Preview text:

lOMoAR cPSD| 58562220

Chapter 5: Valuation: Discounted Cash Flow (DCF) Analysis 1.Definition

• DCF analysis is a fundamental valuation methodology broadly used. It

is premised on the principle that the value of a company, division,

business, or collection of assets (“target”) can be derived from the

present value of its projected free cash flow (FCF).

• Intrinsic value can be derived from PV of projected free cash flow

• Important alternative to market-based valuation techniques

• Typically, FCF is projected for 5 years. Terminal value (“going

concern” value) captures remaining value beyond projection period

• WACC is the discount rate commensurate with business and financial risks

• Sensitivity analysis is used to test assumptions 2.

Steps Step 1: Study the target and determine key performance drivers Study the Target

• Study and learn as much as possible about the target and its sector. A

thorough understanding of the target’s business model, financial profile,

value proposition for customers, end markets, competitors, and key

risks is essential for developing a framework for valuation. Source of

info: SEC filings, earnings call transcripts, investor presentations,

MD&A section, equity research reports.

Determine key performance drivers (sales growth, profitability, FCF generation):

• Internal: new facilities/stores/products/customer contracts, improve

operational and working capital efficiency lOMoAR cPSD| 58562220

• External: acquisitions, end market trends, consumer buying patterns,

macroeconomic factors, legislative/regulatory changes.

Step 2: Project Free Cash Flow

Free Cash Flow: cash generated after paying all cash operating expenses and

taxes and after funding capex and working capital, but before paying interest expense.

FCF is independent of capital structure.

FCF = EBIT – Taxes + D&A – Capex – Increase (Decrease) in Net WC

= EBIT(1-Tc) + D&A – Capex – Increase (Decrease) in Net WC

Considerations for Projecting Free Cash Flow

• Historical performance: Historical performance provides valuable

insight for developing defensible assumptions to project. The DCF

customarily begins by laying out the target’s historical financial data for

the prior three-year period financial statements with adjustments for

non-recurring items and recent events

• Projection period length: 5 years, or when financial performance reaches steady stage

• Alternative cases: Management case, Base case, and upside and downside cases

Projection of Sales, EBITDA, and EBIT Sale Projection

• Using consensus estimates, equity research, industry reports, consulting

studies. Be aware of cyclical business

• Compare projections with target’s historical growth rates, peer

estimates, sector/market outlook

• Growth assumptions need to be justifiable

• Sales projections are consistent with other related assumptions (capex, working capital) lOMoAR cPSD| 58562220

COGS and SG&A Projections

• Historical gross profit margin and SG&A as a percentage of sales

• For private companies, examine research estimates for peer companies

EBITDA and EBIT Projection

• For future 2 or 3 years: use consensus estimates

• For outer years: hold margins constant at the last year level provided by

consensus estimates, consider profitability increasing or decreasing

• For private companies: use historical trends and consensus estimates for peer companies Tax Projection

• The first step in calculating FCF from EBIT is to subtract estimated

taxes. The result is tax-effected EBIT, also known as EBIAT or NOPAT.

This calculation involves multiplying EBIT by (1 – t), where “t” is the target’s marginal tax rate.

• A marginal tax rate of 35% to 40% is generally assumed for modeling purposes.

• The company’s actual tax rate (effective tax rate) in previous years can

also serve as a reference point D&A Projections

• Depreciation: projected as percentage of sales or capex based on

historical levels. Or build a detailed PP&E schedule. Ensure

depreciation and capex are in line by the final year of projection period

• Amortization: projected as percentage of sale, or build detailed

schedule based on existing intangible assets

• For some companies, D&A is a separate line item on income statement.

But more commonly included in COGS or SG&A. lOMoAR cPSD| 58562220

• D&A as one line-item: projected using 2 methods for depreciation

above, or D&A = EBITDA - EBIT

• D&A is non-cash expense. It is added back to EBIAT in the calculation

of FCF. Hence, while D&A decreases a company’s reported earnings, it does not decrease its FCF.

Capital expenditure Projection

• Historical capex is a reliable proxy

• Consider company’s strategy, sector, or phase of operations

• Future planned capex can be found in MD&A section, research reports

• Generally driven as percentage of sales in line with historical levels

Change in net working capital Projections

• An increase in NWC is a use of cash. A decrease in NWC is a source of cash

• NWC is projected as percentage of sales

• Recommended approach is to project each component of current assets

and current liabilities which is projected based on historical ratios from

prior year level or 3-year average

Change in NWC = NWC in year n – NWC in year (n-1)

NWC = Non-cash current assets – Non-interest-bearing current liabilities

= (A/R + Inventory + Prepaid expenses and Other current assets) – (A/P

+ Accrued liabilities + Other current liabilities)

• Accounts receivable: use DSO

• Inventory: use DIH or Inventory turns

• Prepaid expenses and Other current assets: projected as percentage of

sales in line with historical levels lOMoAR cPSD| 58562220 • Accounts payable: use DPO

• Accrued liabilities and Other current liabilities: projected as percentage

of sales in line with historical levels

DSO (Day sale outstanding) = (A/R / Sales)*365

DIH (Days inventory held) = (Inventory/COGS)*365 Inventory Turns =

COGS/Inventory DPO = (A/P / COGS) * 365 Step 3: Calculate

Weighted Average Cost of Capital

WACC is also called opportunity cost of capital Steps for calculating WACC:

• Determine target capital structure

• Estimate cost of debt (rd)

• Estimate cost of equity (re)

Calculate WACC : rWACC = rd* (1-T) * D/(D+E) + re * E/(E+D)

Often use WACC range by sensitizing its key inputs

Target capital structure: is consistent with long-term strategy. Use company’s

current and historical debt-to-total capitalization ratios, or mean and median

of its peers. Target capital structure is held constant throughout projection period.

Cost of debt (rd): if company is currently at its target capital structure, , cost

of debt is derived from blended yield on outstanding debt instruments

(public and private debt). Otherwise, cost of debt is derived from peer companies

• Publicly traded bonds: current yield on all outstanding issues

• Private debt (revolving credit facilities and term loans): consults with

debt capital markets specialist for current yield lOMoAR cPSD| 58562220

• If no current market data, use at-issuance coupons of current debt

maturities, or estimate company’s credit rating at target capital structure

and use cost of debt for comparable credits

Cost of equity (re): use CAPM

• Cost of equity = Risk-free rate + Levered beta x Market risk premium

• Beta for public company: use historical beta

• Beta for private company: is derived from a group of publicly traded

peer companies, but need to neutralize the effects of different capital structures:

✓ Calculate unlevered beta (asset beta) of each peer, then take the average

✓ Calculate relevered beta using company’s target capital structure and marginal tax rate

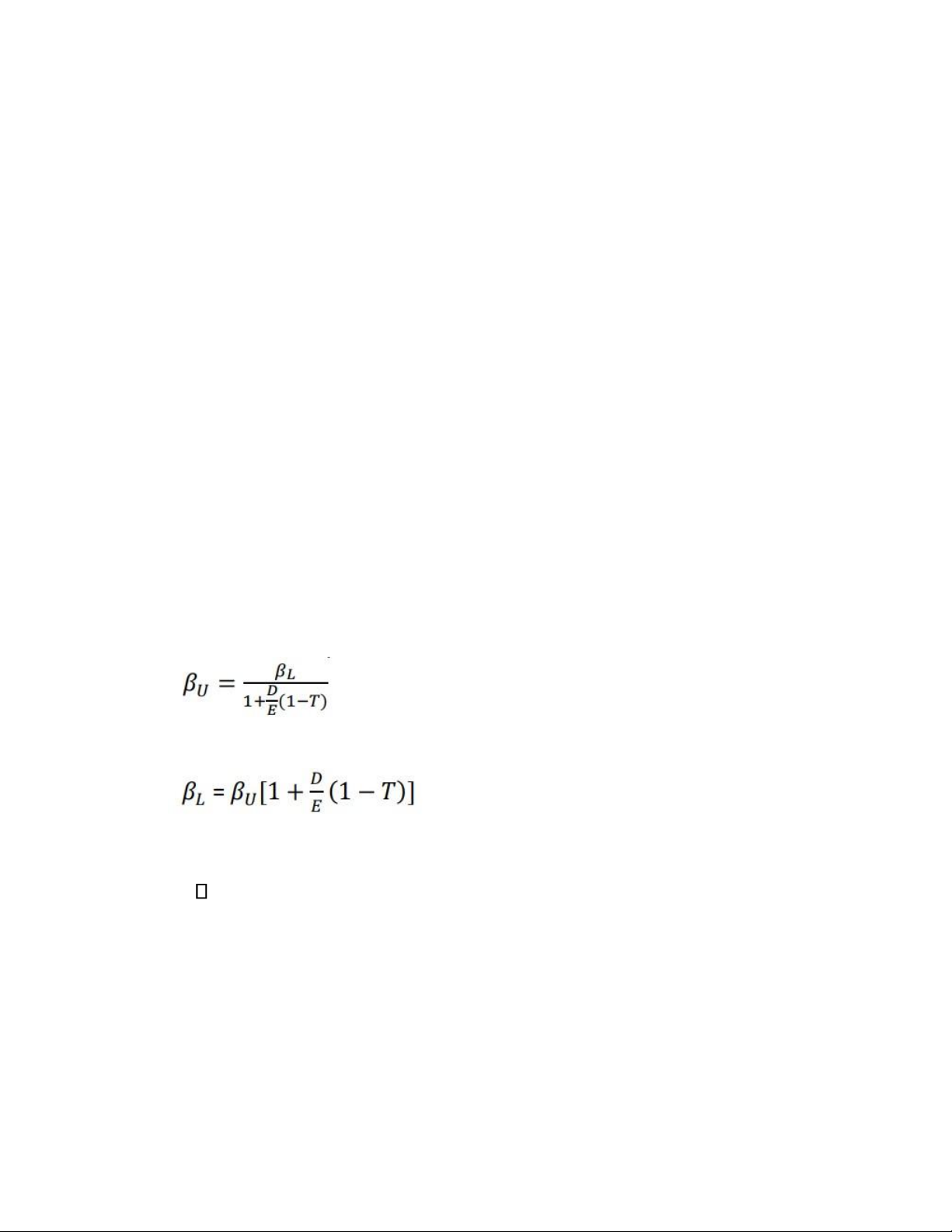

How to calculate levered beta for private company:

Unlevered beta (asset beta) of each peer:

Relevered beta of the target company:

Note: Use avarege 𝛽𝑈 to calculate

Size premium (SP): added to cost of equity of CAPM

re = rf + 𝛽L * (rm –rf) + SP lOMoAR cPSD| 58562220

Step 4: Determine Terminal Value

Terminal value is typically calculated on the basis of the company’s FCF (or

a proxy such as EBITDA) in the final year of the projection period.

Exit multiple method (EMM):

Terminal value = EBITDAn x Exit Multiple

n: terminal year of projection period. Multiple is the current LTM trading

multiples for comparable companies

Use normalized trading multiple, normalized EBITDA

Sensitivity analysis: range of exit multiple Perpetuity growth method (PGM):

Terminal value = [FCFn x (1+g)] / (r-g)

FCF: unlevered free cash flow n: terminal

year of projection period FCF: unlevered free

cash flow g: perpetuity growth rate (2% to 4%) r: WACC

Perpetuity growth rate:

• Based on company’s expected long-term industry growth rate (2%-4%)

• Is sensitized to produce valuation range

The followings are calculated to check between EMM and PGM: lOMoAR cPSD| 58562220

Implied perpetuity growth rate (end-of-year discounting and mid-year

discounting) Implied exit multiple (end-of-year discounting and mid-

year discounting) Step 5: Calculate Present Value and Determine Valuation

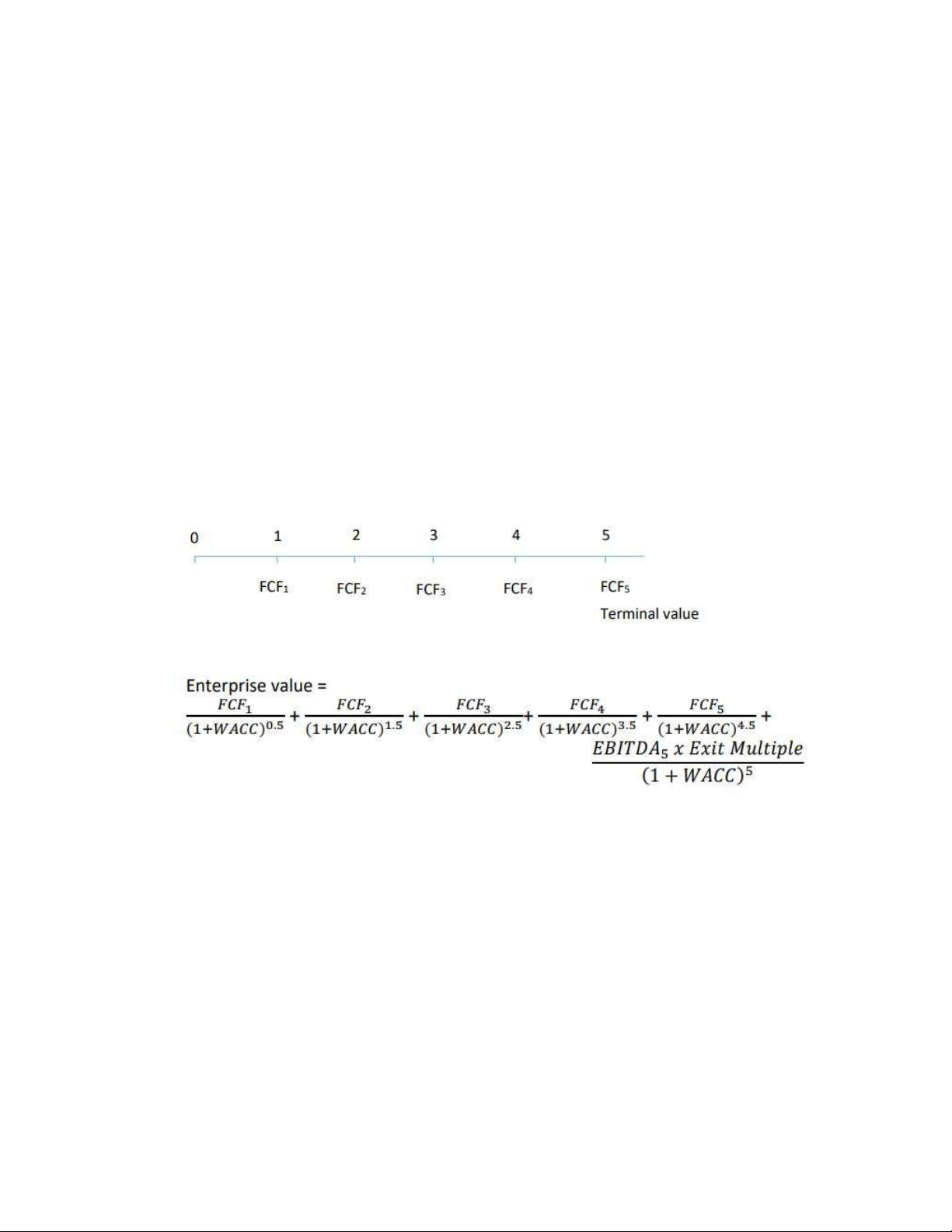

Discount factor: year-end and mid-year convention

• Year end: Discount factor = 1/(1+WACC)n

• Mid year: Discount factor = 1/(1+WACC)n-0.5

Terminal value considerations: if using mid-year convention for FCF of

projection period, use mid-year discounting for terminal value under PGM,

but use year-end discounting under EMM Enterprise value

Using mid-year discounting with EMM method:

Implied equity value = Enterprise Value + Prefrerred Stock + Noncontrolling Interest

Implied share price = Implied equity value/Fully Diluted Shares Outstanding

• Sensitivity analysis: The exercise of deriving a valuation range by

varying key inputs is called sensitivity analysis. Key valuation drivers

such as WACC, exit multiple, and perpetuity growth rate are the most

commonly sensitized inputs in a DCF lOMoAR cPSD| 58562220 Key Pros

• Cash flow-based: reflects value of projected FCF, a more fundamental approach to valuation

• Market independent: more insulated from market bubbles and distressed periods

• Self-sufficient: DCF is important when there are limited or no “pure play” public comparables

• Flexibility: can run multiple financial performance scenarios (growth

rates, margins, capex requirements, working capital efficiency) Key cons

• Dependence on financial projections: accurate forecasting of financial

performance is challenging, especially as projection period lengthens

• Sensitivity to assumptions: small changes in key assumptions (growth

rates, margins, WACC, exit multiple) can produce different valuation ranges

• Terminal value: accounts for three-quarters or more of DCF valuation

=> decrease the relevance of FCF of projection period

• Assumes constant capital structure: no flexibility to change capital

structure over projection period

1.Calculate FCF using the information below Assumptions EBIT $300 D&A 50 Capex 25

Inc/(Dec) in Net Working Capital 10 Tax Rate 38% lOMoAR cPSD| 58562220

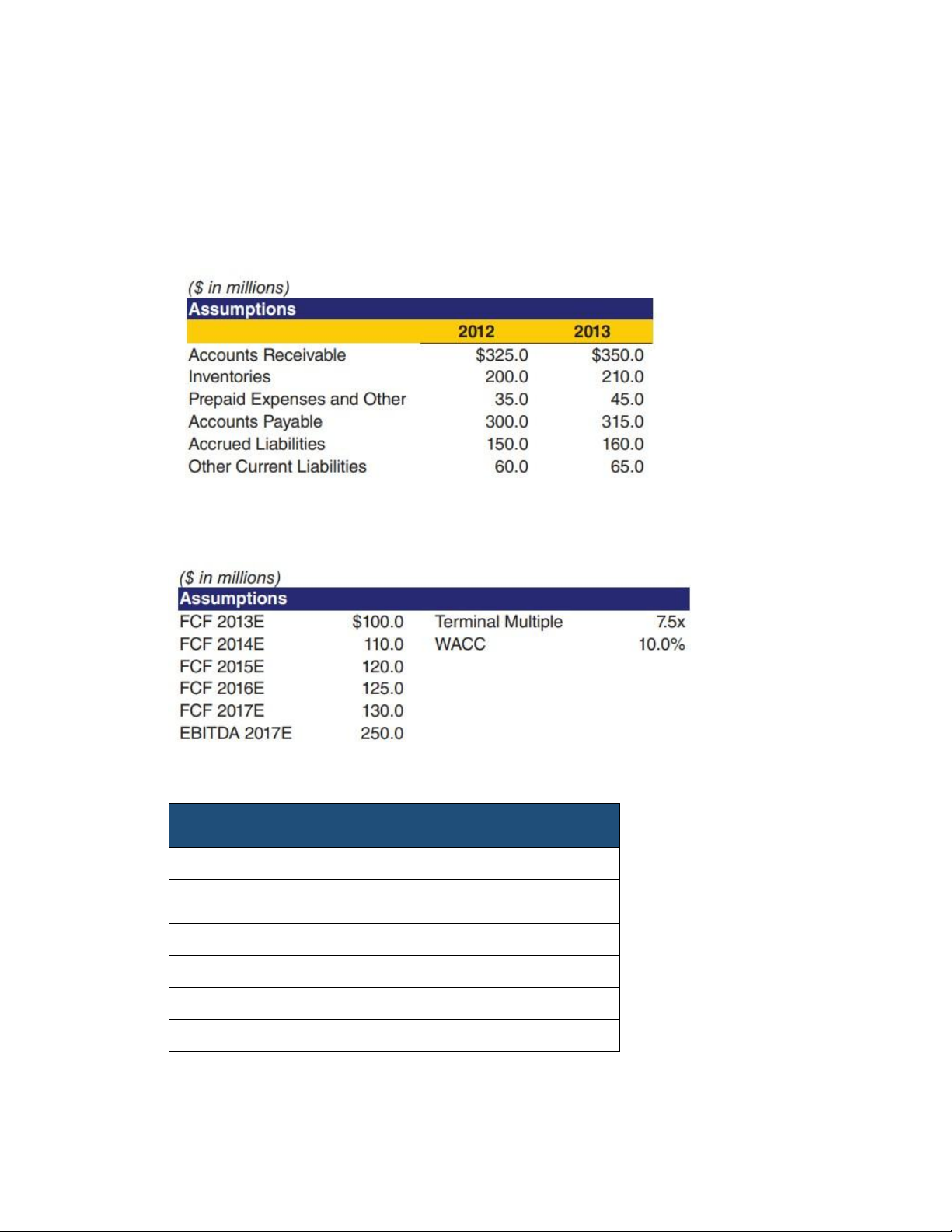

2. Calculate the (increase) / decrease in net working capital from 2012 to 2013

based on the following assumptions

3. Using a mid-year convention and the assumptions below,calculate enterprise value

4. Using the information below to answer question Enterprise Value Cumulative PV of FCF $1,600 Terminal Value Terminal year EBITDA $929.2 Exit Multiple 7.5x Terminal Value Discount Factor 0.62 lOMoAR cPSD| 58562220 PV of Terminal Value % of Enterprise Value Enterprise Value a) Calculate Terminal Value b) Calculate Enterprise Value

c) Calculate the percentage of enterprise value represented by the terminal value