Preview text:

ĐỀ ÔN TẬP CUỐI KỲ

CHƯƠNG 6:

BÀI 1:

Bài giải:

a,

- 1 January 2020:

Dr Invesment in Associate and Joint Venture: $80,000

Cr Machine: $25,000

Cr Cash: $55,000

- 31 Dec 2020:

Dr Share of profit or loss of associate and joint venture: $60,000 x 30% = $18,000 Cr Invesment in associate and joint venture : $18,000

- Asset revaluation surplus:

Dr Invesment in associate and joint venture: $50,000 x 30% = $15,000

Cr Share of OCI of associate and joint venture: $15,000

Dr Share of OCI of associate and joint venture: $15,000 Cr Asset revaluation surplus: $15,000

- 31 Dec 2021:

Dr Invesment in associate and joint venture: ($80,000 - $80,000 x 20%)x30% = $19,200

Cr Share of profit or loss of associate and joint venture: $19,200

- Dividend:

Dr Cash: $20,000 x 30% x 50% = $3,000

Dr Dividends receivable: $3,000

Cr Invesment in associate and joint venture: $20,000 x 30% = $6,000

- Asset revaluation surplus:

Dr Share of OCI of associate and joint venture: $20,000 x 30% = $6,000

Cr Invesment in associate and joint venture: $6,000

Dr Asset revaluation surplus: $6,000

Cr Share of OCI of associate and joint venture: $6,000

B, At 31 Dec 2021 the Invesment in associate and joint venture measures is $84,200

(= $80,000 - $18,000 + $15,000 + $19,200 - $6,000 - $6,000)

C,

Share capitial $100,000

Asset revaluation $ 30,000

General reserve $ 6,000

Retained earning $ 98,000 ( = $120,000 – 60,000 + (80,000 – 80,000 x 20%) – 20,000 –

6,000) Bài 2:

Bài giải:

a,

- 1 January 2020:

Dr Invesment in Associate and Joint Venture: $80,000

Cr Equipment: $22,000

Cr Cash: $58,000

- 31 Dec 2020:

Dr Share of profit or loss of associate and joint venture: $50,000 x 30% = $15,000 Cr Invesment in associate and joint venture : $18,000

- Asset revaluation surplus:

Dr Invesment in associate and joint venture: $40,000 x 30% = $12,000

Cr Share of OCI of associate and joint venture: $12,000

Dr Share of OCI of associate and joint venture: $12,000 Cr Asset revaluation surplus: $12,000

- 31 Dec 2021:

Dr Invesment in associate and joint venture: ($60,000 - $60,000 x 20%)x30% = $14,400 Cr Share of profit or loss of associate and joint venture: $14,400

- Dividend:

Dr Cash: $12,000 x 30% x 50% = $1,800

Dr Dividends receivable: $1,800

Cr Invesment in associate and joint venture: $12,000 x 30% = $3,600

B, At 31 Dec 2021 the Invesment in associate and joint venture measures is $87,800

(= $80,000 - $18,000 + $12,000 + $14,400 - $3,600 )

C,

Share capitial $100,000

Asset revaluation $ 60,000

General reserve $ 6,000

Retained earning $ 80,000 ( = $100,000 – 50,000 + (60,000 – 60,000 x 20%) – 12,000 –

6,000)

Bài 3:

Bài giải:

a,

- 1 January 2015:

Dr Invesment in Associate and Joint Venture: $66,000 Cr Cash: $66,000

- 31 Dec 2015:

Dr Invesment in associate and joint venture: ($60,000 - $60,000 x 20%) x 30% = $14,400 Cr Share of profit or loss of associate and joint venture: $14,400

- Dividend:

Dr Cash: $20,000 x 30% = $6,000

Cr Invesment in associate and joint venture: $6,000

- Asset revaluation surplus:

Dr Invesment in associate and joint venture: $30,000 x 30% = $9,000

Cr Share of OCI of associate and joint venture: $9,000

Dr Share of OCI of associate and joint venture: $9,000 Cr Asset revaluation surplus: $9,000

- 31 Dec 2016:

Dr Share of profit or loss of associate and joint venture: $50,000 x 30% = $15,000 Cr Invesment in associate and joint venture: $15,000 - Asset revaluation surplus:

Dr Share of OCI of associate and joint venture: $20,000 x 30% = $6,000

Cr Invesment in associate and joint venture: $30,000 x 30% = $6,000

Dr Asset revaluation surplus: $6,000

Cr Share of OCI of associate and joint venture:$6,000

B, At 31 Dec 2021 the Invesment in associate and joint venture measures is $62,400

(= $66,000 - $6,000 + $14,400 + $9,000 - $15,000 - $6,000)

C,

Share capitial $100,000

Asset revaluation $ 10,000

General reserve $ 3,000

Retained earning $ 95,000 ( = $120,000 - 50,000+ (60,000 – 60,000 x 20%) – 20,000 – 3,000)

CHƯƠNG 5:

Bài 1:

1,

Building $20,000

Depreciation year 2010 (($20,000 - $2,000)/ 10)/2 = $900

Depreciation year 2011 ($20,000 - $2,000)/ 10 = $1,800

Depreciation year 2012 ($20,000 - $2,000)/ 10 = $1,800

Depreciation year 2013 ($20,000 - $2,000)/ 10 = $1,800

Carrying amount $20,000 – $1,800 x 3 - $900 = $13,700

The manager reconsiders the residual value and changes it to $3,000

After reconsidering

Depreciation for the year ($13,700 - $3,000)/6.5 = $1,646

Dr Depreciation expense $1,646

Cr Accumulated Depreciation $1,646

2,

Building $300,000

Depreciation year 2020 ($300,000 - $2,000)/ 10 = $29,800

Depreciation year 2021 ($300,000 - $2,000)/ 10 = $29,800

Depreciation year 2022 ($300,000 - $2,000)/ 10 = $29,800

Depreciation year 2023 (($300,000 - $2,000)/ 10)/2 = $14,900

Carrying amount $300,000 – S29,800 x 3 - $14,900 = $195,700

The depreciation rates for similar buildings used in its industry and decided that the building should be depreciated 10 years

After reconsidering

Depreciation for the year ($195,700 - $2,000)/16.5 = $11,739

Dr Depreciation expense $11,739 Cr Accumulated Depreciation $11,739

Bài 2:

Bài giải:

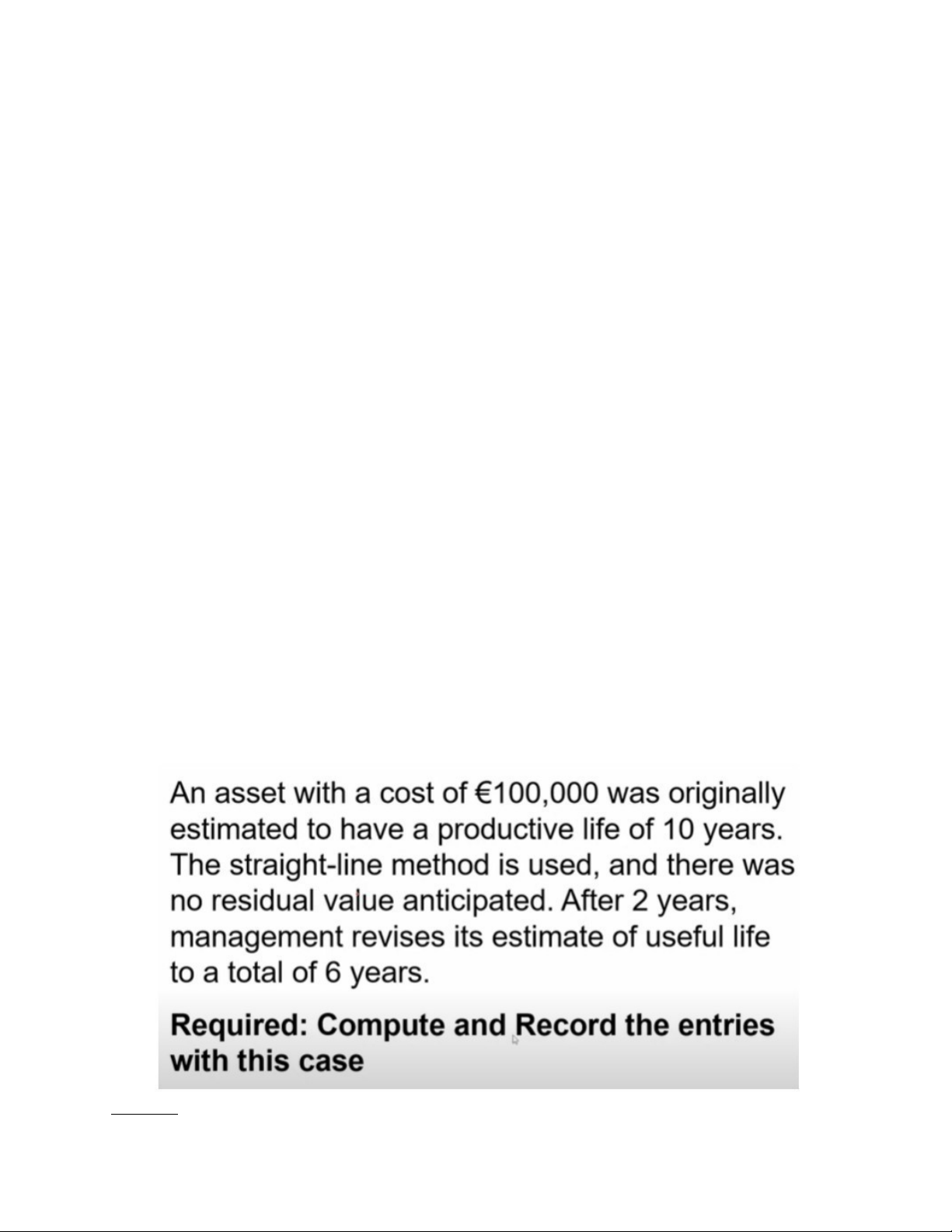

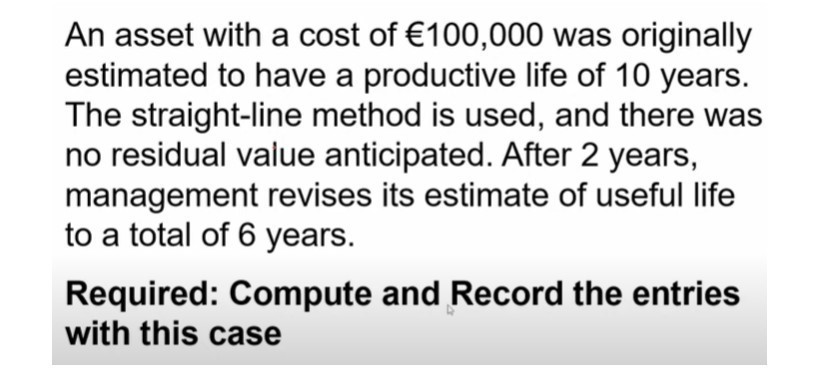

Cost 100,000

Depreciation year 1 ( 100,000 – 0)/ 10 = 10,000

Depreciation year 2 10,000

Carrying amount 100,000 – 10,000 x 2 = 80,000

The management revises its estimate of useful life to a total of 6 years

After revising

Depreciation for the year (80,000 – 0)/ 4 = 20,000

Dr Depreciation expense 20,000 Cr Accumulated Depreciation 20,000 Bài 3:

Bài giải:

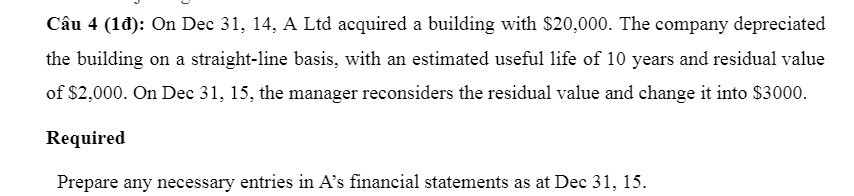

Building $20,000

Depreciation year 14 ($20,000 - $2,000)/ 10 = $1,800

Carrying amount $20,000 - $1,800 = $19,200

The managar reconsiders the residual value and change it into $3000

After Reconsidering

Depreciation for the year ($19,200 - $3,000)/ 9 = $1,800

Dr Depreciation expense $1,800 Cr Accumulated Depreciation $1,800

Bài 4:

Bài giải:

Cost 3,600,000

Depreciation year 2009 (3,600,000 – 0)/ 10 = 360,000

Depreciation year 2010 (3,600,000 – 0)/ 10 = 360,000

Depreciation year 2011 (3,600,000 – 0)/ 10 = 360,000

Carrying amount 3,600,000 – 360,000 x 3 = 2,520,000

The directors deceided the the remaining useful life of the machine at 1 January 2012 was three years

After revising

Depreciation for the year (2,520,000 – 0)/ 3 = 840,000

Dr Depreciation expense 840,000 Cr Accumulated Depreciation 840,000

Bài 5:

Bài giải:

Building $30,000

Depreciation year 10 ($30,000 - $3,000)/5 = $5,400

Depreciation year 11 $5,400

Depreciation year 12 $5,400

Carrying amount $30,000 - $5,400 x 3 = $13,800

The manager reconsider the residual value and change it into $5,000

After reconsidering

Depreciation for the year ( 13,800 – 5,000)/ 2 = 4,400

CHƯƠNG 4

- Có bankruptcy, lower, sale of inventory, discovery, disposal, settlement -> Adjusting events -> This event provides evidence of conditions that existed at the reporting date.

- Còn lại là -> non – adjusting -> This event provides evidence of conditions that existed after the reporting date.

CHƯƠNG 3: