Preview text:

VIETNAM NATIONAL UNIVERSITY – HCM INTERNATIONAL UNIVERSITY SCHOOL OF BUSINESS INTERNSHIP REPORT

INSTRUCTOR: TRẦN NHẬT MINH

Student name and surname: Hoàng Thụy Khanh

Student ID: BAFNIU19014

Internship start and finish dates: 16th March – 19th May

Type of Internship: Individual Department Intern

Company/ Institution name: Bank for Investment and Development of Vietnam JSC

Table of Contents

I. A Brief Executive Summary of the Internship ........................................... 2

II. Description of JSC Bank for Investment and Development of Vietnam . 3

2.1 General Introduction ............................................................................ 3

2.2 Characteristic ........................................................................................ 4

2.3 Our company sector and service ........................................................... 5

2.4 Target customer ..................................................................................... 7

2.5 Management structure .......................................................................... 8

2.6 Functions of main departments ............................................................ 9

2.7 Performance of company .................................................................... 10

2.8 BIDV – Ham Nghi branch.................................................................. 12

III. Internship activities ............................................................................... 13

3.1 My activities ........................................................................................ 13

3.2 Individual Department functions ....................................................... 13

3.3 Performance of Individual Departments ............................................ 15

3.4. BIDV’s corporate culture ................................................................... 15

IV. Internship assessment ............................................................................ 16

4.1 Skill gained after the internship ........................................................ 16

4.2 The Influences of internship on my career plan ............................... 18

4.3 Classroom knowledge and Internship...............................................17 V.

Conclusion.............................................................................................18

VI. References:.........................................................................................19 I.

A Brief Executive Summary of the Internship

Bank for Investment and Development of Vietnam (BIDV for short) is the

largest state-owned commercial bank in Vietnam by total assets. According to

the provisions of the Enterprise Law 2020, BIDV is classified as a joint stock

company with the State shareholder (the State Bank of Vietnam) holding a 2

controlling stake. BIDV was established on April 26, 1957, with the first

name of Vietnam Construction Bank, under the Ministry of Finance.

According to UNDP (United Nations Development Program) 2007, BIDV is

currently Vietnam's fourth-biggest firm and the country's largest state-owned

commercial bank. with a bank structure The bank is organized in the model

of a State corporation, BIDV is a special class state-owned enterprise, having

business cooperation with more than 800 banks around the world. The

mission of BIDV is to deliver the best interests and conveniences to

customers, shareholders, employees, and society.

This internship has been a useful and rewarding experience for me. The

chance to have an internship report at BIDV Ham Nghi was such a valuable

and exciting experience this semester. I have completed this internship report

with much generous help from many individuals and organizations, which I

want to put on record here to express my deep gratitude.

II. Description of JSC Bank for Investment and Development of Vietnam

2.1 General Introduction

Bank for Investment and Development of Vietnam (referred to as BIDV) is

the largest state-owned commercial bank in Vietnam by total assets with

more than VND 2.08 million billion (by the end of 2022).

BIDV was established on April 26, 1957, with the first name of Vietnam

Construction Bank, under the Ministry of Finance. Currently, BIDV is the

largest state-owned commercial bank in Vietnam and the fourth largest

enterprise in Vietnam as reported by UNDP (United Nations Development

Program) 2007. With a bank structure The bank is organized in the model of

a State corporation, BIDV is a special class state-owned enterprise, having

business cooperation with more than 800 banks around the world. As of

2019, BIDV has more than 191 main branches and about 855 transaction

offices located in 63 provinces and cities across the country. BIDV currently

owns a system of 57,825 ATMs along with many POS mobile payment machines. 3

In addition to the Vietnam market, BIDV has also been present in more than

6 countries including Laos, Cambodia, the Czech Republic, Russian

Federation, Myanmar, and Taiwan. Type: Commercial Bank

Lines of business: Banking; Insurance; Securities; and Financial Investment.

Some basic information about BIDV:

+ Official name: Joint Stock Commercial Bank for Investment and

Development of Vietnam (BIDV);

+ Head office: BIDV Tower, 35 Hang Voi Street, Ly Thai To Ward, Hoan Kiem District, Hanoi; + SWIFT CODE: BIDVVNVX;

+ Trading code on the stock exchange: BID;

+ Date of establishment: 26/04/1957; + Logo:

+ Slogan: “Share opportunities, share success”

+ Brand proposition: “The Bank of Today”

+ Mission: To deliver the best interests and conveniences to customers,

shareholders, employees, and society.

+ Vision to 2030: To become a leading financial institution in Southeast Asia,

have the best digital platform in Vietnam, and be among the Top 100 largest banks in Asia.

+ Core value: Quality and Trustworthiness; Customer Orientation;

Innovation; Professionalism; Social Responsibility.

+ Website: https://www.bidv.com.vn/

+ Email customer care: bidv247@bidv.com.vn;

+ Hotline: (+84) 24 22200588 or 19009247 ; 2.2 Characteristic

BIDV is a state-owned commercial bank with an ownership structure of 4

100% state-owned capital. Two major shareholders owning nearly 96% of

BIDV's total shares are the State Bank of Vietnam (80.99%) and KEB Hana Bank, Co., Ltd. (15%).

2.3 Our company sector and service

BIDV engages in investment and development across several industries and

has had great success as they perform so. - Financial investment field

It can be said that financial investment is the most prominent field in BIDV's

fields of operation, worthy of the title of an important field that has created

BIDV's brand in the current investment market. In this field, BIDV has

established many businesses based on capital contribution to invest in projects.

In the field of investment, BIDV always clearly shows its leading and

coordinating role in key national projects such as Expressway Development

Company - BEDC; Aviation Leasing Joint Stock Company - VALC, investing

in the construction of Long Thanh International Airport, ... - Insurance field

BIDV always strives to build and develop this field. Currently, the bank is

providing 2 main insurance products, suitable to the needs and conditions of each customer, specifically:

Life insurance: together with the combination of BIDV MetLife, BIDV

specializes in providing customers with life insurance products, ensuring

their wishes, and providing solutions to save money, develop and grow.

Investment development, protection, and always support to build solid future

financial plans for customers at every stage of life. The products inside these

insurance packages include Happy Gifts, American Safety Insurance, Hung

Gia Safe American Insurance, Terminal Illness Insurance, Personal Accident,

Life Insurance, and Life Insurance. extended life insurance.

Non-life insurance: a combination with BIC, BIDV is currently providing

products such as BIC Binh An, and BIC Home Care to customers to express

their desire to maximize customer protection needs. goods and customer

assets when they use products and services at BIDV. - Securities field 5

To meet all financial needs of customers promptly, BIDV operates in the

securities sector and provides specific products in this field such as:

Securities brokerage: in conjunction with BSC, BIDV provides services to

customers such as securities investment consulting, portfolio structure

consulting, etc. All these services are always performed by a stockbroker. a

team of highly qualified, experienced consultants, who have good business

ethics and understand the general provisions of financial law.

Securities services include customer transaction services, financial services,

depository registration services, and bond payment services.

Securities trading: this service is provided to assist customers to make

transactions most easily and conveniently. Currently, BIDV is providing

transaction services such as Web Trader transactions, Home Trader

transactions, Mobile Trader transactions, Bloomberg transactions, and Telephone transactions.

Derivatives: This is also a combination of BIDV and BSC, specializing in

providing derivative securities products to create opportunities for customers

to use and experience high-class products in the market with low fees. low

deals, plus many offers and promotions. - Banking Sector

In the banking sector, BIDV always strives to create and launch new products

and services with many features and utilities, helping to meet customers' all

needs for savings, payment, loans, cash withdrawals, credit cards, etc. Specifically:

Foreign exchange and capital markets: foreign exchange trading services, structured products, etc.

Treasury: asset preservation services, exchange of unqualified currency for

circulation, exchange of gold bars packaging, overnight cash collection,

collection of money in sealed bags, mobile cash collection/payment.

Digital banking: BIDV online, ATM service, new technology.

Payment and transfer: support domestic money transfer, international money

transfer, payment service, and card payment acceptance service for individual HKD. 6

Card service: issue international debit cards, international credit cards, and domestic debit cards.

Personal loans: demand for housing loans, study abroad loans, car loans,

unsecured consumer loans, business loans, mortgage loans, and consumer loans with collateral.

Deposit services: receive payment deposits, term deposits, securities trading

and specialized deposits, and account packages. 2.4 Target customer

BIDV's customer file includes Personal customers and Corporate customers:

Corporate: BIDV currently has the largest number of corporate customers in

the banking system in Vietnam. BIDV's customers include large corporations

and companies, as well as small and medium enterprises.

According to BIDV's Executive Board Report 2021, the bank's small and

medium-sized enterprise (SME) customer segment is currently enjoying

stable growth. The number of new SME customers in 2020 is about 310

thousand. This number is up 6.2% compared to 2019. It also accounts for

about 40% of the number of small and medium enterprises nationwide.

Financial institutions: BIDV has been a partner for many years and has

received the trust of foreign banks and international organizations present in Vietnam.

BIDV currently has cooperation activities with the World Bank (World

Bank), Japan International Cooperation Agency (JICA), Asian Development

Bank (ADB), and Japan Bank for International Cooperation (BIDV). JBIC),

or Nordic Investment Bank (NIB)…

Individuals: Also according to the early 2021 report from BIDV, individual

customers are currently about 11.6 million people, up 14%. The number of

additional customers in 2020 is about 1.45 million people. 7

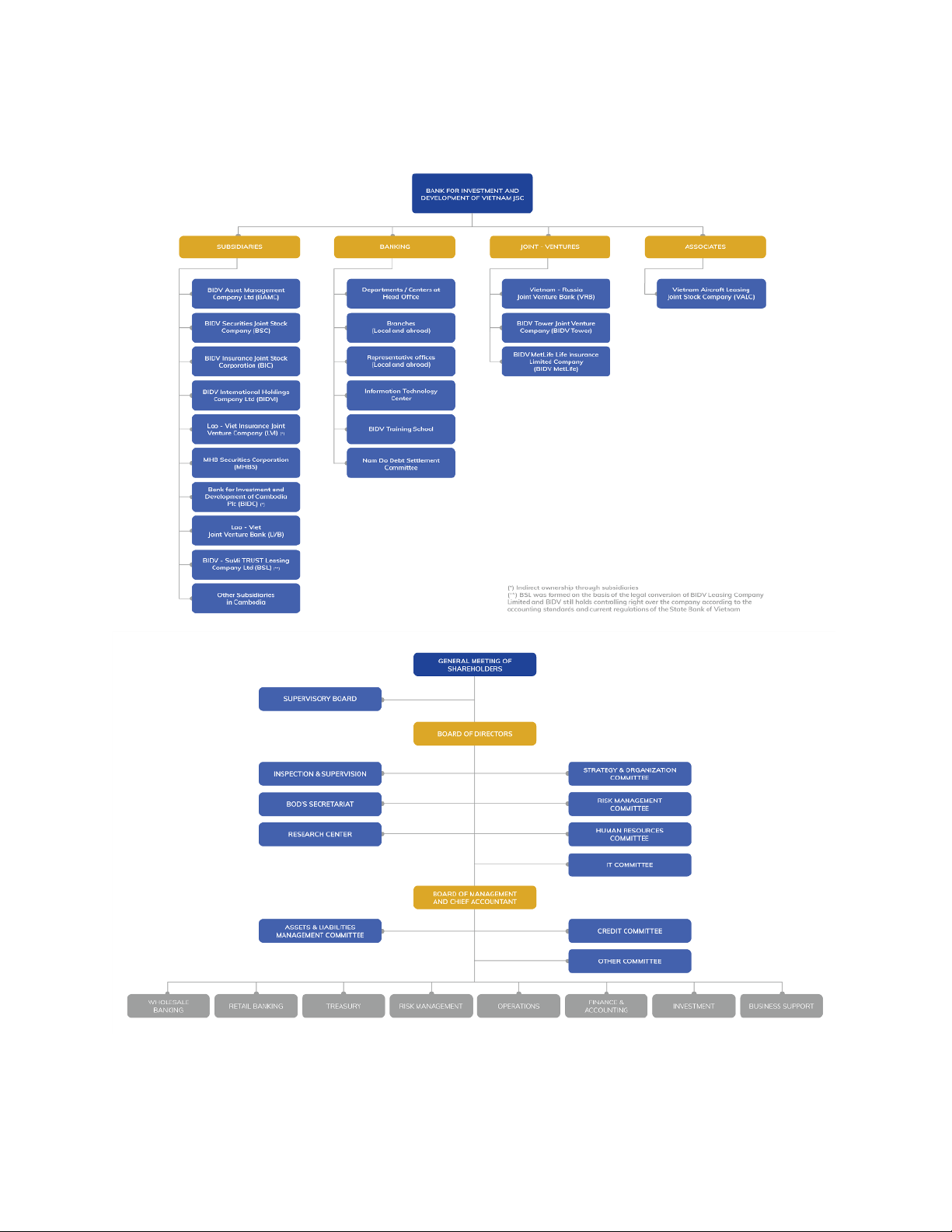

2.5 Management structure 8

BIDV's Board of Directors has 10 members, of which Mr. Phan Duc Tu is the

Chairman of the Board of Directors, and Mr. Nguyen Van Thanh is an

independent member of the Board of Directors.

BIDV's Supervisory Board has 03 members.

BIDV's Board of Management has the General Director, 08 Deputy General

Directors, and 03 other members.

2.6 Functions of main departments

Headquarters are categorized into 8 functional blocks: Wholesale banking;

Retail banks; Treasury; Risk management; Operational; Finance and

Accounting; Investment; Business support. At branches are arranged into 5

departments: Customer management; Risk management; Operation; Internal affairs and Subsidiaries. - Customer management

Consumer banking division takes responsibility for bringing out business

projects to interest personal customers and tackling matters connected with cards and debt management.

Corporate banking division has a duty that is almost the same as consumer

one, but the subjects are corporations. In addition, it also derives the demand

for international payment from companies. This department is responsible for

maintaining and developing the relationships between BIDV and its large

corporate customers. Specifically, the Customer Relationship ..... - Risk Management Department

The department takes responsibility for controlling credit operations, credit

risks, and other risks that the Bank may encounter. This division also

examines the risk from potential business operations proposed by other divisions.

- Operations Department

In BIDV, this department has responsibility for payments and direct

collection payments. In particular, this division handles domestic

payment, international money transfer, and SWIFT telegraphic transfer;

loan management, customer services, and trade finance activities. - Internal Affairs Department 9

The Internal Affairs Department is in charge of financial accounting

information for the Bank and its subsidiaries. This department also manages

financial operations for the transaction office and general accounting, as well

as responsible for financial analysis and monitoring. - Subsidiaries

All Subsidiaries throughout the country provide support to the Bank’s

business activities and overall transactions.

Consumer banking division takes responsibility for bringing out business

projects to interest personal customers and tackling matters connected with cards and debt management.

Corporate banking division has a duty that is almost the same as consumer

one, but the subjects are corporations. In addition, it also derives the demand

for international payment from companies.

2.7 Performance of company

In 2022, despite facing many difficulties and challenges, with the efforts,

determination, and solidarity of the whole system, BIDV's operations took

place safely and smoothly; complete all objectives in terms of scale,

structure, quality, efficiency and institutional development, preserve and

develop State capital, fulfill obligations to the State Budget, ensure protect

the interests of shareholders and employees.

By the end of December 31, 2022, BIDV's business targets had all met the

plan assigned by the State Bank and the General Meeting of Shareholders:

Total assets reached more than VND 2.08 million billion, an increase of

nearly 21% compared to that of the General Meeting of Shareholders. 2021;

was the first commercial bank to surpass this milestone, continuing to

maintain its position as the joint stock commercial bank with the largest total

assets in Vietnam. Total mobilized capital reached 1.95 million billion VND,

up 21.1% compared to the beginning of the year; in which, mobilization of

capital from organizations and individuals reached VND 1.62 million billion,

up 8.8% compared to the beginning of the year and accounted for nearly

13.6% of the deposit market share of the whole banking industry. Total

outstanding loans for credit and investment reached 1.96 million billion

VND, up 19% compared to the beginning of the year; in which the credit 10

balance reached VND 1.5 million billion, up 12.7 5% compared to the

beginning of the year, higher than the implementation level in 2021 (11.8%),

ensuring the limit assigned by the State Bank, leading the market in terms of

credit market share (accounting for about 12.5%). NPL ratio according to

Circular 11/2021/TT-NHNN is controlled at 0.9%. Make a full provision for

risks as prescribed. The bad debt coverage ratio (credit DPRR fund/bad debt

balance) reached 245%, the highest level in recent years. Profit before tax of

commercial banks reached 22,560 billion VND; Consolidated pre-tax profit

reached VND 23,190 billion. Profitability and safety indicators of the system

are guaranteed: ROA is 0.95%; ROE reached 20.2%, exceeding the set plan;

Capital adequacy ratio (CAR) reached 8.76%, ensuring compliance with the

provisions of Circular 41/2016/TT-NHNN. Preserving and developing State

capital at BIDV; more than 6,600 billion VND to the State Budget, ensuring

shareholders' interests and income for employees. BIDV's share value

increased by nearly 4% compared to the beginning of the year in the context

that VN-Index dropped by nearly 34%; BIDV's capitalization reached more

than 8.1 billion USD, ranking third in the whole market. Activities of the

Division of Subsidiaries, Joint Ventures, and Associates in 2021 recorded

positive results. The Group's pre-tax profit in 2022 reached nearly VND 1,600 billion.

In 2023 with the motto of action "Discipline - Efficiency - Transformation",

BIDV is determined to strive to complete the annual business plan with the

main target: Credit balance operating according to the credit limit of the State

Bank of Vietnam. delivery, expected to increase 12% - 13%; Mobilizing

operating capital in line with capital use, ensuring safety and efficiency, is

expected to increase by 11%; Control bad debt ratio according to Circular 11

at ≤1.4%... In addition, as the largest green finance bank in Vietnam

following the Government's orientation, BIDV has also determined core

strategies and activities in the coming time to spend resources focusing on

green development, financial sustainability, and improving environmental,

social and governance (ESG) practices. 11

2.8 BIDV – Ham Nghi branch

BIDV – Ham Nghi branch was Established under Decision 1214/QD-BIDV

dated May 8, 2015, based on receiving from the Saigon branch under the

Joint Stock Commercial Bank for Mekong Delta Housing Development

(MHB). After merging MHB into BIDV, BIDV Ham Nghi branch carries out

banking activities and other related activities by the provisions of law, the

organization's charter, and BIDV's operations, regulations on organizational

regimes. and activities of the Board of Directors and as authorized by the

General Director. BIDV Ham Nghi branch carries out business fields

including: mobilizing capital from domestic and foreign capital sources in all

forms; performing banking services (account opening, payment,

domestic/international money transfer, provision of treasury services...);

providing credit to individuals/organizations in local/foreign currency; carry

out other business activities. To become one of the leading branches of BIDV,

the Ham Nghi branch always respects quality, innovation is a companion, the

customer is the center, and is committed to meeting the needs of customers.

Functions and obligations of departments/groups of branch: organize file

storage, manage information, synthesize and make statistical reports within

the scope of tasks and operations of the department to serve the management

operating management of the branch, BIDV, and at the request of state

management agencies; regularly improve working methods, train staff on

transactional style, professional skills, and professional ethics to improve

customer service quality, meet development requirements, and maintain

prestige credit creates a good impression of BIDV branch. Research and

propose to improve the application of information technology in the

operations that the department is assigned to manage, regularly self-check the

assigned operations; build a strong solidarity collective, comply with labor

regulations and collective bargaining agreements, participate in emulation

movements, and contribute to building strong branches. 12

III. Internship activities 3.1 My activities

I have_Had an overview of the branch that I interned including general

information on BIDV Ham Nghi, structure and function of all dept departments.

Making _ Made the acquaintance of with members of the department. _

Gained some more information about the products catalog that offers to

customers, an overview of International payment including Money

Transfer Regulation 8445, Money transfer handbook, Trade Finance

Regulation 5566. Besides, I was instructed to:

+ Print and photocopy documents, transfer documents transfer documents to the Depts + Number pages of documents

+ Submit documents to the General Planning and Risk Management Dept + Software Swift code, IBAN

_ Translating theory into practice:

+ Read the money transfer records

+ Recommended channels of payment: bilateral, multilateral

+ Stamp the documents with the signatures of the inspectors

+ Send a letter to the Head Office and a shipping company through the _ _

Administrative Organization Department

_ Practice under the instruction of the supervisor.

+ Enter in software the university's tuition fee list links accounts with banks

+ Check CIF numbers via the customers code list

+ Retype the list of corporate customers and CIF numbers

3.2 Individual Department functions

As a professional department that directly deals with individual customers,

exploits capital in VND and foreign currencies; perform credit-related

operations, and manage credit products by current policies, regulations, and 13

guidelines of BIDV. Directly advertising, marketing, introducing, and selling

banking products and services to individual customers. 14

3.3 Performance of Individual Departments -

Directly sell selling products/services at the counter, transacting with customers -

Managing accounts, entering customer information, and recording transactions with customers -

Disbursing the loans to customers based on approved disbursement

documents. Collecting debt, and interest as required by the Department of Credit Management. -

Direct paying remittances to customers (without bank accounts),

notifying and printing documents to customers. Receipting of international

money transfer documents from customers or related departments at the

branch for transfer to the head office (for branches not allowed to transfer international funds). -

The focal point for receiving requests from customers for commercial

finance services, examining dossier consultancy, and coordinating with units

at their branch and head office to conduct trade finance transactions.

3.4. BIDV’s corporate culture

BIDV has cemented its position as the leading bank in Vietnam, building a

corporate culture imbued with BIDV personality which has been fostered over

generations of staff, particularly: -

The dedication and loyalty to the national interest and the country;

takingthe lead and taking up challenges to move forward. -

The pure, wise, and genuine passion for the industry and profession

whichhas shaped a humanitarian corporate culture both traditional and

modern. - The stuff mentality to rise from difficulties. BIDV has built a

pioneering spirit and stuff, finding flexible ways to address obstacles and make breakthroughs. -

The strong emotional bond among BIDV staffs. It’s an honorable

tradition when generations of the bank are dedicated to industry development. -

The mutual love, sharing difficulties with disadvantaged

people,contributing to the community development where BIDV has a 15

presence. Such cultural identity has shaped the bank’s five core values, namely:

Customer orientation – Innovation – Professionalism – Social responsibility –

Quality, and Trustworthiness. All These factors make BIDV a trusted brand

pioneering in the course of investment, development, economic restructuring,

and international economic integration.

IV. Internship assessment

4.1 Skill gained after the internship

_ Identify potential customers. The internship helps me to interact with many

different types of customers, thereby developing the ability to identify

different customer segments. Thereby bringingI learn to bring suitable

products to meet the needs of each customer.

_ Understanding customers – The most basic customer care skill. Recognize

and understand customers' desires and help them come to the most appropriate decision.

_Understanding customers’ psychology - Conquer customers easily. Seeing

and understanding the psychology of many different customers has have

helped me to have an overview of the general psychology of customers when

using products and services at the bank.

_ Make connections quickly through cCommunication skills. My

Ccommunication skills isare also improved day by day thanks to my

exposure to many different issues. Effective negotiation and applying

technology in daily work is also aare also skills that I improved through my

internship. Negotiation skills isare one of the most important skills I have

learned through this internship. Persuading customers to open an account and

use the bank's services is what I do every day. Through this assignment, my

negotiation and persuasion skills have improved markedly compared to

before joining the internship. This was an important foundation for me in my later career journey. 16

_ Work management skill: Besides, my work organization and management

skills have also improved significantly a lot. I know how to organize a plan

so that it is logical and saves time. Make things simpler and smarter. As

expected, I learned a lot of skills that I wouldn't have learned in a university

environment without a real internship. 17

4.2 The Influences of internship on my career plan

This internship laid the first bricks in my quest to find my passion and dream

job. I think this is a good opportunity that I have received to strengthen my

beliefs. I will continue to learn more about research and research the

department that I did during my last internship. My future career plans can be

said to have been laid downare laid down from my first internship position.

4.3 Classroom knowledge and Internship

I found that the work I did in practice didn't have much to do with the

knowledge I learned in class. This requires more soft skills than complex

financial analysis knowledge. Customer care is a process of applying a lot of

practical skills that have to be involved in the work for me to understand. The

knowledge that has been taught contributes to a successful internship in

Business Communication and Ffundamentals of Financial Management.

Business Communication helps me learn communication skills and write

work emails. This can be considered a very important skill in exchanging and

buying bank products for customers and partners. Meanwhile, the

Fundamental of Financial Management gives me a foundation to better

understand projects, and how to calculate interest and cash flow. From there,

I have a broader view of the projects. The last internship has helped me gain

many valuable lessons that only when I have participated in the bank's

activities can I understand. My business school recommendations would be

to add more practical skills subjects to the curriculum such as negotiation

skills, organizational and planning skills, or coping skills. Work. This makes

a huge contribution to anyone's mental health. Only when our mental health

is good can we work effectively and productively.? Regarding the bank

where I interned, the suggestion I can make is to balance the number of

young and experienced employees to create a productive working

environment. As for myself, I understand that I need to hone and develop my

communication skills more because this is very important for a person

working in a sales position. This needs to be experienced and practiced

during a very long process ahead. 18 V. Conclusion

2023 is expected to continue to be a challenging year for the economy in

general and Vietnam's banking industry in particular., hHowever, let's look at

the opportunities that banks can seize: credit growth usage is expected to

continue to increase; idle capital flows continued to return to the banking

system in the context of positive real deposit interest rates; banks' digitization

capacity has great potential to continue to be improved through the ability to

exploit the applications of the most advanced technologies; Sustainable

development through the ESG program will be an opportunity to build a new

competitive advantage for Vietnamese banks. Accompanying the

opportunities will be the main challenges that require the banking system to

identify and effectively manage: a booming credit carries the risk of hot

growth accompanied by an increased risk of bad debt and low efficiency due

to risk provisions increase; increasing risks of technology crimes related to

the digital transformation process due to the application of technology in

transactions and management of information and data; pressure on capital

increase continues in the banking industry; Fintech's rapid growth in the

banking sector can create challenges in regulatory oversight.

This internship is a very valuable experience for students preparing to

graduate. It not only helps students have a clear view of their future work but

also helps us to apply knowledge from the classroom to the actual working

process. Working at JSC Bank for Investment and Development of Vietnam

as a trainee, I have many opportunities to improve myself and hone my skills

for the future journey. From there, I was able to define clearly what needs to

be prepared after graduation. I would like to express my deep thanks to the

company as well as to the colleagues who have been by my side for the past

2 months. Besides, I would like to thank the office of the Faculty of Business

Administration for facilitating this internship. More than that, I would like to

thank my instructor - Mr. Minh- for orientings, and providing assistance to

me helps students during this time. VI. References:

https://marketingai.vn/chien-luoc-marketing-cua-bidv/

https://bidv.com.vn/vn/ve-bidv 19

https://bidv.com.vn/en/quan-he-nha-dau-tu/quan-tri-doanh-nghiep/co-cau- tochuc/

http://vnubw.org.vn/tin-tuc/t7965/bidv-trien-khai-nhiem-vu-kinh-doanh- nam2023.html 20