Preview text:

lOMoAR cPSD| 58562220 MIDTERM _ 2020.2021

THE INTERNATIONAL UNIVERSITY (IU) – VIETNAM NATIONAL UNIVERSITY – HCMC Midterm exam Date: July 26th, 2021 Duration: 100 minutes

Student ID: ..................................

Name: ..............................................

SUBJECT: FUNDAMENTAL OF FINANCIAL MANAGEMENT – BA016IU Lecturer:

School of Business Signature: Signature: Le Dang Thuy Trang, MSc. GENERAL INSTRUCTION(S) 1. This is an OPEN book exam 2. Calculator approved

3. No mobile phone used during the exam 4. Structure of exam:

- Part 1: essay questions on Time Value of Money (40 points)

- Part 2: essay questions on Bond Evaluation (30 points)

- Part 3: essay questions on Stock Evaluation (30 points) lOMoAR cPSD| 58562220 MIDTERM _ 2020.2021

PART I: TIME VALUE OF MONEY (40 POINTS)

1. What interest rates are implied by the following lending arrangements?

a. You lend $1,850 and are repaid $2,078.66 in two years.

b. You lend $750 and are repaid $1,114.46 in five years with quarterly compounding.

c. You borrow $12,500 and repay $21,364.24 in three years under monthly compounding.

(Note: In parts b and c, be sure to give your answer as the annual nominal rate.)

Provide your calculation here: a. r = 6% b. r = 8% c. 6 pts lOMoAR cPSD| 58562220 MIDTERM _ 2020.2021

2. Thomas Jennings, a geography professor, invests $50,000 in a parcel of land that is

expected to increase in value by 12% per year for the next five years. He will take the

proceeds and provide himself with a 10-year annuity. Assuming a 10% interest rate,

how much will this annual payment of the 10-year annuity be? Provide your calculation here: 14 pts lOMoAR cPSD| 58562220 MIDTERM _ 2020.2021

3. Wayne Wilson just purchased a home and took out a $250,000 mortgage for 30

years at 9%, compounded monthly.

a. How much is Wayne’s monthly mortgage payment?

b. How much sooner would Wayne pay off his mortgage if he made an

additional $100 payment each month?

c. Assume Wayne makes his normal mortgage payments and at the end of

five years, he refinances the balance of his loan at 6%. What is the new

loan balance? What is the new monthly payment of the new loan if he

continues to make the same mortgage payments for 30 years?

Provide your calculation here 20 pts

PART II: BOND EVALUATION (30 POINTS) lOMoAR cPSD| 58562220 MIDTERM _ 2020.2021

1. Consider two bonds, a 3-year bond paying an annual coupon of 5% and a 10-year

bond also with an annual coupon of 5%. Both currently sell at face value. Now

suppose that interest rates immediately rise to 8%.

a. What is the new price of the 3-year bonds? (4 points)

b. What is the new price of the 10-year bonds? (4 points)

c. Which bonds are more sensitive to a change in interest rates? (4 points)

Provide your answer here: P1 = 12 pts lOMoAR cPSD| 58562220 MIDTERM _ 2020.2021

2. John Lewis Corporation has bonds on the market with 10.5 years to maturity, a YTM

of 8.5%, and a current price of $1,090. The bonds make semiannual interest

payments. What must the coupon rate (on annual basis) be on John Lewis’ bonds?

Provide your answer here: 8 pts lOMoAR cPSD| 58562220 MIDTERM _ 2020.2021

3. A bond is issued at par with a coupon of 7% paid annually, a maturity of 20 years

and face value of $1,000. An investor purchases the bond and holds it for 1 year.

a. After 1 year, the bond’s yield to maturity decreases by 3%. What will the price of the bond be? (5 points)

b. What is the investor’s rate of return on this bond? (5 points)

Provide your calculation here: 10 pts

PART III: STOCK EVALUATION (30 POINTS)

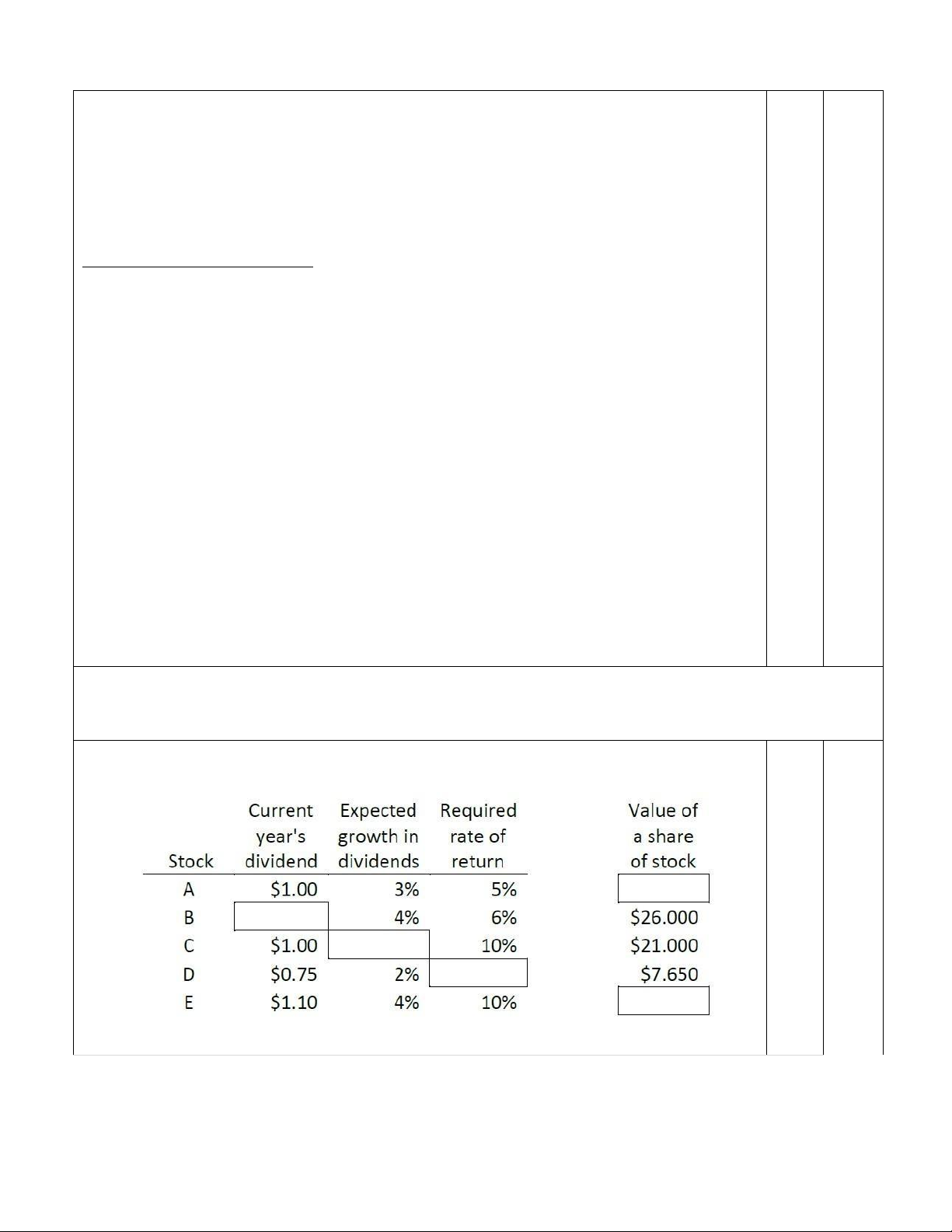

1. Assume constant growth, consider each of the following stocks, and solve for the 15 missing element: pts lOMoAR cPSD| 58562220 MIDTERM _ 2020.2021

Provide your calculation here: lOMoAR cPSD| 58562220 MIDTERM _ 2020.2021

2. The stock of KPG Heavy Metals, Inc. just paid a dividend of $2 per share. Annual 15

dividends are projected to grow 15% per year for the next three years, after which pts

they will grow at a constant rate of 4% per year forever. If the required return on the

stock is 16%, what should be the price per share today? Provide your calculation here: D4 = 2*(1+15%)^3 = lOMoAR cPSD| 58562220 MIDTERM _ 2020.2021 lOMoAR cPSD| 58562220 MIDTERM _ 2020.2021

-------------------------The end---------------------------------