Preview text:

EXERCISES FOR CHAPTER 4 EX1: .

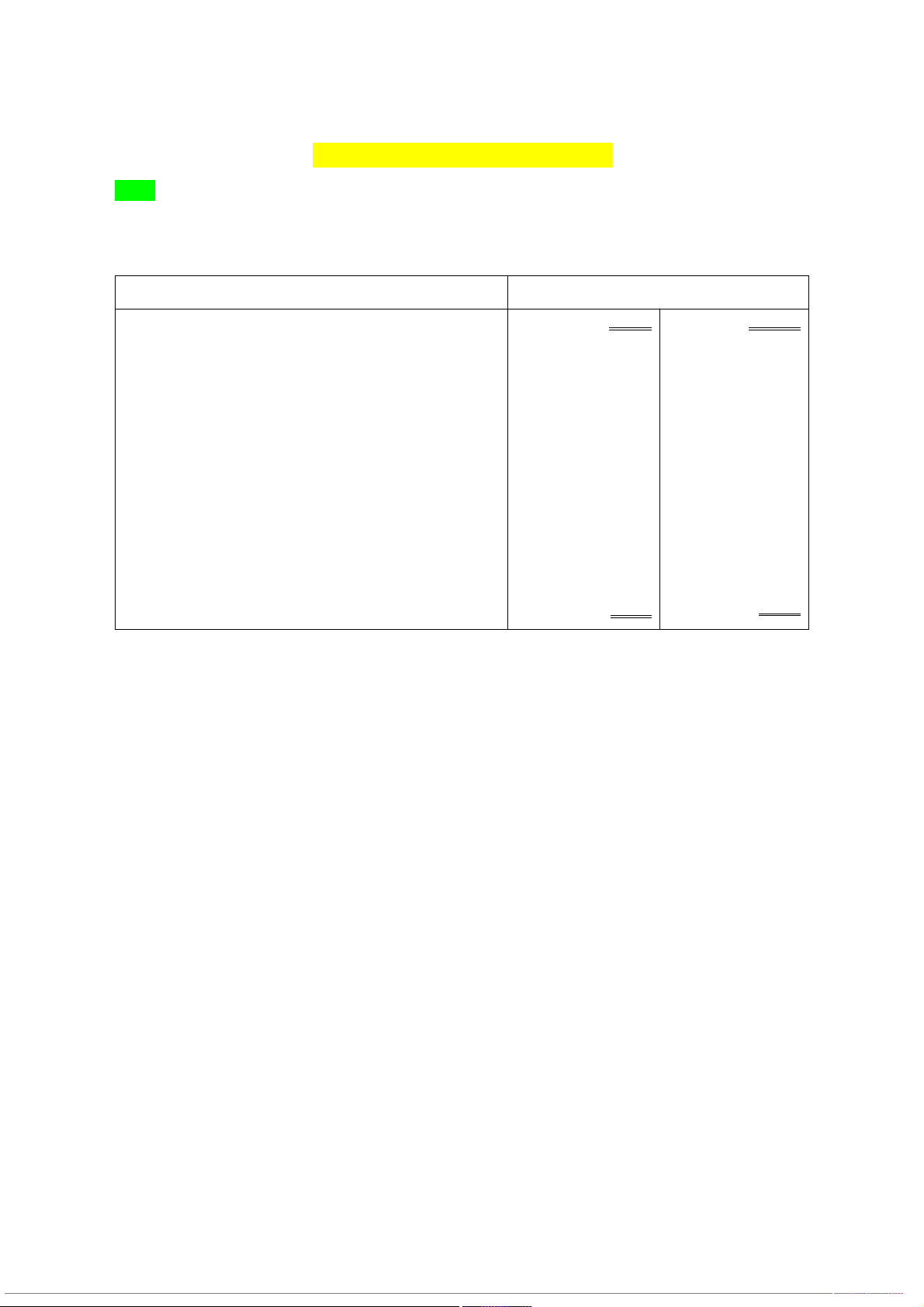

The Adjustments columns of the Worksheet from Mady Company are shown below. UNRUH COMPANY

Trial Balance (Selected Accounts) September 30, 2005 Account Titles Adjustments Debit Credit Accounts Receivable $ 800 Prepaid Insurance 650 Accumulated Depreciation 770 Salaries and Wages payable 1200 Service revenue 800 Salaries and Wages Expense 1,200 Insurance Expense 650 Depreciation Expense 770 3,420 3,420 Instructions

1. Prepare the adjusting entries

2. Assuming the adjusted trial balance amount for each account is normal, indicate the

financial statement column to which each balance should be extended. Solution (10 min.)

a. Accounts Receivable ..................................................................800

Service revenue ........................................................................ 800

b. Insurance Expense .......................................................................... 650

Prepaid Insurance ................................................................... 650

c. Depreciation Expense ...................................................................... 770

Accumulated Depreciation .......................................................... 770

d. Salaries and Wages expense……………………………..1,200

Salaries and Wages Paybalbe.................................................................. 1,200 EX2: .

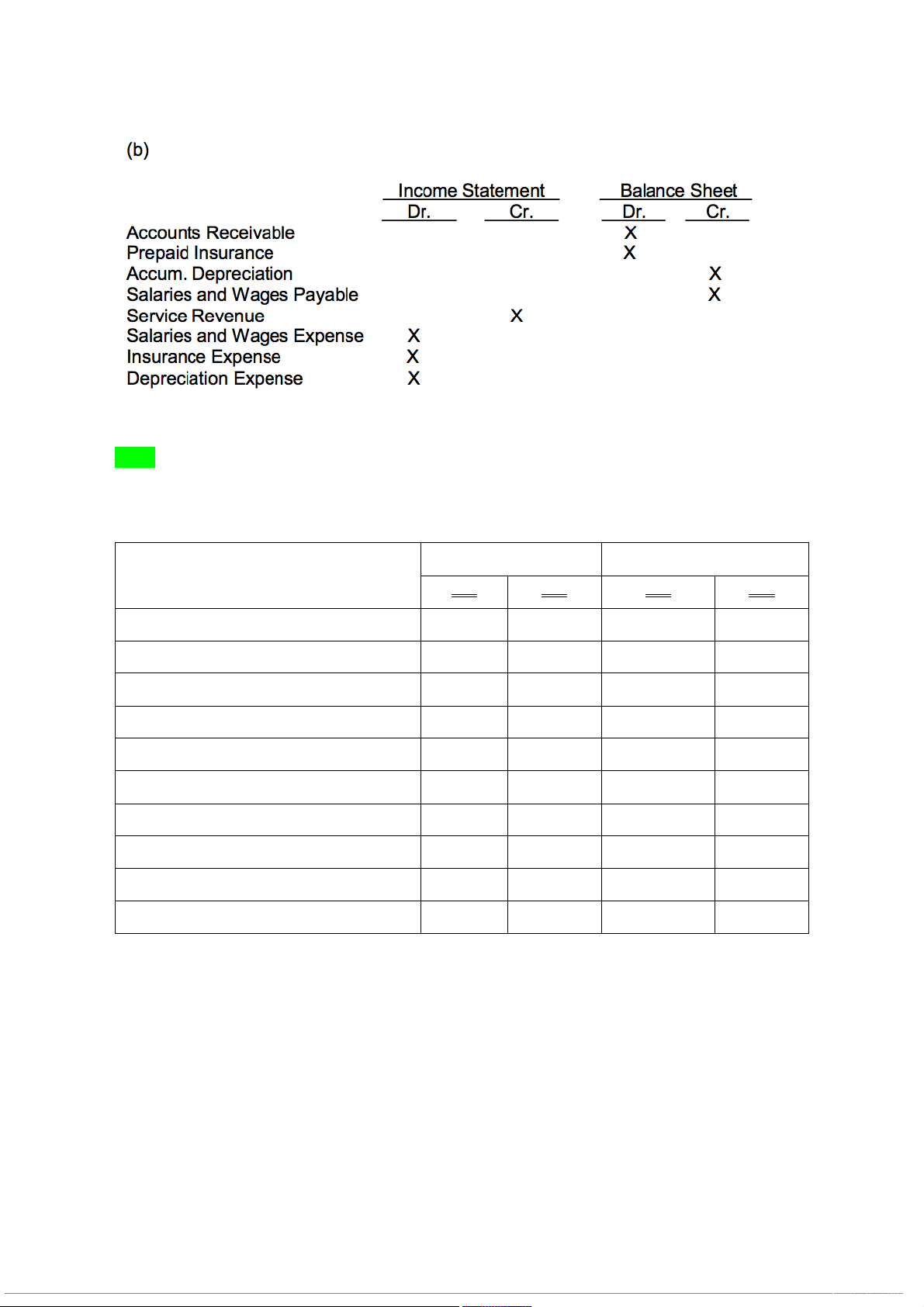

The Adjustments columns of the Worksheet fro Maydy Company are shown below. UNRUH COMPANY

Trial Balance (Selected Accounts) September 30, 2005 Account Titles Trial Balance Adjusted Trial Balance Dr. Cr. Dr. Cr. Accounts Receivable ? 35,000 Prepaid insurance 26,000 18,000 Supplies 7,000 ? Accumulated Depreciation 12,000 ? Salaries and Wages Payable ? 8,500 Service revenue 85,000 95,000 Insurance Expense ? Depreciation Expense 9,600 Supplies Expense 5,800 Salaries and Wages Expense ? 49,000 Instructions 1. Fill in the missing amounts

2. Prepare the adjusting entries that were made. Solution (10 min.) EX3: .

These financial statement items are for Rugen Company at year end, July 31, 2016 UNRUH COMPANY

Trial Balance (Selected Accounts) September 30, 2005 Salaries and Wages Payable

2,980 Notes payable (long term) 3,000 Salaries and Wages Expense 45,700 Cash 5,200 Utilities expenses 21,100 Accounts receivable 9,780 Equipment

38,000 Accumulated depreciation 6,000 Accounts payable 4,100 Owner’s Drawings 4,000 Service revenue 57,200 Depreciation expense 4,000 Rent revenue

6,500 Owner’s Capital (beginning of the year) 48,000 Instructions

1. Prepare an income statement and an owner’s equity statement for the year. The owner

did not make any new investments during the year.

2. Prepare a classified balance sheet at July 31.

EX4: The adjusted account balances of the Wellness Center at July 31 are as follows: UNRUH COMPANY

Trial Balance (Selected Accounts) September 30, 2005 Cash 16,000 Service Revenue 107,000 Accounts receivable 15,000 Interest revenue 8,500 Supplies 4,000 Depreciation expense 25,000 Prepaid insurance 8,000 Insurance expense 6,000 Buildings

300,000 Salaries and Wages Expense 40,000

Accumulated depreciation - Building 120,000 Supplies Expense 8,000 Accounts payable 19,000 Utilities expenses 13,000 Owner’s Capital 195,000 Owner’s Drawings 11,000 Instructions Ser for the Wellness Center.

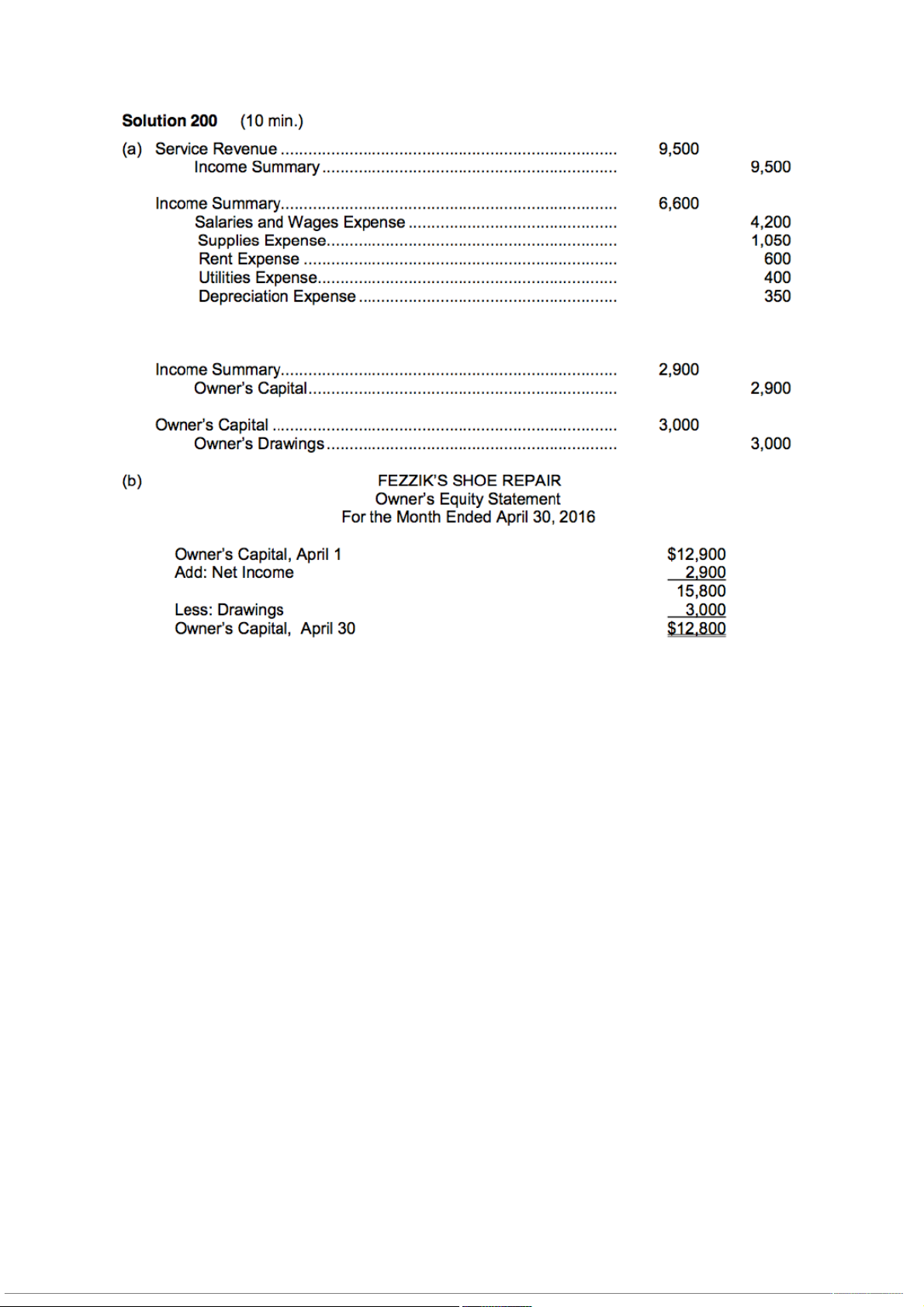

EX5: The income statement of Fezzik’s Shoe Repair is as follows: FEZZIK’S SHOE REPAIR Income Statement

For the Month Ended April 30, 2016 Account Titles Number Dr. Cr. Revenue 9,500 Service Revenue Expenses Salaries and Wages expense 4,200 Deprececiation Expense 350 Utilities Expense 400 Rent Expense 600 Supplies Expense 1,050 Total expenses 6,600 Net income 2,900

On April 1, the Owner’s Capital account had a balance of $12,900. During April, Fezzik

withdrew $3,000 cash for personal use. Instructions 1

Prepare closing entries at April 30. 2

Prepare an owner’s equity statement for the month of April.