Preview text:

ĐỀ ÔN KIỂM TRA 1 TTCK- MS.TRANG Đề 1

PART 1: MULTIPLE CHOICE QUESTIONS

1. Investor A sells a Call option with a strike price of 50.000 VND/share expiring in a month's

time, and being priced at 5000 VND/share. If the market price of this share is at 62.000 VND,

investor A’s net profit will be A. 5.000 VND B. -7.000 VND C. 12.000 VND D. -12.000 VND

2. Zero coupon (discount) bonds

A. Pay no coupon but are issued at a substantial discount to their maturity

B. Pay a coupon which is adjusted in line with some other, usually short-term, interest rate, such as LIBOR

C. Have their par value updated periodically in line with a price index and the coupon payment

increased by the amount of the recent change in the index. D. A, B, C. 3. Bond rating provides

A. probability of default risk of issuers

B. probability of default risk of investors

C. probability of default risk of regulators D. A, B, C. 4. Ex-dividend right date is

A. A date that shareholders receive extra dividends

B. A date that the firm announces its next dividend

C. A date that shareholders are recorded to receive dividends

D. The first day when shares are traded without the right to receive the dividend

5. Vingroup (HOSE VIC)I's total outstanding common shares last month was 730.708.000

shares. Vingroup has recently issued 163.562.000 more shares. It has also bought back

89.012.000 from the stock market by the end of this month. The total common stock outstanding

of Vingroup at the very moment is: A. 730.708.000 shares B. 894.270.000 shares C. 805.258.000 shares ÔN THI TTCCK- MS.TRANG D. 641.696.000 shares

E. Other: _______________ shares

PART 2: TRUE OR FALSE, EXPLAIN

6. Preferred stock has a dividend that must be paid after dividends to common stockholders 12.

7. A coupon bond with face value of 100.000 VND, coupon rate of 8% and semi-annual coupon

payment is issued at the price of 95.000 VND. The bondholders will receive 8000 VND per 6 months

8. When firms issue new shares with share purchase rights, based on the current Vietnamese

regulation, record date is 2 days after the ex-right date. Đề 2

Part I: Multiple choice questions

Which of the following instruments have the characteristics of both equity and bond? A. Government bond B. Corporate bonds C. Common stocks D. Preferred stocks

2 How do you determine the dividend payment of a company?

A, Dividend payment rate x book value

B. Dividend payment rate x market value

C. Dividend payment rate x intrinsic value

D. Dividend payment rate x face value

3. Which of the following is the method of trading on centralized secondary market: Stock Exchange? A. Dutch Auction B. Call Action

C. Discriminatory price auction D. English auction

4. The type of commitment in which the underwriter must sell all of the intended shares or cancel the whole issuance is called A. Firm commitment B. Best effort C. Mini-Maxi D. All or none ÔN THI TTCCK- MS.TRANG

5. Which of the following trading order is available only in opening call auction trading session on secondary market? A. ATO B. ATC C. MP D. Limit Order (LO)

6. The type of trading in which the investor use a proportion of his/her own money while borrow

the rest from the investment bank/ securities firm in order to make a transaction is called A. Buy and hold B. Margin trading C. Short-sale D. Speculation

7. On the continuous auction session for Kido Corporation (KDC) shares, on the sell side,

there’re only orders of 1000 shares at 39.500 VND per share. Then, there is a buying order of

2.000 at MP. How is the trade executed (The tick size is 50 VND) A. NO transaction

B. 1,000 shares is traded, 1.000 buying order at MP turns into 1,000 buying order at 37,450 VND/ share

C. 1,000 shares is traded, 1.000 buying order at MP turns into 1,000 buying order at 37,550 VND/ share

D. 1,000 shares is traded, 1.000 buying order at MP turns into 1,000 buying order at 39,550 VND/ share

8. When will the investor receive a margin call from investment bank in short sale?

A. When the price of stock drop

B. When the price of stock goes up

C. When the price of stock drop so that the true margin is lower than the maintenance margin.

D. When the price of stock goes up so that the true margin is lower than the maintenance margin.

9. What do corporate bond credit ratings by rating agencies such as S&P, Moody’s, Fitch measure? A. Credit risk B. Interest rate risk C. Exchange rate risk D. Maturity risk Part 2: True/ False, explain ÔN THI TTCCK- MS.TRANG

1. The market value/ market capitalization of the stock reflects the expectation of investors

on firm’s value and prospect.

2. Firm commitment means that the commitment of the issuance is made by the firm (issuers)

3. In Discriminatory price auction, only one winning price/ yield is alloted to all winning bidders.

4. If both MP order and ATC order appear at the same time, MP order gets the priority.

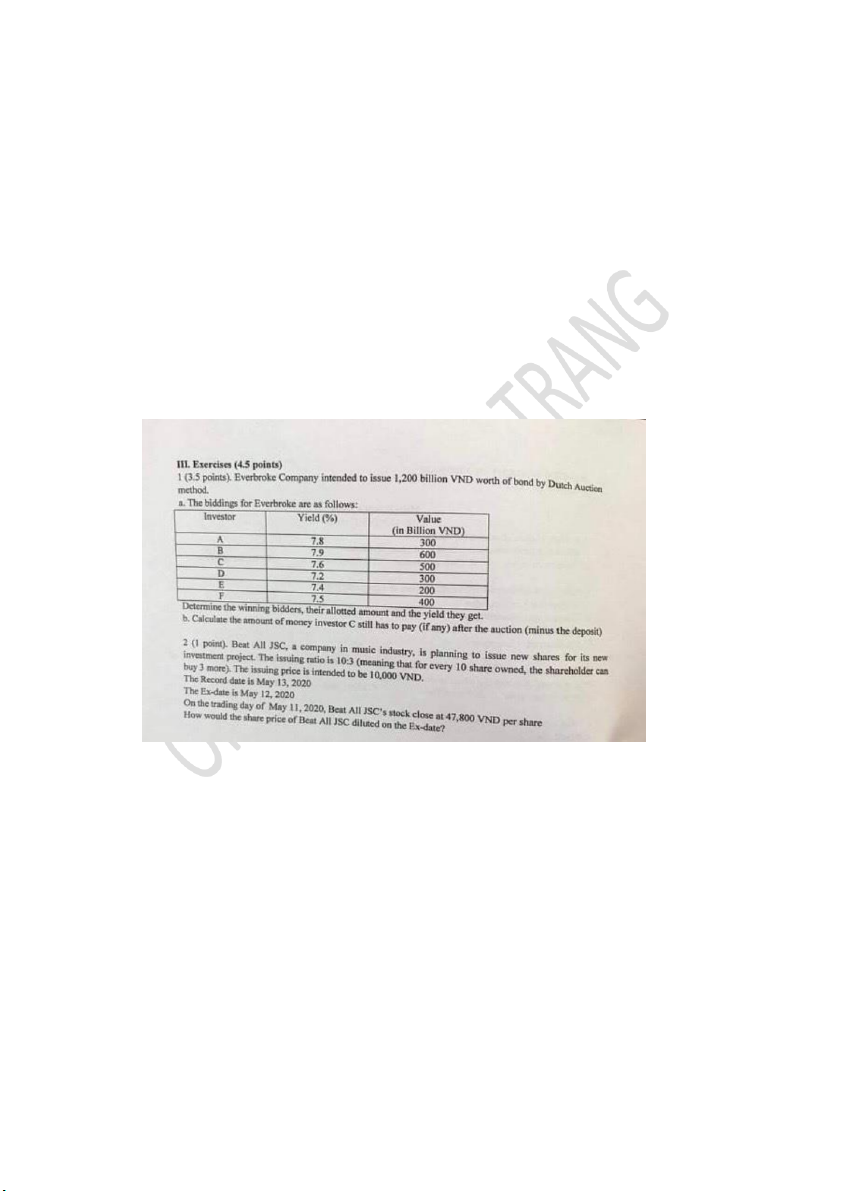

5. Government bond has no credit risk. Part 3: Exercises

1. In the continuous auction session on Hanoi Stock Exchange (HNX), the trading orders of

CAN (Ha Long canned food joint stock company) are as follows: Time Investor Buying Selling Amount (in

Price ( in thousand Amount (in Price ( in thousand shares) VND) shares) VND) 10:50 A 1,200 36.5 10:51 B 500 36.7 10:52 C 1,100 36.6 10:54 D 700 36.4 10:55 E 2,000 MP 10:57 F 800 MP

A, Determine the trading results for each investor

B, What would the results change if at 10:53, there was another investor, G, making an order to buy 500 CAN stock at 36.5

C, Determine the brokerage fee that investor E had to pay if the brokerage fee rate is 0.35% per transaction value. 2.

Everbroke Company intended to issue 5 million shares to public by Auction method.

A, Give an advice to Everbroke for which Auction method (Dutch or Discriminatory Price

Auction) is more beneficial for Everbroker (bring the most proceeds)

B, With the method you advised, the biddings for Everbroke are as follows: ÔN THI TTCCK- MS.TRANG Investor Price (in thousand VND) Amount (in thousand shares) A 35.2 1,000 B 35.3 900 C 35.8 1,200 D 35.6 650 E 35.7 2,100 F 35.4 2,300

Determine the winning bidders, their allotted amount and the price they get. Đề 3 I. MPChoice

1. Which of the following instruments is an equity instrument? A.

Government bonds B. Corporate bonds C. Common stock D. Preferred stock

2. How do you determine the Interest payment of a corporate bond? A. Coupon rate * market rate B. Discount rate * market value C. Coupon rate * market value D. Discount rate * face value

3. The type of commitment in which the underwriter must sell up to certain proportion (say,

80%) of issuing share or cancel the whole insurance is called: A. Firm commitment

B. Best Effort C. Mini- Maxi D. All of None

4. What is the most important risk for a bond? A. Credit risk B. Interest risk C. Inflation risk D. Maturity risk

5. Which of the following is the characteristic of common stock? A. Fixed Income B. Residual claims C. Risk hedging D. Has maturity

6. Which of the following institutions can issue bond? A. Limited Liability Company ÔN THI TTCCK- MS.TRANG B. Government C. Corporation D. All are correct E. None of the above

II. True and False Brief explanations 1. I the best ef n

forts commitment, the underwriter will have to try its best to help the issuer

sell all the securities and will have to buy back any residual securities that have not been sold.

2. In a Zero coupon bond, your interest payment on the day is zero (e-g 10, 20, 30 of the month).

3. In the Dutch auction, only one special winning prize is distributed to all winning bidders.

4. After the IPO, the company cannot issue common stock anymore.

5. Common stock can only be issued by a Public Company III. Exercise ĐỀ 4. I. MPChoice

1. Which of the following is NOT a trading mechanism of the Stock Exchange market in Vietnam? A. Auction B. Negotiable transaction ÔN THI TTCCK- MS.TRANG C. Market making

D. Is the pricing market determined? E None of the above

2. How is the price of newly issued shares on primary market determined? A. Due diligence B. Auctions Book C Book Building D. All of the above

3. Which of the following is the method of trading on centralized secondary market: Stock Exchange? A. Dutch Auction B. Continuous Auction

C. Discriminatory price auction D. English auction

4. What kind of financial institution can provide underwriting service of stocks on primary market? A. Commercial Bank B. Brokerage firm C. Investment Banks D. All of the above

5. Which of the following trading orders is available only in continuous auction trading method on secondary market? A. ATO B. ATC C. MP D. Limit Order (L ) O

6. Listing of a domestic company on a foreign Stock Exchange is called A. Initial Listing B. Back - door Listing C. Cross - listing D. Change Listing

7 On the continuous auction session for Kido Corporation ( KDC ) shares , on the sell side ,

there're only orders of 1,000 shares at 56,500 VND per share. Then , there is a buying order of

2,000 at MP . How is the trade executed? (The price unit / tick size is 50 VND ) A. NO transaction

B. 1,000 shares is traded 1,000 buying order at MP turns into 1,000 buying order at 56,450 VND / share ÔN THI TTCCK- MS.TRANG

C. 1,000 shares is traded, 1,000 buying order at MP turns into 1,000 buying order at 56,550 VND / share

D. 1,000 shares is traded, 1,000 buying order at MP turns into 1,000 buying order at 56,600 VND / share

8. When will the investor receive a margin call from investment bank in short - sale ?

A. When the price of stock drop

B. When the price of stock goes up

C. When the price of stock drop so that the true margin is lower that the maintenance margin

D. When the price of stock goes up 10 that the true margin is lower than the maintenance turnip

9. Which of the following is of the most important preference/ priority for orders on Stock Exchange ? A. Price B. Time C. Amount D. Tick size

10. John bought a European call option for 100 IBM shares with the strike price of $45/ share

and had to pay the premium of $55 / share . Several months later, when the option expires, IBM

shares price is at 5:32 What is the profit (loss) of John ? A. $800 B. -1,800 C. - $500 D. Other (specify)-------- II. True/ False, Explanation

1. The development of the primary market leads to the development of the secondary market.

2. The settlement process of T+ 2 means that after 2 day (including weekends), the stock and money are settled.

3. In Discriminatory price auction, only one winning price/ yield is allotted to all winning bidders.

4. If both MP order and ATO order appear at the same time, MP order gets the priority.

5. The government conducted a Dutch auction for government bond to mobilize 300 billion

VND. The bidders are as follows: Investor Bidding value ( in billions) Yield(%) A 200 6.75 B 210 6.5 C 180 6.95 ÔN THI TTCCK- MS.TRANG D 240 6.6

Investor A is allotted all 200 billion VNĐ in bonds at 6.75 % III. Exercise

On 16 th of September, 201X the orders at Closing session’s call auction are accumulated as follows: Purchase Price( in thousand VND) Sale Investor Amount Investor Amount A 500 23.5 D 1560 0 23.4 E 1400 B 1500 23.2 F 450 C 1750 23.1 ATO G 600 a.

Specify the closing price and the trading results (the LEP is 23.4)

How much do B and G have to pay for brokerage free? (The commission fee is 0.3%)

2. Michael Yass opened a margin account to trade IBM stocks on margin. He intended to buy

1000 IBM shares at $120 per share. The initial margin required is 60%. The maintenance margin is 30%

a. How much would IBM price fluctuate before the investment bank issues a margin call to M. Yass ?

b. After 3 months, IBM stock price rises to $ 135. What is M. Yass's true margin ratio? Would he receive a margin call?

c . After 6 months, IBM stock price drops to $ 80. Would the investment bank issue a margin call to M. Yass? ÔN THI TTCCK- MS.TRANG