Preview text:

z CHAPTER 2 Q1

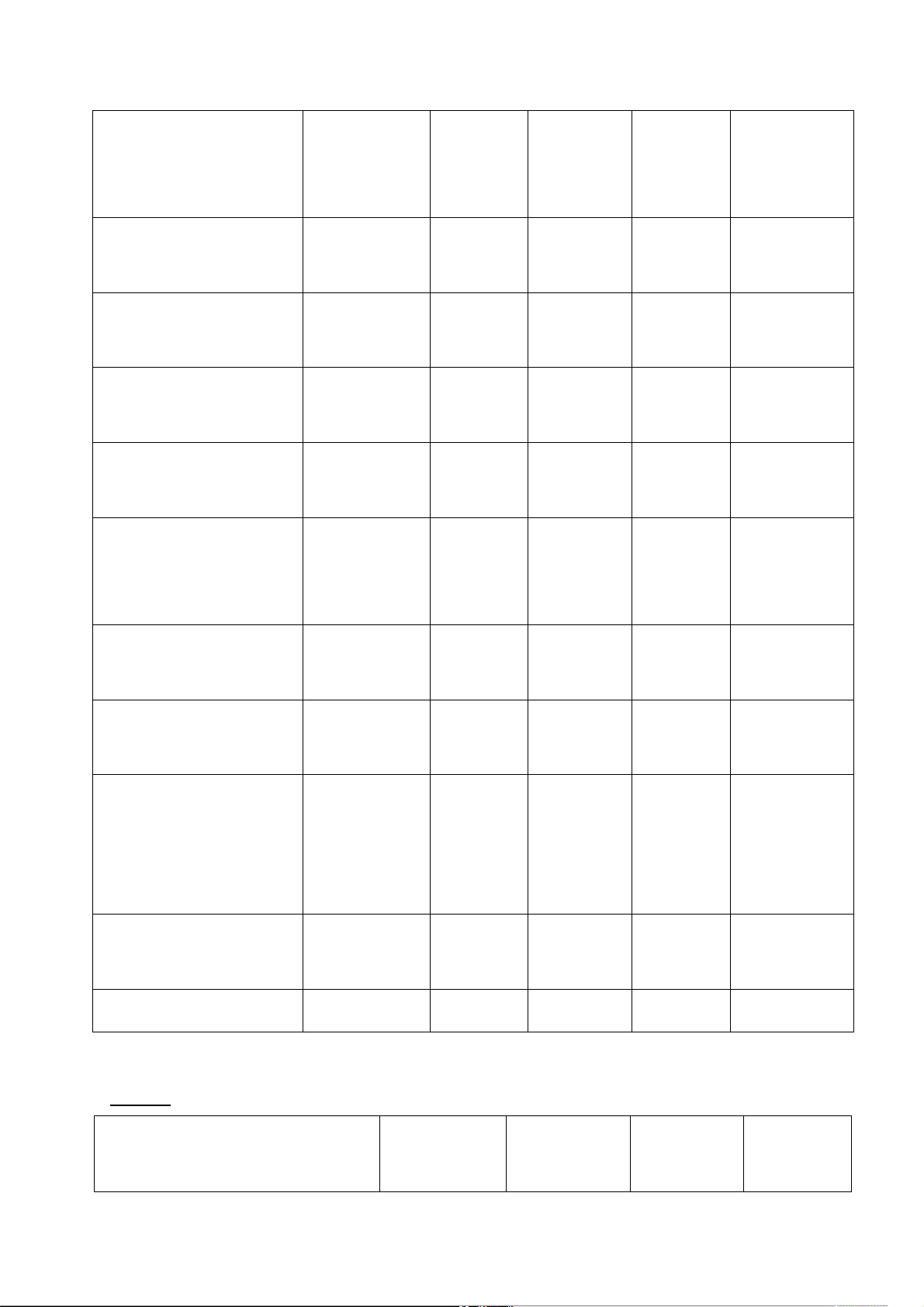

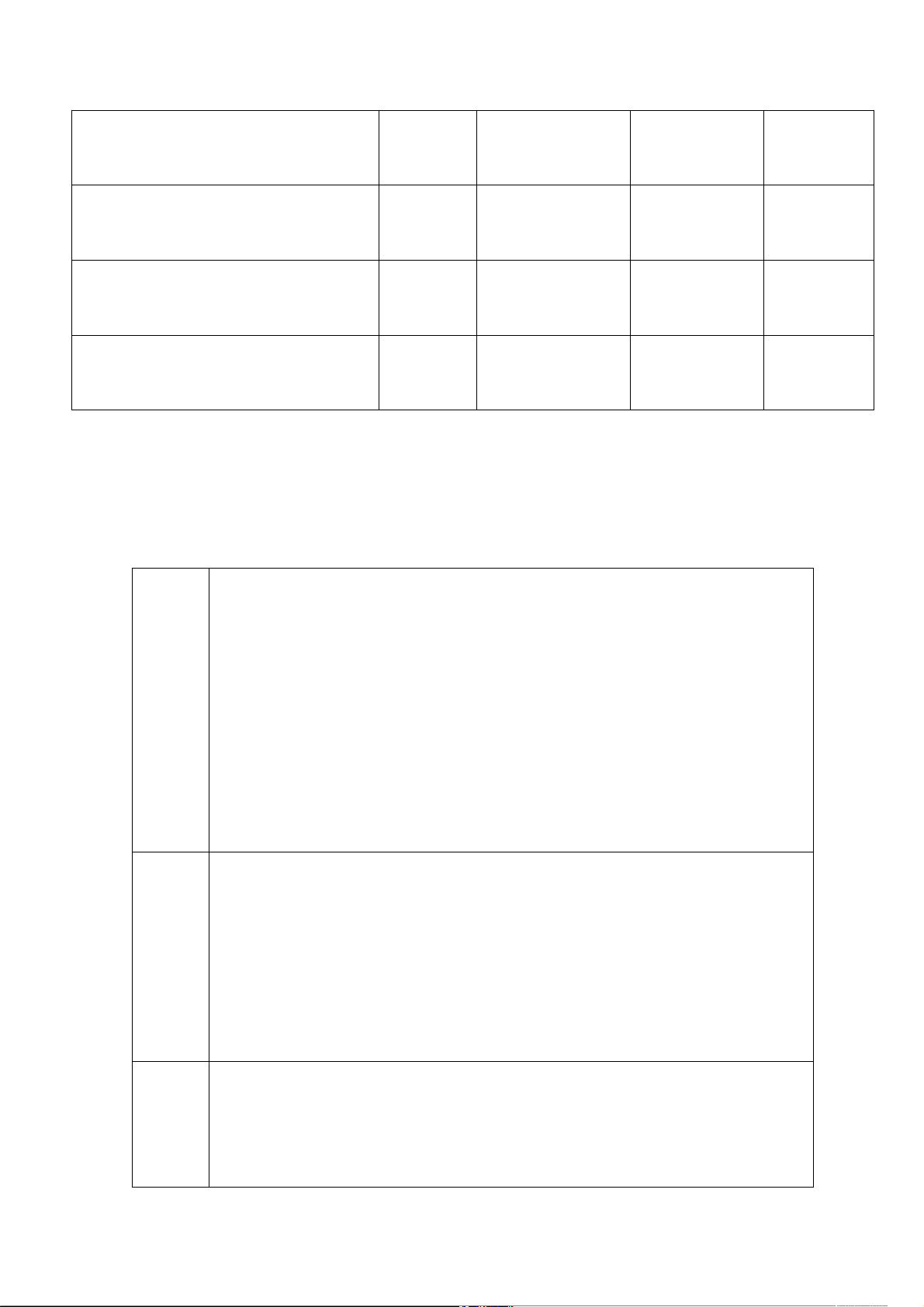

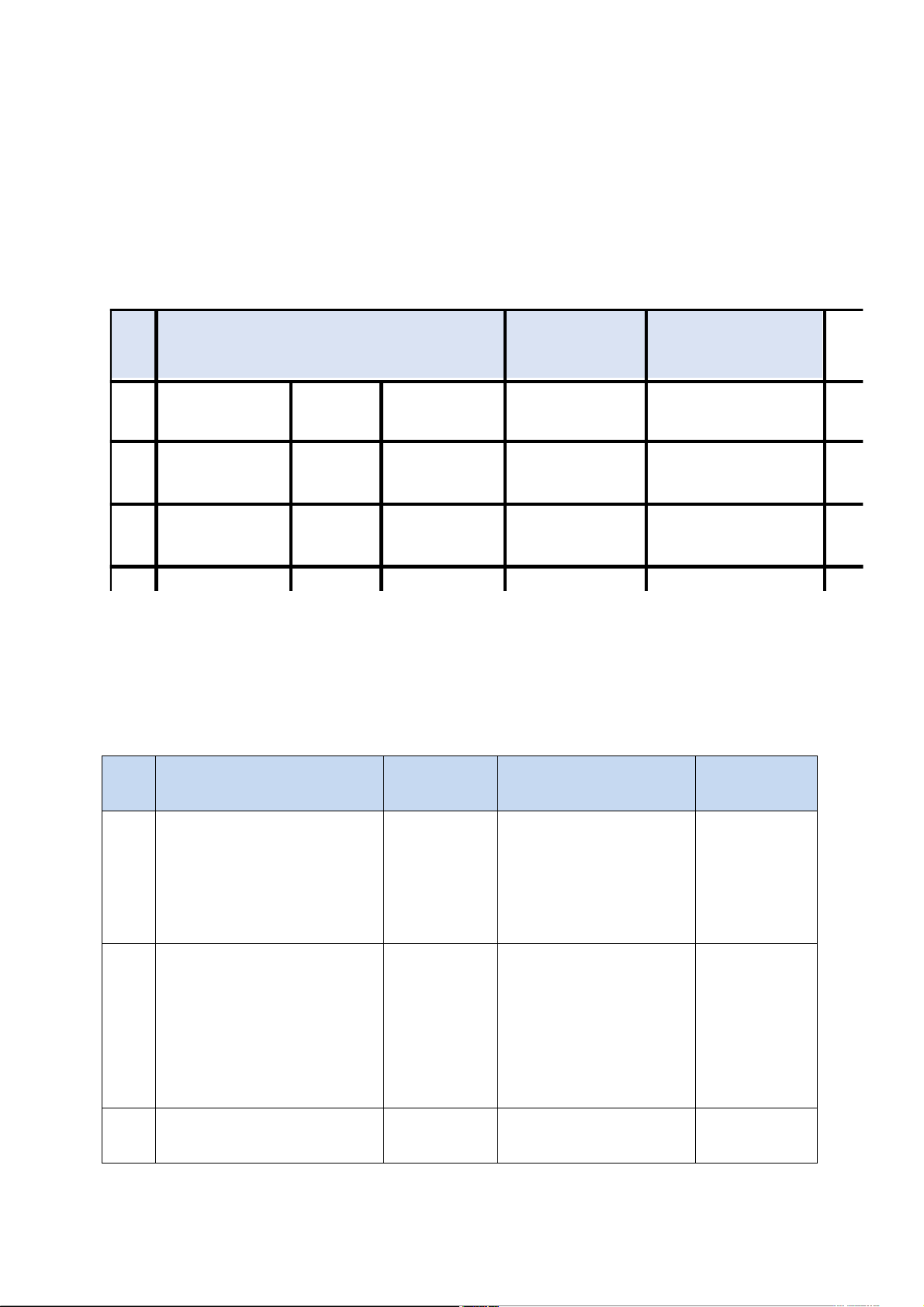

Typical statement of financial position classifications are as follows: a. Long Term Investments f. Share Capital b. Plant Assets g. Share Premium c. Intangible Assets h. Retained Earnings d. Non - Current Assets i. Non-Current Liabilities e. Current Assets j Current Liabilities

Indicate by use of the above letters how each of the following items would be

classified on a statement of financial position prepared at December 31st, 2019. If a

contra account, or any amount that is negative or opposite the normal balance, put

parentheses around the letter selected. A letter may be used more than once or not at all.

1. Accrued salaries and wages j

2. Rental revenues for 3 months collected in advance j 3. Land used as plant site b

4. Equity securities classified as trading e 5. Cash e

6. Accrued interest payable due in 30 days j

7. Share premium–preference shares g 9. Petty cash fund e 10. Ordinary shares f

11. Allowance for doubtful accounts: e

12. Accumulated depreciation: d 13. Goodwill: c 1 14. 90 day notes payable j

15. Investment in bonds of another company; will be held to 2023 maturity d

16. Current maturity of bonds payable j 17. Trade accounts payable j

18. Preference shares ($10 par) f

19. Prepaid rent for next 12 months e 20. Copyright c

21. Accumulated amortization, patents c

22. Earnings not distributed to shareholders h Q2

1- Let’s have a look at a business where capital at the end of 2019 was $20,000.

During 2020, there have been no drawings, and no contributions from the owner.

At the end of 2020, the capital was $30,000. Required:

a. Determine net income (loss) for business for year 2020.

Net income = total ending equity – total beginning equity - investment by the owner + drawing

Net income = 30,000-20,000=10,000

b. Determine net income (loss) for business for year 2020 if drawings had been $7,000.

Net income=30,000-20,000+7,000=17,000

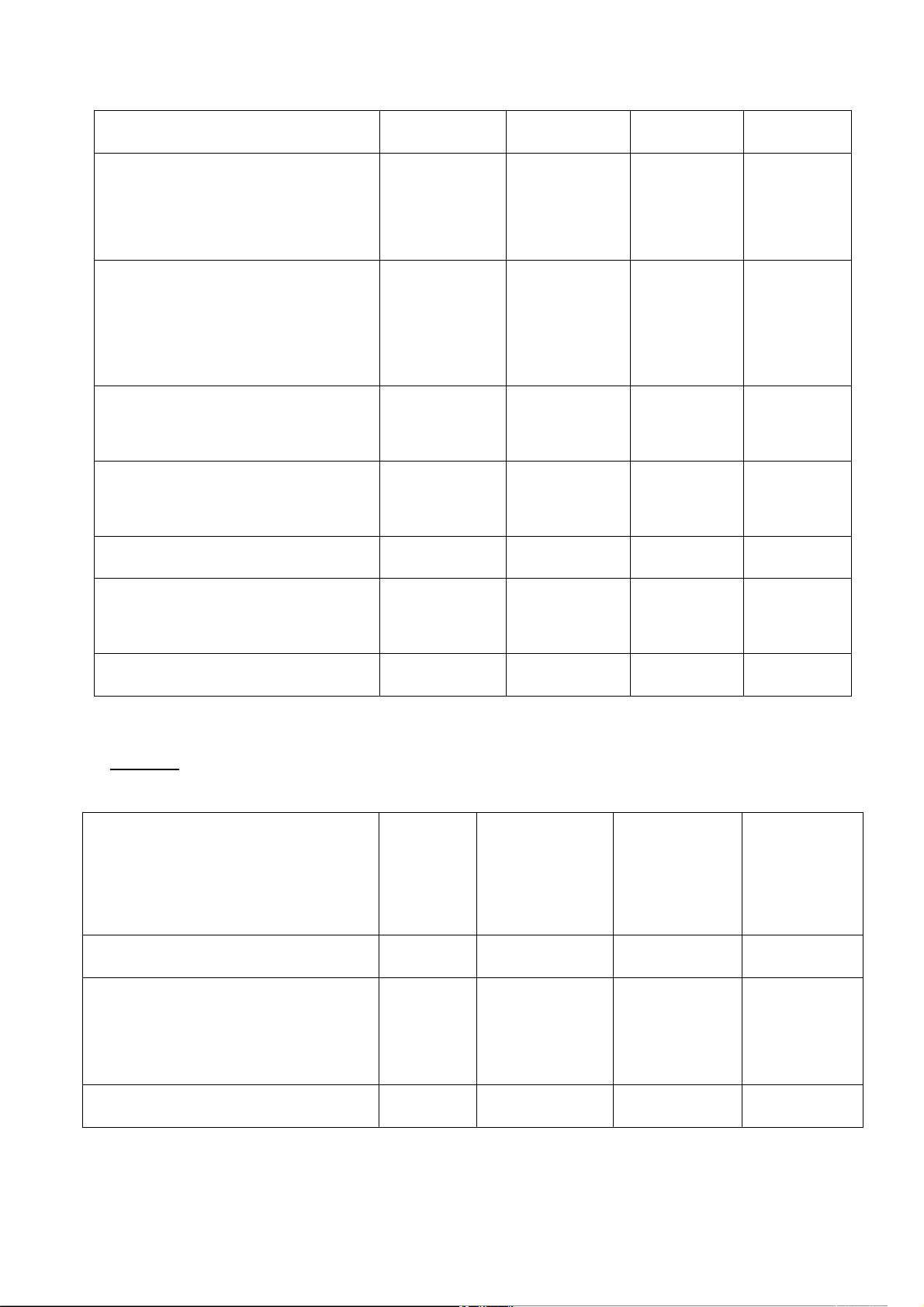

2- ABC company has got following information on 3st Quarter of 2019 .Unit: $ 1/7/2019 30/9/2019 changes Cash 1,000 1,200 200 A/R 1,800 2,400 600 Goods 5,100 4,000 (1100) 2 Equipment 1,000 1,000 - Accumulated (400) (600) (200) depreciation Total asset 8500 8000 -500 Receive in advance 200 100 (100) A/P 1,000 800 (200) Total liabilty 1200 900 -300 OWNER EQUITY 8500-1200=7300 8000- -200 = asset - liability 900=7100

During 3rd Quarter of 2019, owner withdrew by cash $300. no contribution. Determine:

A - Changes of the owner’s equity during 3rd Quarter of 2019.

Changes OE= Changes in asset – changes in liability

B - Net income (net loss) for 3rd Quarter of 2019

Net income = ∆asset - ∆liability- investment by the owner + drawing

= -500 – (-300)+300 =100

3 – XYZ coporation has got following information on Quarter 1st, 2020 Openning Closing balance balance Assets 3,200 5,100 Liabilies 2,300 2,900 OE 900 2200 3

During 1st Quarter of 2020, XYZ coporation issued shares and received cash of $1,000. No drawings.

Require: Determine net income (net loss) for business for 1st Quarter of 2020?

Asset- liability = owner equity=net income + đầu tư

OE tăng 1300, đầu tư tăng 1000 => net incom tăng 300

Net income = (5,100-2,900)-(3,200-2,900)-1,000=300 Q3

Lee started a business on 1st January 2002 with $35,000 in a bank account.

Unfortunately, he did not keep proper books of account.

He must submit a calculation of profit for the year ending 31st Dec 2002 to the

inspector of Taxes. At 31 st December 2002, he had inventory valued at cost of

$6,200, a van which had cost $6,400 during the year and which had depreciated

during the year by $1,600, A/R of $15,200, expense prepaid $310, a bank balance

of $33,490, a cash balance $270, A/P $7,100 and expenses owing $640.

His drawings were: cash $400 per week for 50 weeks, cheque payment $870 Required:

Draw up statements to show the profit or loss for the year. Openning balance Closing balance inventory 6,200 Van (original cost) 6,400 depreciation (1,600) A/R 15,200 expense prepaid 310 Cash at bank 35,000 33,490 Cash on hand 270 4 Total asset 35,000 60,270 A/P 7,100 expenses owing 640 Total liability - 7,740 Owner equity 35,000 52,530

Net income = ∆asset - ∆liability- investment by the owner + drawing

Net income = total ending equity – total beginning equity - investment by the owner + drawing

⇨ Net income = 52,530 – 35,000+400*50+870 = 38400 Q4

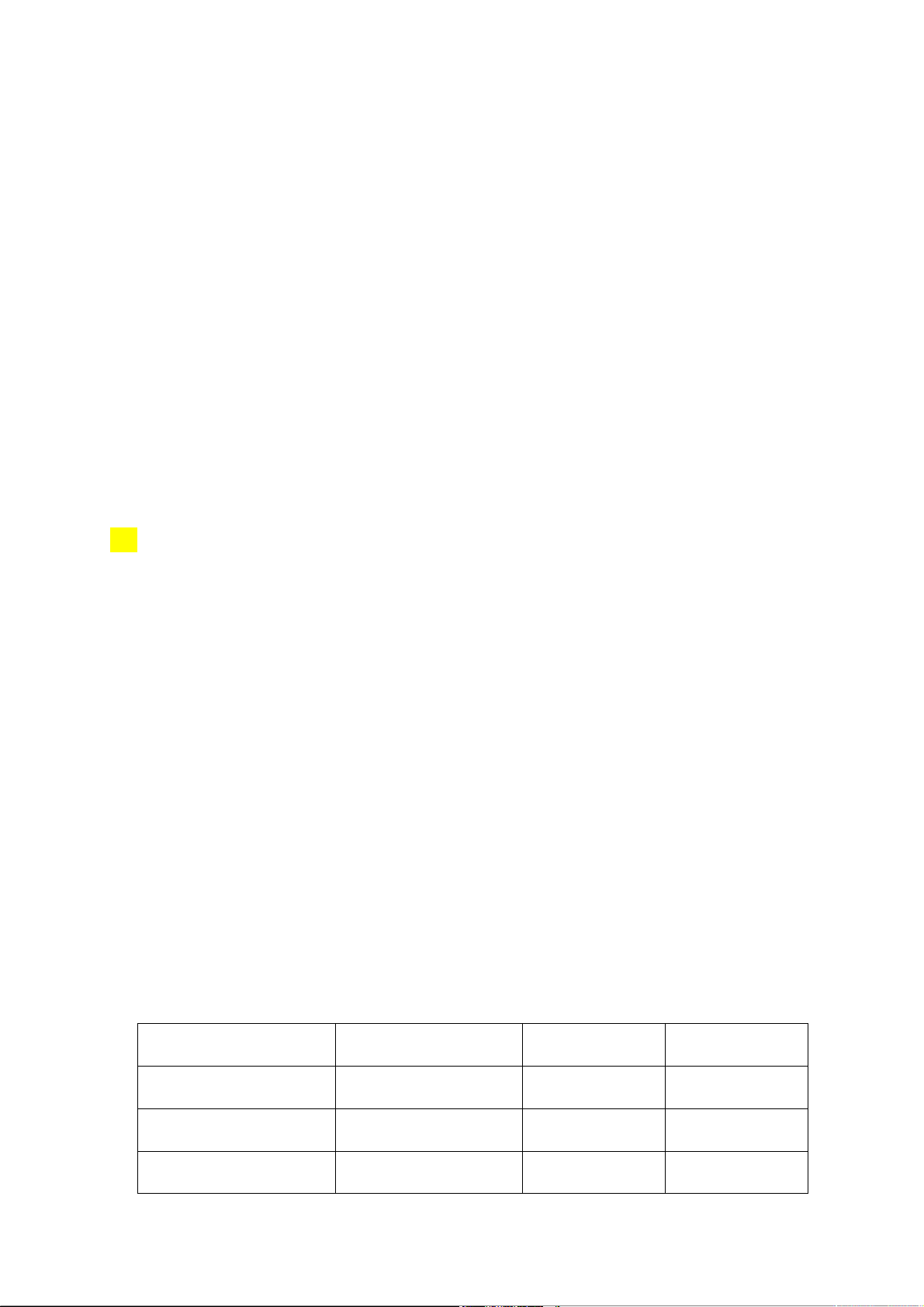

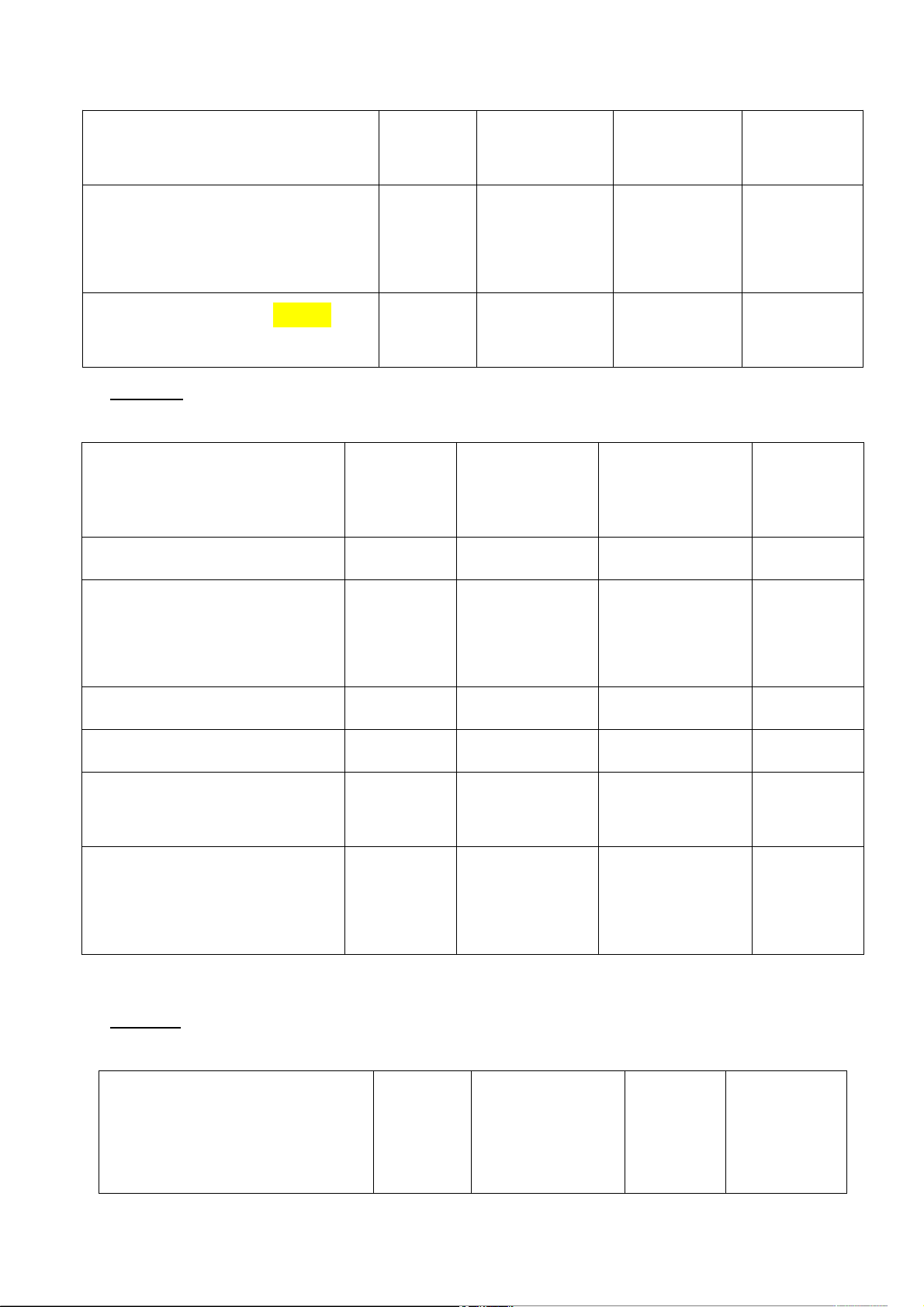

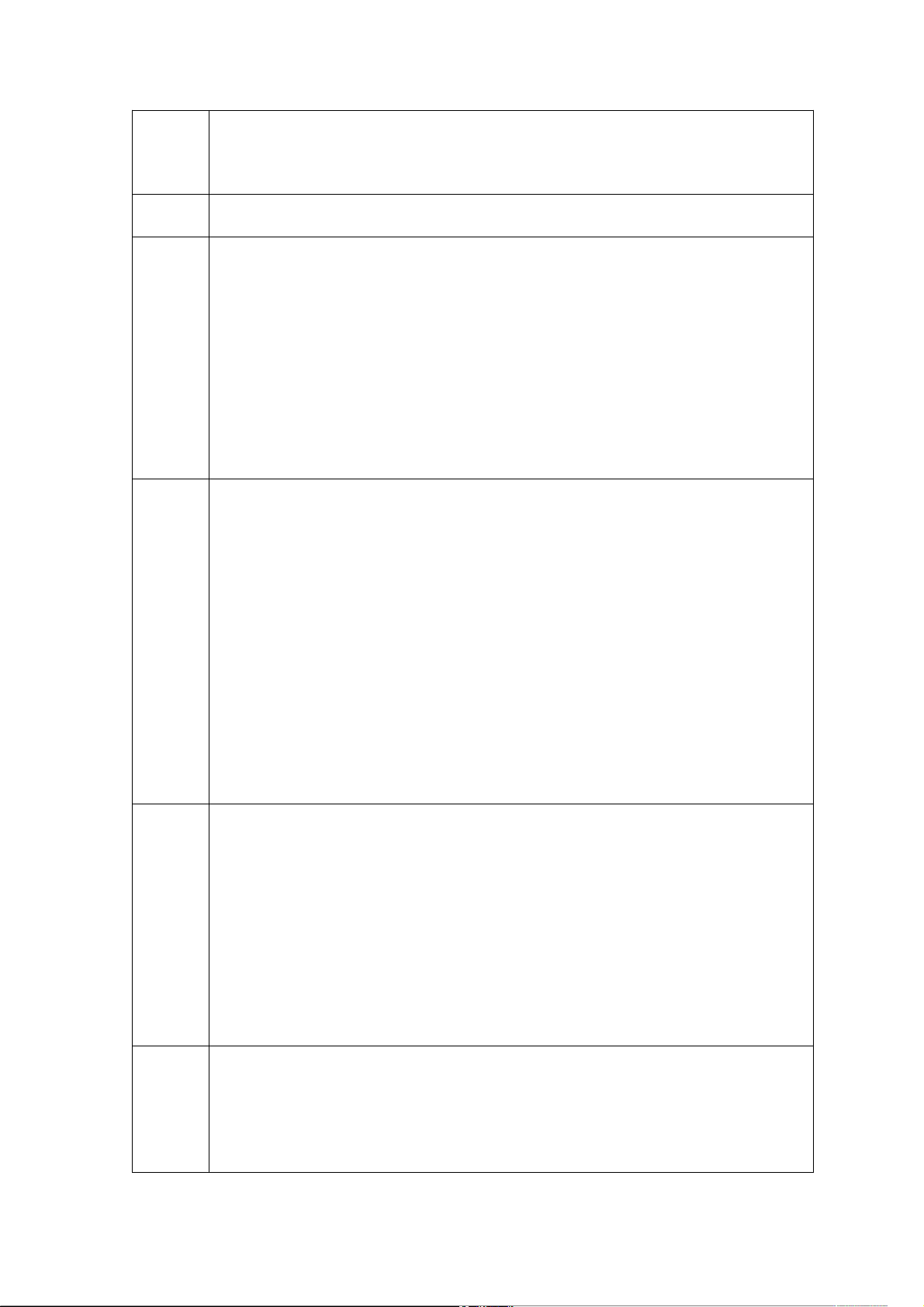

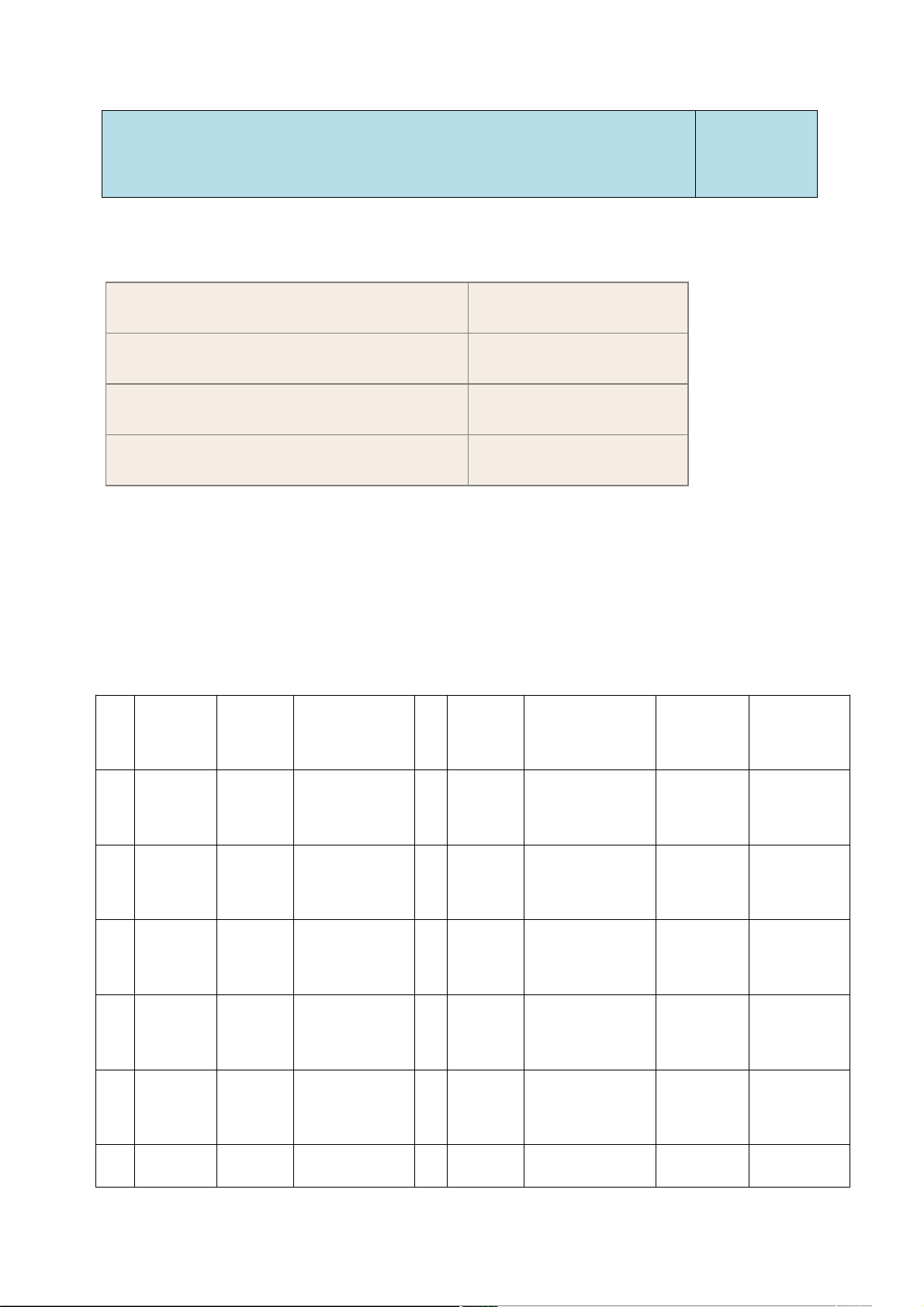

Which of the following transactions meet the recognition criteria of FS’s elements?

+ Meet all the criteria – recognize: √

+ Does not meet any criteria – does not recognize: 0

Part A: Which items/transactions satisfy asset recognition criteria? Result of Future Reliable Controllab Recognition past economic Items/ Transactions measurement le of asset events benefits (1) (2) (3) (4) (5) (6) 1. Company’s reputation; ability of 0 v 0 v 0 employees 2. Value of goods that is committed to be v 0 0 v 0 bought in the future 5 3. Tools, goods stocked on behalf of v v 0 0 0 other parties 4. Financing lease v v v v v asset 5. Operating lease v v 0 v 0 asset 6. Cost of goods sold v v v 0 0 in the period 7. Ordinary repair of v v v 0 0 fixed assets 8. Extraordinary repair of fixed assets v v v v v (Overhauls)nâng cấp 9. Obsolete goods v v v 0 0 cannot be sold 10. Goods from trial v v v 0 0 test cannot be sold 11.Prepayment of leased assets for v v v v v future accounting period trả trc tiền thuê 12. Stolen technology 0 v 0 v 0 secret ...

Part B: Which items/transactions satisfy liability recognition criteria? Reliable Past Present Recognized Items/Transactions measurement transactions obligation liability 6 (1) (2) (3) (5) (6) 1. Share dividend (stock v dividend) declared, not yet v 0 0

issued trả bằng cổ phiếu 2. Cash dividend declared, not yet paid trả bằng tiền v v v V 3. Bonds/ debentures trái v v v v phiếu 4. Receipt in advance from v v v v customers

5. Interest received in advance v v v v 6. Lease payment received in v v v v advance from lessee 7. Provision for warranty v v v v

Part C: Which items/transactions satisfy revenue recognition according to accrual basis? Completed Reliable Increase obligation for Income Items/Transactions measure equity income recognition ment (indirect) transactions (1) (2) (3) (4) (5) 1. Contributions from owners or liabilities v 0 v 0 reclassification 2. Receipt in advance v v 0 0 7

3. Interest/ lease payment, etc v v 0 0 received in advance 4. Revenue from delivering goods/rendering services on v v v v credit

5. Interest, dividend earned, not v v v v yet received.

Part D: Which items/transactions satisfy income recognition criteria in

accordance with cash basis? Reliable Received cash Equity increase Income measureme from the Items/ Transactions (indirect) recognition nt transaction (1) (2) (3) (4) (5) 1. Contributions from owners by assets or v 0 v 0 liabilities reclassification 2. Receipt in advance v v v v 3. Selling goods on credit v v 0 0 4. Interest, dividend on due v v 0 0 date but not received 5. Interest/ asset lease payment received in v v v v advance

Part E: Which items/transactions satisfy expense recognition criteria in

accordance with accrual basis? Matching Reliable Equity decrease with Expense Items/transactions measure (indirect) current recognition period 8 (1) (2) (3) (4) (5) 1. Equity withdrawal from owners: 0 v 0 Distribution to owners v Payments utilized from funds (e.g Bonus and Welfare Fund..) 2. Goods available for sale v v 0 0 3. Cost of goods sold in the v v v v period

4. Obsolete goods cannot sell v v v v 5. Revenue in the period v 0 v 0 6. Salary payable to v v v v employees

Part F: Which items/transactions satisfy expense recognition criteria in

accordance with cash basis? Reliable Cash paid out Equity decrease Expense measure from the Items/transactions (indirect) recognition ment transactions (1) (2) (3) (4) (5)

1. Equity withdrawal of owners Profit distribution to owners v 0 v 0 Payments utilized from funds (e.g Bonus and Welfare Fund, etc) 2. Goods decrease due to v v 0 0 unknown reason 9

3. Purchase goods on credit, sold v v 0 0 in the period

4. Interest/ asset lease paid in v v v v advance

5. Salary paid in cash during the v v v v period

6. Salary payable for employees v v 0 0 during the period Q5

Caren Smith Corporation, supplies a medical practice. During July 2020, the first

month of operation, the business experienced the following events: Jul 6

Caren Smith received $55,000 cash from shareholders and issued common stock. increase asset (Cash) 55,000

Increase stockholders’ equity (Common stock) Dr cash 55000 Cr common stock 55000 9 Paid $46,000 cash for land. Decrease Asset (cash) 46,000 Asset (land) increase 46.000 Dr land 46000 Cr cash 46000 12

Purchased medical supplies of $1,800 on account

Increase liability (A/P) : 1800

Increase Asset : medical supplies 10 Dr medical supplies 1800 Cr (A/P) : 1800 15 Officially opened for business 15-31

During the rest of the month, Caren Smith treated patients and

earned service revenue $ 8,000, receiving cash. Increase revenue 8000 Increase asset (cash) 8000 Dr cash 8000 Cr SERVICE revenue 8000 29

Paid cash expense employees’ salaries, $1,600; office rent, $900, utilities, $100

Decrease asset (cash) 1600+900+100=2600 Increase expense $2600 Dr RENT expense 900 Dr salary expense 1600 Dr utilities expense 100 Cr cash 2600 30

Returned supplies purchased on the 12th for the cost of those supplies, $700 Decrease asset 700 Decrease liability(A/P) 700 Dr a/p 700 Cr supplies 700 31 Paid $1,100 on account Decrease asset (cash) 1100 Decrease liability (A/P) 1100 11 Dr A/P) 1100 Cr cash 1100 Required:

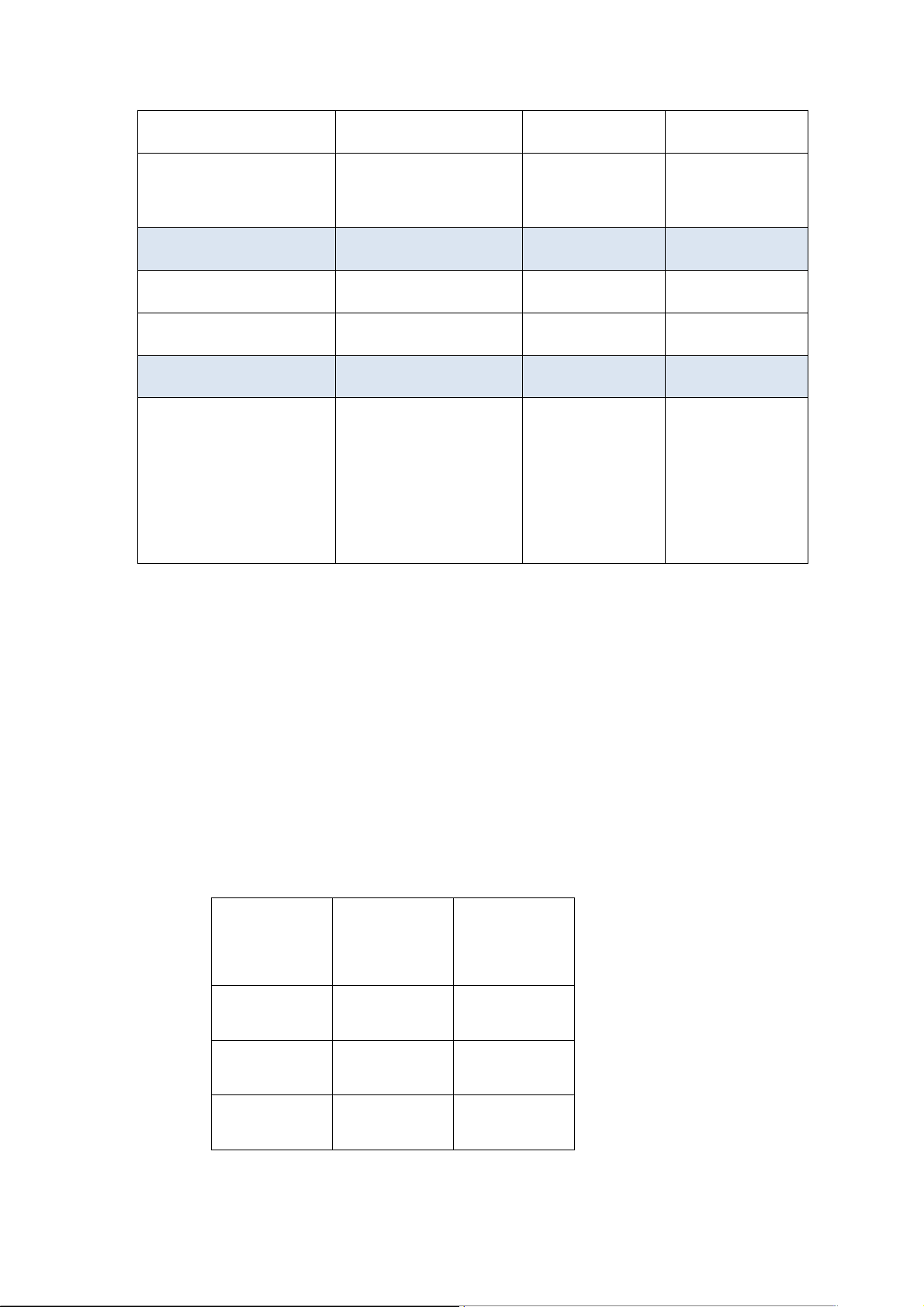

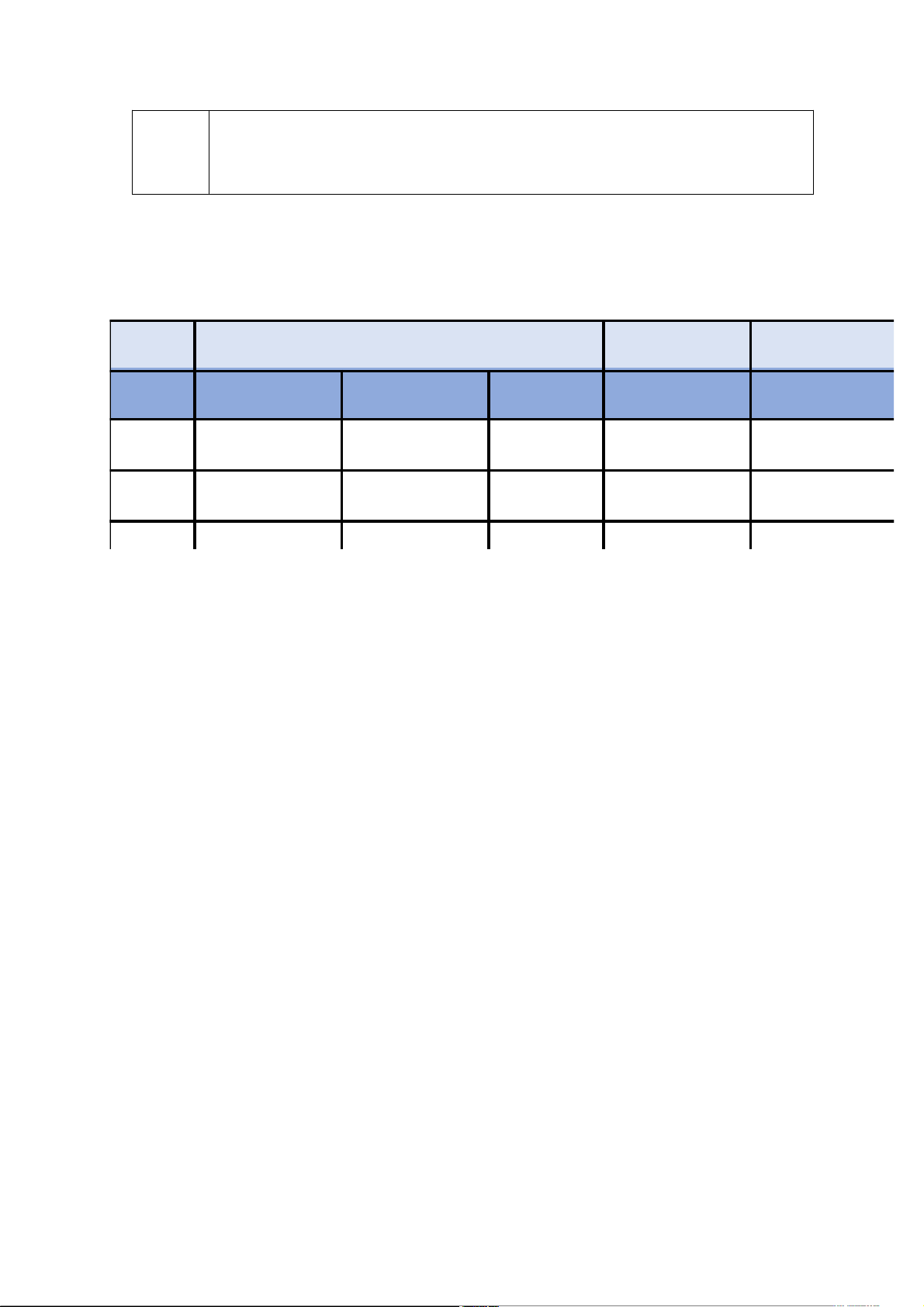

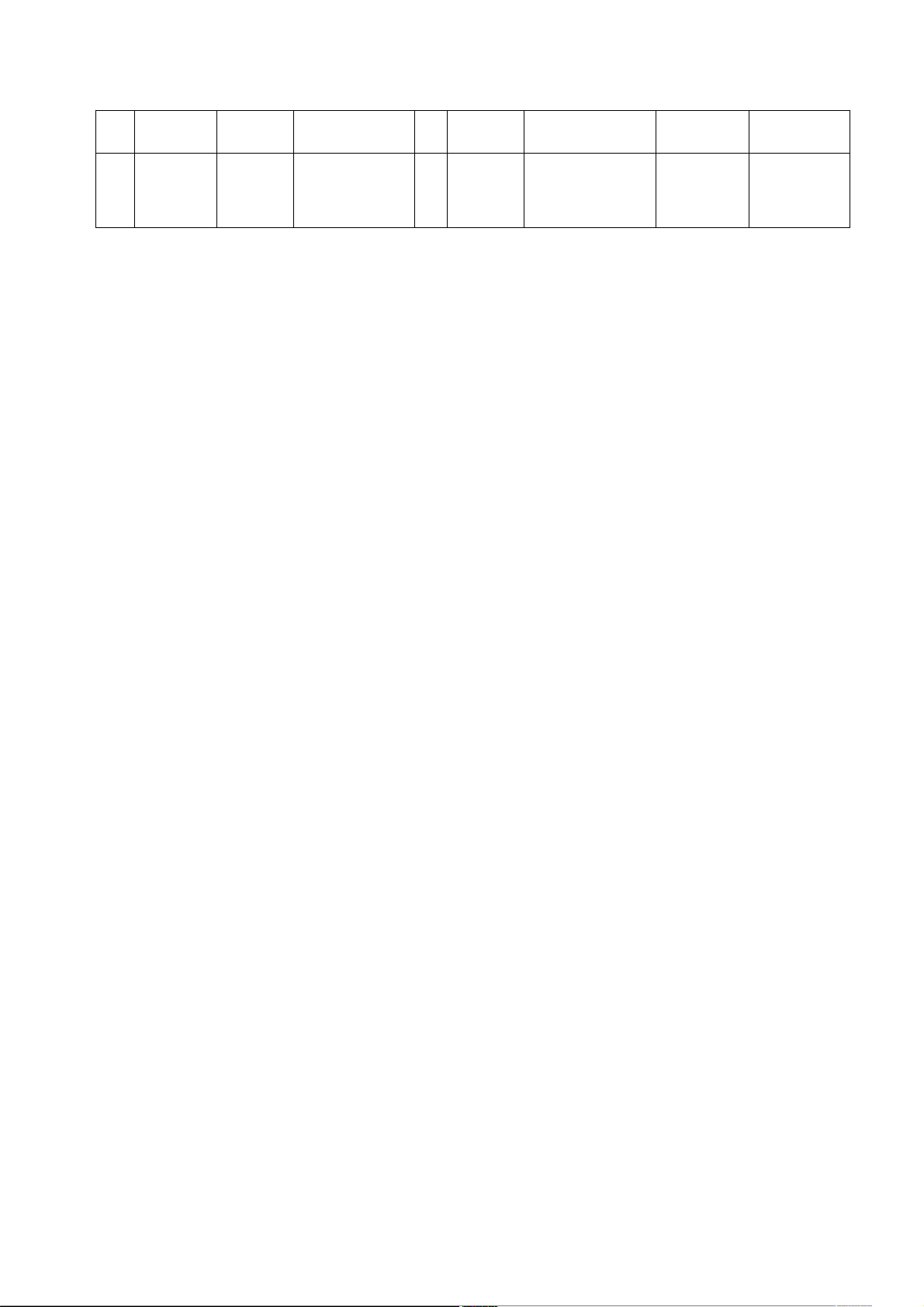

Analyze the effects of these events on the accounting equation of business of Caren Smith Corporation. asset= liability+ common s cash land supply A/P 6 55000 9 -46000 46000 Q6

Indicate the effects of the following business transactions on the accounting

equation of Video Store Corporation. Transaction (a) is answer as a guide. a.

Received cash of $8,000 and issued common stock.

Answer: increase asset (Cash) 8000

Increase stockholders’ equity (Common stock) b.

Earned video rental revenue on account, $1,800 Asset (A/R) Increase 1,800 Service Revenue increase 1.800 c.

Purchased office furniture on account, $400.

Increase asset (office furniture) 400 Increase liability (A/P) 400 d. Received cash on account, $100 Asset (Cash) increase 100 Asset (A/R) decrease 100 12 e. Paid cash on account, $100 Asset (Cash) decrease 100 liability (A/P) decrease 100 f.

Rented videos and received cash of $100 Asset (cash) increase 100 Service Revenue increase 100 g.

Paid monthly office rent expense of $900. Asset (cash) decrease 900 rent expense increase 900 h.

Paid $200 cash to purchase supplies that will be used in the future

Asset (cash) decrease 200 Asset (supplies) increase Q7

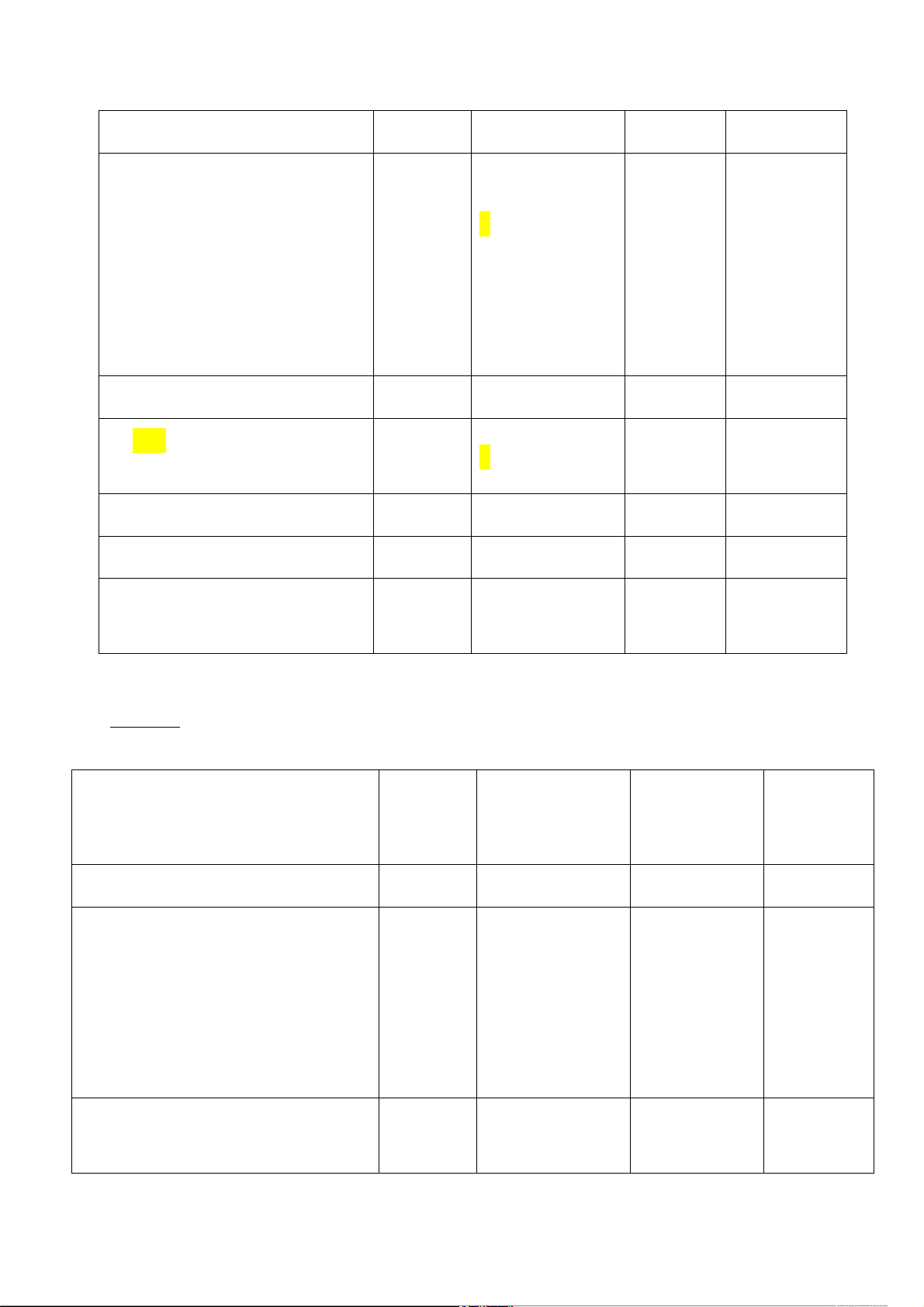

Hongha Corporation has got following information on August 31, 2013. Unit: $ Cash 2,300 Land 14,000 A/R 1,800 A/P 8,000 RE 7,100 Common stock 3,000

During Sept 2013, the business completed the following transaction: a.

Issued common stock and received cash of $13,000. increase asset (Cash) 13,000

Increase Owners’ equity (Common stock) b.

Performed service for client and received cash of $900. 13 Asset (cash) increase 900 Services Revenue increse 900 c.

Paid off the beginning balance of accounts payable. Asset (cash) decrease 8000 Liability ( A/P) decrease 8000 d.

Purchased supplies on account, $600. Asset ( supplies) increase 600 Liability (A/P) increase 600 e.

Collected cash from customer on account, $700. Asset (cash) increase 700 Asset ( A/R) decrease 700 f.

Received cash of $1,600 and issued common stock. Asset (cash) increase 1600

Increase owners’ equity (Common stock) g.

Consulted and billed the client for service rendered, $3,500. Asset ( A/R) increase 3.500

Income ( service) increase 3.500 h.

Recorded the following business expenses for the month: 1. Paid office rent, $1,200. Asset (cash) decrease 1.200 Rent expense increase 1.200 2. Paid advertising, $600 Asset (cash) decrease 600

Advertising expense increase 600 i. Paid cash dividends of $2,000 Asset (cash) decrease 2000 14

Owner’s Equity (RE) decrease 2000 Required: 1.

Analyze the effects of these events on the accounting equation of business of Hongha Corporation. 0 asset = liability+ dividends Cash A/R Supplies A/P a/ 13000 b/ 900 2.

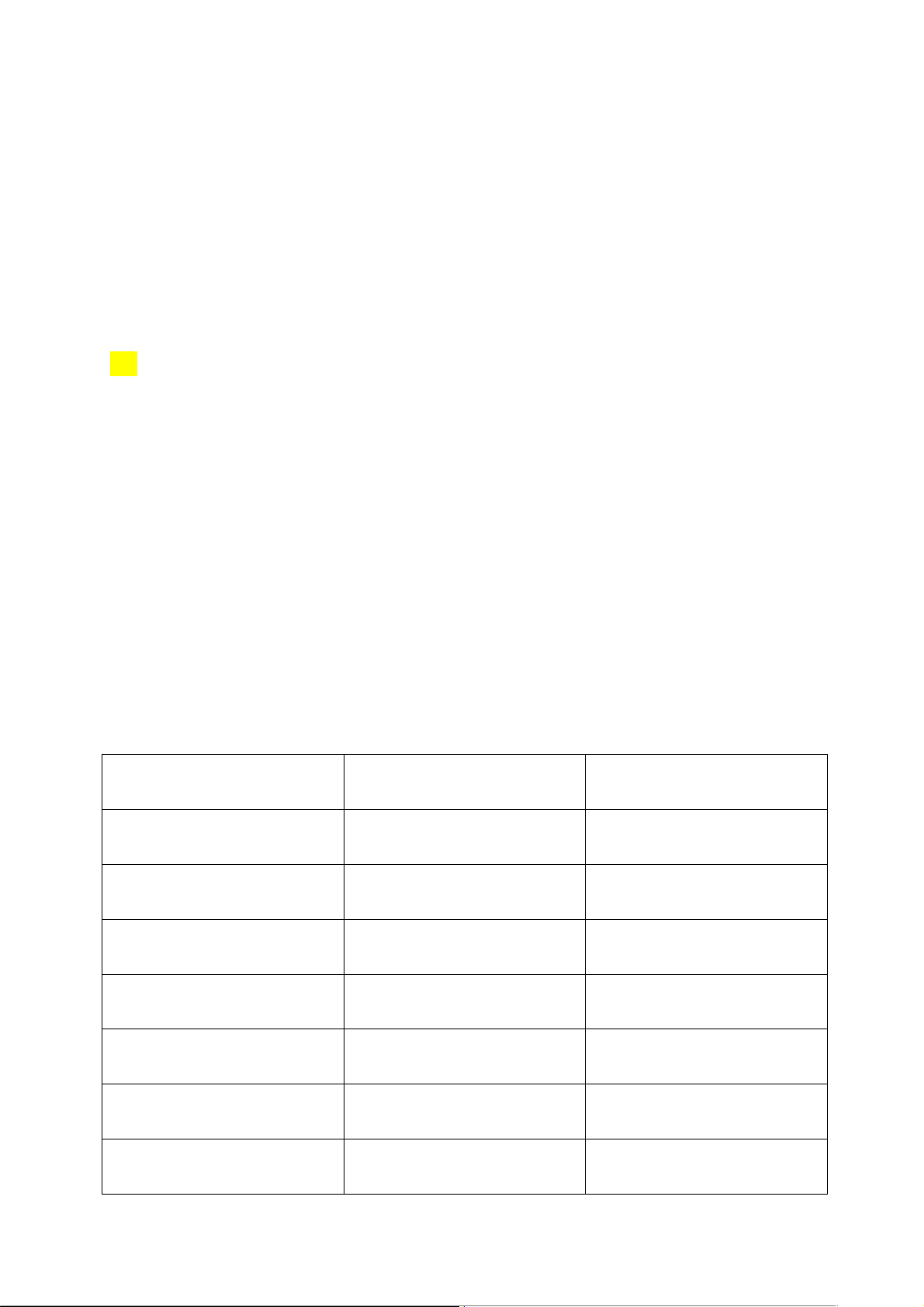

Prepare the following financial statements for the month ended 30 Sept 2013: a. Income statement stt INCOME AMOUNT EXPENSE AMOUNT 1 Performed service for 900 Paid office rent, 1.200 client and received cash $1,200. of $900 2 Consulted and billed 3.500 Paid advertising, 600 the client for service $600 rendered, $3,500. TOTAL INCOME 4.400 TOTAL EXPENSE 1.800 15 TOTAL NET 4.400- INCOME 1.800=2600 b. Statement of RE

Retained earnings at AUGUST 31, 2013 7,100

Net income at ended SEP 31, 2013 2600 Dividends paid to shareholders 2,000

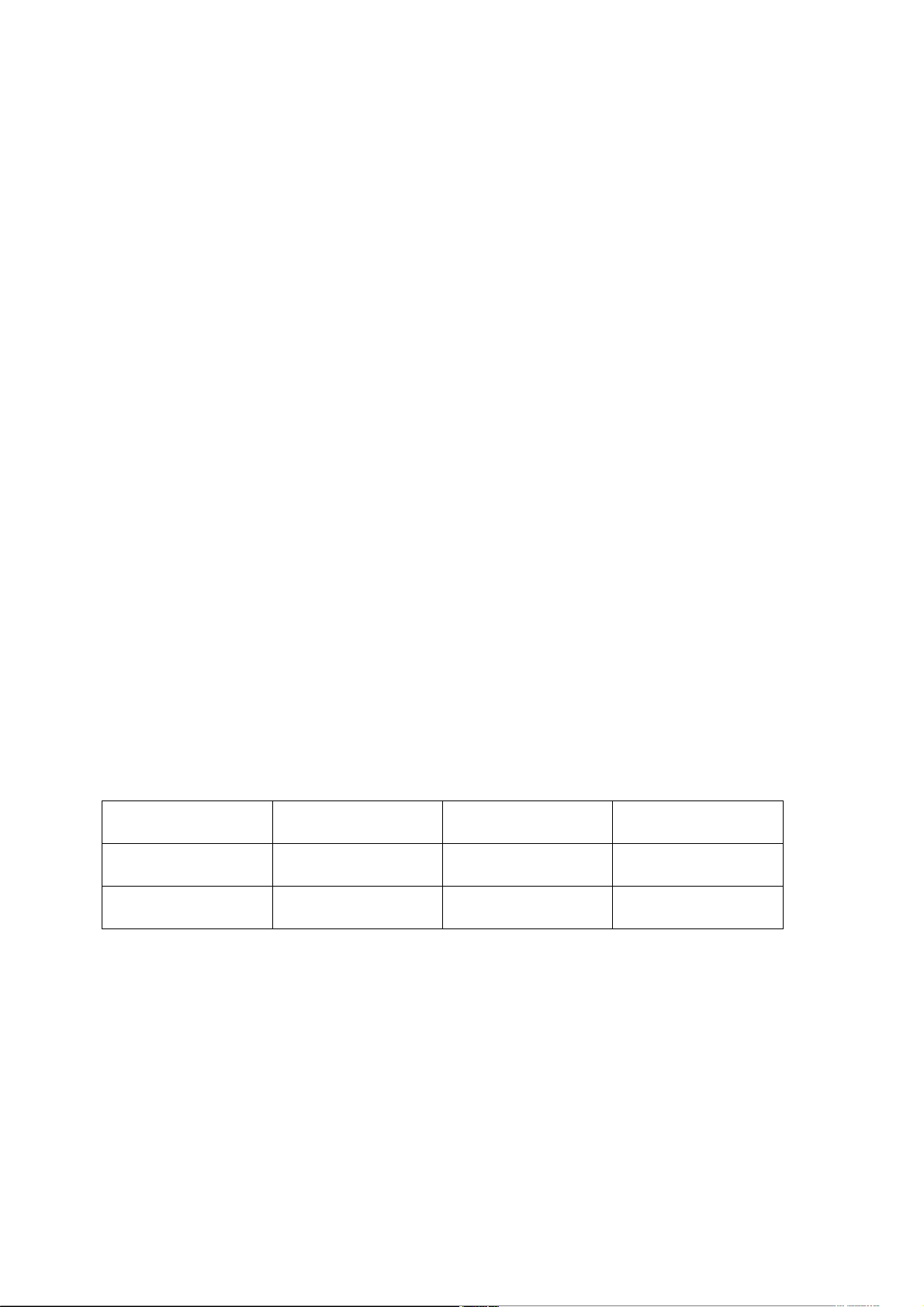

Retained earnings at SEP 31, 2013 7700 c. Balance sheet Q8 Cash + + A/P + Common + - A/R Equipment = Stock Revenue Expense 31,0 31,000 1 00 3,8 3,8 2 00 00 13,400 13,4 3 00 1 - 4 90 190 - - 5 410 410 - - 16 6 8,000 8,000 - - 7 1,500 1,500 Required: Describe each transaction.

1. Received cash of $31,000 and issued common stock.

2. Sale goods on credit $3,800

3. Purchase equipment on credit $13,400

4. Collected cash from customer on account, $190 5. Paid cash on account $410 6. Paid cash on account $8,000

7. Paid office rent expense of $1,500 Q9

On 1/1/Y, Company X signed a contract to supply products ordered by Company

Y with the total contract value of $ 3,000 and received in advance $1,000 by cash

in bank. On 1/5/Y, Company X delivered finished goods to Company Y with total

production cost was $2,500. After finished goods were delivered, the remaining

amount of the contract will be paid in the following period. Required:

With the given transactions, please identify:

A/ How does X record for elements of financial statement if the accrual basis is applied?

- At the time of receiving in advance. 17

- At the time of delivery to customer

- At the time of receiving the remaining amount.

B/ How does Y record for elements of financial statement if the accrual basis is applied?

- At the time of advance payment;

- At the time of receiving goods;

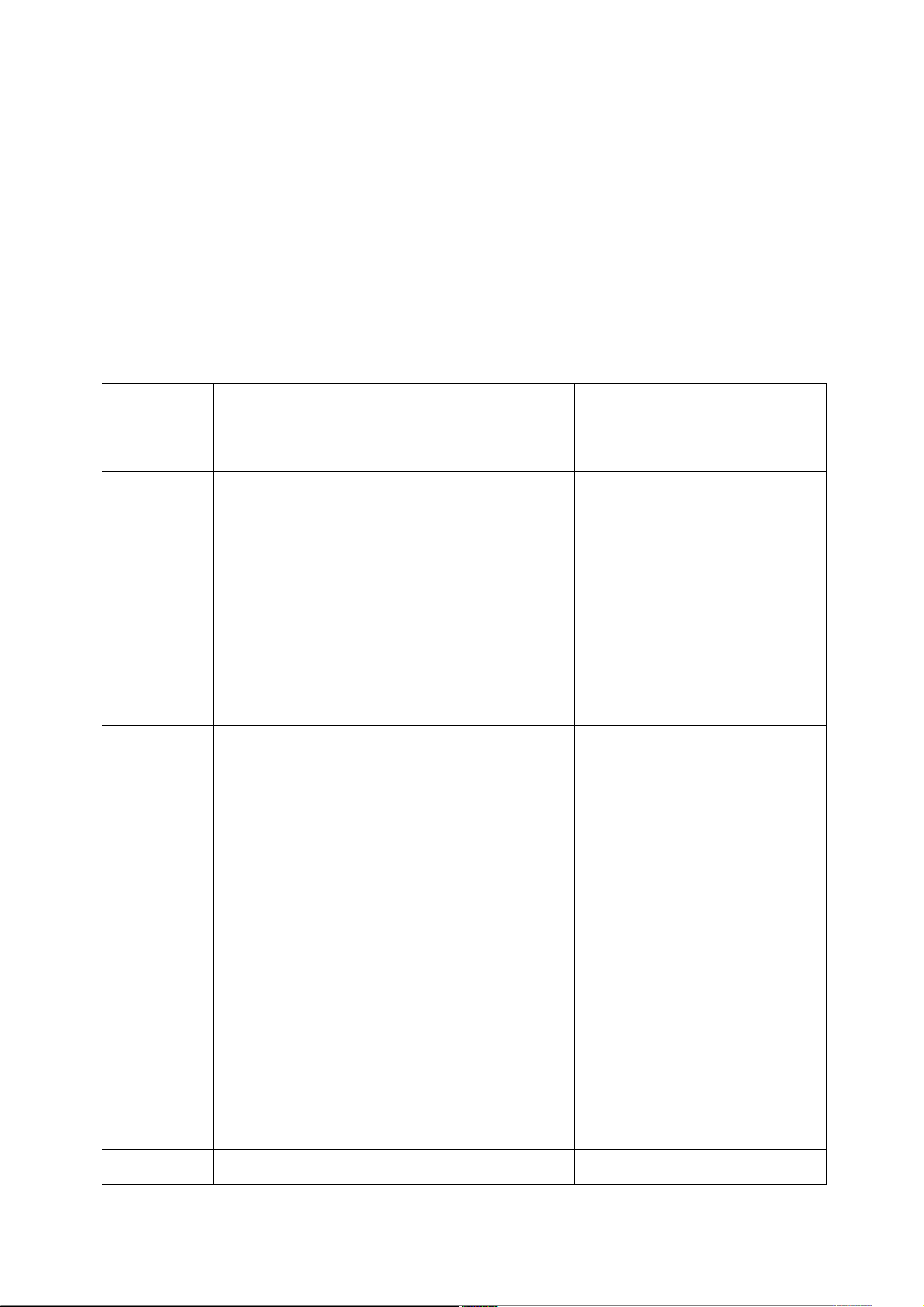

- At the time of paying the remaining amount Thời

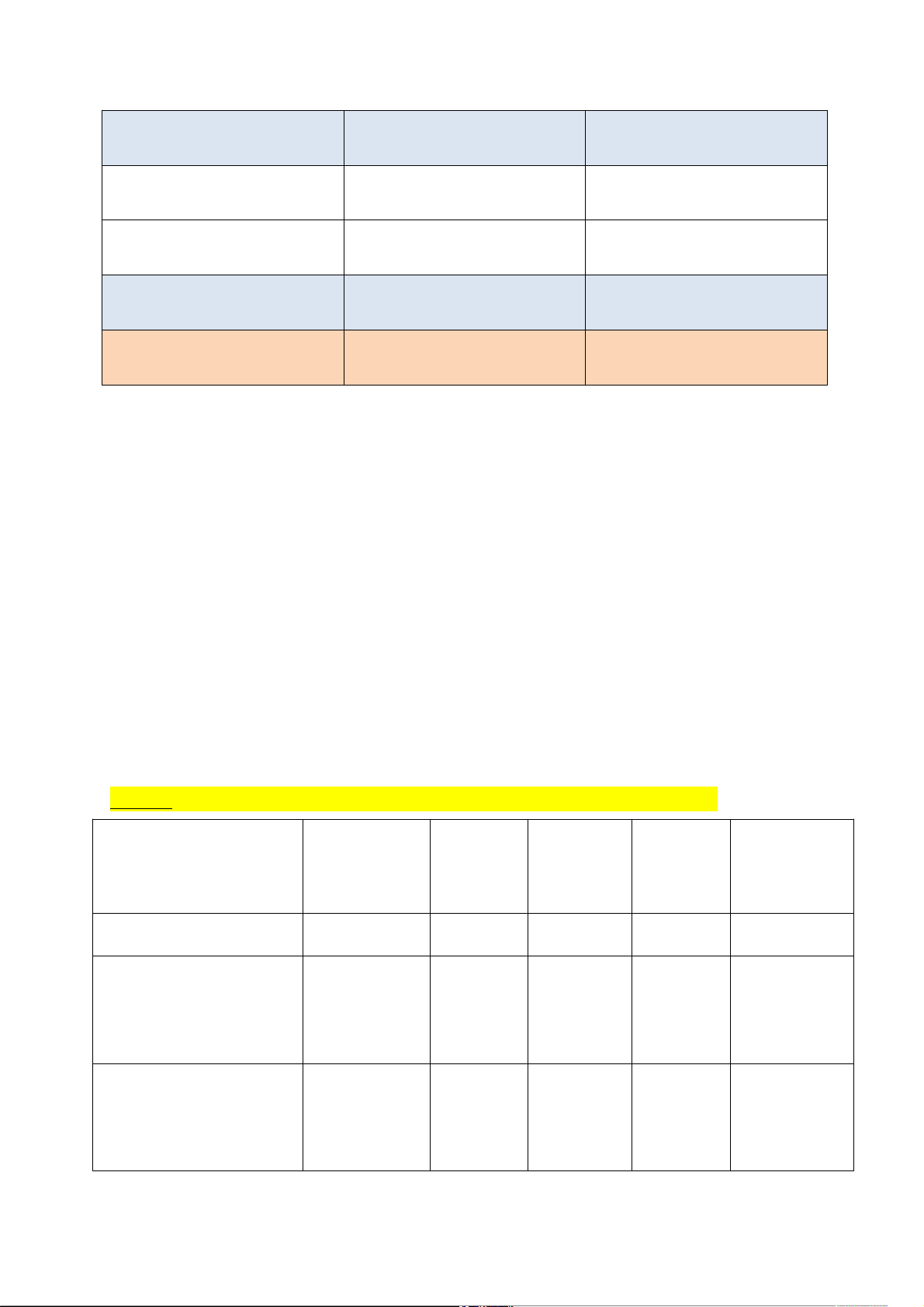

Kế toán X ( bên bán) Thời Kế toán Y( bên mua) điểm điểm

At the - Asset ( cash in bank) - At the - Asset ( cash) decrease time of increase 1000 time of 1000 receiving advance - Liability (receipt in - Asset (advance payment) in advance payment advance) increase 1000 increase 1000

At the - Asset (Fisnish goods) At the - Asset (goods) increase time of decrease 2500 time of 3000

delivery to - Liability (receipt in receivin - Asset (advance customer advance) decrease 1000 g goods payment) decrease - Sale revenue increase 1000 3000 - Liability (A/P) increase - Expense (cost off 2000 Imgoods sale) increase 2500 - Asset ( A/R) increase 2000

At the - Asset ( cash) increase - At the - Asset ( cash) decrease 18 time of 2000 time of 2000 receiving paying

- Asset (A/R) decrease 2000 - Liability (A/P) the the decrease 2000 remaining remaini amount. ng amount Q10

On January 1/Year, Company P gave a loan of VND 500 million in two-year term

and at 12%/year interest to Company Q. On January 4th, the borrower prepaid the

full interest of VND120 million in two years. On 1/04/Y + 1 the borrower paid the

principal to Company P, the interest received for the last 3 quarters of year (Y + 1)

was repaid by the Company P by deducting from the principal.

Required: With the given transactions, please identify:

A/ How does P’s accountant record for elements of financial statement if the

accrual basis is applied and the accounting period is quarterly?

- At the time of transfering to the borrower;

- At the time of receiving 02-year interest;

- By the end of each quarter in year Y;

- At the time of receiving the principal

B/ How does Q’s accountant record for elements of financial statement if the

accrual basis is applied and the accounting period is quarterly?

- At the time of receiving from the lender

- At the time of paying 02-year interest;

- By the end of each quarter in year Y;

- At the time of paying the principal. Thời

Kế toán P ( bên bán) Thời Kế toán Q( bên mua) 19 điểm điểm

At the - Asset ( cash) decrease At the - Asset ( cash) increase time of 500 million VND time of 500 million VND transferin receiving - Liability (A/P) increase - Asset (long term g to the from the 500 million VND investment) increase 500 borrower lender million VND

At the - Asset ( cash) increase At the - Asset ( cash) decrease time of 120 million VND time of 120 million VND receiving - Liability (unearned paying - Asset (prepaid ỉnterest 02-year revenue) increase 120 02-year expense) increase 120 interest million VND interest million VND By the - Liability (unearn

By the - Asset ( prepaid ỉnterest end of revenue) decrease 15 end of expense) decrease 15 each million VND each million VND quarter in - Interest revenue quarter in - interest Expense year Y increase 15 million year Y increase 15 million VND VND

At the - Asset ( cash ) increase At the - Asset ( cash) decrease time of 455 million VND time of 455 million VND receiving

- Asset ( long term paying the - Liability (long term the investment) decrease principal loan) decrease 500 principal 500 million VND million VND - Liability ( unearn - Asset ( prepaid interest revenue) decrease 45 expense) decrease 15 million VND 20