Preview text:

CFA 2025 Level I - Schweser Quicksheet

Financial Management (Trường Đại học Ngoại thương)

LEVEL I SCHWESER’S QuickSheet

CRITICAL CONCEPTS FOR THE 2025 CFA® EXAM

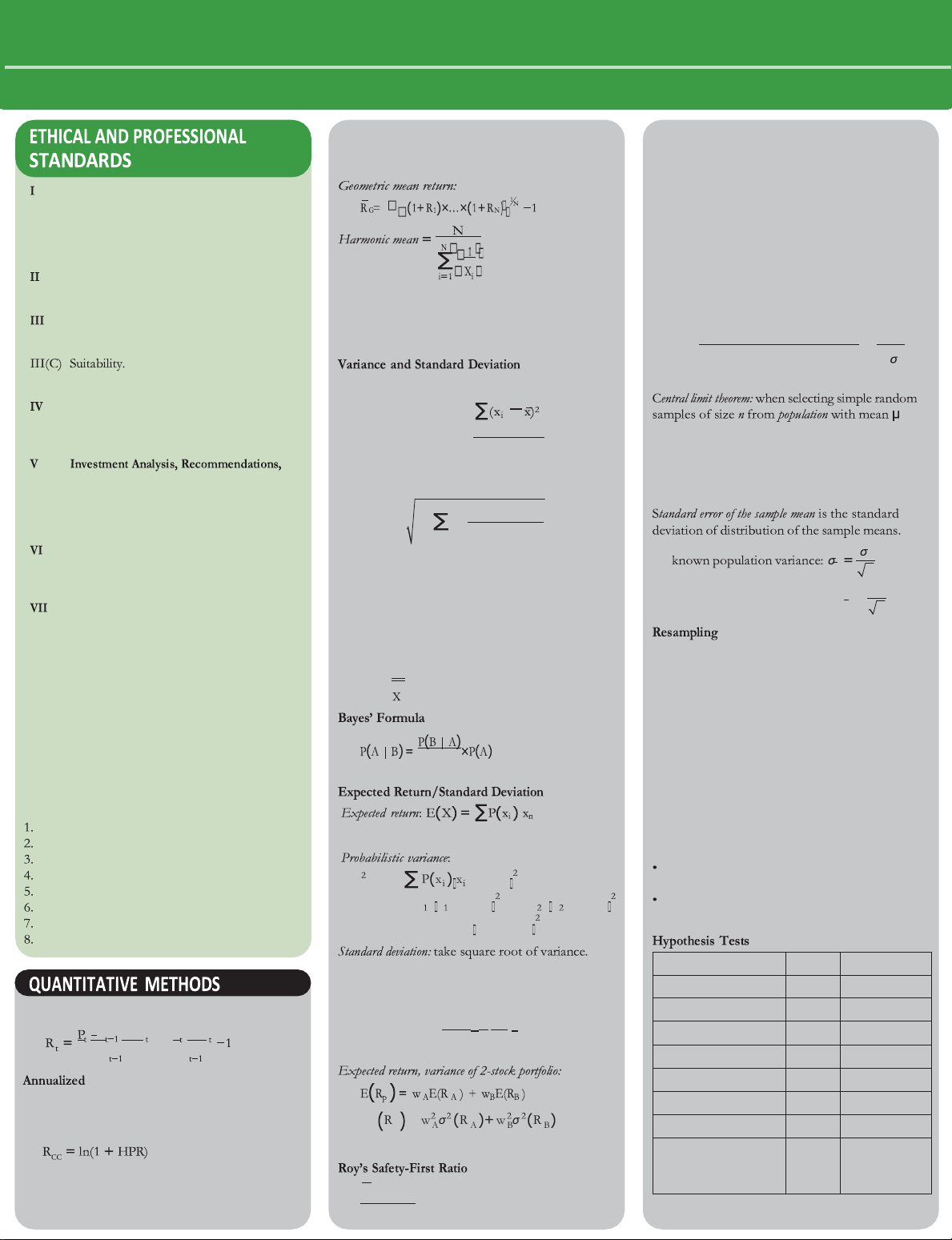

Geometric mean: used when calculating investment Normal Distributions

returns over multiple periods or to measure

Normal distribution is completely described by its compound growth rates. mean and variance.

68% of observations fall within ± 1s. Professionalism 90% fall within ± 1.65s. I(A) Knowledge of the Law. I(B) Independence and Objectivity. 95% fall within ± 1.96s. I(C) Misrepresentation. 99% fall within ± 2.58s. I(D) Misconduct. Computing Z-Scores I(E) Competence.

Z-score: “standardizes” observation from

Integrity of Capital Markets

normal distribution; represents # of standard

II(A) Material Nonpublic Information.

Trimmed mean (x%): Exclude highest and lowest

deviations a given observation is from population II(B) Market Manipulation. x/2 percent of observations. Duties to Clients mean.

III(A) Loyalty, Prudence, and Care.

Winsorized mean (x%): Substitute values for highest III(B) Fair Dealing.

and lowest x/2 percent of observations.

z = observation−population mean = x − µ standard deviation

III(D) Performance Presentation.

Variance: average of squared deviations from mean. Central Limit Theorem

III(E) Preservation of Confidentiality. n Duties to Employers IV(A) Loyalty. sample variance = s2= i=1

and finite variance s2, the sampling distribution

IV(B) Additional Compensation Arrangements. n −1

of sample mean approaches normal probability

IV(C) Responsibilities of Supervisors.

Standard deviation: square root of variance.

distribution with mean µ and variance equal to s2/n and Actions

as the sample size becomes large.

Target Downside Deviation

V(A) Diligence and Reasonable Basis. Standard Error

V(B) Communication with Clients and 2 n Prospective Clients. Starget = (X −target) i n−1 V(C) Record Retention. all X i Conflicts of Interest

VI(A) Avoid or Disclose Conflicts.

Coefficient of Variation x n

VI(B) Priority of Transactions.

Coefficient of variation (CV): expresses how much VI(C) Referral Fees.

dispersion exists relative to mean of a distribution;

unknown population variance: s = s x

Responsibilities as a CFA Institute

allows for direct comparison of dispersion across n

Member or CFA Candidate

different data sets. CV is calculated by dividing Techniques

VII(A) Conduct as Participants in CFA Institute Programs.

standard deviation of a distribution by the mean or

Jackknife: Calculate multiple sample means, each

VII(B) Reference to CFA Institute, the CFA

expected value of the distribution:

with one observation removed, then calculate

Designation, and the CFA Program. CV = s

standard deviation of the sample means

Global Investment Performance Standards

Bootstrap: Draw repeated samples of size n from

the full dataset, replacing the sampled observations

Definition of firm: Corporation, subsidiary, or

each time, then calculate the standard deviation of

division held out to clients as a business entity.

All fee-paying discretionary portfolios must be the sample means

included in at least one composite. P(B)

Nul and Alternative Hypotheses

Verification: Optional, but if chosen it must be

Nul hypothesis (H0): hypothesis that contains the

carried out by an independent third party. equal sign (=, ≤, ≥).

GIPS standards for firms:

Alternative hypothesis (Ha): concluded if there is Fundamentals of Compliance

sufficient evidence to reject the null hypothesis. E(X) = P(x 1)x1 +P(x2 )x2 ++P(xn )xn

Input Data and Calculation Methodology

Type I and Type II Errors

Composite and Pooled Fund Maintenance

Type I error: rejection of null hypothesis when it is

Composite Time-Weighted Return Report σ ( X)= P (x ) x − ( E X ) actually true.

Composite Money-Weighted Return Report = P(x )

Type II error: failure to reject null hypothesis when −E (X) + P(x )

Pooled Fund Time-Weighted Return Report x x −E (X) it is actually false.

Pooled Fund Money-Weighted Return Report ++ P(x ) x −E(X) n n GIPS Advertising Guidelines Test of: Stat d.f. Correlation and Covariance

Correlation: covariance divided by product of the Mean t or z n – 1 two standard deviations.

Holding Period Return (HPR) Difference in means t n + n – 2 1 2 COV(R ) P +D P +D i, R j corr(R )= Mean differences t n – 1 i ,R j or σ( ) P Ri )σ(R j P Variance χ2 n – 1 Return Equal variances F n – 1, n – 1 1 2 (1+ HPR)365/days −1 Correlation t n – 2 var R =

p w σ (R )+ w σ (R )

Continuously Compounded Return A A B B Independence χ2 (r – 1)(c – 1) +2w

A wBσ(R A )σ(RB )ρ(R A ,RB ) Regression slope: Significance Means F 1, n – 2 Value

Arithmetic mean: sum of all observation values in r t n – 2 p −rtarget

sample/population, divided by # of observations. σp

Downloaded by v ng (ngttgi20804@gmail.com)

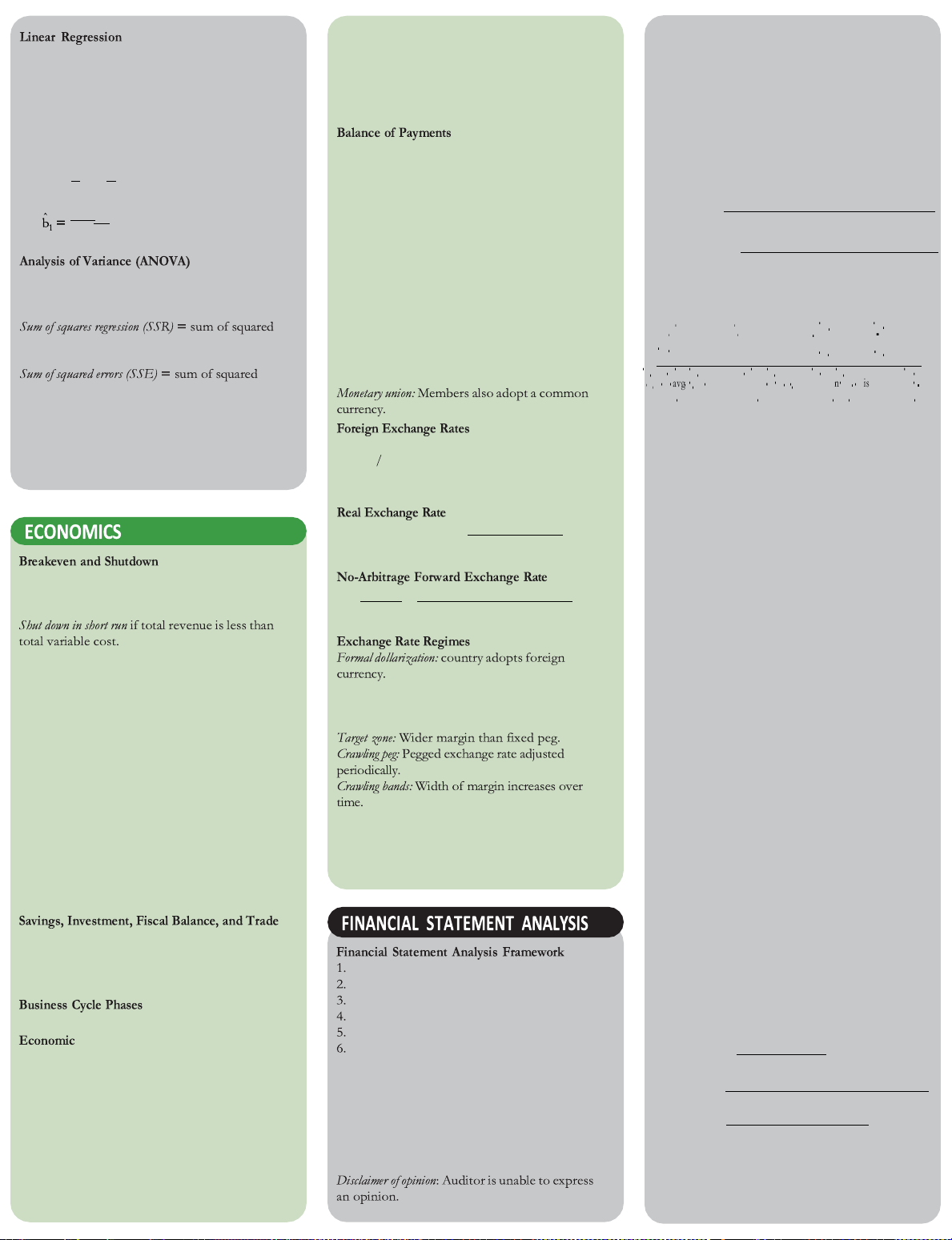

contractionary when the policy rate is greater than Revenue Recognition Y = b + b X + ε the neutral interest rate. i 0 1 i i

Five-step revenue recognition model: where:

Fiscal policy is expansionary when a budget 1. Identify contracts Y = dependent variable

deficit is increasing or surplus is decreasing, and

2. Identify performance obligations X = independent variable

contractionary when a budget deficit is decreasing

3. Determine transaction price b or surplus is increasing. 0 = intercept term

4. Allocate price to obligations b1 = slope term

5. Recognize when (as) obligations are satisfied ε = error term (residual)

Current account: merchandise and services; income i Basic and Diluted EPS

Estimated intercept and slope terms:

receipts; unilateral transfers.

Basic EPS calculation does not consider effects of bˆ

Capital account: capital transfers; sales/purchases of

any dilutive securities in computation of EPS: 0 = Y − bˆ1 X nonfinancial assets. Cov

Financial account: government-owned assets basic EPS =

net income− preferred dividends XY

wtd. avg. no. of common shs. outstanding σ2

abroad; foreign-owned assets in the country. X

Regional Trading Agreements

diluted EPS = adj. income avail. for common shares

Free trade area: Removes barriers to goods and

wtd. avg. common shares plus potential

Total sum of squares (SST) = sum of squared services trade among members. common shares outstanding

differences between actual Y-values and the

Customs union: Members also adopt common trade Therefore, diluted EPS is: mean of Y policies with non-members.

Common market: Members also remove barriers to net

pfd convertible convertible −

+ preferred + debt (1−t)

distances between predicted Y-values and the mean

labor and capital movements among members.

income div dividends of Y interest

Economic union: Members also establish common

institutions and economic policy.

wtd shares from sh’s from shares

avg + conversion of + conversion + issuable from

distances between actual and predicted Y-values sh’s

conv. debt stock options conv. pfd. sh’s

Coefficient of Determination

R2 = SSR/SST = percentage of variation in the

Marketable Security Classifications

dependent variable explained by variation in the

For the exam, FX rates are expressed as price

Held-for-trading: fair value on balance sheet; independent variable

currency base currency and interpreted as the

dividends, interest, realized and unrealized G/L

number of units of the price currency for each unit

recognized on income statement. of the base currency.

Available-for-sale: fair value on balance sheet;

dividends, interest, realized G/L recognized

on income statement; unrealized G/L is other base currency CPI nominal FX rate comprehensive income. price currency CPI

Held-to-maturity: amortized cost on balance

sheet; interest, realized G/L recognized on income

Breakeven: total revenue = total cost. statement.

Operate in short run if total revenue is greater than forward

total variable cost but less than total cost.

= 1 + price currency interest rate

Cash Flows From Operations (CFO) spot

1 + base currency interest rate

Direct method: start with cash collections (cash

equivalent of sales); cash inputs (cash equivalent of

cost of goods sold); cash operating expenses; cash Market Structures interest expense; cash taxes.

Perfect competition: Many firms with no pricing

Indirect method: start with net income, subtracting

power; very low or no barriers to entry;

Monetary union: members adopt common currency.

back gains and adding back losses resulting from homogeneous product.

Fixed peg: ±1% margin versus foreign currency or

financing or investment cash flows, adding back all

Monopolistic competition: Many firms; some basket of currencies.

noncash charges, and adding and subtracting asset

pricing power; low barriers to entry; differentiated

and liability accounts that result from operations.

products; large advertising expense.

Oligopoly: Few firms that may have significant Free Cash Flow

Free cash flow (FCF) measures cash available for

pricing power; high barriers to entry; products may

discretionary purposes and is equal to operating

be homogeneous or differentiated.

Managed floating: Monetary authority acts to

cash flow less net capital expenditures.

Monopoly: Single firm with significant pricing

power; high barriers to entry; advertising used to

influence exchange rate but does not set a target. Critical Ratios

compete with substitute products.

Independently floating: Exchange rate is market-

Common-size financial statement analysis:

In al market structures, profit is maximized at determined.

• Common-size balance sheet expresses all balance

the output quantity for which marginal revenue =

sheet accounts as a percentage of total assets. marginal cost.

• Common-size income statement expresses all

income statement items as a percentage of sales. Balance

• Common-size cash flow statement expresses each

Fiscal budget deficit (G – T) = excess of saving

line item as a percentage of total cash inflows

over domestic investment (S – I) – trade balance

State the objective and context

(outflows), or as a percentage of net revenue. (X – M) Gather data

Horizontal common-size financial statement analysis: Process the data

expresses each line item relative to its value in a

Analyze and interpret the data common base period.

Expansion; peak; contraction; trough.

Report conclusions or recommendations Liquidity ratios: Indicators Update the analysis

Leading: Turning points occur ahead of peaks and

current ratio = current assets Auditor Opinions current liabilities troughs

Coincident: Turning points coincide with peaks and

Unqualified (unmodified, clean): Reasonable

quick ratio = cash + marketable securities + receivables troughs

assurance that financial statements are free from current liabilities

Lagging: Turning points follow peaks and troughs

material omissions and errors. cash + marketable securities

Qualified: Exceptions to accounting principles. cash ratio =

Expansionary and Contractionary Policy current liabilities

Adverse: Statements are not presented fairly or do

Monetary policy is expansionary when the policy

not conform with accounting standards.

rate is less than the neutral interest rate (real trend

rate of economic growth + inflation target) and

Downloaded by v ng (ngttgi20804@gmail.com) DuPont Analysis

defensive interval = cash + mkt. sec. +receivables

Traditional DuPont equation:

For stock grants, performance shares, and employee daily cash expenditures

net income sales assets stock options, the estimated fair value at the grant

Receivables, inventory, payables turnover, and days’ return on equity =

date is expensed over the vesting period. sales

supply ratios—all of which are used in the cash

as ets equity conversion cycle: Estimate revenue growth

receivables turnover = annual sales

You may also see it presented as: net profit asset equity Estimate cost of sales average receivables return on equity = Estimate SG&A expenses

margin turnover multiplier Estimate financing costs

inventory turnover = cost of goods sold Estimate taxes average inventory

Extended DuPont equation further decomposes net profit margin:

Model working capital accounts cost of goods sold

Estimate PP&E, capital spending

payables turnover ratio = average trade payables

ROE = net income EBT EBIT

EBT × EBIT × revenue

Construct pro forma statements days of sales outstanding = 365 × revenue

avg. total asets

avg. total assets × avg. equity receivables turnover 365 CORPORATE ISSUERS days of inventory on hand =

You may also see it presented as: inventory turnover

ROE = tax burden × interest burden × Corporate Governance

EBIT margin × asset turnover × leverage

Stakeholder groups: Shareholders, board of directors, number of days of payables = 365

senior managers, employees, creditors, suppliers. payables turnover ratio Inventory Accounting

Key board committees: Audit, nominating/ days of inventory

In periods of rising prices and stable or increasing

governance, compensation/remuneration. cash conversion cycle = inventory quantities: on hand

Types of Capital Investment Projects

LIFO results in:

FIFO results in:

Going concern: Maintain the business or reduce + days of sales number of days Higher COGS Lower COGS outstanding − of payables Lower gross profit Higher gross profit costs. Lower inventory Higher inventory

Regulatory/compliance: Required to meet concerns

Total asset, fixed-asset, and working capital turnover balances balances

such as safety or environment. ratios:

L ong-Lived Assets Capitalizing vs. Expensing

Expansion: Grow the existing business total asset turnover = revenue

Capitalizing: lowers income variability and

Other: Includes projects outside the existing average total assets

increases near-term profits. Increase assets, equity. business.

Expensing: opposite effect. Capital Allocation fixed asset turnover = revenue Administrative steps: average fixed assets

Revaluation of Long-Lived Assets

IFRS: revaluation gain recognized in net income 1. Generate ideas 2. Analyze project proposals working capital turnover = revenue

only to the extent it reverses previously recognized average working capital

impairment loss; further gains recognized in equity

3. Create firm-wide capital budget

as revaluation surplus. (For investment property,

4. Monitor decisions and conduct post-audit

Gross, operating, and net profit margins:

all gains and losses from marking to fair value are recognized as income.) NPV = CF + CF2 0 + CF1 +...+ CFn

gross profit margin = gross profit (1+ k)1 (1+ k)2 (1+ k)n revenue

U.S. GAAP: revaluation is not permitted.

IRR: discount rate that makes NPV equal to zero.

operating profit margin = operating profit = EBIT Deferred Taxes

• Created when taxable income (on tax return) ≠

Return on Invested Capital (ROIC) revenue net sales

pretax income (on financial statements) due to net income temporary differences. ROIC =

net operating profit after tax net profit margin =

average book value of invested capital revenue

• Deferred tax liabilities are created when taxable

income < pretax income. Treat DTL as equity if

Return on assets [return on total capital (ROTC)]: not expected to reverse. Real Options return on assets = EBIT

• Deferred tax assets are created when taxable income

Timing: Delay investment (total capital) average total capital

> pretax income. Must recognize valuation

Abandonment: Exit project

allowance if more likely than not that DTA will

Expansion: Follow-on investment

Debt to equity ratio and total debt ratio: not be realized.

Flexibility: Change price or inputs

Fundamental: Payoff depends on price of

debt-to-equity ratio = total debt Leases total equity underlying asset

Lessee reporting: Under IFRS, lessee recognizes

Weighted Average Cost of Capital total debt

right-of-use asset (amortized straight-line) and total-debt-ratio =

liability equal to PV of lease payments. Interest total assets

WACC =(wd )[kd(1−t)]+ (wps )(kps ) +(wce )(ks )

portion of each payment is interest expense,

Interest coverage and fixed charge coverage:

principal portion decreases liability.

Capital Structure Theories

U.S. GAAP is same except that right-of-use asset

Modigliani-Miller (MM) with no taxes: Capital interest coverage = EBIT

is amortized to match the lease liability, and for an structure is irrelevant. interest

operating lease, entire lease payment is an expense.

MM with taxes but no costs of financial distress:

fixed charge coverage = EBIT + lease payments

Lessor reporting, finance lease: Remove asset from

100% debt maximizes firm value. interest + lease payments

balance sheet, recognize lease receivable asset,

Static tradeoff theory: Firm value initially increases report interest income.

with debt financing, but decreases when costs

Growth rate: g = RR × ROE

Lessor reporting, operating lease: Keep asset on

of financial distress outweigh tax benefits of retention rate = 1− dividends declared

balance sheet, report lease payments as income, additional debt. operating income after taxes record depreciation expense.

Pecking order theory: Managers prefer internal

capital, then debt, then external equity.

Liquidity ratios indicate company’s ability to pay its Pensions short-term liabilities.

Defined contribution: employer contribution expensed in period incurred.

Operating performance ratios indicate how well

Defined benefit: overfunded plan recognized as net

management operates the business.

pension asset, underfunded plan recognized as net pension liability.

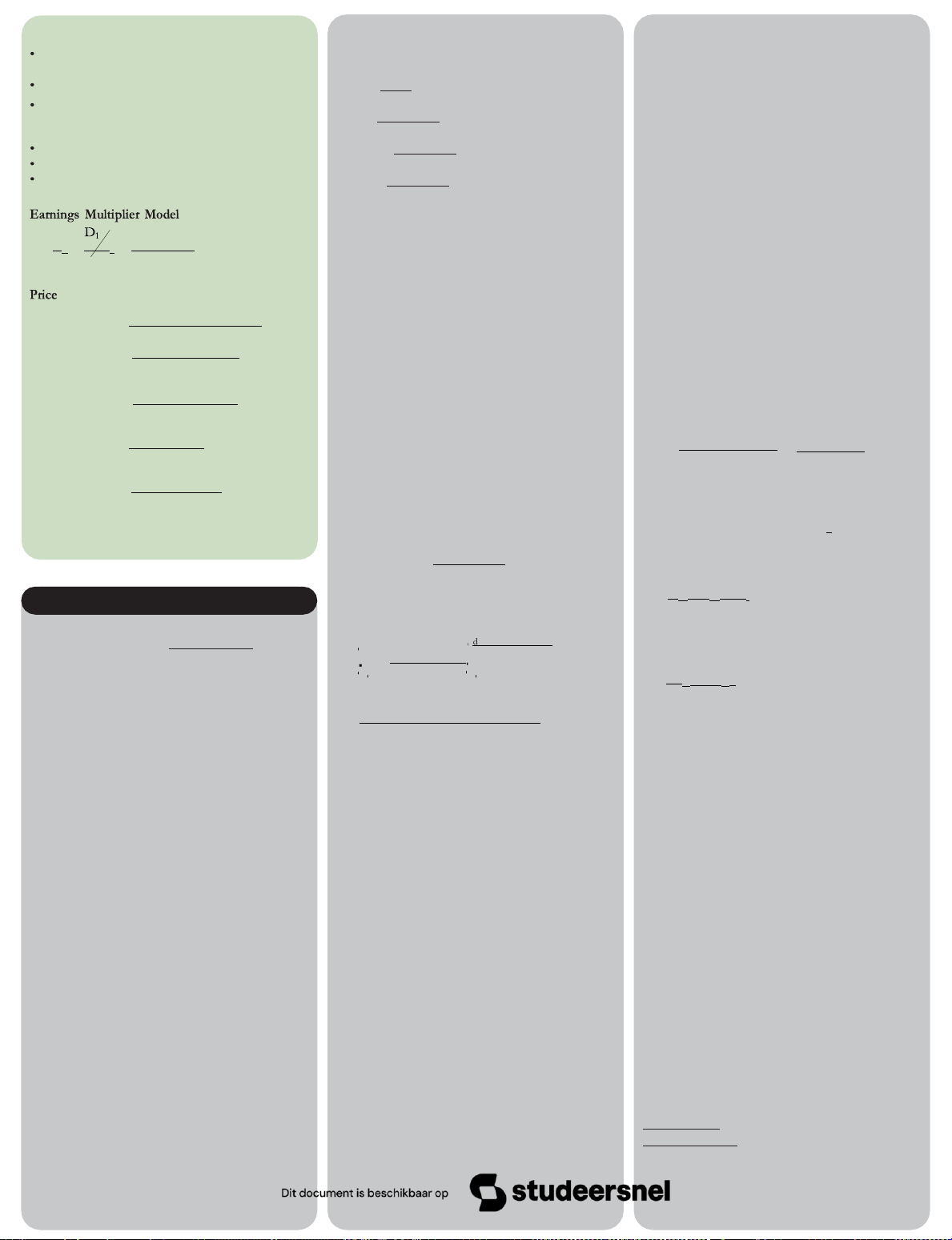

Downloaded by v ng (ngttgi20804@gmail.com) PORTFOLIO MANAGEMENT Types of Orders E(R)

Execution instructions: how to trade; e.g., market

Investment Policy Statement orders, limit orders. Investment objectives: B

Validity instructions: when to execute; e.g., stop • Return objectives.

orders, day orders, fill-or-kill orders. • Risk tolerance.

Clearing instructions: how to clear and settle; for sell Constraints: • Liquidity needs.

orders, specify short sale or sale of owned security. A • Time horizon. Market Structures • Tax concerns.

Quote-driven markets: investors trade with dealers.

• Legal and regulatory factors.

Order-driven markets: buyers and sellers matched RFR • Unique circumstances. by rules. b risk

Brokered markets: brokers find counterparties.

Combining Preferences with the Optimal Set of Portfolios Forms of EMH

Markowitz efficient frontier is the set of portfolios

• Weak form. Current stock prices ful y

that have highest return for given level of risk.

reflect available security market info. Volume

information/past price do not relate to E(Rp)

future direction of security prices. Investor Risk Tolerant I ' I

cannot achieve excess returns using tech analysis. 2 1' Investor

• Semi-strong form. Security prices instantly adjust E(R) I Y

to new public information. Investor cannot achieve 2 I slope = Treynor measure 1

excess returns using fundamental analysis. Risk Averse Efficient Frontier for Portfolio P

• Strong form. Stock prices fully reflect al Investor X

information from public and private sources. p

Assumes perfect markets in which al information Rp

is cost free and available to everyone at the same

time. Even with inside info, investor cannot achieve excess returns.

Security Market Line (SML)

Industry and Competitive Analysis

Investors should only be compensated for risk Jensen’s alpha 1. Define the industry

relative to market. Unsystematic risk is diversified

2. Survey industry size, growth, profitability

away; investors are compensated for systematic risk. Rf

3. Analyze industry structure (Porter)

The equation of the SML is the CAPM, which is a

4. Examine external influences (PESTLE)

return/systematic risk equilibrium relationship. p

5. Analyze companies’ strategies

total risk = systematic + unsystematic risk

Five Competitive Forces Biases

1. Rivalry among existing competitors. E(R ) i 2. Threat of entry. Capital Market Line 3. Threat of substitutes. 4. Power of buyers. Efficient Frontier 5. Power of suppliers. PESTLE Analysis

External forces affecting companies and industries:

Emotional biases: Loss aversion, overconfidence, Market Portfolio • Political

self-control, status quo, endowment, regret • Economic aversion RFR • Social • Technological s • Legal P • Environmental CAPM : E(R

i ) = RFR + βi E(R )− mkt RFR Competitive Strategies

Wel -Functioning Security Markets E(R • Cost leadership i)

Operational efficiency (lowest possible

• Product or service differentiation Security Market Line transactions costs). • Focus (niche market) (SML)

Informational efficiency (prices rapidly adjust to

One-Period Valuation Model new information). Margin Purchases V = D1 + P1 0 (1 + ke ) (1 + ke ) For margin transactions: E(R Market mkt)

Leverage factor = 1/margin percentage.

Be sure to use expected dividend D1 in calculation. Portfolio

Levered return = HPR × leverage factor.

Infinite Period Dividend Discount Models RFR Margin Call Price

Supernormal growth model (multi-stage) DDM: D1 Dn Pn Systematic Risk (Cov + .... .+ + i, mkt) V0 = 1− maintenance margin % (1 + k ) (1 + k )n (1 + k )n e e e D

The SML and Equilibrium Computing Index Prices where: P = n+1 n Identifying mispriced stocks: ∑stock prices (ke −gc ) Price-weighted Index =

Consider three stocks (A, B, C) and SML. adjusted divisor

Estimated stock returns should plot on SML. Constant growth model:

• A return plot over the line is underpriced.

• A return plot under the line is overpriced. V = D0(1+ gc ) = D1 0 k −g k −g ∑(current prices)(# shares) e c e c ×base value

∑(base year prices)(# base year shares)

Downloaded by v ng (ngttgi20804@gmail.com)

Index-linked: Interest-indexed (coupon rate

Money market yields may be on a discount or add-

Critical relationship between k and g : e c

adjusted) or capital-indexed (principal adjusted).

on basis and may use a 360- or 365-day year. Bond-

As difference between k and g widens, value of e c stock fal s. Embedded Options

equivalent yield is an annualized add-on yield based

As difference narrows, value of stock rises.

Cal able: Issuer may repay principal early. Increases on a 365-day year.

Small changes in difference between k and g yield and decreases duration. Forward and Spot Rates e c

cause large changes in stock’s value.

Putable: Bondholder may sell bond back to issuer.

Forward rate is a rate for a loan that begins at a

Critical assumptions of infinite period DDM: Decreases yield and duration.

future date. “1y3y” = 3-year forward rate 1 year

Stock pays dividends; constant growth rate.

Convertible: Bondholder may exchange bond for from today.

Constant growth rate, g , never changes. issuer’s common stock.

Example of spot-forward relationship: c

k must be greater than g (or math will not e c

Warrants: Bondholder may buy issuer’s common

(1 + S )2 = (1 + S )(1 + 1y1y) 2 1 work).

stock at exercise price. Warrants are typically Interest Rate Risk detachable from the bond.

Interest rate risk has two components: reinvestment risk Bond Markets

and market price risk from YTM changes. These risks P0

Domestic bonds. Domestic issuer and currency.

have opposing effects on an investor’s horizon yield. = E1 = payout ratio E1 k −g k − g

Foreign bonds. Foreign issuer, domestic currency.

• Bond investors with short horizons are more

Eurobond market is outside any one country, with

concerned with market price risk. Multiples

bonds denominated in currencies other than those

• Bond investors with long horizons are more price per share

of countries in which bonds are sold.

concerned with reinvestment risk.

leading P/E = forecast EPS next 12 mo.

Global bonds trade in both a national bond market

• The horizon at which market price risk and and the eurobond market.

reinvestment risk just offset is a bond’s Macaulay price per share trailing P/E= Bond Issuance

duration. This is the weighted average of times EPS previous 12 mo.

Underwritten offering: Investment banks buy entire

until a bond’s cash flows are scheduled to be paid. issue, sell to public.

Modified duration is the approximate change in a price per share P/B=

Best efforts offering: Investment banks act as brokers.

bond’s price given a 1% change in its YTM: book value per share

Shelf registration: Register entire issue with price per share

regulators but sell over a period of time. (V P/S=

= Macaulay duration ≈ −)−(V+ ) sales per share Repurchase Agreements (1+ r) 2V0 (∆y)

Short-term borrowing with a fixed income security price per share P/CF = as collateral.

Price change estimates based on duration only are cash flow per share

Repo rate: Annualized percent difference between

improved by adjusting for convexity: sale and repurchase prices.

%∆price = −duration(∆y) + 1 convexity (∆y)2

Initial margin: Extra collateral above loan amount. 2 Haircut = 1− 1 Approximate convexity: initial margin FIXED INCOME V− + V+ − 2V0 Bond Pricing (∆YTM)2 V0

Price, Yield, Coupon Relationships

Full price = PV on last coupon date ×

Effective duration is required if a bond has

Bond prices and yields are inversely related. days since last coupon embedded options:

Increase in yield decreases price; decrease in yield 1+ YTM days in coupon period increases price.

periods per year (V−)−(V+)

Coupon < yield: Discount to par value.

Accrued interest = coupon payment × 2V0 (∆curve)

Coupon > yield: Premium to par value.

days from last coupon to settlement

Constant-yield price trajectory: Price approaches

Credit Risk and Analysis

par as bond nears maturity from amortization of days in coupon period

Bottom-up credit analysis factors:

discounts and premiums. Capital gains and losses

Flat price = full price - accrued interest • Capacity

are calculated relative to this trajectory.

Bonds are quoted at their flat prices. • Capital

Other things equal, a lower coupon rate and a longer

Matrix pricing: For illiquid bonds, use yields of • Col ateral

maturity make a bond price more sensitive to

bonds with same credit quality to estimate yield; • Covenants changes in yield.

adjust for maturity differences with linear • Character

Top-down credit analysis factors:

Basic Features of Bonds interpolation. • Conditions

Issuer. Sovereign governments, corporations, local Yield Measures • Country

governments, agencies, supranational entities,

Ef ective yield depends on periodicity. YTM = • Currency special purpose entities.

effective yield for annual-pay bonds.

Maturity. Money market (one year or less); capital

Semiannual bond basis: YTM = 2 × semiannual

Expected loss = probability of default × loss given

market (greater than one year). discount rate. default

Par value. Bond’s principal value (face value).

Current yield = annual coupon / price. Credit ratings:

Coupon. Annual percent of par; fixed or floating.

Simple yield = current yield ± amortization.

Investment grade: Baa3/BBB- or above

Divide by periodicity to get periodic rate.

Yield to cal is based on call date and call price.

Non-investment grade: Ba1/BB+ or below

Seniority. Senior > junior (subordinated).

Yield to worst is lowest of a bond’s YTCs or YTM.

Corporate family rating (CFR): issuer rating.

Contingency provisions. Cal able, putable, Yield Spreads

Corporate credit rating (CCR): security rating. convertible.

G-spread: Basis points above government yield.

Secured bonds are backed by specific collateral and Cash Flow Structures

I-spread: Basis points above swap rate. senior to unsecured bonds.

Bullet: All principal repaid at maturity.

Z-spread: Accounts for shape of yield curve.

Unsecured bonds are general claims to issuer’s cash

Ful y amortizing: Equal periodic payments include

Option-adjusted spread: Adjusts Z-spread to remove flows and assets. both interest and principal. effects of embedded options.

Asset-Backed Securities

Partial y amortizing: Periodic payments include Floating-Rate Notes

Residential MBS: home mortgages are collateral.

interest and principal, balloon payment at maturity

Quoted margin: Fixed margin above the MRR.

Agency RMBS include only conforming loans; repays remaining principal.

Required margin or discount margin: Margin above

nonagency RMBS may include nonconforming

Sinking fund: Schedule for early redemption.

the MRR that would price the note at par. Decrease

loans and need credit enhancement.

Floating-rate: Coupon payments based on reference

in credit quality causes the required margin to be

Internal credit enhancement: Excess spread, rate plus margin.

greater than the quoted margin.

overcollateralization, waterfall structure.

Downloaded by v ng (ngttgi20804@gmail.com)

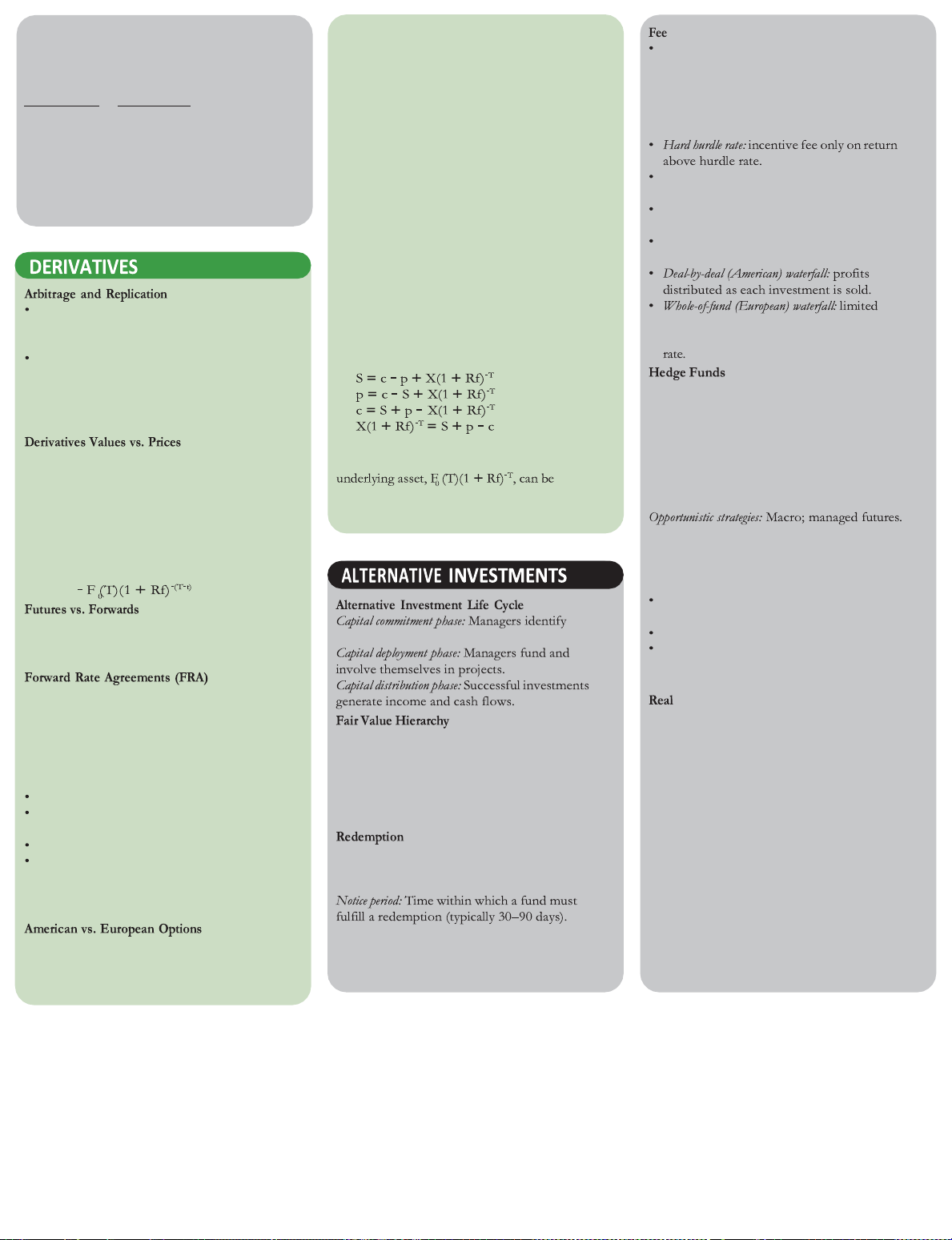

Factors that Affect Option Values Structures

Prepayment risk: contraction risk from faster

prepayments; extension risk from slower Increase in: Calls Puts

Management fee and performance fee, for example

“2 and 20”: 2% management fee plus 20% prepayments. Asset price Increase Decrease

performance fee. Management fee is typically a

CMOs: pass-through MBS are collateral. May have

sequential-pay or PAC/support structure. Exercise price Decrease Increase

percentage of assets under management for hedge

funds, percentage of committed capital for private

Commercial MBS: non-recourse mortgages on Risk-free rate Increase Decrease equity.

commercial properties are collateral. Volatility Increase Increase

Credit card ABS: credit card receivables are collateral.

CDOs: Bonds, bank loans are collateral; employ a Time to Increase Increase* collateral manager. expiration

Soft hurdle rate: incentive fee on whole return, but

only paid if return is greater than hurdle rate. Holding costs Increase Decrease

High water mark: no incentive fee until value Holding Decrease Increase exceeds previous high. benefits

Clawback provision: limited partners can recover

*Except some deep-in-the-money European puts.

performance fees if earlier gains are reversed Put-Cal Parity

The put-call parity relationship for European

Law of one price: two assets with identical cash options at time t:

partners receive all distributions until they have

flows in the future, regardless of future events, c + X(1 + Rf)-T = S + p

recovered their initial investment plus the hurdle should have the same price.

Each security in the put-call parity relationship can

Two assets with uncertain returns can be combined be expressed as:

in a portfolio that will have a certain payoff. If a

portfolio has a certain payoff, the portfolio should

Event-driven strategies: merger arbitrage; distressed/

yield the risk-free rate. For this reason, derivatives

restructuring; activist shareholder; special situations.

Relative value strategies: convertible arbitrage;

values are based on risk-neutral pricing.

specific fixed income; general fixed income; Put-Cal Forward Parity

The price of a forward, futures, or swap contract multi-strategy.

The present value of the forward price of the

is the forward price stated in the contract and is

Equity strategies: market neutral; fundamental

set such that the contract has a value of zero at

growth; fundamental value; fundamental long/

substituted for S in any of the put-cal parity short; short bias.

initiation. Value may change during the contract’s relationships at time 0.

life with opposite gains/losses to the long and short. Forward Contract Value Private Capital At time t:

Leveraged buyouts: management buyouts (existing +

managers), management buy-ins (new managers) V (T) = [S PV (costs) - PV (benefits)] t t t t

Venture capital stages of development:

Formative stage: angel investing, seed stage, early stage.

Futures are standardized, exchange-traded forward

Later stage: expand production, increase sales.

contracts that require daily cash settlement of

investments and make capital calls from partners.

Mezzanine stage: prepare for IPO.

mark-to-market gains and losses.

Exit strategies: trade sale; IPO; recapitalization; secondary sale; write-off.

Can be viewed as a forward contract to borrow/ Estate

lend money at a certain rate at some future date.

Includes residential property; commercial property; Interest Rate Swaps

Level 1: Active market, quoted prices readily

real estate investment trusts (REITs); whole loans;

May be replicated by a series of FRAs with present available. construction loans.

values at swap initiation that sum to zero.

Level 2: Can be valued based on observable inputs Commodities Options or with models.

Contango: futures price > spot price.

Buyer of a cal option—long asset exposure.

Level 3: Require unobservable inputs to establish a

Backwardation: futures price < spot price.

Writer (seller) of a cal option—short asset

fair value; few or no market transactions.

futures price ≈ spot price(1 + R ) + storage costs f exposure. – convenience yield Restrictions

Buyer of a put option—short asset exposure.

Lockup period: Time after initial investment during

Writer (seller) of a put option—long asset Infrastructure

which limited partners cannot request redemptions exposure.

Long-lived assets for public use, including

or incur significant penalties.

transportation, utility, communications, social.

intrinsic value of a call option = Max[0, S – X]

Greenfield: Invest in new infrastructure assets, often

intrinsic value of a put option = Max[0, X – S]

on a “Build-Operate-Transfer” basis.

Gate: Temporary restriction of redemptions.

Brownfield: Develop existing infrastructure assets.

American options allow the owner to exercise the

Second-stage: Invest in infrastructure assets that do

option any time before or at expiration. European not need further development.

options can be exercised only at expiration.

Document Outline

- Revenue Recognition

- Basic and Diluted EPS

- Marketable Security Classifications

- Cash Flows From Operations (CFO)

- Free Cash Flow

- Critical Ratios

- DuPont Analysis

- CORPORATE ISSUERS

- Inventory Accounting

- Corporate Governance

- Types of Capital Investment Projects

- Revaluation of Long-Lived Assets

- Capital Allocation

- Deferred Taxes

- Return on Invested Capital (ROIC)

- Real Options

- total assets

- Leases

- Pensions

- Weighted Average Cost of Capital

- Capital Structure Theories

- PORTFOLIO MANAGEMENT

- Investment Policy Statement

- Combining Preferences with the Optimal Set of Portfolios

- Types of Orders

- Forms of EMH

- Security Market Line (SML)

- Industry and Competitive Analysis

- Five Competitive Forces

- PESTLE Analysis

- Competitive Strategies

- One-Period Valuation Model

- Infinite Period Dividend Discount Models

- The SML and Equilibrium

- Bond Markets

- Bond Issuance

- Forward and Spot Rates

- Interest Rate Risk

- Repurchase Agreements

- FIXED INCOME

- Price, Yield, Coupon Relationships

- Bond Pricing

- Approximate convexity:

- Basic Features of Bonds

- Cash Flow Structures

- Yield Measures

- Floating-Rate Notes

- Credit Risk and Analysis

- Asset-Backed Securities