Preview text:

lOMoAR cPSD| 41487147 Conception: Deflation

- Mirror images of inflation, deflation can have significant impacts on individuals,

businesses, and overall economy. - Measured by CPI and PPI. - Caused by: o decrease in AD,

o reduction in the supply of money, o a decline in confidence,

o or an increase in aggregate supply. - Consequences: detrimental o lower income for producers

o an increase in unemployment rates

o increase the real debt burden -> making it harder for individuals and businesses to repay debts.

* Deflationary spirals, where consumers delay spending, can further exacerbate the economic situation

=> Overall, deflation poses significant challenges for governments and economies

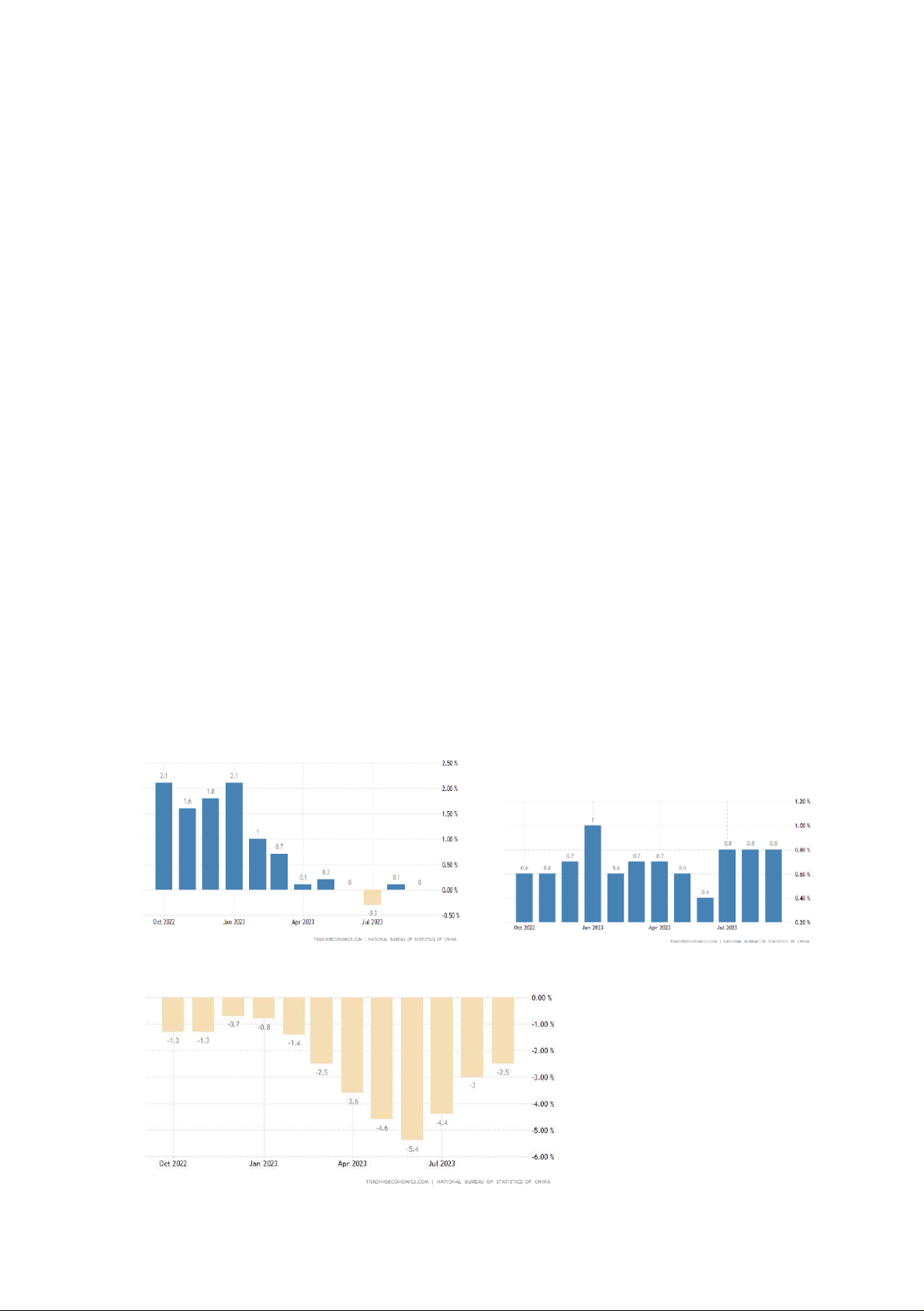

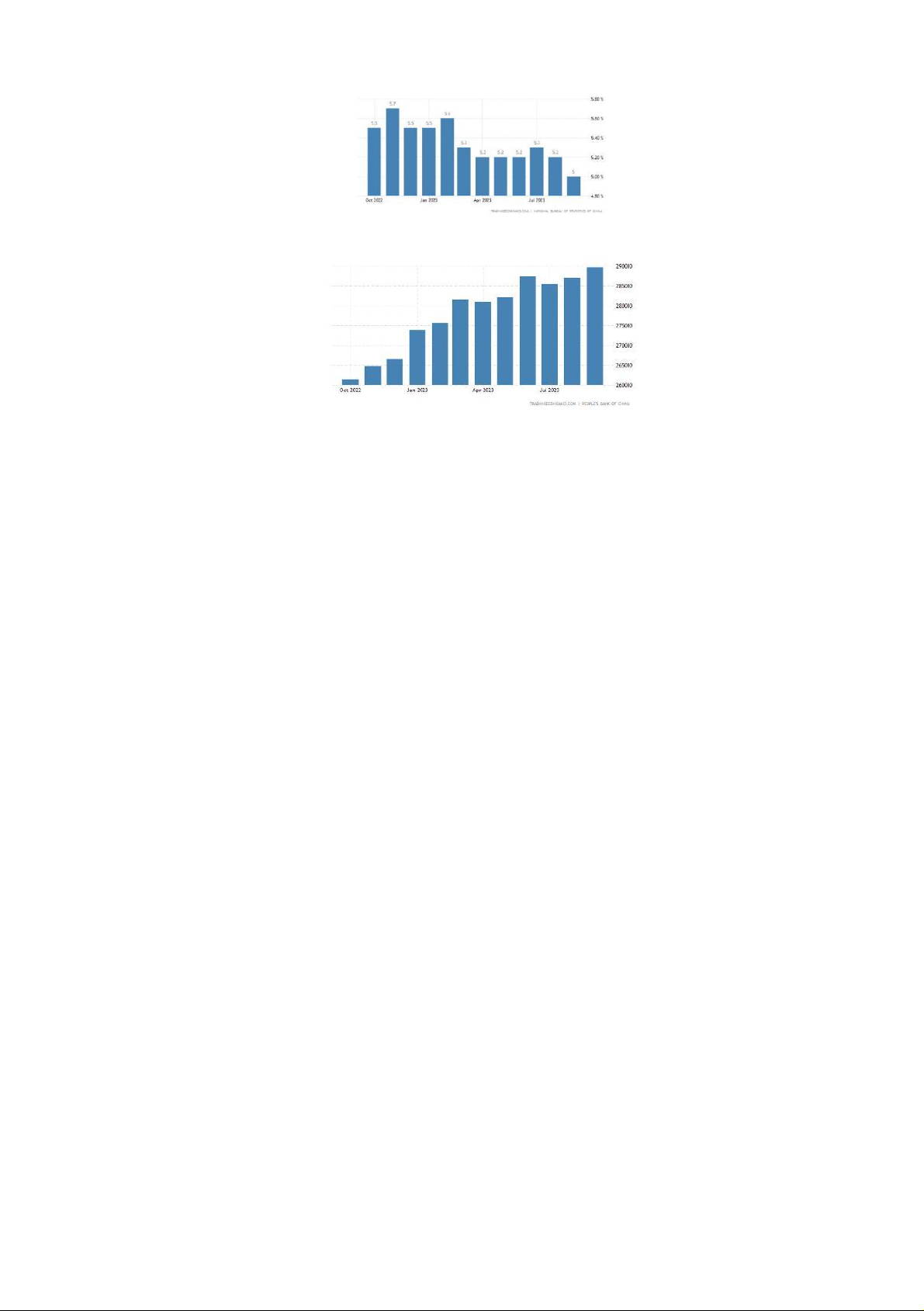

in managing their debt and stimulating economic growth. CHINA’S ECONOMY 1. Through indexes: a) CPI b) PPI lOMoAR cPSD| 41487147 c) M2 MONEY SUPPLY

temporary deflation and riskily becoming permanent.

2. Causes of China’s deflation 2.1. Real estate crisis:

-Has been the major driver of economic growth,

- The market has been responsible for generating about 30% of China's GDP

(Iori) => Now becoming stagnant *Reasons:

- a slowdown in population growth,

- the impact of the Covid-19 pandemic,

- and government control over high-risk activities in the real estate industry. *Main issues: a)

a pile of debt coupled with an oversupply of housing: China's property developers

collectively owe over $390 billion to various suppliers, which poses a significant threat to the economy.

Example: The corruption of Evergrande and Country Garden.

b) House prices in China have increased sixfold in the last 15 years, leading to an

inflated real estate "bubble".

=> “3 red lines” policy curbs financial leverage in the real estate sector.

=> Decrease in house prices => impacting the savings and assets of many Chinese individuals. c) Liquidity problem

Mini conclusion: The significant decrease in property prices could contribute to long-term

deflation, as the property sector holds a substantial amount of money in the economy. A

burst in the property bubble would result in the disappearance of this money, exacerbating

the deflationary problem. Moreover, deflation makes people more cautious about purchasing

big-ticket items such as houses, further worsening the situation. lOMoAR cPSD| 41487147 2.2.

High youth unemployment rate

-The Chinese economy is in the midst of a slowdown and its steadily climbing youth

unemployment prompted the government to suspend age-specific unemployment data for the near future *Reasons: 1. Covid-19

2. High aspirations of young people in China (High ego). *Its consequences

1. The decrease in spending (no income).

2. Conversely, deflation also worsens the condition.

Mini conclusion: Deflation and Youth unemployment rate have spiral relation.

3. Impacts of deflation in China 3.1. Debt

Figure 1.LGFV is nearly equal in scale of Central and local government

Corporate debt is also a pressing issue, with levels equivalent to 119% of GDP.

Deflation makes this problem more complicated as it increases the real value of debt. This is

also called “debt deflation” when it raises the level of “real” or inflation-adjusted interest

rates in the economy. Some economists believe such “debt deflation” can trigger recessions or

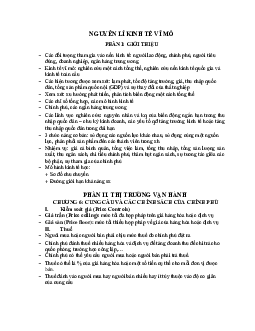

depressions as people default on their loans and banks are undermined. 3.2. Export and Import lOMoAR cPSD| 41487147

Figure 2 China’s Export and Import growth rate in recent months

The deflation has decreased the yuan exchange rate that makes China’s market become

less attractive when compared to other emerging markets such as Vietnam, Thailan, etc. 3.3. Confidence

Figure 3 Consumer Confidence Index in China from March 2018 to March 2023

-Has been plummeted since Covid-19 *Reasons: a) Covid-19 b) Trade War with U.S. c) Real estate problem

Losing customers leads to short-term but Confidence crisis leads to long-term

deflation. (Because consumers are holding back on spending. Businesses are reluctant

to invest and create jobs. And would-be entrepreneurs are not starting new

businesses. So that the prices of products and real estate will go down and that causes

permanent deflation in China).

4. Policies and Results 4.1.

Policies (Small method)

- reducing restrictions on the real estate sector

- reduce interest rates on home mortgage loans lOMoAR cPSD| 41487147

- PBoC has cut interest rates to support the economy and protect the value of the yuan.

- prevent speculation and ensure stability, tightened liquidity for yuan futures contracts in non-mainland markets. *Stimulate consumption

- The National Development and Reform Commission recently launched 20 measures aimed

at boosting consumption in sectors such as automobiles, furniture, home appliances,

tourism, entertainment, exhibitions, and digital products.

=> encourage spending and optimize supply and demand in various industries

- The Chinese government is focusing on investment in the high-tech industry, particularly

in sectors like electric cars and chip production.

Ex: For example, Guangzhou has established a fund worth $29 billion to support

manufacturing businesses in the semiconductor field, renewable energy, and other high-

tech sectors. The government in Anhui province has also announced the establishment of a

guidance fund worth $29 billion, targeting technology industries. (Bao Ngoc, 2023). 4.2. Result (Evaluation) 4.2.1. Recovery

- In domestic services and tourism especially in tourism when holiday prices jumped by 10% YoY in July

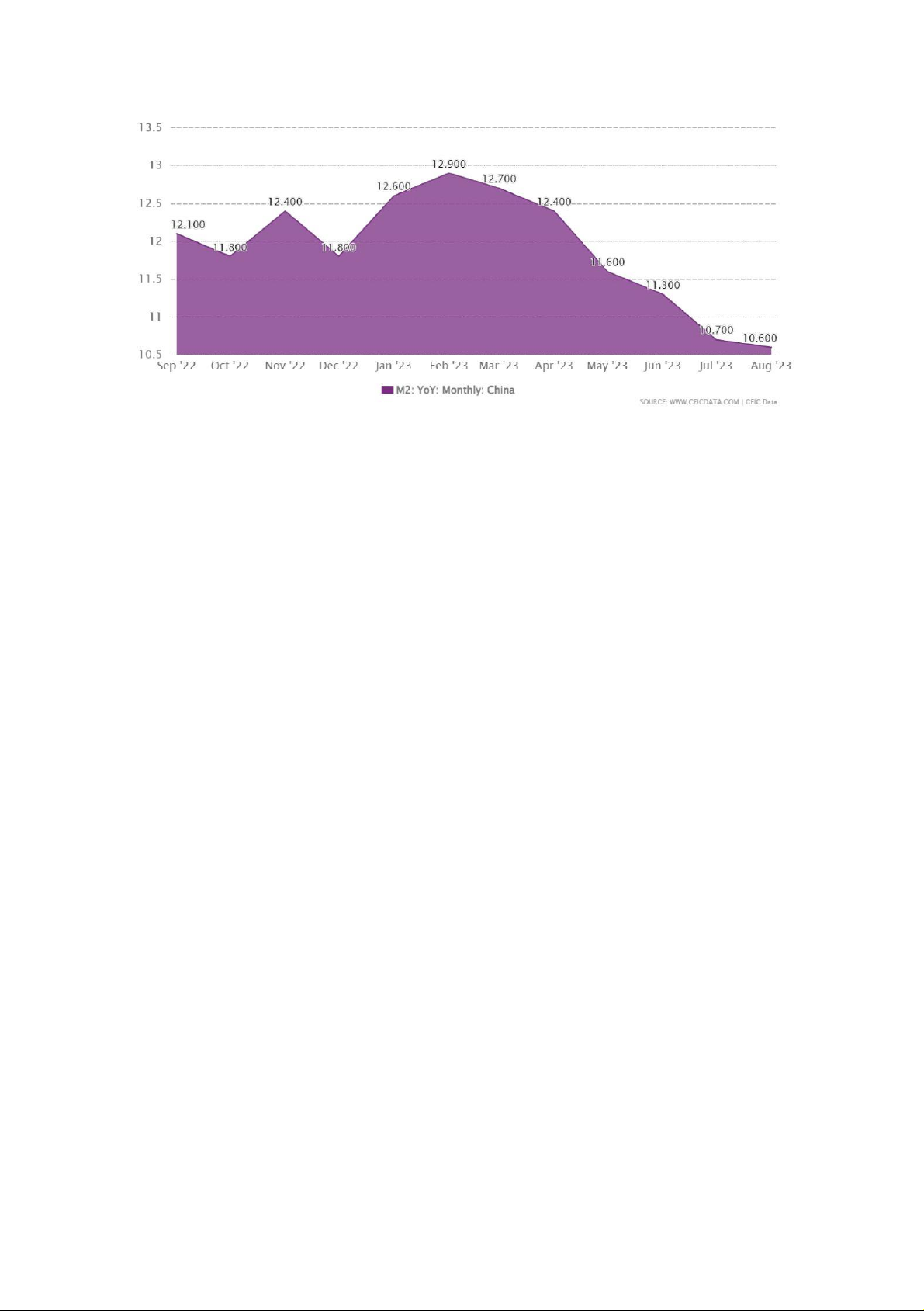

- According to the China National Bureau of Statistics, China's third-quarter GDP growth

rate exceeded expectations at 4.9% compared to the projected 4.6%. This strong growth

raises hopes that the world's second-largest economy will meet or even surpass Beijing's

target of around 5% growth for this year. The previous quarters also showed growth, with 6.3% in Q2 and 4.5% in Q1.

Figure 4. China GDP Annual Growth Rate

Figure 5. Industrial production and Retail sales growth rate lOMoAR cPSD| 41487147

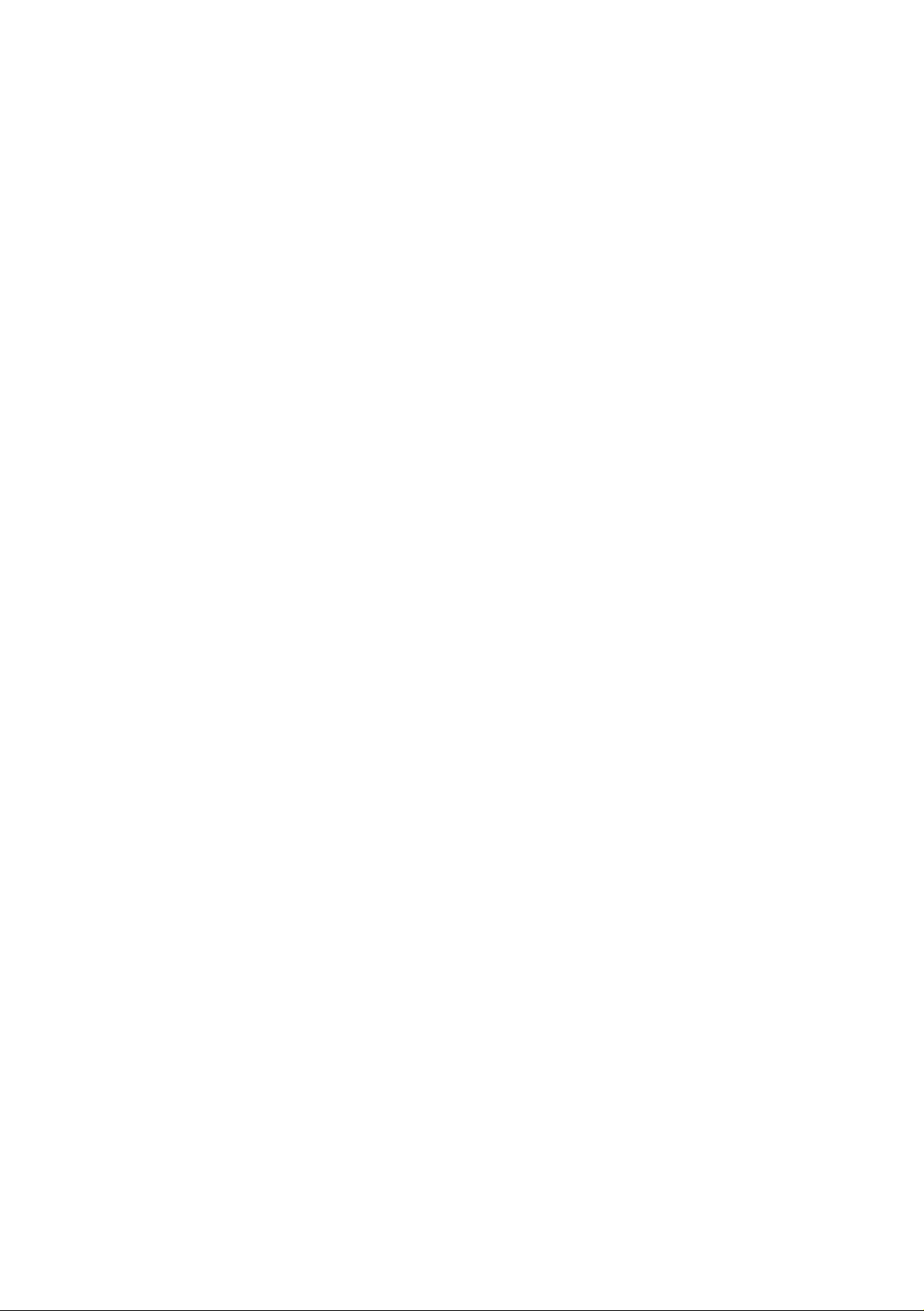

Figure 6. Unemployment rate in China

Figure 7. M2 Money Supply

-Positive sign in electric car industry: BYD becomes the biggest supplier in this industry.

Mini conclusion: In conclusion, although there have been some positive spots, the recovery

process of China’s economy is still “tortuous”. Industrial production and consumer spending

are now the main motivation of China’s economy.

5. Orientation, Policy Implication, and Recommendation 5.1.

China’s orientation and policy implications

China is actively pursuing its goal of building a modern socialist nation with a focus on

common prosperity and unique paths to modernization. Despite recent economic challenges,

there's optimism about achieving a 5% growth target this year, contingent on containing the

real estate crisis. The government prioritizes quality growth, avoiding the use of real estate as

a short-term stimulus. Job creation is key, with plans for tax reductions to support businesses.

Efforts to stimulate demand are targeted, and the China Securities Regulatory Commission

plans reforms for investor confidence through extended trading hours and reduced transaction fees. 5.2. Recommendations

-Monetary easing (similar to 2008 financial crisis): quantitative easing and purchasing

government bonds to increase liquidity for lending by commercial banks

-Increasing nominal wages: reducing employer contributions to the social security fund and

offsetting the loss with fiscal transfers supported by government bonds, which can be

monetized by the central bank if needed

Deflation-in-China-summary-gr-1

Nguyên Lý Kinh Tế Vĩ Mô (Đại học Khoa học Xã hội và Nhân văn, Đại học

Quốc gia Thành phố Hồ Chí Minh)