TRƯỜNG ĐẠI HỌC THƯƠNG MẠI

VIỆN KINH DOANH QUỐC TẾ VÀ LOGISTICS

BỘ MÔN KINH TẾ QUỐC TẾ

BÀI TẬP LỚN

HỌC PHẦN: International Investment

MÃ LỚP HỌC PHẦN: 251_FECO2631_01

GVGD: Nguyễn Thị Thanh

MÃ ĐỀ/TÊN ĐỀ TÀI: CÂU 8

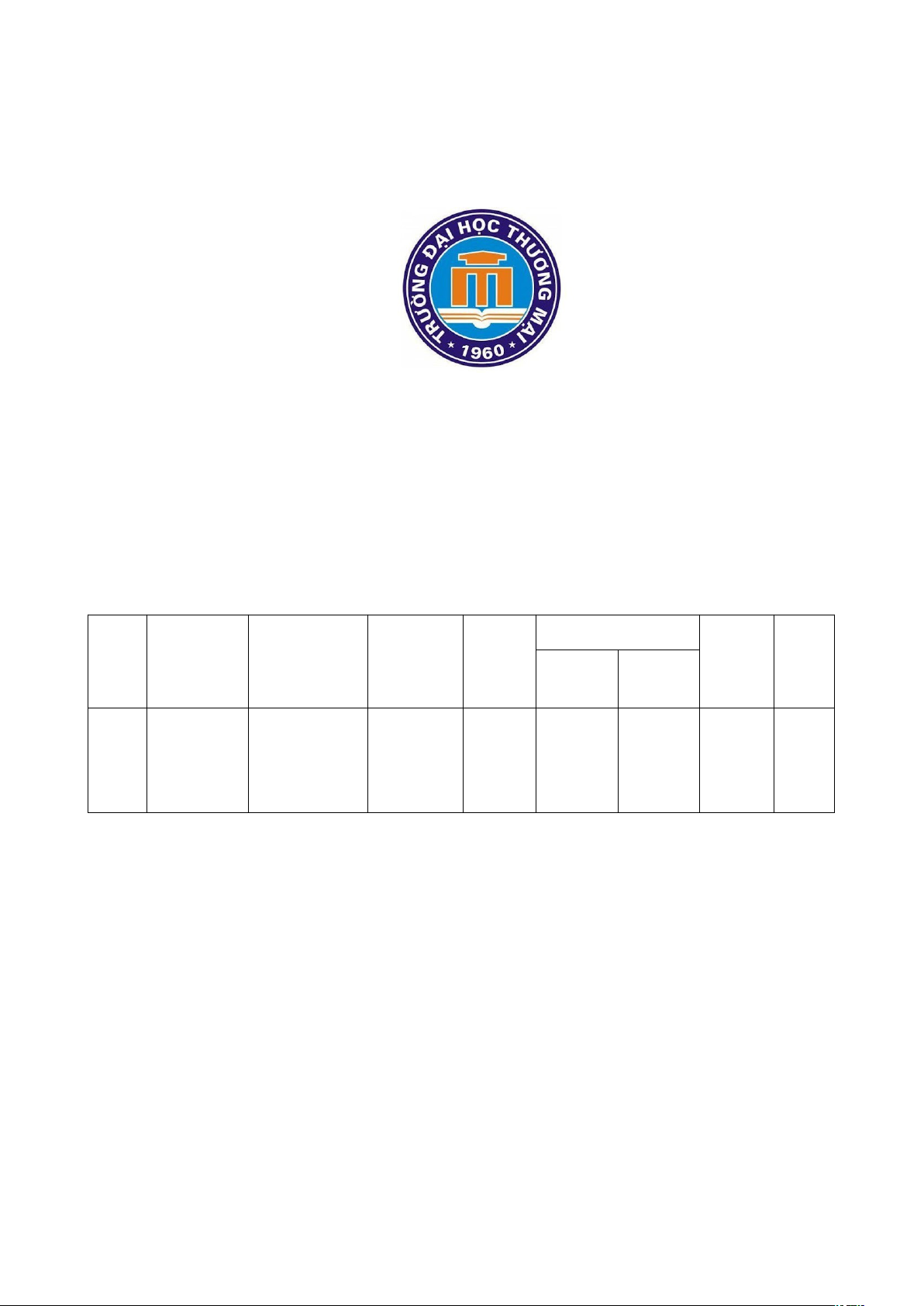

SBD Họ và tên Mã số SV LHC Ký

nộp

Điểm BTL Điểm

kết

luận

Ghi

chú

Chấm

1

Chấm

2

39

Nguyễn

Thị

Phương

Thảo

23D131043 K59EE1 Thảo

Hà Nội, ngày 23 tháng 12 năm2025

Cán bộ chấm 1

(Ký và ghi rõ họ tên)

Cán bộ chấm 2

(Ký và ghi rõ họ tên)

HỌC KỲ I NĂM HỌC 2025-2026

TABLE OF CONTENTS

INTRODUCTION.......................................................................................................5

CHAPTER 1. THEORETICAL FRAMEWORK OF CROSS-BORDER

MERGERS AND ACQUISITIONS............................................................................6

!

"#$%&

'()$($!&

*$+

**$+

",--$.

/$0$%1.

"%23!#$%4

"$1%!4

" $1%#$%4

""%$*%%'2('3

CHAPTER 2. PRACTICE OF CROSS-BORDER MERGERS AND

ACQUISITIONS IN VIETNAM...............................................................................13

5((6%!"

%$%6%71$"

8%*91'%#3()/

"1:%3#$!$3(:%;

/%6%

<(:$(!(6%

*('%%3(#$%

1$5=*(=82>3

"*8%-?1=1=@%-=

'(A

/-1-==%&

;1%%&

*2*3(@(-#$%6%

&

"%23!#$%(6%5 &

"%'%$%)2)&

" %'%8:52+

""%'%0==09-

+

"/%(*2(2+

/*-$!6%.

/0$$3(*!'.

/ (!:% 4

/"(7!$

;%)!0%%3('($

;:)%0,B!

; 25*(%$) /

;"C9*(6% ;

;/()!) ;

;;%(%30%'(

$ ;

CHAPTER 3. OVERALL ASSESSMENT AND POLICY

RECOMMENDATIONS...........................................................................................26

"0$%!$6%?)$A

"%%()$:$

" %%()$6%

""%%(6%%

" 1%(!$?>$A &

" 8D%* &

" 8,)!09@%- &

" "1'(6 &

" /1%$) +

" ;-16% +

""*((D$!6% +

""*(*-( +

"" *6% .

"""*:$ .

CONCLUSION..........................................................................................................30

REFERENCES...........................................................................................................31

(EFGG$GG(%2($%($

%G"

(EFGG$$G$2G(%"

(EFGG333$2%$G((G2(("

(EFGG333%$G(%GG(% 4 /

((%(% %G"

(EFGG$%3$G2G& +44G$($%

%%"

TABLE OF FIGURES

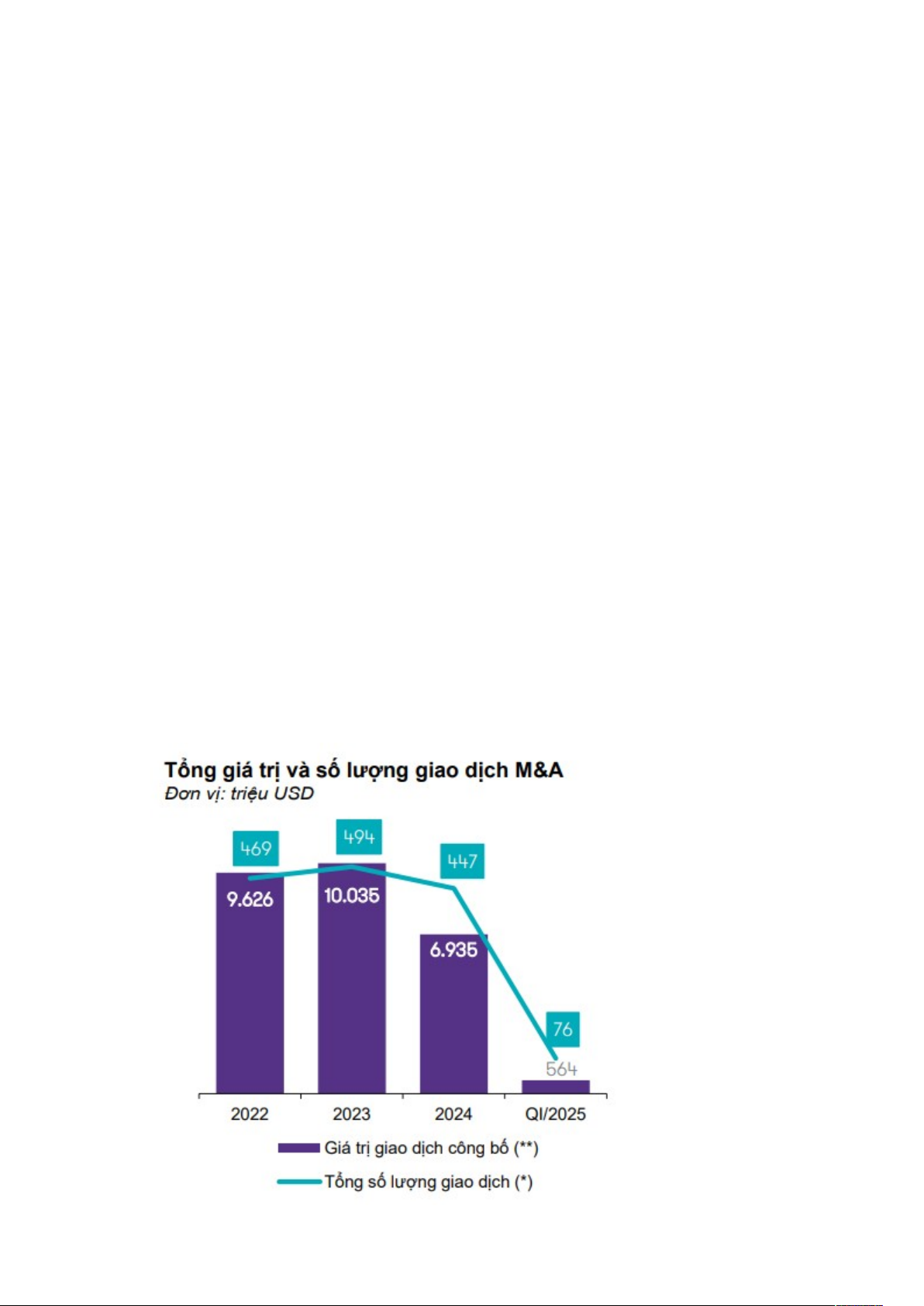

Figure 2.1. Total Value and Number of M&A Transactions in Vietnam, 2022–

Early 2025...................................................................................................................13

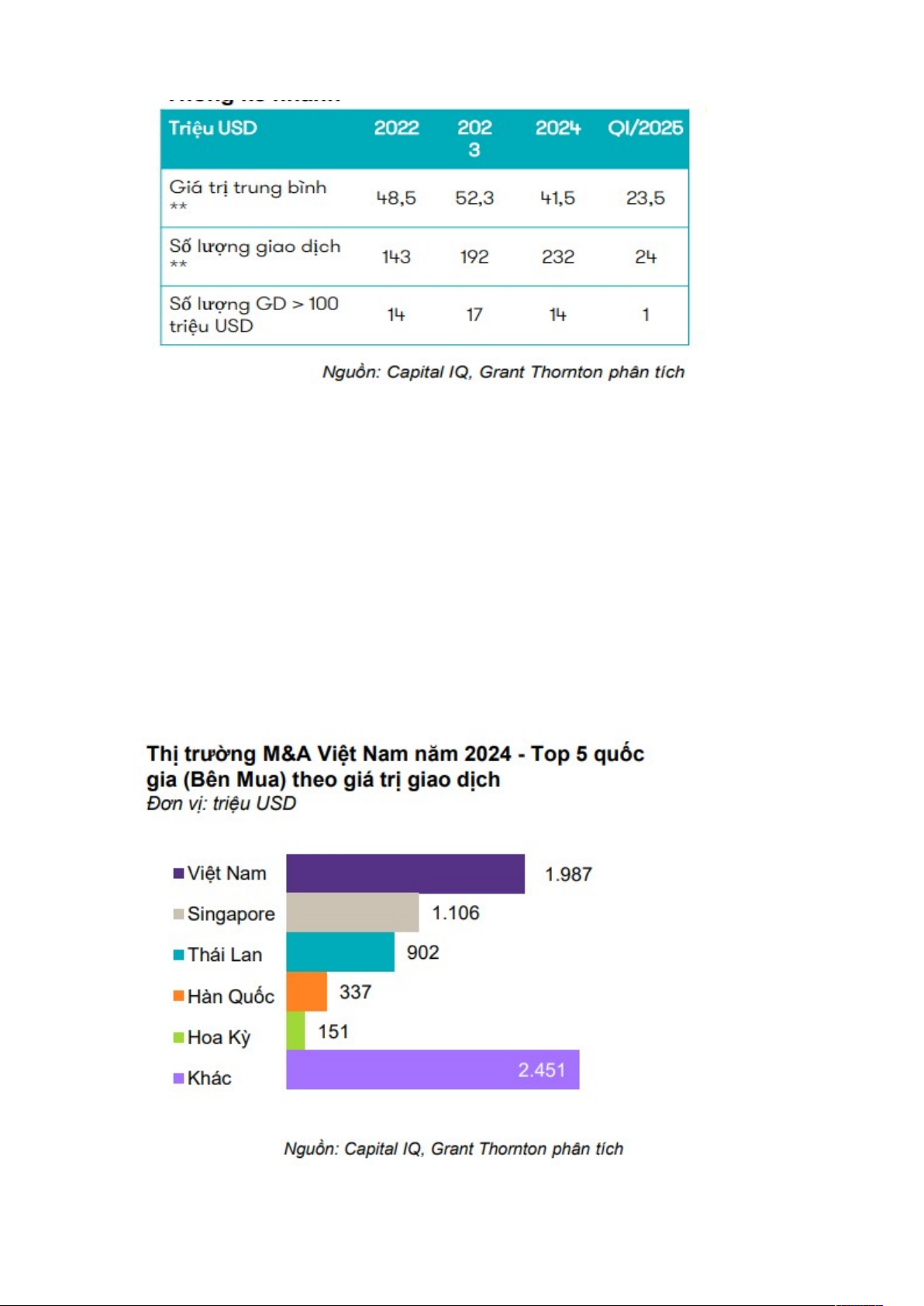

Figure 2.2. Vietnam’s M&A Market in 2024............................................................14

Figure 2.3. Vietnam’s GDP within ASEAN-6...........................................................15

Figure 2.4. Loan growth and profit growth of FE Credit.......................................20

Figure 2.5: FE Credit’s Revenue during the Period 2020–2025.............................23

Figure 2.6: FE Credit’s Profit by Quarter in 2025..................................................24

INTRODUCTION

In the context of deepening globalization and international economic integration,

cross-border mergers and acquisitions (M&A) have become one of the most important

forms of foreign direct investment (FDI), reflecting multinational enterprises’

strategies for market expansion and operational restructuring. For developing

economies such as Vietnam, M&A is not only a channel for attracting foreign capital

but also a means of acquiring technology, improving management capacity, and

promoting corporate restructuring.

In practice, instead of choosing greenfield investment, many foreign investors prefer

M&A as a faster and more efficient route to market entry. The theoretical literature on

the motives for cross-border M&A indicates that firms often undertake M&A to gain

market access, seek strategic assets, enhance operational efficiency, and overcome

legal and institutional barriers in host countries. Vietnam, with its large market size,

long-term growth potential, and certain sectors that impose constraints on new

investment, represents a typical destination for strategically oriented M&A

transactions.

Based on this theoretical and practical foundation, this essay focuses on analyzing why

foreign investors choose M&A as a mode of entry into the Vietnamese market rather

than greenfield investment, drawing on the theoretical framework of cross-border

M&A motives. On that basis, the paper selects and examines a representative case: the

acquisition by Sumitomo Mitsui Banking Corporation (SMBC) of a 49% stake in FE

Credit, one of Vietnam’s leading consumer finance companies, in order to assess the

extent to which the post-M&A outcomes align with the initial theoretical motivations.

CHAPTER 1. THEORETICAL FRAMEWORK OF CROSS-BORDER

MERGERS AND ACQUISITIONS

1.1. Concepts and Classification of International Market Entry Modes

1.1.1. Cross-Border Mergers and Acquisitions

An acquisition refers to a transaction in which one company obtains ownership and

control, in whole or in part, of another company or business entity.

A merger is the combination of two or more companies into an existing company or to

form a new company.

Mergers and acquisitions (M&A) are a form of investment in which an investor

acquires all or a sufficiently large portion of the assets of an existing business entity

with the objective of gaining control over that company, or absorbs another business

entity through a merger, or when two companies agree to combine to form a new

company.

Cross-border mergers and acquisitions (cross-border M&A) refer to M&A activities (a

form of foreign direct investment – FDI) conducted between parties from at least two

different countries. Fundamentally, the difference between M&A in general and cross-

border M&A lies in the presence of a foreign element or the cross-border movement of

capital.

1.1.2. Classification of M&A

M&A can be classified based on the following three typical criteria:

Classification by the production and business chain

Classification by the method of financing

Classification by the willingness of the parties involved

M&A by the Production and Business Chain

Horizontal M&A: This refers to M&A transactions between companies operating in

the same industry or between competitors with similar production processes and

markets.

Vertical M&A: This is a form of M&A between companies operating at different

stages within the same production chain for a final product. There are two types of

vertical integration: Backward integration, which involves a linkage between suppliers

and manufacturers; Forward integration, which involves a linkage between

manufacturers and distributors.

Conglomerate M&A: This refers to mergers or acquisitions between companies

operating in different industries. The objective of such transactions is to diversify

business activities, and they often attract companies with substantial cash reserves.

M&A by Method of Financing

Asset acquisition transactions involve the purchase and sale of assets of the target

company.

According to Article 105 of the 2015 Civil Code of Vietnam, assets include objects,

money, valuable papers, and property rights. Assets may be classified as immovable or

movable property and may be existing assets or assets formed in the future. In M&A

transactions, the assets acquired may be tangible (such as physical facilities,

equipment, machinery, etc.) or intangible (including brands, reputation, human

resources, supply sources, and others).

Share or capital contribution acquisition transactions involve the transfer of ownership

of shares or capital contributions in the target company from the existing shareholders

to the acquiring party. This type of transaction aims at taking over the target company

as a separate legal entity, rather than acquiring its business operations. The acquirer

purchases shares in the target company to obtain ownership and control. This is a

transaction between the share purchaser and the shareholders of the target company.

All assets remain under the ownership of the company; only the ownership structure of

the company changes.

M&A by the Willingness of the Parties

UNCTAD (2011) classifies M&A based on the nature of the transaction and the

willingness of the parties involved into two types: friendly M&A and hostile M&A.

Friendly M&A refers to mergers and acquisitions in which the management of the

target company agrees with and supports the transaction. Such deals typically arise

from the mutual interests of both the acquiring and target companies.

Hostile M&A, also known as non-cooperative M&A, refers to transactions in which

the management of the target company does not consent to the acquisition and

employs measures to resist the takeover by the acquiring company. Hostile M&A often

involves transactions where the takeover or merger causes losses to the target company

or its management.

1.1.3. Greenfield Investment

Greenfield investment refers to a form of foreign investment in which a foreign

investor contributes capital to establish a new production or business facility in the

host country. This form of investment is often highly valued by host countries because

it has the potential to increase capital inflows, create employment, and generate added

value for the economy.

1.2. Theoretical Perspectives on the Motives for Cross-Border M&A

Cross-border mergers and acquisitions (cross-border M&A) are one of the most

important forms of foreign direct investment (FDI), reflecting firms’ strategies for

international expansion. Unlike greenfield investment, M&A enables firms to gain

rapid access to markets, assets, and existing resources in the host country.

Research in international economics and strategic management identifies four main

groups of motives driving cross-border M&A: market-seeking, strategic asset-seeking,

efficiency and risk reduction, and the desire to overcome legal and institutional

barriers.

1.2.1. Market-Seeking Motives

Market-seeking is the most common motive in cross-border M&A, particularly in

developing countries. Under this motive, foreign firms undertake M&A to expand or

strengthen their presence in host-country markets characterized by large populations,

rapidly increasing purchasing power, or strong long-term growth potential.

First, M&A allows firms to enter markets quickly. Instead of building operations from

scratch through greenfield investment, foreign firms can acquire an established local

company and immediately gain access to existing customers, suppliers, and

distribution channels.

Second, through M&A, foreign firms can expand market share and enhance

competitiveness. Acquiring competitors or firms with strong market positions helps

reduce competitive pressure while enabling rapid penetration of the target market.

Third, market-seeking motives are also linked to the protection of export markets.

When exports face trade barriers such as tariffs, quotas, or technical standards, firms

tend to shift toward direct investment through M&A in order to maintain and expand

their market presence.

In the context of Vietnam, with its large population, growing middle class, and rapid

urbanization, market-seeking motives play a central role in foreign investors’ M&A

activities, particularly in consumer goods, retail, beverages, and financial services.

1.2.2. Strategic Asset-Seeking Motives

Strategic asset-seeking motives arise from foreign firms’ need to enhance their long-

term competitiveness. Under this motive, M&A is used as a tool to gain access to

strategic tangible and intangible assets that are difficult to develop internally in the

short term.

Such strategic assets typically include:

Strong domestic brands

Distribution networks and customer relationships

Technology, managerial know-how, and market data

Human resources with deep knowledge of the local market

Access to land, business locations, and industry-specific licenses

M&A enables foreign firms to internalize these assets by acquiring ownership or

control of the target company, rather than accessing them indirectly through

contractual arrangements.

In emerging markets such as Vietnam, many strategic assets are highly localized,

difficult to replicate, and not easily tradable. As a result, M&A becomes the most

effective pathway to acquire such assets.

Strategic asset-seeking motives are particularly evident in M&A transactions in sectors

such as banking, technology, modern retail, and energy, where licenses, customer data,

and market knowledge carry exceptional strategic value.

1.2.3. Efficiency and Risk Reduction Motives

Another important motive driving cross-border M&A is the optimization of

operational efficiency and the reduction of investment risk. Compared with greenfield

investment, M&A helps foreign firms significantly lower both costs and risks during

market entry.

In terms of costs, M&A allows firms to avoid substantial initial setup expenses, such

as constructing facilities, recruiting staff, establishing supply chains, and developing

management systems. Moreover, acquiring existing firms enables investors to exploit

existing scale, thereby reducing average production and distribution costs.

Regarding risk, M&A reduces information asymmetry and operational risk, as the

target firm is already familiar with the local legal environment, business culture, and

consumer behavior. This is particularly important in markets characterized by high

uncertainty or underdeveloped institutional frameworks.

In addition, M&A facilitates geographic risk diversification by enabling firms to

expand operations across multiple countries, thereby reducing dependence on any

single market.

In practice, many investors choose M&A in Vietnam as a way to mitigate market entry

risks, especially in capital-intensive industries or sectors with long investment cycles.

1.2.4. Motives to Overcome Legal and Institutional Barriers

Motives related to overcoming legal and institutional barriers reflect the reality that in

many countries, including Vietnam, greenfield investment by foreign investors is

subject to strict regulations concerning market entry conditions, ownership limits,

business licenses, and administrative procedures.

In this context, M&A serves as an indirect yet effective route for foreign firms to enter

the market. By acquiring equity stakes or control in domestic firms that already

possess the necessary licenses and legal status, foreign investors can significantly

reduce compliance costs and administrative processing time.

Furthermore, domestic firms often maintain established relationships with regulators,

partners, and the business community, which helps foreign investors adapt more

effectively to the host country’s institutional environment.

This motive is particularly prominent in sectors such as:

Banking and finance

Conditional retail sectors

Energy and infrastructure

Telecommunications and technology

In Vietnam, where certain industries continue to impose market access restrictions on

foreign investors, M&A plays a strategic role as a legitimate and effective instrument

for overcoming institutional barriers.

1.3. Comparison between M&A and Greenfield Investment in Market Entry

1.3.1. Advantages and Limitations of M&A

Advantages

M&A enables foreign firms to enter the market rapidly by taking over an existing

company that is already operating in the host country. Through M&A, investors can

leverage established brands, market share, customer bases, distribution networks, and

existing human resources, thereby significantly shortening the market entry period

compared with greenfield investment. In addition, M&A helps reduce information

asymmetry and institutional risk, as the target firm is already familiar with the local

legal environment, business culture, and consumer practices. In the context of many

countries imposing restrictions on greenfield investment by foreign investors, M&A is

widely regarded as an effective pathway to overcome legal and institutional barriers.

Limitations

M&A also involves significant risks. The cost of acquiring a target company is often

high, especially when the target has a strong market position. Moreover, post-M&A

integration frequently encounters difficulties due to differences in corporate culture,

management styles, and operational systems, which may reduce the expected

efficiency gains of the transaction. Foreign firms may also face risks related to hidden

liabilities, legal disputes, or a lack of financial transparency in the acquired company.

1.3.2. Advantages and Limitations of Greenfield Investment

Advantages

Greenfield investment allows foreign firms to exercise full control over business

operations, including strategy, governance structures, and corporate culture. This mode

of entry enables firms to build integrated production and business facilities, adopt

advanced technologies, and implement standardized management practices consistent

with their global strategies. Furthermore, greenfield investment typically avoids risks

associated with inheriting existing problems of local firms, while also contributing to

job creation and increased productive capacity in the host economy.

Limitations

Greenfield investment requires substantial capital, long implementation periods, and

high initial costs. Firms must build physical infrastructure from scratch, recruit

personnel, develop markets, and establish distribution networks, which leads to higher

market entry risks. In addition, foreign investors often face significant challenges in

obtaining licenses, accessing land, and complying with legal regulations, particularly

in markets with complex or underdeveloped institutional frameworks.

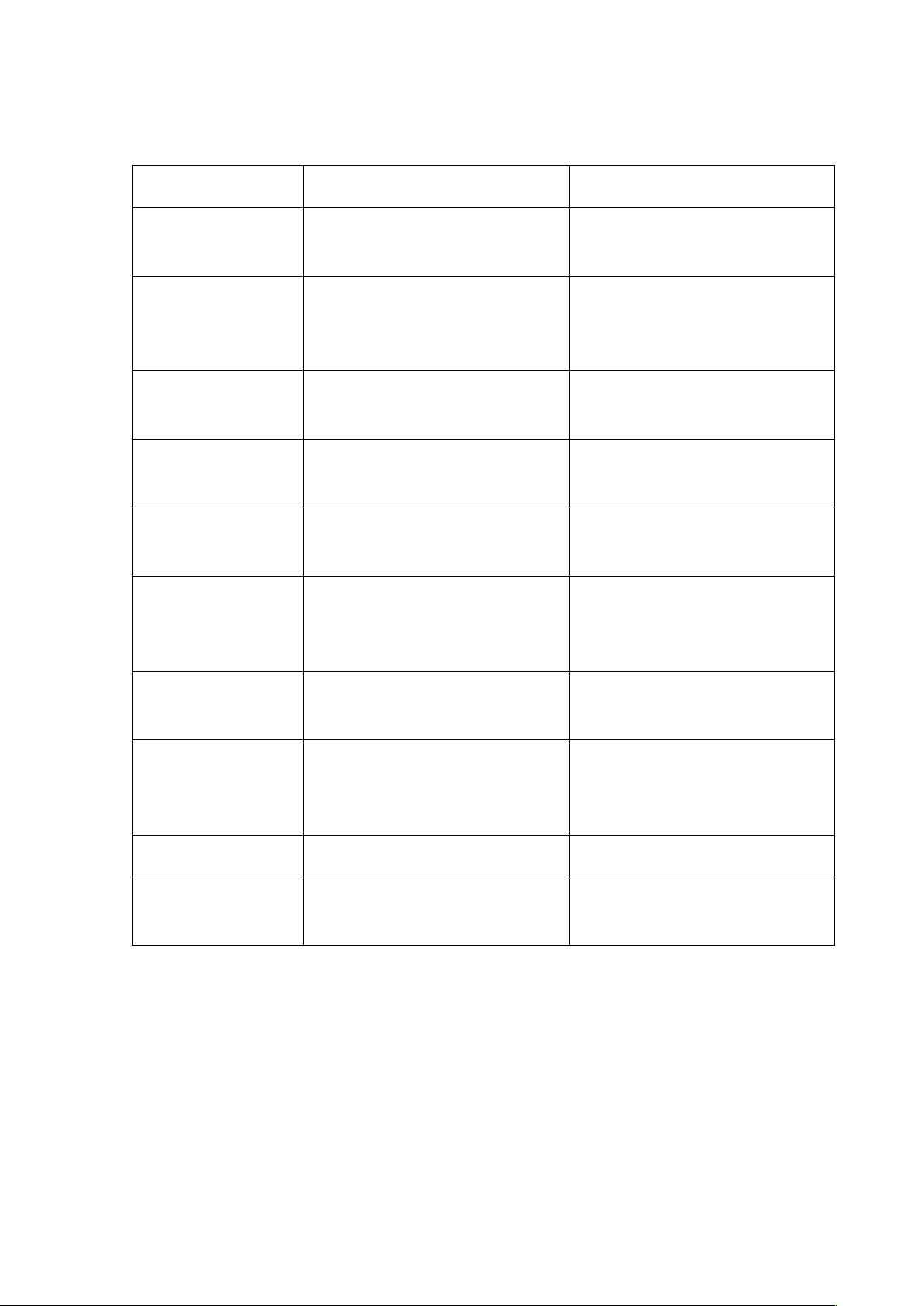

1.3.3. Comparative Summary Table of the Two Entry Modes

Criteria Cross-Border M&A Greenfield Investment

Nature of the mode

Acquisition or merger with an

existing firm in the host country

Establishment of an entirely

new firm or production facility

Primary objective

Rapid market entry, market

penetration, and access to

strategic assets

Building long-term production

capacity and exercising full

control

Speed of market

entry

Very fast (immediately after

transaction completion)

Slow (2–5 years to reach stable

operations)

Initial costs

High, concentrated in the

acquisition price

High, but spread across multiple

stages

Market risk

Lower (the firm already has

revenue and market share)

Higher (no existing customers

or brand presence)

Operational risk

Higher (cultural conflicts and

post-M&A integration

challenges)

Lower (operations aligned with

parent company standards)

Ability to overcome

legal barriers

Strong (target firm already holds

licenses and land-use rights)

Limited (requires new

approvals; lengthy procedures)

Impact on

competition

Reduces the number of

competitors and increases

market concentration

Does not reduce the number of

existing firms

Job creation Limited Significant

Industry suitability

Retail, beverages, banking,

services

Manufacturing, technology,

electronics

CHAPTER 2. PRACTICE OF CROSS-BORDER MERGERS AND

ACQUISITIONS IN VIETNAM

2.1. Context and Characteristics of the Vietnamese Market for Cross-Border

M&A

2.1.1. Macroeconomic Environment and Vietnam’s Level of International

Integration

According to Dealogic data, the total value of announced global M&A transactions as

of September 25, 2024 reached USD 846.8 billion, representing a 14% increase

compared to the same period of the previous year. Notably, M&A transaction value in

the Asia Pacific region increased by 54% year on year, reaching USD 273 billion,

driven by several large-scale deals.

In 2024, Vietnam’s M&A market recorded 447 transactions with a total disclosed value

of approximately USD 6.93 billion. Industry, finance, and real estate were the sectors

with the largest number of high-value transactions. The industrial sector stood out with

five deals exceeding USD 100 million, while the finance and real estate sectors

recorded four and three transactions of similar scale, respectively. The average deal

value was USD 56.3 million, and the largest transaction reached USD 982 million.

Notably, 88% of total transaction value came from the real estate, consumer staples,

and industrial sectors.

Figure 2.1. Total Value and Number of M&A Transactions in Vietnam, 2022–Early

2025

Vietnam is widely regarded as one of the most dynamic developing economies in the

Asia Pacific region, with relatively high and stable long-term GDP growth. The

macroeconomic environment has generally remained stable, inflation has been kept

under control, and the economic structure has been gradually shifting toward

industrialization and service orientation.

Vietnam’s accession to the World Trade Organization (WTO) and the signing of

several new-generation free trade agreements (FTAs), such as the CPTPP, EVFTA, and

RCEP, have significantly contributed to improving the investment climate, enhancing

transparency, and expanding market access opportunities for foreign investors.

2.1.2. Domestic Market Size and Long-Term Growth Potential

Figure 2.2. Vietnam’s M&A Market in 2024

Figure 2.3. Vietnam’s GDP within ASEAN-6

In 2024, domestic investors participated actively in Vietnam’s M&A market, with the

disclosed transaction value of this group accounting for 29% of the total market value.

This represents a significant increase compared to 16% in 2023 and 20% in 2022,

reflecting growing confidence and the strengthened capacity of domestic enterprises to

execute large-scale transactions.

In contrast, the total transaction value from foreign investors recorded a substantial

decline in 2024, falling from USD 8,917 million in the previous year to USD 4,947

million, equivalent to a 45% decrease. This downturn was mainly attributable to

volatile macroeconomic conditions, geopolitical instability, and subdued global growth

in the post Covid-19 period.

These developments nevertheless highlight Vietnam’s large domestic market size, with

a population exceeding 100 million, a young demographic structure, and a rapidly

expanding middle class. Continuous improvements in per capita income have strongly

stimulated consumer demand, particularly in sectors such as retail, food and beverages,

banking and finance, and services.

2.1.3. Legal Framework Governing M&A Activities with Foreign Elements

The Ministry of Finance is currently developing the Project on the Development of the

Foreign-Invested Economic Sector and the Project on Attracting a New Generation of

Foreign Direct Investment, which set out orientations toward more open, attractive,

and competitive institutional and policy frameworks.

In parallel with efforts to amend key laws including the Land Law, Planning Law,

Investment Law, and tax-related laws such as the Law on Personal Income Tax and the

Law on Tax Administration featuring provisions on investment incentives and the

simplification of procedures, Vietnam’s investment and business environment is

expected to continue improving. These reforms are anticipated to play an important

role in attracting high-quality investment inflows into Vietnam, while also fostering

the development of the domestic private sector.

However, the legal system still exhibits certain limitations, including complex

administrative procedures, overlapping regulations among different laws, and foreign

ownership restrictions in some sensitive sectors. These characteristics make M&A a

suitable option, enabling foreign investors to access the market through firms that

already possess the necessary licenses and established legal status.

2.1.4. Industry Competition and Market Concentration in Vietnam

Many economic sectors in Vietnam are characterized by high levels of competition

alongside a certain degree of market concentration, particularly in industries such as

beverages, modern retail, banking, and energy. In these sectors, large domestic firms

often hold significant market shares and possess hard-to-replicate advantages,

including strong brands, extensive distribution networks, and established relationships

with local partners.

As a result, rather than undertaking greenfield investment and engaging in direct

competition from the outset, foreign investors tend to favor M&A as a means of

rapidly securing market positions and mitigating competitive risks during the initial

stage of market entry.

2.2. Analysis of Why Foreign Investors Choose M&A to Enter the Vietnamese

Market

2.2.1. Shortening Market Entry Time Compared with Greenfield Investment

Compared with greenfield investment, M&A enables foreign investors to significantly

shorten the time required to enter the Vietnamese market. By acquiring or merging

with a domestic firm, investors can quickly commence business operations without

having to undergo the lengthy process of constructing facilities, obtaining licenses, and

developing the market from scratch. This factor is particularly important in industries

characterized by intense competition and rapid change.

2.2.2. Leveraging Existing Brands, Market Share, and Distribution Networks

One of the greatest advantages of M&A is the ability to immediately leverage the

target company’s existing intangible assets, including brands, market share, and

distribution networks. In Vietnam, many domestic brands have built strong consumer

trust, which foreign firms would find difficult to achieve within a short period if they

opted for greenfield investment.

2.2.3. Access to Strategic Domestic Resources (Land, Licenses, Human Resources,

and Technology)

Through M&A, foreign investors can gain access to strategic, locally embedded

resources such as land use rights, business licenses, human resources with in-depth

knowledge of the local market, and technologies adapted to domestic conditions.

These resources are often difficult or time-consuming to obtain through greenfield

investment, especially given the complexity of regulations governing land access and

licensing procedures.

2.2.4. Reducing Legal Risks, Institutional Barriers, and Compliance Costs

Domestic firms are generally familiar with Vietnam’s legal system, administrative

procedures, and business practices. Acquiring such firms helps foreign investors

reduce legal risks, avoid compliance errors, and save the costs associated with

adapting to a new institutional environment. This constitutes a key motivation for

prioritizing M&A over greenfield investment.

2.2.5. Increasing Control and Limiting Industry Competition

M&A allows foreign investors to rapidly increase control over target firms and

indirectly reduce the number of competitors in the market. In highly concentrated

industries, this strategy helps firms consolidate their positions, expand market share,

and strengthen long-term competitiveness.

2.2.6. Suitability for Sectors with High Restrictions on Greenfield Investment in

Vietnam

Finally, M&A is particularly suitable for sectors in Vietnam where greenfield

investment by foreign investors faces significant restrictions, such as banking, modern

retail, energy, and certain conditional service industries. In these sectors, M&A is often

the most feasible pathway for foreign investors to enter the market in a lawful and

effective manner.

2.3. Comparison between M&A and Greenfield Investment in the Vietnamese

Context

2.3.1. Comparison in Terms of Investment Costs and Payback Period

In terms of initial investment costs, M&A typically requires a substantial amount of

capital to acquire equity stakes or the entire domestic firm, particularly in industries

with strong brands and large market shares. For example, ThaiBev’s acquisition of

Sabeco in 2017 was valued at approximately USD 4.8 billion, reflecting the high

valuation of a leading company in Vietnam’s beer and beverage industry. Although the

upfront cost of M&A is high, it allows investors to significantly shorten the payback

period, as the target firm already generates revenue, holds market share, and maintains

stable cash flows.

By contrast, greenfield investment usually spreads investment costs over multiple

phases, including the construction of facilities, procurement of machinery, recruitment,

and training of personnel. While total investment capital may be very large in the long

run, the initial financial pressure is often lower than that of M&A. However, the

payback period for greenfield investment tends to be longer, as firms require many

years to achieve optimal production scale and market penetration. Samsung’s case in

Vietnam with total investment exceeding USD 20 billion since 2008 illustrates that

greenfield investment can deliver long-term returns but requires patience and long-

term strategic commitment.

2.3.2. Comparison in Terms of Degree of Control and Managerial Flexibility

With respect to control, greenfield investment allows foreign firms to exercise near

complete control over operations, including strategy, technology, and corporate

culture. This enables investors to implement a unified management model aligned with

global standards, minimize internal conflicts, and enhance operational efficiency. For

this reason, greenfield investment is often preferred in manufacturing, high technology,

or export-oriented industries.

In contrast, M&A provides a high but not absolute level of control, especially in cases

where investors acquire a controlling stake rather than full ownership. Foreign firms

must often balance new strategic directions with existing governance structures,

resulting in lower managerial flexibility in the short term. Nevertheless, in the medium

to long term, if post M&A restructuring is carried out effectively, M&A can still enable

investors to achieve relatively strong strategic control.

2.3.3. Comparison in Terms of Operational, Cultural, and Organizational

Integration Risks

One of the greatest risks of M&A in Vietnam lies in post-merger integration, including

differences in corporate culture, management styles, and operational systems. Many

M&A transactions face challenges in aligning strategies and personnel, thereby

reducing the expected efficiency gains. In addition, foreign investors may encounter

latent risks related to the target firm’s financial conditions, legal issues, or outstanding

liabilities.

In contrast, greenfield investment involves fewer organizational integration risks, as

the enterprise is built from the ground up according to the parent company’s standards.

However, this mode entails higher market and institutional risks, including slow

adaptation to the local business environment, difficulties in land access and licensing

procedures, and exposure to policy changes. Therefore, greenfield investment is more

suitable for investors with substantial international experience and strong risk

management capabilities.

2.3.4. Assessment of the Suitability of Each Mode by Industry

In the Vietnamese context, M&A is particularly well suited to consumer, service, and

financial sectors, where brands, distribution networks, and business licenses play a

decisive role. Industries such as beverages, modern retail, banking, and insurance often

face significant restrictions on greenfield investment, making M&A the most effective

market entry route for foreign investors.

Conversely, greenfield investment is more appropriate for manufacturing, high-

technology, and export-oriented industries, where competitive advantages stem from

scale, technology, and production costs. Greenfield projects by Samsung, LG, and Intel

in Vietnam demonstrate how this mode has positioned Vietnam as a key link in global

supply chains, while also generating long term value creation and employment.

2.4. Analysis of Selected Representative Cross-Border M&A Cases in Vietnam

2.4.1. Overview of the Selected M&A Transactions

On October 28, SMBC Consumer Finance Co., Ltd. (SMBCCF), a member of the

Sumitomo Mitsui Financial Group (SMBC), announced the completion of its

acquisition of a 49% equity stake in VPBank Finance Company Limited (VPB FC, FE

Credit) from Vietnam Prosperity Joint Stock Commercial Bank (VPBank), and the

company was subsequently renamed VPBank SMBC Finance Company Limited.

Previously, on April 28, 2021, VPBank and SMBCCF had signed the capital transfer

agreement. The total maximum investment value amounted to USD 1.4 billion,

marking the largest investment ever made by a Japanese bank in a Vietnamese

financial institution.

Following October 28, 2021, the ownership structure of FE Credit consisted of 49%

held by SMBCCF, 50% by VPBank, and 1% by other shareholders.

Through this investment, the SMBC Group aims to cooperate with FE Credit to further

develop Vietnam’s financial sector by leveraging the expertise and know-how

accumulated by SMBCCF over many years in consumer finance in Japan and other

Asian countries. At the same time, SMBC seeks to accelerate its growth strategy in

Asia by applying advanced digital transformation practices derived from FE Credit.

SMBC Consumer Finance (SMBCCF), a wholly owned subsidiary of Sumitomo

Mitsui Financial Group (SMFG), served as the acquiring entity in this transaction.

SMBC Group is one of Japan’s three largest financial and banking groups, with total

assets exceeding USD 2.1 trillion as of December 31, 2020, and is also the leading

consumer finance company in Japan, operating more than 900 branches nationwide.

FE Credit is currently the largest consumer finance company in Vietnam, holding

approximately 50% market share equivalent to the combined share of all other

consumer finance companies. The company operates around 20,000 service

introduction points nationwide and employs more than 13,000 staff. To date, FE Credit

has served nearly 11 million Vietnamese consumers through unsecured lending

products and services.

In 2020, FE Credit recorded operating income of over VND 18.2 trillion, of which

more than VND 17.2 trillion came from net interest income. Pre-tax profit exceeded

VND 3.7 trillion. By year-end, the company’s total assets surpassed VND 73.3 trillion,

with outstanding customer loans of over VND 66 trillion.

FE Credit successfully capitalized on the early-stage boom of Vietnam’s consumer

finance market and maintained its leading position during the 2015–2020 period.

Bấm Tải xuống để xem toàn bộ.