Preview text:

CASE STUDY ANALYSIS

The Surprising Elasticity of Demand for Luxuries

1. How can you use the theory of “Supply,Demand – and elasticity“ to explain the case (by using graphs) ?

The assumtion was that the demand for the these luxury goods was quite inelastic

and the supply is elastic. That is, sellers are very responsive to changes in the

price of the good (so the supply curve is relatively flat), whereas buyers are not

very responsive (so the demand curve is relatively steep). When a tax is imposed

on a market with these elasticities, the price received by sellers does not fall

much, so sellers bear only a small burden. By contrast, the price paid by buyers

rises substantially, indicating that buyers bear most of the burden of the tax.

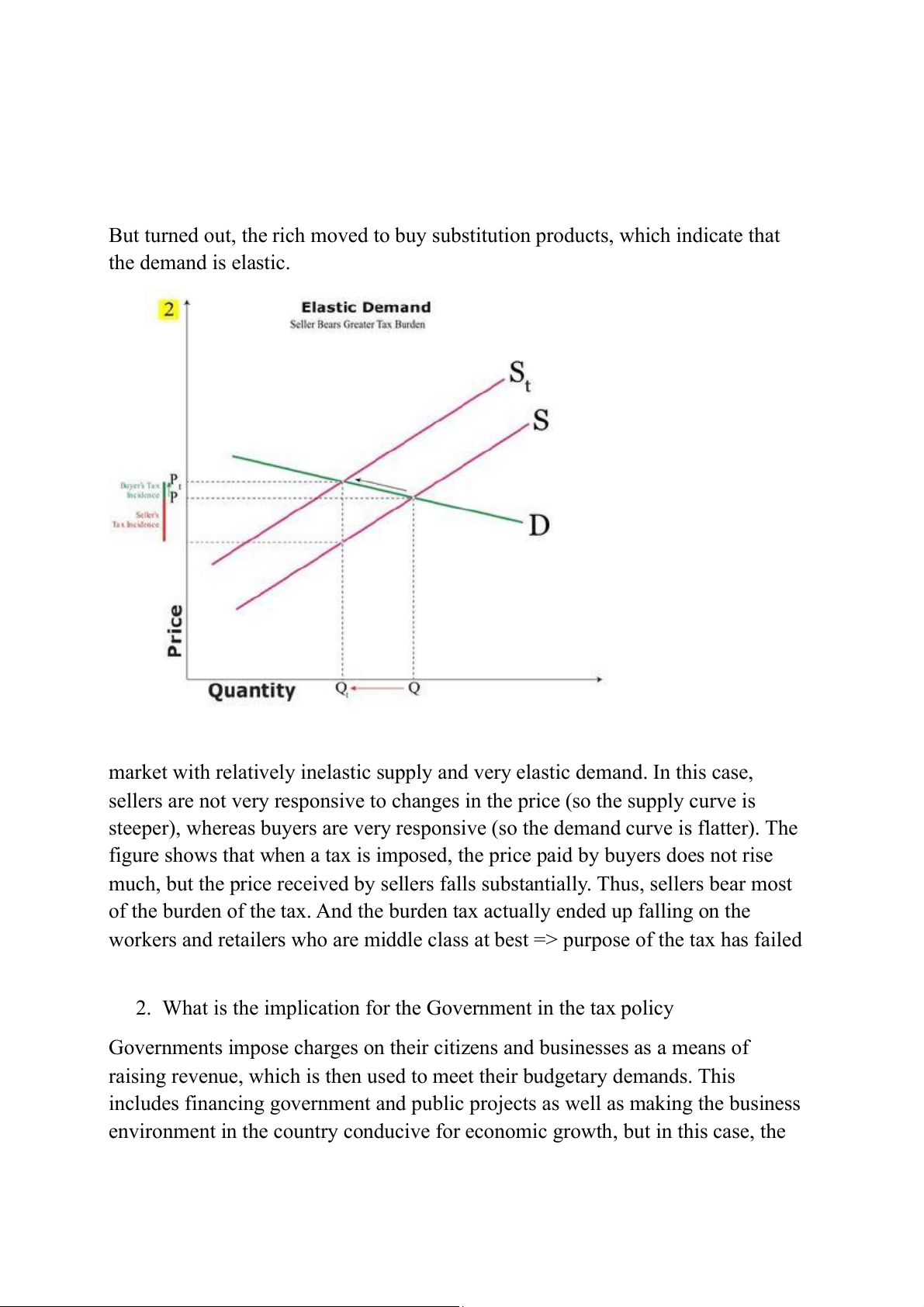

But turned out, the rich moved to buy substitution products, which indicate that the demand is elastic.

market with relatively inelastic supply and very elastic demand. In this case,

sellers are not very responsive to changes in the price (so the supply curve is

steeper), whereas buyers are very responsive (so the demand curve is flatter). The

figure shows that when a tax is imposed, the price paid by buyers does not rise

much, but the price received by sellers falls substantially. Thus, sellers bear most

of the burden of the tax. And the burden tax actually ended up falling on the

workers and retailers who are middle class at best => purpose of the tax has failed

2. What is the implication for the Government in the tax policy

Governments impose charges on their citizens and businesses as a means of

raising revenue, which is then used to meet their budgetary demands. This

includes financing government and public projects as well as making the business

environment in the country conducive for economic growth, but in this case, the

assumption of the elasticity of the demand for these luxury goods is not correct

.The Congress adopted a 10% “luxury tax” which is an inappropriate tax. This

leads to the loss of money in the government and the fall of the supply quantity ->

making this kind of policy detrimental to entire economy.