Preview text:

CHAPTER 3

(IFRS 13 – FAIR VALUE MEASUREMENT) Lecturer: Ho Hanh My Learning Objectives

• Understand objective, scope and key definitions of IFRS 13.

• Understand fair value measurement techniques and disclosure requirements. 2 1 References

• Wiley, Interpretation and Application of IFRS Standards 2021, PKF International

Ltd, ISBN: 978-1-119-69936-1: Chapter 25

• IFRS 13 - Fair Value Measurement 3 Contents

3.1. Introduction to IFRS 13 –Fair Value Measurement 3.1.1. Objective 3.1.2. Scope 3.1.3. Important definitions 3.2. Standard content 3.2.1. Fair value hierarchy 3.2.2. Fair value Measurement 3.2.3. Disclosure 4 2

3.1. Introduction to IFRS 13 –Fair Value Measurement 3.1.1. Objective 3.1.2. Scope 3.1.3. Important definitions 5

3.1. Introduction to IFRS 13 –Fair Value Measurement Objective definition of fair value

sets out in a single IFRS a framework for measuring fair value

requires disclosures about fair value measurements 6 3 3.1.1 Objective Fair value is a market-based measurement, not an entity-specific measurement.

For some assets and liabilities, observable market transactions or market

information might be available.

For other assets and liabilities, observable market transactions and market

information might not be available.

The objective of a fair value measurement: to estimate the price at which an

orderly transaction to sell the asset or to transfer the liability would take place

between market participants at the measurement date under current market

conditions (ie an exit price at the measurement date from the perspective of a

market participant that holds the asset or owes the liability). 7 3.1.1 Objective

• When a price for an identical asset or liability is not observable, an entity

measures fair value using another valuation technique that maximises the use of

relevant observable inputs and minimises the use of unobservable inputs.

• Because fair value is a market-based measurement, it is measured using the

assumptions that market participants would use when pricing the asset or liability,

including assumptions about risk.

• As a result, an entity’s intention to hold an asset or to settle or otherwise fulfil a

liability is not relevant when measuring fair value. 8 4 3.1.1 Objective

• The definition of fair value focuses on assets and liabilities because they are a

primary subject of accounting measurement.

• In addition, this IFRS shall be applied to an entity’s own equity instruments measured at fair value. 9 3.1.2 Scope

This IFRS applies when another IFRS requires or permits fair value measurements or disclosures about fair value measurements (and

measurements, such as fair value less costs to sell, based on fair value or

disclosures about those measurements), except for: 10 5 3.1.2 Scope

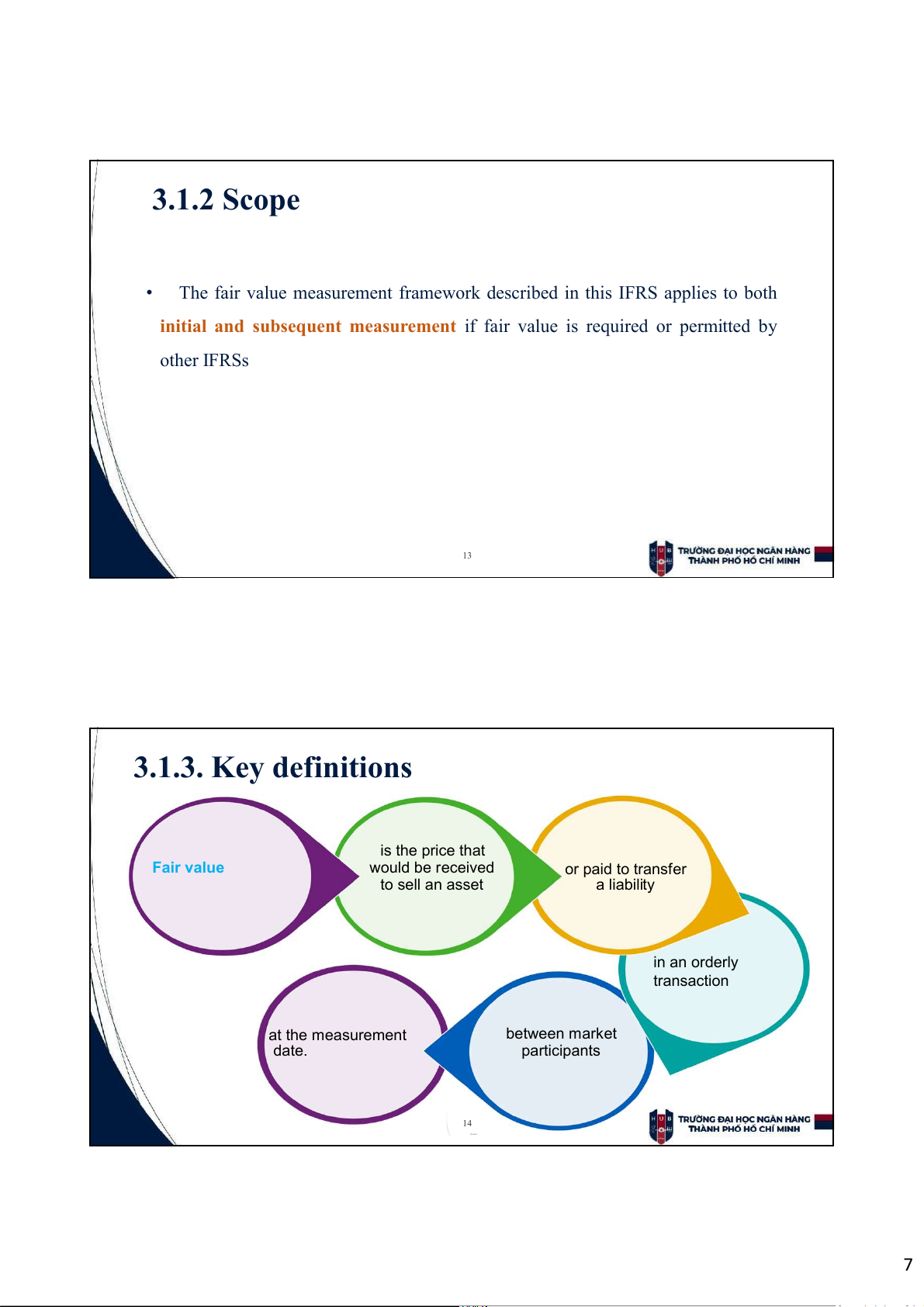

• The measurement and disclosure requirements of this IFRS do not apply to the following:

(a) share-based payment transactions within the scope of IFRS 2 Share-based Payment

(b) leasing transactions accounted for in accordance with IFRS 16 Leases

(c) measurements that have some similarities to fair value but are not fair

value, such as net realizable value in IAS 2 Inventories or value in use in IAS 36 Impairment of Assets. 11 3.1.2 Scope

• The disclosures required by this IFRS are not required for the following:

(a) plan assets measured at fair value in accordance with IAS 19 Employee Benefits

(b) retirement benefit plan investments measured at fair value in accordance with

IAS 26 Accounting and Reporting by Retirement Benefit Plans

(c) assets for which recoverable amount is fair value less costs of disposal in accordance with IAS 36. 12 6 3.1.2 Scope •

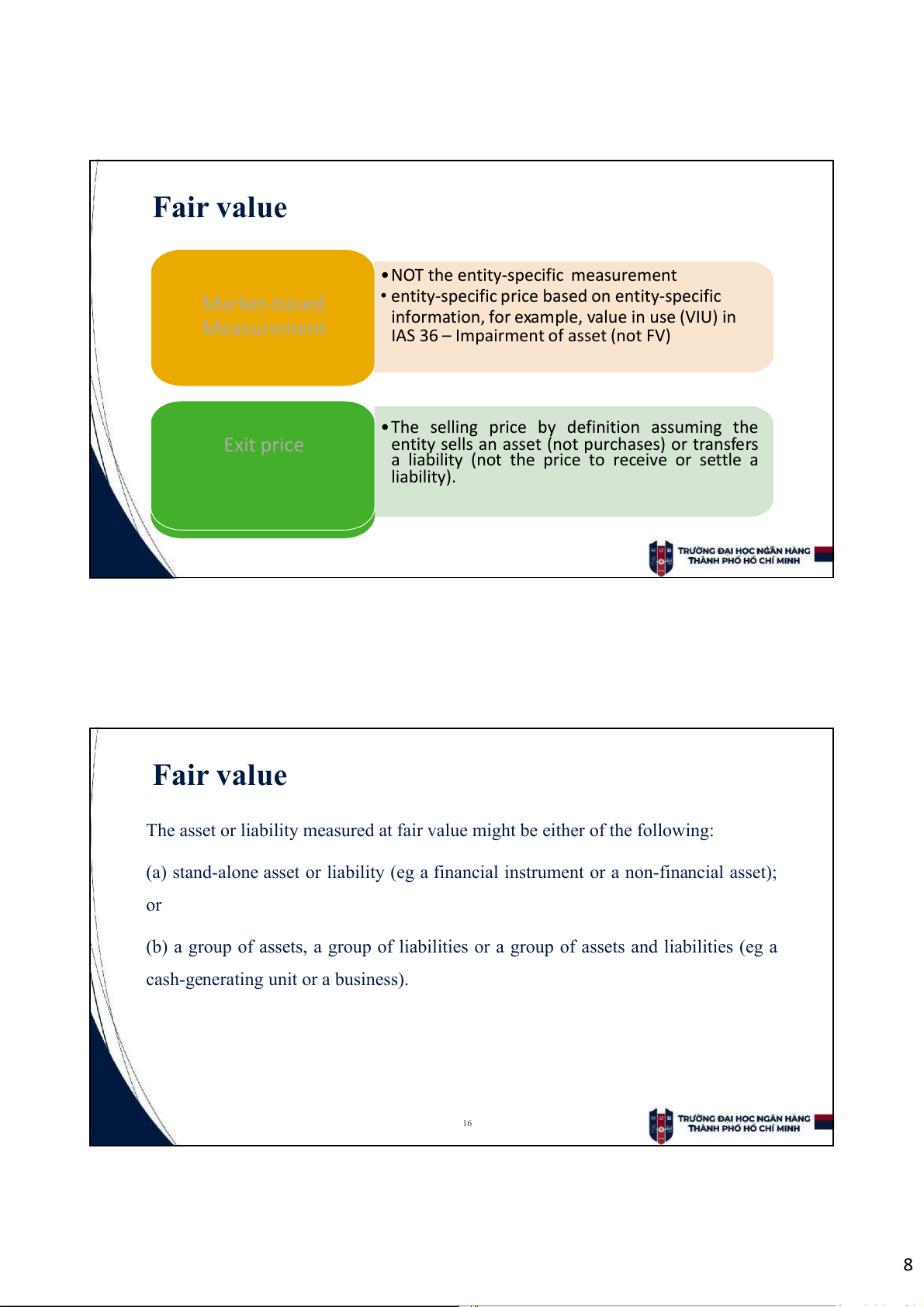

The fair value measurement framework described in this IFRS applies to both

initial and subsequent measurement if fair value is required or permitted by other IFRSs 13 3.1.3. Key definitions is the price that Fair value would be received or paid to transfer to sell an asset a liability in an orderly transaction at the measurement between market date. participants 14 7 Fair value

•NOT the entity-specific measurement

• entity-specific price based on entity-specific Market-based

information, for example, value in use (VIU) in Measurement

IAS 36 – Impairment of asset (not FV)

•The selling price by definition assuming the Exit price

entity sells an asset (not purchases) or transfers

a liability (not the price to receive or settle a liability). 15 Fair value

The asset or liability measured at fair value might be either of the following:

(a) stand-alone asset or liability (eg a financial instrument or a non-financial asset); or

(b) a group of assets, a group of liabilities or a group of assets and liabilities (eg a

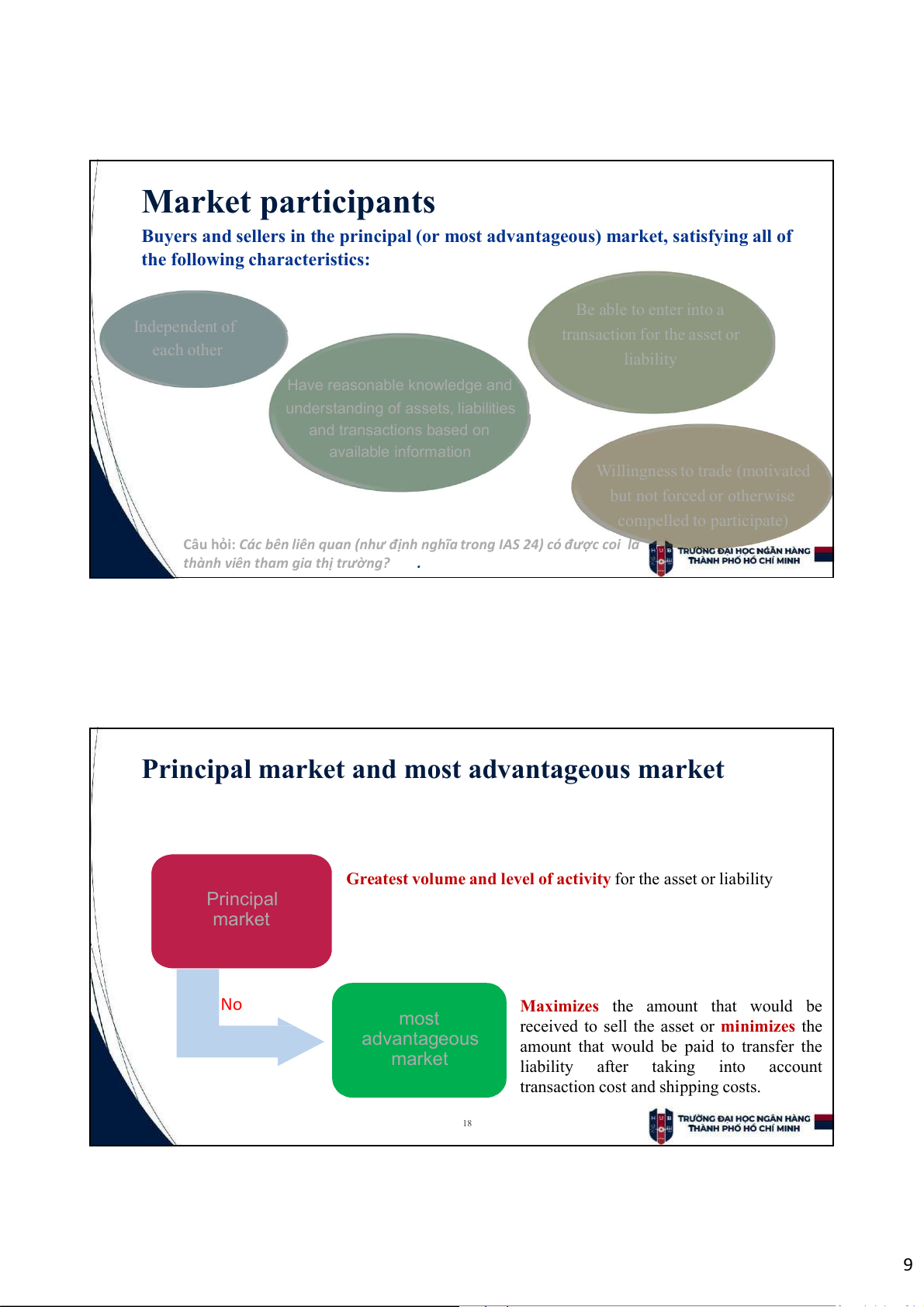

cash-generating unit or a business). 16 8 Market participants

Buyers and sellers in the principal (or most advantageous) market, satisfying all of the following characteristics: Be able to enter into a Independent of transaction for the asset or each other liability Have reasonable knowledge and

understanding of assets, liabilities and transactions based on available information

Willingness to trade (motivated but not forced or otherwise compelled to participate)

Câu hỏi: Các bên liên quan (như định nghĩa trong IAS 24) có được coi là 17

thành viên tham gia thị trường? .

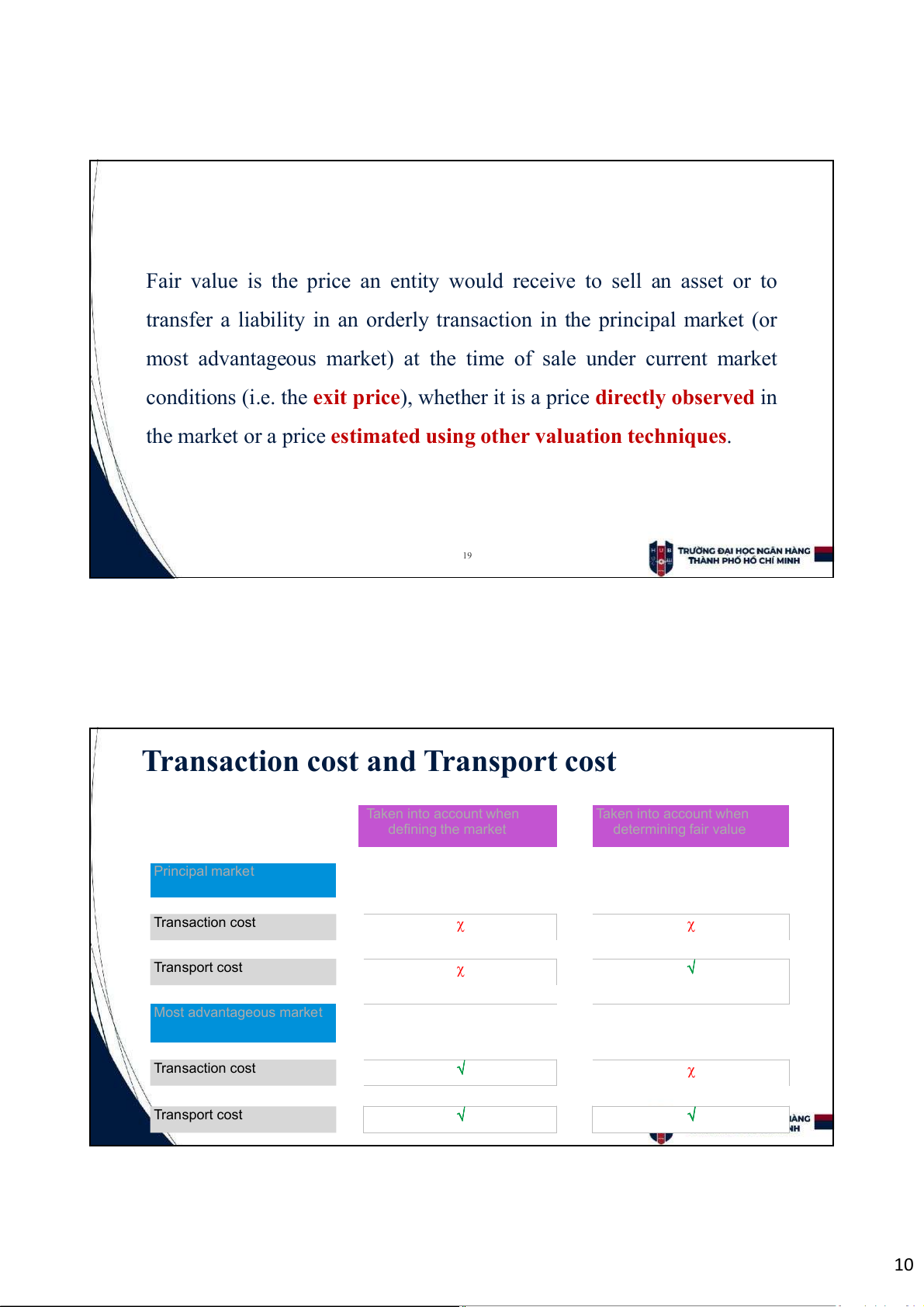

Principal market and most advantageous market

Greatest volume and level of activity for the asset or liability Principal market No

Maximizes the amount that would be most

received to sell the asset or minimizes the advantageous

amount that would be paid to transfer the market liability after taking into account

transaction cost and shipping costs. 18 9

Fair value is the price an entity would receive to sell an asset or to

transfer a liability in an orderly transaction in the principal market (or

most advantageous market) at the time of sale under current market

conditions (i.e. the exit price), whether it is a price directly observed in

the market or a price estimated using other valuation techniques. 19

Transaction cost and Transport cost Taken into account when Taken into account when defining the market determining fair value Principal market Transaction cost Transport cost Most advantageous market Transaction cost Transport cost 10 Transaction costs

The price in the principal (or most advantageous) market used to measure the

fair value of the asset or liability shall not be adjusted for transaction costs.

• Transaction costs shall be accounted for in accordance with other IFRSs.

• Transaction costs are not a characteristic of an asset or a liability; rather,

they are specific to a transaction and will differ depending on how an entity

enters into a transaction for the asset or liability. 21

Transaction costs do not include transport . costs

If location is a characteristic of the asset (as might be the case, for example,

for a commodity), the price in the principal (or most advantageous) market shall

be adjusted for the costs, if any, that would be incurred to transport the asset

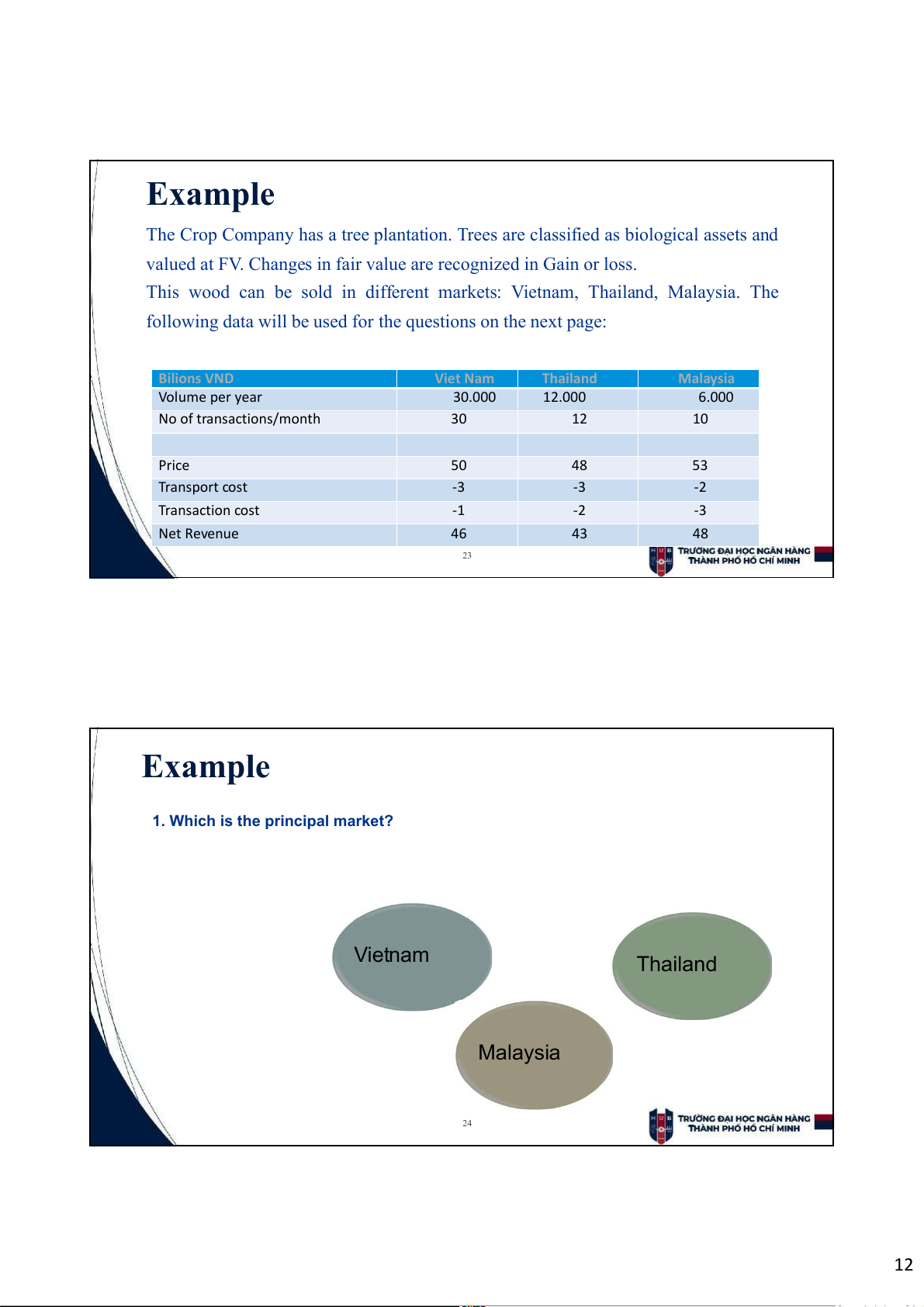

from its current location to that market. 22 11 Example

The Crop Company has a tree plantation. Trees are classified as biological assets and

valued at FV. Changes in fair value are recognized in Gain or loss.

This wood can be sold in different markets: Vietnam, Thailand, Malaysia. The

following data will be used for the questions on the next page: Bilions VND Viet Nam Thailand Malaysia Volume per year 30.000 12.000 6.000 No of transactions/month 30 12 10 Price 50 48 53 Transport cost -3 -3 -2 Transaction cost -1 -2 -3 Net Revenue 46 43 48 23 Example

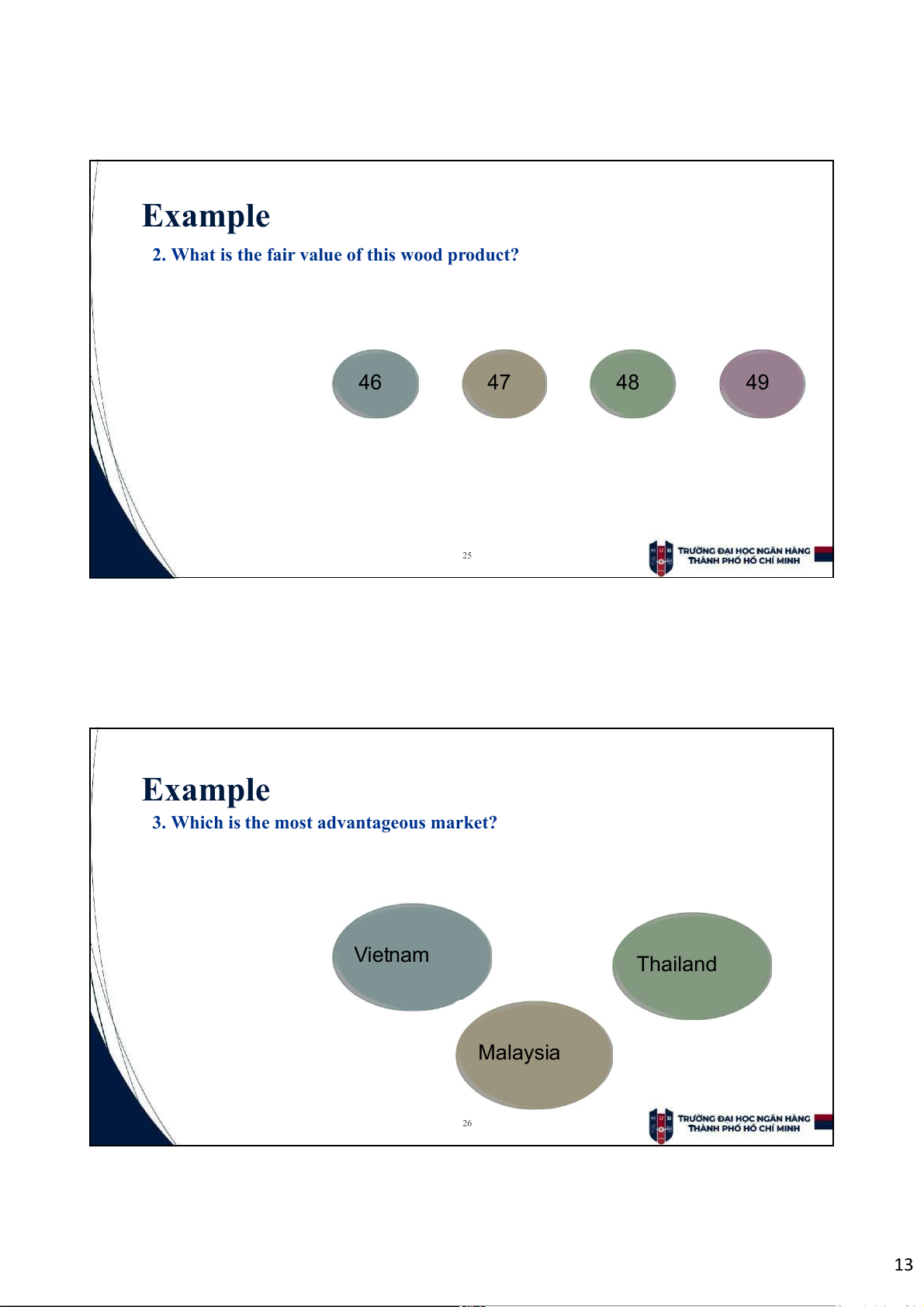

1. Which is the principal market? Vietnam Thailand Malaysia 24 12 Example

2. What is the fair value of this wood product? 46 47 48 49 25 Example

3. Which is the most advantageous market? Vietnam Thailand Malaysia 26 13 Example

Assuming that the principal market cannot be determined, what is the

fair value of this wood product? 50 45 51 27 3.2. Content of IFRS 13 3.2.1. Fair value hierarchy 3.2.2. Fair value measurement 3.2.3. Disclosures 28 14 3.2.1 Fair value hierarchy 3.2.1. Fair value hierarchy

• To increase consistency and comparability in fair value measurements and

related disclosures, this IFRS establishes a fair value hierarchy that categorises

into three levels the inputs to valuation techniques used to measure fair value.

• The fair value hierarchy gives the highest priority to quoted prices (unadjusted)

in active markets for identical assets or liabilities and the lowest priority to unobservable inputs.

• The inputs used to measure the fair value of an asset or a liability might be

categorised within different levels of the fair value hierarchy. In those cases, the

fair value measurement is categorised in its entirety in the same level of the fair

value hierarchy as the lowest level input that is significant to the entire

measurement (based on judgement). 30 15

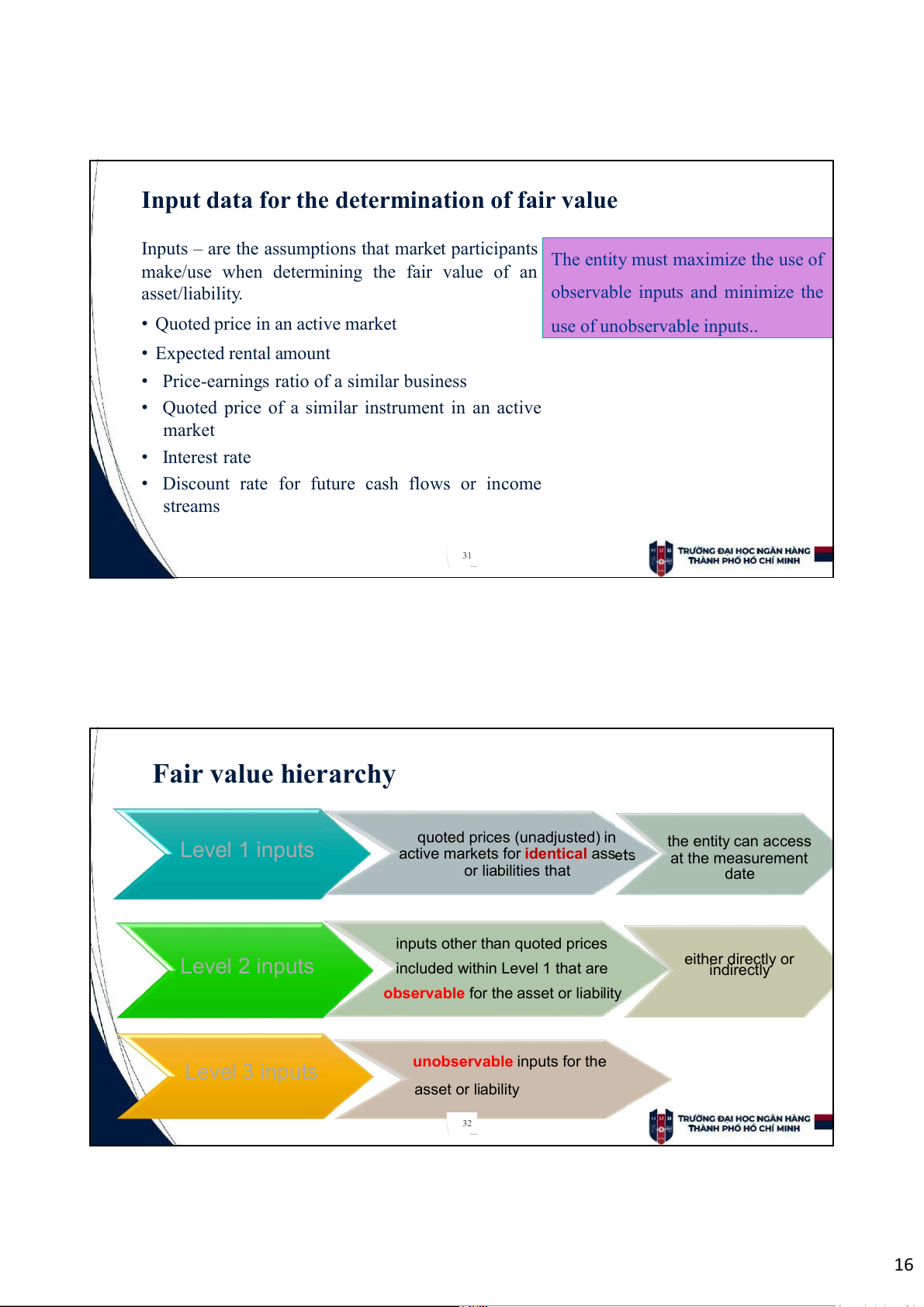

Input data for the determination of fair value

Inputs – are the assumptions that market participants The entity must maximize the use of

make/use when determining the fair value of an asset/liability.

observable inputs and minimize the

• Quoted price in an active market use of unobservable inputs.. • Expected rental amount

• Price-earnings ratio of a similar business

• Quoted price of a similar instrument in an active market • Interest rate

• Discount rate for future cash flows or income streams 31 Fair value hierarchy quoted prices (unadjusted) in Level 1 inputs the entity can access

active markets for identical ass at the measurement or liabilities that date

inputs other than quoted prices Level 2 inputs either directly or

included within Level 1 that are indirectly

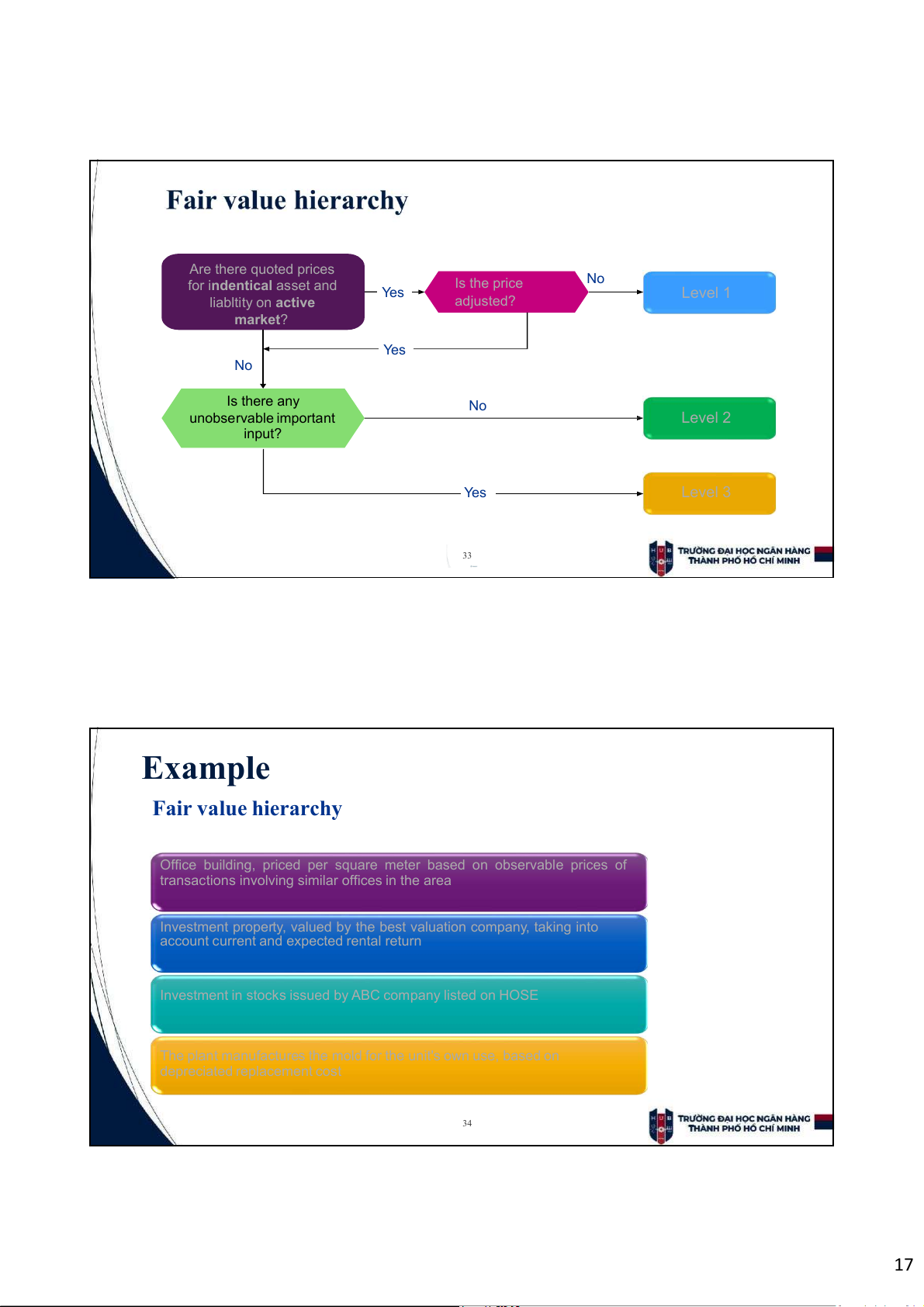

observable for the asset or liability unobservable inputs for the Level 3 inputs asset or liability 32 16 Are there quoted prices No for indentical asset and Is the price Yes Level 1 liabltity on active adjusted? market? Yes No Is there any No unobservable important Level 2 input? Yes Level 3 33 Example Fair value hierarchy

Office building, priced per square meter based on observable prices of

transactions involving similar offices in the area

Investment property, valued by the best valuation company, taking into

account current and expected rental return

Investment in stocks issued by ABC company listed on HOSE

The plant manufactures the mold for the unit's own use, based on depreciated replacement cost 34 17 3.2.2 Fair value measurement 3.2.2. Fair value measurement

The objective of a fair value measurement is to estimate the price at which an orderly

transaction to sell the asset or to transfer the liability would take place between market

participants at the measurement date under current market conditions. A fair value

measurement requires an entity to determine all the following:

• the particular asset or liability that is the subject of the measurement (consistently with its unit of account).

• for a non-financial asset, the valuation premise that is appropriate for the measurement

(consistently with its highest and best use).

• the principal (or most advantageous) market for the asset or liability.

• the valuation technique(s) appropriate for the measurement, considering the availability of

data with which to develop inputs that represent the assumptions that market participants

would use when pricing the asset or liability and the level of the fair value hierarchy 36

within which the inputs are categorized. 18 3.2.2. Fair value measurement

Measurement Guide: IFRS 13 provides guidance on measuring fair value, including:

• An entity considers the characteristics of the measured asset or liability that

market participants would consider when valuing the asset or liability at the

measurement date (e.g. condition and location of the assets and any restrictions on

the sale and use of the assets)

• The fair value measurement assumes an organized voluntary transaction between

market participants at the measurement date under current market conditions.

• The fair value measurement assumes a transaction takes place in the principal

market for the asset or liability, or in the absence of a principal market, most

advantageous market for the asset or liability is used. 37 3.2.2. Fair value measurement Measurement Guide

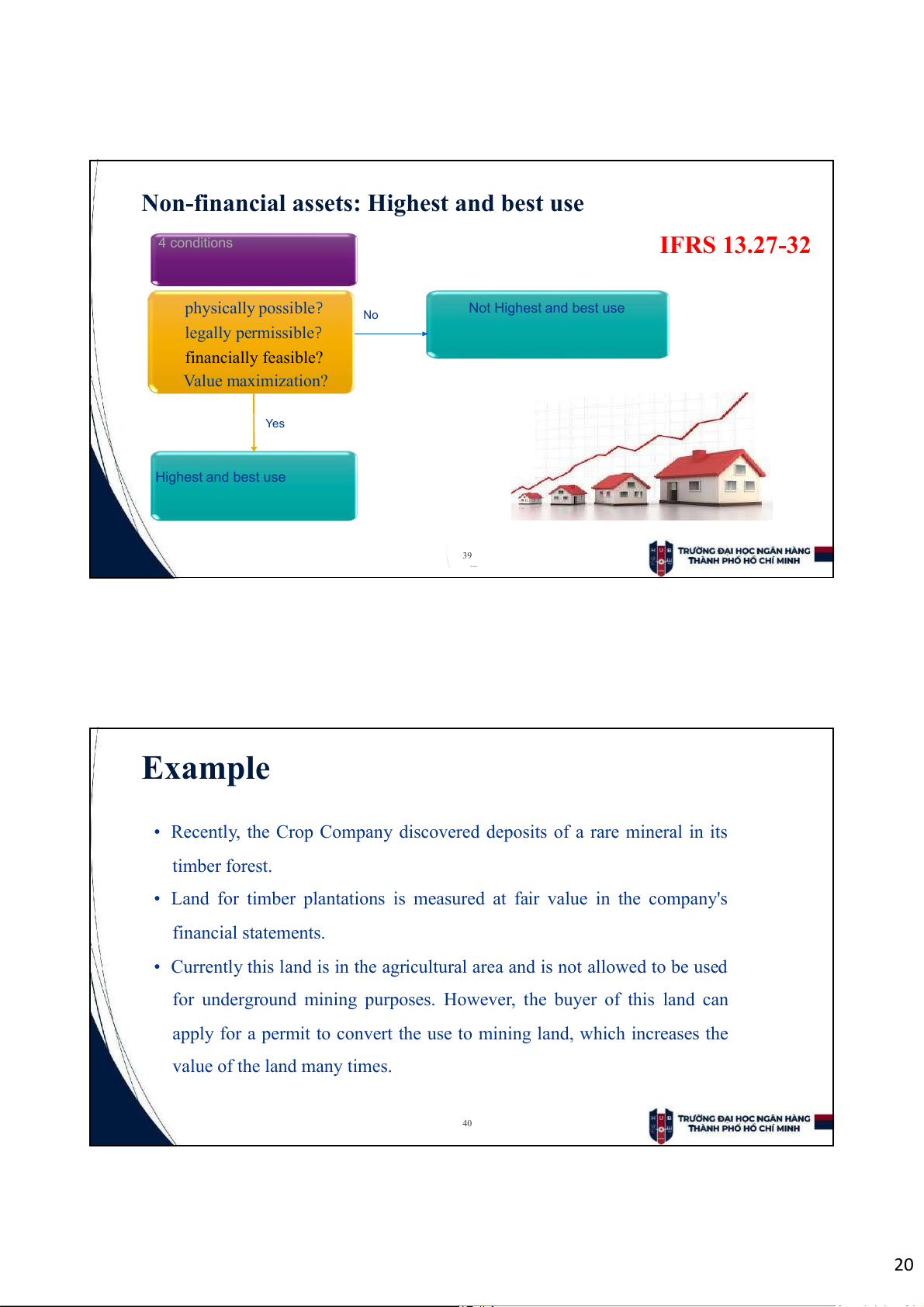

• Measure the fair value of a non-financial asset with consideration of highest and the best use.

• Measure the fair value of an entity's financial or non-financial liability or equity

instrument assuming that it is transferred to a market participant on the

measurement date, without payment, write-off or cancellation at measurement date.

• The fair value of the liability reflects the risk of default (the risk that the entity will

default), including the entity's own credit risk and the assumption of default risk

for similar obligations before and after the transfer of the liability. 38 19

Non-financial assets: Highest and best use 4 conditions IFRS 13.27-32 physically possible? Not Highest and best use No legally permissible? financially feasible? Value maximization? Yes Highest and best use 39 Example

• Recently, the Crop Company discovered deposits of a rare mineral in its timber forest.

• Land for timber plantations is measured at fair value in the company's financial statements.

• Currently this land is in the agricultural area and is not allowed to be used

for underground mining purposes. However, the buyer of this land can

apply for a permit to convert the use to mining land, which increases the value of the land many times. 40 20