Preview text:

lOMoARcPSD| 50205883

FIN2001 - FINANCIAL MARKETS AND INSTITUTIONS 1 lOMoARcPSD| 50205883 Chapter 6 COMMERCIAL BANKS 2 lOMoARcPSD| 50205883 Content

Definition of commercial banks and their functions The

most common sources of funds for commercial banks The

most common uses of funds for commercial banks Typical

off-balance sheet activities for commercial banks Discuss the

system of commercial banks in Vietnam lOMoARcPSD| 50205883 Reading

Chapter 1 – Commercial Bank Management (4th Edition)

– Peter S. Rose, 1999 Chapter 17 – Commercial Bank

Operations (11th Edition) – Madura, 2015 commercial banks 6.1.1. Definitions

• Commercial banks are among the most important financial institutions in the economy. lOMoARcPSD| 50205883

6.1 Definitions and functions of

• Banks can be identified by the functions (services or roles) they perform in the economy.

• Like other businesses, banks are profit-maximizing firms. Banks

are those financial institutions that offer the widest range of

financial services – especially credit, savings, and payments

services – and perform the widest range of financial functions of

any business firm in the economy. commercial banks 6.1.2. Functions

Thrift or saving function – Taking the surplus funds as deposits from

individuals and institutions in the economy lOMoARcPSD| 50205883

6.1 Definitions and functions of

Credit function – Providing principal source of credit for households, for

most local units of government and for businesses

Payments function – Carrying out payments for goods and services on behalf of their customers

Cash management function– Handle cash collections and disbursements for

a business firm and to invest any temporary cash surpluses in interestbearing

assets until cash is needed to pay bills.

Insurance function – Selling insurance and providing financial advice to

their customers. For example, banks sell credit life insurance to their

customers receiving loans, guaranteeing repayment if borrowers die or become disabled. 6 lOMoARcPSD| 50205883

6.1 Definitions and functions of commercial banks

6.1.2. Functions (Cont.)

Brokerage function – Offering their customers the opportunity to buy

individual stocks, bonds, and other securities without having to go to a security dealer.

The guarantor function – Standing behind their customers to pay off

customer debts when those customers are unable to pay (such as by issuing L/C)

Investment banking – Identifying possible merger targets, financing

acquisitions of other companies, dealing in a customer’s securities (i.e,

new security underwriting), providing strategic marketing advice, and lOMoARcPSD| 50205883

6.1 Definitions and functions of

offering hedging services to protect their customers against risk from

fluctuating world currency prices and changing interest rates. 8 lOMoARcPSD| 50205883

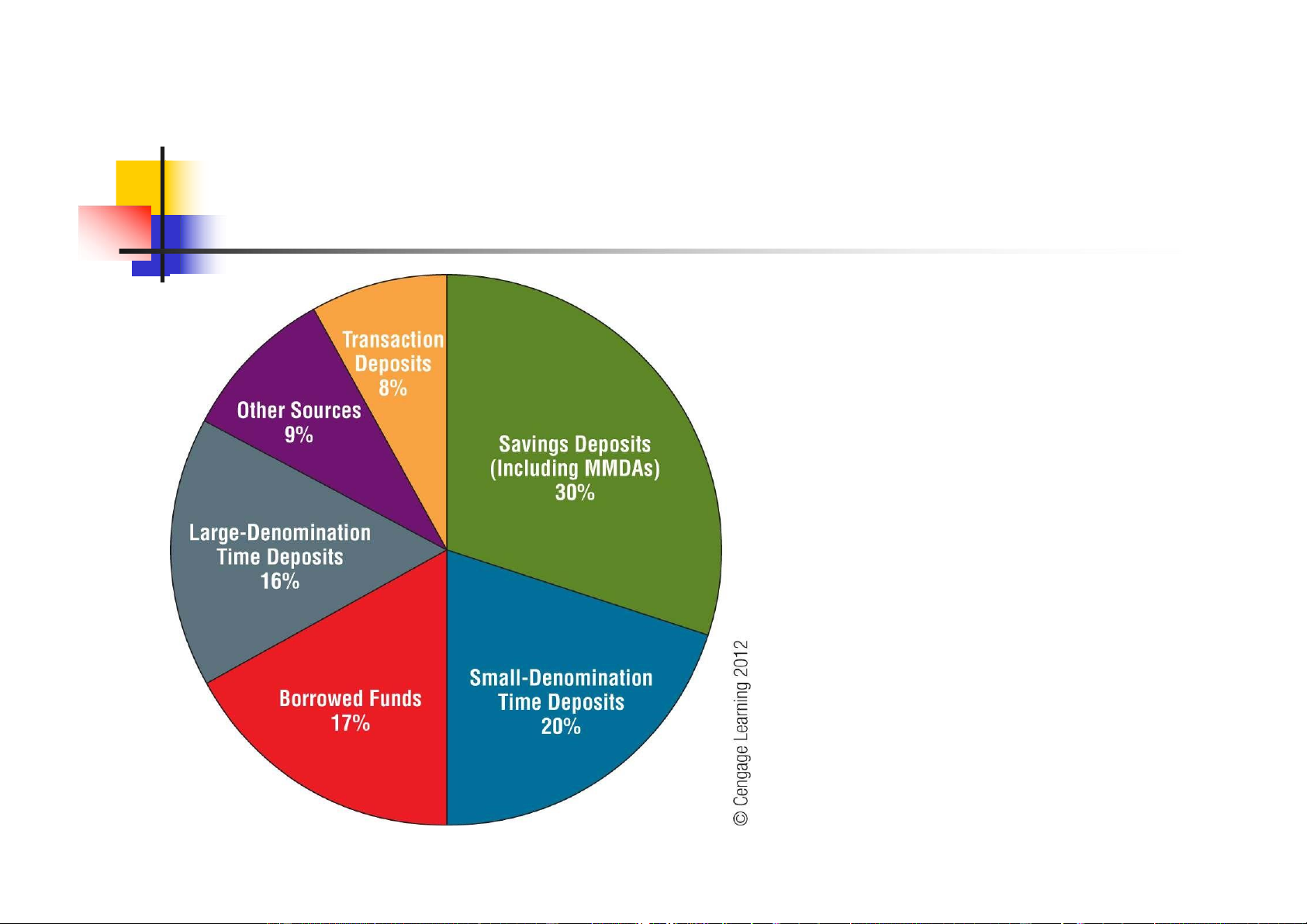

6.2. Bank sources of funds Deposit Accounts - Transaction deposits - Saving deposits

- Time deposits Borrowed Funds

- Interbank funds purchased (borrowed)

- Borrowing from the Central Bank

- Repurchase agreements Long-Term Sources of

Funds - Bonds issued by the bank - Bank capital 9 lOMoARcPSD| 50205883

6.2. Bank sources of funds 6.2.1. Deposit accounts

Transaction deposits

Demand deposit account (Checking account)

- Offered to customers who desire to write checks against their account

- Require small minimum balance and pays no interest

Savings deposits Passbook savings account

- Does not permit check writing

- Have no required minimum balance 10 lOMoARcPSD| 50205883

6.2. Bank sources of funds 6.2.1. Deposit accounts

Time deposits cannot be withdrawn until a specified maturity date.

Certificates of Deposit (retail CD) -

Require a specified minimum amount of funds to be deposited for a specified period of time -

The interest rate and maturity types vary among banks -

No secondary market for retail CDs -

Cannot withdraw until the specified maturity or forgo a portion of the interest as a penalty -

Recently, callable CDs are issued. They can be called by the FI, forcing an earlier maturity. 11 lOMoARcPSD| 50205883

6.2. Bank sources of funds

Negotiable Certificates of Deposit -

Similar to retail CDs (have a specified maturity date and require a minimum deposit) -

Typically, short term, available secondary market. 6.2.2. Borrowed Funds

Interbank Funds Purchased (or borrowed)

The interbank lending market allows depository institutions to

accommodate the short-term liquidity needs of other financial institutions.

Represent a liability to the borrowing bank and an asset to the lending bank 12 lOMoARcPSD| 50205883

6.2. Bank sources of funds

Interbank loans are typically for maturity of one to seven days and can be rolled over.

Used to correct short-term fund imbalances

The interest rate charged is called the interbank rate. It is adjusted

by the changes in demand or supply or both, and increase

according to the increase of the bank’s default risk. 6.2.2. Borrowed Funds

Borrowing from the Central Banks

The short-term loans provided by the Central Bank to commercial banks,

referred to as borrowing at the discount window. 13 lOMoARcPSD| 50205883

6.2. Bank sources of funds

The interest rate charged on these loans is known as the primary credit lending rate.

Loans from the Central Bank are short term, commonly from one day to a few weeks.

Banks must first obtain the Central Bank’s approval.

Loans are mainly used to resolve a temporary shortage of funds

(unanticipated shortages of reserves)

The Central Bank may veto (refuse) continuous borrowing by a bank unless

there are extenuating circumstances that prevent the bank from obtaining

temporary financing from other financial intermediaries. 6.2.2. Borrowed Funds 14 lOMoARcPSD| 50205883

6.2. Bank sources of funds

Repurchase Agreements (Repo)

A repo represents the sale of securities by one party to another with an

agreement to repurchase the securities at a specified date and price.

Banks often use a repo as source of funds when they expect the need funds for just a few days.

Banks simply sell some of its government securities to a corporation with

a temporary excess of funds and buy those securities back shortly

thereafter. The securities serve as collateral in the repo transaction.

Repurchase agreement transactions occur through a telecommunications

network connecting large banks, other corporations, government securities

dealers, and brokers. The yield on repurchase agreements is slightly less

than the interbank rate at any given time. 15 lOMoARcPSD| 50205883

6.2. Bank sources of funds

6.2.3. Long-term Sources of Funds

Bonds issued by the bank

Banks own some fixed assets such as land, buildings, and

equipment. These assets often have an expected life of 20 years

or more and are usually financed with such long-term sources as the issuance of bonds.

Common purchasers of these bonds are households and various

financial intermediaries, including life insurance companies and pension funds. 16 lOMoARcPSD| 50205883

6.2. Bank sources of funds

6.2.3. Long-term Sources of Funds Bank capital

Represent funds acquired by the issuance of stock or the retention of earnings.

The bank has no obligation to pay out funds in the future.

A bank’s capital must be sufficient to absorb operating losses in the

event that expenses or losses exceed revenues.

Bank regulators are concerned that banks might maintain a lower

level of capital than they should and have therefore imposed capital

requirements on them such as Capital Adequacy Ratio 17 lOMoARcPSD| 50205883

6.2. Bank sources of funds

(CAR), minimum legal capital… 18 lOMoARcPSD| 50205883

6.2. Bank sources of funds

Distribution of Bank Sources of Funds The distribution bank sources of funds isinfluenced bybank size. Smaller banks rely more heavilyon saving deposits than do larger banks. Largerbanks rely more on short-term borrowings than do smaller banks. 19 lOMoARcPSD| 50205883

6.3. Uses of Funds by Banks of Source: Federal Reserve

6.3. Uses of Funds by Banks Cash Bank loans Investment in securities

Interbank funds sold (loaned out) Repurchase agreements 20