Preview text:

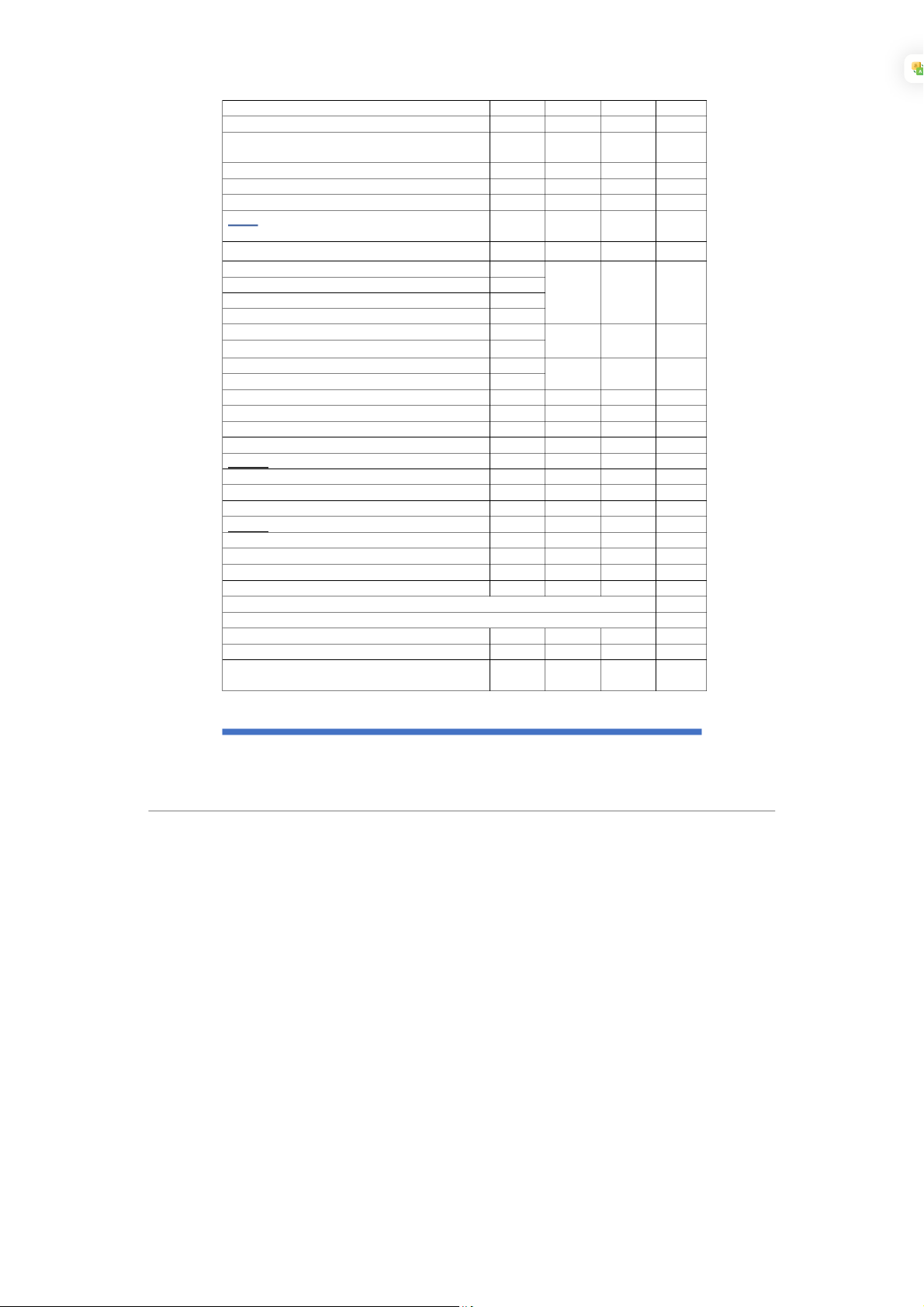

Chap 6: CAPITAL BUDGETING 0 1 2 n

Step 1: Initial Investment

Fixed Assets (machine, equipment, building, (#) land) Shipping Cost (#) Install Cost (#)

Total Initial Investment (100k)

Note: Land & Opp. Cost ko tính vào Depreciation

Step 2: Operating Cash Flow Sales/Cost Savings # # #

Costs (Variable Cost, Fixed Cost) (#) (#) (#)

Increase Sales /Loss Sales -> Indirect Effect #/(#) #/(#) #/(#) Depreciation (#) (#) (#) EBIT # # # Taxes = EBIT x Tax rate (T) (#) (#) (#) Net Income= EBIT x (1-T) # # # Depreciation # # # OCF = NI + Dep # # #

Step 3: Net Working Capital

NWC = Current Assets – Current Liabilities

Dạng 1: Cho 1 số NWC 1000 1000 1000 0

△NWC = 𝑁𝑊𝐶𝑡− 𝑁𝑊𝐶𝑡−1 1000 0 0 -1000 CF (△NWC) = −△NWC -1000 1000

Dạng 2: NWC thay đổi qua từng năm NWC 100 150 200 0

△NWC = 𝑁𝑊𝐶𝑡− 𝑁𝑊𝐶𝑡−1 100 50 50 -200 CF (△NWC) = −△NWC -100 -50 -50 200

Step 4: ATSV: After tax salvage value = SV – T x (SV – BV) #

Step 5: Opportunity cost x x x

Step 6: Project CFs=Terminal CFs (#) # # #

Step 7: Apply decision criteria (NPV, IRR,…) KHANH VY 1

Step 1: Determine initial investment: Forget about sunk cost (Feasibility study/market research cost, marketing cost, etc..) Step 2: Determine OCF: a. Tính Depreciation:

- Dạng 1: Straight line method: 𝑫 = 𝑰𝒏𝒊𝒕𝒊𝒂𝒍 𝑪𝒐𝒔𝒕 −𝑺𝒂𝒍𝒗𝒂𝒈𝒆 𝑽𝒂𝒍𝒖𝒆 (𝒉𝒂𝒚 𝒄ò𝒏 𝒈ọ𝒊 𝒍à 𝑩𝒐𝒐𝒌 𝑽𝒂𝒍𝒖𝒆)

# 𝒐𝒇 𝒖𝒔𝒆𝒇𝒖𝒍 𝒍𝒊𝒗𝒆𝒔

Note: Straight line to zero: 𝑫 = 𝑰𝒏𝒊𝒕𝒊𝒂𝒍 𝑪𝒐𝒔𝒕

# 𝒐𝒇 𝒖𝒔𝒆𝒇𝒖𝒍 𝒍𝒊𝒗𝒆𝒔 => BV = 0

Initial Cost = Depreciable Basis

- Dạng 2: MACRS: 𝑫 = 𝑰𝒏𝒊𝒕𝒊𝒂𝒍 𝑪𝒐𝒔𝒕 × % 𝒕ươ𝒏𝒈 ứ𝒏𝒈

Note: Land & Opp. Cost ko tính vào Initial cost trong công thức tính Depreciation b. Tính OCF:

- Top down approach: don’t subtract non-cash deductions:

𝑶𝑪𝑭 = 𝑪𝒂𝒔𝒉 𝑹𝒆𝒗𝒆𝒏𝒖𝒆𝒔 − 𝑪𝒂𝒔𝒉 𝑬𝒙𝒑𝒆𝒏𝒔𝒆 − 𝑻𝒂𝒙𝒆𝒔

- Bottom up approach: works only when no interest expense

𝑶𝑪𝑭 = 𝑵𝑰 + 𝑫𝒆𝒑𝒓𝒆𝒄𝒊𝒂𝒕𝒊𝒐𝒏

- Tax shield approach: Depreciation reduces taxable income →tax payment falls → CFs increases

𝑶𝑪𝑭 = (𝑪𝒂𝒔𝒉 𝑹𝒆𝒗𝒆𝒏𝒖𝒆𝒔 − 𝑪𝒂𝒔𝒉 𝑬𝒙𝒑𝒆𝒏𝒔𝒆𝒔) × (𝟏 − 𝑻) + 𝑫𝒆𝒑𝒓𝒆𝒄𝒊𝒂𝒕𝒊𝒐𝒏 × 𝑻

NOTE: ignore bank loan and interest expense

Step 3: Net working capital: considered as a “loan” to the project and fully recovered in the last year of project life

- Increase in WC → Negative CFs (outflows)

- Decrease in WC → Positive CFs (inflows)

Step 4: After tax salvage value (of fixed assets):

- If 𝑩𝒐𝒐𝒌 𝑽𝒂𝒍𝒖𝒆 ≠ 𝑺𝒂𝒍𝒗𝒂𝒈𝒆 𝑽𝒂𝒍𝒖𝒆 (𝑴𝒂𝒓𝒌𝒆𝒕 𝒑𝒓𝒊𝒄𝒆) =

> There is a tax effect from selling fixed asset.

𝐵𝑉 = 𝐼𝑛𝑖𝑡𝑖𝑎𝑙 𝐶𝑜𝑠𝑡 − 𝑇𝑜𝑡𝑎𝑙 𝐴𝑐𝑐𝑢𝑚𝑢𝑙𝑎𝑡𝑒𝑑 𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛 = 𝐼𝑛𝑖𝑡𝑖𝑎𝑙 𝐶𝑜𝑠𝑡 × 𝑇ổ𝑛𝑔 % 𝑐ò𝑛 𝑙ạ𝑖

𝑨𝑻𝑺𝑽 = 𝑺𝑽 −(𝑺𝑽 −𝑩𝑽)× 𝑻𝒂𝒙 𝒓𝒂𝒕𝒆

- If SV > BV => over-depreciation in previous periods → excessive tax shield in previous

periods → tax paid to the government.

- If SV < BV => under-depreciation in previous periods → insufficient tax shield in previous

periods → tax rebate (government pays back)

Step 5: Project CFs: c ng t ộ ất cả dòng cu i ố cùng c a ủ m i ỗ step lại theo từng c t ộ

Step 6: Apply decision rule KHANH VY 2