Preview text:

lOMoARcPSD| 50032646

CHAPTER 2 – INTEREST RATE 1. Fixed payment loans

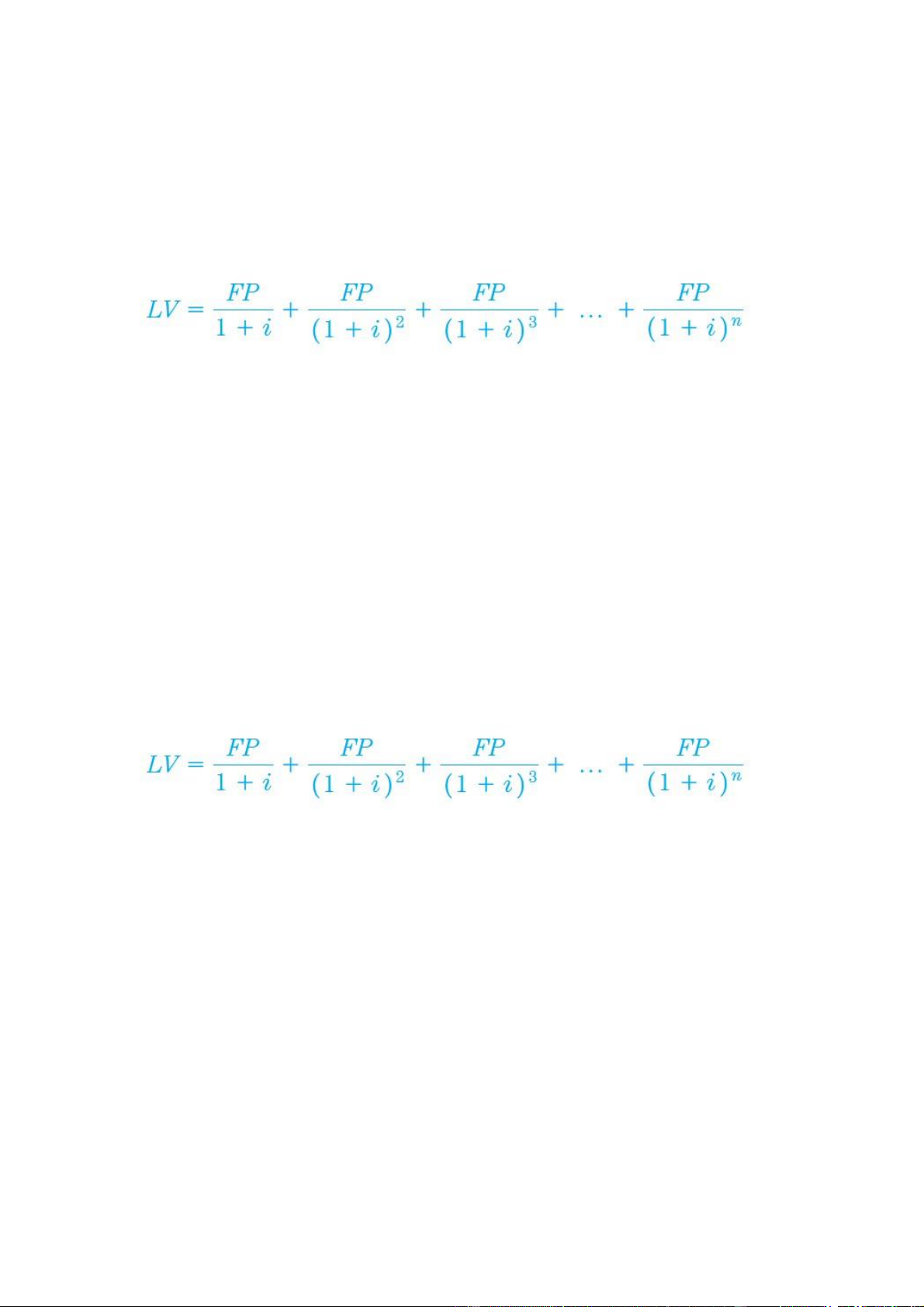

a. You are planning to make a loan of $1000, and will repay $250 each year for the

next 5 years. What is the yield to maturity on this loan? LV = 1000 FP = 250 n = 5 i = ? 1000 = + + + + => i = 7.93%

b. You decide to buy a house with a loan of 100 million VND. The interest rate fixed

by the bank is 12% within the next 10 years. How much do you have to pay for the bank each year? LV = 100 i = 12% n = 10 FP = ? 100 = FP *

=> FP = 17.7 (million VND) 2. Coupon bonds

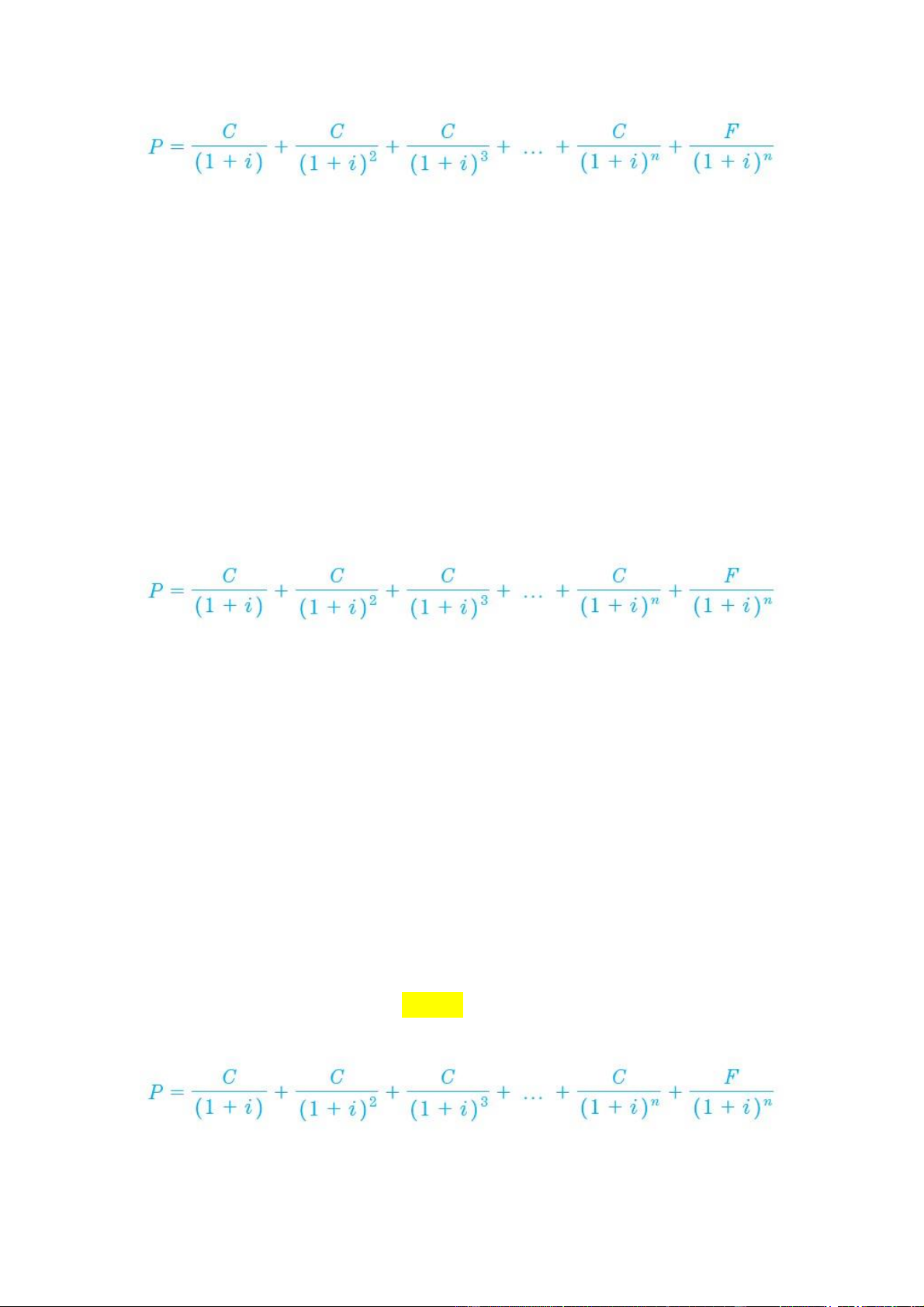

a. Calculating the price of a coupon bond, which has a par value of $1000, pays

interset of 10% within 8 years, and yield to maturity is 12.25%? lOMoARcPSD| 50032646 F = 1000 ic = 10% i = 12.25% n = 8 P = ? C = ic * F = 10% * 1000 = 100 P = + = 889.2

b. Calculating the yield to maturity of a coupon bond, which has par value of

$1000, pays interest of 20% within 6 years and being sold for $1300. F = 1000 P = 1300 ic = 20% n = 6 i = ? C = ic * F = 20% * 1000 = 200 1300 = + + + + + + => i = 12.58%

c. Calculating the yield to maturity of a coupon bond, which has par value of $1000,

pays interest of 10% within 7 years and being sold for $1200, $1100, $1000, $900, $800 respectively? lOMoARcPSD| 50032646 F = 1000 P = 1200 ic = 10% n = 7 i = ? C = ic * F = 10% * 1000 = 100

Công thức dạng rút gọn, vẫn dùng tổ hợp phím P = C * + ( Shift+Solve) P = 1200 => i = 6.4% P = 1100 => i = 8.1% P = 1000 => i = 10% P = 900 => i = 12.2% P = 800 => i = 14.8%

=> P moves in the opposite direction to i 3. Discount bonds

a. Calculating the yield to maturity of a 1-year discount bond, which has par value

of $1000 and being sold at $900. lOMoARcPSD| 50032646 F = 1000 P = 900 n = 1 => i = 11.11%

b. Calculating the price of a 1-year discount bond, which has a par value of $1000 and yield to maturity of 7%. F = 1000 n = 1 i = 7% => P = $934.58

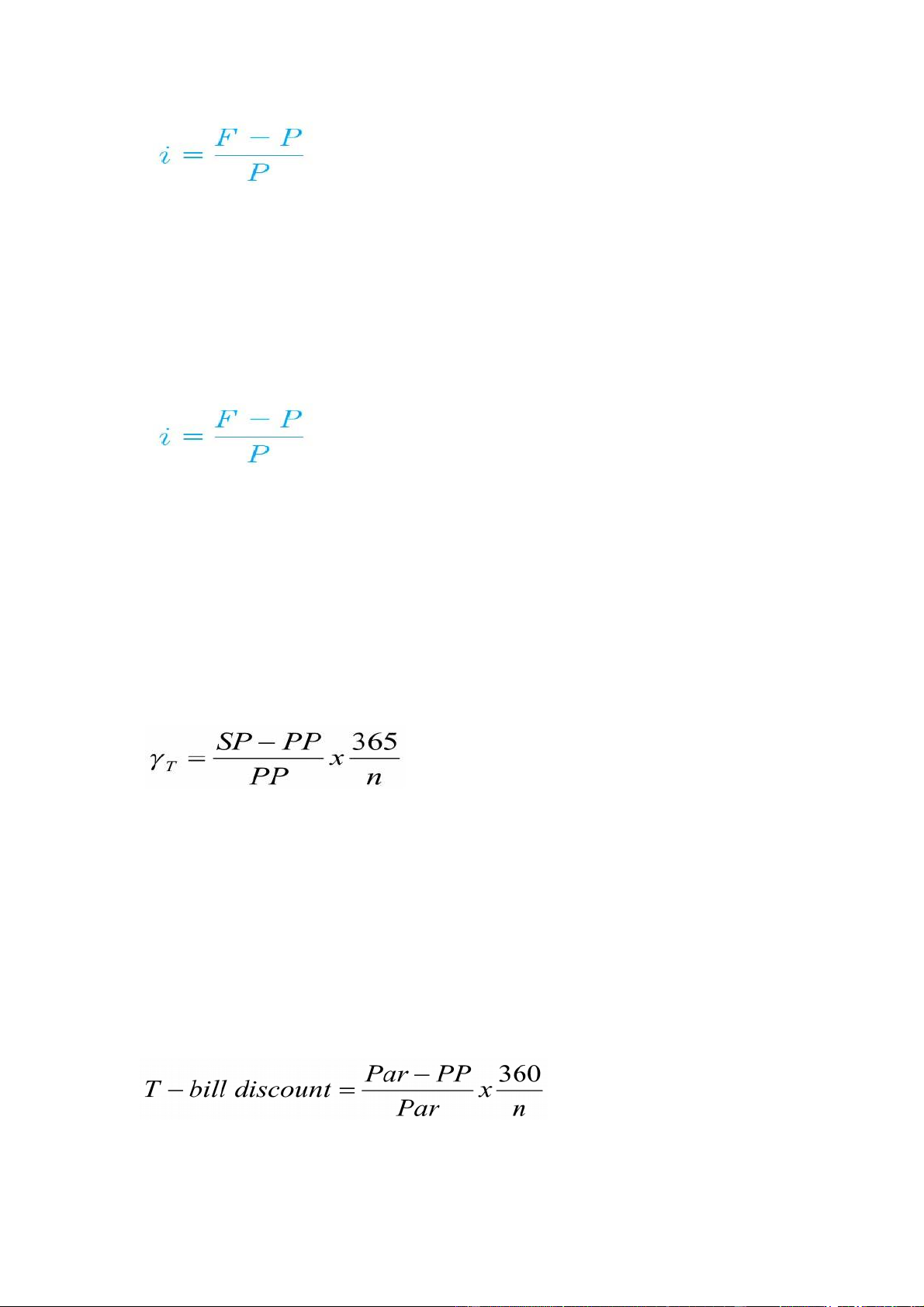

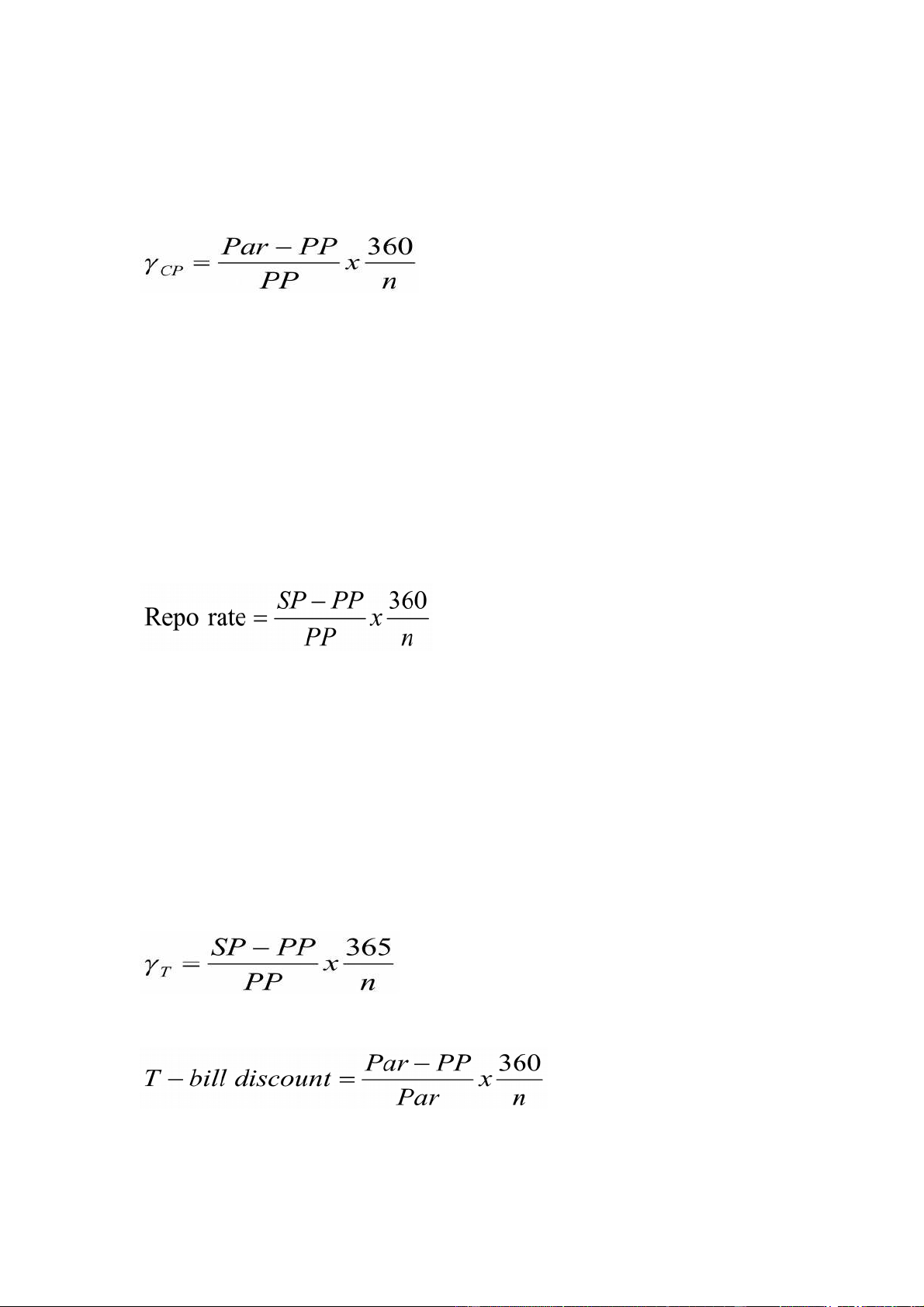

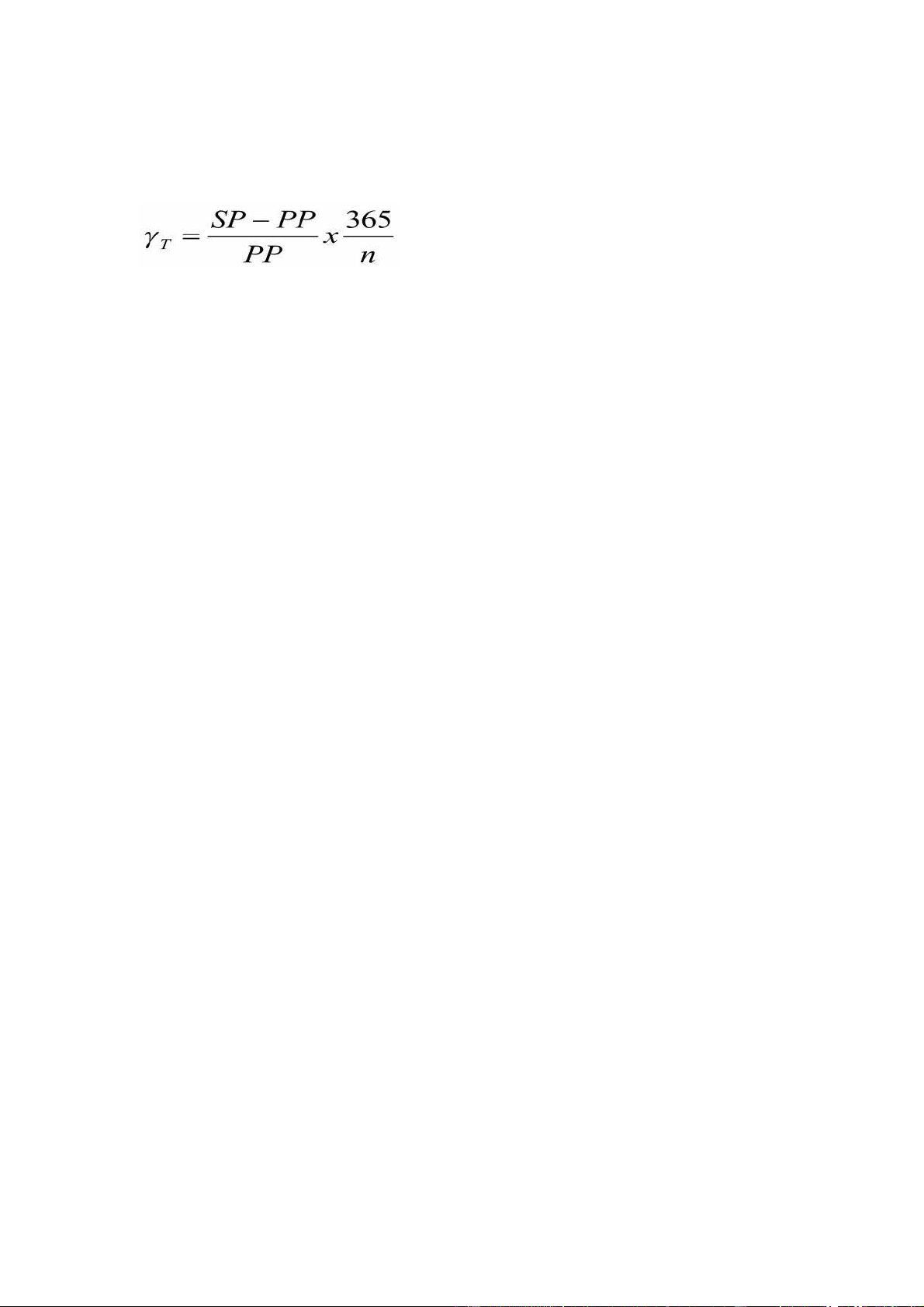

CHAPTER 3 – MONEY MARKET SECURITIES 1. T-bill Yields Par = 10,000 nM = 6 months PP = 9,000 SP = 9,100 n = 90 days => = 4.5% 2. T-bill discount Par = 10,000 nM = 3 months = 90 days PP = lOMoARcPSD| 50032646 9,700 => Discount = 12% 3. Commercial Paper Par = 1,000,000 nM = 6 months = 180 days PP = 940,000 => = 12.8% 4. Repo PP = 4.9 SP = 5 n = 40 days => = 18.4% 5. T-bill PP = 98,000 Par = 100,000 n = 120 days => = 6.2% lOMoARcPSD| 50032646 => Discount = 6% 6. T-bill Par = 10,000 PP = 9,900 n = 91 days => = 4.05% 7. Required rate of return

P = => 8,816.6 = => i = 6.5%