Preview text:

Case Study Analysis: The Surprising Elasticity of Demand for Luxuries Case Summary

As part of an overall package to reduce the US budget deficit, Congress adopted a

10% luxury tax on big-ticket items such as pleasure boats, private airplanes,

high-priced cars, and jewelry. The assumption was that the demand for these goods

was inelastic, so the tax burden would fall mainly on wealthy consumers. However,

demand turned out to be more elastic than expected. Sales of luxury goods, especially

pleasure boats, dropped significantly as buyers avoided the tax by purchasing

elsewhere. The tax burden ended up affecting workers and retailers, and the

government raised much less revenue than projected.

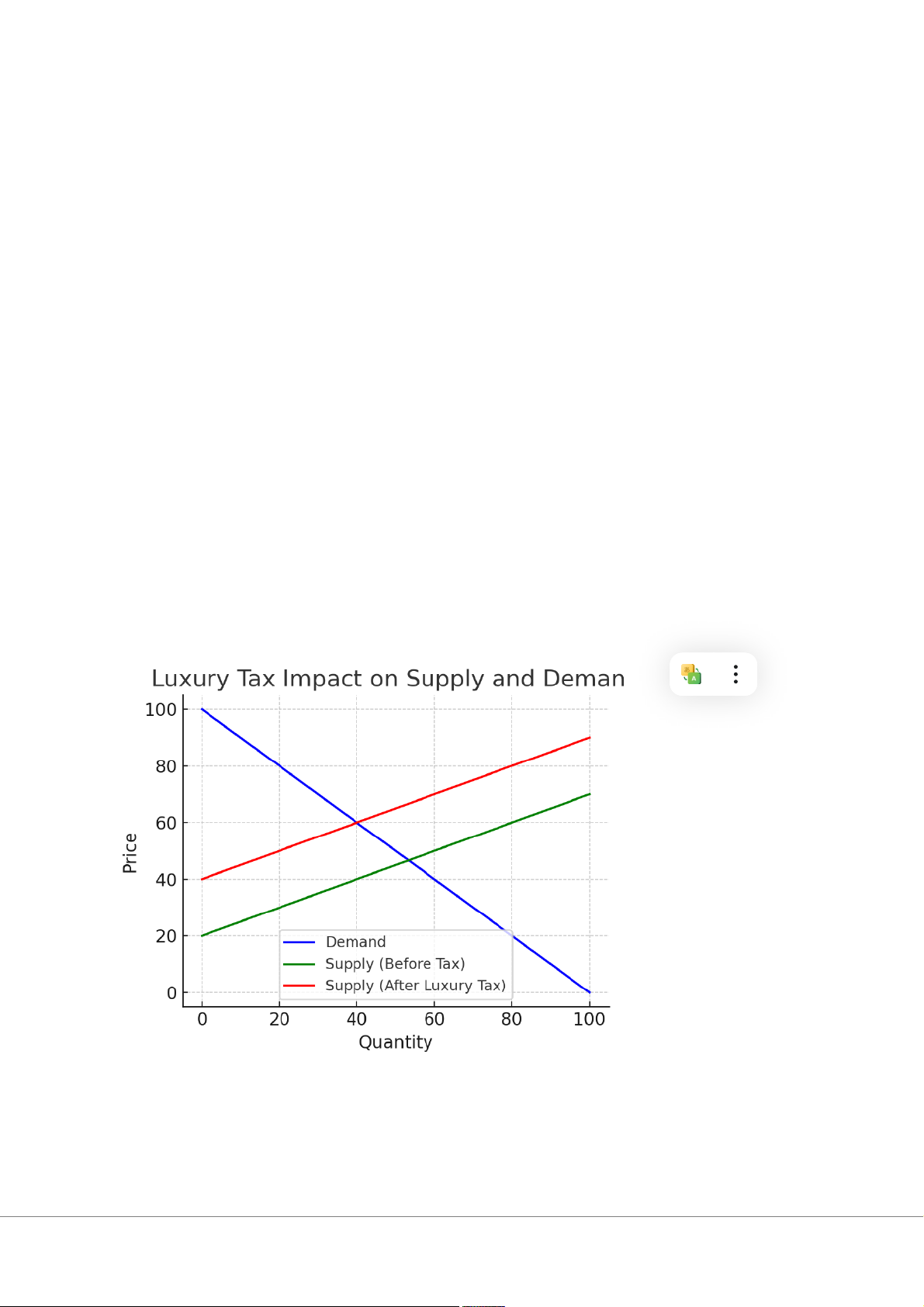

Graph: Supply–Demand with Luxury Tax Discussion Question 1

Using the theory of supply, demand, and elasticity, the case can be explained as follows:

Initially, the market was at equilibrium where the demand and supply curves

intersected. When the government imposed the luxury tax, it increased the cost of

production and shifted the supply curve upward by the amount of the tax. If demand

had been perfectly inelastic, the quantity would have stayed the same and prices

would simply rise by the tax amount. However, because the demand for luxury goods

was relatively elastic, the price increase led to a proportionally larger decrease in

quantity demanded. This is illustrated in the graph, where the new equilibrium shows

a smaller increase in price but a larger reduction in quantity. As a result, sales of

luxury goods dropped significantly, especially for pleasure boats and high-priced cars. Discussion Question 2

The implication for government tax policy is that assumptions about elasticity are

critical. If a tax is placed on goods with elastic demand, it may lead to a large fall in

quantity demanded, reducing tax revenue and harming producers and workers rather

than the intended wealthy consumers. In this case, the luxury tax raised far less

revenue than expected and shifted the burden onto middle-class workers in affected

industries. This suggests that governments should carefully assess demand elasticity

before designing tax policies to avoid unintended economic consequences.