Preview text:

Financial Accounting IFRS 3rd Edition Solutions Manual Weygandt Kimmel Kieso

Completed download Instructor Manual, Solutions Manual Answer all chapters,

matcha creations problem, Solutions for appendix chapter:

https://testbankarea.com/download/financial-accounting-ifrs-3rd-edition-solutions- manual-weygandt-kimmel-kieso/

TEST BANK for Financial Accounting IFRS 3rd Edition by Jerry J.

Weygandt, Paul D. Kimmel, Donald E. Kieso Completed download:

https://testbankarea.com/download/financial-accounting-ifrs-3rd-edition-test-bank- weygandt-kimmel-kieso/ CHAPTER 3 Adjusting the Accounts

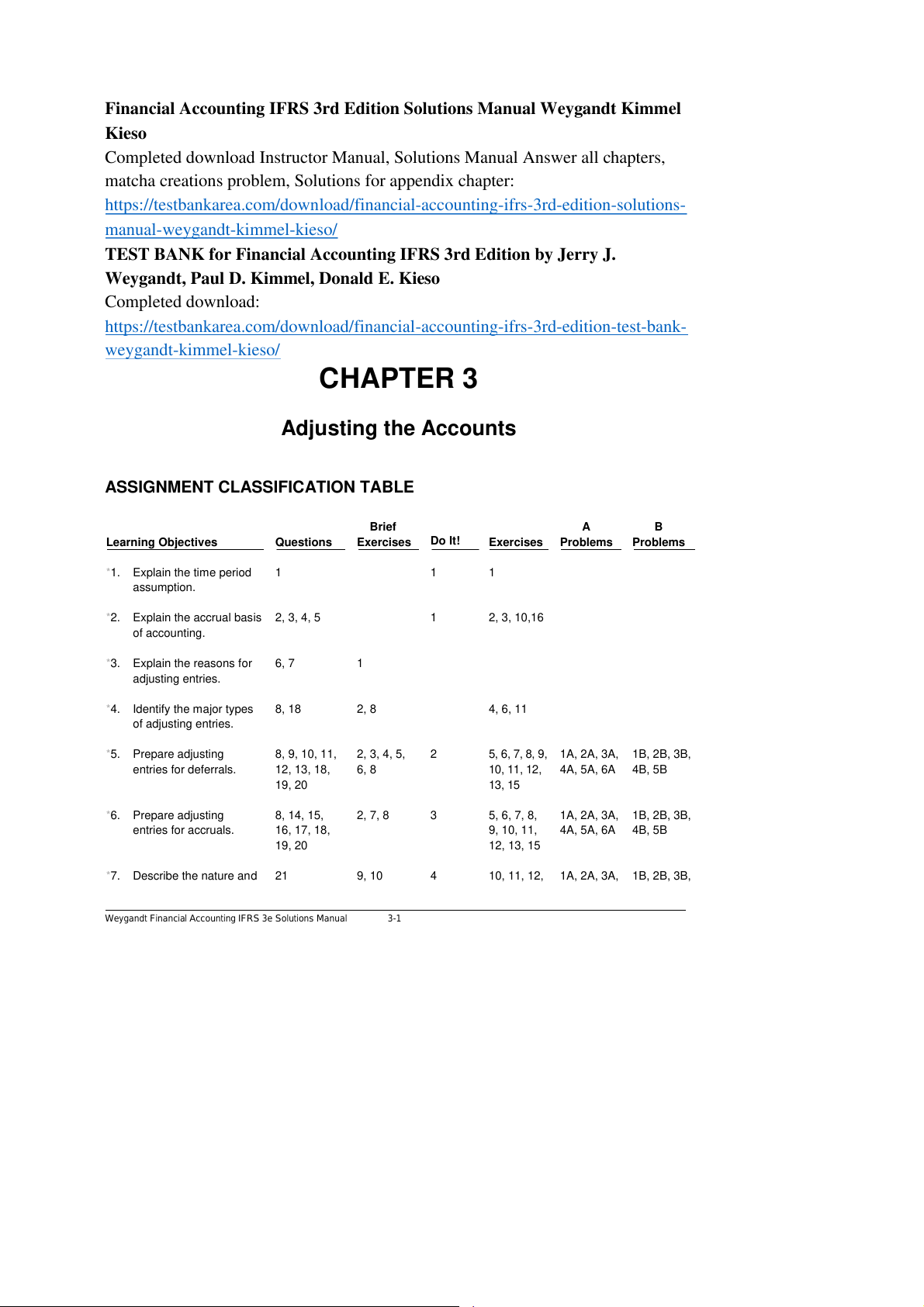

ASSIGNMENT CLASSIFICATION TABLE Brief A B Learning Objectives Questions Exercises Do It! Exercises Problems Problems *1. Explain the time period 1 1 1 assumption.

*2. Explain the accrual basis 2, 3, 4, 5 1 2, 3, 10,16 of accounting.

*3. Explain the reasons for 6, 7 1 adjusting entries.

*4. Identify the major types 8, 18 2, 8 4, 6, 11 of adjusting entries. *5. Prepare adjusting 8, 9, 10, 11, 2, 3, 4, 5, 2

5, 6, 7, 8, 9, 1A, 2A, 3A, 1B, 2B, 3B, entries for deferrals. 12, 13, 18, 6, 8 10, 11, 12, 4A, 5A, 6A 4B, 5B 19, 20 13, 15 *6. Prepare adjusting 8, 14, 15, 2, 7, 8 3

5, 6, 7, 8, 1A, 2A, 3A, 1B, 2B, 3B, entries for accruals. 16, 17, 18, 9, 10, 11, 4A, 5A, 6A 4B, 5B 19, 20 12, 13, 15

*7. Describe the nature and 21 9, 10 4

10, 11, 12, 1A, 2A, 3A, 1B, 2B, 3B,

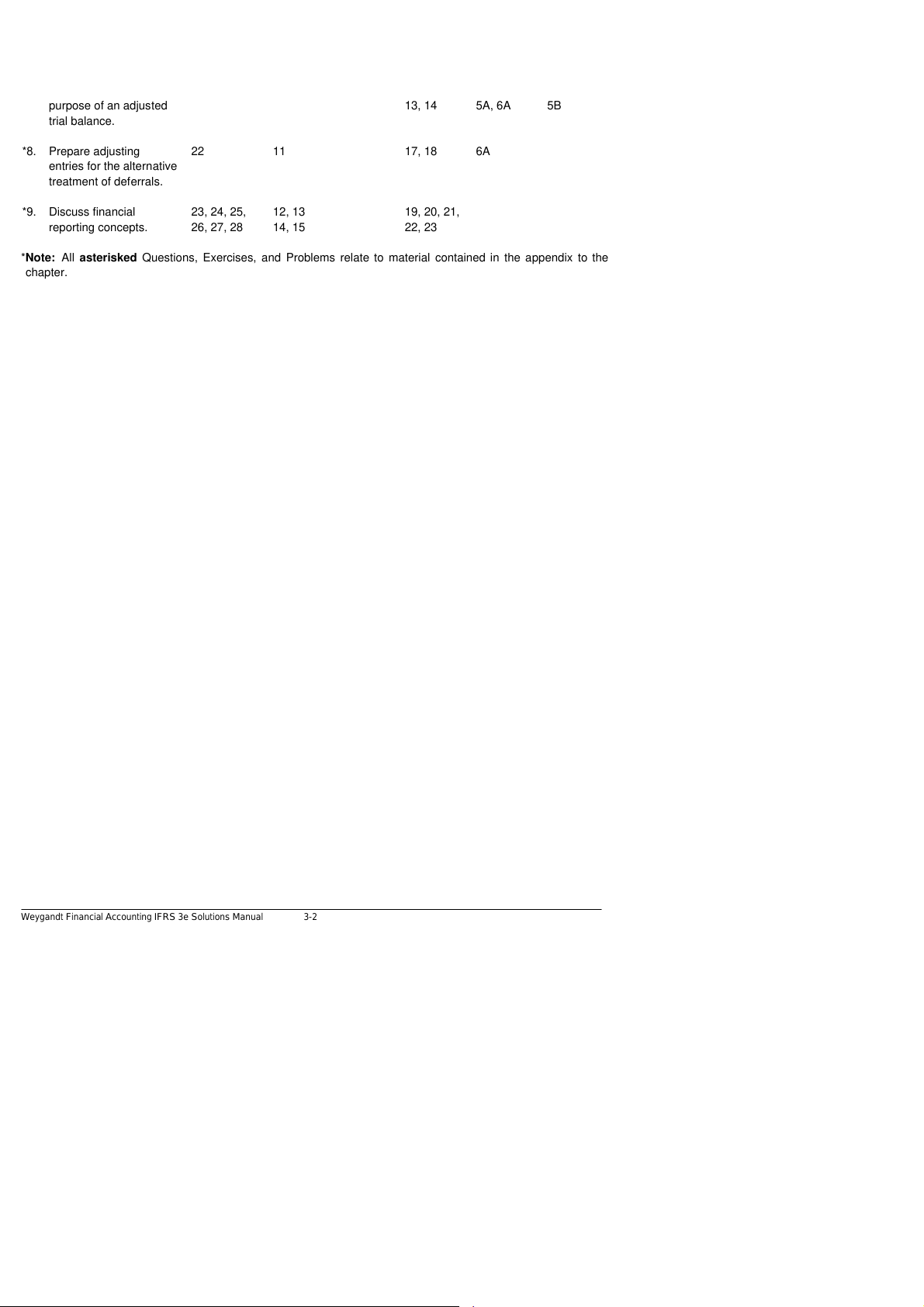

Weygandt Financial Accounting IFRS 3e Solutions Manual 3-1 purpose of an adjusted 13, 14 5A, 6A 5B trial balance. *8. Prepare adjusting 22 11 17, 18 6A entries for the alternative treatment of deferrals. *9. Discuss financial 23, 24, 25, 12, 13 19, 20, 21, reporting concepts. 26, 27, 28 14, 15 22, 23

*Note: Al asterisked Questions, Exercises, and Problems relate to material contained in the appendix to the chapter.

Weygandt Financial Accounting IFRS 3e Solutions Manual 3-2

ASSIGNMENT CHARACTERISTICS TABLE Problem Difficulty Time Number Description Level Allotted (min.)

1A Prepare adjusting entries, post to ledger accounts, Simple 40–50

and prepare an adjusted trial balance.

2A Prepare adjusting entries, post, and prepare adjusted Simple 50–60

trial balance and financial statements.

3A Prepare adjusting entries and financial statements. Moderate 40–50 4A Prepare adjusting entries. Moderate 30–40

5A Journalize transactions and fol ow through accounting Moderate 60–70

cycle to preparation of financial statements.

*6A* Prepare adjusting entries, adjusted trial balance, Moderate 40–50

and financial statements using appendix.

1B Prepare adjusting entries, post to ledger accounts, Simple 40–50

and prepare an adjusted trial balance.

2B Prepare adjusting entries, post, and prepare adjusted Simple 50–60

trial balance and financial statements.

3B Prepare adjusting entries and financial statements. Moderate 40–50 4B Prepare adjusting entries. Moderate 30–40

5B Journalize transactions and fol ow through accounting Moderate 60–70

cycle to preparation of financial statements.

Weygandt Financial Accounting IFRS 3e Solutions Manual 3-3

WEYGANDT FINANCIAL ACCOUNTING, IFRS EDITION, 3e CHAPTER 3 ADJUSTING THE ACCOUNTS Number LO BT Difficulty Time (min.) BE1 3 C Simple 4–6 BE2 4–6 AN Moderate 6–8 BE3 5 AN Simple 3–5 BE4 5 AN Simple 3–5 BE5 5 AN Simple 2–4 BE6 5 AN Simple 2–4 BE7 6 AN Simple 4–6 BE8 4–6 AN Simple 5–7 BE9 7 AP Simple 4–6 BE10 7 AP Simple 2–4 BE11* 8 AN Moderate 3–5 BE12* 9 K Simple 3–5 BE13* 9 K Simple 2–4 BE14* 9 K Simple 2–4 BE15* 9 K Simple 1–2 DI1 1, 2 K Simple 2–4 DI2 5 AN Simple 6–8 DI3 6 AN Simple 4–6 DI4 7 AN Moderate 20–30 EX1 1 C Simple 3–5 EX2 2 E Moderate 10–15 EX3 2 AP Simple 6–8 EX4 4 AN Simple 5–6 EX5 5, 6 AN Moderate 10–15 EX6 4–6 AN Moderate 10–12 EX7 5, 6 AN Moderate 8–10 EX8 5, 6 AN Moderate 8–10 EX9 5, 6 AN Simple 8–10 EX10 2, 5–7 AN Moderate 8–10 EX11 4–7 AN Moderate 12–15 EX12 5–7 AN Moderate 8–10

Weygandt Financial Accounting IFRS 3e Solutions Manual 3-4

ADJUSTING THE ACCOUNTS (Continued) Number LO BT Difficulty Time (min.) EX13 5–7 AN Simple 8–10 EX14 7 AP Simple 12–15 EX15 5, 6 AN, S Moderate 8–10 EX16 2 AN Moderate 8–10 EX17* 8 AN Moderate 6–8 EX18* 8 AN Moderate 10–12 EX19* 9 K Simple 3–5 EX20* 9 C Simple 3–5 EX21* 9 K Simple 6–8 EX22* 9 E Simple 10–20 EX23* 9 E Simple 10–20 P1A 5–7 AN Simple 40–50 P2A 5–7 AN Simple 50–60 P3A 5–7 AN Moderate 40–50 P4A 5, 6 AN Moderate 30–40 P5A 5–7 AN Moderate 60–70 P6A 5–8 AN Moderate 40–50 P1B 5–7 AN Simple 40–50 P2B 5–7 AN Simple 50–60 P3B 5–7 AN Moderate 40–50 P4B 5, 6 AN Moderate 30–40 P5B 5–7 AN Moderate 60–70 BYP1 5, 6 AN Simple 10–15 BYP2 — AN Simple 10–15 BYP3 2–7 S Moderate 15–20 BYP4 3–6 C Simple 10–15 BYP5 3–6 E Moderate 10–15

Weygandt Financial Accounting IFRS 3e Solutions Manual 3-5

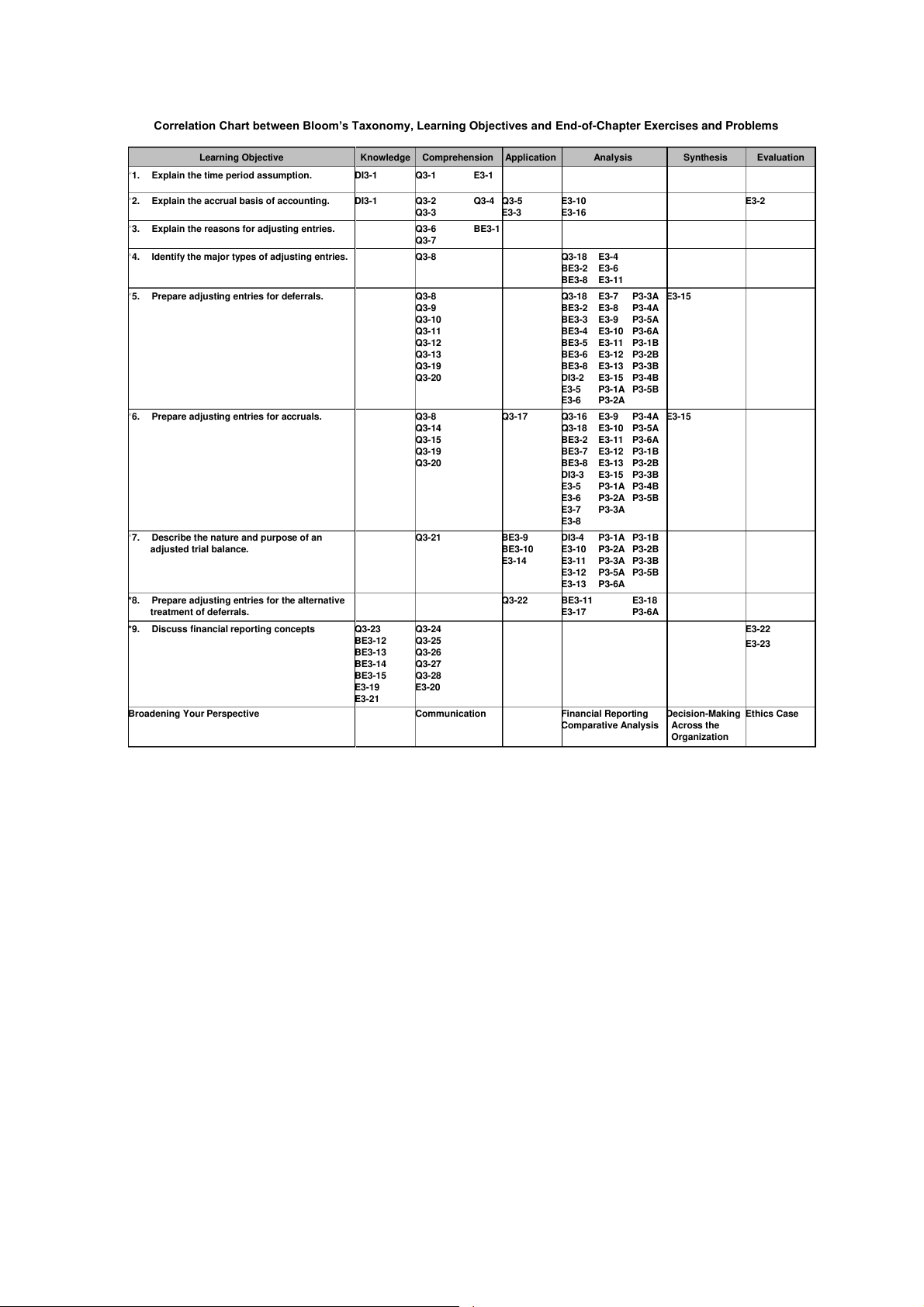

Correlation Chart between Bloom’s Taxonomy, Learning Objectives and End-of-Chapter Exercises and Problems Learning Objective

Knowledge Comprehension Application Analysis Synthesis Evaluation B LOOM

*1. Explain the time period assumption. DI3-1 Q3-1 E3-1

*2. Explain the accrual basis of accounting. DI3-1 Q3-2 Q3-4 Q3-5 E3-10 E3-2 Q3-3 E3-3 E3-16 ’S

*3. Explain the reasons for adjusting entries. Q3-6 BE3-1 Q3-7 T A

*4. Identify the major types of adjusting entries. Q3-8 Q3-18 E3-4 XON BE3-2 E3-6 BE3-8 E3-11

*5. Prepare adjusting entries for deferrals. Q3-8 Q3-18 E3-7 P3-3A E3-15 O Q3-9 BE3-2 E3-8 P3-4A M Q3-10 BE3-3 E3-9 P3-5A Y Q3-11 BE3-4 E3-10 P3-6A T Q3-12 BE3-5 E3-11 P3-1B A Q3-13 BE3-6 E3-12 P3-2B B Q3-19 BE3-8 E3-13 P3-3B L Q3-20 DI3-2 E3-15 P3-4B E E3-5 P3-1A P3-5B E3-6 P3-2A

*6. Prepare adjusting entries for accruals. Q3-8 Q3-17 Q3-16 E3-9 P3-4A E3-15 Q3-14 Q3-18 E3-10 P3-5A Q3-15 BE3-2 E3-11 P3-6A Q3-19 BE3-7 E3-12 P3-1B Q3-20 BE3-8 E3-13 P3-2B DI3-3 E3-15 P3-3B E3-5 P3-1A P3-4B E3-6 P3-2A P3-5B E3-7 P3-3A E3-8

*7. Describe the nature and purpose of an Q3-21 BE3-9 DI3-4 P3-1A P3-1B

adjusted trial balance. BE3-10 E3-10 P3-2A P3-2B E3-14 E3-11 P3-3A P3-3B E3-12 P3-5A P3-5B E3-13 P3-6A

*8. Prepare adjusting entries for the alternative Q3-22 BE3-11 E3-18

treatment of deferrals. E3-17 P3-6A

*9. Discuss financial reporting concepts Q3-23 Q3-24 E3-22 BE3-12 Q3-25 E3-23 BE3-13 Q3-26 BE3-14 Q3-27 BE3-15 Q3-28 E3-19 E3-20 E3-21

Broadening Your Perspective Communication Financial Reporting

Decision-Making Ethics Case

Comparative Analysis Across the Organization ANSWERS TO QUESTIONS

1. (a) Under the time period assumption, an accountant is required to determine the relevance of

each business transaction to specific accounting periods.

(b) An accounting time period of one year in length is referred to as a fiscal year. A fiscal year

that extends from January 1 to December 31 is referred to as a calendar year. Accounting

periods of less than one year are cal ed interim periods. LO: 3.1 Difficulty: Easy BLOOMCODE: Comprehension AACSB: Reflective thinking

2. The two principles that relate to adjusting the accounts are:

The revenue recognition principle, which states that revenue should be recognized in the accounting

period in which the performance obligation is satisfied.

The expense recognition principle, which states that efforts (expenses) should be matched with accomplishments (revenues). LO: 3.2 Difficulty: Easy BLOOMCODE: Comprehension AACSB: Reflective thinking

3. The law firm should recognize the revenue in April. When a company agrees to perform a service

for a customer it has a performance obligation. The revenue recognition principle states that

revenue should be recognized in the accounting period in which the performance obligation is

satisfied which is April in this case. LO: 3.2 Difficulty: Easy BLOOMCODE: Comprehension AACSB: Reflective thinking

4. Information presented on an accrual basis is more useful than on a cash basis because it reveals

relationships that are likely to be important in predicting future results. To il ustrate, under accrual

accounting, revenues are recognized when earned so they can be related to the economic

environment in which they occur. Trends in revenues are thus more meaningful. LO: 3.2 Difficulty: Easy BLOOMCODE: Comprehension AACSB: Reflective thinking

5. Expenses of £4,700 should be deducted from the revenues in April. Under the expense

recognition principle efforts (expenses) should be matched with accomplishments (revenues). LO: 3.1 Difficulty: Easy BLOOMCODE: Application AACSB: Reflective thinking

Weygandt Financial Accounting IFRS 3e Solutions Manual 3-7

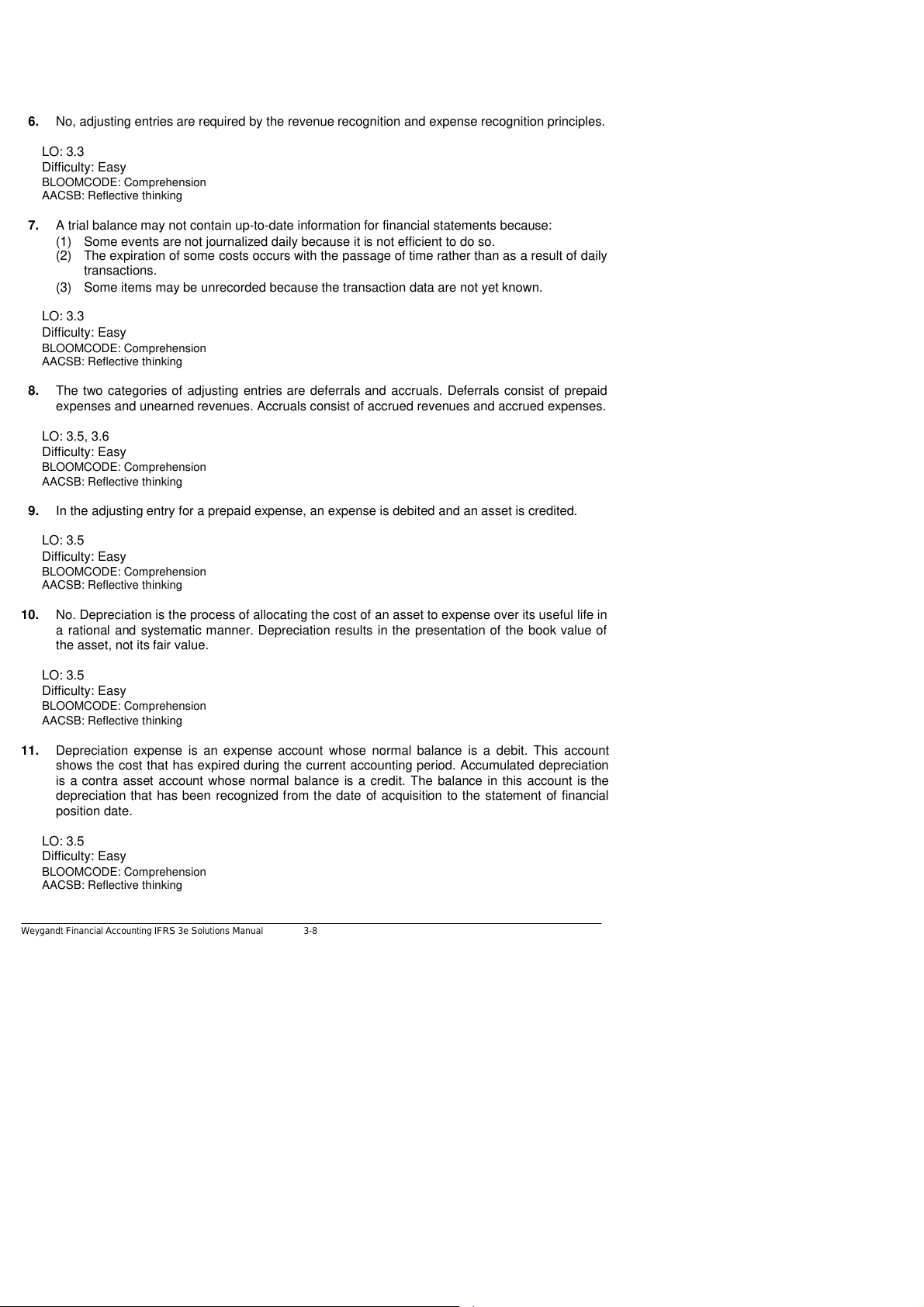

6. No, adjusting entries are required by the revenue recognition and expense recognition principles. LO: 3.3 Difficulty: Easy BLOOMCODE: Comprehension AACSB: Reflective thinking

7. A trial balance may not contain up-to-date information for financial statements because:

(1) Some events are not journalized daily because it is not efficient to do so.

(2) The expiration of some costs occurs with the passage of time rather than as a result of daily transactions.

(3) Some items may be unrecorded because the transaction data are not yet known. LO: 3.3 Difficulty: Easy BLOOMCODE: Comprehension AACSB: Reflective thinking

8. The two categories of adjusting entries are deferrals and accruals. Deferrals consist of prepaid

expenses and unearned revenues. Accruals consist of accrued revenues and accrued expenses. LO: 3.5, 3.6 Difficulty: Easy BLOOMCODE: Comprehension AACSB: Reflective thinking

9. In the adjusting entry for a prepaid expense, an expense is debited and an asset is credited. LO: 3.5 Difficulty: Easy BLOOMCODE: Comprehension AACSB: Reflective thinking

10. No. Depreciation is the process of al ocating the cost of an asset to expense over its useful life in

a rational and systematic manner. Depreciation results in the presentation of the book value of

the asset, not its fair value. LO: 3.5 Difficulty: Easy BLOOMCODE: Comprehension AACSB: Reflective thinking

11. Depreciation expense is an expense account whose normal balance is a debit. This account

shows the cost that has expired during the current accounting period. Accumulated depreciation

is a contra asset account whose normal balance is a credit. The balance in this account is the

depreciation that has been recognized from the date of acquisition to the statement of financial position date. LO: 3.5 Difficulty: Easy BLOOMCODE: Comprehension AACSB: Reflective thinking

Weygandt Financial Accounting IFRS 3e Solutions Manual 3-8

Questions Chapter 3 (Continued)

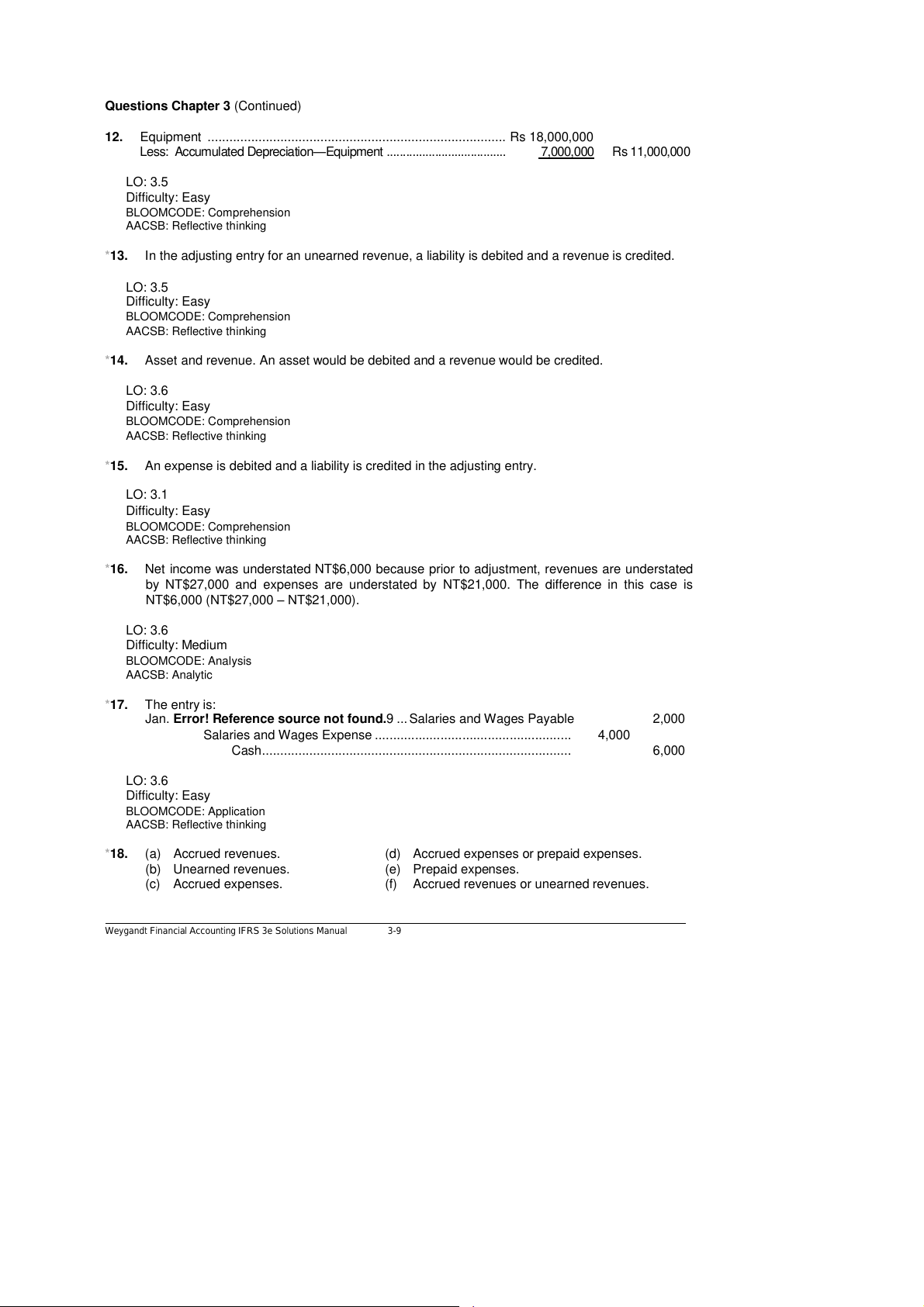

12. Equipment .................................................................................. Rs 18,000,000

Less: Accumulated Depreciation—Equipment . . . . . . . .. . . . . .. . . . . . 7,000,000 Rs 11,000,000 LO: 3.5 Difficulty: Easy BLOOMCODE: Comprehension AACSB: Reflective thinking

*13. In the adjusting entry for an unearned revenue, a liability is debited and a revenue is credited. LO: 3.5 Difficulty: Easy BLOOMCODE: Comprehension AACSB: Reflective thinking

*14. Asset and revenue. An asset would be debited and a revenue would be credited. LO: 3.6 Difficulty: Easy BLOOMCODE: Comprehension AACSB: Reflective thinking

*15. An expense is debited and a liability is credited in the adjusting entry. LO: 3.1 Difficulty: Easy BLOOMCODE: Comprehension AACSB: Reflective thinking

*16. Net income was understated NT$6,000 because prior to adjustment, revenues are understated

by NT$27,000 and expenses are understated by NT$21,000. The difference in this case is

NT$6,000 (NT$27,000 – NT$21,000). LO: 3.6 Difficulty: Medium BLOOMCODE: Analysis AACSB: Analytic *17. The entry is:

Jan. Error! Reference source not found.9 ... Salaries and Wages Payable 2,000

Salaries and Wages Expense ...................................................... 4,000

Cash ..................................................................................... 6,000 LO: 3.6 Difficulty: Easy BLOOMCODE: Application AACSB: Reflective thinking

*18. (a) Accrued revenues.

(d) Accrued expenses or prepaid expenses. (b) Unearned revenues. (e) Prepaid expenses. (c) Accrued expenses.

(f) Accrued revenues or unearned revenues.

Weygandt Financial Accounting IFRS 3e Solutions Manual 3-9 LO: 3.6 Difficulty: Medium BLOOMCODE: Analysis AACSB: Analytic

*19. (a) Salaries and Wages Payable. (d) Supplies Expense. (b) Accumulated Depreciation. (e) Service Revenue. (c) Interest Expense. (f) Service Revenue. LO: 3.5, 3.6 Difficulty: Easy BLOOMCODE: Comprehension AACSB: Reflective thinking

*20. Disagree. An adjusting entry affects only one statement of financial position account and one income statement account. LO: 3.5, 3.6 Difficulty: Easy BLOOMCODE: Comprehension AACSB: Reflective thinking

*21. Financial statements can be prepared from an adjusted trial balance because the balances of

al accounts have been adjusted to show the effects of al financial events that have occurred during the accounting period. LO: 3.7 Difficulty: Easy BLOOMCODE: Comprehension AACSB: Reflective thinking

*22. For Supplies Expense (prepaid expense): expenses are overstated and assets are understated. The adjusting entry is:

Assets (Supplies) ...................................................................................... XX

Expenses (Supplies Expense) ............................................................ XX

For Rent Revenue (unearned revenues): revenues are overstated and liabilities are understated. The adjusting entry is:

Revenues (Rent Revenue) ....................................................................... XX

Liabilities (Unearned Rent Revenue) .................................................. XX LO: 3.8 Difficulty: Medium BLOOMCODE: Application AACSB: Reflective thinking

*23. (a) The primary objective of financial reporting is to provide financial information that is useful to

investors and creditors for making decisions about providing capital.

(b) The fundamental qualitative characteristics are relevance and faithful representation. The

enhancing qualities are comparabiIity, verifiability, timeliness, and understandability. LO: 3.9 Difficulty: Easy BLOOMCODE: Knowledge

Weygandt Financial Accounting IFRS 3e Solutions Manual 3-10 AACSB: Reflective thinking

Weygandt Financial Accounting IFRS 3e Solutions Manual 3-11

Questions Chapter 3 (Continued)

*24. Gross is correct. Consistency means using the same accounting principles and accounting

methods from period to period within a company. Without consistency in the application of

accounting principles, it is difficult to determine whether a company is better off, worse off, or the same from period to period. LO: 3.9 Difficulty: Easy BLOOMCODE: Comprehension AACSB: Reflective thinking

*25. Comparability results when different companies use the same accounting principles.

Consistency means using the same accounting principles and methods from year to year within the same company. LO: 3.9 Difficulty: Easy BLOOMCODE: Comprehension AACSB: Reflective thinking

*26. The constraint is the cost constraint. The cost constraint al ows accounting standard setters to

weigh the cost that companies wil incur to provide information against the benefit that financial

statement users wil gain from having the information available. LO: 3.9 Difficulty: Easy BLOOMCODE: Comprehension AACSB: Reflective thinking

*27. Accounting relies primarily on two measurement principles. Fair value is sometimes used when

market price information is readily available. However, in many situations reliable market price

information is not available. In these instances, accounting relies on cost as its basis. LO: 3.9 Difficulty: Easy BLOOMCODE: Comprehension AACSB: Reflective thinking

*28. The economic entity assumption states that every economic entity can be separately identified

and accounted for. This assumption requires that the activities of the entity be kept separate and

distinct from (1) the activities of its owners (the shareholders) and (2) al other economic entities.

A shareholder of a company charging personal living costs as expenses of the company is an

example of a violation of the economic entity assumption. LO: 3.9 Difficulty: Easy BLOOMCODE: Comprehension AACSB: Reflective thinking

Weygandt Financial Accounting IFRS 3e Solutions Manual 3-12

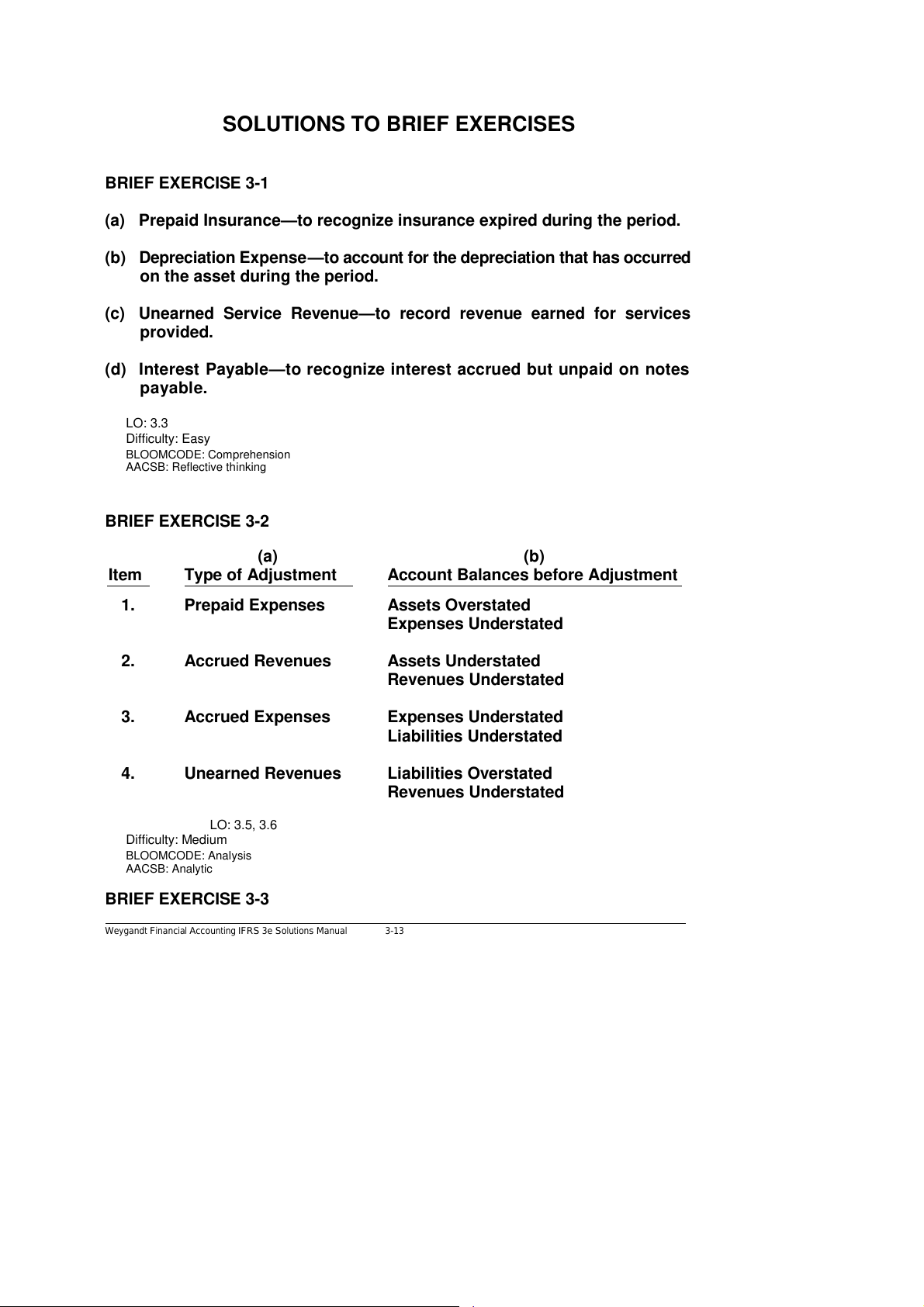

SOLUTIONS TO BRIEF EXERCISES BRIEF EXERCISE 3-1

(a) Prepaid Insurance—to recognize insurance expired during the period.

(b) Depreciation Expense—to account for the depreciation that has occurred

on the asset during the period.

(c) Unearned Service Revenue—to record revenue earned for services provided.

(d) Interest Payable—to recognize interest accrued but unpaid on notes payable. LO: 3.3 Difficulty: Easy BLOOMCODE: Comprehension AACSB: Reflective thinking BRIEF EXERCISE 3-2 (a) (b) Item Type of Adjustment

Account Balances before Adjustment 1. Prepaid Expenses Assets Overstated Expenses Understated 2. Accrued Revenues Assets Understated Revenues Understated 3. Accrued Expenses Expenses Understated

Liabilities Understated 4. Unearned Revenues Liabilities Overstated Revenues Understated LO: 3.5, 3.6 Difficulty: Medium BLOOMCODE: Analysis AACSB: Analytic BRIEF EXERCISE 3-3

Weygandt Financial Accounting IFRS 3e Solutions Manual 3-13

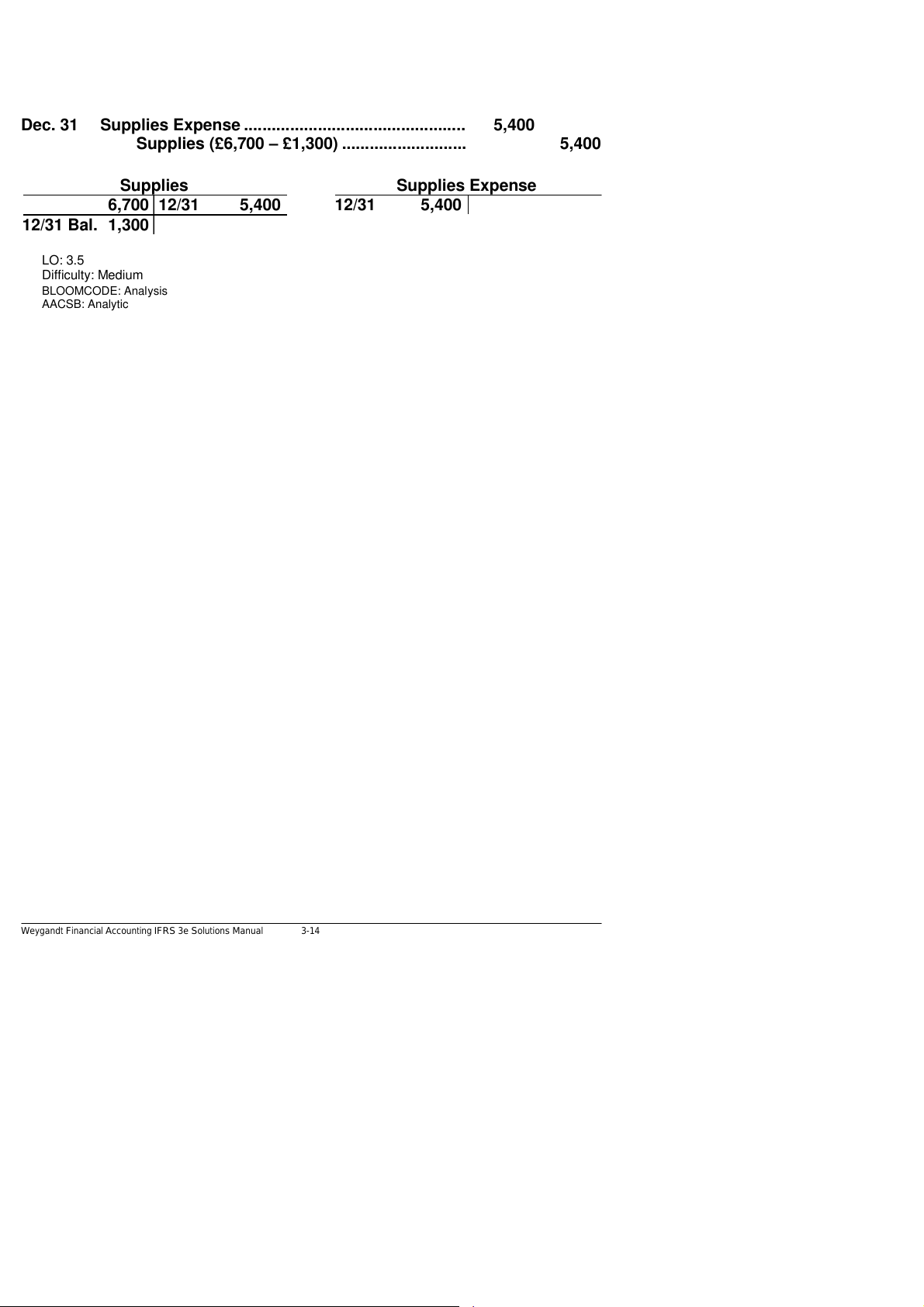

Dec. 31 Supplies Expense ................................................ 5,400

Supplies (£6,700 – £1,300) ........................... 5,400 Supplies Supplies Expense 6,700 12/31 5,400 12/31 5,400 12/31 Bal. 1,300 LO: 3.5 Difficulty: Medium BLOOMCODE: Analysis AACSB: Analytic

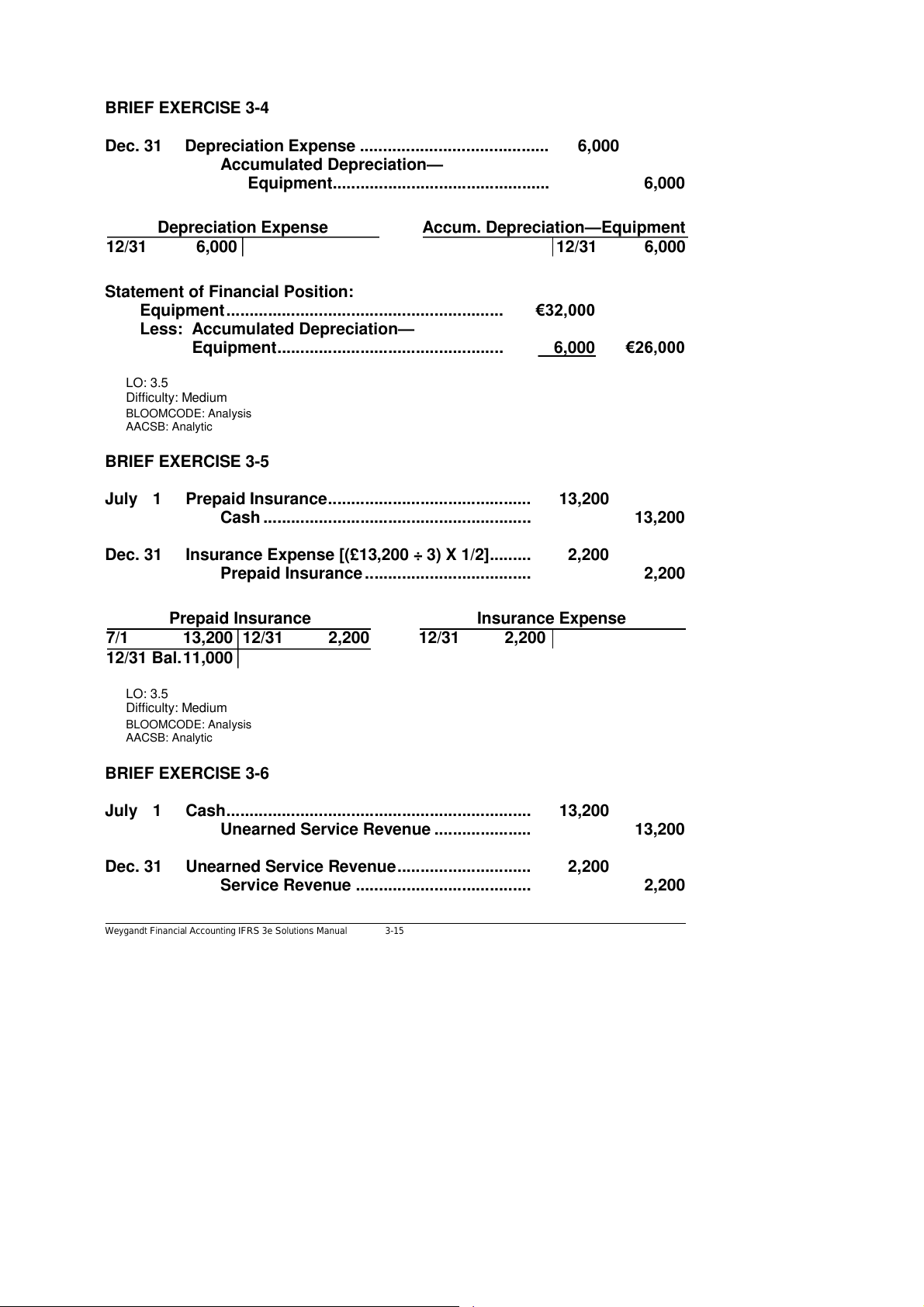

Weygandt Financial Accounting IFRS 3e Solutions Manual 3-14 BRIEF EXERCISE 3-4

Dec. 31 Depreciation Expense ......................................... 6,000

Accumulated Depreciation—

Equipment ............................................... 6,000 Depreciation Expense

Accum. Depreciation—Equipment 12/31 6,000 12/31 6,000

Statement of Financial Position:

Equipment ............................................................ €32,000

Less: Accumulated Depreciation—

Equipment ................................................. 6,000 €26,000 LO: 3.5 Difficulty: Medium BLOOMCODE: Analysis AACSB: Analytic BRIEF EXERCISE 3-5

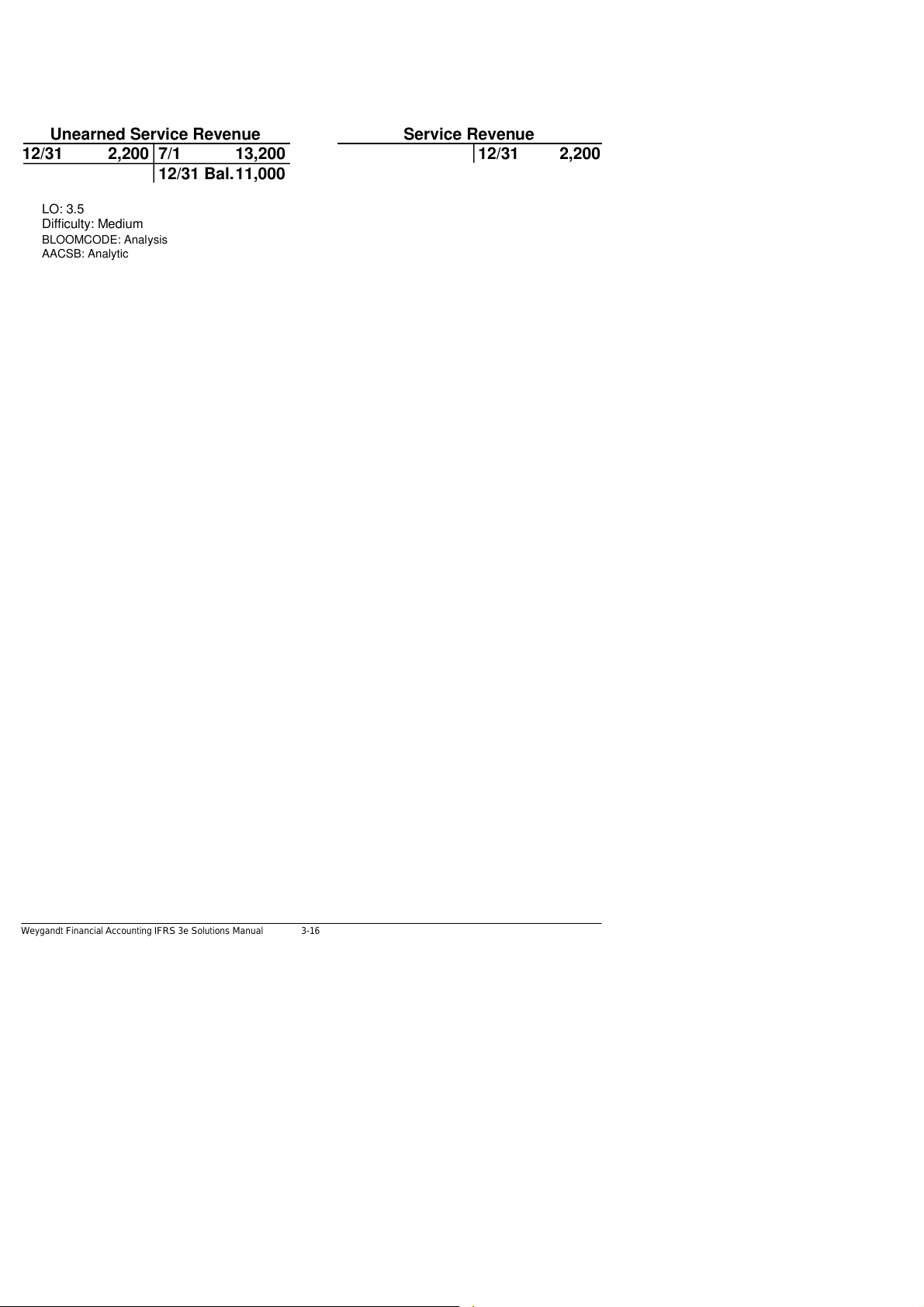

July 1 Prepaid Insurance ............................................ 13,200

Cash .......................................................... 13,200

Dec. 31 Insurance Expense [(£13,200 ÷ 3) X 1/2] ......... 2,200

Prepaid Insurance .................................... 2,200 Prepaid Insurance Insurance Expense 7/1 13,200 12/31 2,200 12/31 2,200 12/31 Bal. 11,000 LO: 3.5 Difficulty: Medium BLOOMCODE: Analysis AACSB: Analytic BRIEF EXERCISE 3-6

July 1 Cash .................................................................. 13,200

Unearned Service Revenue ..................... 13,200

Dec. 31 Unearned Service Revenue ............................. 2,200

Service Revenue ...................................... 2,200

Weygandt Financial Accounting IFRS 3e Solutions Manual 3-15

Unearned Service Revenue Service Revenue 12/31 2,200 7/1 13,200 12/31 2,200 12/31 Bal. 11,000 LO: 3.5 Difficulty: Medium BLOOMCODE: Analysis AACSB: Analytic

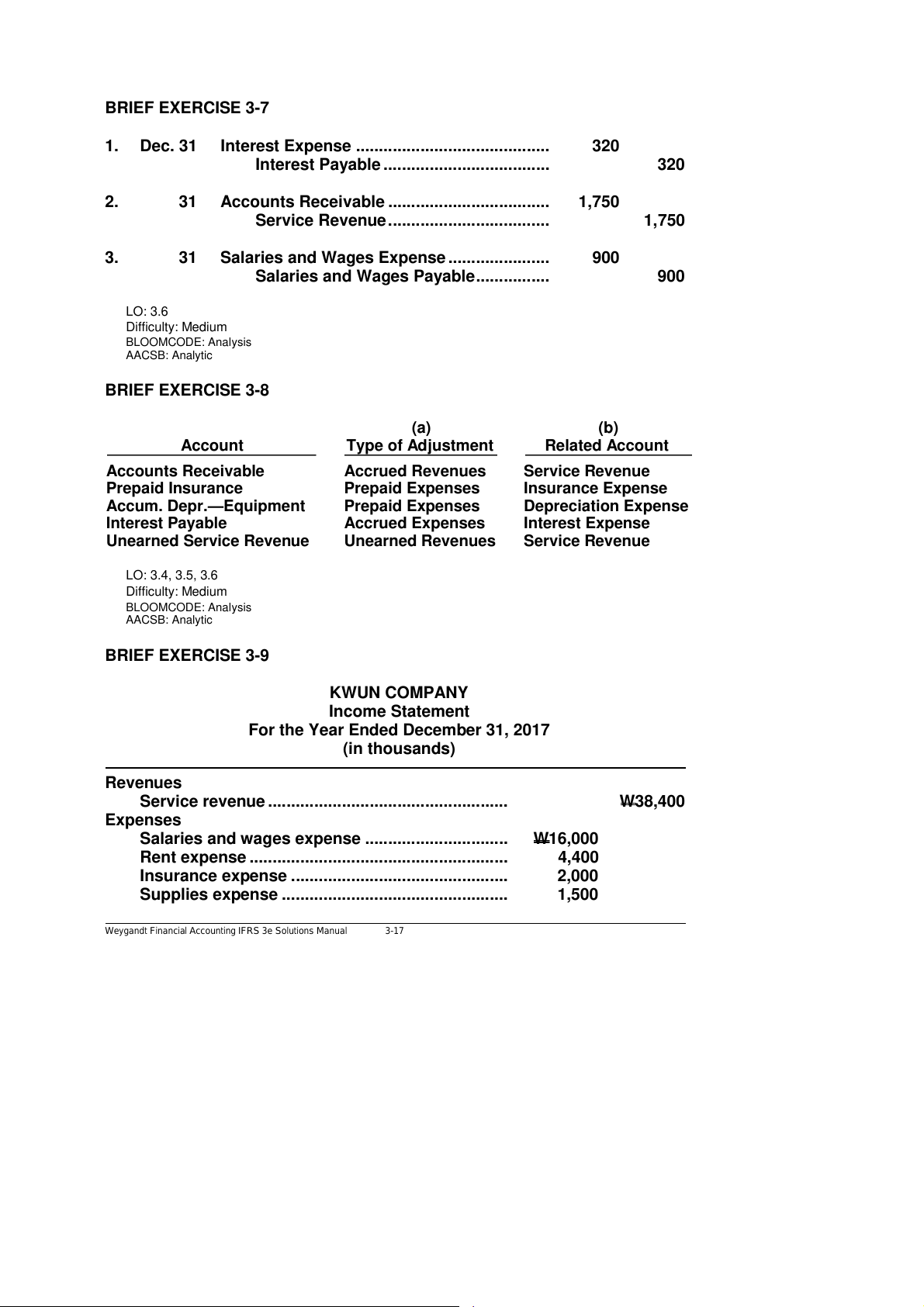

Weygandt Financial Accounting IFRS 3e Solutions Manual 3-16 BRIEF EXERCISE 3-7

1. Dec. 31 Interest Expense .......................................... 320

Interest Payable .................................... 320 2.

31 Accounts Receivable ................................... 1,750

Service Revenue ................................... 1,750 3.

31 Salaries and Wages Expense ...................... 900

Salaries and Wages Payable ................ 900 LO: 3.6 Difficulty: Medium BLOOMCODE: Analysis AACSB: Analytic BRIEF EXERCISE 3-8 (a) (b) Account Type of Adjustment Related Account Accounts Receivable Accrued Revenues Service Revenue Prepaid Insurance Prepaid Expenses Insurance Expense

Accum. Depr.—Equipment Prepaid Expenses Depreciation Expense Interest Payable Accrued Expenses Interest Expense

Unearned Service Revenue Unearned Revenues Service Revenue LO: 3.4, 3.5, 3.6 Difficulty: Medium BLOOMCODE: Analysis AACSB: Analytic BRIEF EXERCISE 3-9 KWUN COMPANY Income Statement

For the Year Ended December 31, 2017 (in thousands) Revenues

Service revenue .................................................... W38,400 Expenses

Salaries and wages expense ............................... W16,000

Rent expense ........................................................ 4,400

Insurance expense ............................................... 2,000

Supplies expense ................................................. 1,500

Weygandt Financial Accounting IFRS 3e Solutions Manual 3-17

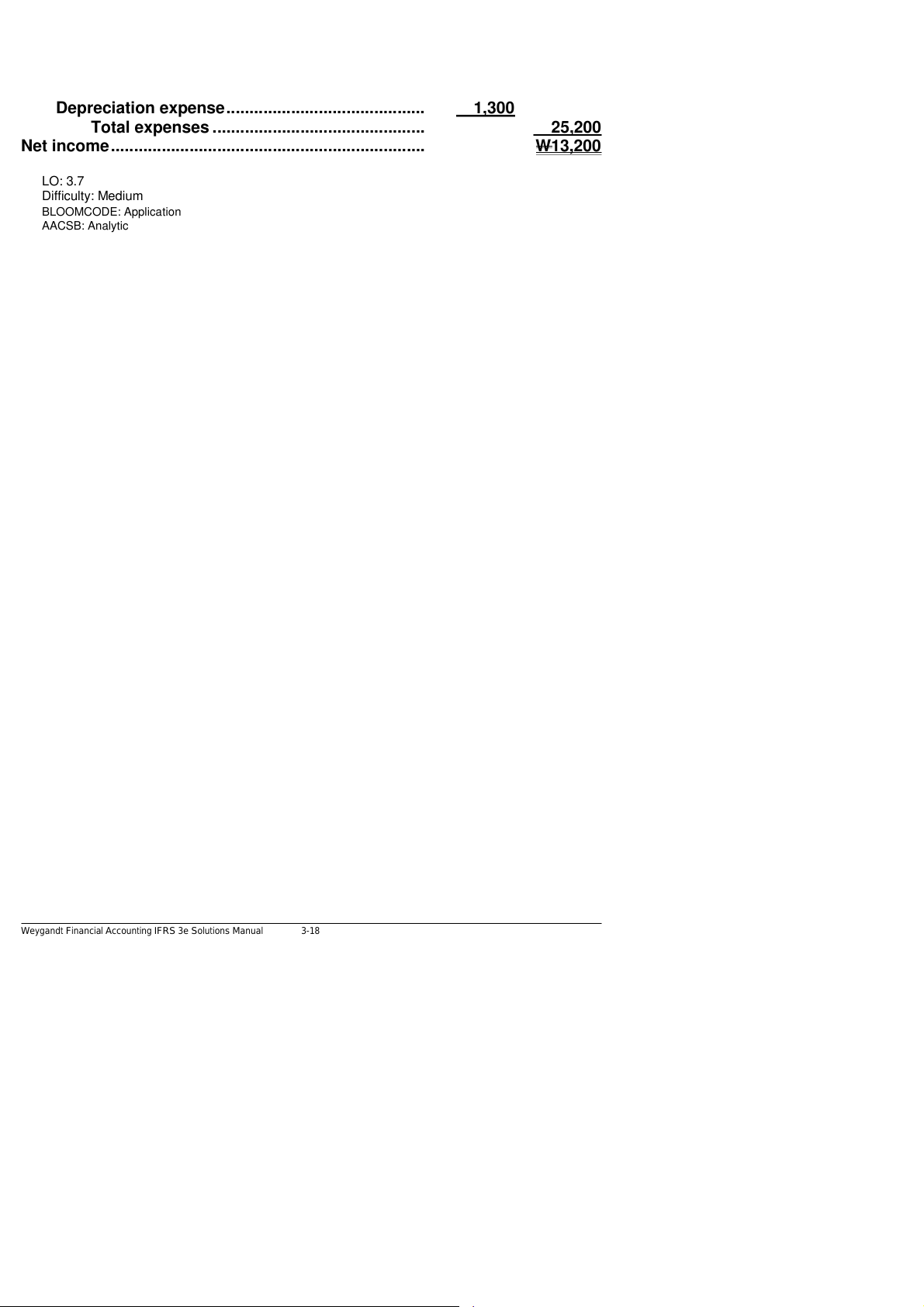

Depreciation expense ........................................... 1,300

Total expenses .............................................. 25,200

Net income .................................................................... W13,200 LO: 3.7 Difficulty: Medium BLOOMCODE: Application AACSB: Analytic

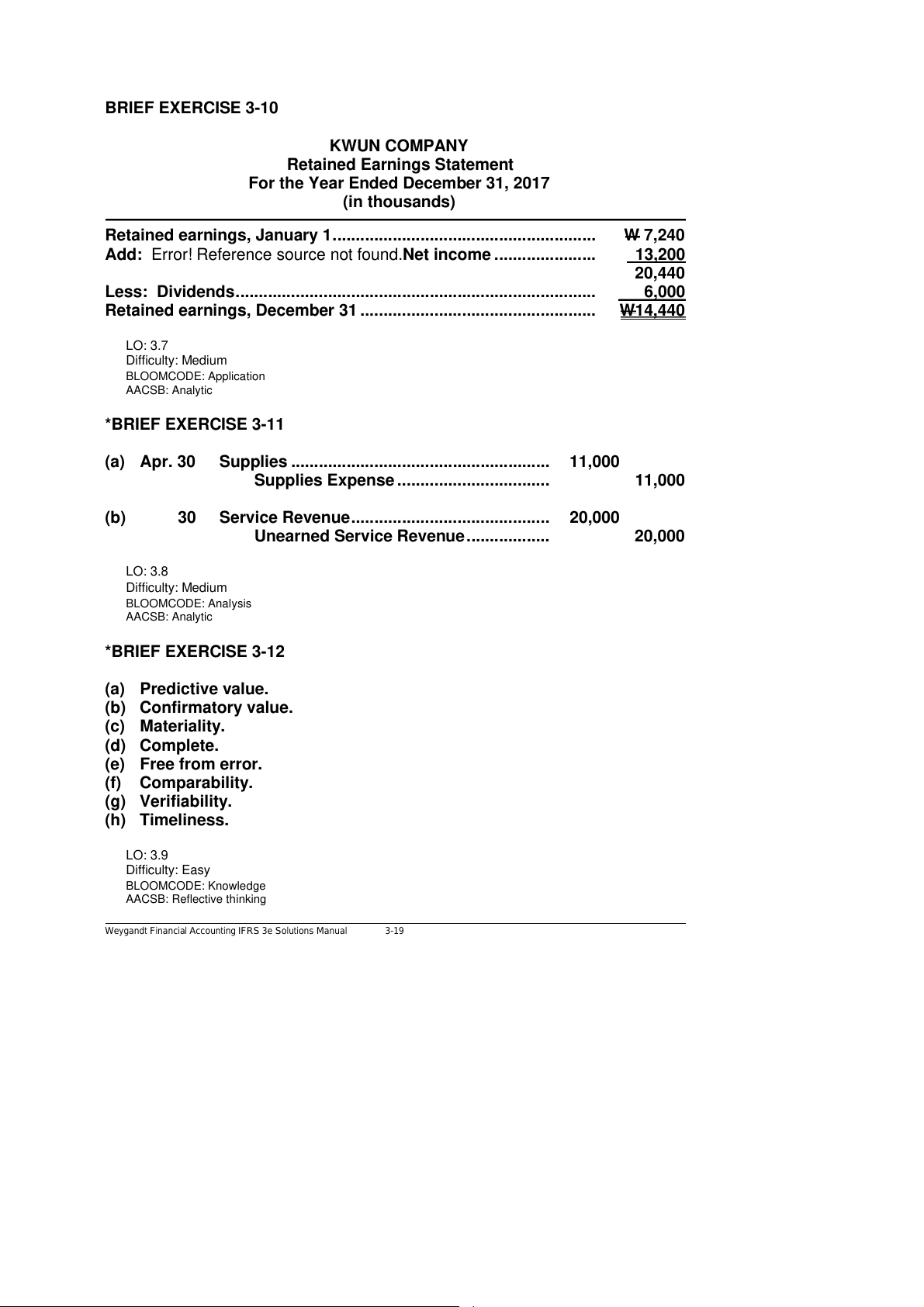

Weygandt Financial Accounting IFRS 3e Solutions Manual 3-18 BRIEF EXERCISE 3-10 KWUN COMPANY

Retained Earnings Statement

For the Year Ended December 31, 2017 (in thousands)

Retained earnings, January 1 ......................................................... W 7,240

Add: Error! Reference source not found.Net income ...................... 13,200 20,440

Less: Dividends .............................................................................. 6,000

Retained earnings, December 31 ................................................... W14,440 LO: 3.7 Difficulty: Medium BLOOMCODE: Application AACSB: Analytic *BRIEF EXERCISE 3-11

(a) Apr. 30 Supplies ........................................................ 11,000

Supplies Expense ................................. 11,000 (b)

30 Service Revenue ........................................... 20,000

Unearned Service Revenue .................. 20,000 LO: 3.8 Difficulty: Medium BLOOMCODE: Analysis AACSB: Analytic *BRIEF EXERCISE 3-12 (a) Predictive value.

(b) Confirmatory value. (c) Materiality. (d) Complete. (e) Free from error. (f) Comparability. (g) Verifiability. (h) Timeliness. LO: 3.9 Difficulty: Easy BLOOMCODE: Knowledge AACSB: Reflective thinking

Weygandt Financial Accounting IFRS 3e Solutions Manual 3-19 *BRIEF EXERCISE 3-13 (a) Relevant.

(b) Faithful representation. (c) Consistency. LO: 3.9 Difficulty: Easy BLOOMCODE: Knowledge AACSB: Reflective thinking *BRIEF EXERCISE 3-14 (a) 3. Verifiable. (b) 4. Timely.

(c) 1. Predictive value. (d) 2. Neutral. LO: 3.9 Difficulty: Easy BLOOMCODE: Knowledge AACSB: Reflective thinking *BRIEF EXERCISE 3-15 (c) LO: 3.9 Difficulty: Easy BLOOMCODE: Knowledge AACSB: Reflective thinking

SOLUTIONS FOR DO IT! REVIEW EXERCISES DO IT! 3-1

1. (d) 2. (e) 3. (h) 4. (c) LO: 3.1, 3.2 Difficulty: Easy BLOOMCODE: Knowledge AACSB: Reflective thinking

Weygandt Financial Accounting IFRS 3e Solutions Manual 3-20