Preview text:

OUTLINE Intro:

Good afternoon, everyone. Our Group 1 is pleased to be here today to discuss an important

topic: global economic uncertainties and their impact on Vietnam's international trading

activities. In this presentation, we will mainly explore two uncertainties which are the

geopolitical tensions and trade war leading to the supply chain disruptions, examine how

these economic instabilities worldwide influence Vietnam's trade dynamics, and how

countries like Vietnam navigate these turbulent waters.

maybe có thể có câu hỏi giao lưu trước hoặc sau phần intro: before we delve into this topic,

can you please tell us what you have known about global economics uncertainties or some

significant events that affect the international market ? Overview I.Definition

Economic uncertainty refers to a situation in which the future economic environment is

challenging to predict, and there is a high degree of risk or unknowns involved. II.Trade war

A trade war occurs when countries impose tariffs or other trade barriers on each other in

response to trade policies or practices perceived as unfair. Here are some key aspects:

1. Causes of Trade war

Trade Imbalances : Countries may perceive that they are importing more than they are

exporting, leading to calls for corrective measures.

Intellectual Property Issues : Disputes over the theft of intellectual property or technology can spark tensions.

Domestic Protectionism : Governments may seek to protect local industries from foreign competition.

2. Impact of Trade war: increase tariff, employment, supply chain disruptions, consumers’ behaviours….

III.Geopolitical tensions

Geopolitical tensions refer to conflicts and rivalries between nations influenced by

geographical, political, economic, and cultural factors.

1. Causes of Geopolitical Tensions

Territorial Disputes : Conflicts over borders and territories, such as those in the South China

Sea or between India and Pakistan.

Resource Competition : Nations may compete for access to natural resources like oil,

minerals, and water, leading to conflicts.

Political Ideologies : Differences in governance systems, such as democracy versus

authoritarianism, can create friction.

Historical Grievances : Past conflicts or colonial histories may fuel ongoing tensions. 2. Impacts

Geopolitical tensions can significantly affect global stability, economies, and international

relations by fluctuating energy prices, raising security concerns and trade disruptions…

**Ultimately, these two uncertainties have led to the supply chain disruption

Trade wars and geopolitical tensions can disrupt supply chains across various industries,

leading to increased costs, delays, and a reevaluation of sourcing strategies: political

instability can affect trade routes and supplier reliability and changes in trade policies can

disrupt established supply chains.

VIETNAM MAIN TRADING PARTNERS

● China: China is Vietnam's largest trading partner, accounting for a significant portion of its imports and exports.

● United States: The United States is another major trading partner for Vietnam, with a

growing bilateral trade relationship.

● European Union (EU): The EU is a significant market for Vietnamese goods, and

Vietnam has signed a free trade agreement with the EU.

● Japan: Japan is a long-standing trading partner of Vietnam, with strong economic ties.

● South Korea: South Korea is another important market for Vietnamese products, and

the two countries have a free trade agreement.

● ASEAN Member States: Vietnam is a member of the Association of Southeast Asian

Nations (ASEAN), and it has free trade agreements with other ASEAN countries.

Notable Trade Agreements

● European Union (EU): The EU-Vietnam Free Trade Agreement (EVFTA) is one of

Vietnam's most significant trade deals, providing preferential market access for both sides.

● United States: The Vietnam Comprehensive Agreement on Trade and Investment

(EVFTA) offers similar benefits to Vietnam's trade relationship with the United States.

● Association of Southeast Asian Nations (ASEAN): Vietnam is a member of

ASEAN and actively participates in regional trade initiatives, such as the ASEAN Free Trade Area (AFTA).

● Other Countries: Vietnam has also signed FTAs with countries such as South Korea,

Japan, China, Chile, and Australia.

III. Impact of Global Economic Uncertainties on VN's international trade

1. Trade volatility:

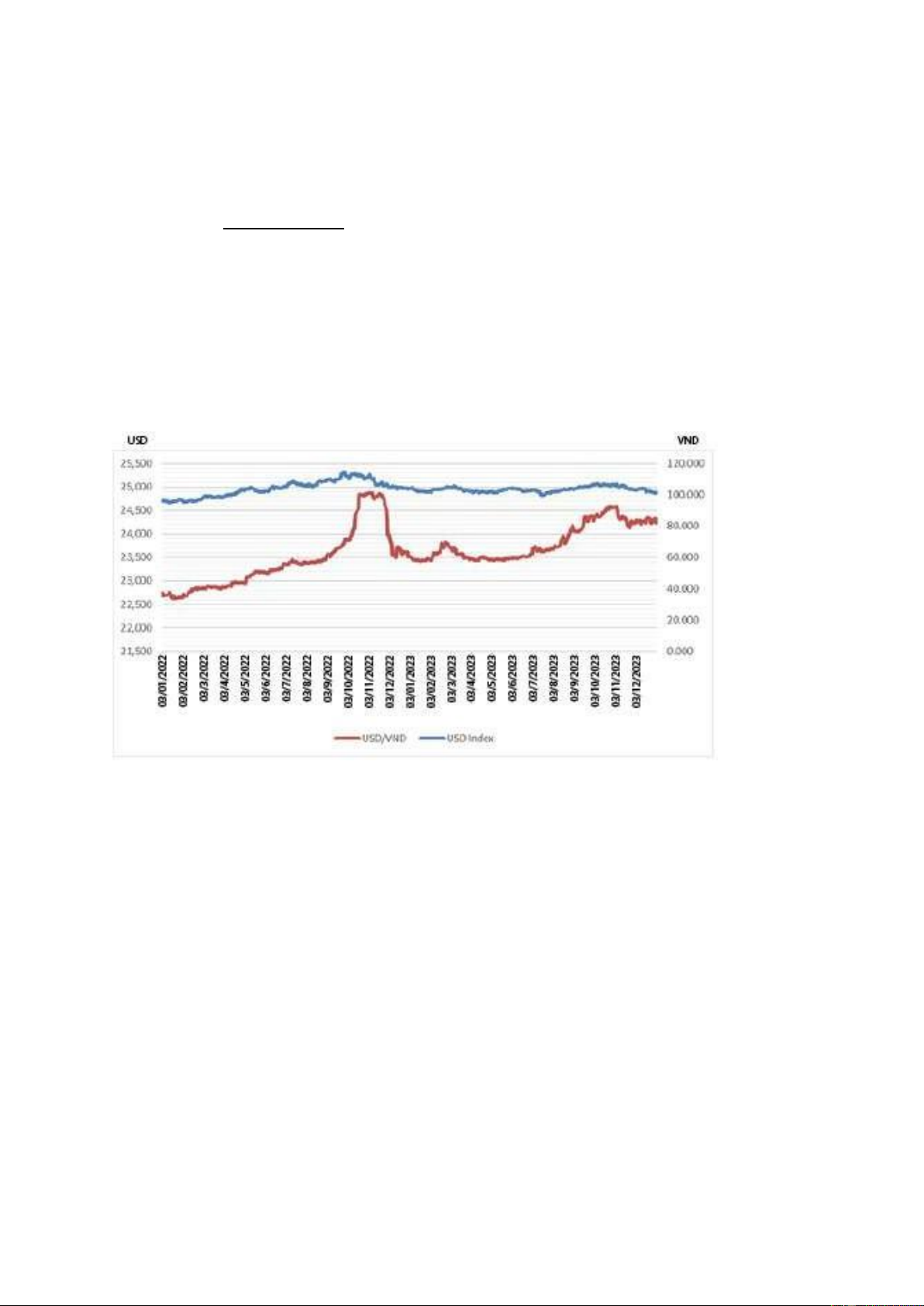

The economic uncertainties have led Vietnam into trade volatility. The result of these are the

fluctuations in exchange rates of VND, out of all the big countries that affect the instability of

the exchange rate in VietNam, like China or EU, USA has the most impact to this. Since

2022, the FED has continuously raised interest rates and kept effective rates at high levels to

control inflation, causing the USD to appreciate against other currencies. Accordingly, the

State Bank of Vietnam (SBV) has managed relatively stable exchange rates in order to

maintain domestic macro stability, support investments and other economic activities.

In that context, FED has thrice raised its key interest rate within just six months of 2022; with

the interest rate increases announced on June 15 (0.75 percentage points) being the highest

increase over the past 28 years. And the FED is expected to continue to tighten its monetary

policy in the coming time. The USD has appreciated strongly (the DXY index has increased

by about 10% since the beginning of 2022), causing the currencies of many large and

developing economies to depreciate sharply. These developments have adversely affected the

balance of supply and demand of foreign currencies, and the customers’ psychology in the

domestic market, putting pressure on the stability of the exchange rate and the forex market.

In 17/12/2022, SBV had to adjust the exchange rate from +3% to +5% and at the same time

negotiated with the USA government and Department of the Treasury to remove Vietnam

from the Currency manipulators monitoring list. As a consequence of this, VND only lost

4,35% of its value compared to USD. Despite the strong fluctuations in the international

market, the domestic forex market is still stable, the market liquidity has been smooth, and

the legitimate demands for foreign currencies have been fully and promptly met, especially

the demand for foreign currencies to import essential commodities for serving production and

business operations in the context of a sharp increase in energy and commodities’ prices.

But up till April 19 2024, SBV has announced it’s selling US dollar to intervene in the

USD/VNĐ, the greenback price has remained high, which has been directly affecting many

domestic enterprises like seafood import, mechanical or beverage manufacturing companies,

they will have to import materials with the higher costs by 4-5 percent and the international

transportation will cost higher due to the rising of gasoline prices

Exchange rate volatility can also create uncertainty for foreign investors, since a stable

exchange rate is often seen as a sign of economic stability, encouraging foreign direct

investment (FDI), making Vietnam less attractive to foreign investors. They may fear that

their returns could be eroded by unfavorable exchange rate movements.

2. Supply chain disruption :

It is obvious that Vietnam is deeply integrated into global supply chains, specifically

in manufacturing and electronics. Even though this can bring about many benefits and

chances for Vietnam to develop, if there is a problem, Vietnam is also impacted.

Starting in December of 2019, the outbreak of the COVID - 19 pandemic significantly

affects not only the health but also the supply chain in and from Vietnam. Firstly, being an

economy with a high degree of trade openness, Vietnam’s economy has been severely

influenced since many strict measures such as lockdown used to curb the situation have

restricted the import and export ways. As a result, this has led to a disrupted supply chain.

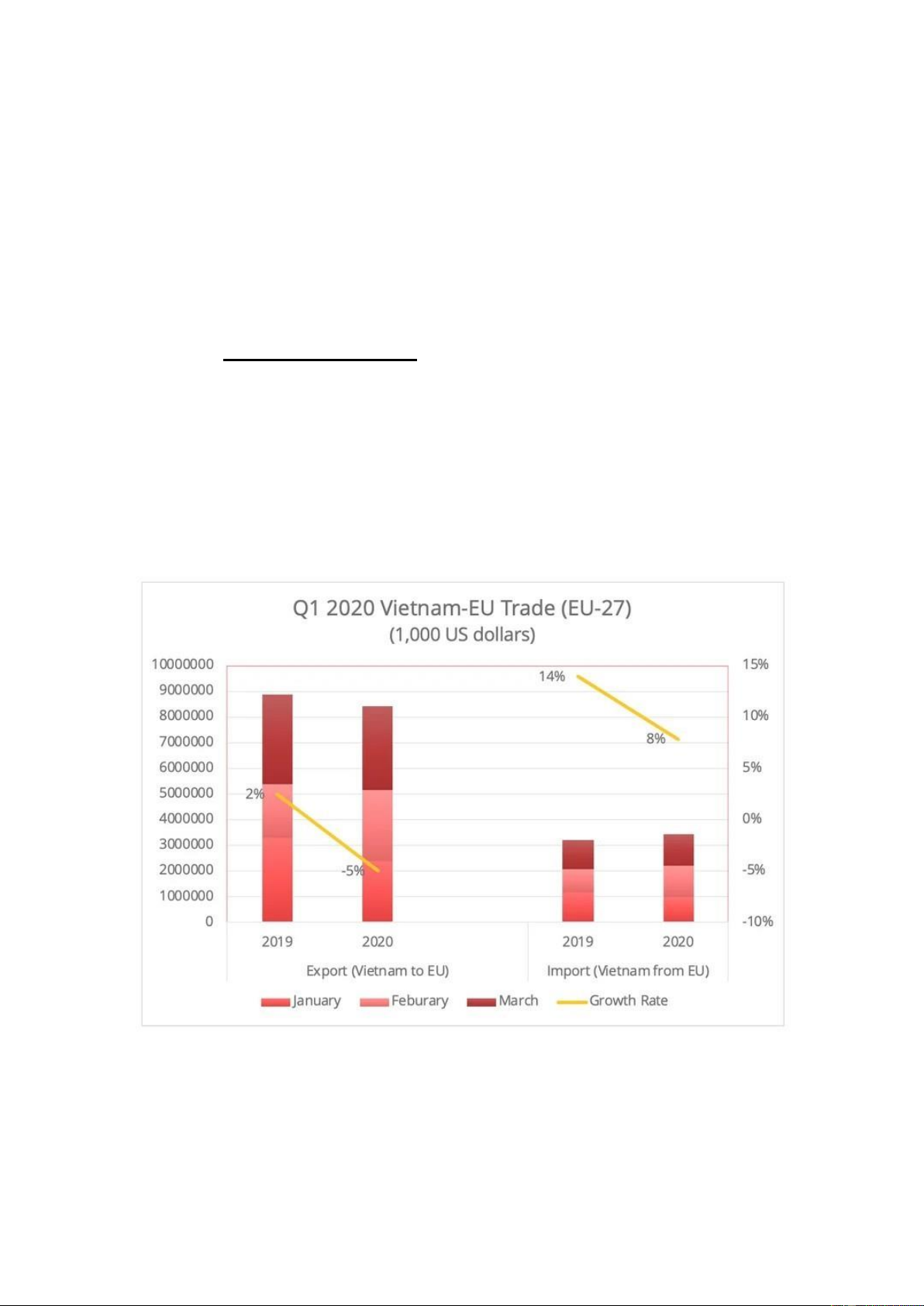

Figure 1 - The growth rate of the EU (EU-27)-Vietnam trade in the first quarter of

2020 is calculated by the author based on data from the General Department of Vietnam

Customs and General Statistics Office of Vietnam. The 2019 growth rate is also calculated on EU-27.

Here is one example of this case. Vietnam is the EU's second-largest ASEAN trading

partner and the largest exporter in Southeast Asia. The country's exports to the EU are mainly

consumer products, such as smartphones, footwear, and apparel, and the EU's exports are

primarily automobile and high-tech products. In the first quarter, Vietnam’s exports to the EU

dropped by 5%. China has long been the leading exporter of fabrics and garment accessories

for Vietnam. However, as China shows no sign of abandoning its zero-Covid approach, many

shipments of fabrics and garment pieces are piling up at its ports, leading Vietnamese

garment firms to delay production and delivery. In general, the disrupted supply chain not

only affected the import that Vietnam gained from China but it also influenced the proportion that Vietnam exported.

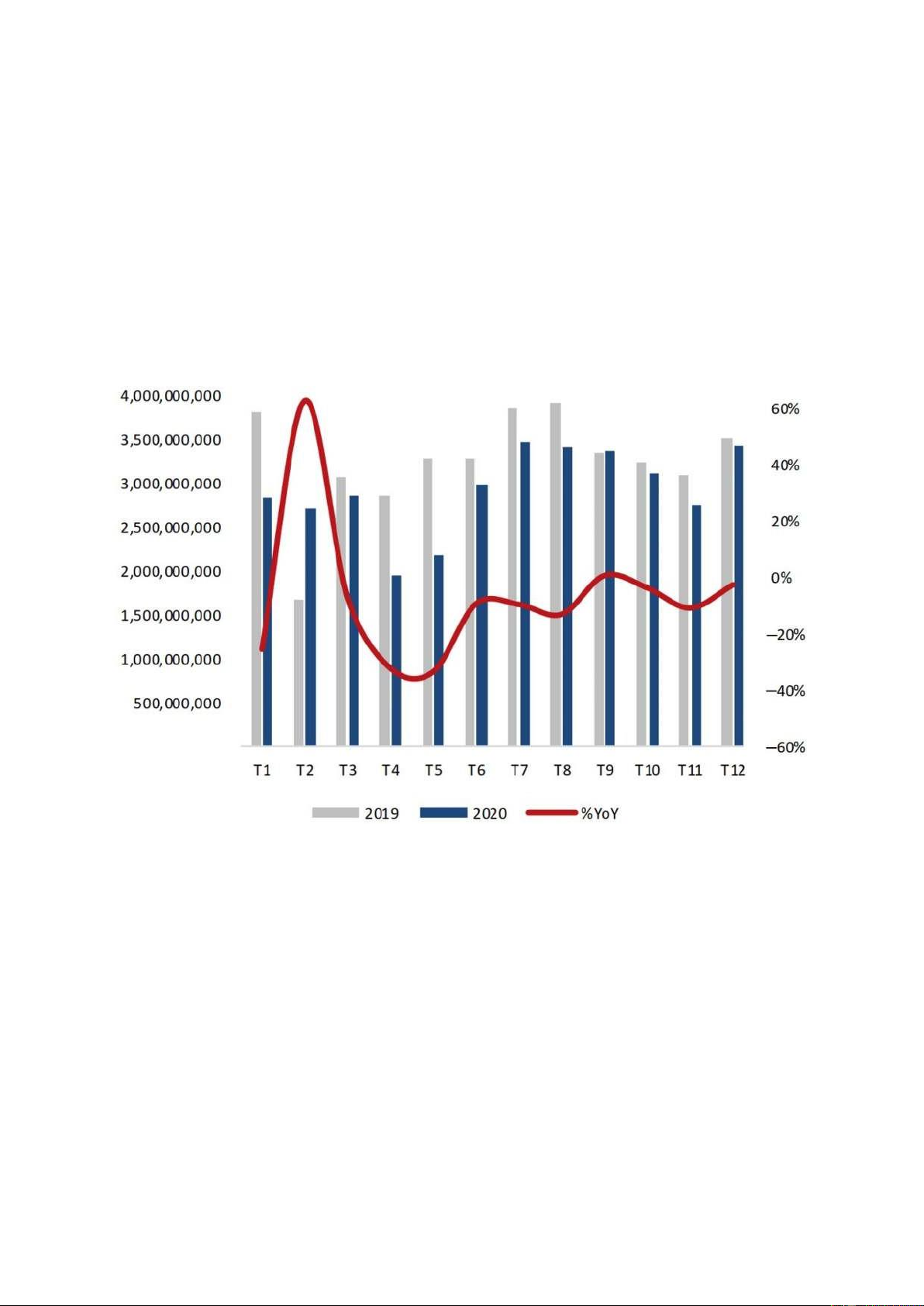

In 2020, due to the heavy impact of the COVID-19 pandemic, Vietnam’s textile and

garment industry faced many challenges, including breaking the supply chain of raw

materials. The supply chain, in terms of human resources, was also greatly affected. Orders

dropped significantly when Vietnam implemented social distancing. By the end of 2020, the

entire Vietnam textile and garment industry achieved an export turnover of 35.29 billion

USD, down 10.91% compared to 2019.

More than that, geopolitical tensions can also be a factor leading to the disruptions.

Recently, the Russia-Ukraine conflict has had many negative impacts on the supply chain to and from Vietnam.

Firstly, Ukraine is a major supplier of wheat, corn, and sunflower oil, while Russia is

a leading exporter of fertilizers, metals, and energy. The conflict has severely disrupted the

availability of these commodities on the global market. As a consequence, Vietnam's

agricultural sector, which relies on imported fertilizers and animal feed, has faced shortages

and rising costs. To be more specific, since 2021, the price of raw materials, including wheat,

corn, and soybeans, has surged by 30 to 40 percent, leading to the loss in profits of

Vietnamese firms in the industry at around 50-100 billion VND. The disruption in metal

supplies has also affected Vietnam's manufacturing sector, particularly in industries that

require steel and aluminum for production (ESMA).

Secondly, it is undeniable that the higher logistics costs can also influence the

international trade of Vietnam. The conflict has increased fuel prices and disrupted shipping

routes, leading to higher costs and delays for Vietnamese companies involved in international

trade. Besides, the fact that Vietnam has to find alternative trade routes, which can also

require a larger amount of money.

→ Sanctions and shifts in trade routes and sourcing can make international trade more

difÏcult and costly, making Vietnamese goods less competitive.

3. Market access and export growth: INTRODUCTION

Statistically, Global economic uncertainties can significantly impact market access and

export growth in countries like Vietnam. As a rapidly growing economy with an export-

driven model, Vietnam faces both challenges and opportunities.

1. Trade Policy Shifts and Market Access

● Tariffs and Trade Barriers: Global trade tensions, especially between major

economies like the U.S. and China, have a ripple effect on Vietnam’s export access.

Trade barriers, changing tariffs, or restrictions in key markets can directly limit

Vietnam's ability to expand its reach.Global trade tensions, particularly between large

economies like the U.S. and China, have significant implications for Vietnam's export

market. Since Vietnam relies heavily on its export sector, shifts in trade policies, such

as tariffs, trade barriers, and restrictions imposed by major trading partners, can create

direct challenges to its economic growth.

● For instance, when the U.S. and China impose tariffs on each other’s goods, Vietnam

might see an increase in demand as companies seek alternative suppliers. However,

this can also mean increased scrutiny on Vietnamese exports, as well as indirect

exposure to the consequences of disruptions in the global supply chain. Additionally,

if key markets impose stricter trade barriers or protectionist policies, Vietnam's access

to those markets could be limited, hindering its potential for expansion.

● Free Trade Agreements (FTAs): Vietnam has strategically signed numerous FTAs,

such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership

(CPTPP) and the EU-Vietnam Free Trade Agreement (EVFTA), which provide

significant opportunities for market access. However, any disruptions in global trade

environments (e.g., Brexit or policy changes in major economies) could impact the

stability and benefits of these agreements.

Evidence :The U.S.-China trade war, which began in 2018, led to a shift in supply

chains as companies sought alternatives to Chinese manufacturing. Vietnam emerged

as a key beneficiary, with significant increases in exports to the U.S. as businesses

relocated manufacturing there.

Statistics: According to the General Statistics Office of Vietnam, exports from

Vietnam to the U.S. rose by 27.8% in 2019, largely due to shifting trade flows from

China to Vietnam. Vietnam’s electronics and apparel sectors saw particular growth as

companies such as Samsung, LG, and others expanded production in Vietnam during the trade war .

2. Currency Volatility

● Exchange Rate Fluctuations: The global economic environment often leads to

currency volatility, affecting the Vietnamese money (VND). If the VND strengthens

against the U.S. dollar or the euro, Vietnamese products will be more expensive in

global markets, making them less attractive and reducing their demand. Conversely, a

weaker VND can enhance competitiveness but raise import costs, especially for inputs in manufacturing:

- Stronger VND: If the VND appreciates against the USD or the euro,

Vietnamese goods become more expensive in global markets. This could

reduce the attractiveness of Vietnamese products to foreign buyers, potentially

lowering demand for exports. Such a scenario may lead to a decrease in

revenue for Vietnamese exporters, especially in competitive industries like

textiles, electronics, and agriculture, where pricing is a key factor.

- Weaker VND: Conversely, if the VND weakens, Vietnamese goods become

cheaper for international buyers, boosting export competitiveness. However,

this comes with the downside of increasing the cost of imports, especially for

raw materials and machinery that Vietnam relies on for its manufacturing

sector. As a result, the cost of production could rise, impacting profit margins

despite increased export sales.

● Currency Depreciation of Trading Partners: If major trading partners experience

currency depreciation, it might reduce their purchasing power, leading to lower

demand for Vietnamese goods. For example, a significant drop in the Chinese yuan

could affect Vietnam’s exports to China, which is one of its largest trading partners.

● Evidence: The Comprehensive and Progressive Agreement for Trans-Pacific

Partnership (CPTPP) and the EU-Vietnam Free Trade Agreement (EVFTA) have

improved Vietnam’s access to markets in Europe, Canada, and Japan. This has

boosted export volumes in sectors such as textiles, footwear, and agriculture. ● Statistics:

○ Vietnam’s exports to the European Union grew by 9% in 2021, with an

increase in key products such as footwear, textiles, and agricultural goods after the EVFTA came into effect .

○ The Vietnam Ministry of Industry and Trade reported that the CPTPP

contributed to a 7.2% increase in exports to CPTPP countries in 2021 .

● Example: Vietnamese textile exporters gained preferential access to European

markets, which allowed them to increase their market share, despite the global

uncertainty during the pandemic .

3. Foreign Direct Investment (FDI) and Export Capacity

● FDI Slowdowns: Vietnam’s export growth has been fueled by strong FDI, especially

in sectors like electronics, textiles, and machinery. Global economic uncertainties,

particularly in investor confidence, can slow down FDI inflows. Reduced foreign

investments can limit Vietnam’s capacity to expand its production capabilities, thus

constraining future export growth.

● Relocation of Manufacturing: However, uncertainties in other regions (e.g., trade

tensions, rising costs in China) have also prompted many multinational corporations

to move production to Vietnam, enhancing its export growth. Companies like

Samsung, Nike, and Intel have expanded their operations in Vietnam, contributing

significantly to the country’s exports.

● Evidence: Fluctuations in the value of VND against the USD impact export

competitiveness, especially in the agricultural and manufacturing sectors. Currency

volatility often correlates with global economic uncertainties. ● Statistics:

○ In 2022, the Vietnamese đồng depreciated by nearly 2% against the U.S. dollar due to

rising global inflation and economic instability . This devaluation made Vietnamese

exports more competitive but also increased import costs for inputs.

○ Vietnam’s rice exports rose by 19.3% in value in 2022 due in part to favorable

currency fluctuations that made Vietnamese rice more competitively priced . Conclusion

While global economic uncertainties pose risks for Vietnam’s export-oriented economy, the

country has demonstrated resilience by capitalizing on trade diversification, supply chain

shifts, and strategic policy alignments. However, its continued export growth will depend on

its ability to navigate these uncertainties, diversify export markets, and enhance

competitiveness through innovation and policy adaptation.

4. Strategic responses and adaptations I.

Government and policy responses in Vietnam.

Vietnam has undergone significant economic, social, and political changes over the past few

decades, driven by a mix of government and policy responses aimed at fostering

development, managing crises, and addressing global challenges. Below are key areas where

the Vietnamese government has implemented important policy responses:

1. Economic Policy Responses

Trade and Integration into Global Markets

● Policy: The government has pursued an aggressive strategy of trade liberalization,

entering into free trade agreements (FTAs) such as the Comprehensive and

Progressive Agreement for Trans-Pacific Partnership (CPTPP) and EU-Vietnam

Free Trade Agreement (EVFTA).

● Impact: These agreements have opened new markets for Vietnamese exports,

particularly in Europe and North America, while reducing tariffs on imports,

promoting industrial growth, and expanding Vietnam’s export-driven economy. ● Results:

- High Economic Growth: Vietnam has consistently achieved robust economic

growth, with an average annual GDP growth rate of 6-7% over the last two

decades. This growth has been largely driven by exports, FDI, and increased trade integration.

- Poverty Reduction: Trade liberalization and integration have contributed

significantly to poverty reduction. According to the World Bank, the poverty

rate in Vietnam fell from over 50% in the 1990s to less than 6% by 2021,

lifting millions out of poverty.

2. Health Policy Responses

COVID-19 Pandemic Response

Economic Support: The government also implemented various support measures such as tax

deferrals, financial aid packages, and low-interest loans to help businesses and workers impacted by lockdowns. ⇒Example:

- Export-Oriented Manufacturing: Specific industries that are crucial to

Vietnam’s export economy, such as electronics, textiles, and agriculture,

received targeted support. For example:

+ The government worked with Samsung, Intel, and other major manufacturers

to keep their production facilities operating despite global supply chain challenges.

+ For textile and garment manufacturers, the government supported shifts to

producing medical supplies, such as personal protective equipment (PPE),

which became a significant export product during the pandemic.

- Agricultural Exports: Vietnam supported agricultural exporters by ensuring

smooth operation of the supply chain and offering logistics solutions for

transporting rice, seafood, and coffee. The Ministry of Agriculture and Rural

Development (MARD) worked to ensure compliance with international

phytosanitary standards, facilitating agricultural exports even amid border restrictions.

3. Foreign Policy and Diplomatic Responses

● Regional Cooperation: Vietnam has played an increasingly active role in regional

diplomacy, particularly within the framework of ASEAN (Association of Southeast

Asian Nations). It has pursued peaceful resolution of disputes, particularly in the

South China Sea, while balancing relations with both China and the United States.

● Bilateral and Multilateral Agreements: In addition to trade agreements, Vietnam

has strengthened its international ties through multilateral diplomacy and participation

in global organizations such as the United Nations and World Trade Organization (WTO). II.

Business strategies in Vietnam.

Vietnam’s business strategies have evolved as the country transitions from a centrally

planned economy to a market-oriented one. Businesses in Vietnam are adopting strategies

that leverage the country’s growing economy, young labor force, integration into global

trade, and evolving consumer demands. Below are the key business strategies commonly used in Vietnam:

1. Export-Driven Strategy

● Goal: Focus on producing goods for export to international markets.

● How It's Achieved: Vietnam has embraced trade liberalization through free trade

agreements (FTAs) like the Comprehensive and Progressive Agreement for Trans-

Pacific Partnership (CPTPP) and EU-Vietnam Free Trade Agreement (EVFTA).

Businesses have aligned themselves to take advantage of these agreements by

focusing on export-led growth.

● Examples: Major sectors like electronics, textiles, footwear, and agriculture

(especially rice, coffee, and seafood) are export-oriented. Companies like Vinamilk

(dairy), TH True Milk (beverages), and Minh Phu Seafood Corporation have

aggressively expanded into global markets.

2. Focus on FDI (Foreign Direct Investment) Strategy

● Goal: Attract foreign investments to boost business operations and access technology.

● How It's Achieved: Vietnam has become a prime destination for foreign direct

investment, with the government offering favorable policies like tax breaks,

simplified regulations, and special economic zones (SEZs). Businesses are focusing

on forming joint ventures, strategic partnerships, and foreign investments to bring in new technology and expertise.

● Examples: The electronics sector, with companies like Samsung and Intel, has

thrived due to massive foreign investment in Vietnam. The government also promotes

FDI in high-tech sectors, renewable energy, and infrastructure development, with

large foreign firms increasingly setting up operations in the country.