Preview text:

lOMoAR cPSD| 58605085

Chapter 23: Budgetary Planning

- Lập ngân sách cho một kế hoạch sản xuất/kinh doanh của công ty vào một khoảng thời gian cụ thể trong tương lai.

- Ở chap 24 đề cập đến Master Budget: 1 bộ những ngân sách có mối tương quan với nhau, bao gồm 2 classes: Operating

Budgets và Financial Budgets.

- Vì các ngân sách có mối quan hệ mật thiết với nhau nên thông thường lập Budget sẽ theo 1 thứ tự nhất định, bắt đầu với

Sales Budget ⇒ Production Budget ⇒ Direct Materials Budget + Direct Labor Budget + Manufacturing Overhead Budget ⇒

Selling & Administrative Expense Budget ⇒ Budgeted Income Statement ⇒ Cash Budget ⇒ Budgeted Statement of Financial Statement. 1. Sales Budget Company Name Sales Budget

For the Year Ended December 31, 2024 Quarter 1 2 3 4 Year Expected unit sales 3,000 3,500 4,000 4,500 15,000 Unit selling price $60 $60 $60 $60 $60 Total sales 180,000 210,000 240,000 270,000 900,000

(Total sales từng quý = Unit price x Unit sales đề cho sẵn)

2. Production Budget Company Name Production Budget

For the Year Ended December 31, 2024 Quarter 1 2 3 4 Year lOMoAR cPSD| 58605085 Expected unit sales 3,000 3,500 4,000 4,500 Add: Desired ending finished goods units (20%) Total required units Less: Beginning finished goods units (20%)

Required production units 15,400

(Desired ending finished goods units = x% of next quarter budgets sales volume ⇒ Ending units quý 1 = Unit sales quý 2 nhân với x%

Beginning finished goods units = Units sales quý đó nhân với x%)

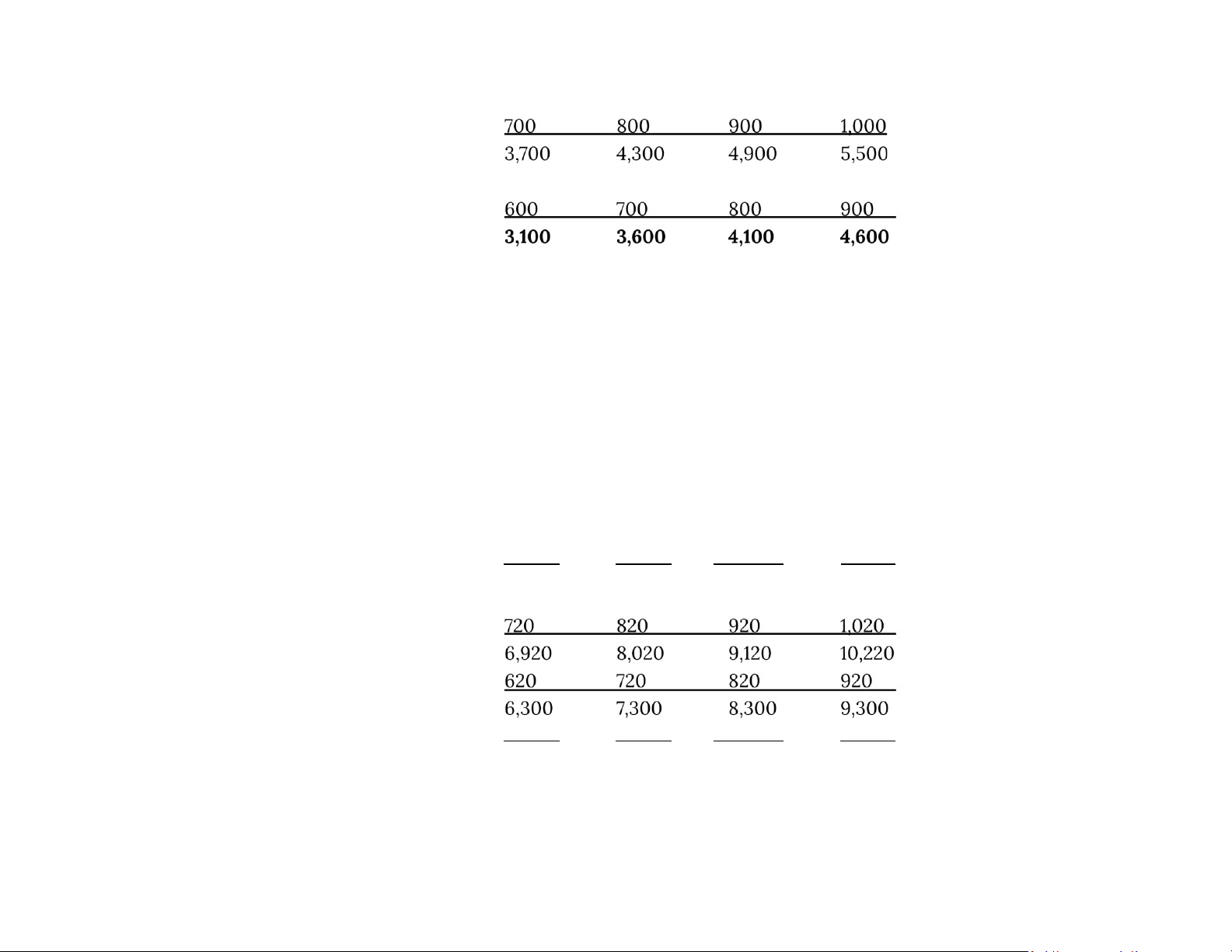

3. Direct Materials Budget Company Name Direct Materials Budget

For the Year Ended December 31, 2024 Quarter 1 2 3 4 Year Units to be produced 3,100 3,600 4,100 4,600 Direct materials per unit x2 x2 x2 x2

Total kilo needed for production 6,200 7,200 8,200 9,200

Add: Desired ending direct materials (10%) Total materials required

Less: Beginning direct materials (10%) Direct materials purchased Cost per kilo x$4 $4 $4 $4

Total cost of direct materials purchase 25,200 29,200 33,200 37,200 124,800 lOMoAR cPSD| 58605085 4. Direct Labor Budget Company Name Direct Labor Budget

For the Year Ended December 31, 2024 Quarter 1 2 3 4 Year Units to be produced 3,100 3,600 4,100 4,600 Direct labor time per unit x2 x2 x2 x2

Total required direct labor hours 6,200 7,200 8,200 9,200 Direct labor cost per hour x$10 x$10 x$10 x$10 Total direct labor cost $62,000 72,000 82,000 92,000 308,000

5. Manufacturing Overhead Budget Company Name Manufacturing Overhead Budget

For the Year Ended December 31, 2024 Quarter 1 2 3 4 Year Variable costs Indirect materials ($1/h) 6,200 7,200 8,200 9,200 30,800 Indirect labor ($1.4/h) 8,680 10,080 11,480 12,880 43,120 Utilities ($0.4/h) 2,480 2,880 3,280 3,680 12,320 Maintenance ($0.2/h) 1,240 1,440 1,640 1,840 6,160 Total variable costs 18,600 21,600 24,600 27,600 92,400 Fixed costs Supervisory salaries 20,000 20,000 20,000 20,000 80,000 lOMoAR cPSD| 58605085 Depreciation 3,800 3,800 3,800 3,800 15,200 Property taxes and insurance 9,000 9,000 9,000 9,000 36,000 Maintenance 5,700 5,700 5,700 5,700 22,800 Total fixed costs 38,500 38,500 38,500 38,500 154,000 Total manufacturing overhead 57,100 60,100 63,100 66,100 246,400 Direct labor hours 6,200 7,200 8,200 9,200 30,800

Manufacturing overhead rate per direct labor hour (246,400 / 30,800) $8

Nơte: Ở trên là 5 loại Budget dễ tính và thường sẽ có trong Midterm nên khuyên các bạn nên note down cẩn thận và đầy đủ, các

Budget phía sau hiếm và ít xuất hiện trong đề (due to time limit) nên có thể xem sơ qua để hiểu cấu trúc và challenge ở những Problem Set A nha.

6. Selling and Administrative Expense Budget Company Name

Selling and Administrative Expense Budget

For the Year Ended December 31, 2024 Quarter 1 2 3 4 Year Budgeted sales in units 3,000 3,500 4,000 4,500 Variable expenses Sale commisstions ($3/unit) Freight-out ($1/unit) Total variable expenses Fixed expenses Advertising 5,000 Sales salaries 15,000 Office salaries 7,500 lOMoAR cPSD| 58605085 Depreciation 1,000 Property, taxes and insurance 1,500 Total fixed expenses

Total selling and administrative expenses 7. Budgeted Income Statement Company Name Budgeted Income Statement

For the Year Ended December 31, 2024 Sales COGS Gross profit

Selling and administrative expenses Income from operations Interest expense Income before income taxes Income tax expense Net income

8. Cash budget (Bảng chi tiết Slides 43 chapter 23) Company Name Cash Budget Beginning cash balance Add: Cash receipts Total available cash Less: Cash Disbursements

Excess of available cash over cash disbursements Financing lOMoAR cPSD| 58605085 Ending cash balance

9. Budgeted Statement of Financial Position (chi tiết Slides 45 chapter 23) _

BÀI TẬP ỨNG DỤNG DOIT! 23-2

Pargo Company is preparing its master budget for 2017. Relevant data pertaining to its sales, production, and direct materials budgets are as follows.

Sales. Sales for the year are expected to total 1,000,000 units. Quarterly sales are 20%, 25%, 25%, and 30%, respectively. The sales

price is expected to be $40 per unit for the first three quarters and $45 per unit beginning in the fourth quarter. Sales in the first

quarter of 2018 are expected to be 20% higher than the budgeted sales for the first quarter of 2017.

Production. Management desires to maintain the ending finished goods inventories at 25% of the next quarter’s budgeted sales volume.

Direct materials. Each unit requires 2 pounds of raw materials at a cost of $12 per pound. Management desires to maintain raw

materials inventories at 10% of the next quarter’s production requirements. Assume the production requirements for first quarter of 2018 are 450,000 pounds.

● Prepare the sales, production, and direct materials budgets by quarters for 2017. GIẢI NÈ: PARGO COMPANY Sales Budget

For the Year Ending December 31. 2017 Quarter 1 2 3 4 Year Expected unit sales 200,000 250,000 250,000 300,000 1,000,000 Unit selling price $40 $40 $40 $45 $60 Total sales

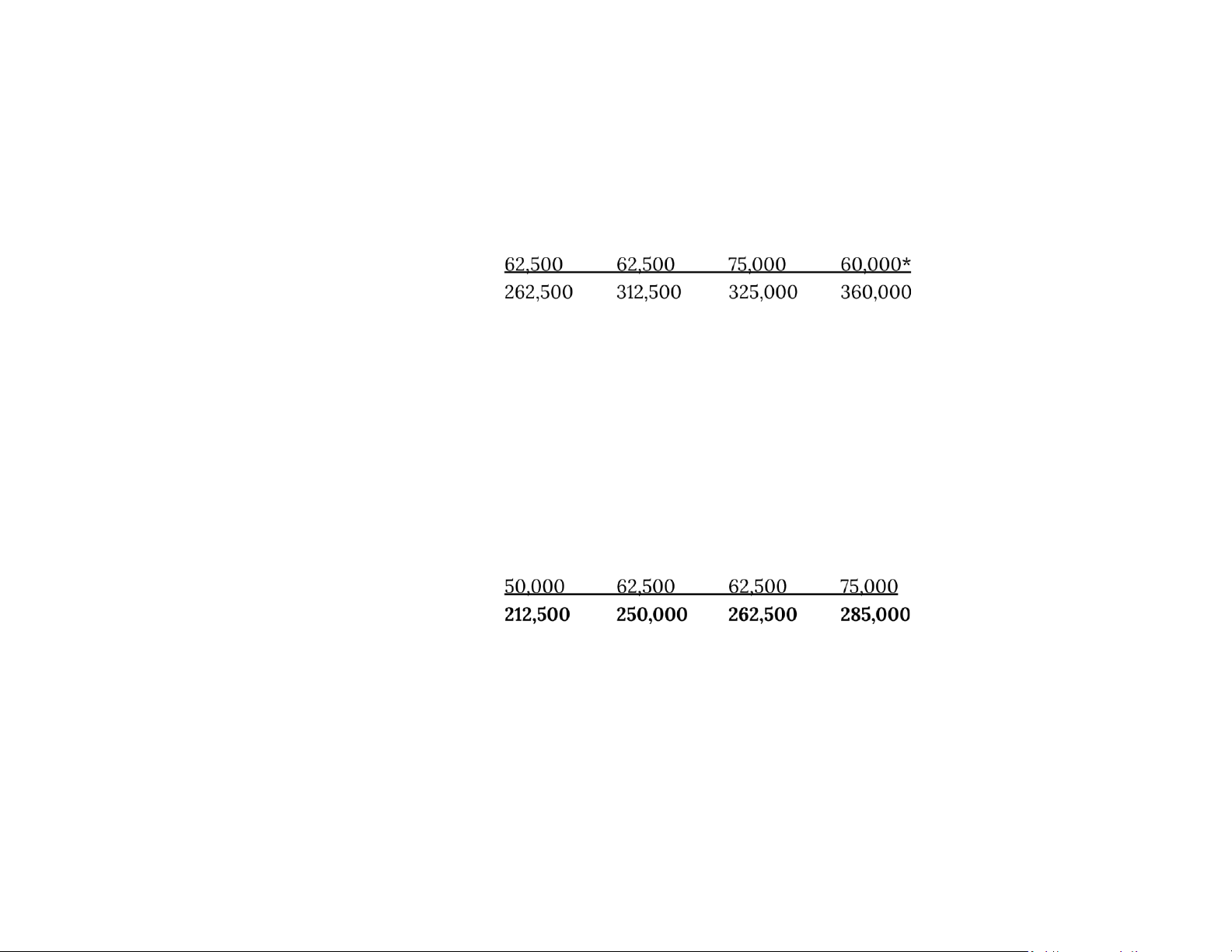

$8,000,000 $10,000,000 $10,000,000 $13,500,000 $41,500,000 PARGO COMPANY lOMoAR cPSD| 58605085 Production Budget

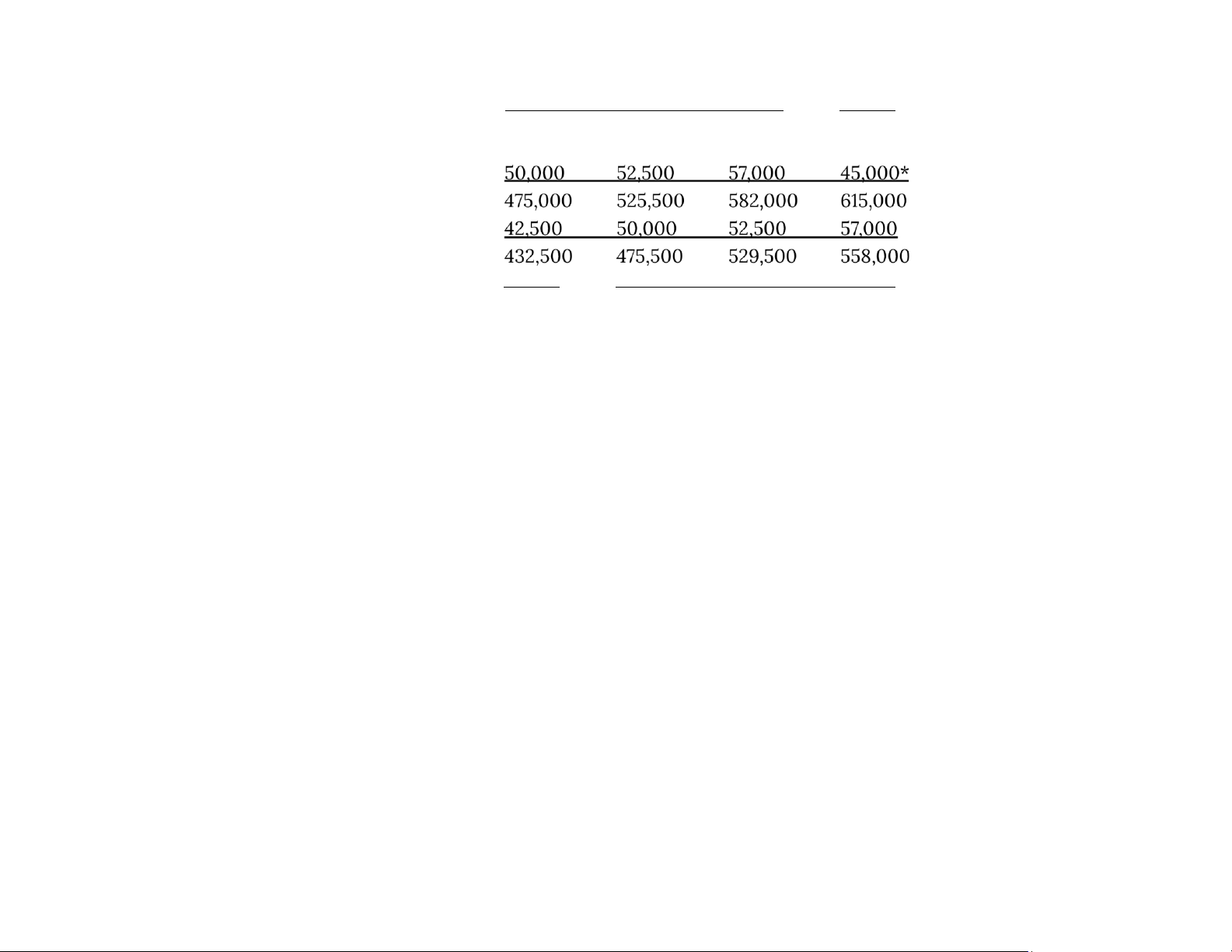

For the Year Ending December 31. 2017 Quarter 1 2 3 4 Year Expected unit sales 200,000 250,000 250,000 300,000 Add: Desired ending finished goods units (25%) Total required units Less: Beginning finished goods units (25%)

Required production units 1,010,000

*Estimated Q1 2018 sales units: 200,000 x 120% = 240,000 ⇒ 240,000 x 25% = 60,000 PARGO COMPANY

Direct Materials Budget

For the Year Ended December 31, 2017 Quarter 1 2 3 4 Year lOMoAR cPSD| 58605085 Units to be produced 212,500 250,000 262,500 285,000 Direct materials per unit x2 x2 x2 x2

Total pound needed for production 425,000 500,000 525,000 570,000

Add: Desired ending direct materials (10%) Total materials required

Less: Beginning direct materials (10%) Direct materials purchased Cost per pound x$12 $12 $12 $12

Total cost of direct materials purchase

$5,190,000 $5,706,000 $6,354,000 $6,696,000

*Assumed production requirement Q1 2018 = 450,000 ⇒ 450,000 x 10% = 45,000