Preview text:

Accountancy-book - Hope this can help you guys Basic accountancy

Introduction to basic techniques on

how to handle money in your new business 1

WHAT IS ACCOUNTANCY .......................................................................................... 3

WHY ACCOUNTANCY? ..................................................................................................... 3

ACCOUNTABILITY............................................................................................................ 4

ACCOUNTANCY STEP BY STEP ........................................................................................ 5

SHOULD I USE PC BOOKKEEPING.................................................................................... 6 BOOKKEEPING O

N A PC .................................................................................................. 7

ADMINISTRATION MADE EASY ....................................................................................... 8

IT SYSTEMS ..................................................................................................................... 9

SAFEGUARDING YOUR ASSETS.............................................................................. 11

DELEGATED AUTHORITY AND SEPARATION OF DUTIES ................................................. 11

RECONCILIATION ........................................................................................................... 12 CASH C

ONTROL ............................................................................................................. 13

PHYSICAL CONTROL ...................................................................................................... 14

PRINCIPLES IN ACCOUNTING ................................................................................ 16

WHO IS ABLE TO DO THE ACCOUNTS ............................................................................ 16

DOUBLE-ENTRY BOOKKEEPING .................................................................................... 16

ACCOUNT PLAN - CHART OF ACCOUNTS ...................................................................... 18

EXAMPLE OF AN ACCOUNT PLAN.................................................................................. 19

VOUCHERS ..................................................................................................................... 20

MAKE AN INVOICE......................................................................................................... 21

INPUT TO THE DAILY ACCOUNTANCY WORK ................................................. 23

OFFICE SUPPLIES ........................................................................................................... 23 DAILY R

OUTINES FOR SHOPKEEPERS - AND O

THERS ................................................... 23

PURCHASE TRANSACTION VOUCHER ............................................................................ 25

SALES TRANSACTION VOUCHER ................................................................................... 26

PAYMENT TRANSACTION VOUCHER ............................................................................. 27

SALARY ENTRIES AND RECORDS................................................................................... 27

STOCK REGISTRATION................................................................................................... 28

ADDING VOUCHERS ....................................................................................................... 30

NON-CASH VOUCHERS .................................................................................................. 30

RE-POSTING A VOUCHER ............................................................................................... 31

CREDIT SALE ................................................................................................................. 32

MIS-ENTRY .................................................................................................................... 32 KEEPING ACCOUNTS MEANS LESS T

ROUBLE ............................................................... 33 2 What is Accountancy Why accountancy?

You may have your own company or be managing a project. When you are

making money and spending money it is necessary to know how much money you make and spend.

If you don’t know suddenly you have spent too much money.

Accountancy for an individual

When you get your salary at the end of the month you probably also make

your little accountancy in your head.

• You know that you have to buy food for the family, maybe pay rent for the house and pay back a loan.

• If you have money left, you might buy a nice thing for yourself.

• If you have more expenses during a month than the money you earn,

you have a problem as you have not enough money.

Then you have to consider what to do.

Are you able to cut down some of your expenses or do you have to borrow some money?

If you borrow money how are you then going to pay back the loan?

Is there some way you could make more money?

These considerations you have to go through every month. It is the same

for a shop, an IT company, a workshop, a graphics designer and many other businesses. Accountancy for a company

The only difference between a company and your personal accounting is

the amount of money and the number of transactions involved. With your

personal accountancy you can manage to keep track of the money

transactions in your head. In a company you need to put it on paper.

Otherwise you will lose track of the transactions within a week. Tools for accountancy

To keep proper track of how much money is going in and out of the

company you can use a computer based bookkeeping programme.

In this programme you register all the money coming in the company. And

all the money going out of the company.

If you do this registering in a proper way you will always be able to monitor how the company is doing.

At the same time you follow the financial legislation of the country. 3 Accountability

Keeping accounts is a crucial business management tool. The way you

actually it must also comply with your country´s Accounts Act and

provisions on VAT, Sales Tax and other settlement.

When running a company you must keep annual accounts providing

information on all financial activities in your firm.

Accounts must be kept on a regular basis and must be well documented

with vouchers (invoices, receipts, pay slips, statements, etc.).

Vouchers must be kept accessible for a period of years.

You do not have to keep the accounts yourself, but you are responsible for the keeping.

As a side effect from this work, you will be able to calculate the annual tax

base and currently keep track of your VAT payable. Annual Accounts

Annual accounts and VAT settlements are two mandatory issues in your country´s tax requirements.

Annual accounts must be kept in such a way that it is clear to the tax

authority how you have reached the profit of your firm.

Being a sole trader you obviously have to pay income tax on your profit.

Annual accounts are basically made as follows:

Total sales of the year / turnover

- less the company’s total expenses

= The company’s profit, which is your wage.

Companies are also liable to pay tax, although the calculation differs from

that of an individually taxpayer’s.

Who is to keep the accounts?

If you can manage the various financial routines yourself then you have met

most of your administrative obligations.

You yourself do not have to keep the books etc. Most companies let an

accountant do the job, others hire a freelance bookkeeper or have a consultancy take care of it. 4

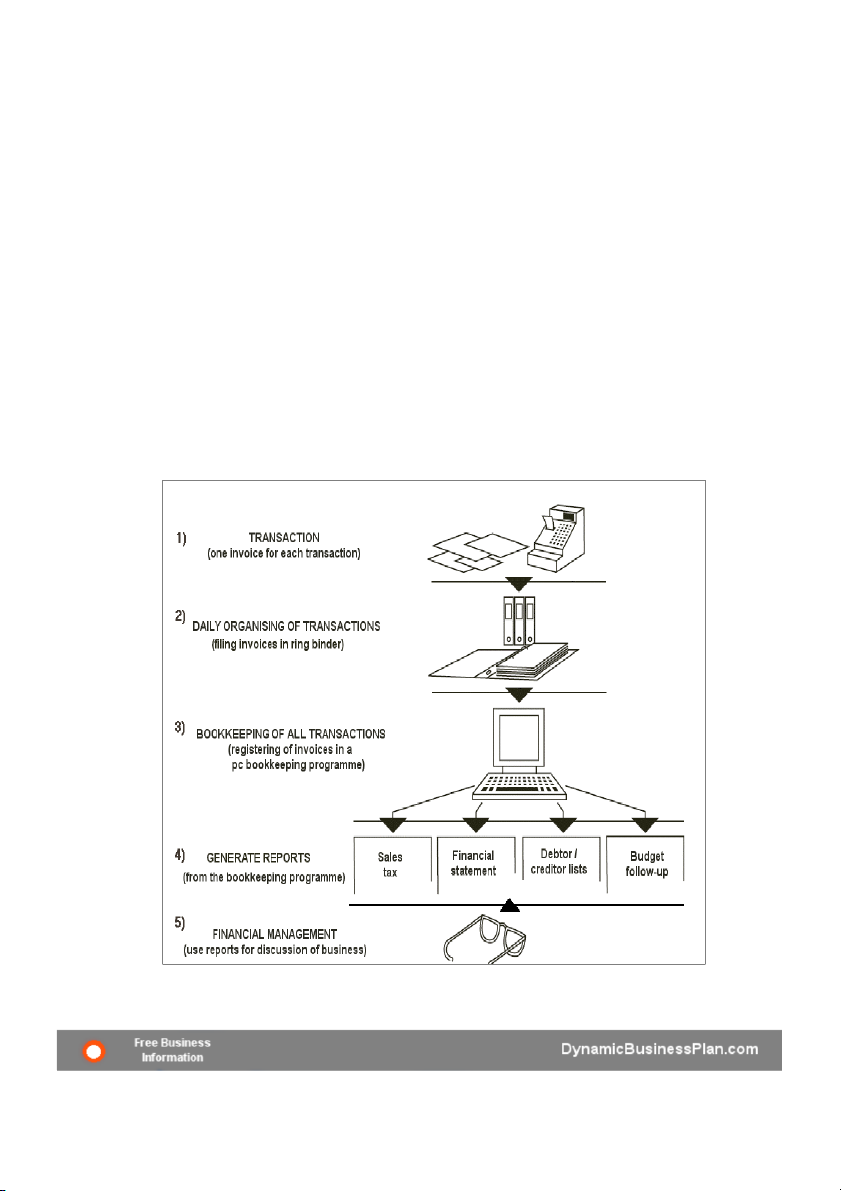

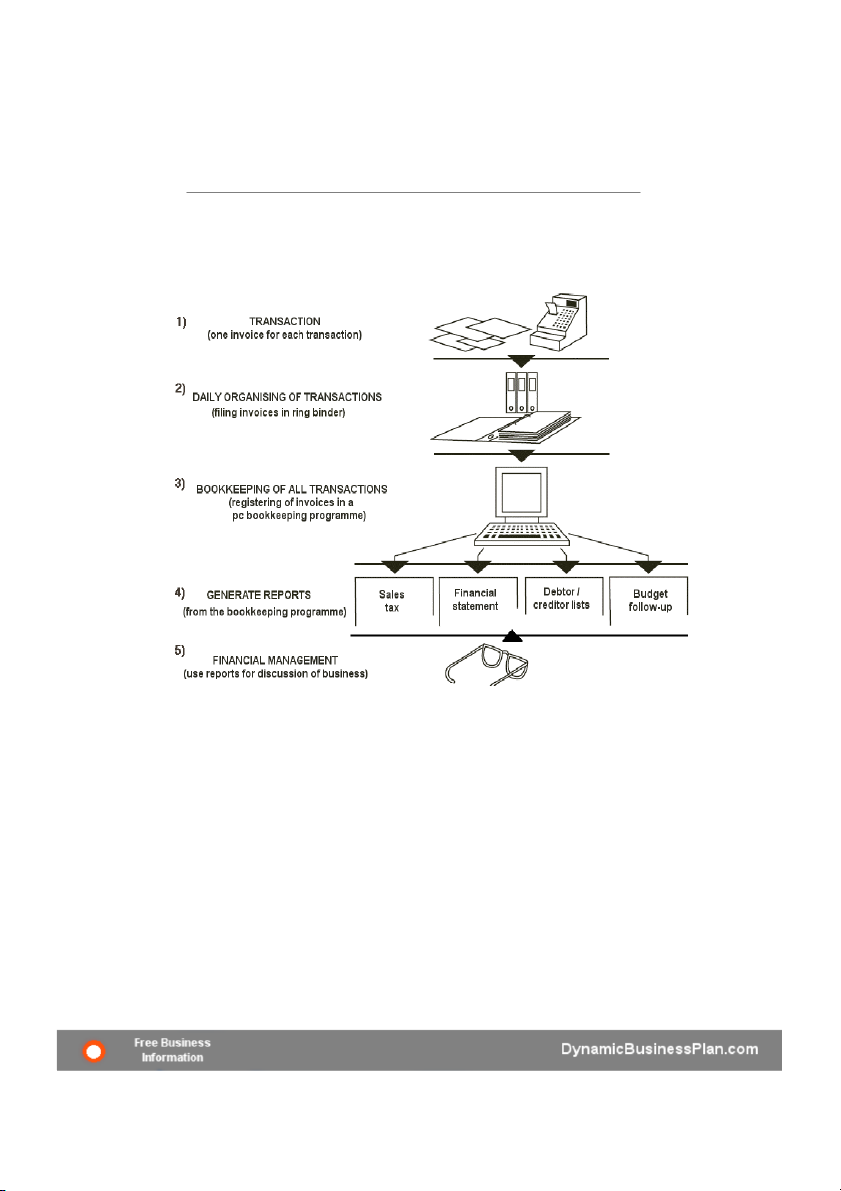

Accountancy Step by Step

Below you see the 5 step system of accountancy. If you are able to

manage this you will get a financially well managed company. Step 1

Make sure that you get an invoice for all financial transaction you make in

your company. When you buy goods, get a receipt. When you sell goods,

issue an invoice. When you pay out salary, make a salary statement. Step 2

Every evening you organise the invoices, receipts, salary statements and

other financial documentation. File them in date order in a ring binder. I

necessary write a text that explains the content of the invoice if it is unclear.

This make you remember the content of the invoice when you have to do the bookkeeping. 5 Step 3

At regular intervals the invoices must be entered in a bookkeeping

programme. If you have many invoices you may have to do it every day. If

you only have five invoices in a week, you can do it once a month.

If you purchase a PC bookkeeping programme you can do it yourself. You

can also outsource the bookkeeping work. Maybe to an accountant. Or to

your wife, husband or to another family member. Step 4

All the invoices are now entered in the PC bookkeeping programme. The

programme can now generate reports. Reports about the financial situation in the company. Step 5

Use the different reports to look critically at your company. Does it perform

well? What can you do better? When you are doing this and acting on it,

you are performing financial management.

Should I Use PC bookkeeping

When designing your financial system you should consider whether to use

a PC bookkeeping programme, a piece of paper, a ledger book or a spreadsheet.

It all depends of the number of transactions and the complexity of the company. 10 transactions per month

If you are a freelancer with only 10 transactions per month you could use a

ledger book or a spreadsheet as the tool for keeping your accounts. Within

a year you will only have to register 120 transactions. 10 transaction per week

If you have 10 transaction per week you should consider a PC bookkeeping

programme. In a year you will have entered 520 transactions. Using a PC

will help you make the paper work and at the end of the financial year it will

be easy to make the financial statement.

You don´t have to buy an expensive and complicated bookkeeping

programme for this purpose. You might even find freeware programmes. 10 transactions a day

If you have 10 transactions a day you should definitely use a PC based

bookkeeping programme. You cannot keep track of 3650 transactions a year without a PC programme. Questionnaire

You could ask yourself the following question before acquiring a bookkeeping programme: 6

• How much time do you spend keeping the books?

• How much time do you spend preparing reports?

• What information do you need and how quick do you need it?

• Can a manual system give this information?

• What programmes are available for your sized business?

• How much training do you / your staff need?

• What does training, programme, hardware, expertise cost? Bookkeeping On a PC

Most of those who choose in-house bookkeeping use IT.

All standard computers meeting a few minimum requirements are capable

of running accounting programs. However, not all applications are optimised for all computers.

If you use a Mac you should find a bookkeeping programme specially made for Mac´s Knowledge of accounting

You should be aware that basic IT skills are not enough to operate an

accounting program. It is imperative to be familiar with the fundamental accounting rules.

No matter how sophisticated and user-friendly today´s software may be, it

is a fact that if you do not have basic knowledge of accounting you will not manage. IT tools at hand

Compare it to riding a bike without knowing the traffic regulations. You will

only make things worse if you replace the bike with a car.

Likewise: A person who plunges into computer-based accounting without

knowing the basic principles of accounting, will, because of the computer,

make even more mistakes than if he/she did it the manual way.

But if you know basic principles of accounting, the proper accounting

program is an invaluable assistance to streamlining the day to day

bookkeeping. And today´s IT tools are so inexpensive that even a modest

requirement justifies the investment.

What accounting program should I acquire?

There are numerous accounting programs available. New ones and

updated versions of existing programs keep coming. Therefore, it is

impossible to recommend one in preference to others.

You should contact other business owners and inquire about their

experiences with specific accounting programs. 7

Administration Made Easy

A lot of those who start business feel confronted with bureaucratic

requirements of unreasonable proportions - especially from public

authorities. Lumped all together as: "trouble".

There is no denying that there are many rules to be complied with and

many requirements to be met. However, the vast majority of trouble comes

from lack of bookkeeping and accounting systematics. Many could cut the

trouble simply by outsourcing such tasks. Service providers

Many companies are specialised in making life easy for other companies

concerning bureaucracy. Such companies differ significantly in terms of

working method as well as product range and unfortunately not all service

providers have high standards of professionalism.

Here is a brief description of various groups of such service providers:

State authorised or certified accountants

To an entrepreneur, there is no substantial legal difference between state

authorised and certified accountants as both types of accountant are

subject to almost similar legislation.

Both types offer a range of accounting and administrative services varying

from one firm to another. Prices vary likewise. Other accountants

Several persons offer accountancy without being neither a state authorised

nor a certified accountant. This is fully legal as the title "accountant" is free

to adopt without any sort of restrictions.

This group of accountants are under no public control and customers do

not benefit from the same secureness as those who consult a state

authorised or certified accountant. In return, they often get a better price. Bookkeeping agencies

A typical bookkeeping agency exclusively offers daily bookkeeping and

similar administrative tasks to its customers and does not take on

assignments such as annual accounts, etc. This is handled by the customer´s accountant.

In some cases a bookkeeping agency will be slightly cheaper than an

accountant. This should, however, be held against the fact that by

employing the same accountant for your daily bookkeeping as well as the

making of you annual accounts you are likely to see a saving on the total

accounting and administration expenditure. 8 IT Systems

You probably need some sort of IT (a computer and accessories) for

various purposes in your company. Also for the accounting.

Examples of the utility value a PC offers most companies:

• Letters and other documents - word processing program

• Make your own accounts - accounting program

• Financial calculations - spreadsheet

• Internet searching - web browser

• Send and receive e-mails - e-mail program

Companies´ IT requirements vary a lot and there are probably not two

persons in the world using a computer the exact same way.

The technology has developed in such a way that - along with a high

degree of standardisation - computer applications can be tailored to fit each

individual user and his/her requirements.

Other services offered to companies by a PC and its software:

• Homepage setting-up - web design program/CM application

• Customer relations follow-up - customer relationship program/CRM application

• Graphics/photo - paint and design applications

What kind of computer is required?

If your company does not run extremely IT intensive tasks such as image

processing or other graphic assignments or heavy use of the Internet, an

ordinary computer will do the job, and it does not have to be brand-new.

Thus, most computers from 2002 and newer are sufficiently fast and

powerful to handle day-to-day word processing, bookkeeping and other routines.

Do-it-yourself - within limits

Often the computer´s software set-up is far more important. If neither you

nor anyone from your circle of friends is a computer wizard, it is a good

investment to have a computer expert spend a few hours setting up your computer.

Software optimisation of a relatively new used computer will in practice

often be as good as buying a new computer. Likewise, adding more

memory is no longer a costly affair and it will speed up your computer and give it more headroom. Backup

You have vital information of different nature (letters, customer files,

accounts, etc.) in your business computer. Losing such information could 9 be critical to your business.

There is always a risk that your computer is stolen, breaks down due to

malfunction, or your data could disappear or be destroyed in another way.

At best, re-entering such data is time consuming, at worst, it is not even an

option because the information is not to be found elsewhere. Back-up routines

Thus, it is of utmost importance that you and your staff integrate a routine

ensuring that the worst case scenario depicts a few days´ work lost.

Whether to backup on floppy discs, CD-roms or maybe professional data

tapes, is a matter of taste and a question of the file sizes you handle.

It is also important that you establish this routine correctly to ensure that

you backup the right data and that another computer will be able to recognise your backup files.

The backup data must be stored where they are not exposed to loss due to theft, fire, etc.

Software backup is usually not normally necessary. Software take up so

much hard disk space that it will be impossible to backup unless you have a

CD-rom burner or a data tape unit. Virus

Your PC will eventually get a virus. However, you can limit the probability

and frequency significantly by installing an anti-virus program. 10

Safeguarding Your Assets

When you start your business you also start to gather assets. You have

money in the bank, stock of goods for sale, an office computer, chairs and other things you have bought.

If your are alone in the company it is fairly easy to safeguard your assets.

When getting staff, customers and others entering your company your

assets can wrongfully disappear.

The accounting system together with four different internal control

procedures help you safeguard your assets:

1. Delegated authority and separation of duties

2. Reconciliation (check written records with reality) 3. Cash control 4. Physical control

Delegated authority and separation of duties

If your business has grown to 5-15 persons it is not practical or time-

efficient to expect that you should personally make all the decisions and

authorise all transactions. You have to delegate authority to members of staff.

In order to protect the ones you have delegated authority to and to avoid

temptation and mis-use of your assets there must be a separation of the

different duties in the company.

No one person should be in charge of all the duties: • Ordering goods • Receiving goods • Authorising the payment

• Keeping the account records

• Reconciliation of the accounts

You should make procedures that include instructions for:

• Placing and authorising orders for goods and services • Signing cheques • Authorising staff expenses

• Handling incoming checks and cash

• Checking and authorising accounting records

Checking and authorising accounting records

The key responsibility for you as the owner of the company is to check and 11

authorise records, count petty cash and review orders from suppliers from time to time.

If you show too little interest for the financial control it can tempt weak souls. Reconciliation

To reconcile is to “check written records to see if they are in tune with

reality”. If the record shows that there should be 20 $ in the petty cash box

you open the cash box to see if it is true. Then you have reconciled the petty cash.

The records that should be reconcile at regular interval is: • Bank Book • Petty Cash Book

• Salaries and deductions schedules • Stock control records Reconciliation of Bank Book

The Bank Book should be reconciled against the bank statement at least

once a month. Here you will find out whether the company record is in

accordance with the bank´s records.

This you do by taking the “closing bank statement balance” for a specific

period of time. For the same period you retrieve a report from the PC

bookkeeping programme from the “Bank account”. Then you compare the two.

There will almost always be a difference because of time delays, such as:

• Money banked, not yet credited to the account

• Cheques issued by the company but not yet drawn by the supplier

• Bank charges and interest applied • Standing orders

• Errors made by the bank or by the company

Reconciliation of Petty Cash Book

Reconciliation of the Petty Cash Book should be done every week. It

should be easy if you use the “imprest system“.

Imprest means that the petty cash box gets a specific amount in advance.

You add or subtract the entries in the petty cash book since last

reconciliation. You count the cash in the petty cash box.

The two figures have to add up to the advance given to the petty cash box.

Reconciliation of Wages Book

The wage records and specially the deductions records are notorious for

containing inaccuracies. They must be reconciled every month to ensure 12

the correct deductions are being made.

Reconciliation of stock records

Stock must be checked against the supplies held in the store and receipts from sales. An example:

• You have 60 computer games in stock in your Game Shop at 1 January

• From 1 January to 31 March you buy another 16 games

• From 1 January to 31 March you sell 26 games

• 31. March there should be 50 computer games in stock

• You go to the Shop and count how many games there are in stock

• You only find 49 games. 1 is missing

• 1 computer game cost you 50 $. You sell it for 100 $

A simple stock control system could look like this: Product: Computer games Item Cost Resale value value Value of stock at 1 January 60 3.000 6.000

Add: Value of purchase between 1 Jan. to 16 800 1.600 31. March

Deduct: Value of sale during period 26 1.300 2.600 Expected stock value 50 2.500 5.000 Actual stock value 49 2.450 4.900 Difference -1 - 50 - 100 Cash Control

You have to introduce good control procedures concerning cash. “Cash in

hand” is very tempting for humans. Good cash procedures avoid tempting humans. Open a company account

You have to separate company money from your personal money. The

easiest way is to open a company account. And get a company credit card.

Then you will know if you withdraw company money for personal use.

Keep money coming in separate from money going out

Never put cash received into the petty cash box. Or in your purse. It will

lead to error and confusion in the accounting records. All money coming

into the company must be paid into the bank promptly and entered into the record.

If you have a shop the money must be entered into the cash register as soon as you receive it.

Money not registered is “burning in the hands of the beholder”. 13

Always give receipts for money received

Giving a receipt protects the person receiving the money. S/he has

documentation. It also assures the person handing over the money that it is

properly accounted for. Receipts should come from a numbered receipt book and written in ink.

Always obtain receipts from money paid out

Sometimes it is not possible. For instance when purchasing materials from

the market. In this case the amount should be noted down straight away.

Then it can be remembered when coming home. Remember when no

receipts there is there are no proof that a purchase was made.

Pay surplus cash into the bank

Having surplus money laying around the office is a temptation for thieves. A

casual approach to cash on the premises might also make people ´borrow´ from it.

Every attempt should be made to pay cash into the bank every day or at least every third day.

Proper procedures when receiving uncounted cash

To protect those who are handling money, there should always be two

persons present when opening cash collection boxes, pay phones and

other boxes with uncounted cash. Both should count the cash and sign the receipt.

Restrict access to petty cash and safe

Restrict access to petty cash and safe to as few people as possible.

Keep cash transaction to an minimum

Petty cash should only be used as payment when all other methods are

inappropriate. Whenever possible use cheque or electronic bank transfers

to pay bills. The advantage of this is that it produces a parallel set of

accounts. It will show when you receive the bank statement.

It also minimises unauthorised staff to make payments. It reduces theft and fraud. Physical Control

Besides the other more administrative control mechanisms you could also

safeguard your assets by physical control. Having a safe

You could buy a strong safe to keep cash, cheques, legal documents etc. At least use a safe place.

If you often hold large sums of cash you should consider a strong safe.

Alternatively go to the bank daily and deposit the money. 14 Insurance cover

Securing sufficient insurance cover is a way of safeguarding the assets you

already have acquired. Go through your assets and evaluate whether you

will take the risk of losing it. If not you can take out an insurance.

You could have the following assets insured:

• Inventory - all risk cover of the content in the buildings

• Buildings - cover for fire, storm, flood damage etc.

• Vehicle - cover for theft, damage etc. of cars and other vehicle

• Employers liability - claims from workers who had an accident

• Public liability - covers injury, loss and damage made by company staff towards others

Management and control of fixed assets

You should implement a system for control and management of your fixed

assets. Little by little, you - or more precise your company - become the

owner of cars, computers, office equipment, nice modern lamps, stock of

papers and pencils, office chairs etc.

If these assets are not managed properly they will loose value because of

lack of maintenance. They could also be stolen.

Draw up a list - an Assets Register - and make a policy on how to check up on your assets. 15

Principles in Accounting

Who is Able to do the Accounts

To be a good bookkeeper you do not need to have 12 years of education.

Although it is nice to have education, but it is more important to be an

honest person and have a careful and cautious way of thinking. Basic

knowledge of using a PC would also be appropriate.

Most of the mistakes made in accountancy are made because the one who

makes them does not take the time to look properly at the voucher and to

transfer the right figures from the vouchers into the bookkeeping

programme. This you do not learn in school. It is a part of your personality and way of thinking.

With a basic education and a careful and cautious way of thinking most

people should be able do the accounts of a small company. Delegation of authority

If your business has grown to 5-15 persons it is not practical or time-

efficient to expect that you should make all the decisions and authorise all

transactions yourself. You have to delegate authority to members of staff.

In order to protect the ones to whom you have delegated authority and to

prevent temptation and to mis-use of your assets there must be a

separation of the different duties in the company.

Double-entry Bookkeeping

The Double-Entry System is a world wide used system to keep track of money.

The double-entry bookkeeping system is based on the principle of double

registration in the bookkeeping programme of all income and expenses , -

one debit and one credit entry.

1. A debit for something coming in - money or other value

2. A credit for something going out.

Every time you debit an amount you have to credit it too. And the other way round. Things you buy

You can think of it like this: When you pay out money from the cash box it

does not just disappear from you. The value of the thing you have bought is 16 coming into your company.

So in the PC bookkeeping programme you register the amount of money

that was “paid out” on the Cash/Bank-Account (credit).

And you register the value that was “put into” the company in return, on the

relevant account from the account plan (debit)

• Example: If you buy 12 computer games to your shop, you take money

out of the cash box or the bank (which you credit the Cash/Bank- Account).

Then you enter value (12 computer games) into the shop (which you

debit on the Shop Purchase-Account account in the PC bookkeeping programme). Things you sell

And opposite, the money that comes into the company does not just come out of the blue.

When money comes in, some value goes out of the company.

So when you in the Cash/Bank-Account register the amount of money that

came in, you also register the value that was taken out of the project

instead on the relevant account in the account plan.

• Example: The sale for a full day in the PC Game Store is registered in

the PC bookkeeping programme (which you debit the Cash/Bank-

Account). Since you have taken the value of the computer games out of

the shop you also credit the Shop Sale-Account .

Always both a debit and a credit

When you enter a debit on the Cash/Bank-Account you must enter a credit

on the relevant account from the account plan.

And opposite, when you enter a credit in the Cash/Bank-Account you must

enter a debit on the relevant account from the account plan.

The debit in the Cash/Bank-Account balances with the credit on the

relevant account from the account plan

The credit in the Cash/Bank-Account balances with the debit on the

relevant account from the account plan The PC helps you

If the registered accounts in the debit and credit sides do not balance there

is a mistake somewhere in the registration. The PC bookkeeping

programme will usually attract your attention to the is-balance in the entries. 17

Account Plan - Chart of Accounts

A chart of accounts is a tool to categorise a company´s financial activities,

thus creating a better overview.

Companies must have a suitable chart of accounts and there are no

provisions as to the contents and structure of a chart of accounts. Only an

outline provision stating that a company must have a chart of accounts

designed for its individual requirements. This means that you are allowed to

design your own account numbering. Structure of the accounts

The purpose of a chart of accounts is to secure a fixed structuring of the

accounts created in the bookkeeping.

Typically, the chart is structured like this:

• Accounts concerning the day-to-day running of the company - show

the company´s earnings and expenses (Profit and loss)

• Asset accounts - show the values in the company (Assets)

• Liability accounts - show the debt/financing of the company (Liabilities) Standard chart of accounts

In all bookkeeping programmes for PC there is a standardised chart of

accounts. Therefore, you need to adjust it to suit your company´s specific requirements.

However, in many aspects it suits most small companies as it is. There are

probably a lot of unnecessary accounts for your specific needs. Just delete them. Account and information

When you make an account plan for your company you need to know

which activities you want to have information about. The shortest account

plan you can make consists of two accounts: • 001 Income • 002 Expenses

If you have only got these two accounts for registering information about

your company´s economy, you will not be able to find out which activities

are working well or badly. The only thing you can see is if the company in

general is loosing or making money. This is too little information for a modern project or company.

Consider carefully what information you need from your new business. The

information you need should be shown in the account plan. 18 Account and numbering

Each account has - besides its name - its own number. It makes it easier to

work with in the daily work with the accounting.

Example of an Account Plan

This is an example of an account plan for a company called Kafue Super.

Kafue Super runs a shop and a tailoring workshop.

The account plan is structured like this:

• Asset accounts - show the value in the company (Assets)

• Liability accounts - show the debt/financing of the company (Liabilities)

• Income and Expenses accounts - show the day-to-day running of

the company - (Profit and loss)

Account Plan for Kafue Supermarket ASSETS INCOME AND EXPENSES 000 Cash in hand Activity centre: Shop 010 Cash in bank 300 Shop sale 030 Staff debtors 310 Shop purchase 040 Other debtors 320 Shop salary Buildings

Activity centre: Tailors 100 Shop 400 Tailoring sale 110 Tailoring workshop 410 Tailoring purchase 420 Tailoring salary Tools and equipment 120 in the shop Fixed costs 130 in the tailoring workshop 500 Stationary 510 Salary LIABILITIES Administration 200 Creditors, Owner 520 Sundry 210 Other creditors 530 Cash deviations 220 Donations 540 Fuel/transport 230 Capital account 240 Sale tax Maintenance of buildings 600 Shop 610 Tailoring workshop Other income 700 Interest 710 Other income 19 Jump in the numbering

In the account plan there are two “jumps in the numbering”

• 100-200-300… This helps you remember the structure of the account plan

• 500-510-520…. This gives you the possibility to divide the accounts in even more detailed accounts.

For instance: 511: Salary Mr. Vijay, 512: Salary Mrs. Gian, 513: Mr. Wu Vouchers

Bookkeeping means registration of all financial transactions of a company.

A voucher is required to register a transaction. You must have a voucher: • Whenever you buy something

• Whenever you sell something

• Whenever you settle an invoice for something you have bought on credit

• Whenever a customer, whom you have granted a credit, settles his/her debt

Vouchers, receipts, invoices etc. are the foundation of the accounting

system. Without vouchers, receipts, invoices etc. there could not be an accounting system.

This may appear overwhelming. Usually, it is just a matter of once and for

all getting the routines straight, thus securing a correct registration. Definition

A voucher is a piece of paper featuring information on the transaction.

Various requirements apply to a voucher depending on the nature of the

transaction. Some transactions do not require a voucher. Numbering vouchers

When documenting a posting by a voucher, you give the voucher a

number. When using a PC bookkeeping programme the programme will

issue the number, when you do the bookkeeping. You write this number on the voucher.

When auditing the accounts you can use this number to identify the

voucher. Vouchers are filed in numerical order in a ring binder.

When no receipt is available

Sometimes it can be difficult to get a voucher from a supplier. It is therefore

a good idea that staff, who are sent out to buy small items for the company, carry a receipts book.

• Example: The company´s driver or the shop assistant goes to the

market to buy a special item. The salesperson at the market may not be 20