Preview text:

𝑹𝒆𝒂𝒍𝒊𝒛𝒆𝒅 𝒓𝒆𝒕𝒖𝒓𝒏 = 𝑪𝒂𝒑𝒊𝒕𝒂𝒍 𝒈𝒂𝒊𝒏 + 𝑫𝒊𝒗𝒊𝒅𝒆𝒏𝒅(𝒐 𝒓 𝑪𝒐𝒖𝒑𝒐𝒏) Chap 7: RISK AND RETURN

1. Realized Return (Already occurred): 𝑰𝒏𝒊𝒕𝒊𝒂𝒍 𝒔𝒉𝒂𝒓𝒆 𝒑𝒓𝒊𝒄𝒆(𝒐 𝒓𝒃𝒐𝒏𝒅 𝒑𝒓𝒊𝒄𝒆) 2. Expected Return: 𝒊=𝟏 𝒑𝟐× 𝑹𝟐…

- the rate of return expected to be earned from an investment.

- Based on the probabilities of possible outcomes. 𝑬(𝑹)= ∑ 𝒑𝒊

𝒏 × 𝑹𝒊= 𝒑𝟏× 𝑹𝟏+

where 𝑅𝑖: possible return of state i

𝑝𝑖: probability of occurrence for 𝑅𝑖

3. Risk premium: The level of risk and required rate are directly related: investors require

higher rates of return for increased risk.

- The “extra” return earned for taking on risk

- US Treasury bills are considered as risk free asset

- The risk premium is the return over and above the risk-free rate investment. 4. Measuring Risk:

- Risk: the variability of return

- Variance and Standard Deviation measure the volatility of asset returns (The greater the 𝑽𝒂𝒓 = 𝟏

volatility, the greater uncertainty →risker) 𝑻∑(𝑹𝒕− 𝑹 a. D

ạng 1: Đề ko cho probability mà cho return theo các năm 𝑻 )𝟐 𝒕=𝟏

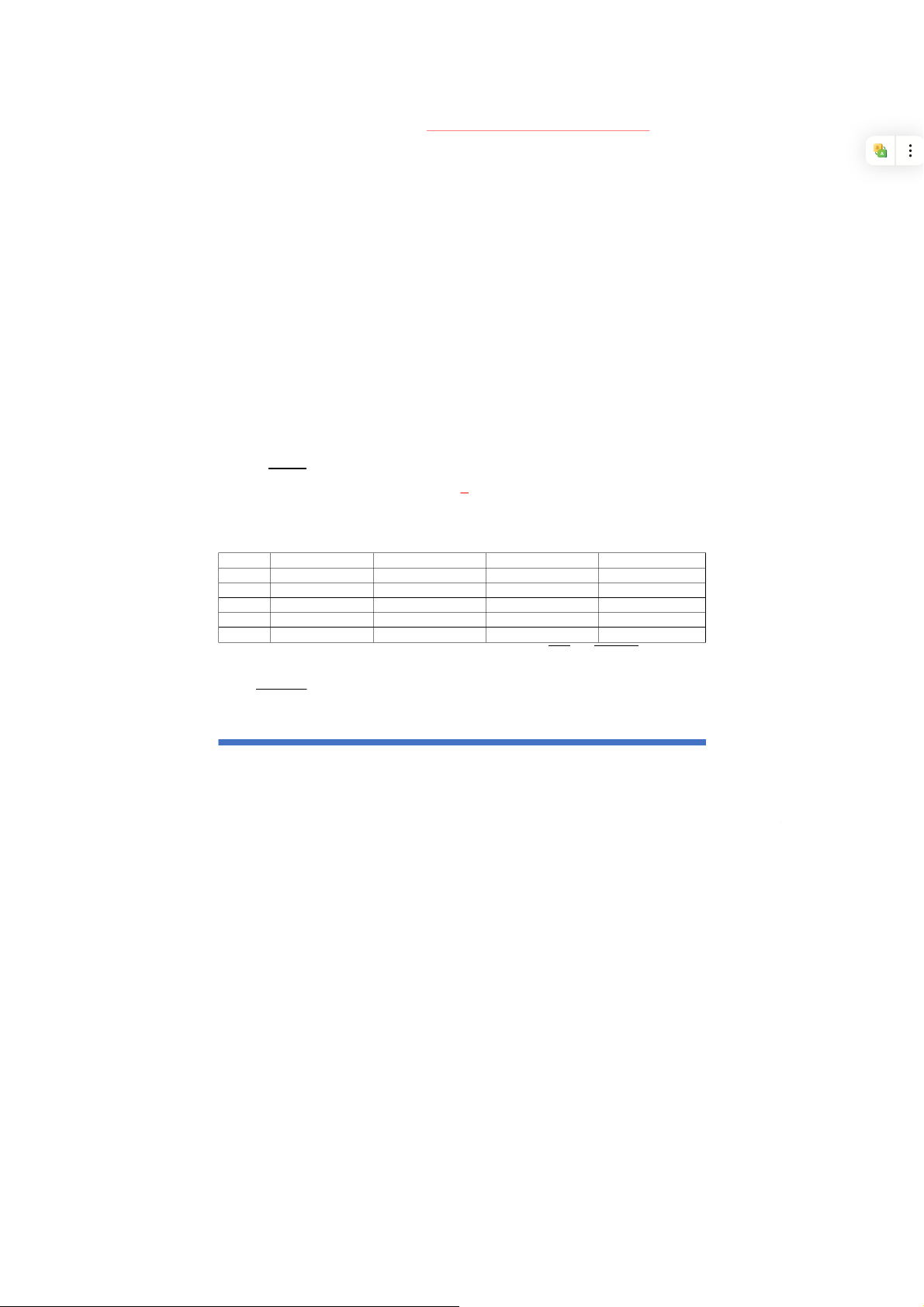

Example: Suppose a particular investment had returns of 10%, 12%, 3% and -9% over

the last 4 years. Compute the average return, variance and standard deviation. Deviation (1) (2) –

Actual Return (1) Average Return (2) Squared Deviation 0.1 0.04 0.06 0.0036 0.12 0.04 0.08 0.0064 0.03 0.04 -0.01 0.0001 -0.09 0.04 -0.13 0.0169 Total V 0.16

ariance = 0.027/4 = 0.00675 and Standard Deviation = √𝑉𝑎𝑟 = √0.00675 0.027 = 0.0822

b. Dạng 2: Cho probability 𝑽𝒂𝒓𝒊𝒂𝒏𝒄𝒆 = ∑𝒑

𝒏 𝒊×[𝒓𝒊− 𝑬(𝑹)]𝟐 𝒊=𝟏 KHANH VY 1

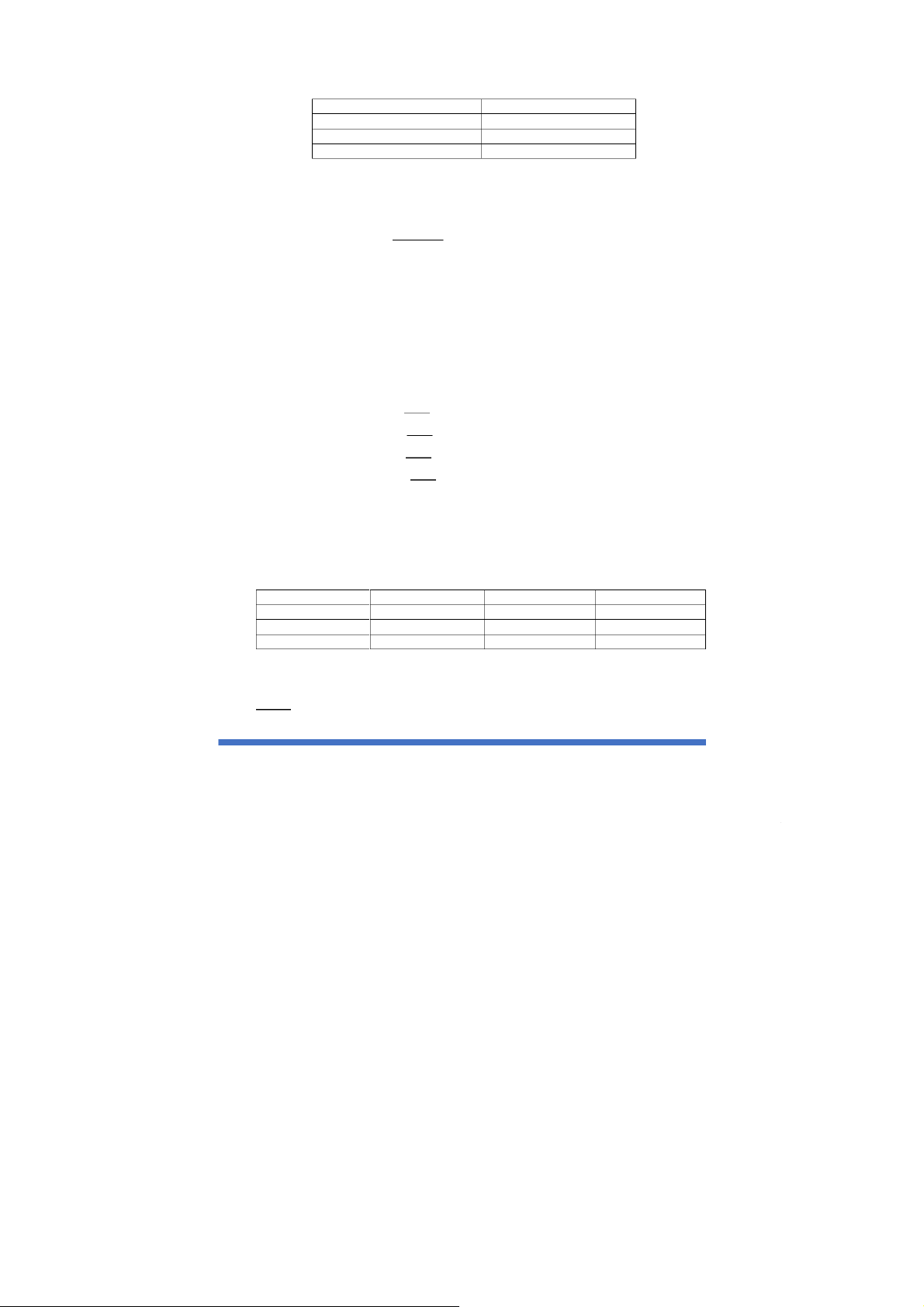

Example: ABC stock has the following probability distribution: Probability Return 0.25 8% 0.55 10% 0.20 12%

What are its expected return and standard distribution?

Expected Return: 𝐸(𝑅)= 0.25 ×8% + 0.55 ×10% + 0.20 ×12% = 9.9%

𝑉𝑎𝑟𝑖𝑎𝑛𝑐𝑒 = 0.25 ×(8% − 9.9%)2+ 0.55 ×(10% − 9.9%)2+ 0.20 × (12% − 9.9%)2= 0.000179

𝑆𝑡𝑎𝑛𝑑𝑎𝑟𝑑 𝐷𝑒𝑣𝑖𝑎𝑡𝑖𝑜𝑛 = √0.000179 = 1.34%

5. Portfolio Risk & Return: - A collection of assets

- The risk-return trade-off for a portfolio is measured by the portfolio expected return and

standard deviation, just as with individual assets.

- Portfolio weights: the proportion of the total investment in the portfolio invested in each asset.

Example: Suppose you have $15,000 to invest and you have purchased securities in the

following amounts. What are your portfolio weights in each security? ⦁ $2,000 of VCB 𝑊 → 𝑉𝐶𝐵 =2000 15000 = 0.133 ⦁ $3,000 of HAG → 𝑊 𝐻𝐴𝐺 =3000 15000 = 0.2 ⦁ $4,000 of KDC → 𝑊 𝐾𝐷𝐶 =4000 15000 = 0.267 ⦁ $6,000 of VNM → 𝑊 𝑉𝑁𝑀 =6000 15000 = 0.4 - Portfolio expected return: 𝒎

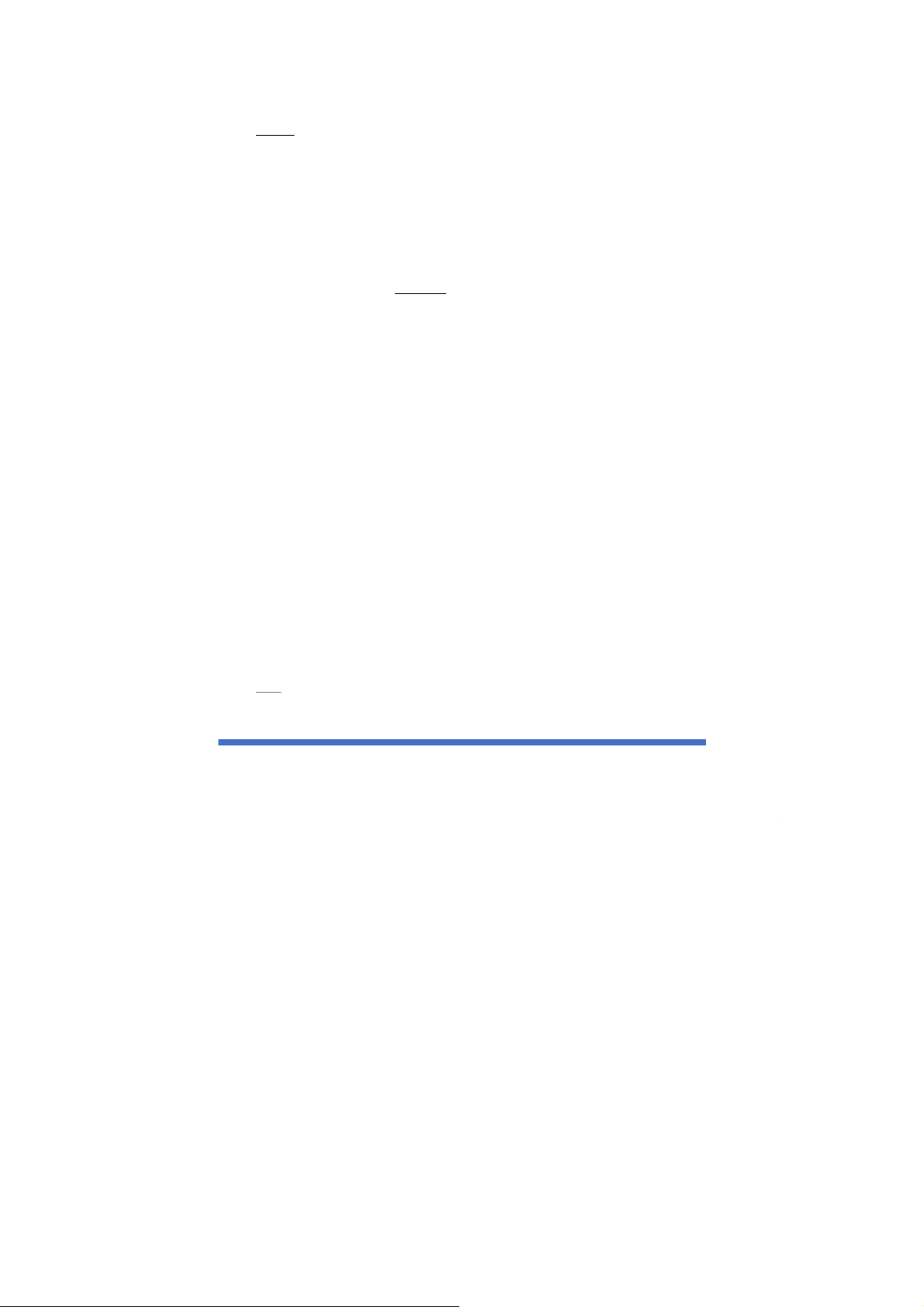

𝑬(𝑹𝑷)= ∑ 𝒘𝒋× 𝑬(𝑹𝒋) 𝒋=𝟏 Example: State Probability Stock A Stock B Boom 0.25 15% 10% Normal 0.60 10% 9% Recession 0.15 5% 10%

What are the expected return and standard deviation for a portfolio with an investment of

$6,000 in stock A and $4,000 in stock B? → 𝑤𝐴=60% 𝑎𝑛𝑑 𝑤𝐵=40%

Cách 1: each asset (ko dùng để tính Variance)

𝐸(𝑅𝐴)= 0.25 ×15% + 0.6 × 10% + 15 0. ×5% =10 5% . KHANH VY 2

𝐸(𝑅𝐵)= 0.25 ×10% + 0.6 × 9% + 0.15 ×10% = 9.4%

𝐸(𝑅𝑃)= 𝑤𝐴× 𝐸(𝑅𝐴)+ 𝑤𝐵× 𝐸(𝑅𝐵)= 0.6 × 10 5% . + 0.4 × 9.4% =10 06% . Cách 2: each state

⦁ Return of portfolio in case economy boom / normal / recession:

𝐸(𝑅𝑃𝑏𝑜𝑜𝑚)= 0.6 × 15% + 0.4 × 10% =13%

𝐸(𝑅𝑃𝑛𝑜𝑟𝑚𝑎𝑙)= 0.6 × 10% + 0.4 × 9% = 9.6%

𝐸(𝑅𝑃𝑟𝑒𝑐𝑒𝑠𝑠𝑖𝑜𝑛)= 0.6 × 5% + 0.4 × 10% =7%

=> Expected return on portfolio:

𝐸(𝑅𝑃)= ∑ 𝑝𝑖× 𝐸(𝑅𝑃𝑖)= 0.25 ×13% + 0.6 × 9.6% + 0.15 ×7% =10 06% .

⦁ Variance and Standard of portfolio:

𝑉𝑎𝑟(𝑅𝑃)= 0.25 × (13% −10 06% . )2+ 0.6 × (9.6% −10 06% . )2 + 0.15 × (7% −10 06% . )2=

𝑆𝑡𝑎𝑛𝑑𝑎𝑟𝑑 𝐷𝑒𝑣𝑖𝑎𝑡𝑖𝑜𝑛 = √𝑉𝑎𝑟𝑖𝑎𝑛𝑐𝑒 = 1.92 6. Risk and Diversification:

- Diversification: Reduced risk by spreading the portfolio across many investments.

- Market risk vs Specific risk:

+ Market risk (Systematic or Non-diversifiable risk): affect the overall stock market

(changes in GDP, inflation, interest rates,..) and measured by : the sensitivity of a 𝜷

stock’s returns to the returns on the market portfolio

⦁ 𝜷 = : stock has the same market risk as the overall market 𝟏

⦁ 𝜷 > 𝟏: stock has more market risk than the market

⦁ 𝜷 < 𝟏: stock has less market risk than the market

⦁ 𝜷 = 𝟎: risk-free asset 𝜷𝑷= ∑𝒋𝒘 = 𝒋 𝟏 × 𝜷𝒋

+ Specific risk (Unsystematic or Diversifiable risk): affect only that firm (CEO

retirement, lawsuit,…) and can be eliminated by diversification.

7. Capital Asset Pricing Model (CAPM):

𝑬(𝑹)= 𝑹𝒇+ 𝜷 × (𝑹𝒎− 𝑹𝒇)

where 𝑅𝑓: risk free rate 𝑅𝑚: market return

𝑅𝑚− 𝑅𝑓: market risk premium (the reward for bearing systematic risk) Note:

- Đề ghi “expected return on the market portfolio” → 𝑅𝑚= 𝐸(𝑅𝑃)

- Có thể dùng công thức này tính 𝐸(𝑅𝑃) KHANH VY 3

𝑬(𝑹𝑷)= 𝑹𝒇+ 𝜷𝑷× (𝑹𝒎− 𝑹𝒇)

8. Coefficient of Variance: measure the risk per unit of return. Measure risk when

expected return on 2 assets are not the same 𝑪𝑽 =𝝈 𝒓 KHANH VY 4