Preview text:

lOMoAR cPSD| 47206071 Page 185 CHAPTER 5

Planning, understanding the entity and assessing business risk

LEARNING OBJECTIVES (LO) 5.1

Explain why the decision to accept a client is important, and describe

the primary features of client acceptance and continuance, including the

purpose and content of an audit engagement letter.

5.2Explain the importance of planning to the audit process.

5.3Identify the important aspects of the auditor’s understanding of an entity and its environment.

5.4Assess entity business risk.

5.5Explain how an auditor develops an overall audit strategy and prepares a

detailed audit plan or audit program.

5.6Describe the process of assigning and scheduling audit staff.

5.7Outline the types and uses of analytical procedures and distinguish

those that are useful in obtaining an understanding of an entity and assessing business risk. RELEVANT GUIDANCE ASA 210/ISA 210

Agreeing the Terms of Audit Engagements ASA 220/ISA 220

Quality Control for an Audit of a Financial Report and

Other Historical Financial Information

Planning an Audit of a Financial Report ASA 300/ISA 300 ASA 315/ISA 315

Identifying and Assessing the Risks of Material

Misstatement through Understanding the Entity and Its Environment

The Auditor’s Responses to Assessed Risks ASA 330/ISA 330

Initial Audit Engagements—Opening Balances ASA 510/ISA 510 lOMoAR cPSD| 47206071 ASA 520/ISA 520 Analytical Procedures ASA 710/ISA 710

Comparative Information—Corresponding Figures and

Comparative Financial Reports ASQC 1/ISQC 1

Quality Control for Firms that Perform Audits and Reviews of

Financial Reports and Other Financial Information, Other

Assurance Engagements and Related Services Engagements

Code of Ethics for Professional Accountants APES 110/IFAC Terms of Engagement APES 305

Quality Control for Firms APES 320 Page 186 lOMoAR cPSD| 47206071 CHAPTER OUTLINE

Before commencing an audit, the auditor must determine whether to accept the

client and undertake the audit. This requires an understanding of the entity and its

environment. After the audit commences, the planning and conduct of the audit are

influenced by the auditor’s understanding of the entity’s operations, trends within its

industry and the effects of economic and political influences on the entity. The auditor

uses this knowledge to identify existing or potential accounting and auditing problems

and to develop an overall audit strategy and a detailed audit plan or program for the

conduct and scope of the audit.

The major topics covered in this chapter are acceptance and continuance of audit

clients, including evaluation of potential clients, communications with a previous

auditor, engagement letters and preliminary conferences with the client; audit

planning, including obtaining an understanding of the entity’s organisational

structure, its operations and its industry; assessing client business risk; developing an

overall audit strategy and a detailed audit plan or program; assigning and scheduling

audit staff; and using analytical procedures for identifying and investigating unusual

changes in account balances or transaction totals, for planning purposes.

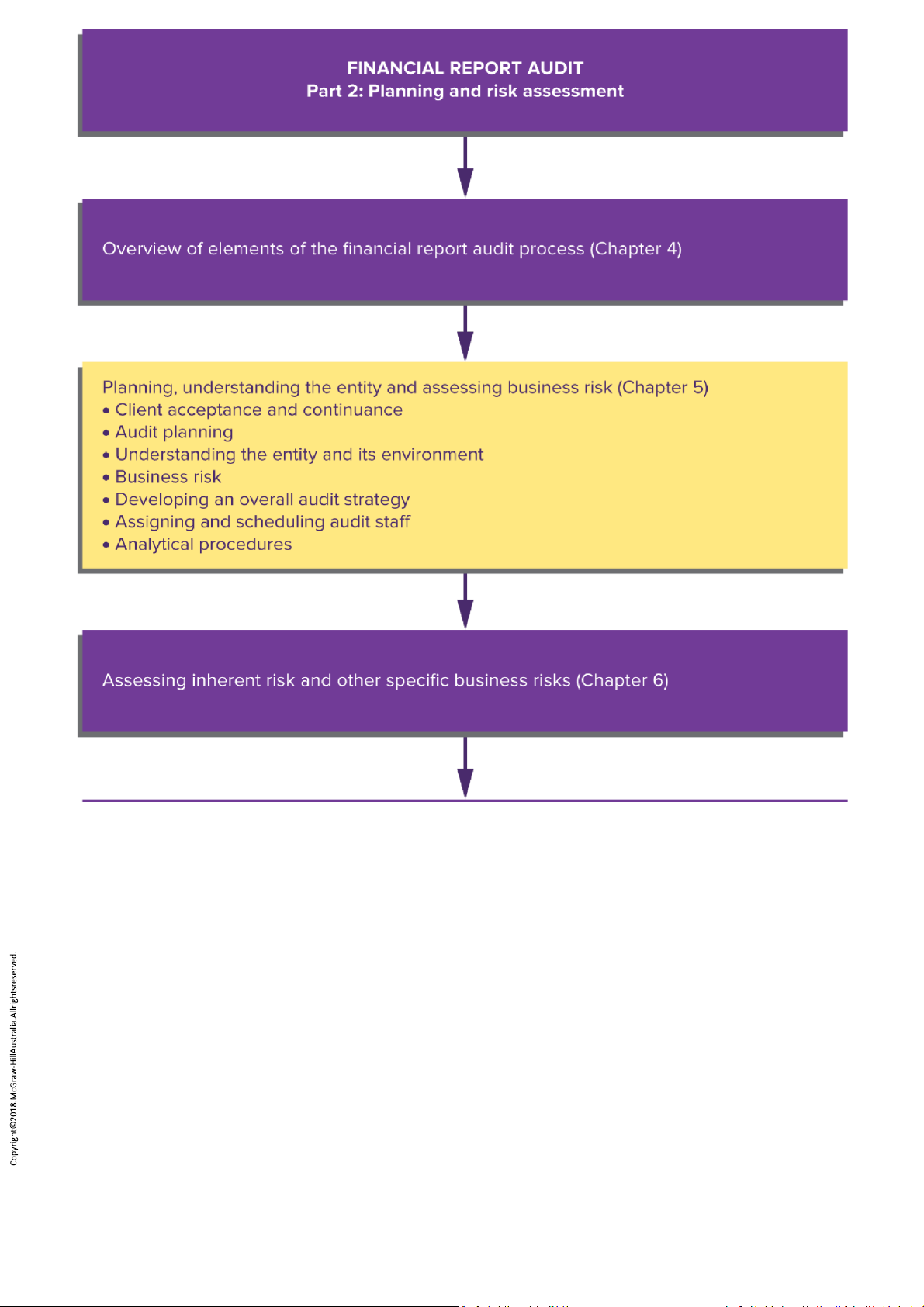

How this chapter fits into the overall financial report audit is illustrated in Figure 5.1

, which is an expansion of part of the overall flowchart provided in Chapter 1 . lOMoAR cPSD| 47206071 lOMoAR cPSD| 47206071

FIGURE 5.1 Flowchart of planning and risk-assessment stage of a financial report audit lOMoAR cPSD| 47206071 Page 187

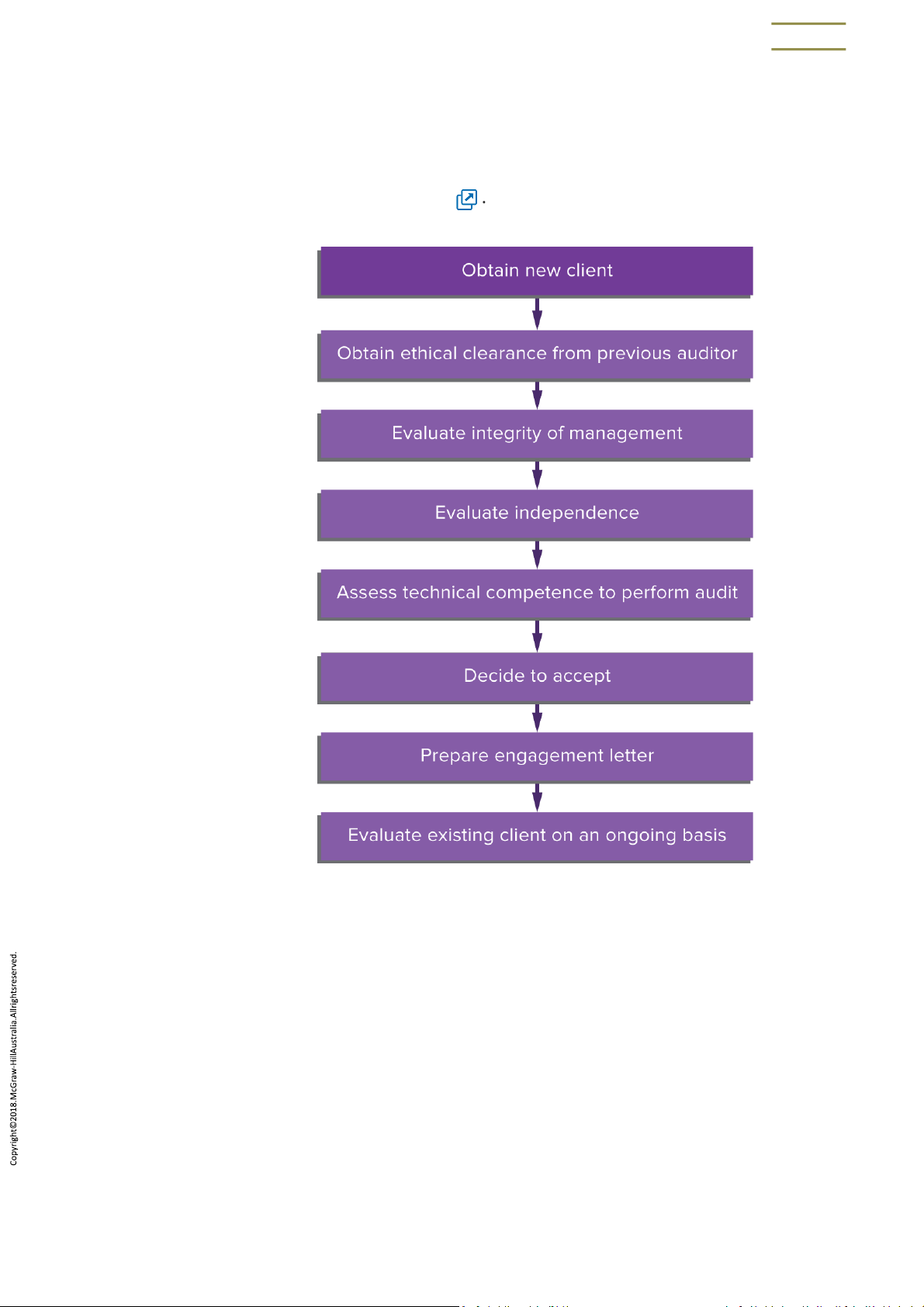

LO 5.1 Client acceptance and continuance

The auditor’s need to understand the client starts when considering acceptance of an

engagement and continues throughout association with the client. The steps in accepting an audit client are shown in Figure 5.2

FIGURE 5.2 Steps in accepting an audit Obtaining clients

Since the services of public accounting firms are of a highly personal nature and involve

individual character traits such as competence and integrity, the auditor’s services cannot

be offered in the same manner that commercial goods and services are sold. The most

effective way of obtaining recommendations is to render services of a high quality. lOMoAR cPSD| 47206071

APES 110 section 250.2 permits advertising provided that its content and nature is not

false, misleading or deceptive and does not otherwise reflect adversely on the profession.

As a result, an auditor should not:

make exaggerated claims for services offered, qualifications possessed or experience

gained make disparaging references or unsubstantiated comparisons to the work of

another falsely advertise or mislead potential clients.

Potential clients may be approached personally or through direct mailing to make known

the range of services that the audit firm offers. However, follow-up communications must

be terminated when requested by the recipient or this will be considered harassment,

which is unprofessional conduct.

An issue that has been around for a number of years, but continues to occur frequently in

practice and has caused some concern within the audit profession, is the calling by

companies for competitive tenders for audit appointments, and the active involvement

by audit firms in the tendering process. This issue is symptomatic of the increased

competition for audit work. While acknowledging the right of companies to choose their

auditors in order to obtain the most cost-efficient audit, there is a major danger for Page

188 the profession in the potential loss of credibility that could result from a real or

perceived loss of independence of the auditor, by being placed in a position where there

may be an unreasonable threat of dismissal as a result of the auditor’s actions. An

example is the practice of opinion shopping . This may occur where an audit is put out

to tender following the issue of a modified opinion by the previous auditor or where a

new issue arises that may involve consideration of the issuing of a modified opinion and

the client seeking the views of potential new auditors as to how they would interpret the

client’s action in terms of the application of a certain accounting practice. APES 110

section 230.2 indicates that when an auditor is requested by an entity to give an opinion

on an actual or hypothetical accounting issue, they should consider the potential effect

on the professional responsibilities of the auditor, the purpose of the request and the

intended use of any response. The auditor whose opinion is requested is also required to

communicate with the existing auditor and provide a copy of the opinion to them.

Tendering may also subject an auditor to undue pressure because of the cost of the audit

examination and the ability to conduct the necessary audit procedures and the impact of

low-balling (discussed in Chapter 3 ), where firms bid an unreasonably low fee to win

the tender. While it is likely that the practice of audit tendering will continue, audit firms

must recognise that the tender they submit needs to reflect the level of professional skill, lOMoAR cPSD| 47206071

knowledge and responsibility required for the audit work. Auditors and management

should also be aware of the increased audit risk and hidden costs associated with

changes of client as a result of the tendering process—for example, the loss of audit

continuity and the extensive knowledge of a client’s business and personnel by the audit

firm, which are beneficial to an effective audit process. On the other hand, the tendering

process appears to have led to some increases in audit efficiency as auditors have

implemented more efficient and effective audit techniques.

As indicated in Chapter 3 , audit tendering received recent support in the European

Commission Green Paper, which recommended mandatory rotation of audit firms

accompanied by mandatory tendering with full transparency with regard to the criteria

according to which the auditor will be appointed. The Green Paper recommended that

quality and independence should be key selection criteria in any tendering procedure.

Subsequent legislation has provided for the rotation period for audit firms for European

Union companies to be extended if a public tender is held after 10 years.

Quality control policies and client evaluation procedures

APES 320 section 38 and ASQC 1.26–28 (ISQC 1.26–28) require an audit firm, as part of its

quality control, to establish policies and procedures for investigating potential clients and

acceptance of an engagement and for periodically reviewing continuance of clients.

Policies and procedures for client acceptance and continuance are important because an

audit firm needs to take precautions to avoid association with a client whose management

lacks integrity. This will include consideration of the identity and business reputation of

the client’s principal owners, key management, related parties and those charged with its

governance, as well as the nature of the client’s operations, including its business

practices. As discussed in Chapter 3 , care should also be exercised to avoid situations

where the auditor–client relationship lacks independence and where there are other

impediments to undertaking the audit function, such as an inability to serve the client

properly owing to a lack of competence, time or resources. In addition, an auditor needs

to consider the effect of a client’s reputation on its image in the financial community, as

well as the increased risk of litigation, which was discussed in Chapter 2 .

ASA 220.12 (ISA 220.12) requires that the engagement partner be satisfied that

appropriate procedures have been followed regarding the acceptance and continuance of lOMoAR cPSD| 47206071

clients. Procedures that may be used to establish the appropriateness of accepting clients include:

obtaining and reviewing available financial information concerning the prospective

client, such as annual reports, interim financial reports and income tax returns making

enquiries of third parties, such as the client’s bankers, legal advisers or investment

banker, concerning the integrity of the prospective client and its management

communicating with the previous auditor

considering circumstances in which the engagement would require special attention or present unusual risks

evaluating the firm’s independence and ability to serve the client, including Page 189

technical skills, knowledge of the industry and personnel

determining that acceptance of the client would not violate the Code of Ethics for

Professional Accountants.

APES 320 section 43 and ASQC 1.A21 (ISQC 1.A21) indicate that when deciding whether

to continue a client relationship, the auditor needs to consider significant matters that

have arisen during the current or previous period and their implications for continuing

the relationship. Examples of significant matters include:

a major change in ownership, directors, management, legal advisers, financial condition,

litigation status, scope of the engagement and/or nature of the client’s business the

existence of conditions that would have caused the auditor to reject the client had such

conditions existed at the time of the initial acceptance.

Much of the information relevant to this process should be available to the auditor

through the records and working papers of the audit itself.

Communication with a previous auditor

Normally, an auditor who accepts a new client is replacing another auditor. Therefore,

when approached by a potential client, an auditor should enquire about the client’s

present arrangements for accounting and auditing work. If the previous financial report

has been audited, the ethical rules of the Australian accounting profession, which were

discussed in Chapter 3 , require that the prospective auditor has the opportunity to

ascertain whether there are any professional reasons why the appointment should not be accepted. lOMoAR cPSD| 47206071

APES 110 sections 210.13–14 require that, before accepting a nomination, an auditor

must: request the prospective client’s permission to communicate with the previous auditor

if permission is refused, carefully consider such refusal when determining

whether to accept the engagement, or

on receipt of permission, ask the previous auditor in writing for all information necessary

to enable a decision as to whether the nomination should be accepted.

The auditor should treat the reply from the previous auditor in the strictest confidence

and judge whether the factors precipitating the proposed change are unusual, or whether

they indicate that the previous auditor is being treated unfairly.

APES 110 section 210.12 points out that the previous auditor is bound by a duty of

confidentiality, as discussed in APES 110 section 140. Therefore, in the absence of the

client’s permission to do so, the previous auditor should not volunteer information about

the client’s affairs. However, where the previous auditor does provide information, APES

110 section 210.13 requires that it should be provided honestly and unambiguously.

APES 110 section 210.13 requires that if the proposed auditor is unable to communicate

with the previous auditor, the proposed auditor should try to obtain information about

possible threats by other means, such as enquiries of third parties or background

investigations on senior management and those charged with the governance of the prospective client.

As a result of this process of communication, the interests of three groups are protected:

An auditor does not accept an appointment in circumstances of which they are not fully aware.

Shareholders are fully informed of the circumstances in which the change is proposed.

The existing auditor cannot be easily removed or interfered with in the conscientious

exercise of their duty as an independent professional.

While enquiries of the previous auditor about matters that bear on acceptance of the

client are required prior to acceptance, the auditor may also make enquiries of the

previous auditor after acceptance. For example, the auditor needs to consider the

relationship of the financial report of the previous period to the financial report of the

current period on which the auditor will express an opinion. Page 190 lOMoAR cPSD| 47206071 Engagement letters

After accepting an appointment, ASA 210.9 (ISA 210.9) and APES 305.3.1 require the

auditor and the entity to agree on the terms of engagement. ASA 210.10–11 (ISA 210.10–

11) require that the agreed terms of the engagement shall be recorded in an engagement

letter or other suitable form of written agreement, unless law or regulation prescribes

in sufficient detail the terms of the audit engagement. The auditor should document the

arrangements made with the client and clarify any matters that may be misunderstood.

This should help protect the audit firm and ensure that the client fully understands the auditor’s position.

The form and content of the audit engagement letter vary for each client. It should

generally include reference to the following matters set out in ASA 210.10 (ISA 210.10):

the objective and scope of the financial report

audit the auditor’s responsibilities management’s responsibilities

the identification of the applicable financial reporting framework

the form and contents of any reports, and a statement indicating that there may be

circumstances in which the form and content may differ.

An example of an audit engagement letter is contained in Appendix 1 to ASA 210 (ISA

210). A sample of an audit engagement letter prepared on this basis is presented in

Exhibit 5.1 . The letter may need to be modified in accordance with the circumstances.

Other matters that could be included are: specification of the schedules to be prepared

by the client; arrangements concerning the involvement of other auditors, experts or

internal auditors; and the method and frequency of billing of fees. EXHIBIT 5.1

SAMPLE AUDITOR’S ENGAGEMENT LETTER lOMoAR cPSD| 47206071

Jan Smith & Associates Chartered Accountants 30 Banks St Newtown The Managing Director ABC Ltd 15 Queen Street Newtown Dear Mr Spencer Scope

You have requested that we audit the financial report of ABC Ltd as of and for the

year ending 30 June 20X5. We are pleased to confirm our acceptance and our

understanding of this engagement by means of this letter. Our audit will be

conducted pursuant to the Corporations Act 2001 with the objective of expressing an

opinion on the financial report.

Responsibilities of the auditor

We will conduct our audit in accordance with the Australian auditing standards.

These standards require that we comply with ethical requirements and plan and

perform the audit to obtain reasonable assurance about whether the financial

report is free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts

and disclosures in the financial report. The procedures selected depend on the

auditor’s judgment, including the assessment of the risks of material misstatement of

the financial report, whether due to fraud or error. An audit also includes evaluating

the appropriateness of accounting policies used and the reasonableness of

accounting estimates made by management, as well as evaluating the overall

presentation of the financial report.

Because of the inherent limitations of an audit, together with the inherent limitations

of internal control, there is an unavoidable risk that some material misstatements

may not be detected, even though the audit is properly planned and performed in

accordance with the Australian auditing standards.

In making our risk assessments, we consider internal control relevant to the Page 191

entity’s preparation of the financial report, in order to design audit lOMoAR cPSD| 47206071

procedures that are appropriate in the circumstances, but not for the purpose of

expressing an opinion on the effectiveness of the entity’s internal control.

However, we will communicate to you in writing concerning any significant deficiencies

in internal control relevant to the audit of the financial report that we identify during the audit.

Responsibilities of management

Our audit will be conducted on the basis that management and directors acknowledge

and understand that they have responsibility:

(a) for the preparation of the financial report that gives a true and fair view in

accordance with the Corporations Act 2001 and the Australian accounting standards

(b) for such internal control as management determines is necessary to enable the

preparation of the financial report that is free from material misstatement,

whether due to fraud or error (c) to provide us with: (i)

access to all information of which the directors and management are aware that

is relevant to the preparation of the financial report, such as records,

documentation and other matters (ii)

additional information that we may request from the directors and

management for the purpose of the audit (iii)

unrestricted access to persons within the entity from whom we determine it

necessary to obtain audit evidence.

As part of our audit process, we will request from management and, where

appropriate, directors written confirmation concerning representations made to us in connection with the audit.

Other matters under the Corporations Act 2001 Independence

We confirm that, to the best of our knowledge and belief, we currently meet the

independence requirements of the Corporations Act 2001 in relation to the audit of

the financial report. In conducting our audit of the financial report, should we become

aware that we have contravened the independence requirements of the Corporations

Act 2001, we shall notify you on a timely basis. As part of our audit process, we shall

also provide you with a written independence declaration as required by the Corporations Act 2001. lOMoAR cPSD| 47206071

The Corporations Act 2001 includes specific restrictions on the employment

relationships that can exist between the audited entity and its auditors. To assist us

in meeting the independence requirements of the Corporations Act 2001, and to

the extent permitted by law and regulation, we request you discuss with us:

the provision of services offered to you by Jan Smith & Associates prior to

engaging or accepting the service

the prospective employment opportunities of any current or former partner or

professional employee of Jan Smith & Associates prior to the commencement of

formal employment discussions with the current or former partner or professional employee.

Annual general meetings

The Corporations Act 2001 provides that shareholders can submit written

questions to the auditor before an annual general meeting, provided that they

relate to the auditor’s report or the conduct of the audit. To assist us in meeting

this requirement in the Corporations Act 2001 relating to annual general meetings,

we request that you provide to us written questions submitted to you by

shareholders as soon as practicable after the question(s) has been received and no

later than five business days before the annual general meeting, regardless of

whether you believe the questions(s) to be irrelevant.

Presentation of audited financial report on the internet

It is our understanding that the entity intends to publish a hard copy of the

audited financial report and auditor’s report for members, and to electronically

present the audited financial report and auditor’s report on its internet website.

When information is presented electronically on a website, the security and

Page 192 controls over information on the website should be addressed by the

entity to maintain the integrity of the data presented. The examination of the

controls over the electronic presentation of audited financial information on the

entity’s website is beyond the scope of the audit of the financial report.

Responsibility for the electronic presentation of the financial report on the entity’s

website is that of the governing body of the entity. Fees

We look forward to full cooperation with your staff and we trust that they will

make available to us whatever records, documentation and other information we

request in connection with our audit. Our fees, which will be billed as work

progresses, are based on the time required by the individuals assigned to the

engagement, plus outof-pocket expenses. Individual hourly rates vary according to

the degree of responsibility involved and the experience and skill required. lOMoAR cPSD| 47206071 Reporting

We will issue an auditor’s report expressing our opinion on the financial report of

ABC Ltd in accordance with the Australian auditing standards. The form and content

of our report may need to be amended in the light of our audit findings.

Please sign and return the attached copy of this letter to indicate that it is in

accordance with your understanding of the arrangements for our audit of the

financial report, including our respective responsibilities. Yours faithfully Jan Smith Partner 15 September 20X5

Acknowledged on behalf of ABC Ltd by Jim Spencer Managing Director 30 September 20X5

On recurring audits, ASA 210.13 (ISA 210.13) requires the auditor to assess whether

circumstances require the terms of the engagement to be revised and whether it is

necessary to remind the entity of the existing terms of the audit engagement.

Conferences with the client’s personnel

Soon after acceptance of an engagement, the auditor should meet with key client

personnel, including the principal administrative, financial and operating officers, the chief

internal auditor, and the IT (information technology) manager, to discuss matters expected

to have a significant effect on the financial report or on the conduct of the audit.

Good relations with client personnel are important. An audit usually causes considerable

inconvenience and disruption to some personnel, and their assistance is often needed to

obtain documents, records and explanations of various matters. Effective early

conferences establish a foundation for a good working relationship with all client personnel.

Effective communications with top management are particularly important. The auditor

should have an opportunity to consider the accounting implications of important planned

transactions, such as merger negotiations or lease or purchase decisions. The chief lOMoAR cPSD| 47206071

executive officer should be informed on a regular basis of new accounting and disclosure

requirements that may affect company plans. A good working relationship throughout

the engagement helps to avoid a crisis conference at year end over a potential

modification of the auditor’s report. Page 193 Initial engagements

ASA 510.6 (ISA 510.6) requires that for initial audit engagements, the auditor obtains

sufficient appropriate audit evidence that:

the opening balances do not contain material misstatements affecting the current period’s financial report

the previous period’s closing balances have been correctly brought forward to the

current period, or have been restated when appropriate

appropriate accounting policies are consistently applied or changes have been properly

accounted for and adequately disclosed.

In addition, the auditor needs to consider the impact of the opening balances on the

appropriateness of the comparative figures disclosed in the financial report in accordance

with ASA 710 (ISA 710), which will be discussed in Chapter 12 .

Obtaining sufficient appropriate audit evidence about opening balances could be

facilitated by reviewing the audit working papers of the previous auditor. However, ASA

510.A4 (ISA 510.A4) points out that in these circumstances the auditor also needs to

consider the independence and professional competence of the previous auditor.

The previous auditor is not obliged to provide information and advice to enable the

current auditor to substantiate the existence and value of assets and liabilities as at the

end of the previous financial year. However, the previous auditor may do so as a

professional courtesy, with the knowledge and consent of the client. The audit working

papers of the previous auditor are their property and they have no obligation to make

available any information contained therein.

Where the working papers of the previous audit are not available, the auditor applies

other audit procedures in order to form an opinion about the opening balances,

accounting policies and comparative figures. These could include: lOMoAR cPSD| 47206071

further consultation with management

review of the records and working papers of the client and the accounting and internal

control activities that relate to the previous period

analysis of the audit work of the current period to the extent that it relates to the

opening balances review of the minutes of the board of directors and other important

committees review of policy manuals.

If the previous financial report was not audited, the first examination needs to be even more extensive.

ASA 510.10–12 (ISA 510.10–12) state that the auditor needs to modify the auditor’s

report in the following situations:

the auditor is unable to obtain sufficient appropriate audit evidence concerning opening balances

the opening balances contain misstatements that materially affect the current period’s

financial report and these are not properly accounted for and adequately disclosed the

current period’s accounting policies have not been consistently applied in relation to

opening balances and the change has not been properly accounted for and adequately disclosed. QUICK REVIEW

Important steps in relation to accepting and continuing an audit engagement are as follows.

1. Obtain ethical clearance from previous auditor.

2. Evaluate management’s integrity, unusual risks and the auditor’s independence,

skills and competence to complete the audit.

3. Once the auditor has decided to accept or continue an engagement, issue an

engagement letter to confirm the terms of the engagement.

4. Arrange a conference with key client personnel soon after accepting the engagement.

5. For initial audit engagements, the auditor needs to consider whether they will

be able to obtain sufficient appropriate audit evidence for opening balances. Page 194 lOMoAR cPSD| 47206071

LO 5.2 Audit planning

The conduct of an efficient and effective audit requires adequate planning . ASA 300.2

(ISA 300.2) indicates that adequate planning benefits the audit by assisting the auditor to:

devote appropriate attention to important areas of the audit

identify and resolve potential problems on a timely basis

properly organise and manage the audit engagement so that it is performed effectively and efficiently

select engagement team members with appropriate levels of capabilities and

competence to respond to anticipated risks, and properly assign work to them direct

and supervise engagement team members and review their work coordinate work to

be done by auditors of components and experts.

ASA 300.5 (ISA 300.5) requires that the engagement partner and other key members of

the audit team be involved in planning the audit. This enables the audit to be performed in an effective manner. The nature of audit planning

The concept of adequate planning involves obtaining an understanding of the entity’s

business operations and risks, and developing an overall audit strategy and a detailed a

udit plan or audit program . ASA 300.7 (ISA 300.7) requires the auditor to establish an

overall audit strategy that sets the scope, direction and timing of the audit and guides the

more detailed audit plan. ASA 300.9 (ISA 300.9) requires the auditor to develop an audit

plan that sets out the nature, timing and extent of risk-assessment procedures and audit

procedures at the assertion level and any other audit procedures necessary to meet the

Australian auditing standards. In practice, audit plans are often referred to as audit

programs. The audit strategy and the audit plan or audit program often need to be

revised due to changes in conditions or the unexpected results of audit procedures. The

reasons for such changes need to be documented in the audit working papers. The

contents of the audit strategy and the audit plan or audit program will be discussed in

more detail later in this chapter.

The audit strategy helps to ensure that important and potential risk areas of the audit are

given appropriate attention, and that problems are identified and dealt with. Adequate

planning also helps to make the audit efficient and effective, by allocating the appropriate lOMoAR cPSD| 47206071

quality and quantity of audit staff to the engagement and coordinating resources and

work done by other auditors or experts.

The extent of planning for an engagement depends on the size and complexity of the

entity and whether the auditor has had previous experience with the entity. The

responsibility for the overall audit strategy is the auditor’s. However, discussion of

elements of the strategy and proposed audit procedures with the entity’s management

and staff enables the auditor to coordinate the work of the entity’s staff and the auditor’s staff.

As indicated in ASA 315.18 (ISA 315.18), in planning the audit the auditor also needs to

obtain an understanding of the methods the entity uses to process accounting

information, because such methods influence the design of the accounting system and the

nature of control activities. The extent to which the computer is used in significant

accounting applications, as well as the complexity of that processing, also influences the

nature, timing and extent of audit procedures.

Because most audit clients have accounting systems with both manual and IT portions, all

auditors need to be proficient at understanding the accounting system and internal

control (both manual and IT) and plan the audit to address both portions of the

accounting systems. As explained in Chapter 4 , computer audit specialists may still be

used, but the determination of the need for their skills and the evaluation of their results

and conclusions are the responsibility of the auditor who issues the opinion on the financial report. Overall timing of engagement

The timing of the audit can be viewed as comprising three stages: planning, interim and

final. Interim work is done before the date of the financial report, while final work is

done at or after that date. The three phases of the audit—planning, interim and final—

are normally related to the major steps in the audit in defined ways. Obtaining an

understanding of the entity and its environment and assessing inherent risk is part Page

195 of planning. The study and evaluation of internal control and assessment of control

risk span both the planning and interim phases. The review of the accounting system is a necessary part of planning. lOMoAR cPSD| 47206071

As will be discussed in Chapter 8 , tests of controls may be undertaken on an interim

basis or, where controls have not changed, testing from previous periods may be used.

However, the auditor must obtain evidence concerning the continuity of the controls. As

will be discussed in Chapter 9 , tests of transactions undertaken for substantive

purposes may be either interim or final work. In an extreme case, a small entity with few

controls and a relatively small volume of transactions might permit all audit tests to be

undertaken as final work with no tests of controls, although the auditor would still need

to understand internal control.

Interim work permits the audit firm to allocate its staff efficiently among clients, and

enables the auditor to identify potential accounting or auditing problems early so that

they can be resolved with the client on a timely basis. In addition, reporting deadlines

may not allow the auditor to perform extensive audit procedures after the balance date.

Some substantive tests can conveniently be performed at or near the balance date and

there is no particular advantage to doing them on an interim basis. For example, counts of

assets such as cash and marketable securities are usually performed at or near the

balance date. Similarly, the auditor is concerned with obtaining evidence that transactions

are recorded in the proper accounting period. These so-called cut-off tests must be

performed around the balance date.

Other substantive tests are done as close to the completion of the engagement as

possible, because they depend on evidence collected in the earlier steps in the audit.

These so-called completion and review procedures are always done as final work. Exhibit

5.2 shows the overall timing of an audit engagement, indicating the approximate date

when certain typical procedures might be performed. However, there is substantial

variation in practice on the timing of audit tests and the time between the date of the

financial report and the delivery of the auditor’s report.

EXAMPLE OF THE OVERALL TIMING OF AN AUDIT EXHIBIT 5.2 ENGAGEMENT