Preview text:

lOMoARcPSD| 59629529

151. Your firm values inventory using the weighted average cost method. At 1 October

20X8, there were 60 units in inventory valued at $12 each. On 8 October, 40 units were

purchased for $15 each, and a further 50 units were purchased for $18 each on 14

October. On 21 October, 75 units were sold for $1,200.

What was the value of closing inventory at 31 October 20X8? $1.110

152. An organisation’s inventory at 1 July is 15 units at $3.00 each. The following movements occur: 3 July 20X4 5 units sold at $3.30 each 8 July 20X4

10 units bought at $3.50 each 12 July 20X4 8 units sold at $4.00 each

What would be the closing inventory valuation at 31 July using the FIFO method of inventory valuation? A. $31.50 B. $36.00 C. $39.00 D. $41.00

153. In times of rising prices, the valuation of inventory using the First In First

Out method, as opposed to the Weighted Average Cost method, will result in which

ONE of the following combinations? Cost of sales Profit Closing inventory A. Lower Higher Higher B. Lower Higher Lower C. Higher Lower Higher D. Higher Higher Lower

154. A company determines its order quantity for a component using the Economic OrderQuantity (EOQ) model.

What would be the effects on the EOQ and the total annual ordering cost of an

increase in the annual cost of holding one unit of the component in inventory? EOQ Total annual ordering cost A. Lower Higher B. Higher Lower C. Lower No effect D. Higher No effect lOMoARcPSD| 59629529

155. A company uses the Economic Order Quantity (EOQ) model to establish reorder quantities.

The following information relates to the forthcoming period: Order costs = $25 per order

Holding costs = 10% of purchase price Annual demand = 20,000 units Purchase price = $40 per unit EOQ = 500 units No safety inventory is held.

What are the total annual costs of inventory (i.e. the total purchase cost plus total

order cost plus total holding cost)? A. $22,000 B. $33,500 C. $802,000 D. $803,000

156. Data relating to a particular stores item are as follows: Average daily usage 400 units Maximum daily usage 520 units Minimum daily usage 180 units

Lead time for replenishment of inventory 10 to 15 days Reorder quantity 8,000 units

What is the reorder level (in units) that avoids inventory stockouts? 7800 units

Maximum usage × maximum lead time = 520 × 15 = 7,800 units

157. A large store selling office furniture stocks a popular chair for which the following information is available: Annual demand: 4,000 chairs Maximum inventory: 75 chairs Minimum inventory: 20 chairs Lead time: 5 days Re order quantity: ‐ 100 chairs

What is the average inventory level? A. 75 chairs B. 70 chairs C. 55 chairs lOMoARcPSD| 59629529 D. 47 chairs

Average inventory = ROQ/2 + minimum inventory = 100/2 + 20 = 70 chairs

158. What is the economic batch quantity used to establish? A. Optimal reorder quantity B. Optimal reorder level C. Maximum inventory levels

D. Optimal quantity to be manufactured

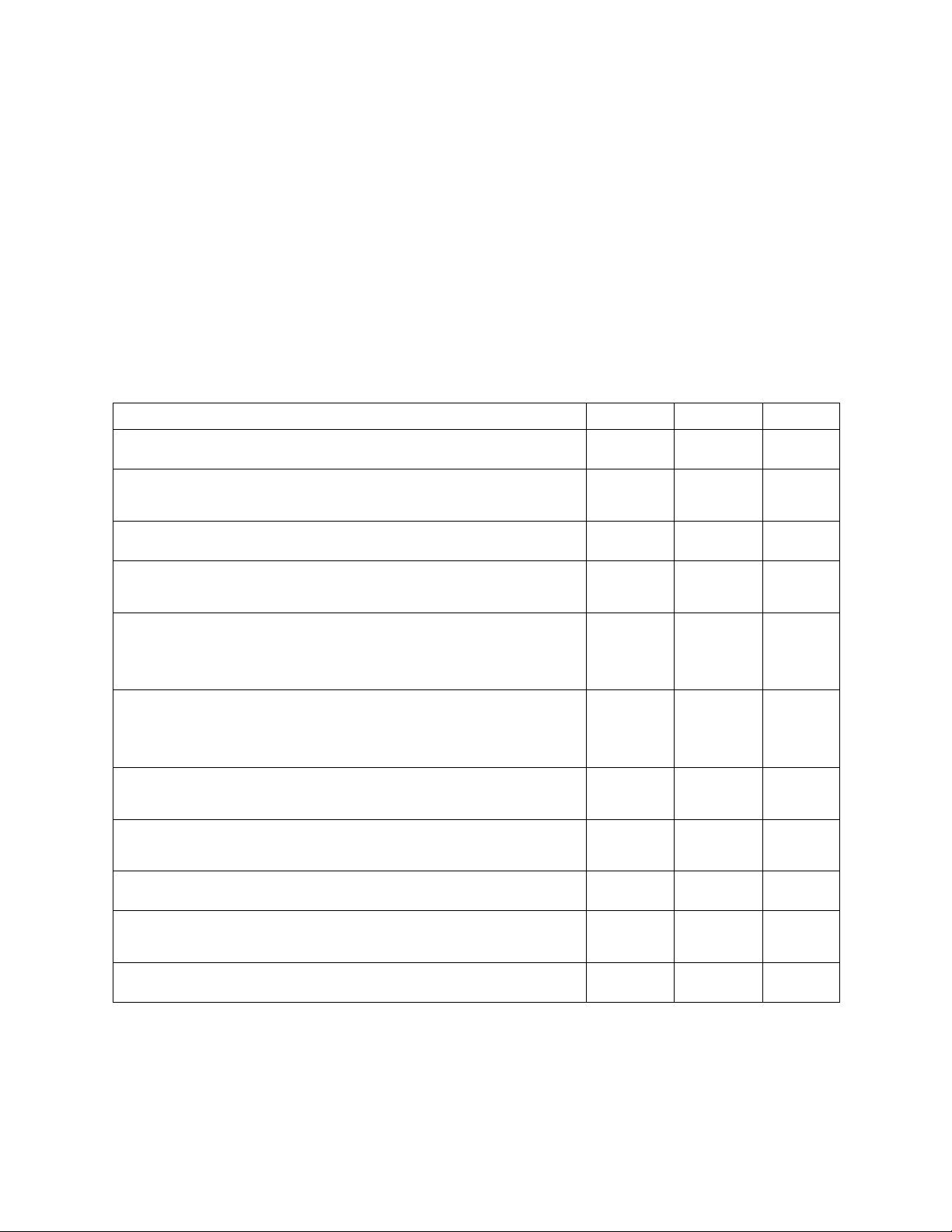

159. Which method of inventory valuation is being described? Characteristic FIFO LIFO AVCO

Potentially out of date valuation on issues. ●

The valuation of inventory rarely reflects the actual ●

purchase price of the material.

Potentially out of date closing inventory valuation. ●

This inventory valuation method is particularly suited ●

to inventory that consist of liquid materials e.g. oil.

This inventory valuation method is particularly suited ●

to inventory that has a short shelf life e.g. dairy products.

This inventory valuation method is suited to a wheat ●

farmer who has large silos of grain. Grain is added to

and taken from the top of these silos.

In times of rising prices this method will give higher ● profits.

In times of rising prices this method gives a middle ●

level of profits compared to the other two.

Issues are valued at the most recent purchase cost. ●

Inventory is valued at the average of the cost of ● purchases.

Inventory is valued at the most recent purchase cost. ●

160. A company manufactures a product in batches and then holds the items produced in

finished goods inventory until they are sold. It is capable of replenishing the product

at the rate of 100,000 units/year, but annual sales demand is just 40,000 units. The lOMoARcPSD| 59629529

cost of setting up a batch production run is $1,500 and the cost of holding a unit of

the product in inventory is $25/year.

What is the economic batch quantity for manufacturing this product? A. 2,191 units B. 2,828 units C. 4,472 units D. 10,954 units

161. Which TWO of the following are included in the cost of holding inventory? A. The cost of insurance B. The delivery costs

C. Rental payments on storage space D. The cost of placing an order

162. A manufacturing company uses 25,000 components at an even rate during a year.

Each order placed with the supplier of the components is for 2,000 components, which is

the economic order quantity. The company holds a buffer inventory of 500 components.

The annual cost of holding one component in inventory is $2.

What is the total annual cost of holding inventory of the component? A. $2,000 B. $2,500 C. $3,000 D. $4,000

Annual holding cost = {[Buffer inventory + (EOQ ÷2)] × Annual holding cost per

component} = {[500 + (2000 ÷2)] × 2} = 3,000

163. The purchase price of an inventory item is $42 per unit. In each three month period

the usage of the item is 2,000 units. The annual holding costs associated with one unit is

5% of its purchase price. The EOQ is 185 units.

What is the cost of placing an order (to 2 decimal places)? $4.49

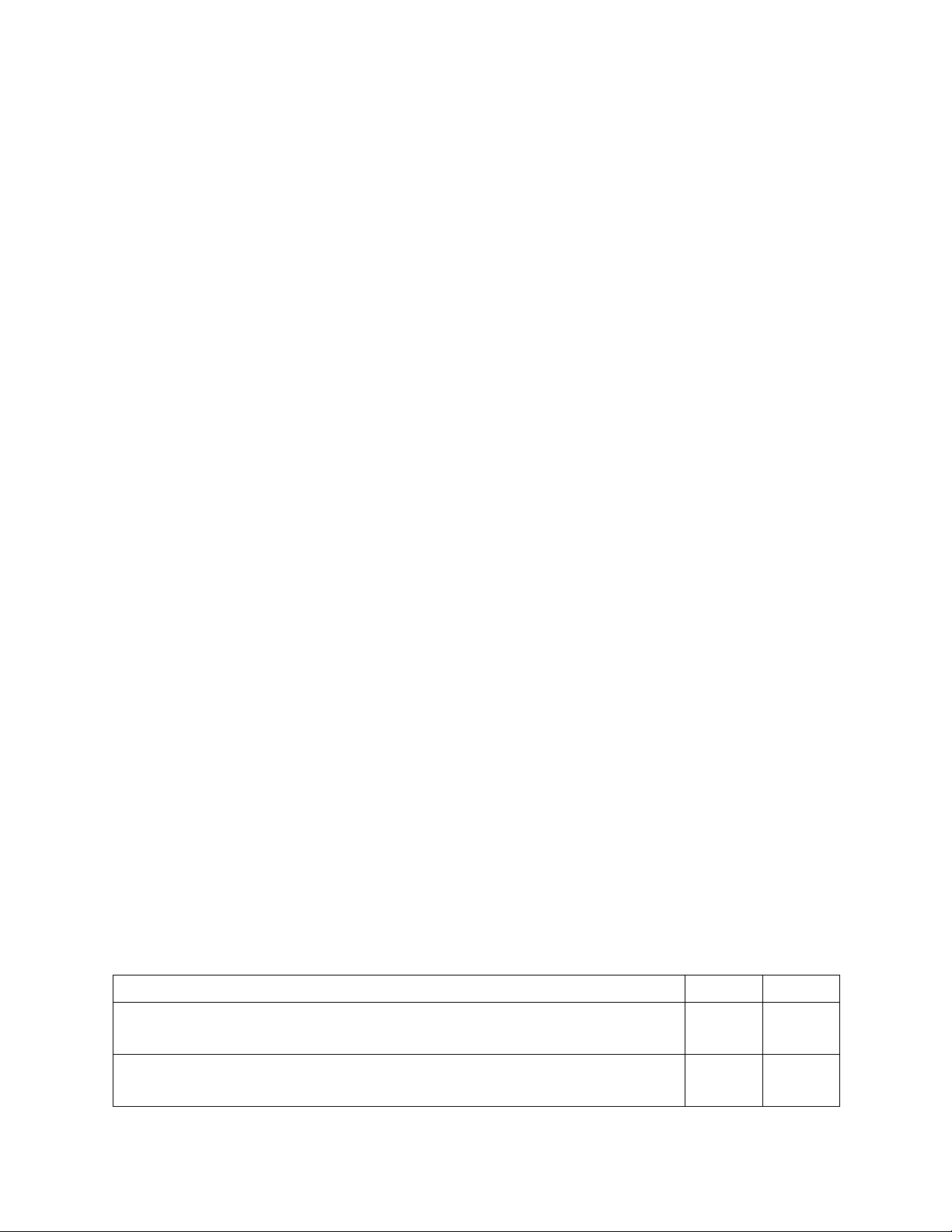

164. Are the following statements true or false? Statement True False

In periods of rising prices, FIFO gives a higher valuation of closing ● inventory than LIFO or AVCO.

In periods of falling prices, LIFO gives a higher valuation of ●

issues of inventory than FIFO or AVCO. lOMoARcPSD| 59629529

AVCO would normally be expected to produce a valuation of ●

closing inventory somewhere between valuations FIFO and LIFO.

FIFO costs issues of inventory at the most recent purchase price. ●

AVCO costs issues of inventory at the oldest purchase price. ●

LIFO costs issues of inventory at the oldest purchase price. ●

FIFO values closing inventory at the most recent purchase price. ●

LIFO values closing inventory at the most recent purchase price. ●

AVCO values closing inventory at the latest purchase price. ●

The following information applies to the next THREE questions

Point uses the economic order quantity (EOQ) model to establish the reorder quantity for

raw material Y. The company holds no buffer inventory. Information relating to raw material Y is as follows: Annual usage 48,000 units Purchase price $80 per unit Ordering costs $120 per order Annual holding costs 10% of the purchase price

165. What is the EOQ for raw material Y? A. 438 B. 800 C. 1,200 D. 3,795

Using the formula given: EOQ = √[(2 × 120 × 48,000) ÷ (0.10 × 80)] = 1,200 units

166. What is the total annual cost of purchasing, ordering and holding inventory of

raw material Y? A. $3,849,600 B. $3,850,400 C. $3,853,600 D. $3,854,400

167. The supplier has offered Point a discount of 1% on the purchase price if each order placed is for 2,000 units.

What is the total annual saving to Point of accepting this offer? lOMoARcPSD| 59629529 A. $29,280 B. $30,080 C. $37,200 D. $38,000

168. A company uses components at the rate of 600 units per month, which are bought in

at a cost of $2.24 each from the supplier. It costs $8.75 each time to place an order,

regardless of the quantity ordered. The supplier offers a 5% discount on the purchase

price for order quantities of 2,000 items or more. The current EOQ is 750 units. The total

holding cost is 10% per annum of the value of inventory held.

What is the change in total cost to the company of moving to an order quantity of 2,000 units? A. $601 additional cost B. $730 additional cost C. $730 saving D. $601 saving

169. A company makes a component for one of its products in house. It uses an average

of 5,000 of these throughout the year. The production rate for these components is 500

per week and the cost of holding one item for the year is $1.50. The factory is open for

50 weeks per year. The company has calculated that the economic batch quantity is 2,000.

What is the production setup cost per batch? A. $213 B. $240 C. $480 D. $960

170. Which of the following is in the correct chronological sequence for sales documents?

A. Enquiry – Order – Invoice – Payment

B. Order – Enquiry – Invoice – Payment

C. Enquiry – Order – Payment – Invoice

D. Enquiry – Invoice – Order – Payment lOMoARcPSD| 59629529

171. Which of the following is in the correct chronological sequence for purchase documents?

A. Purchase order – Invoice – Goods received note – Delivery note

B. Delivery note – Goods received note – Purchase order – Invoice

C. Purchase order – Delivery note – Goods received note – Invoice

D. Goods received note – Delivery note – Purchase order – Invoice172. Which of the

following describes a purchase order?

A. Issued by the purchasing department, sent to the supplier requesting materials

B. Issued by the stores department, sent to the purchasing department requesting materials

C. Received together with the materials and compared to the materials received

D. Issued by the production department, sent to the stores department requesting materials

173. Which TWO of the following statements describe the information a Goods

Received Note (GRN) provides?

A. Information used to update inventory records

B. Information to check that the correct price has been recorded on the supplier’s invoice

C. Information to check that the correct quantity of goods has been recorded on the supplier’s invoice

D. Information to record any unused materials which are returned to stores

174. When charging direct material cost to a job or process, the details would be

taken from which document? A. Purchase requisition

B. Material requisition C. Goods received note D. Purchase order

175. Which TWO of these documents are matched with the goods received note in

the buying process? A. Invoice from supplier B. Purchase order C. Purchase requisition D. Stores requisition lOMoARcPSD| 59629529

176. The following relate to the management of raw materials:

(i) Holding costs per unit of inventory would increase

(ii) The economic order quantity would decrease

(iii) Average inventory levels would increase

(iv) Total ordering costs would decrease

Which of the above would result from the introduction of buffer (safety) inventory? A. (iii) only B. (i) and (ii) C. (iii) and (iv) D. (i) and (iv)

177. Which of the following is least relevant to the simple economic order quantity

model for inventory? A. Safety inventory B. Annual demand C. Holding costs D. Ordering costs

178. The following documents are used in accounting for raw materials: (i) goods received note (ii) materials returned note

(iii) materials requisition note (iv) delivery note

Which of the documents may be used to record raw materials sent back to stores from production? A. (i) and (ii) B. (i) and (iv) C. (ii) only D. (ii) and (iii)

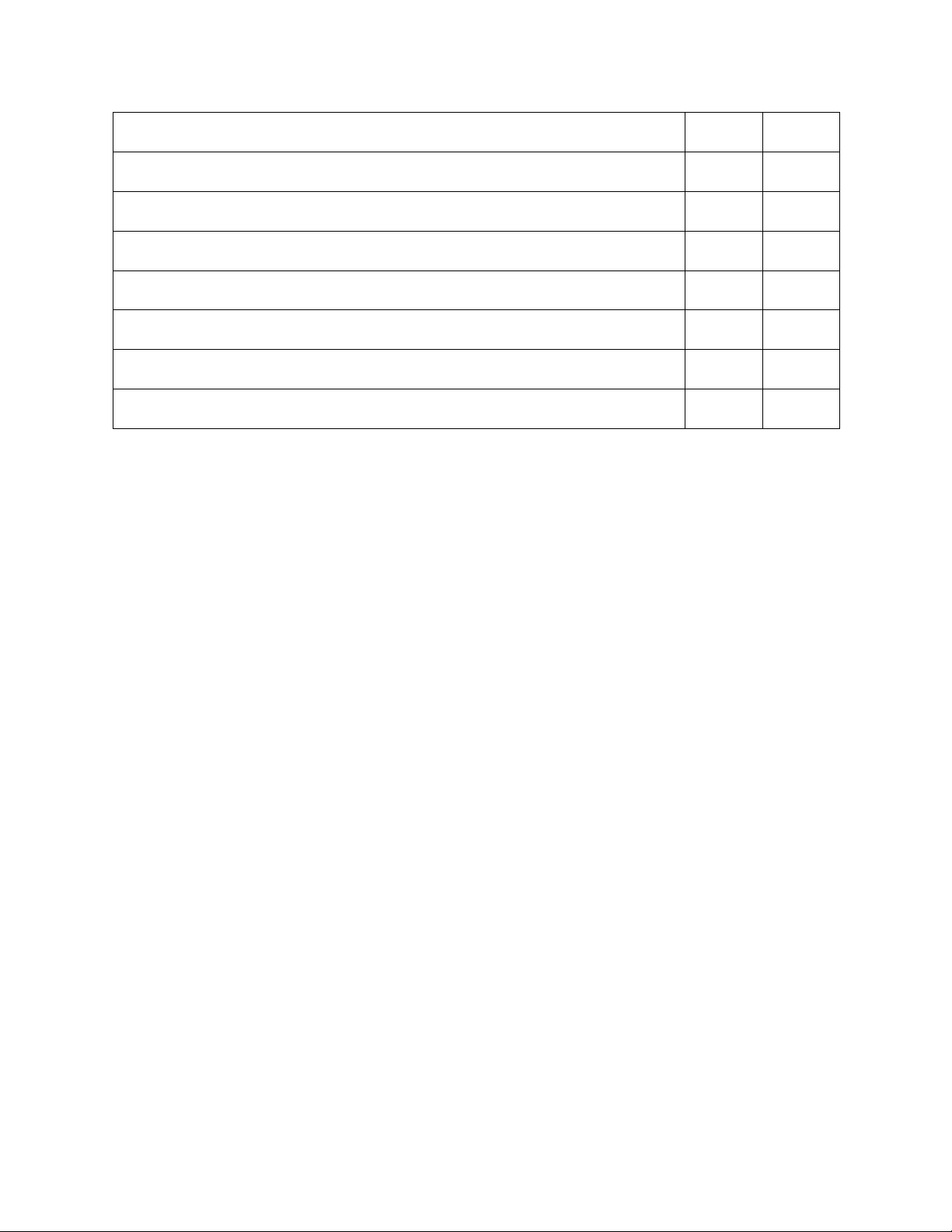

179. Which of the following documents should be checked before a purchase invoice

is paid, to confirm that the price and quantities are correct? Price check Quantity check A. Purchase order Purchase order B. Goods received note Delivery note C. Purchase invoice Goods received note lOMoARcPSD| 59629529 D. Purchase order Goods received note