Preview text:

TROY UNIVERSITY IN VIETNAM COURSE: MACROECONOMICS FINAL EXAMINATION

Student Name: Trương Huyền Trang Class: K19 C Date of birth: 06/11/2001 I. Short Answer

1. Explain the main aims of government macro-economic policy?

⇨ Macroeconomic policies seek to maximize national income by encouraging economic

growth, which enhances the utility and standard of living of individuals who engage in the economy.

2. What is the appropriate response for a recession using fiscal policy?

⇨ When an economy is in a slump and producing less than its potential GDP,

expansionary fiscal policy is the best option. Expansionary fiscal policy boosts

aggregate demand by boosting government spending or decreasing taxation.

3. What is the appropriate response for a recession using monetary policy?

⇨ When an economy is in a slump, an expansionary monetary policy should be

implemented to increase the money supply, increase the quantity of accessible loans,

lower interest rates, and improve aggregate demand. II.

Problem-solving questions

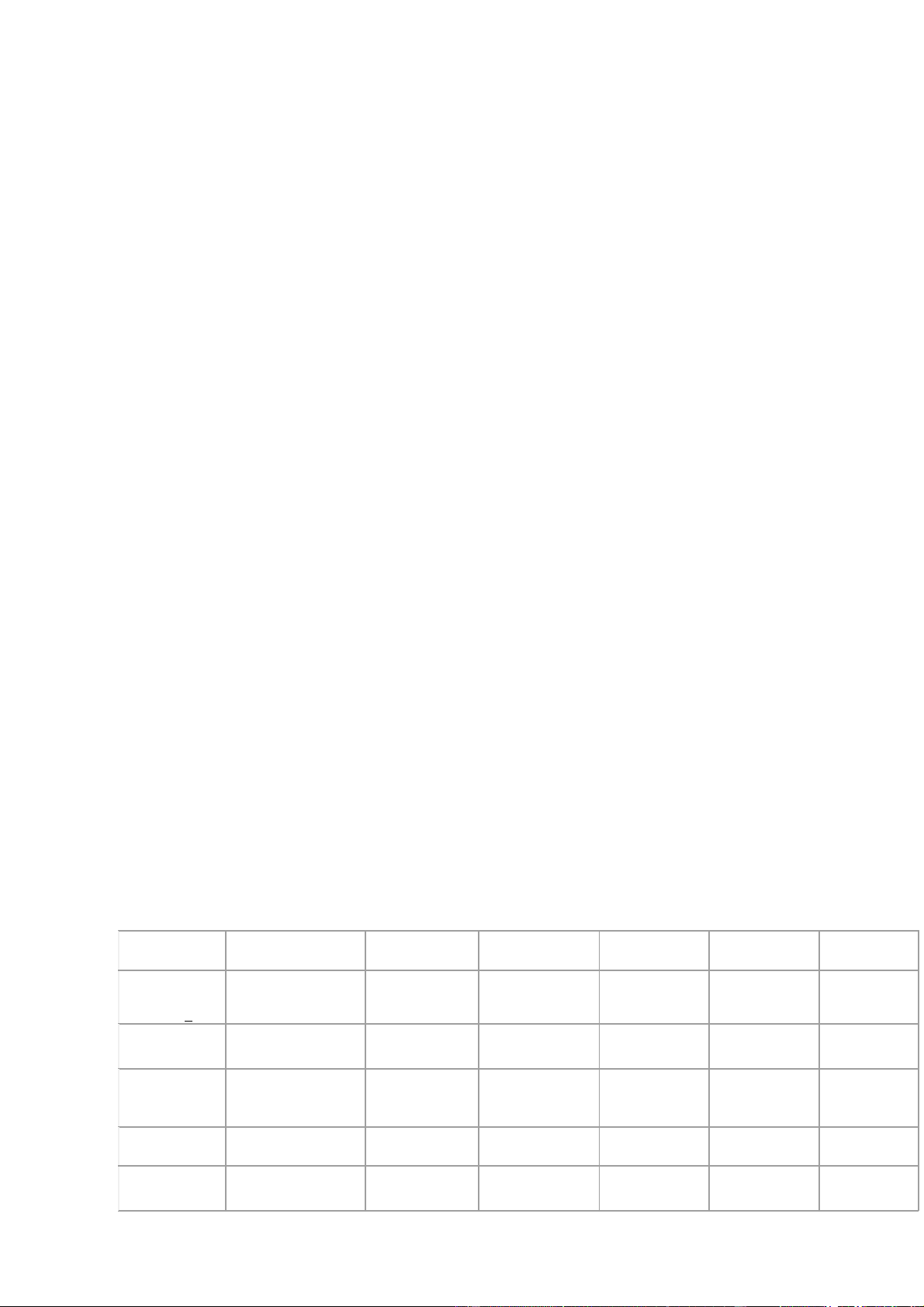

1. Describe in detail the household survey of unemployment and, in the context of the

survey, explain what is meant the terms below and give the number or rate of each

based on the table below for the following dates-- December 2007; June 2009; and

February 2020, April 2020, May 2020, and January 2021:

a. Employed: currently working for pay

b. Unemployed: out of work and actively looking for a job

c. Not in the labor force: out of paid work and not actively looking for a job

d. The unemployment rate: is not the percentage of the total adult population without

jobs, but rather the percentage of adults who are in the labor force but who do not have jobs Unemployment rate =

e. The labor force participation rate: is the percentage of adults in an economy who are

either employed or who are unemployed and looking for a job

The labor force participation rate=

f. The employment rate (employment -population ratio): the number of employed

people as a percentage of the civilian noninstitutional population. In other words, it is

the percentage of the population that is currently working. The employment rate=

g. if the answer for 'e' in December 2007 were the same as in February 2020

and the number of employed in February 2020 remained the same at 158,759,000,

how many people would be unemployed in February 2020 and what, therefore,

would the unemployment rate be in February 2020?

If the labor force participation rate in February 2020= December 2007

⇨ The labor force in February 2020= population labor force participation rate in

December 2007= 259,835,000 65.98%=171,439,133

⇨ Unemployment= labor force – employment = 171,439,133- 158,759,000 = 12,680,000 ⇨ Unemployment rate= December 2007 June 2009 February 2020 April 2020 May 2020 January 2021 Civilian 233,290,000 235,695,000 259,835,000 260,045,000 260,197,000 260,849,000 noninstitutional population >16 Civilian labor 153,918,000 154,730,000 165,546,000 137,224,000 156,481,000 160,161,000 force Employed 146,273,000 140,003,000 158,759,000 133,403,000 137,224,000 150,031,000 7,645,000 14,727,000 6,787,000 3,821,000 19,257,000 10,130,000 Unemployed 79,372,000 80,965,000 94,289,000 122,821,000 103,716,000 100,688,000 Not in labor force 4,97% 9,52% 4,10% 2,78% 12,31% 6,32% Unemployment Rate Labor 65,98% 65,65% 63,71% 52,77% 60,14% 61,40% Force Participati on Rate Employment- 62,70% 59,40% 61,10% 51,30% 52,74% 57,52% Population Ratio 2. Calculate GDP: • Consumption (C) 310 • Investment (I) 115

• Government purchases (G) 60 • Exports (X) 305 • Imports (M) 245

GDP = Consumption + Investment + Government Spending + Net Exports (Exports- Imports) GDP = C + I + G + (X – M) = 310+115+60+( 305-245) = 545

3. A company is growing rapidly, and is investing nearly all of its income, so its

marginal propensity to consume (MPC) is 0.85. Remembering that MPC + MPS

equals 1, we find out that the MPS is 0.15. What is the spending multiplier in this case?

We have MPC+ MPS=1 => MPS=1-MPC=0.15

According to the spending multiplier formula=

So in this case the spending multiplier is 6.67

4. The GDP in Vietnam is equal to $25 millions. Company spends $7,500, and with the

spending multiplier is (?), as previously calculated in question 3. Please calculate the

actual increase in GDP and the new GDP.

According to the spending multiplier formula= MPS=0.15

Aggregate demand= AD= C+I+G+NX= $7,500 The change in GDP =

So the new GDP = $25,000,000+ $50,000= $25,050,000 millions

5. You are given the following information: Bank deposits (D) 350

Currency-to-deposits ratio (c) 0.20

Required reserve ratio (rr) 0.15

a) Solve for the monetary base level (B) in this economy.

Currency= Currency to deposits ratio Bank deposits =0.2 350 =70

Reserves= Required reserve ratio Bank deposits =0.15 350 = 52.5

Monetary base level (B) in this economy= Currency + Reserves = 70+52.5 =122.5

b) Solve for the level of bank reserves (R) in this economy.

Following section a) we have bank reserves (R)= 52.5

c) Solve for the money supply level (M) in this economy.

Money supply (M)= Currency + Bank deposits =70+350 = 420

d) Suppose there is a sudden rise in the currency-to-deposits ratio, from the original level of

0.2 to a new level of 0.4. If everything else remains unchanged, find the level of monetary

base needed to keep money supply fixed at the level you solved for in part c.

When a sudden rise in the currency-to-deposits ratio from 0.2 to 0.4 ⇨ Bank deposits= 300

While the money supply fixed in section c) is 420

⇨ The level of monetary needed= 300 (0.4+0.15)=165

e) Continue to consider c=0.4. Find the level of required reserve ratio needed to keep the

monetary base and the money supply fixed at the level you solved or in parts a and c, respectively.

When monetary supply equals 165 ⇨ Required reserve ratio=

6. Using the CPI measure of the price level, which is 100 in the base year of 2001,

calculate the annual inflation rates for

(a) 2002, when the index is 103.7. CPI= 103.7= So inflation rates =

(b) 2003, when the index is 105.5. CPI= 105.5= So inflation rates =

(c) 2004, when the index is 107.7. CPI= 107.7= So inflation rates =

7. Assume the current equilibrium level of income is $200 billion as compared to the

full-employment income level of $240 billion and that consumption is the only

component of aggregate expenditures that depends upon the level of GDP. If the

MPC is 5/8, what change in aggregate expenditures is needed to achieve full employment?

From the given data, the change in GDP = $240 billion – $200 billion = $40 billion

Marginal Propensity to Consume= MPC=

According to the multiplier formula =

Change in AE = Change in GDP = 40 = 15

Aggregate expenditures need to be increased by $15 billion to achieve full employment. III.

Fill in the blank

1. While the study of economic activities of individuals, households, and

businesses at the sub-national level is the concern of microeconomics, the

study of economic activities at the national and global level is the concern of

macroeconomics.

2. When producers change their level of output, rather than price, in response to

higher or lower sales, this is called quantity adjustment.

3. The increase in the level of production in a country or region is called

economic growth while improvements in diet, housing, medical

attention, education, working conditions, access to care, transportation,

communication, entertainment, etc. is called living standards growth.

4. The process of moving from a situation of poverty and deprivation to a

situation of increased production and plenty is referred to as economic development.

5. The fluctuations in the level of production, including recessions on the one

hand and booms on the other hand, is called the business cycle.

6. Commodity money takes the form of a commodity with intrinsic value.

7. Fiat money

is used as money because of government decree.

8. Currency (notes and coins) issued by the Central Bank are called banknotes.

9. The required reserve ratio is the minimum fraction of deposits that

banks are required to keep as reserves.

10. Monetary policy

is conducted when the government controls the money supply.

III. Multiple Choice Questions

1. Which of the following assets is the MOST liquid? A) a $50 bill

B) a $50 Amazon.com gift certificate

C) 100 shares of Microsoft stock D) an economics textbook

2. Changing the level of government spending is an example of: A) fiscal policy. B) interest rate policy. C) monetary policy. D) exchange rate policy.

3. Alice's disposable income increases by $1,000, and she spends $600 of it. Alice's:

A) MPS is 0.4 and she saves $400.

B) MPC is 0.4 and she saves $400.

C) MPS is 0.4 and she saves $600.

D) MPC is 0.6 and she consumes $400.

4. What are the tools of macroeconomics? A) Monetary Policy B) Fiscal Policy C) Income Policy D) All of the above.

5. In macroeconomics, we study about ------------------

A) Theory of National Income & Employment

B) Theory of Money Supply & Price Level

C) Theory of International Trade & Eco growth D) All of the above.

6. The study of groups and broad aggregates of the economy is known as----------- A) Microeconomics B) Macroeconomics C) International Economics D) None of the above.

7. When national output rises, the economy is said to be in A) an expansion B) a deflation C) an inflation D) a recession

V. Essay Questions

What is the fiscal and monetary policy for Vietnam after Covid19?

The COVID-19 epidemic originated in China, which is Vietnam's northern border.

Vietnam was unable to prevent the effects of the virus's spread due to its geographical

proximity and the active activities of travel and trade between the two countries. To

keep up with the macroeconomic situation and international financial markets while

also dealing with the negative impact of the COVID-19, the State Bank has

proactively and continuously reduced operating interest rates to remove difficulties for

production and business activities, liquidity support for credit institutions, and

lowering the cost of borrowing capital for businesses and households.

According to the General Statistics Office's report on the socioeconomic

condition for the first nine months of the year, the deposit interest rate in VND is fixed

at 0.1 - 0.2 annualized percentage point for demand deposits and deposits with

durations of less than one month. Deposit interest rates for durations of 12 months or

more have also fallen to 6.0 percent -7.1 percent per year. The greatest deposit interest

rate offered by certain state-owned banks was only 5.5 percent to 6 percent per year.

For some popular businesses and fields, the maximum short-term loan interest rate in VND was 5.0 percent per year.

In the current circumstances, the solution to lower interest rates has not been

helpful in stimulating capital for production and commercial activities because most

firms' inputs and outputs have been affected at the same time. Because of the

pandemic effects, some demands have almost completely vanished. Furthermore, the

interest rate reduction is only applicable to new loans, while business loan demand is

low or enterprises do not meet all loan access criteria, such as collateral, financial

image, or a sound business strategy. Many businesses are unable to obtain new loans

because they owe money to banks. The impact of recent interest rate reduction on the

economy has diminished. Indeed, deposit and loan rates in market 1 (the market

between banks, residents, and enterprises) have fallen since the beginning of the year,

when the banking sector has always been in a position of money surplus, owing mostly to slow credit growth.

As a result, if we use the market interest rate as the aim, the recent fall in the

executive interest rate had little impact on loan absorption in the economy. The key

explanation is that credit growth has been slow and persistent, especially in the face of

falling interest rates, indicating that demand for loans was low or banks' fears about bad debts.