lOMoARcPSD|44862240

TRƯỜNG ĐẠI HỌC CÔNG NGHIỆP TP HCM

KHOA KẾ TOÁN KIỂM TOÁN

--------

ĐỀ THI GIỮA KỲ HỌC KỲ 2 NĂM HỌC 2021-2022

Môn: CMBCTCQT 2

Đề 1

Thời gian làm bài: 45 phút

Question 1 (1.5 marks):

a What is the definition of functional currency? (0.5 mark) b How many statements include in the financial

statements? What does Statement of changes in equity present? And what kind of stakeholders need Statement of

changes in equity? (1 mark)

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

Question 2: (4 marks)

On 30 October Barney, a company with $ as its functional currency, buys goods from Rubble for £90,000.

The contract requires Barney to pay for the goods in sterling, in four equal installments on 30 November, 31

December, 31 January and 28 February.

Additionally, on 30 October Barney also sells goods to XYZ Company for £200,000,000 on account. On 30

November, XYZ Company pays ¼ amount owed to Barney. On 31 December XYZ Company pays ¾ amount owed

to Barney.

Additionally, on 30 October, the company makes a loan from Agribank with an amount of £40,000 and receive cash

at bank. On 31 January, the company pays all the money owed to Agribank by using cast at bank

Barney’s end of reporting period is 31 December.

Exchange rate:

30 October $1.80 =

£1

30 November $1.90 =

£1

31 December $1.70 =

£1

31 January $1.50 =

£1

28 February $2.10 =

£1

Require:

Prepare the journal entries that would appear in Barney’s books in respect of the purchase of the goods and the

settlement made

lOMoARcPSD|44862240

Accounts used in question 2:

+ Cast at bank

+ Account Receivable

+ Account Payable

+ Revenue

+ Loan payable

+ Merchandise Goods

+ Exchange Gain (P/L)

+ Exchange Loss (P/L)

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

Question 3: (1 marks)

The general ledger trial balance of Lachlan Ltd includes the following accounts at 30 June 2013:

(a) Sales revenue $1 500 000

(b) Interest income 29 000

(c) Gain on sale of plant 10 000

(d) Valuation gain on trading securities 30 000

(e) Dividend revenue 8 000

(f) Cost of sales 800 000

(g) Finance expenses 30 000

lOMoARcPSD|44862240

(h) Selling and distribution expenses 80 000

(i) Administrative expenses 40

000

(j) Income tax expense 48

000

Additional information

The loss on valuation of available-for-sale investments was $1000 net of tax. No available-for- sale investments

were sold during the year.

Required

Prepare the statement of profit or loss and other comprehensive income of Lachlan Ltd for the year ended 30 June

2013, showing the analysis of expenses in the statement

Lachlan Ltd

Statement of Comprehensive Income for the year ended 30 June 2013

Revenue

Cost of sales

Gross profit

Other income

Selling and distribution expenses

Administrative expenses

Finance costs

Profit before tax

Income tax expense

Profit for the year

Other comprehensive income:

Revaluation loss on available-for-sale financial assets, net of tax

Total comprehensive income for the year Calculations:

Other income comprises:

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

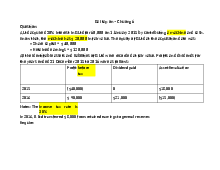

Question 5: (1 mark)

For each of the following, determine the missing balance. a.

lOMoARcPSD|44862240

b.

Question 6: (1.5 marks)

Ramond Company has hired you to prepare financial statements for the year ending 12/31. On your first day of

work, your assistant comes to you with several items that could be classified as expenses or could be classified as

assets. Based on your knowledge of accounting so far, determine whether the following items should be recorded as

an expense or an asset.

+ On 12/31, Ramond paid $14,000 to rent office space for the next twelve months.

+ On 10/1, Ramond paid $40,000 for insurance that covered the company’s property for the last quarter of the year.

+ On 6/1, Ramond purchased $27,000 in supplies, all of which were used by 12/31.

+ On 12/31, Ramond purchased $5,000 worth of supplies for the coming month.

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

lOMoARcPSD|44862240

Question 7: (1 mark)

What are the major limitations of a statement of financial position as a source of information for users of general

purpose financial statements?

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

Lưu ý: Sinh viên làm bài trực tiếp trên đề thi

--------------Hết-----------

TRƯỜNG ĐẠI HỌC CÔNG NGHIỆP TP HCM

KHOA KẾ TOÁN KIỂM TOÁN

--------

ĐỀ THI GIỮA KỲ HỌC KỲ 2 NĂM HỌC 2022-2023

Môn: CMBCTCQT 2

Đề 1

Thời gian làm bài: 45 phút

Question 1: NP Co, whose year end is 31 December, Use Functional currency of dolar ($), buys some goods from

AP of Germany on 31 August. The invoice value is €60,000 and is due for settlement in equal instalments on 30

November and 31 January. The exchange rate moved as follows.

1$= €

31 August 1.20

30 November 1.40

31 December 1.80

31 January 1.60

Required

State the accounting entries in the books of NP Co.

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

............................................................................................................................................................................................................................................................... .

..............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

lOMoARcPSD|44862240

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

Question 2: (2 marks) – CLO 1

Jodomo Ltd acquired a 40% interest in NPA Ltd for $170 000 on 1 July 2013. The share capital, reserves and

retained earnings of NPA Ltd at the acquisition date and at 30 June 2014 were as follows:

1 July 2013 30 June 2014

Share capital $ 300 000 $ 300 000

Asset revaluation surplus — 100 000

General reserve — 15 000

Retained earnings $100 000 109 000

At 1 July 2013, all the identifiable assets and liabilities of NPA Ltd were recorded at fair value. The following is

applicable to NPA Ltd for the year to 30 June 2014:

a Profit (after income tax expense of $11 000): $39 000 b Increase in reserves – General (transferred from

retained earnings): $15 000 – Asset revaluation (revaluation of freehold land and buildings at 30 June 2014): $100

000 c Dividends paid to shareholders: $15,000 d The tax rate is 30%. e Jasmine Ltd does not prepare

consolidated financial statements.

Required: Prepare the journal entries in the records of Jodomo Ltd for the year ended 30 June 2014 in

relation to its investment in the associate, NPA Ltd.

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

lOMoARcPSD|44862240

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

Question 3 (2 marks):

EHB Ltd

STATEMENT OF PROFIT OR LOSS

For the year ended 30 June 2013

Sales revenue $ 1,300,000

Cost of sale $ (820,000)

Gross profit $ 480,000

Other operating income $ 41,000

Finance expenses $ (34,000)

Selling and distribution cost $ (175,000)

Administrative expenses $ (152,000)

Research cost $ (58,000)

Total operating expense $ (419,000)

Profit before tax $ 102,000

Income tax $ 31,000

Profit after tax $ 71,000

Other comprehensive income

Asset revaluation $ 100,000

Income tax relating to asset revaluation $ (30,000)

Total other comprehensive $ 70,000

Total comprehensive income $ 141,000

Explanations:

Other operating income including

Interest income $ 2,000

Gain on sale of plant $ 26,000

Rental income $ 2,000

Royalty income $ 10,000

Other revenue $ 1,000

Finance expenses including

Sundry borrowing costs $ (1,000)

Interest on borrowings $ (33,000)

lOMoARcPSD|44862240

Selling and distribution cost including

Advertising expense $ (25,000)

Sale staff salaries $ (97,000)

Freight out $ (32,000)

Shipping supplies $ (16,000)

Depreciation on sales equipment $ (5,000)

Administrative expenses including

Administrative salaries $ (72,000)

Legal and professional fees $ (13,000)

Office rent expense $ (30,000)

Insurance expense $ (14,000)

Depreciation of office equipment $ (16,000)

Stationery and supplies $ (5,000)

Miscellaneous expense $ (2,000)

Research cost including

Research expense $ (51,000)

Amortisation of patents $ (7,000)

Question 4 a (1 mark): Measuring an owner-occupied item of property, plant, and equipment On Dec 31, 10, entity

E gains control of entity S, S owns a specialized building, The building was constructed by S at the beginning of the

year 01, The costs of conversion were CU 10, Between the time of construction and Dec 31, 10, the appropriate

price index increased by 20%, Originally the realistically estimated useful life was 30 years, On Dec 31, 10, the

remaining useful life is 20 years

Required Determine the carrying amount (fair value) of the building in E’s consolidated financial statements

as at Dec 31, 10?

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

Question 4 b (1 mark): On Jan,1,12, NPA Ltd acquired a building with $40,000, NPA Depreciation the building on

a straight – line basis, with an estimated useful life of 5 year and residual value of $2000, On Dec 31, 13 the

manager reconsider the residual value and change it into $4000

Required: Prepare any necessary entries in NPA’S Financial statement Dec 31,13

...............................................................................................................................................................................................................................................................

lOMoARcPSD|44862240

............................................................................................................................................................................................................................................................... ....

...........................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

Question 5 (2 marks): Consider the following items for Cooper Ltd at 30 June 2016:

(a) Contingent liabilities

(b) The effect on retained earnings of the correction of a prior period error

(c) Cash and cash equivalents

(d) Capital contributed during the year

(e) Revaluation gain on land (not reversing any previous revaluation)

(f) Judgements that management has made in classifying financial assets

(g) Income tax expense

(h) Provisions

(i) The effect on retained earnings of the correction of a prior period error

(j) Revaluation gain a property (not reserving any previous revalue)

(k) Accumulated depreciation equipment

(l) Allowance for doubtful debts

(m) Valuation gain on trading instruments

(n) Interest in income

(o) Gain from translation financial statement

Required State whether each item is reported:

1.In the statement of financial position

2.In profit or loss in the statement of profit or loss and other comprehensive income 3, in other comprehensive

income in the statement of profit or loss and other comprehensive income

3.In the statement of changes in equity

4.In the notes to the financial statements

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

............................................................................................................................................................................................................................................................... ....

...........................................................................................................................................................................................................................................................

lOMoARcPSD|44862240

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

CHAPTER 1: FOREIGN EXCHANGE

1. Definitions of terms

Closing rate.......................................................................................................................................................................................................................................

Conversion.........................................................................................................................................................................................................................................

Exchange

difference..................................................................................................................................................................................................................... Exchange

rate................................................................................................................................................................................................................................... Fair

value. .........................................................................................................................................................................................................................................

Foreign currency.

lOMoARcPSD|44862240

.......................................................................................................................................................................................................................... Foreign currency

financial statements. ............................................................................................................................................................................

Foreign currency transactions. ..............................................................................................................................................................................................

1. Buys or sells goods or services whose prices are denominated in foreign currency;

2. Borrows or lends funds and the amounts payable, or receivable are denominated in foreign currency;

3. Is a party to an unperformed foreign exchange contract; or

4. For other reasons acquires or disposes of assets or incurs or settles liabilities denominated in foreign currency.

Foreign currency translation. .................................................................................................................................................................................................

Foreign operation. ........................................................................................................................................................................................................................

Functional currency. ...................................................................................................................................................................................................................

Group....................................................................................................................................................................................................................................................

Monetary items...............................................................................................................................................................................................................................

Net investment in a foreign

operation................................................................................................................................................................................ Nonmonetary

items...................................................................................................................................................................................................................... Presentation

currency.................................................................................................................................................................................................................. Reporting

entity.............................................................................................................................................................................................................................. Spot

exchange rate........................................................................................................................................................................................................................

Transaction

date..............................................................................................................................................................................................................................

2. QUESTION

Question 1: Monetary vs. non-monetary items

(a) In Dec 01, entity E delivers merchandise to entity F. Hence, E recognizes a trade receivable.

(b) On Dec 31, 01, merchandise is stored in E's warehouse

(c) On Dec 01, 01, E pays the rent for a machine rented under an operating lease for the period Dec 01, 01 to Feb

28,02 in advance. The rent is CU 1 per month. Correctly, E makes the following entry:

Dec 01, 01

Dr Deferred expense 2

Dr Expense 1

Cr Cash 3

(d) E holds 3% of the shares of entity G.

(e) E has recognized a deferred tax liability in its statement of financial position.

Required

Determine whether the bold items are monetary or non-monetary items in E's financial statements as at Dec 31, 01

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

lOMoARcPSD|44862240

Question 2: Foreign currency transactions-monetary items

On Dec 31, 01, entity E has trade receivables from the foreign customers A and B. E's functional currency is the yen.

The following quotes are direct (1 foreign currency unit = x yen):

Date of the Foreign Currency Exchange rate on the date

of the transaction

Exchange rate on

Dec 31.01

Customer A Nov 01, 01 20m 3 4

Customer B Dec 01, 01 50m 10 8

Required

Prepare any necessary entries in E's financial statements as at Dec 31, 01.

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

Question 3: Translation of foreign currency financial statements- current rate method

On Jan 01, 01, entity E (a Chinese entity) acquires 100% of the shares of a foreign operation.

E's consolidated financial statements are presented in CNY (presentation currency). The financial statements of the

foreign operation are presented in foreign currency F. Assume that currency F is the foreign operation's functional

currency, Consequently, translation is effected according to the current rate method. The following quotes are direct

(1 unit of currency F = x CNY):

Exchange rate on Jan 01, 01 4

Exchange rate on Dec 31, 01 6

Average exchange rate for 01 5

The following tables are simplified presentations of the foreign operation's statement of financial position II as at

Dec 31, 01 and its separate income statement II for the year 01 (in currency F):

Statement of financial position II Dec 31, 01

Land 50m

Buildings 50m Inventories20m

Cash 30m

Total assets 150m

Share capital 80m

Retained earnings 10m

Liabilities 60m

Total equity and liabilities 150m

Separate income statement II Year

01

Revenue 80m

Raw material and consumables used 50m

Depreciation expense 10m

Other expenses 10m

Profit for the year 10m

Required

E prepares its consolidated financial statements as at Dec 31, 01. Perform the necessary foreign currency translation

of the financial statements of the foreign operation. Assume for simplification purposes that it is acceptable to use an

average exchange rate for the year for the appropriate items.

...............................................................................................................................................................................................................................................................

lOMoARcPSD|44862240

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

Question 4:

White Cliffs Co, whose year end is 31 December, buys some goods from Rinka SA bill of France on 30 September.

The invoice value is €40,000 and is due for settlement in equal instalments on 30 November and 31 January. The

exchange rate moved as follows. 1€= $1

30 September 1.60

30 November 1.80

31 December 1.90

31 January 1.85

Required

State the accounting entries in the books of White Cliffs Co

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

............................................................................................................................................................................................................................................................... ..

.............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

Question 5:

NP Co, located texas at US, whose year end is 31 December, buys some goods from Pier of France on 20

August. The invoice value is € 60,000 and is due for settlement in equal instalments on 20 November and 20

February. The exchange rate moved as follows.

1€= $

20 August 1.60

lOMoARcPSD|44862240

20 November 1.85 31

December 1.90

20 February 1.80

Required

State the accounting entries in the books of White NP Co Co.

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

...............................................................................................................................................................................................................................................................

CHAPTER 3: IAS 1 - PRESENTATION OF FINANCIAL STATEMENTS

1. DEFINITIONS OF TERMS

General-purpose financial statements..............................................................................................................................................................................

Impracticable.................................................................................................................................................................................................................................

. Notes.

................................................................................................................................................................................................................................................

Other comprehensive income...............................................................................................................................................................................................

1. Changes in revaluation surplus (IAS 16 and IAS 38);

2. Actuarial gains and losses on defined benefit plans (IAS 19);

3. Translation gains and losses (IAS 21);

4. Gains and losses on remeasuring available-for-sale financial assets (IAS 39);

5. The effective portion of gains and losses on hedging instruments in a flow hedge (IAS 39).

Owners...............................................................................................................................................................................................................................................

Profit or loss....................................................................................................................................................................................................................................

Reclassification adjustments.................................................................................................................................................................................................

Total comprehensive income.................................................................................................................................................................................................

1. QUESTION

Exercise 3.1 FAIR PRESENTATION

The directors of a New Zealand company that is required to prepare financial reports under the New Zealand

Companies Act conclude that applying the requirements of the New Zealand equivalent of IAS 36 Impairment of

lOMoARcPSD|44862240

Assets would not provide a fair presentation because the resulting $80 000 impairment loss is temporary. The

company is subject to the Financial Reporting Act 1993 (New Zealand) which prohibits departure from the

requirements of NZ IFRSS. Required