Preview text:

TRƯỜNG ĐẠI HỌC NGÂN HÀNG THÀNH PHỐ HỒ CHÍ MINH INTERNATIONAL

FOREIGN DIRECT INVESTMENT OF VIETNAM Group 7 Lecturer's name C lass Nguyê n Thị Hông Vinh DH38DD01 TABLE OF CONTENTS LIST OF MEMBERS 3 LIST OF FIGURES 4 INTRODUCTION 1

CHAPTER 1. OVERVIEW OF FOREIGN DIRECT INVESTMENT (FDI) 1

1.1 CONCEPT OF FOREIGN DIRECT INVESTMENT 1

1.2 CHARACTERISTICS OF FOREIGN DIRECT INVESTMENT (FDI) 2

1.3. THE ROLE OF FOREIGN DIRECT INVESTMENT (FDI) 2

1.3.1. THE ROLE OF FDI FOR COUNTRIES EXPORTING INVESTMENT CAPITAL 2

1.3.2. THE ROLE OF FDI FOR COUNTRIES RECEIVING INVESTMENT CAPITAL3

1.3.3. THE ROLE OF FDI FOR THE VIETNAMESE MARKET 3

1.4. FORMS OF FOREIGN INVESTMENT 4

1.4.1. ACCORDING TO THE INVESTOR'S PURPOSE 4 1.4.2. EQUITY-BASED 4

1.4.3. ACCORDING TO THE FORM AND INVESTMENT PROCESS 4

CHAPTER 2: VIETNAM'S FOREIGN DIRECT INVESTMENT SITUATION 5

2.1. STATE PERSPECTIVE ON FOREIGN DIRECT INVESTMENT IN VIETNAM. 5

2.2. FOREIGN DIRECT INVESTMENT LEGAL SYSTEM IN VIETNAM 5

2.3. FOREIGN DIRECT INVESTMENT ACTIVITIES IN VIETNAM 6

2.4.IMPACT OF FOREIGN INVESTMENT ON THE ECONOMY. 8

2.5. VIETNAM'S DIRECT INVESTMENT ACTIVITIES ABROAD 10

2.5.1. CURRENT STATUS OF VIETNAM'S DIRECT INVESTMENT ACTIVITIES ABROAD 10

2.5.2. SOME LESSONS LEARNED FROM THE SITUATION OF VIETNAM'S

DIRECT INVESTMENT ACTIVITIES ABROAD 13 1

CHAPTER 3: MEASURES TO IMPROVE THE EFFECTIVENESS OF

VIETNAM'S FOREIGN DIRECT INVESTMENT ACTIVITIES 14 IN CONCLUSION 16 REFERENCES 17 2 LIST OF MEMBERS Name Student ID Mission Contributed Research the topic and learn about the concept of investment and investment Đặng Bảo An 120604220034 activities. 100% Create a quiz for everyone to participate. Phan Việt Hà

120604220043 Research on vietnam's foreign direct investment situation. 100% Research on overview of Huỳnh Thị Thanh Hằng 120604220007 foreign direct investment 100% (FDI) Research on Vietnam's direct investment activities abroad. Đoàn Thị Nhật Vy

120604220031 Propose solutions to at ract 100% more effective FDI 3

LIST OF FIGURES

FIGURE 1: FOREIGN INVESTMENT FIELDS IN 2023 (SOURCE: MINISTRY OF

PLANNING AND INVESTMENT) 7

FIGURE 2: TOP 10 LOCALITIES ATTRACTING THE MOST FDI CAPITAL IN

2023 (SOURCE: SENVANGDATA.COM ) 7

FIGURE 3: FOREIGN INVESTMENT IN 2023 BY PARTNER ( SOURCE:

GENERAL STATISTICS OFFICE) 8

FIGURE 4: TOTAL REALIZED INVESTMENT CAPITAL OF THE WHOLE

SOCIETY AT CURRENT PRICES IN 2019-2023 (SOURCE: GENERAL STATISTICS OFFICE) 9

FIGURE 5: VIETNAM'S FOREIGN DIRECT INVESTMENT (FDI) ACTIVITIES

RECORDED STRONG DEVELOPMENT WITH TOTAL INVESTMENT CAPITAL

IN THE FIRST 11 MONTHS OF 2019. 11

FIGURE 6: VIETNAM'S FOREIGN INVESTMENT STRUCTURE BY COUNTRY (2024) 12 4 INTRODUCTI INTRODU ON

The world is standing on the threshold of globalization, promising many changes. The

increasingly widespread influence of multinational corporations along with the

development of science and technology has ended up pushing the whole society to race on the path of development.

The process of specialization and cooperation is increasingly specialized, contributing to

increasing the total product of the whole society. We are living in a period witnessing

rapid changes in the overal economy, engineering, technology, and other changes in politics and society.

To integrate with the world economy, we must also have changes so as not to be removed

from the cycle of development. In that context, the trend of opening the window,

economic cooperation with other countries is a prominent viewpoint of our Government.

Demonstrating this, on December 19, 1987, the National Assembly passed the Law on

Foreign Direct Investment, al owing foreign organizations and individuals to invest in

Vietnam. Next, the National Assembly passed the Investment Law 2005 (effective in July

2006) with additional provisions on foreign direct investment. In the context of an

underdeveloped economy and low integration capacity, increasing the mobilization of

foreign capital sources to supplement total development investment capital is very

important. Foreign investment is a source of additional capital for investment, a way to

transfer technology, a solution to create jobs and income for workers, generate revenue

for banks and ultimately accelerate the process of economic restructuring. The issue of

at racting foreign direct investment in the coming years is very important for economic

growth. In that context, our State must improve the organization and policies to at ract

foreign direct investment, meeting the need for effective use of foreign direct investment

in accordance with the important policy of our Party and State, which is to consider

internal strength as decisive and external strength as important; combining internal

strength and external strength into a combined strength in national construction.

So how should we properly perceive the role of FDI? And what should be done to

enhance the role of this important capital source to realize Vietnam's industrialization

and modernization goals in the context of deep integration into the world economy? 1

CHAPTER 1. OVERVIEW OF FOREIGN DIRECT INVESTMENT (FDI)

1.1. Concept of foreign direct investment

FDI activities have become very popular today. The nature of this activity is the same

but there are many different interpretations depending on each aspect considered.

According to the International Monetary Fund (IMF), FDI is an investment activity

carried out to achieve long-term benefits in an enterprise operating in the territory of

an economy other than the investor's economy. , the investor's purpose is to gain real

management rights of the enterprise.

According to the Organization for Economic Cooperation and Development (OECD),

FDI is made to establish long-term economic relationships with a business, especial y

investments that bring the ability to influence the economy. Managing the above

mentioned enterprise by: (i) Establishing or expanding an enterprise or a branch under

the ful management of the investor; (i ) Acquiring al existing businesses; (i i)

Participate in a new business; and (iv) long-term credit (>5 years).

UNCTAD defines FDI as a long-term investment activity to gain long-term benefits

and control by an entity (foreign direct investor or parent enterprise) of a country in

the country. an enterprise (overseas branch) in another country. The purpose of the

direct investor is to have more influence in the management of businesses located in

that economy. This definition does not tel us exactly what an investment is.

The WTO believes that: “Foreign direct investment takes place when an investor from

one country (the investor country) acquires an asset in another country (the investment

recipient country) with the right to manage that asset. ”. This concept emphasizes that

FDI is an asset. The management aspect is what distinguishes FDI from other

financial instruments. In this case, the investor is often cal ed the “parent company”

and the assets are called “subsidiaries” or “company affiliates”.

The concepts of the above organizations are basical y consistent with each other

regarding the relationship, role and interests of investors and time in FDI activities.

The most widely accepted international definition of FDI today is given by the IMF

and UNCTAD based on the concept of balance of payments. 1

In short, FDI can be understood as a form of international investment in which an

investor from one country invests al or a large enough capital in a project in another

country to gain control or participate in making profits control that project.

2. Characteristics of foreign direct investment (FDI)

Investors must contribute a minimum amount of capital according to the

regulations of each country (according to Vietnam's regulations, the minimum is 30%).

The division of management rights depends on the level of capital contribution.

The profits of investors depend on the business performance and are divided

according to the capital contribution ratio.

FDI is implemented through the construction of new enterprises, the acquisition of

al or consulting part of operating enterprises or the merger of enterprises.

FDI is not only associated with capital movement but also with the transfer of

technology and management experience.

FDI is currently associated with the international business activities of multinational companies.

3. The role of foreign direct investment (FDI)

3.1. The role of FDI for countries exporting investment capital

There are a number of advantages to the function that FDI plays for nations that export investment capital:

Economic support: Investors can take ful advantage of the recipient countries,

thereby reducing production costs, while also possessing a stable supply of raw materials.

Increase competitiveness: Thanks to production in the new environment, investors

have the conditions to innovate production structures, apply new technologies and improve competitiveness.

Improve reputation: Help investor countries affirm their economic potential,

expand consumption markets and avoid countries' protective trade barriers.

There are various drawbacks to FDI for nations that export investment money. 2

Increasing unemployment: Moving production to another country causes the supply

of jobs to decline, thereby increasing the unemployment rate.

Difficulties in the new environment: Investing in less developed countries requires

investors to spend time, effort to correct and provide initial guidance.

3.2. The role of FDI for countries receiving investment capital

The role of FDI for countries receiving investment capital has several positive aspects:

Economic growth: Contribute to increasing income sources and creating conditions

to improve the state budget situation, creating a positive competitive environment.

Promoting transformation: FDI brings modern scientific technology, highly

specialized techniques, and advanced management levels.

Providing employment: FDI helps to solve socio-economic difficulties, typical y

unemployment among manual workers.

Improving the quality of manpower: Workers and line managers have the

opportunity to learn and improve their qualifications.

There are various drawbacks to FDI's involvement in nations that receive investment funds.

Financial disadvantage: capital contribution ratio in enterprises puts the receiving

country at a disadvantage in profit sharing, and high production costs also increase

the cost of domestic products.

Pol uting the environment: Because of policies to encourage investment, the long-

term issue of environmental protection is stil not strictly regulated, which wil

greatly affect the environment of the host country.

Political instability: The amount of capital poured into developing countries can

add to regional imbalances, adversely affect society such as changes in personality,

human outlook, the occurrence of evils…

3.3. The role of FDI for the Vietnamese market

Economy: Contribute to perfecting market economic institutions, improving economic

management and corporate governance capacity.

Markets: Providing capital resources, improving technological capabilities,

competitiveness of firms in the market, and opportunities to access international markets. 3

Structure: Contribute to changing economic structure, forming a number of key industries.

Human resources: Through cooperation with foreign businesses, workers can acquire

modern technical qualifications and management skil s, suitable for the current

environment. Improve labor productivity, support strategic industries of countries.

4. Forms of foreign investment

4.1. According to the investor's purpose

Horizontal Investment is a form of investment that only pours capital into foreign

companies in the same industry or produces similar products as in the investing company.

Vertical Investment is a form of investment made throughout the length of a

company's supply chain, which can be in one industry or many different industries. 4.2. Equity-based

Investment in establishing an economic organization is a form of direct investment in

which the investor as a legal economic organization puts his capital and assets into establishing a new business.

Private Investment is a form of investment in which the investor as a business

individual provides investment resources in another country.

4.3. According to the form and investment process

Joint Venture is a form that al ows partners from two or more countries to cooperate

in investing and sharing profits.

Mergers and Acquisition consists of the acquisition of part or al of the shares of a

business available in the recipient country.

Greenfield Investment is a form of investment from the beginning by building a new

business or expanding production in the receiving country. 4

CHAPTER 2: VIETNAM'S FOREIGN DIRECT INVESTMENT SITUATION

2.1. State perspective on foreign direct investment in Vietnam.

The Government of Vietnam views foreign direct investment (FDI) as vital for economic

growth and modernization. Policies are in place to improve the investment environment,

protect investor rights, and prioritize high-tech and eco-friendly sectors. The government

also focuses on human resource development, technology transfer, and reducing regional

disparities. With a commitment to environmental protection, sustainable development,

and international cooperation, Vietnam has created an at ractive, stable, and transparent

investment environment, drawing increasing FDI inflows.

2.2. Foreign direct investment legal system in Vietnam

Vietnam is considered one of the most stable and safest countries in the world, which

significantly influences its at ractiveness for foreign direct investment (FDI). Political

stability creates a business environment based on trust and minimizes risks for

investors. According to the World Bank's 2005 World Development Report, Vietnam

is evaluated to have a good legal framework and a favorable investment environment,

contributing to diversified and multilateral economic relations with other countries.

The Foreign Investment Law in Vietnam was first enacted in 1987 and has undergone

multiple amendments and supplements, aligning with international standards and

practices. This law initiated the at raction and efficient utilization of FDI into

Vietnam, promoting economic diversification and multilateral economic relations.

Alongside the continuous enhancement of legal frameworks and bilateral/multilateral

agreements related to FDI, Vietnam has signed 51 investment encouragement and

protection agreements with various countries and territories.

In 2005, the National Assembly enacted the Investment Law effective from July 1,

2006, replacing the Foreign Investment Law and the Domestic Investment

Encouragement Law. This change reflects the Party and State's at ention to the FDI 5

sector, a crucial component of Vietnam's economy, adapting to general laws to timely

respond to objective changes in domestic and international economic developments.

Research on FDI activities in Vietnam over different periods has demonstrated that the

Investment Law has significantly contributed to positive transformations, facilitating

the at raction and effective utilization of FDI into Vietnam's economy. Improved

management mechanisms include strong decentralization to provincial People's

Commit ees and Management Boards of Industrial Parks, Export Processing Zones,

High-Tech Zones, and Economic Zones, enhancing policy-making, inspection,

supervision, and support for FDI activities at local levels. The "one-stop shop" and

"red carpet" approaches have widely applied, further enhancing the effectiveness of

at racting and utilizing FDI in Vietnam.

2.3. Foreign direct investment activities in Vietnam

Since implementing the Renovation Campaign in 1986, Vietnam has at racted

significant FDI inflows, emerging as a rising star in the global production supply

chain. While initial y most investments were directed towards low value-added sectors

such as textiles, apparel, and footwear, Vietnam quickly ascended the value chain,

developing into a crucial hub for electronics assembly. Despite fierce trade chal enges,

Vietnam continues to lead in at racting high-quality FDI. Investment in manufacturing

sectors now accounts for 85% of total new FDI.

In 2023, a notable highlight was the significant increase in new FDI flows into the

manufacturing sector, despite global economic chal enges and post-Covid-19

limitations. FDI remains a "favorable wind" for Vietnam amidst global supply chain

diversification. Despite existing chal enges related to the quality of the workforce,

Vietnam is stil recognized for its at ractive investment environment with numerous

competitive advantages and appealing foreign investment policies.

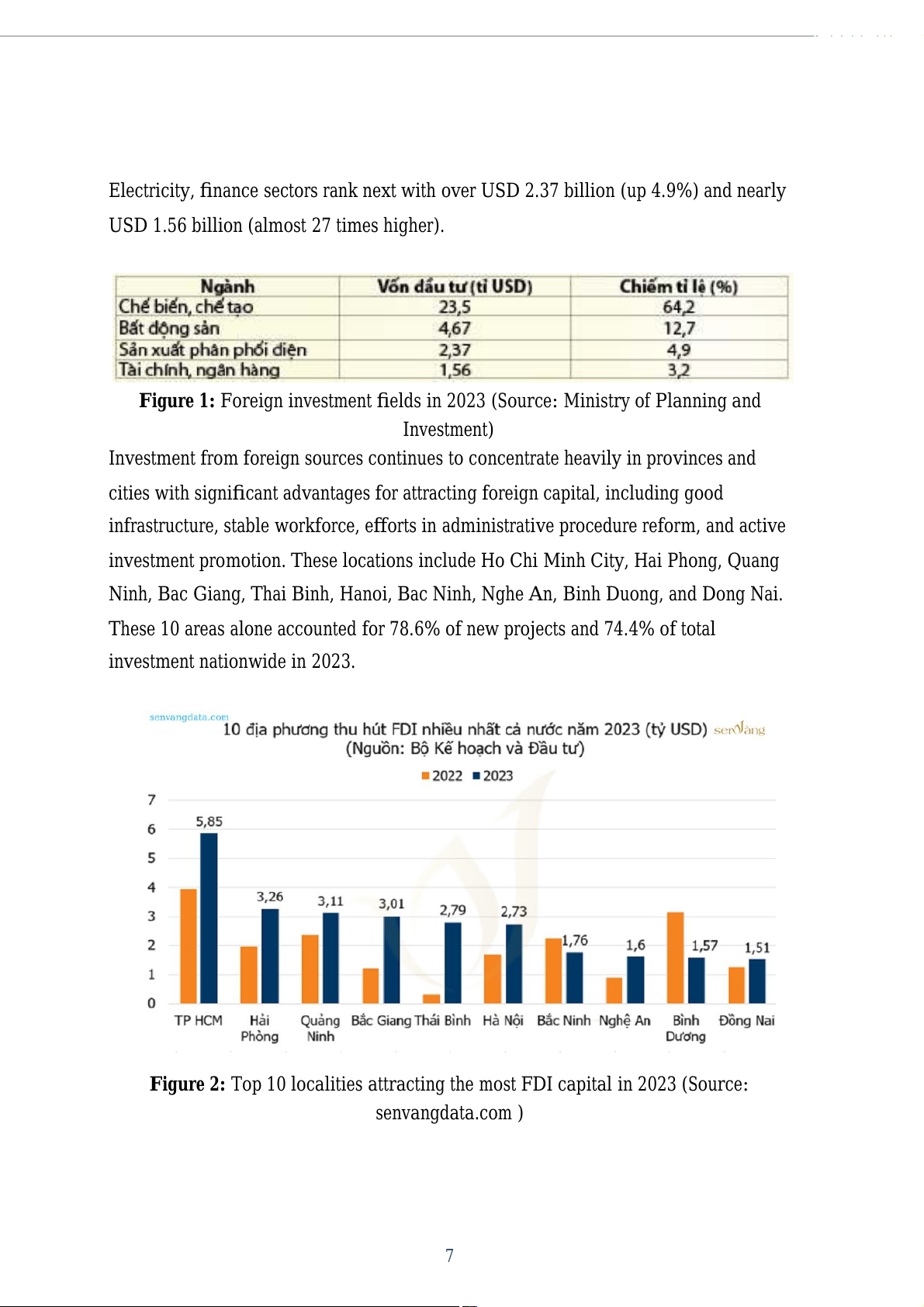

Foreign investors have entered 18 out of Vietnam's 21 economic sectors.

Manufacturing leads with over USD 23.5 bil ion, 64.2% of total investment, up

39.9%. Real estate fol ows with nearly USD 4.67 bil ion, 12.7% of total, up 4.8%. 6

Electricity, finance sectors rank next with over USD 2.37 bil ion (up 4.9%) and nearly

USD 1.56 bil ion (almost 27 times higher).

Figure 1: Foreign investment fields in 2023 (Source: Ministry of Planning and Investment)

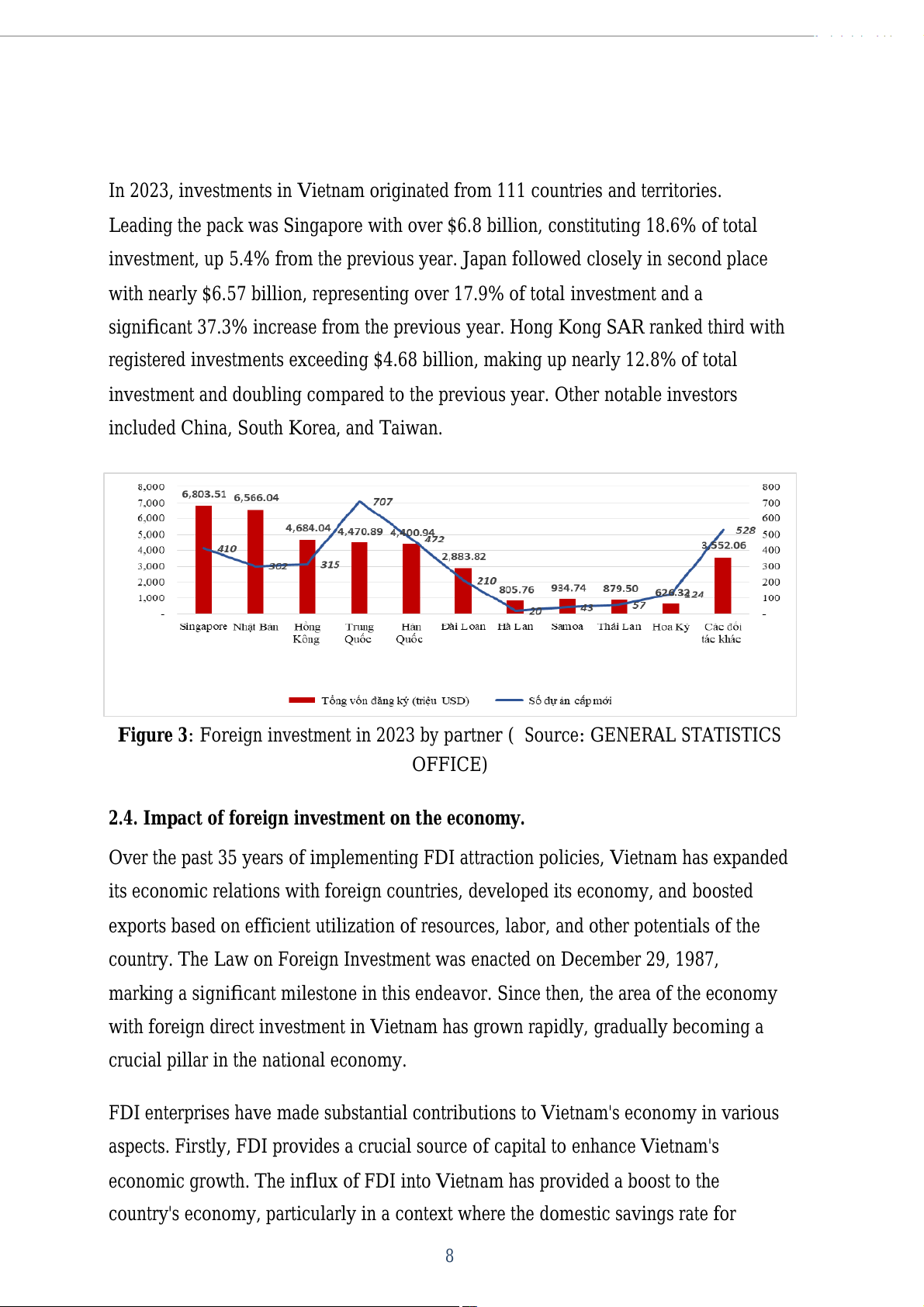

Investment from foreign sources continues to concentrate heavily in provinces and

cities with significant advantages for at racting foreign capital, including good

infrastructure, stable workforce, efforts in administrative procedure reform, and active

investment promotion. These locations include Ho Chi Minh City, Hai Phong, Quang

Ninh, Bac Giang, Thai Binh, Hanoi, Bac Ninh, Nghe An, Binh Duong, and Dong Nai.

These 10 areas alone accounted for 78.6% of new projects and 74.4% of total

investment nationwide in 2023.

Figure 2: Top 10 localities at racting the most FDI capital in 2023 (Source: senvangdata.com ) 7

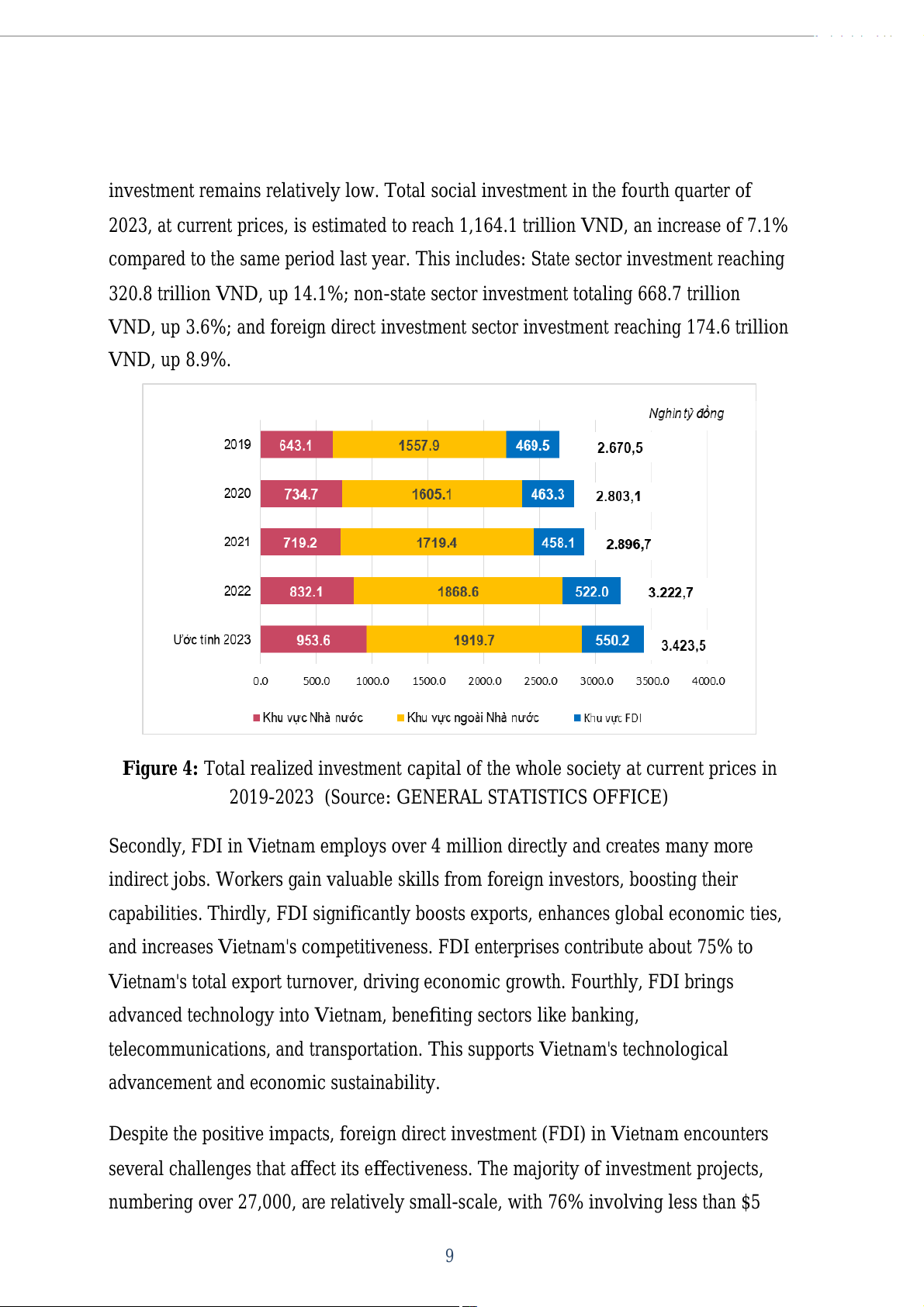

In 2023, investments in Vietnam originated from 111 countries and territories.

Leading the pack was Singapore with over $6.8 bil ion, constituting 18.6% of total

investment, up 5.4% from the previous year. Japan fol owed closely in second place

with nearly $6.57 bil ion, representing over 17.9% of total investment and a

significant 37.3% increase from the previous year. Hong Kong SAR ranked third with

registered investments exceeding $4.68 bil ion, making up nearly 12.8% of total

investment and doubling compared to the previous year. Other notable investors

included China, South Korea, and Taiwan.

Figure 3: Foreign investment in 2023 by partner ( Source: GENERAL STATISTICS OFFICE)

2.4. Impact of foreign investment on the economy.

Over the past 35 years of implementing FDI attraction policies, Vietnam has expanded

its economic relations with foreign countries, developed its economy, and boosted

exports based on efficient utilization of resources, labor, and other potentials of the

country. The Law on Foreign Investment was enacted on December 29, 1987,

marking a significant milestone in this endeavor. Since then, the area of the economy

with foreign direct investment in Vietnam has grown rapidly, gradual y becoming a

crucial pil ar in the national economy.

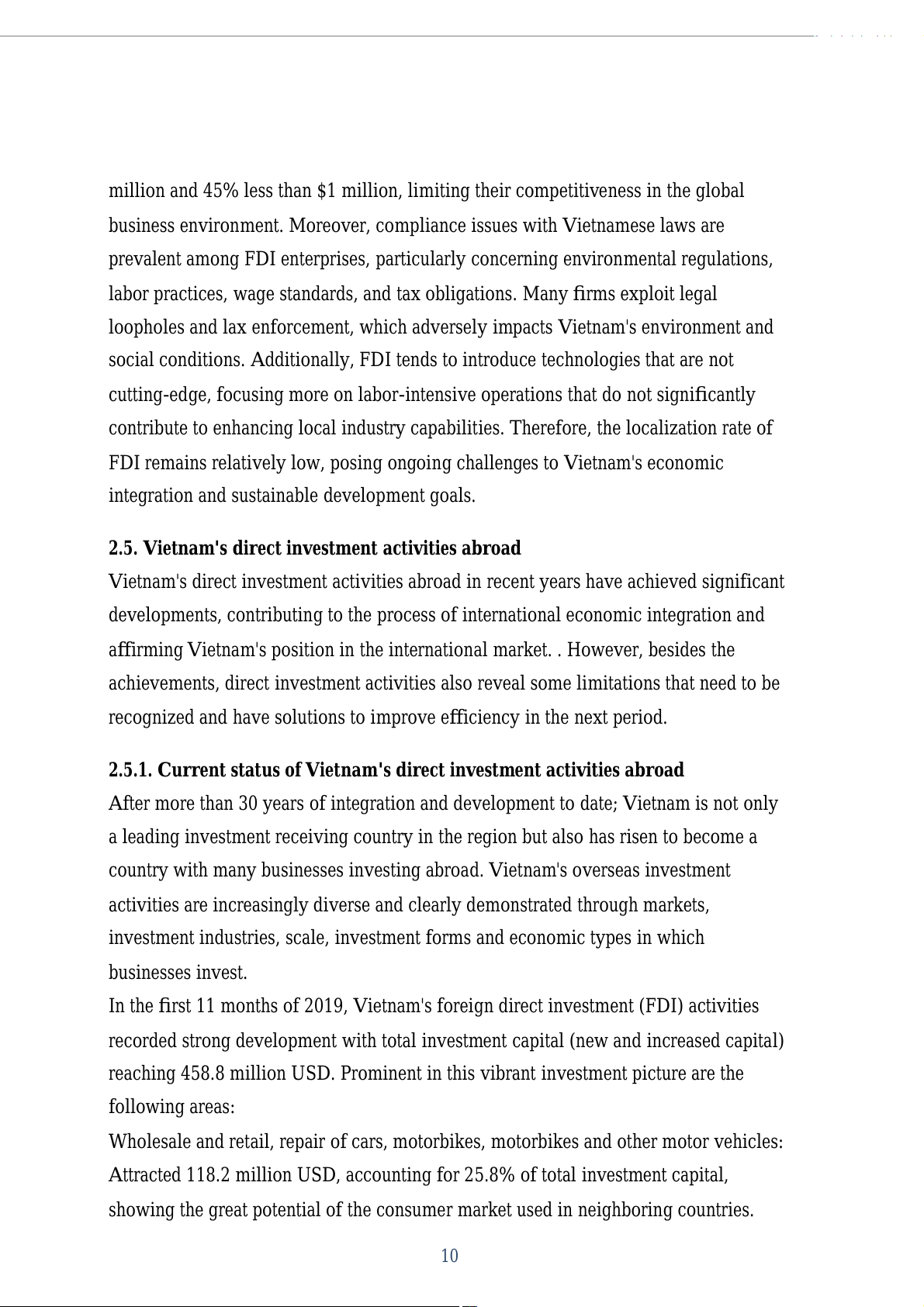

FDI enterprises have made substantial contributions to Vietnam's economy in various

aspects. Firstly, FDI provides a crucial source of capital to enhance Vietnam's

economic growth. The influx of FDI into Vietnam has provided a boost to the

country's economy, particularly in a context where the domestic savings rate for 8

investment remains relatively low. Total social investment in the fourth quarter of

2023, at current prices, is estimated to reach 1,164.1 tril ion VND, an increase of 7.1%

compared to the same period last year. This includes: State sector investment reaching

320.8 tril ion VND, up 14.1%; non-state sector investment totaling 668.7 tril ion

VND, up 3.6%; and foreign direct investment sector investment reaching 174.6 tril ion VND, up 8.9%.

Figure 4: Total realized investment capital of the whole society at current prices in

2019-2023 (Source: GENERAL STATISTICS OFFICE)

Secondly, FDI in Vietnam employs over 4 mil ion directly and creates many more

indirect jobs. Workers gain valuable skil s from foreign investors, boosting their

capabilities. Thirdly, FDI significantly boosts exports, enhances global economic ties,

and increases Vietnam's competitiveness. FDI enterprises contribute about 75% to

Vietnam's total export turnover, driving economic growth. Fourthly, FDI brings

advanced technology into Vietnam, benefiting sectors like banking,

telecommunications, and transportation. This supports Vietnam's technological

advancement and economic sustainability.

Despite the positive impacts, foreign direct investment (FDI) in Vietnam encounters

several chal enges that affect its effectiveness. The majority of investment projects,

numbering over 27,000, are relatively smal -scale, with 76% involving less than $5 9

mil ion and 45% less than $1 mil ion, limiting their competitiveness in the global

business environment. Moreover, compliance issues with Vietnamese laws are

prevalent among FDI enterprises, particularly concerning environmental regulations,

labor practices, wage standards, and tax obligations. Many firms exploit legal

loopholes and lax enforcement, which adversely impacts Vietnam's environment and

social conditions. Additional y, FDI tends to introduce technologies that are not

cut ing-edge, focusing more on labor-intensive operations that do not significantly

contribute to enhancing local industry capabilities. Therefore, the localization rate of

FDI remains relatively low, posing ongoing chal enges to Vietnam's economic

integration and sustainable development goals.

2.5. Vietnam's direct investment activities abroad

Vietnam's direct investment activities abroad in recent years have achieved significant

developments, contributing to the process of international economic integration and

affirming Vietnam's position in the international market. . However, besides the

achievements, direct investment activities also reveal some limitations that need to be

recognized and have solutions to improve efficiency in the next period.

2.5.1. Current status of Vietnam's direct investment activities abroad

After more than 30 years of integration and development to date; Vietnam is not only

a leading investment receiving country in the region but also has risen to become a

country with many businesses investing abroad. Vietnam's overseas investment

activities are increasingly diverse and clearly demonstrated through markets,

investment industries, scale, investment forms and economic types in which businesses invest.

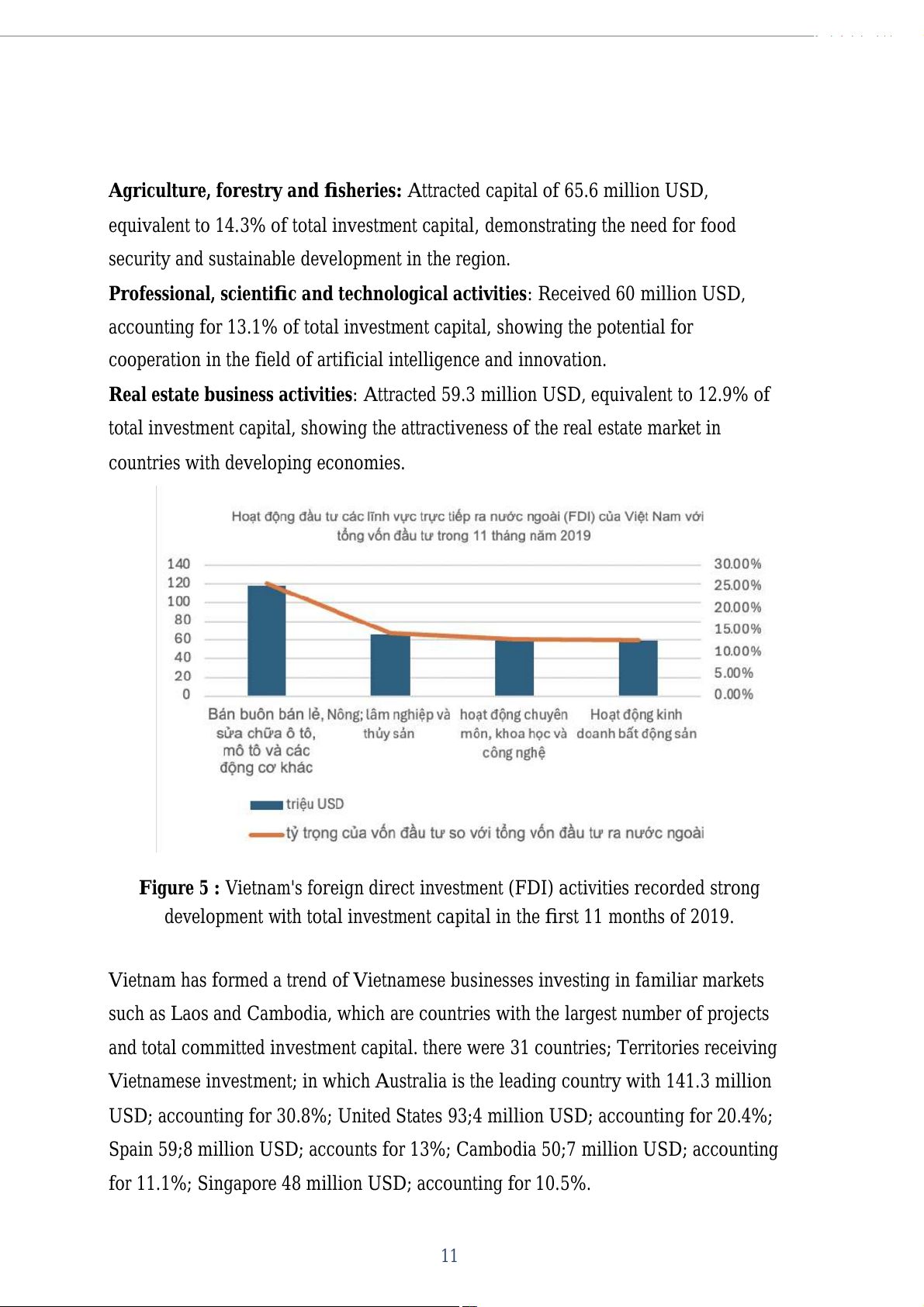

In the first 11 months of 2019, Vietnam's foreign direct investment (FDI) activities

recorded strong development with total investment capital (new and increased capital)

reaching 458.8 mil ion USD. Prominent in this vibrant investment picture are the fol owing areas:

Wholesale and retail, repair of cars, motorbikes, motorbikes and other motor vehicles:

At racted 118.2 mil ion USD, accounting for 25.8% of total investment capital,

showing the great potential of the consumer market used in neighboring countries. 10

Agriculture, forestry and fisheries: At racted capital of 65.6 mil ion USD,

equivalent to 14.3% of total investment capital, demonstrating the need for food

security and sustainable development in the region.

Professional, scientific and technological activities: Received 60 mil ion USD,

accounting for 13.1% of total investment capital, showing the potential for

cooperation in the field of artificial intel igence and innovation.

Real estate business activities: At racted 59.3 mil ion USD, equivalent to 12.9% of

total investment capital, showing the at ractiveness of the real estate market in

countries with developing economies.

Figure 5 : Vietnam's foreign direct investment (FDI) activities recorded strong

development with total investment capital in the first 11 months of 2019.

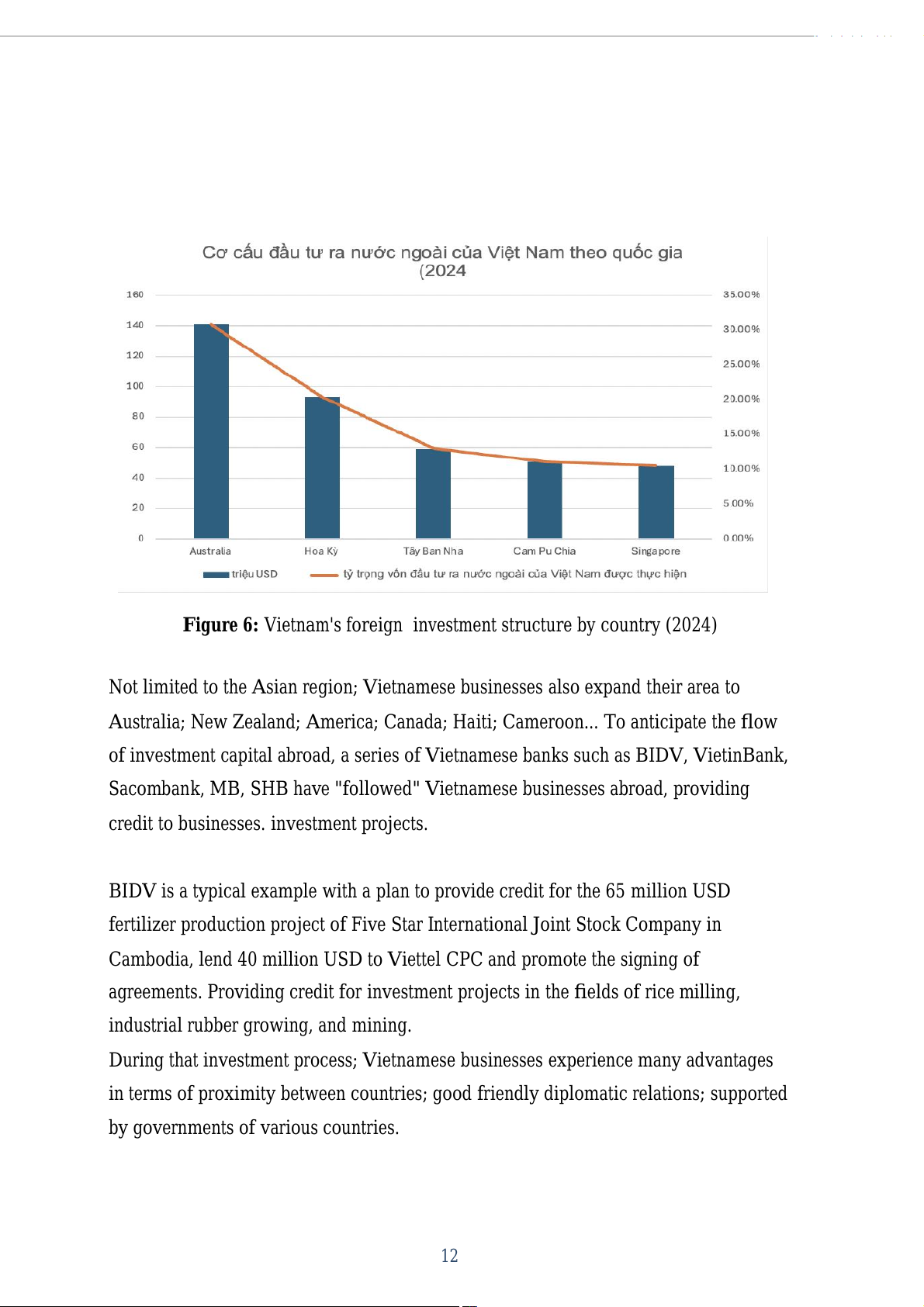

Vietnam has formed a trend of Vietnamese businesses investing in familiar markets

such as Laos and Cambodia, which are countries with the largest number of projects

and total commit ed investment capital. there were 31 countries; Territories receiving

Vietnamese investment; in which Australia is the leading country with 141.3 mil ion

USD; accounting for 30.8%; United States 93;4 mil ion USD; accounting for 20.4%;

Spain 59;8 mil ion USD; accounts for 13%; Cambodia 50;7 mil ion USD; accounting

for 11.1%; Singapore 48 mil ion USD; accounting for 10.5%. 11

Figure 6: Vietnam's foreign investment structure by country (2024)

Not limited to the Asian region; Vietnamese businesses also expand their area to

Australia; New Zealand; America; Canada; Haiti; Cameroon. . To anticipate the flow

of investment capital abroad, a series of Vietnamese banks such as BIDV, VietinBank,

Sacombank, MB, SHB have "fol owed" Vietnamese businesses abroad, providing

credit to businesses. investment projects.

BIDV is a typical example with a plan to provide credit for the 65 mil ion USD

fertilizer production project of Five Star International Joint Stock Company in

Cambodia, lend 40 mil ion USD to Viet el CPC and promote the signing of

agreements. Providing credit for investment projects in the fields of rice mil ing,

industrial rubber growing, and mining.

During that investment process; Vietnamese businesses experience many advantages

in terms of proximity between countries; good friendly diplomatic relations; supported

by governments of various countries. 12

Decree No. 83/2015/ND-CP on investment abroad was issued, the Government of

Vietnam created more favorable conditions for businesses to expand the scope of

investment and business abroad.

The Ministry of Planning and Investment also issued Circular No. 03/2018/TT-

BKHDT guiding and promulgating sample documents for implementing overseas

investment procedures, contributing to standardizing legal procedures and creating an

investment environment. clear privacy.

Thanks to practical support policies and an increasingly perfect investment

environment, Vietnam's FDI activities abroad have made certain impressions.

Many Vietnamese corporations, corporations and businesses have had investment

capital abroad exceeding the threshold of 1 bil ion USD, typical y Vietnam Oil and

Gas Group, Military Telecommunications Group (Viet el), Hoang Gia Joint Stock Company. Anh - Gia Lai.

The success of Vietnamese businesses affirms the competitiveness and great potential of FDI activities abroad.

2.5.2. Some lessons learned from the situation of vietnam's direct investment activities abroad

Vietnamese enterprises' overseas investment activities are growing, but there are stil

many limitations that need to be overcome to improve efficiency. Some key limitations include:

Limited financial capacity and investment experience: Vietnamese businesses are

often smal in scale, have limited capital, and lack experience operating in the

international environment, leading to low competitiveness.

Industry structure is not reasonable: Some industries and fields have potential but

have not at racted many foreign investment projects

Ineffective management: The implementation of the reporting regime is incomplete,

coordination between authorities is limited, and there is a lack of survey teams to

evaluate the effectiveness of overseas investment activities.

Loose relationship with diplomatic representative agencies: When a dispute

occurs, businesses investing abroad have difficulty accessing support from the state. 13

Cumbersome administrative procedures: The legal framework is unclear, the

licensing verification process is lengthy, hindering investment activities.

Inadequate business support: Lack of practical support solutions for finance, market

information, partner connections, etc.

CHAPTER 3: MEASURES TO IMPROVE THE S TO IMPROV EFFECTIVENESS OF EFFECTIV VIETNAM'S FOREIGN DIRECT 'S FOREIG INVESTMENT ACTIVITIES INVESTMENT ACTIVITI

Through analysis and research of Vietnam's foreign direct investment activities, to

at ract FDI more effectively, Vietnam needs to synchronously implement many

solutions, of which the top priorities are:

Perfecting institutions, laws and effective enforcement:

Improve the legal system on investment, ensuring transparency, consistency and

compliance with international practices. Promulgate and amend the Investment Law

and other investment-related laws to ensure transparency and consistency. consistent

and consistent with international practices. Complete the system of legal regulations

on fields and industries at racting FDI and provide complete, easily accessible legal

information for foreign investors.

Strengthen law enforcement, associate with decentralization, decentralization,

individualization of responsibilities and promotion of the responsibilities of leaders.

Improve the law enforcement capacity of state agencies, especial y state management

agencies on investment. Apply strict handling measures for violations of investment laws.

Improve the operational efficiency of state agencies in at racting FDI, creating an

open, safe and stable investment environment for investors.

Enhance endogenous potential:

Develop high-quality human resources with professional qualifications and skil s to

meet the requirements of foreign investors. Improve the management and operating 14