Preview text:

lOMoARcPSD|47206417

VIETNAM NATIONAL UNIVERSITY – HO CHI MINH CITY INTERNATIONAL UNIVERSITY

SCHOOL OF BUSINESS ADMINITRATON

INTRODUCTION TO CORPORATE FINANCE Lecturer: Trinh Thu Nga REPORT

CASE STUDY: CALIFORNIA PIZZA KITCHEN __Group Members__ Hồ Ngọc Phương Nguyên MAMAIU20041 Nguyễn Văn Trường MAMAIU20050 Nguyễn Trần Thu Thảo MAMAIU20077 Hồ Ngọc Huyền Trang MAMAIU20091 Phan Thị Thùy Trang MAMAIU20049 Nguyễn Phước Phú Quý MAMAIU20046

Semester 2 - 2022-2023, Ho Chi Minh City TABLE OF CONTENTS 1 I.

What is going on at CPK? What decisions does Susan Collyns face? 1. What is going on at CPK?

2. What decisions does Susan Collyns face? II. How does debt affect CPK? 1. Calculation of variables. 2. How does debt affect CPK? III.

What should Collyns recommend? I.

What is going on at CPK? What decisions does Susan Collyns face? 1. What is going on at CPK?

California Pizza Kitchen (CPK) is an American restaurant that has been operating since

1985 in Beverly Hills, California. It is now being led by Susan Collyns who is the Chief 2 lOMoARcPSD|47206417

Financial Officer. By the end of the second quarter of 2007, it had a total of 213 retail

locations across the United States and worldwide, with approximately 41% of its

activities based in California. At the moment, CPK is running completely owned shops,

some are partnerships, and the others are franchises, they are regarded as the main sources of income.

According to CPK's finance team, the company generated $554 million in sales in FY06

from three primary revenue sources. For starters, analysts predict that up to 500 units

would be created from corporate-owned eateries. Secondly, CPK got $50,000 to

$60,000 in franchise fees for each new site, as well as 5% of gross sales from each

store. Finally, although accounting for less than 1% of income from CPK-branded frozen

pizza distribution, the relationship with Kraft Foods supports its worldwide branding.

Since the restaurant industry is highly competitive, the CPK company's success can be

attributed to its emphasis on a family-friendly environment, excellent ingredients,

innovative menu, relatively low-priced offerings, dedication to guest satisfaction, and

attracted relatively wealthy clients. All of this compensates for a 1% advertising

expenditure by increasing consumer word-of-mouth marketing.

2. What decisions does Susan Collyns face?

Nevertheless, restaurant industry executives face many challenges, including increasing

commodity prices, higher labor costs (from $5.15 to $7.25 per hour in May, 2007),

softening demand due to high gas prices, and activist shareholders.

When the finance team produced preliminary data for the second quarter in 2007, it

was discovered that even though the company's stock price had dropped 10% in the

preceding month to its current value of $22.10, CPK was still running profitably.

Revenue increased significantly when compared to competitors in the market due to

rising commodity prices and higher manufacturing expenses. Furthermore, CPK's

management has guaranteed that the firm follows a conservative financial strategy,

preventing the appearance of indebtedness on the balance sheet.

Susan Collyns has several decisions that need to be made. Her two primary issues are

how to finance expansion and the firm’s most appropriate capital structure. CPK is

considering building at least 16-18 new branches and maybe shutting an existing one in

the near future; however, in order to get financing for such a project, Collyns must

evaluate the suitable capital structure. It's better to move on. The current action plan

under discussion is a share repurchase, which is aided by the fact that stock prices are

now declining. Because the impact of this share repurchase will be felt in the market, it

is reasonable to predict that the value of the shares will rise in the future as a result of

greater return on equity and lower cost of capital. However, in order to do so, CPK may

need to contemplate debt financing, despite its efforts to protect the firm from

incurring debt. However, in order to do so, CPK may need to contemplate debt 3

financing, despite its efforts to protect the firm from incurring further debt. So capital

structure is the most pressing issue she is dealing with right now. II. How does debt affect CPK?

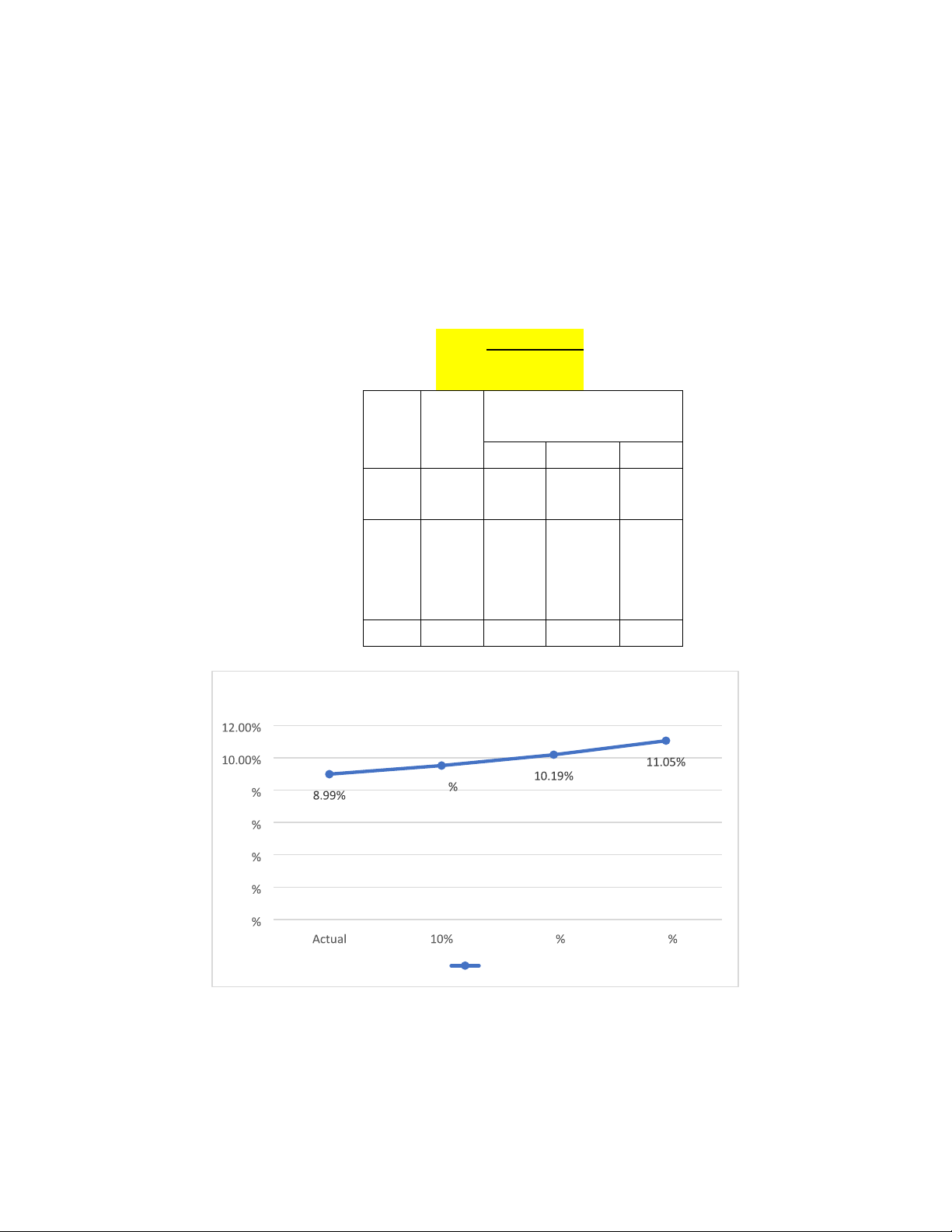

1. Calculation (when CPK is unlevered, and is levered at 10%, 20%, 30%) 1.1 Return on equity (ROE)

𝑵𝒆𝒕 𝒊𝒏𝒄𝒐𝒎𝒆

ROE = 𝑩𝒐𝒐𝒌 𝒗𝒂𝒍𝒖𝒆

𝒐𝒇 𝒆𝒒𝒖𝒊𝒕𝒚 Debt/Total Actual Capital 10% 20% 30%

Net 20,299 19,359 18,419 17,480 Income

Book 225,888 203,299 180,17 158,122 value of equity ROE 8.99% 9.52% 10.19% 11.05% ROE 8.00 9.52 6.00 4.00 2.00 0.00 20 30 ROE

When we calculated the ROE, we observed that it increases as the debt is higher. This

signifies that the company's ROE has increased since they grew their firm by utilising 4 lOMoARcPSD|47206417

more debt for operations while marginally raising equity as part of the growth, the fall

of equity (book value) is still larger than the decrease in net income. 1.2 Price per share Price per share = Original

𝑫𝒆𝒃𝒕∗𝑻𝒂𝒙 𝒓𝒂𝒕𝒆 𝑵𝒖𝒎𝒃𝒆𝒓 𝒐𝒇 𝒔𝒉𝒂𝒓𝒆𝒔 price +

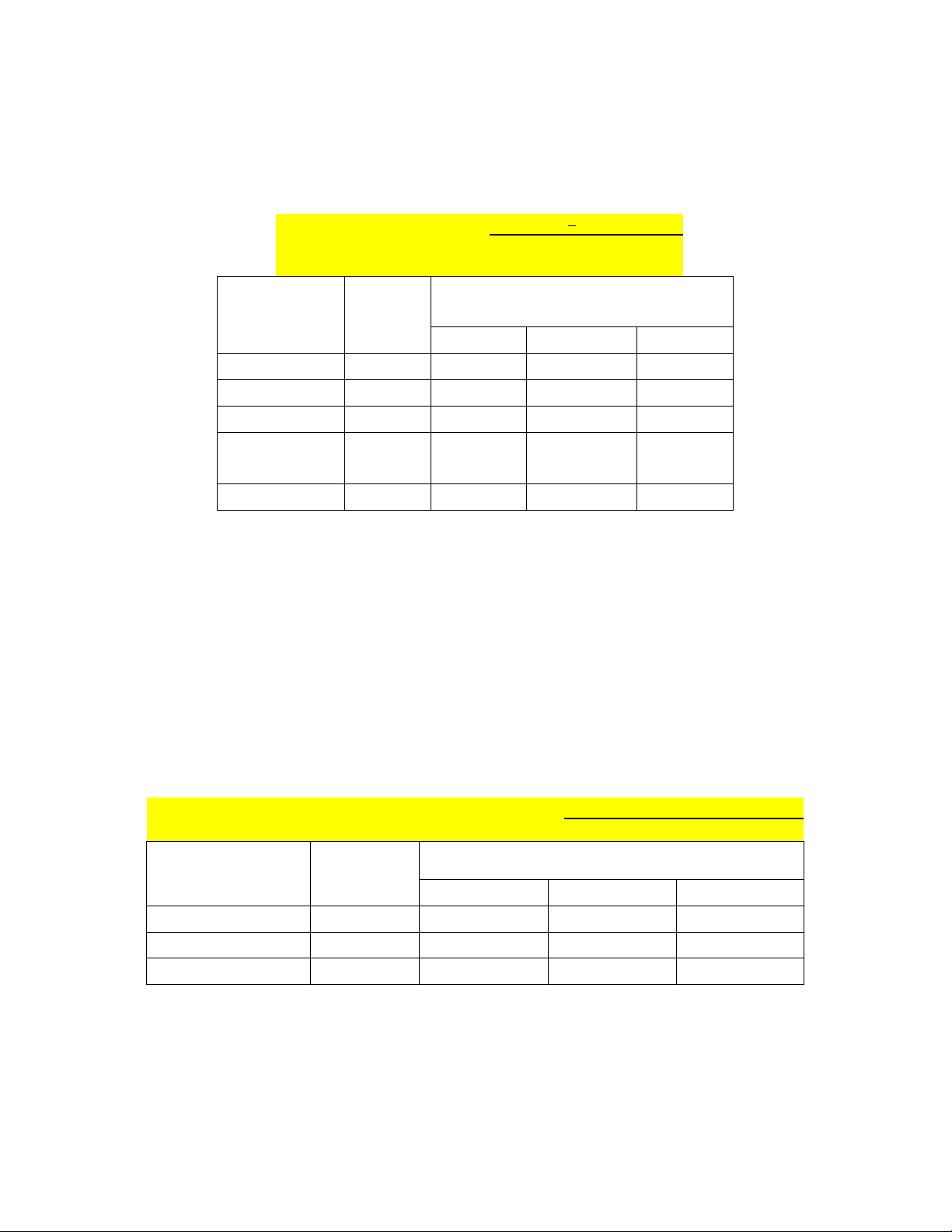

𝒐𝒖𝒕𝒔𝒕𝒂𝒏𝒅𝒊𝒏𝒈 Debt/Total Actual Capital 10% 20% 30% Original Price 22.10 22.10 22.10 22.10 Debt 0 22,589 45,178 67,766 Tax rate 32.5% 32.5% 32.5% 32.5% Number of 29,130 29,130 29,130 29,130 shares Price per share $22.10 $22.35 $22.60 $22.86

When evaluating the impact of share buybacks on the firm, utilising 10% debt on the

overall capital structure would raise the stock price to $22.35, resulting in a 1.13% gain

and allowing for the redemption of 1,011,000 shares, resulting in a 3.47% decline in

shares. Increasing the debt ratio to the whole capital structure by 20% would raise the

price to $22.60, resulting in a 2.26% gain and allowing the company to buy back

1,999,000 shares, bringing the total capital structure down by $6,685. A debt-to-capital

structure ratio of 30% would raise the share price to $22.86, a 2.99% gain, and allow

for the repurchase of 2,965,000 shares, a 10.18% drop in stock (see the figures below). 1.3 Shares repurchased

𝑫𝒆𝒃𝒕 𝒖𝒔𝒆𝒅 𝒕𝒐 𝒓𝒆𝒑𝒖𝒓𝒄𝒉𝒂𝒔𝒆 𝒔𝒉𝒂𝒓𝒆𝒔

Number of shares repurchased (thousand shares) =

𝑷𝒓𝒊𝒄𝒆 𝒑𝒆𝒓 𝒔𝒉𝒂𝒓𝒆 Debt/Total Capital Actual 10% 20% 30% Debt 0 22,589 45,178 67,766 Price per share $22.10 22.35 22.60 22.86 Shares repurchased 0 1011 1999 2965

The appropriate course of action for the corporation is to issue a share redemption

mandate. If they issue around $45,178,000 in debt to reach a debt-to-equity ratio of

20%. CPK is also advised to repurchase about 1,999,000 shares with this money. This

will result in a 2.26% gain in share price, which will satisfy their shareholders. This level 5

was chosen due to the evident advantage to shareholders and the moderate amount

of risk connected with stockholders. While a 30% debt ratio in the whole capital

structure is more favourable to shareholders, it presents too much risk to the organisation. 1.4 Shares outstanding

Number of shares outstanding (thousand 𝑴𝒂𝒓𝒌𝒆𝒕 𝒗𝒂𝒍𝒖𝒆 𝒐𝒇 𝒆𝒒𝒖𝒊𝒕𝒚 shares) =

𝑷𝒓𝒊𝒄𝒆 𝒑𝒆𝒓 𝒔𝒉𝒂𝒓𝒆 Debt/Total Actual Capital 10% 20% 30% Market value of 643,773 628,516 613,259 598,002 equity Price per share $22.10 22.35 22.60 22.86 Shares outstanding 29,130 28,119 27,131 26,165 1.5 Earning per share (EPS)

𝑵𝒆𝒕 𝒊𝒏𝒄𝒐𝒎𝒆

EPS = 𝑵𝒖𝒎𝒃𝒆𝒓 𝒐𝒇 𝒔𝒉𝒂𝒓𝒆𝒔 𝒐𝒖𝒕𝒔𝒕𝒂𝒏𝒅𝒊𝒏𝒈

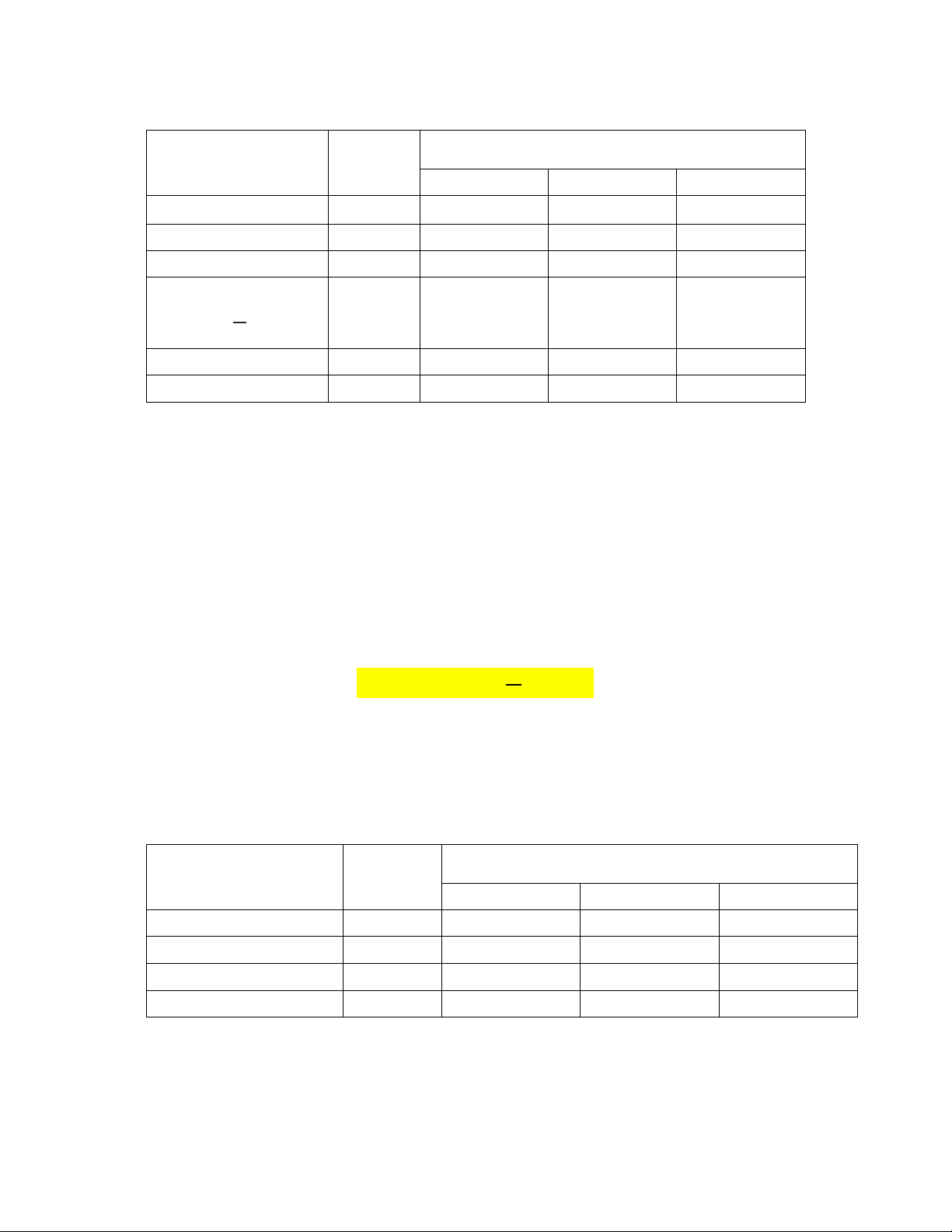

𝒂𝒇𝒕𝒆𝒓 𝒓𝒆𝒑𝒖𝒓𝒄𝒉𝒂𝒔𝒆𝒅 Debt/Total Actual Capital 10% 20% 30% Net Income 20,299 19,359 18,419 17,480 Shares 29,130 28,119 27,131 26,165 outstanding EPS 0.6968 0.6885 0.6789 0.6681

The earnings per share (EPS) of a stock represents its rate of return or market forecast.

We can see from the calculations that a greater profits per share ratio can cause CPK's

stock to rise. However, many investors ignore EPS since it can be controlled by invisible

influences and hence has little impact on investment decisions.

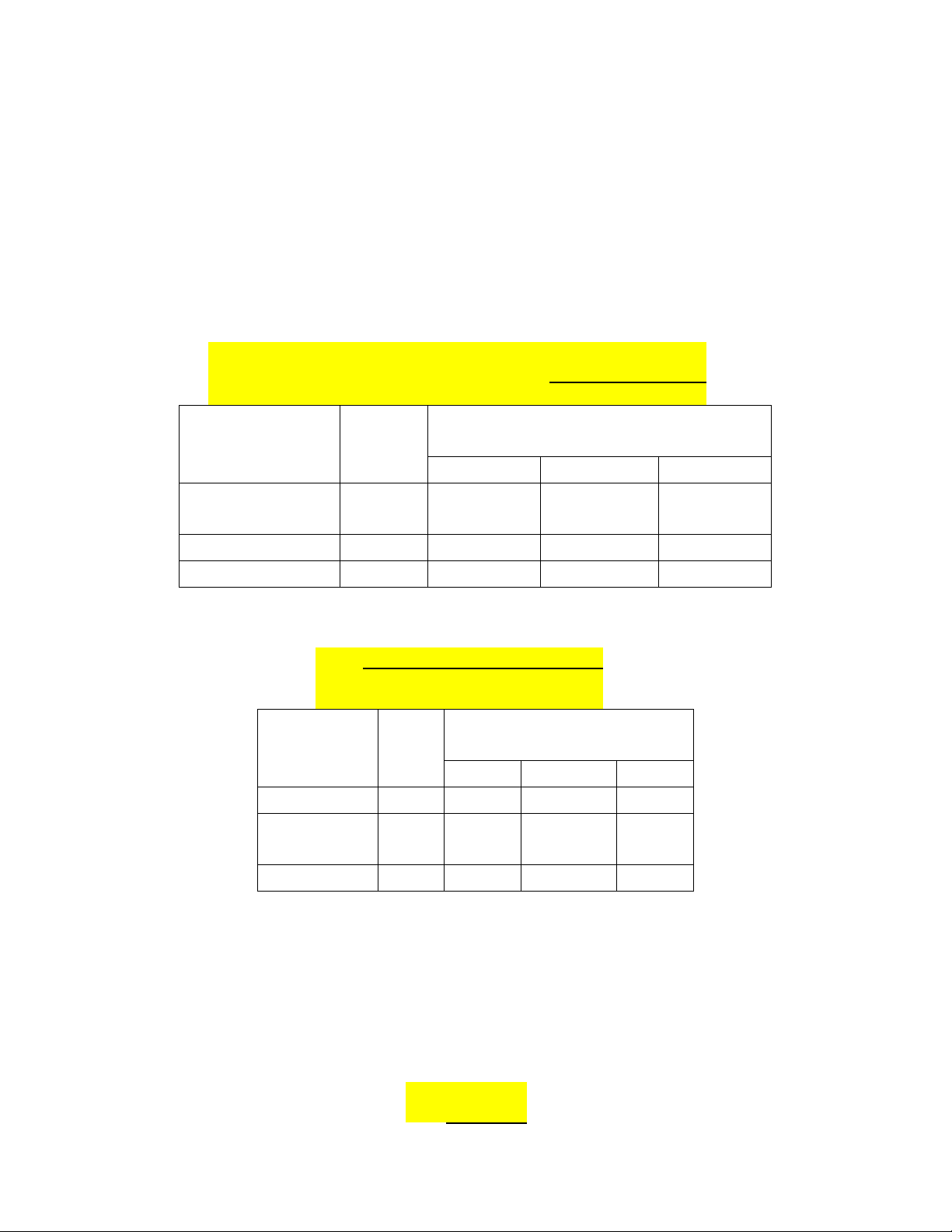

1.6 Price to earning ratio (P/E)

𝑷𝒓𝒊𝒄𝒆 𝒑𝒆𝒓 P/E = 𝒔𝒉𝒂𝒓𝒆 6 lOMoARcPSD|47206417 𝑬𝒂𝒓𝒏𝒊𝒏𝒈

𝒑𝒆𝒓 𝒔𝒉𝒂𝒓𝒆 (𝑬𝑷𝑺) Debt/Total Actual Capital 10% 20% 30%

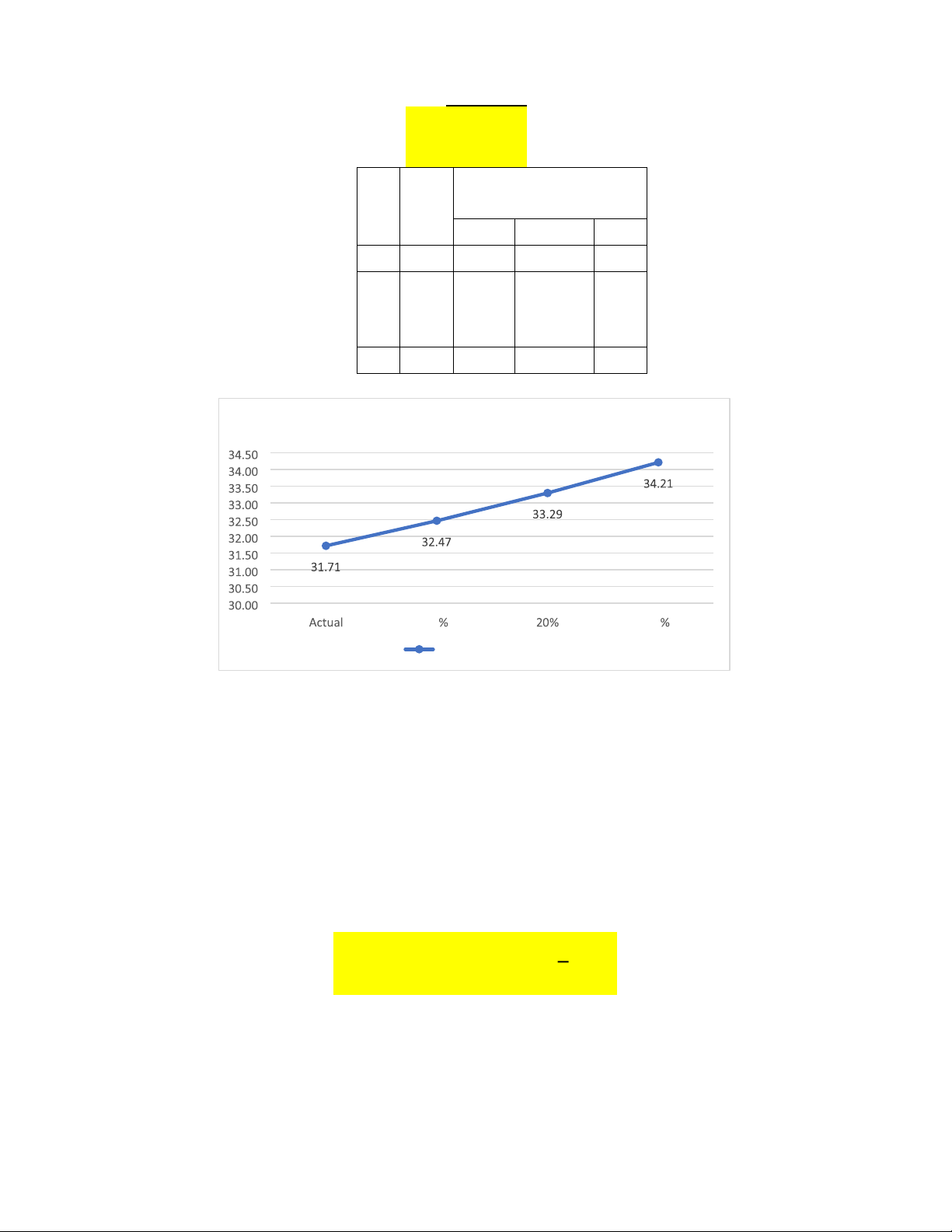

EPS 0.6968 0.6885 0.6789 0.6681 Price $22.10 22.35 22.60 22.86 per share P/E 31.71 32.47 33.29 34.21 Price to earning ratio 10 30 Price to earning ratio

The price-to-earnings ratio (P/E) represents what more investors are willing to pay per

dollar of current profits; greater PEs are frequently seen as indicating that a CPK has

significant prospective growth opportunities. Of course, if the company had little or

almost no earnings, its PE would have been rather high; so, care is urged while

considering this ratio. As a result, the PE ratio is inversely related to the company's risk. 1.7 Beta

Beta = 𝜷𝒖 ∗ (𝟏 + (𝟏 − 𝑻𝑪) ∗ 𝑩) S Where: 𝛽 : Beta of Unlevered firm B: Market value of debt S: Market value of equity 7 𝑇 : Tax rate Debt/Total Capital Actual 10% 20% 30% 𝛽 0.85 0.85 0.85 0.85 B 0 22,589 45,178 67,766 S 643,773 628,516 613,259 598,002 𝐵 𝑆 0 3.59% 7.37% 11.33% 𝑇 32.5% 32.5% 32.5% 32.5% Beta 0.85 0.87 0.89 0.92

Financial leverage increased the ROE of BETA, but it comes with a considerable risk.

The second issue we were concerned about was the influence of leverage on the WACC

when calculating the company's beta using the CAPM model. The unlevered beta was

0.85, which is the company's beta without any debt. It eliminates the financial

consequences of leverage. We used the calculation "Where BL is the firm's beta with

leverage, Tc is the tax rate, and D/E is the debt-to-equity ratio. At debt to total capital

ratios of 10%, 20%, and 30%, the figures are 0.87, 0.89, and 0.915, respectively. 1.8 Cost of equity (𝑹𝑺)

𝑹𝒔 = 𝒓𝒇 + 𝜷 ∗ (𝒓𝒎 − 𝒓𝒇) Where:

𝑟 : Risk – free rate (Usually, the Risk-free rate will be equal to the interest rate of 10-year government bonds)

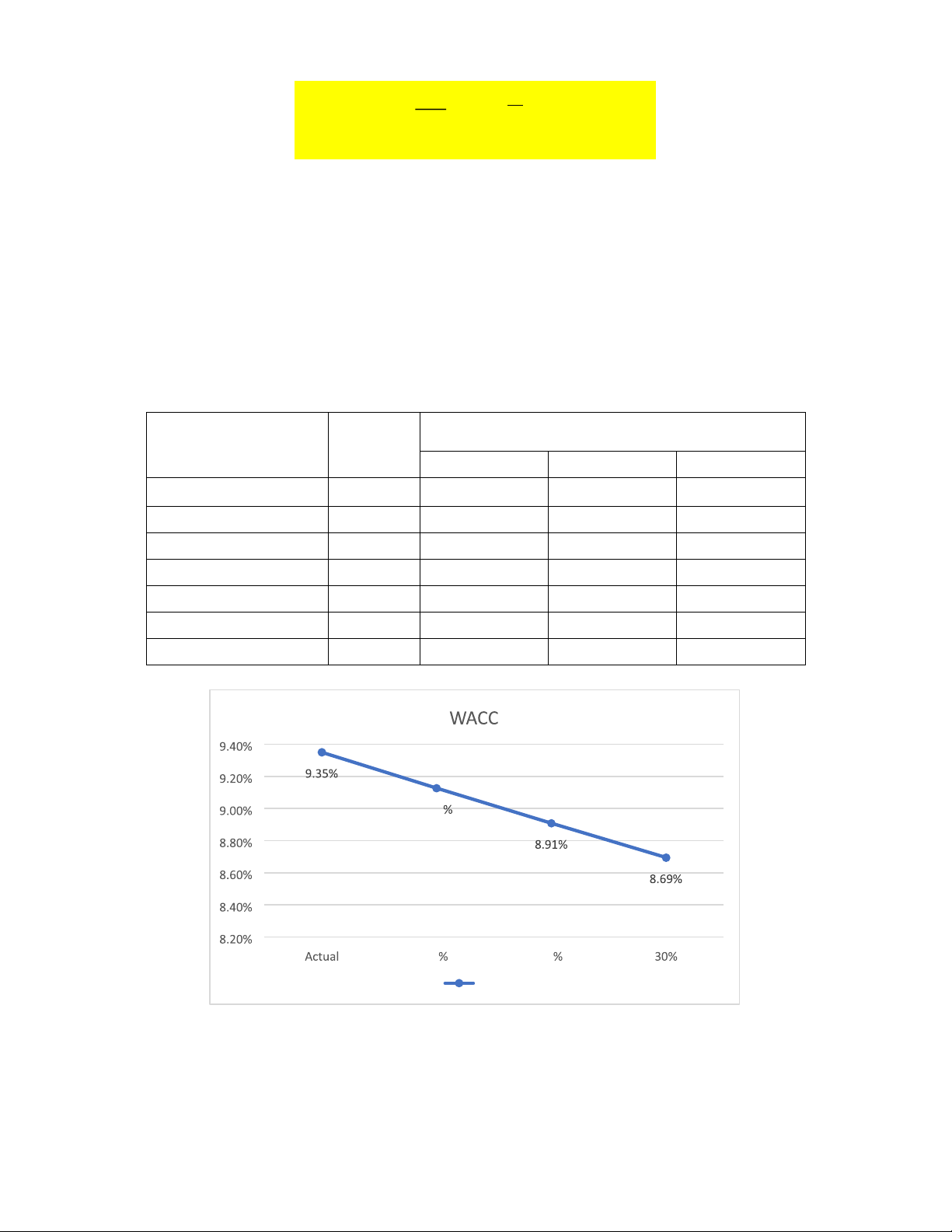

𝑟 − 𝑟 : Market risk premium β : Beta of the firm Debt/Total Capital Actual 10% 20% 30% β 0.85 0.85 0.85 0.85 𝑟 5.1% 5.1% 5.1% 5.1% 𝑟 − 𝑟 5% 5% 5% 5% 𝑅 9.35% 9.45% 9.56% 9.68%

1.9 Weighted average cost of capital (WACC) 8 lOMoARcPSD|47206417 WACC = 𝑹𝑩 ∗

𝑩 ∗ (𝟏 − 𝑻𝑪) + 𝑹𝑺 ∗ 𝑺/BS Where: 𝑅 : Cost of debt 𝑅 : Cost of equity 𝑇 : Tax rate B: Market value of debt S: Market value of equity Debt/Total Capital Actual 10% 20% 30% 𝑅 6.16% 6.16% 6.16% 6.16% B 0 22,589 45,178 67,766 S 643,773 628,516 613,259 598,002 B+S 643,773 651,105 658,437 665,769 𝑇 32.5% 32.5% 32.5% 32.5% 𝑅 9.35% 9.45% 9.56% 9.68% WACC 9.35% 9.13% 8.91% 8.69% 9.13 10 20 WACC

In terms of the cost of capital, our calculations in the figure above demonstrate a

distinct WACC for three different Debt/total capital scenarios of 10%, 20%, and 30% is 9

9.13%, 8.91%, and 8.69%, respectively. The financial leverage impact on cost of capital

was the decrease in WACC owing to the proportion differential of debt to total capital

from 10%, 20%, and 30%, respectively. 2. How does debt affect CPK?

For many businesses, debt is viewed as a liability that they owe to their creditors, and

repayment is a continuous worry. However, there are certain advantages to borrowing

debt for a business. Companies may often raise their EPS due to the interest tax shield

by significantly increasing their leverage and repurchasing shares. As a result, issuing

debt is often less costly than issuing equity. When debt is utilized to repurchase

outstanding shares, the interest tax shield will lower taxable income, resulting in a rise

in EPS. The same is true for CPK, who will gain from the taxes that happens while

financing a loan. The tax implications of debt differ from those of ownership.

Leveraging CPK will help them to obtain a lower tax rate, since reduced taxable income

equals lower tax paid. Furthermore, this will be reflected in the company's market

value because a tax shield increases market value by reducing a company's cash flow.

Another advantage for CPK will be an increase in ROE as a result of the higher

percentage of debt to equity. However, because of the tax break, income will not be

significantly affected. According to the ROE formula, net income/shareholders equity

drops in a higher proportion to net income, and ROE rises. This gives value to the

organisation as well. Because CPK's stock price is declining owing to undervaluation of

its stocks, they might repurchase it using loans. CPK will be able to influence the

impact of their stock price and enhance their value as a result of this. The debt inquiry

will benefit not just CPK, but also their shareholders, who will be able to earn more

money thanks to the tax shield.

III. What should Collyns recommend?

CPK is in a unique position to take advantage of the current financial environment by

financing its debt at 30%. This decision carries some risks, but the potential rewards

outweigh any negative consequences. The company has seen steady growth in sales,

net operating income, and net income over the past four years which makes this an

ideal time for CPK to acquire debt. Additionally, benchmarking results have been

positive indicating that returns on investment should be substantial with this strategy.

Repurchasing stock can raise its value as well; however, it does not provide an actual

investment into the firm itself so it may not be worth pursuing if CPK would need to

refinance more than 20% of their credit line of 75 million dollars just for repurchase

purposes. Instead, they could use those funds elsewhere within their business such as

improving or innovating products and services which could lead to greater long-term success for them overall. 10 lOMoARcPSD|47206417

In conclusion, California Pizza Kitchen should change its capital structure by issuing

debt and repurchasing shares. This instates a tax shield, which reduces taxable income,

increases the value of the company, and in turn increases the return to shareholders.

Subsequently allowing earnings to be spread out over fewer shares and as the market

increases, shareholders will have greater ROE and EPS. Taking on debt at 30% is a

favorable option given that risks are minimized due to strong performance from recent

benchmarking tests and consistent growth across key metrics over several years now.

By doing so they will benefit from increased returns while still being able to maintain

control via appropriate refinancing levels when needed. 11