Preview text:

H O C H I M I N H U N I V E R S I T Y O F B A N K I N G

S A I G O N I N T E R N A T I O N A L S C H O O L O F B U S I N E S S ASIAN FINANCIAL CRISIS

A N E V E N T T H A T B R I N G S U S B A C K T O #6 FULL NAME STUDENT ID Phung Hai Danh 050608200270 Nguyen Thuy Hai Giang 110302200008 Truong Bao Linh 050608200426 Dau Vu Thao Nhi 030736200179 Pham Ngoc Quynh Nhu 110302200017 Hoang Gia Thy 110302200028 Nguyen Bao Tran 110302200033 TABLE OF CONTENTS

THE CONCEPT OF THE 1997 MONETARY CRISIS - THE 1

BACKGROUND OF SOUTHEAST ASIA COUNTRIES 1 Definitions 2 Relative background in Asia 7

Why did East Asia attract so much capital before the crisis? 8

DEVELOPMENT - EFFECTS - LESSONS OF THE 1997 CURRENCY 9 Crisis developments

10 The causes of the East Asian currency crisis

12 How to deal with the crisis? 13 Lessons for countries

14 COMPARISON WITH THE 1997 CURRENCY THE CONCEPT O& F THE 1997 MONETARY

CRISIS SOUTHEAST ASIA'S BACKGROUND Financial crisis definition

In a financial crisis, asset prices Rapid currency depreciation see a sharp decrease in value,

resulted in stock market falls,

firms, and individuals are unable decreased import receipts, and

to pay their loans, and financial political unrest in East Asia.

institutions face a shortage of

The nations most impacted by this

liquidity. During a panic or bank crisis include Thailand, South

run, investors sell off their assets Korea, and Indonesia. The or withdraw cash from savings

unexpected decline in prices had a

accounts out of fear that their

significant impact on Hong Kong,

value will decline if they keep Malaysia, Laos, and the

them in a financial institution.

Philippines as well. Although not This is a common feature of significantly, China, Taiwan, financial crises.

Singapore, and Vietnam are also Moreover, the deflation of a impacted.

financial bubble, a stock market

Despite being known as the "East

crash, a sovereign default, or a

Asian" crisis because it started in currency crisis is further

that region, its repercussions were circumstances that could be worldwide in scope and had a

classified as a financial crisis. A

significant impact on the rest of

financial crisis might only affect

the world. nations including the

certain banks, or it might affect US, Brazil, and Russia.

the entire global economy or just

In order to stabilize the Asian one particular economy. economies, the International Monetary Fund (IMF) stepped in

Asian financial crisis definition and provided several bailouts

(rescue packages). Roughly $110

The Asian financial crisis, also

billion in short-term loans were

known as the "Asian Contagion,"

advanced to Thailand, Indonesia,

was a series of devaluations of and South Korea to help them

currencies and other occurrences

stabilize their economies. They

that started in the summer of 1997

thus had to adhere to stringent and spread throughout various requirements such as greater Asian economies. The

taxes, higher interest rates, and

government's decision to no longer less public spending.

tie the local currency to the dollar caused the currency markets to

first crash in Thailand (in the USD form of currency). 1

R E L A T I V E B A C KG R O U N D

Ro o t c au s e s : Ec o n o m i c m o d e ls o f S ou t h e a st A s i an c o u n tr i e s .

Production only focuses on exporting to foreign countries, leading to a balance trade deficit.

Attach your Southeast Asia currency to the USD Dollar.

The exchange rates are not flexible.

The demand for domestic goods from international consumers drives

domestic manufacturing. Meanwhile, the demand of the domestic market

for its own goods is almost forgotten, in the long run, the national

currency of Southeast Asia is compelled to fluctuate against the US dollar.

The unstable economic model in Southeast Asian countries was the first

step that pushed Southeast Asian countries into the 1997 financial crisis.

19 9 7 A S I AN F I NA N C IA L CR I S I S

Foreign investors are rushing to invest money in Thailand in order to benefit from

this country's growth potential. But over time, these funds have become more and

more concentrated on speculative sectors like the real estate market. By 1997, Thai

banks held $15 billion in bad loans from real estate investors.

In the middle of the 1990s, the Fed initiated a policy of raising the dollar's credit

interest rates to reduce the risk of inflation in the US. The US gradually received

money from regions that used to have high-interest rates, and Southeast Asian

nations then increased interest rates to attract investors. The increase in interest

rates leads to the appreciation of the currencies of Southeast Asian countries, which

makes most of these countries start to face a decline in export growth. Additionally,

Thai companies were less able to pay back their debts due to the decrease in exports

throughout 1997, hence raising the possibility of baht depreciation.

When the currency depreciates, the external debt burden suddenly increases greatly

(paid in USD Dollars and there is no precaution when the currency depreciates).

Furthermore, the investments are no longer able to generate commensurate returns

to repay the loans. It eventually led to a large-scale capital run. 2

Direct causes: Speculative attacks and mass capital outflows from Asian countries.

At that time, there was a lot of credit available, which led to a highly

leveraged economic climate and unsustainable asset price levels,

particularly in the case of real estate. When the value of this asset

inevitably drops, people and businesses default.

It also leads to the withdrawal of a sizable quantity of credit from the

crisis countries at the time, causing a credit crisis and ongoing bankruptcy.

To prevent a collapse in currency values, the governments of these

crisis countries raised domestic interest rates to extremely high levels

and bought any excess local currencies at the fixed exchange rate

(intervened in the exchange market).

However, neither of these policies can be sustained for long, because:

Some countries do not have enough foreign exchange reserves.

Excessively high-interest rates can be extremely damaging to an

economy in recession with limited foreign exchange reserves.

The administrations ceased defending the fixed exchange rate and

allowed these countries' currencies to float once it became evident that

the capital leaving these countries was inexorable. More bankruptcies

and a worsening of the crisis are the results. Another cause: Moral hazard.

Definition: A situation in which people or organizations do not suffer

from the results of their bad decisions, so may increase the risks they take. Description:

MH circumstances are commonplace in the economy. The idea has so

been used in a variety of situations. Last but not least, it was utilized to

explain financial crises by connecting them to the "irresponsible" actions

of lenders, creditors, depositors, investors, businesses, banks, etc. The

presence of "insurers" like governments and even IFIs, such as the

International Monetary Fund (IMF), as a global "lender of last resort,"

undoubtedly had an impact on these actors' conduct (LLR).

As a result, MH was used as evidence to support the theory that very

significant capital flows contributed to the construction of massive

financial bubbles in emerging markets, notably in East Asia. The new

"capital account" crises of the twenty-first century were distinct from the

previous debt crises, which mostly affected current accounts (e.g.,

commodity-price shocks, interest-rate shocks, etc.).

MH "explains" why the private sector engaged in excessive borrowing

and lending in the years leading up to the Asian crises and why this

contributed to the development of financial vulnerabilities. 3 THAILAND

Thailand maintained the value of the baht at

a consistent level from the 1980s through

the 1990s, and this, combined with low

inflation and steady GDP development,

made Thailand a very attractive investment market. Thailand received investments

totaling more than USD 100 billion in just ten years, from 1987 to 1996.

Unstable economic model: To start, the

demand for imports rose faster than the

demand for exports, resulting in a current

interest deficit of (-8%) in Thailand. Second,

with roughly 45% of total debt being short-

term, Thailand is no longer concentrating

on economic development and instead uses

the majority of its income to pay off debt as

quickly as possible. Third, while the foreign

debt is high, the dollar reserve is steadily

declining and is insufficient to make a

difference in the country's monetary status

(the Dollar reserve decreased from 31.6% in

1994 to 29.5% in 1995 to 26.6% in 1996).

Fourth, at this point, foreign investment

funding flows are utilized for speculative

rather than production-related investments (Real Estate). Thailand and some Southeast Asian

countries have tried to conduct the policy

called the “Impossible trinity”, including

free capital flow, fixed exchange rate, and sovereign monetary policy.

Thailand has allowed for the free flow of

capital while fixing the value of its currency

to the US dollar. Southeast Asia's swift

economic development during the 1980s

and the early part of the 1990s put pressure

on the local currency to increase in value. The Southeast Asian central banks

implemented an easy monetary policy to

safeguard the fixed exchange rate. In turn,

this results in inflationary pressure when

the money supply is increased. In order to

counteract hidden inflation and encourage capital inflows into the economy, a

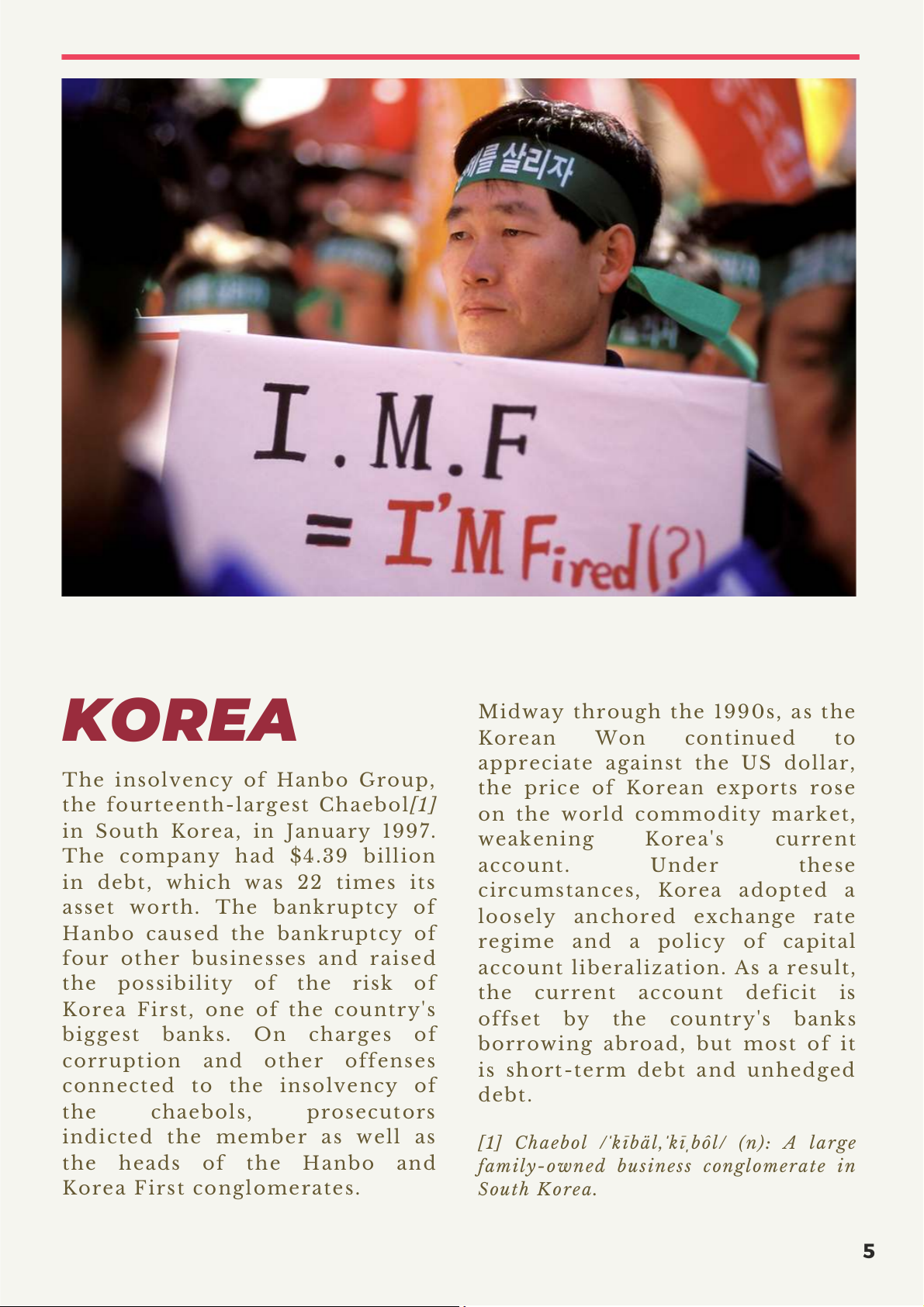

sterilization policy has been implemented. 4 KOREA

Midway through the 1990s, as the Korean Won continued to

appreciate against the US dollar, The insolvency of Hanbo Group,

the price of Korean exports rose

the fourteenth-largest Chaebol[1] on the world commodity market,

in South Korea, in January 1997. weakening Korea's current The company had $4.39 billion account. Under these

in debt, which was 22 times its circumstances, Korea adopted a asset worth. The bankruptcy of loosely anchored exchange rate Hanbo caused the bankruptcy of regime and a policy of capital

four other businesses and raised

account liberalization. As a result, the possibility of the risk of the current account deficit is

Korea First, one of the country's offset by the country's banks biggest banks. On charges of

borrowing abroad, but most of it corruption and other offenses

is short-term debt and unhedged connected to the insolvency of debt. the chaebols, prosecutors indicted the member as well as

[1] Chaebol /ˈkībäl,ˈkīˌbôl/ (n): A large the heads of the Hanbo and

family-owned business conglomerate in Korea First conglomerates. South Korea. 5 I N D O N E S I A E C O N O M I C

GDP growth climbed from 6.1% yearly in 1980-1990 to 7.6% in 1990-1995 and 7.8%

in 1996. This steady rate of expansion is linked to a dramatic diversification of the economy.

Between 1985 and 1995, the manufacturing sector's activity increased at a 10%

annual pace and contributed 25% of the country's GDP. Textiles and clothes, wood

products, and petrochemicals are only a few of the many things that are exported.

Commodity export growth averaged 15% from 1986 to 1993. In 1997, the growth of

the GDP started to decline to 5%.

Indonesia now accounts for 32% of global investments. Additionally, domestic

savings rose (31% in 1996) and continued to provide funding for around 90% of domestic investment.

Performance in terms of employment is less outstanding. The structure of

employment by industry has changed significantly, yet the rate of job growth is

slower than the rate of labor force growth. E M P L O Y M E N T

Throughout the years 1985 to 1995, the growth rate of employment gradually

climbed. However, due to the crisis, during the years 1985 to 1989, this rate

gradually dropped. The open unemployment rate has been rising over time.

Urban areas and educated persons are more likely to have unemployment issues,

with jobless rates among those with a university degree growing from 6.7% in 1990

to 11.5% in 1995. Almost two-thirds of all employment is still in the informal

sector, and nearly one-third of all workers are underemployed, meaning they

work fewer than 35 hours per week. The informal sector still dominates the job

market and there is a significant percentage of underemployment. S O C I A L S E C U R I T Y

Indonesia has performed admirably in terms of reducing poverty. Although they

did so to differing degrees and from different starting points, all provinces have

seen a gain in income, consumption, and employment, suggesting that the

benefits of growth have been fairly evenly spreading at various intensities.

Due to the year's severe drought, rice production — a staple of Indonesia's food—

is 4% lower than it was in 1996. As a result, after many years of self-sufficiency, the

nation must begin importing food. A consequence of the worst wildfire in almost

ten years on the agriculture and tourism industries.

The financial crisis has had an impact on Indonesia's economy at a time when

the nation is dealing with declining exports, slowing overall growth, and a

significant decline in rice production that has led to an increase in rice imports and food price forecasts. 6 WHY DID EAST ASIA ATTRACT SO MUCH CAPITAL BEFORE THE CRISIS? Singapore, Korea, Thailand, Malaysia, Indonesia, and the

Philippines, among others. They

were regarded as the world's best

investment locations at the time because: Average economic growth is between 8% and 10%.

The attractive interest rate for

investments and a thriving stock market.

Low inflation and a surplus in the budget. This fuels a drive to seize development possibilities, particularly those in Thailand,

where foreign investors are rushing

to pour cash into the economy. To

put it another way, Southeast Asian

nations are particularly attractive to

foreign fund inflows for short-term financial investment. 7

DEVELOPMENT - EFFECTS & LESSONS OF THE 1997 CURRENCY

Between 1985 and 1996, the Thai economy expanded by an

average of more than 9% per year, which was the highest

economic growth rate of any country at that time. Inflation was

kept in a manageable range of 3.4 - 5.7%. The USD/Baht exchange rate was 25.

Until June 14 - 15th, 1997, Thailand's currency market was full of

orders to sell baht. Thailand was ultimately compelled to float the

baht on July 2, 1997, enabling the money market to determine the

value of the currency because Thailand lacked foreign exchange

reserves to support the USD-Baht exchange rate. As a result, the

Baht swiftly declined in value and lost more than half of its

worth; in particular, in January 1998, when the exchange rate was USD/Baht 56. 8 NEGATIVE EFFECTS

Thailand's economy stagnated as a

result of widespread layoffs in the financial, real estate, and construction sectors, which

resulted in the return of 600,000 foreign employees. The market

capitalization of Thailand's stock

market decreased by 75%, from $141

billion to $23.5 billion. At the time,

Finance One, Thailand's largest

financial institution, failed. As a

result of the crisis, poverty and

inequality rose as social welfare, wages, and employment all declined. IMF RESCUE PLAN On August 11, 1997, the IMF

unveiled a rescue plan for Thailand

that included more than 17 billion USD and mandatory terms. On

August 20, 1997, there was also another rescue totaling $2.9 billion. RESULTS The Thai economy expanded in

2001. In 2003, the country's tax

collection increased, allowing it to

balance its budget and pay back the IMF. In October 2010, the Thai

baht strengthened more against the dollar, reaching 29 baht. 9 W I T H I N A S I A

Significant macro repercussions of the crisis included

asset price declines in various Asian nations, stock

market collapse, and currency devaluations. In 1997–

1998, a large number of enterprises failed, which

caused millions of individuals to fall below the poverty line.

Some countries did not face a crisis economically

because of the decline in exports and FDI inflows, but

the economy was nonetheless negatively impacted. The

decline in GDP and GNP per capita in USD caused by

the local currency's depreciation was one major and long-lasting effect.

Thailand's GDP per capita decreased from $8,800 in

1997 to $8,300 in 2005, Indonesia's from $4,600 to

$3,700, and Malaysia's from $11,100 to $10,400,

according to the CIA World Fact Book.

Large US investment in Thailand ceased, being

replaced largely by European investment, although Japanese investment remained. Politically:

The economic crisis sparked a political upheaval that

culminated in the resignations of Prime Minister

Chavalit Yongchaiyudh in Thailand and President Suharto in Indonesia. 10 OUTSIDE ASIA

Not only did the crisis spread to East Asia, but it also played a role

in the financial crises in Brazil and Russia.

International investors were hesitant to lend to emerging nations

after the Asian crisis, which caused an economic downturn in several of these nations.

For instance, the abrupt decline in oil prices to as little as $11 a

barrel in late 1998 led to economic hardship in OPEC and other oil-

exporting nations. Super corporations conducted a series of sizable

M&A transactions between 1998 and 2002 in an effort to offset the sharp decline in oil prices. 11 HOW TO DEAL WITH THE CRISIS?

The international world organized

significant loans totaling $118 billion to

Thailand, Indonesia, and South Korea in

reaction to the crisis's spreading.

Particularly, the IMF, the World Bank, the

Asian Development Bank, and governments

in the Asia-Pacific region, Europe, and the

United States provided financial support.

The fundamental plan was to assist crisis-

affected nations in replenishing reserve

buffers and making necessary policy

changes to boost confidence and stabilize the economy. People are now more conscious

of the need for a robust and open financial-banking system as a

result of the East Asian financial

crisis. Additionally, it sparked much-needed changes in the

financial and political systems of nations like Thailand, South Korea, Japan, and Indonesia. Today, economists may learn a

lot from the Asian crisis by using it as a case study, especially when it comes to managing national accounts and trading currencies.

Foreign bank loans and indirect foreign investment inflows may

hurt those countries economies. Many of the lessons from the

Asian financial crisis are still

relevant to today's situations and

can be utilized to prevent issues in the future. 12 LESSONS FOR COUNTRIES

First, investors need to be cautious of asset bubbles

because some of them can bust, leaving investors stranded.

Second, governments should monitor spending as another possible lesson. Third, any government-mandated infrastructure

expenditure might have fueled the asset bubbles that

sparked this crisis, and the same is true of any potential future occurrences.

Fourth, the best transparency and disclosure against

speculative attacks, especially in the banking and financial sector.

Fifth, there is a shift from fixed to floating exchange rates with management and regulation by the

government through the central bank.

Last but not least, effectively examine economic actors'

excessive risk-taking (which is fueled by vanity, greed

and moral hazard) through implicit guarantees and bailouts clear. 13 es g chan rs. cy crisis. isis, cr yea rren cy t 20 cu ex rren cu e n icy to a er th 1997 ov ys pol a ce d the a a pl fter Now A took ACTUAL CONTACT

First, the countries in crisis have now

Asia's nations are now, at long last,

lowered their investment and growth

cooperating to safeguard the area.

expectations to a level that can be

When the crisis was over in 2000,

sustained. Asian governments still

they established the Chiang Mai

emphasize growth, but not at all costs.

Initiative, a localized network of

Second, Southeast Asian countries

financial loans and currency swaps. In

now have more flexible exchange

order to regionalize the funding of

rates. No country has a fully flexible

infrastructure development, they now

exchange rate, and governments in have the Asian Infrastructure

the region have at least abandoned Investment Bank.

their dependence on the dollar, the Since 1997, China has seen

root cause of vulnerability in 1997. tremendous growth, and its

Third, countries like Thailand now

expanding leadership position has

run a surplus. The trade surplus

paved the door for institutional helped them accumulate foreign development and regional

exchange reserves, which acted as a

collaboration. Since the crisis, this is form of insurance.

the biggest development to have an impact on Asia. 14

Ba, A. D. (2022, 09 28). Asian financial crisis. Retrieved from Britannica:

https://www.britannica.com/event/Asian-financial- crisis

Le Phan Dieu Thao and Nguyen Tran Phuc. (2015). TAI

CHINH QUOC TE. Ho Chi Minh: NXB Phuong Dong. R

Luiz A. Pereira da Silva and Masaru Yoshitomi. (2001).

Can “Moral Hazard” Explain the Asian Crises? Asian E Development Bank Institute. FE

Singh, A. (1998). FINANCIAL CRISIS IN EAST ASIA:

"The End of the Asian Model?”. Development Policies

Department. ISBN 92-2-111037-0. N

THE INVESTOPEDIA TEAM. (2021, 04 28). Asian CE Financial Crisis. Retrieved from Investopedia:

https://www.investopedia.com/terms/a/asian- financial-crisis.asp S THIS PRODUCT BELONGS TO Group 6: SV5T

39 Ham Nghi St., Dist. 1, Ho Chi Minh City, Vietnam DH36DD01 INE307_221_K2D1 sv5thhhb@gmail.com GROUP 6: SV5T