𝐸(𝑅 ) = ∑ 𝑃 * 𝑅 = 𝑃 * 𝑅 + 𝑃 * 𝑅 + 𝑃 * 𝑅 𝑌 𝑖=1 𝑖 𝑌𝑖

𝑅𝑒𝑐𝑒𝑠𝑠𝑖𝑜𝑛

𝑌,𝑅𝑒𝑐𝑒𝑠𝑠𝑖𝑜𝑛 𝑁𝑜𝑟𝑚𝑎𝑙 𝑌,𝑁𝑜𝑟𝑚𝑎𝑙

𝐸𝑥𝑝𝑎𝑛𝑠𝑖𝑜𝑛

𝑌,𝐸𝑥𝑝𝑎𝑛𝑠𝑖𝑜𝑛

= 0. 25 * (5. 3%) + 0. 5 * 6. 8% + 0. 25 * 7. 9% = 0. 067

b. Standard deviation of stock X and bond Y Answer: 𝑛=3 σ = ∑ 𝑅

( − 𝐸(𝑅 ))2 * 𝑃 = ⎡⎢(𝑅 − 𝐸 𝑅 ⎤ 2 ⎡ ⎤ 2 ⎡ ⎤ ⎣ ( ))2 * 𝑃 ⎢ − 𝐸 𝑅 ⎣ ( )) * 𝑃 ⎢ − 𝐸 𝑅 ⎣ ( )) * 𝑃 𝑋 ⎥ ⎥ ⎥ 𝑖=1 𝑋𝑖 𝑋 𝑖

𝑋,𝑅𝑒𝑐𝑒𝑠𝑠𝑖𝑜𝑛 𝑋

𝑅𝑒𝑐𝑒𝑠𝑠𝑖𝑜𝑛⎦ + (𝑅𝑋,𝑁𝑜𝑟𝑚𝑎𝑙 𝑋

𝑁𝑜𝑟𝑚𝑎𝑙⎦ + (𝑅𝐸𝑥𝑝𝑎𝑛𝑠𝑖𝑜𝑛 𝑋

𝐸𝑥𝑝𝑎𝑛𝑠𝑖𝑜𝑛⎦ = (−

[ 8.2% − 0.1055)2 × 0.25]+ [(12.3% − 0.1055)2 × 0.5] + [(25.8% − 0.1055)2 × 0.25] = 0.1215 𝑛=3 σ = ∑ 𝑅 − 𝐸(𝑅 ) ( )2 * 𝑃 = ⎡ 2 2 ⎢(𝑅 − 𝐸 𝑅 ⎤ ⎡ ⎤ ⎡ ⎤ ⎣ ( ))2 * 𝑃 ⎢⎣ ( )) * 𝑃 ⎢⎣ ( )) * 𝑃 𝑌 ⎥ − 𝐸 𝑅 ⎥ − 𝐸 𝑅 ⎥ 𝑖=1 𝑌𝑖 𝑌 𝑖

𝑌,𝑅𝑒𝑐𝑒𝑠𝑠𝑖𝑜𝑛 𝑌

𝑅𝑒𝑐𝑒𝑠𝑠𝑖𝑜𝑛⎦ + (𝑅𝑌,𝑁𝑜𝑟𝑚𝑎𝑙 𝑌

𝑁𝑜𝑟𝑚𝑎𝑙⎦ + (𝑅𝐸𝑥𝑝𝑎𝑛𝑠𝑖𝑜𝑛 𝑌

𝐸𝑥𝑝𝑎𝑛𝑠𝑖𝑜𝑛⎦ = (5. 3% − 0. 067)2 × 0. 25 [ ]+ (6.8% − 0.067)2 × 0.5 [ ] + (7.9% − 0.067)2 × 0.25 [ ] = 9. 25×10−3

c. Calculate expected return of portfolio in which 40% of X and 60% of Y. Answer:

Portfolio’s expected return:

𝐸(𝑅 ) = 𝑊 * 𝐸(𝑅 ) + 𝑊 * 𝐸(𝑅 ) = 0. 1055 * 40% + 0. 067 * 60% = 0. 0824 𝑃 𝑋 𝑋 𝑌 𝑌 Ms. Tran Thi Hoang Vi Corporate Finance Class