Preview text:

SM-TEST

Student needs to choose True or False, explanation; or do the following questions.

Question 1. The single-price auctioning method is more competitive for bidders than the

multiple-price auctioning method.

Question 2. Borrowers in the new issue market may be raising capital for converting

private capital into public capital

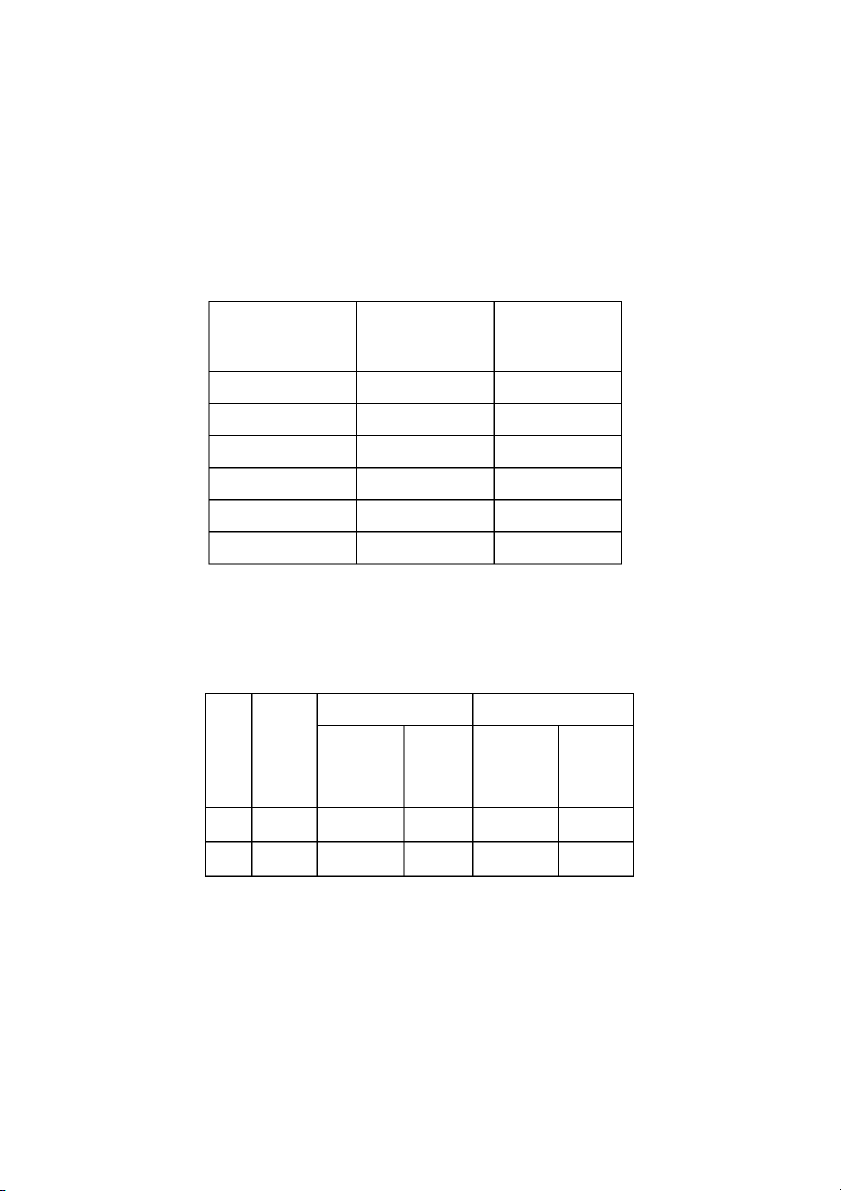

Question 3. An Dutch Bond Auction for raising 600 Billion Dong for Lovely Firm (which

is listed on HOSE) is shown in the following table: Investors Interest Rate Auction (Bidders) (%) volume (Billion Dongs) A 6.62 100 B 6.35 130 C 6.18 80 D 6.75 50 E 6.21 220 F 6.09 80 Requirements: a. Determine auction results

b. Define the payment value of investor D after successful action (if available). Question

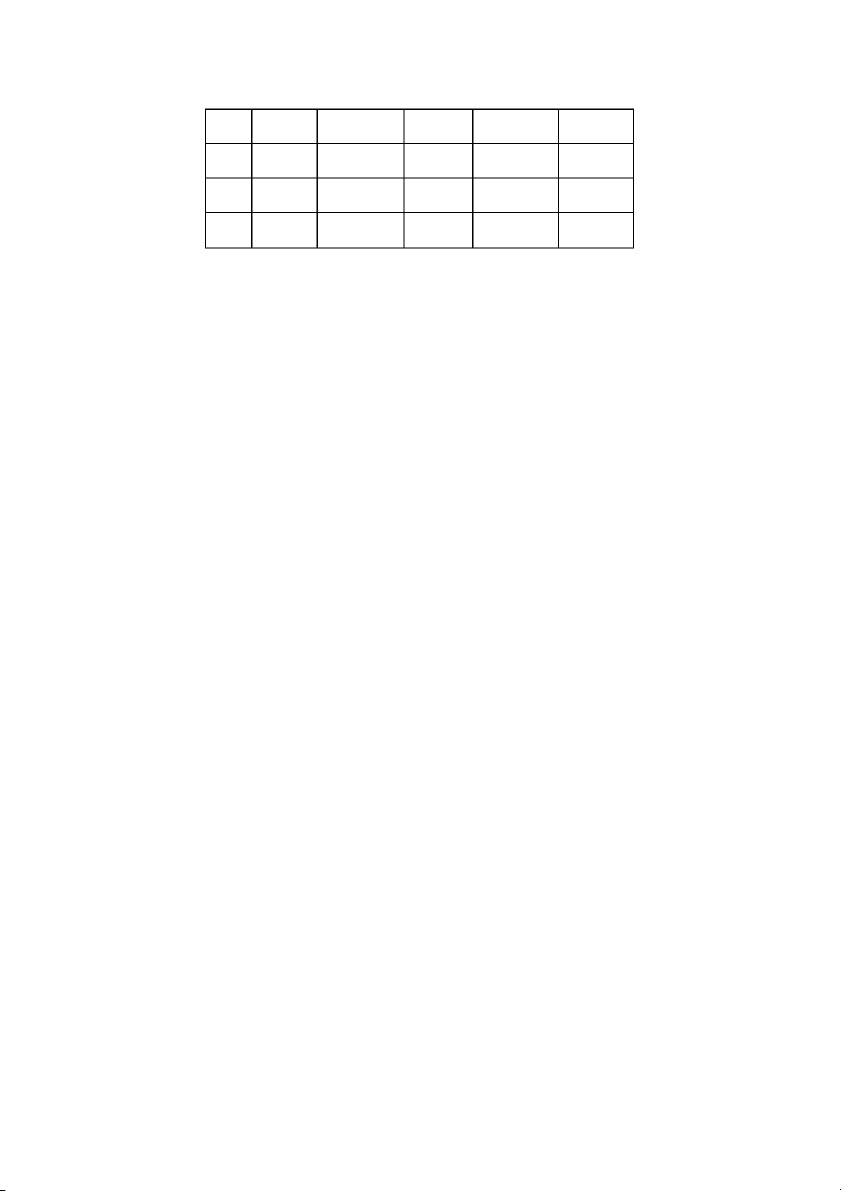

4. In the continuous trading session of JVC’s shares, the trading information is shown below: Time Invest Buy Sell or s Price Volume Price Volume (1 share) (1000 (1000 (1 share) VND) VND) 9:30 A1 24.1 2,000 9:31 A2 24.2 3,500 9:32 A3 24.3 2,500 9:33 A4 24.4 2350 9:40 A5 MP 6,500 9:43 A6 24.4 5,000 9:45 A7 24.3 1,500

a. Determine the continuous matching session's results.

b. Calculate the brokerage fee of A5 and A6 if the brokerage fee rate is 0.2% Question

5. Company X discloses information related to its share dividend payment policy as following: − Ex-date: 23/8/20XX − Record-date: 24/8/ 20XX

− Content: Paying dividend in shares for outstanding investors − Dividend payment

ratio: 3:1 (An investor with 10 outstanding shares receives 01 new share)

Determine X’s reference price on the ex-date, given X’s closing prices on 22/8/20XX is

35000 dong. Calculate the total share dividend of investor A (with the 5,000 shares at

record date). The payment process of Vietnam’s stock market is T+2

Question 6. The seller of a put option contract has the right to sell a specific number of

stocks at a given price determined on the contract.

Question 7. Limit order is an order to buy or sell stocks at the opening price.

Question 8. The primary market is where already issued securities are traded.