Preview text:

lOMoARcPSD| 50205883

FIN2001 - FINANCIAL MARKETS AND INSTITUTIONS 1 lOMoARcPSD| 50205883 Chapter 7 NONBANK OPERATIONS 2 lOMoARcPSD| 50205883 Reading

Chapter 16,17,18,19, Financial Institutions, Markets & Money;

David S. Kidwell, David W. Blackwell, David A. Whidbee,

Richard W. Sias; John Wiley & Sons (2012).

Chapter 21,22,23,25, Financial Markets and Institutions; Jeff

Madura; South-Western Cengage Learning (2010).

Chapter 20,21,22,25,26, Financial Markets and Institutions;

Federic S. Mishkin, Stanley G. Eakins; Pearson (2012). 3 lOMoARcPSD| 50205883 Content

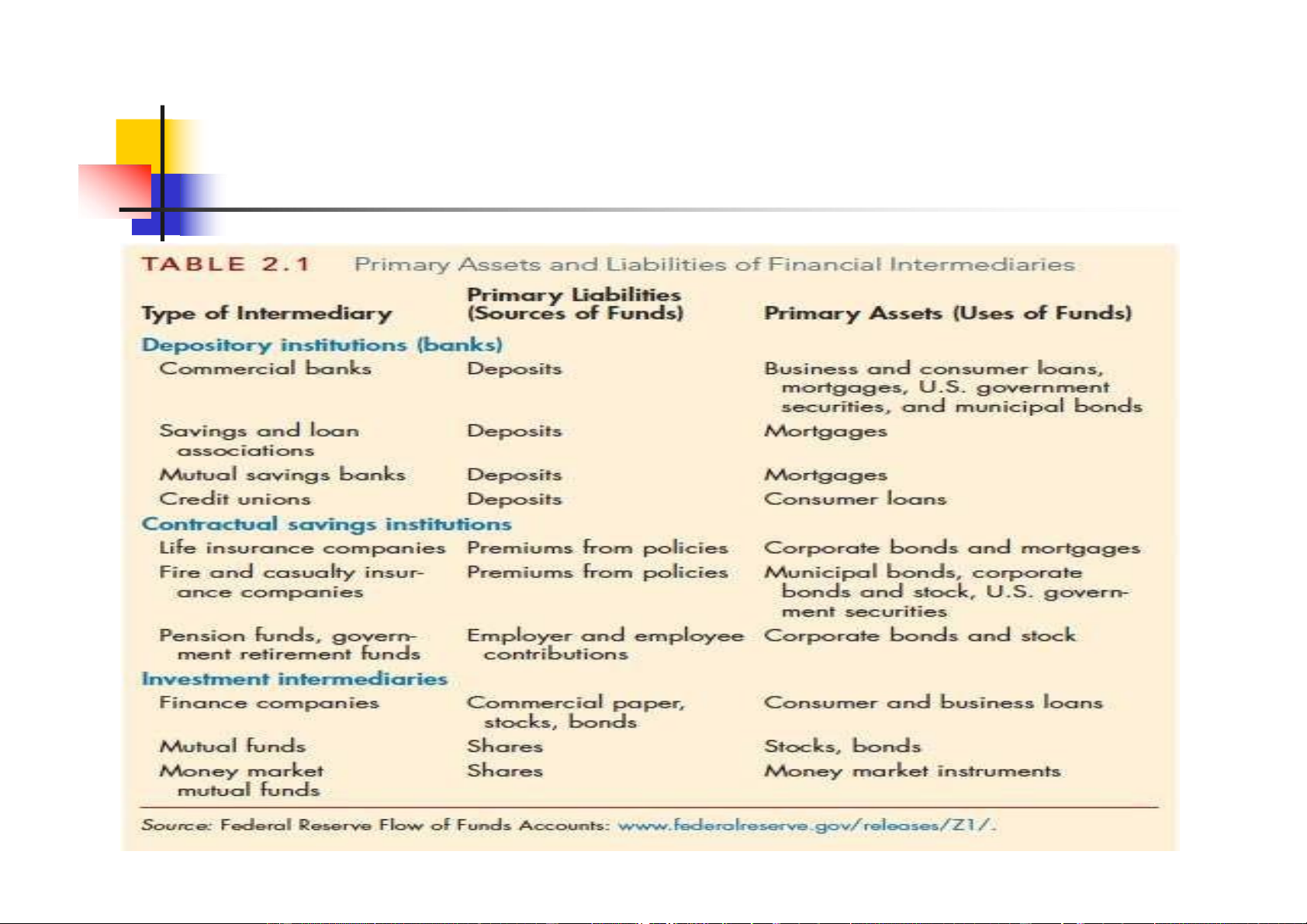

Finance Companies Insurance Companies Pension Funds

Mutual Funds Securities Firms 7.1. Introduction

A part of financial intermediary institutions

• Raise capital by issuing financial tools • Invest in financial tools

Not commercial banks Include: 4 lOMoARcPSD| 50205883

• Contractual Savings Institutions: Insurance Companies, Pension Funds

• Investment Intermediaries: Finance Companies, Mutual Funds, Securities Firms 5 lOMoARcPSD| 50205883 7.1. Introduction 6 lOMoARcPSD| 50205883

7.2. Contractual Savings Institutions

Receive investment funds (premiums fees charged on financial

services) from their customers

Pay insurance benefits and insurance claims for their customers

Place their money in a variety of money-earning investments

including commercial mortgage loans, stock and bond investments.

Thus, these institutions are financial intermediaries in that they take

in funds from one sector and invest it in another.

Contractual Savings Institutions includes: • Insurance Companies • Pension Funds 7 lOMoARcPSD| 50205883

7.2. Contractual Savings Institutions

7.2.1. Insurance Companies

Provide various forms of insurance and investment services to individuals

and charge a fee (premium) for this financial service under specified

conditions based on a contract.

An individual’s decision to purchase insurance may be influenced by the

likelihood of the conditions that would result in receiving an insurance payment.

The performance of insurance companies is partially dependent on the

return on the invested funds. Investment decisions must balance the goals

of return, liquidity and risk Insurance companies includes: • Life insurance companies 8 lOMoARcPSD| 50205883

• Property and Casualty Insurance

7.2. Contractual Savings Institutions

7.2.1.1. Life Insurance Companies

Life insurers offer a wide variety of financial services products are

designed to protect insurees and/or their dependents against the

economic risk of premature death, poor health, and living too long.

Life insurance products includes: Term life Whole life 9 lOMoARcPSD| 50205883

7.2. Contractual Savings Institutions

7.2.1.1. Life Insurance Companies Sources of funds: • Premiums

• Provision of annuity plans

• Capital: built by retaining earning and issuing new stock. • Investment income

Insurance companies maintain an adequate capital level not only to

cushion potential losses, but also to reassure their customers 10 lOMoARcPSD| 50205883

7.2. Contractual Savings Institutions

7.2.1.1. Life Insurance Companies

Uses of funds: Because life insurance liabilities are very predictable, these

insurers are able to invest in long-term assets. • Government securities

• Corporate securities: life insurance companies usually hold a mix of

medium- and long-term corporate bonds for cash management and liquidity needs.

• Real estate: insurance companies sometime purchases real estate and

lease it for commercial purposes.

• Mortgages: all types of mortgage including one to four family,

multifamily, commercial, and farm related. 11 lOMoARcPSD| 50205883

• Policy loans: life insurance companies lend a small protion of their

funds to whole life policyholders (called policy loans).

7.2. Contractual Savings Institutions Companies

7.2.1.2. Property and casualty insurance

Protects against fire, theft, liability, and other events that result in

economic and noneconomic damage.

Property insurance: buildings, automobiles, othe assets.

Casualty insurance: potential liabilites for harm to others (products failure of accidents)

Premium reflects the probability of a payout to the insured and the

potential magnitude of the payout. 12 lOMoARcPSD| 50205883

Property and casualty insurance usually has a much shorter term than most life insurance.

7.2. Contractual Savings Institutions Companies

7.2.1.2. Property and casualty insurance Sources of funds: • Premiums • Investment income

Uses of funds: Property and casualty insurance companies must

keep their assets more liquid to pay out on unexpected losses.

• Short-term assets (like T-bills) 13 lOMoARcPSD| 50205883

• Investment-grade bonds such as treasury bonds, municipal

bonds, high-grade corporate bonds.

7.2. Contractual Savings Institutions 7.2.2. Pension Funds

Provide a savings plan for employees that can be used for retirement.

A pension plan is an asset pool that accumulates over an

individual’s working years and is paid out during the nonworking years. 14 lOMoARcPSD| 50205883

Pensions are used to protect against the risk of superannuation,

which can be defined as outliving your ability to earn a living to support yourself.

7.2. Contractual Savings Institutions 7.2.2. Pension Funds Types of pensions:

• Defined-contribution plans: provide benefits that are determined by

the accumulated contributions and the fund’s investment performance.

• Defined-benefit plans: constributions are dictated by the benefits that will eventually be provided

- Private pension funds: Are created by private agencies, including

industrial, labor, service, nonprofit, charitable, and educational organizations. 15 lOMoARcPSD| 50205883

- Public pension funds: are managed by the government (currently

Social Security, which is a pay-as-you-go system. Current retirees

receive payments from current workers.)

7.2. Contractual Savings Institutions 7.2.2. Pension Funds

Private pension funds:

• Sources of funds: premiums from the employers and employees, investment income. • Uses of funds:

-Pay retirement benefits for retirees.

-Invest in stocks, bonds, and various types of loan

packages such as mortgage-backed securities. 16 lOMoARcPSD| 50205883

7.2. Contractual Savings Institutions 7.2.2. Pension Funds

Public pension funds:

• Sources of funds: premiums from the employers and employees, investment income. • Uses of funds:

-Pay retirement benefits for retirees.

-Invest in government securities, financial instruments

issued by government-owned commercial banks… 17 lOMoARcPSD| 50205883

7.3. Investment Intermediaries

Investment Intermediaries includes: • Finance Companies • Mutual Funds • Securities Firms 18 lOMoARcPSD| 50205883

7.3. Investment Intermediaries 7.3.1. Finance Companies

Finance companies specilize on providing short- and

intermediate-term credit to consumers and small businesses.

Types of finance companies

• Captive finance subsidiaries

• Consumer finance companies

• Business finance companies 19 lOMoARcPSD| 50205883

7.3. Investment Intermediaries 7.3.1. Finance Companies

Types of finance companies:

• Captive finance subsidiaries (CFS): is a wholly owned

subsidiary whose primary purpose is to finance sales of the parent

company’s products and services, provide wholesale financing to

distributiors of the parent’s company products, and purchase

receivables of the parent’s company.

• Consumer finance companies: provide financing for customers

of retail stores or whole salers.

• Business finance companies: offer loans to small businesses. 20