Preview text:

Student: Huynh Viet Le Duy Thinh Student ID:2146158 Business Accounting

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS Module Business Accounting Student name: Huynh Viet Le Duy Thinh Student ID: 2146158 Tutor: Ngo Ngoc Thuyen Submission date: 16/01/2016 Term: T3-2015

Tutor Name: Ngo Ngoc Thuyen T3-2015 0

Student: Huynh Viet Le Duy Thinh Student ID: 2146158 Business Accounting TASK 1 ( P1) [Student’s writing]

Tutor Name: Ngo Ngoc Thuyen T3-2015 1

Student: Huynh Viet Le Duy Thinh Student ID: 2146158 Business Accounting P1

The Accounting is very important in business.They need accouting to record transaction , monitor

avtivity, control, management of the business and measure of finanncial performence.

Record Transaction : When we open the business, we have to record the finance information of this

business to caculate the money that the money in and the money out. The most important things that if our

outlet does not record the finance information , we will not have the information about tax and revenue

.Dave should need accouting to record the financial report of every month .For examples , the money that

Dave spend on by pants , shoes , shirt and the renting fee. Dave should record the cost on water,

electricity bills every month. We could have the penalties of the goverment about tax. When the outlet

does not record the revenue , they do not know the business has loss or they has profit. The business will

be fail if we do not record finance information , we would pay wrong tax and we do not understand

clearly the situation of the business.

Monitor Activity : Our outlet have to record and update the finance information frequenly . Because we

have to caculate the expenses of the oulet every day about the money going in the outlet and the cost that

we spend on our business. For examples , If we do not have accouting , we do not know the real reveure

or the profit of our Outlet in every month.This information will be provide for the business and we will

know the sales situation , the payment and the revenue of our business.

Control : The accounting will help we control our business. When our outlet have the conclit , having

the record of finance will have us solve that problem because we could know what need to be fixed and

we know where to start and recover situation. Based on the finance information , Handsome Outlet could

control the business and maintain between the cashflow and the cost . For example , if Handsome Outlet

has loss, the sales revenue is going down and the costs are too much , the owner will have the ways to cut

the costs and recover the sales revenue.

Management of the business : The manager who is the most important position in Handsome Outlet.

Dave run the business so he is also the manager of Handsome Outlet. He has responsibility to control ,

manage and develop the business of Outlet. Dave should have the knowledge about the accounting .

Because he has to manage and caculate the money pay on their staffs or the costs of this business.He has

to ensure that their decission will be good for the business and what Handsome outlet need to pay for

their business . He needs to have stragety planning for our business.Otherwise, he will help us with the

accounting problems of Handsome Outlet , he will caculate the revenue when Handsome Outlet have

discount for customers to compete with others competitor.

Measure of financial performence: If Handsome Outlet does not have the finance record , it is not

possible for them to know the business is making profit or loss by the net profit of the outlet .In case that

we are the credictor or we are the debtor..If the company does not record all the finance information , they

would not understand the financial performance that means they do not know how much the revenue of

the comppany and how much money they are owed and the others owed them..

Tutor Name: Ngo Ngoc Thuyen T3-2015 2

Student: Huynh Viet Le Duy Thinh Student ID: 2146158 Business Accounting

Tutor Name: Ngo Ngoc Thuyen T3-2015 3

Student: Huynh Viet Le Duy Thinh Student ID: 2146158 Business Accounting TASK 2 (P2) [Student’s writing]

Tutor Name: Ngo Ngoc Thuyen T3-2015 4

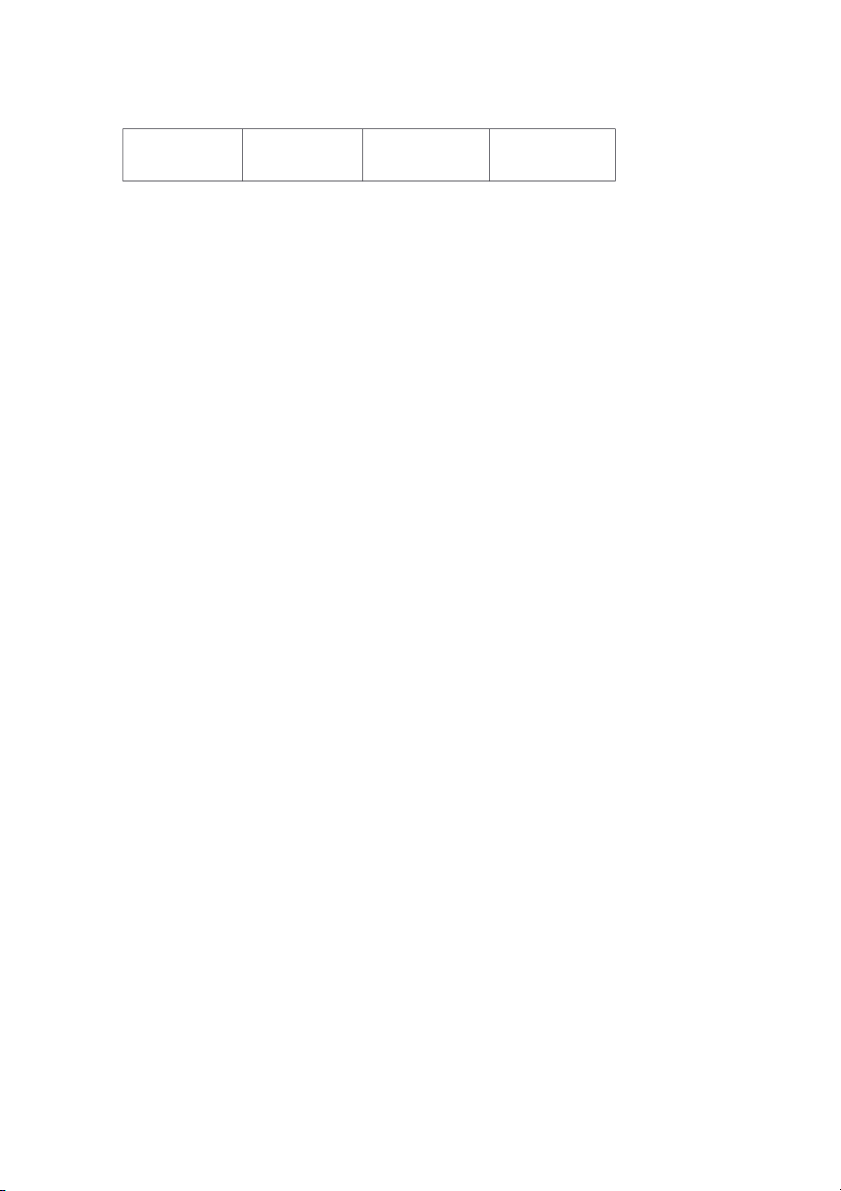

Student: Huynh Viet Le Duy Thinh Student ID: 2146158 Business Accounting P2 Company name Sony corporation LG Corporation Puma Core business Sony is largerest LG is the one lagest Puma is the company which technology company manufacturing company provides electronic about manufacturing which produce devides,mobile , consumer sportwears ,casual entertainment... in electronic,telecom,mobile footwear, in services,and home Herzogenaurach, Japan appliances.... Germany. Capital income The money that Long-term loans from The equity of shareholders invest in Korea Development Bank shareholders in 2014 is the company by bying 1.772,037,5 millions stock ( 549,040 (127,427 millions of USD (Puma ,2015) shareholders and USD) (LG, , 2015 and 1,262,216 shares in 2014, 2015) stock market, which revenue ) (Sony , 2015) Revenue income The sales and operating Gross profit of sale in Consolidated net sales of revenue were (75,410 2014 (587,501 millions of Puma in 2014 is about 3 millions U.S.D) from USD) (LG , 2015) billions of USD.(Puma , selling their products 2015) (Sony , , 2015) Capital expenditure The costs pay for The cost pay for property Capital expenditure rose assets : , machinery , ,plant , and equipment from 37 to 52 millions equipment and (899,282,millionsof USD PUMA invested in construction in progress USD ) (LG, 2015) opening more stores and are 24,712 millions refurbished their retail USD ( Sony , 2015) stores, their offices and IT equipments in 2014 (Puma ,2015) Revenue expenditure The costs that they pay The costs LG pays of The cost that they pay on for taxes , electronic promotion ,advertising, the marketing campaign bills , salary of their employees benefit

named ‘’ Forever Faster’’ employees,etc.. are (rewards , bonusess , in World Cup in Brazil is about pension,etc) are about about 1,332,5 millions of 1,802,467,millions of 9,378,465 millions of USD,retail expension,

Tutor Name: Ngo Ngoc Thuyen T3-2015 5

Student: Huynh Viet Le Duy Thinh Student ID: 2146158 Business Accounting USD ( Sony , 2015) USD (LG, 2015) marketing activities are about 1,187,337 millions of USD .(Puma,2015)

Tutor Name: Ngo Ngoc Thuyen T3-2015 6

Student: Huynh Viet Le Duy Thinh Student ID: 2146158 Business Accounting TASK 3 (P3)

Tutor Name: Ngo Ngoc Thuyen T3-2015 7

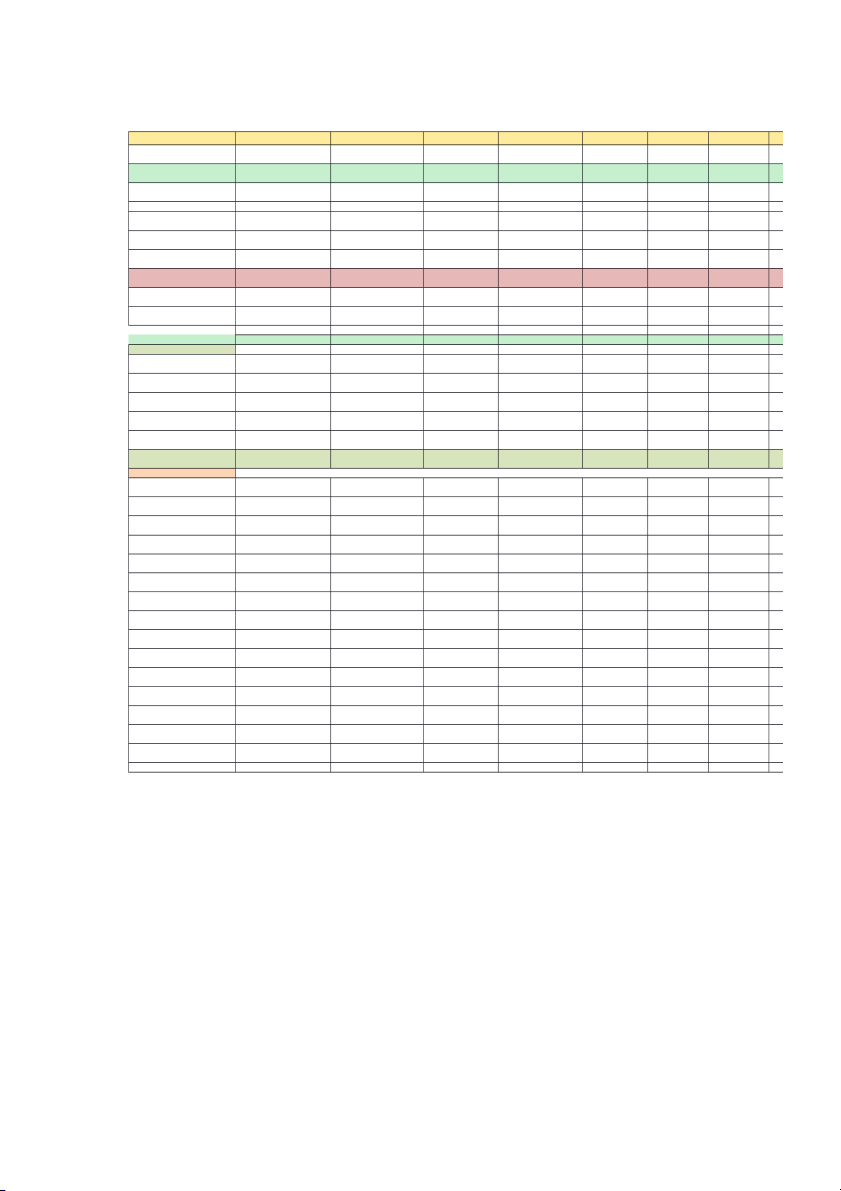

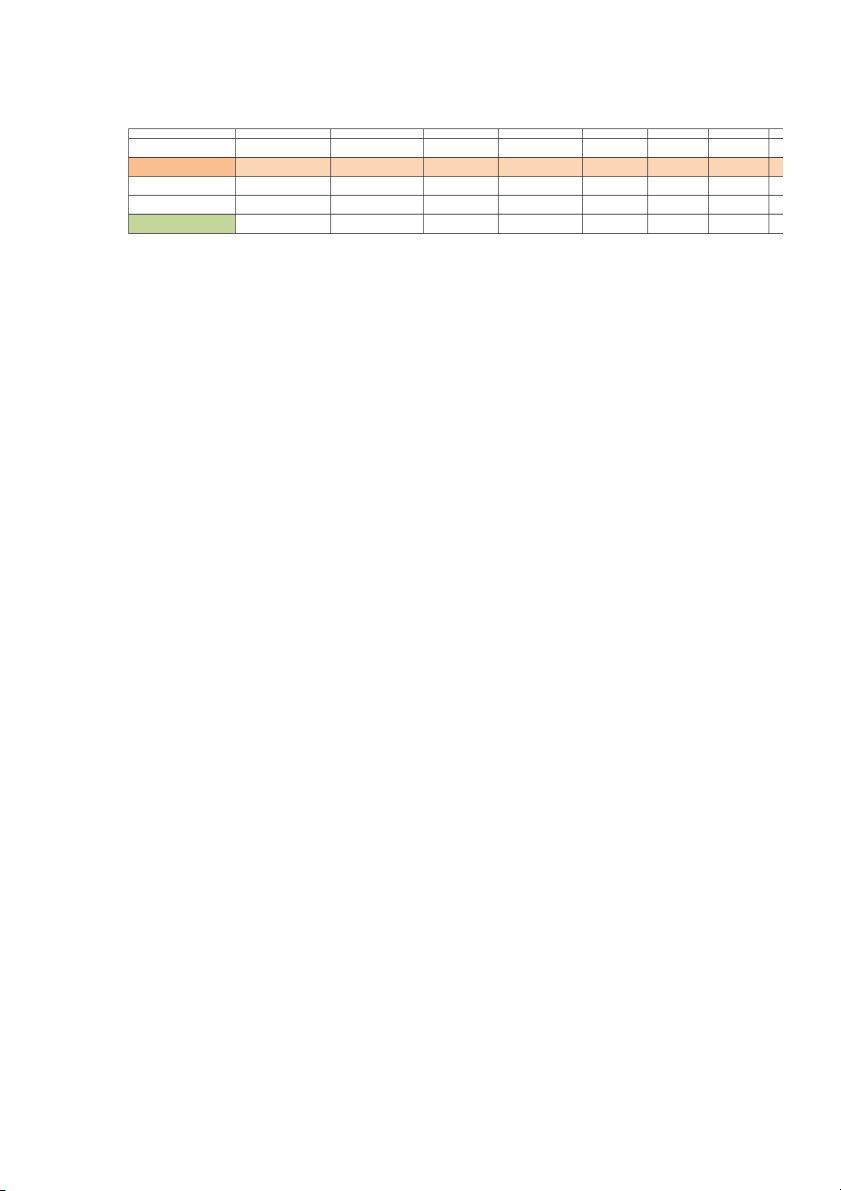

Student: Huynh Viet Le Duy Thinh Student ID:2146158 Business Accounting November December January February March April May Ju £ £ £ £ SALES £ 8.600 £ 6.000 9.000 £ 6.800 £ 7.000 9.000 9.300 7.2 £ £ £ £ CASH SALE £ 6.800 £ 4.200 9.000 £ 6.800 £ 7.000 9.000 9.300 7.2 £ £ £ £ CREDIT SALES £ 1.800 £ 1.800 1.800 £ 1.800 £ 1.800 1.800 1.800 1.8 COST OF GOODS SOLD £ £ £ £ (COGS) £ 7.310 £ 4.200 6.300 £ 4.760 £ 4.900 6.300 6.510 5.0 £ £ £ £ OPENING STOCKS £ - £ 2.940 4.410 £ 3.332 £ 3.430 4.410 4.557 3.5 £ £ £ £ CLOSING STOCKS £ 2.940 £ 4.410 3.332 £ 3.430 £ 4.410 4.557 3.528 4.1 £ £ £ £ TOTAL PURCHASE £ 10.250 £ 5.670 5.222 £ 4.858 £ 5.880 6.447 5.481 5.6 £ £ £ £ CASH PURCHASE £ - £ 10.250 5.670 £ 5.222 £ 4.858 5.880 6.447 5.4 £ £ £ £ CREDIT PURCHASE £ 10.250 £ 5.670 5.222 £ 4.858 £ 5.880 6.447 5.481 5.6 November December January February March April May Jun CASH INFLOWS INVESTMENT $ 8.000 BANK LOANS $ 4.000 $ $ $ $ VAT ON CASH SALES $ 1.190 $ 735 1.575 $ 1.190 $ 1.225 1.575 1.628 1.2 $ $ $ $ CASH SALES $ 6.800 $ 4.200 9.000 $ 6.800 $ 7.000 9.000 9.300 7.2 $ $ $ $ RECEIVED FROM GOV - $ - $ - - - - $ $ $ $ TOTAL INFLOWS (A) $ 19.990 $ 4.935 10.575 $ 7.990 $ 8.225 10.575 10.928 8.4 CASH OUTFLOWS FURNITURE $ 5.000 $ $ $ $ INTEREST RATE $ 20 $ 20 20 $ 20 $ 20 20 20 20 MACHINE $ 4.500 $ $ $ $ OVERDRAFT $ - $ - 27 $ 23 $ 35 40 44 41 $ $ $ $ DAVE'S SALARY 1.000 $ 1.000 $ 1.000 1.000 1.000 1.0 $ $ $ $ STAFFS'S SALARY $ 600 $ 600 600 $ 600 $ 600 600 600 600 $ $ $ $ ELECTRICITY $ 120 $ 120 120 $ 120 $ 120 120 120 120 $ $ $ $ RENT $ 350 $ 350 350 $ 350 $ 350 350 350 350 $ $ $ $ FUEL $ 100 $ 100 100 $ 100 $ 100 100 100 100 $ $ $ $ ADVERTISING $ 130 $ 130 130 $ 130 $ 130 130 130 130 $ $ $ $ TELEPHONE $ 75 $ 75 75 $ 75 $ 75 75 75 75 $ $ $ $ STATIONERY $ 140 $ 140 140 $ 140 $ 140 140 140 140 $ $ $ $ INSURANCE $ 500 $ 500 500 $ 500 $ 500 500 500 500 VAN $ 2.000 $ $ $ $ PURCHASE $ - $ 10.250 5.670 $ 5.222 $ 4.858 5.880 6.447 5.4 VAT ON CASH PURCHASE $ - $ 1.794 $ $ 914 $ 850 $ $ $

Tutor Name: Ngo Ngoc Thuyen T3-2015 1

Student: Huynh Viet Le Duy Thinh Student ID: 2146158 Business Accounting 992 1.029 1.128 959 $ $ PAY FOR GOVERMENT 430 983 $ $ $ $ TOTAL OUTFLOWS $ 11.535 $ 16.079 10.154 $ 9.194 $ 8.778 10.967 10.654 9.5 $ $ $ $ $ NET CASH FLOW $ 8.455 $ (11.144) 421 $ (1.204) (553) (392) 273 (1. $ $ $ $ $ OPENING BALANCE $ - $ 8.455 (2.689) $ (2.268) (3.472) (4.024) (4.416) (4. $ $ $ $ $ CLOSING BALANCE $ 8.455 $ (2.689) (2.268) $ (3.472) (4.024) (4.416) (4.143) (5.

Tutor Name: Ngo Ngoc Thuyen T3-2015 2

Student: Huynh Viet Le Duy Thinh Student ID: 2146158 Business Accounting TASK 4 (P4)

Tutor Name: Ngo Ngoc Thuyen T3-2015 3

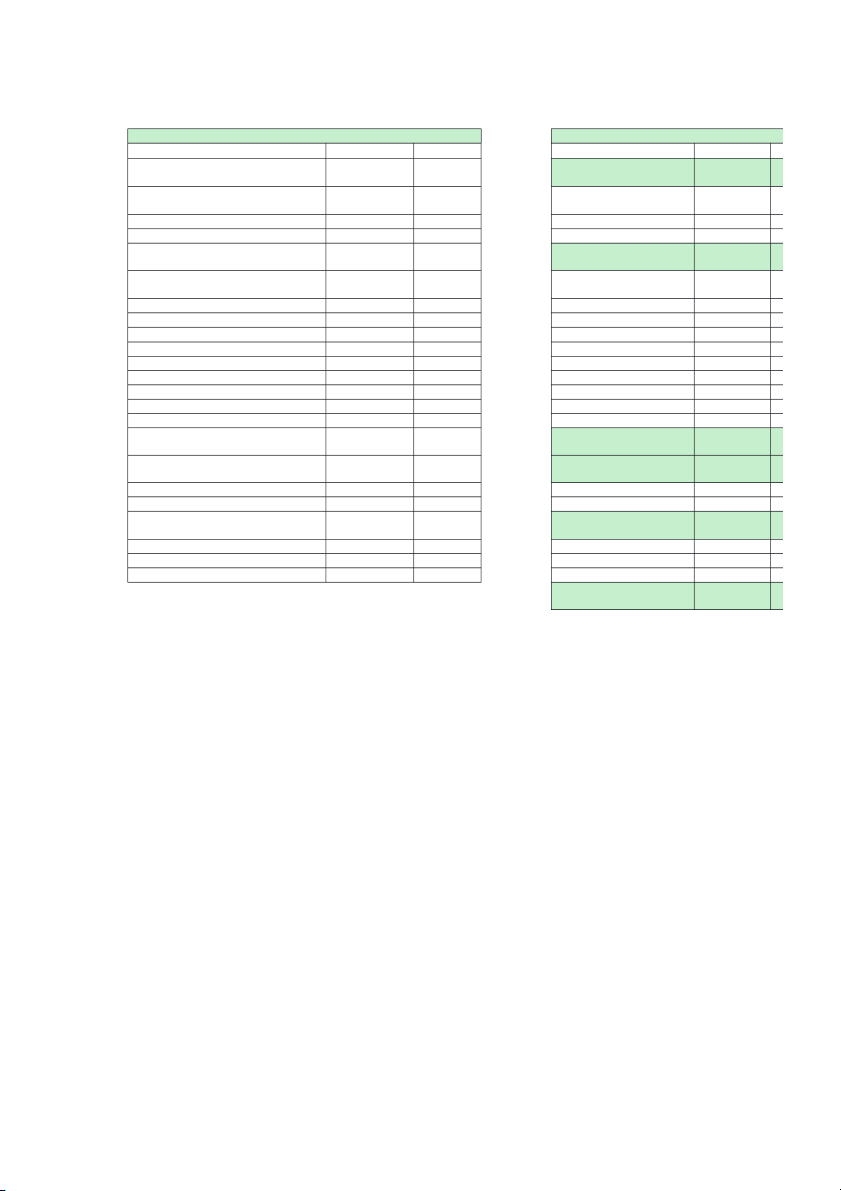

Student: Huynh Viet Le Duy Thinh Student ID: 2146158 Business Accounting HANDSOME OUTLET HANDSOME OUTLET

Tutor Name: Ngo Ngoc Thuyen T3-2015 4

Student: Huynh Viet Le Duy Thinh Student ID: 2146158 Business Accounting P&L ACCOUNT BALANCE SHEET £ £ £ £ £ SALE 94.900 CURRENT ASSET £ COST OF GOODS SOLD (COGS) 67.720 CASH 0 OPENING STOCKS £ - DEBTOR £ 4.230,00 (+) PURCHASE £ 72.130 STOCK £ 4.410 $ (-) CLOSING STOCKS £ 4.410 NON CURRRENT ASSET 10 £ GROSS PROFIT 27.180 VAN EXPENSES AT COST $ 2.000 OVERDRAFT $ 465 DEPRECIATION $ 183 STAFF'S SALARY $ 7.200 FURNITURE DAVE'S SALARY $ 10.000 AT COST $ 5.000 ELECTRICITY $ 1.440 DEPRECIATION $ 500 RENT $ 4.200 MACHINE FUEL $ 1.200 AT COST $ 4.500 ADVERTISING $ 1.560 DEPRECIATION $ 450 TELEPHONE $ 900 TOTAL DEPRECIATION $ $ STATIONERY $ 1.680 Total asset 19 $ INTEREST RATE $ 240 OWER'S EQUITY (8 INSURANCE $ 6.000 Capital $ 8.000 Depreciation $ 1.133 Retained earning -£ 8.839 $ £ Total expenses 36.019 LIABILITIES 19 Net profit -£ 8.839 CREDITOR £ 7.032 Withdraw 0 OVERDRAFT $ 8.813 Retained Earning -£ 8.839 BANK LOANS $ 4.000 $ Total equity and liabilities 19

Tutor Name: Ngo Ngoc Thuyen T3-2015 5

Student: Huynh Viet Le Duy Thinh Student ID: 2146158 Business Accounting TASK 8 (P5)

Tutor Name: Ngo Ngoc Thuyen T3-2015 6