Preview text:

lOMoAR cPSD| 58562220 4.

Which one of the following statements is correct concerning the payback period? A.

An investment is acceptable if its calculated payback period is less than some pre-specified period of time. B.

An investment should be accepted if the payback is positive and rejected if it is negative. C.

An investment should be rejected if the payback is positive and accepted if it is negative. D.

An investment is acceptable if its calculated payback period is greater than some pre-specified period of time. E.

An investment should be accepted any time the payback period is less than the discounted

payback period, given a positive discount rate. A. INVESTMENT RULES.

1. Which one of the following statements is correct concerning the payback period?

A. An investment is acceptable if its calculated payback period is less than some pre-specified period of time.

B. An investment should be accepted if the payback is positive and rejected if it is negative.

C. An investment should be rejected if the payback is positive and accepted if it is negative.

D. An investment is acceptable if its calculated payback period is greater than some pre-specified period of time.

E. An investment should be accepted any time the payback period is less than the discounted payback

period, given a positive discount rate.

2. Which one of the following statements concerning net present value (NPV) is correct?

A. An investment should be accepted if, and only if, the NPV is exactly equal to zero. B.

An investment should be accepted only if the NPV is equal to the initial cash flow.

C. An investment should be accepted if the NPV is positive and rejected if it is negative.

D. An investment with greater cash inflows than cash outflows, regardless of when the cash flowsoccur,

will always have a positive NPV and therefore should always be accepted.

E. Any project that has positive cash flows for every time period after the initial investment shouldbe accepted.

3. An investment is acceptable if its IRR:

A. is exactly equal to its net present value (NPV). B. is exactly equal to zero.

C. is less than the required return.

D. exceeds the required return. E. is exactly equal to 100%

4. A situation in which accepting one investment prevents the acceptance of another investment is called the: A. net present value profile.

B. operational ambiguity decision.

C. mutually exclusive investment decision. D. issues of scale problem. lOMoAR cPSD| 58562220

E. multiple choices of operations decision

5. In actual practice, managers may use the:

I. IRR because the results are easy to communicate and understand.

II. payback because of its simplicity.

III. net present value because it is considered by many to be the best method of analysis. A. I and II only B. II and III only C. I and III only D. I, II, and III E. None of these

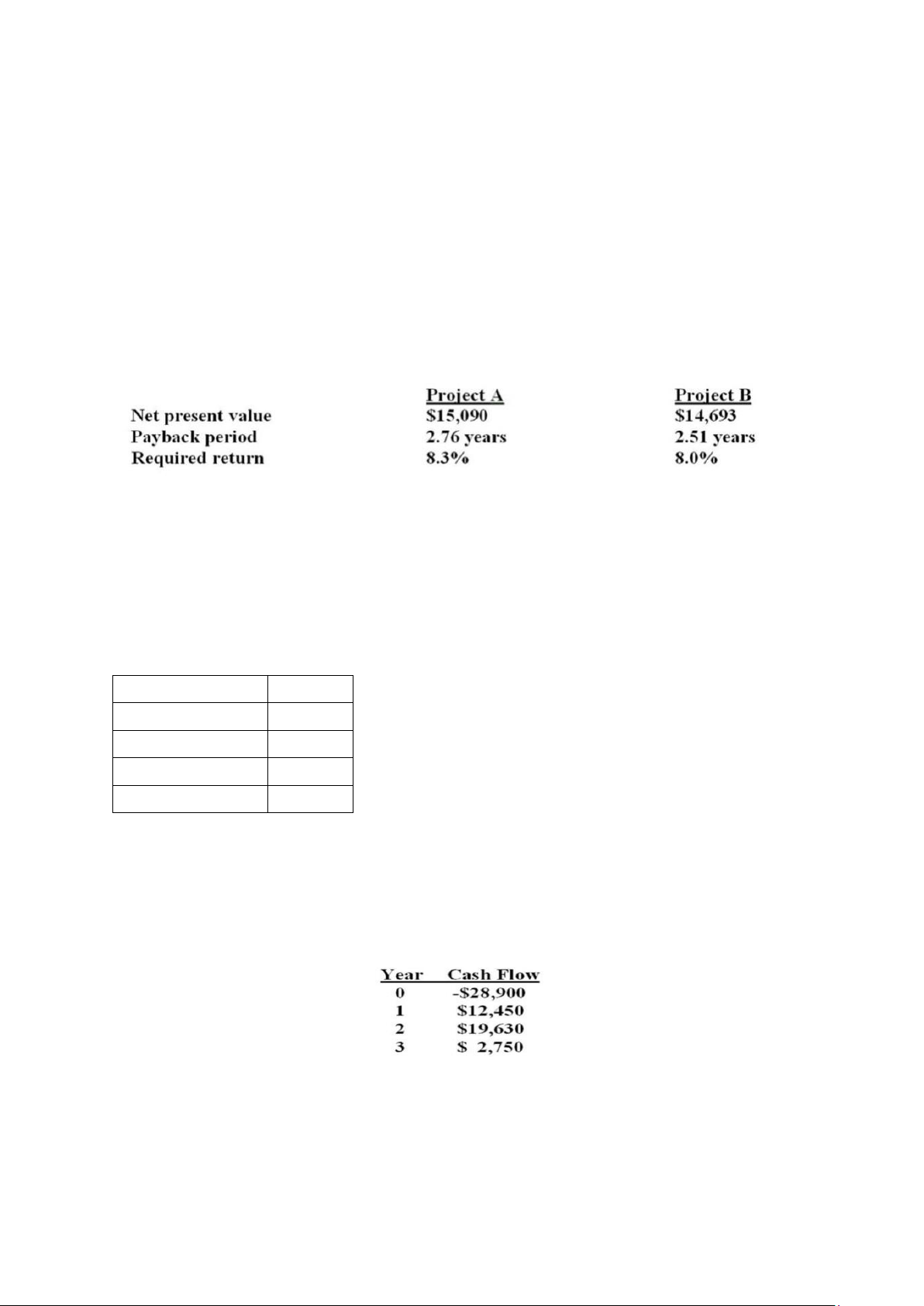

6. Mr. Thien is analyzing two mutually exclusive projects of similar size and has prepared the following data.

Both projects have 5 year lives.

Mr. Thien has been asked for his best recommendation given this information. His recommendation should be to accept:

A. project B because it has the shortest payback period.

B. both projects as they both have positive net present values.

C. project A and reject project B based on their net present values.

D. project B and reject project A based on other criteria not mentioned in the problem.

E. project B and reject project A based on both the payback period and the average accountingreturn.

7. You are considering a project with the following data: Internal rate of return 8.7% Profitability ratio .98 Net present value -$393 Payback period 2.44 years Required return 9.5%

Which one of the following is correct given this information?

A. The discount rate used in computing the net present value must have been less than 8.7%.

B. The discounted payback period will have to be less than 2.44 years.

C. The discount rate used to compute the profitability ratio was equal to the internal rate of return.

D. This project should be accepted based on the profitability ratio.

E. This project should be rejected based on the internal rate of return.

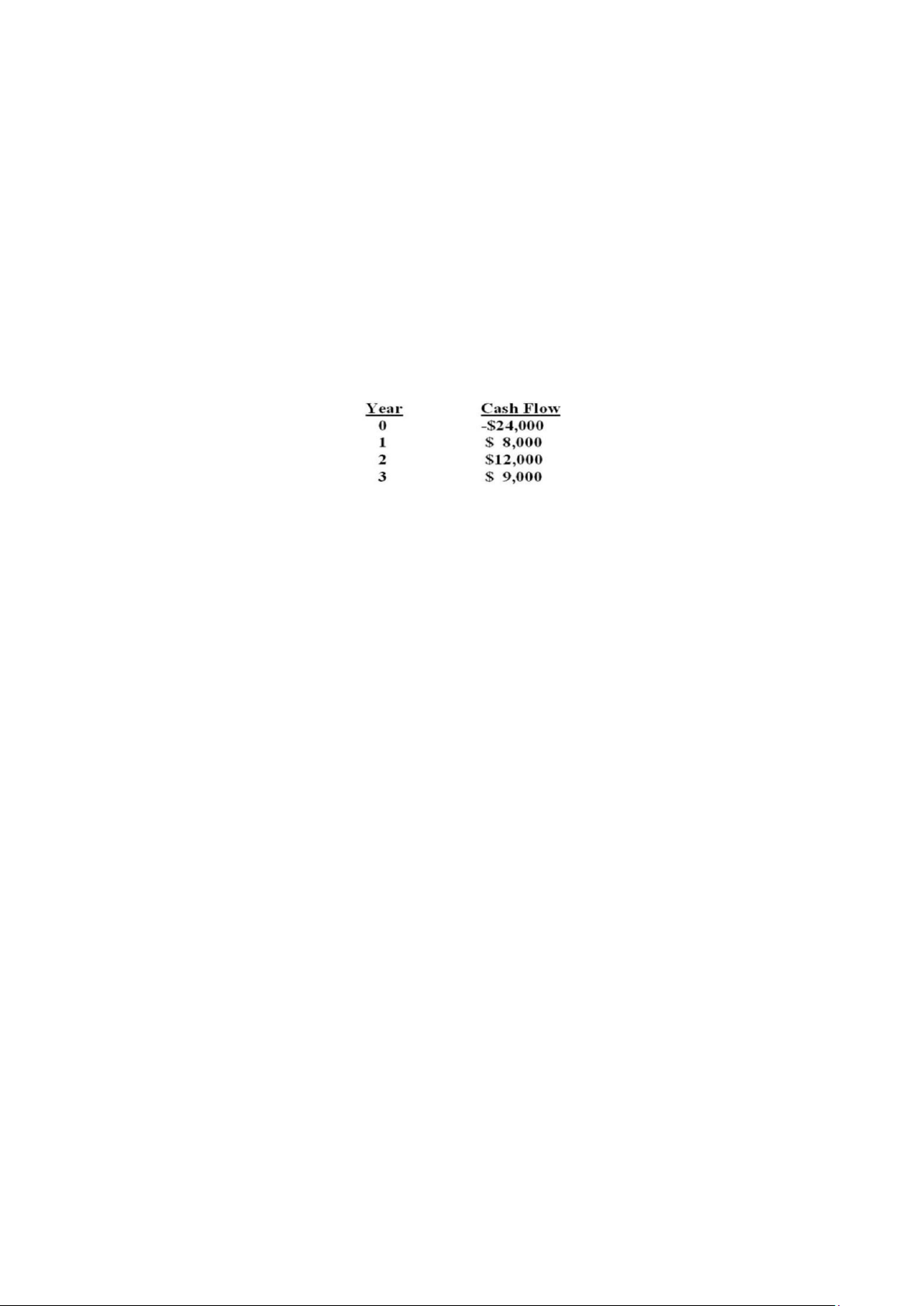

8. What is the net present value of a project with the following cash flows and a required return of 12%? A. -$287.22 B. -$177.62 C. $177.62 D. $204.36 E. $287.22 lOMoAR cPSD| 58562220

Solution: NPV= -28,900 + 12,450/1.12 + 19,630/1.12^2 + 2,750/1.12^3 = B

9. A project will produce cash inflows of $1,750 a year for four years. The project initially costs $10,600 to get

started. In year five, the project will be closed and as a result should produce a cash inflow of $8,500. What is

the net present value of this project if the required rate of return is 13.75%? A. -$5,474.76 B. -$1,011.40 C. -$935.56 D. $1,011.40 E. $5,474.76

Solution: NPV =10,6 + 1,75[(1-1/1.375^3)/.1375] + 8,5/1.375^4

10. An investment has the following cash flows. Should the project be accepted if it has been

assigned a required return of 9.5%? Why or why not?

A. yes; because the IRR exceeds the required return by about 0.39%.

B. yes; because the IRR is less than the required return by about 3.9%.

C. yes; because the IRR is positive.

D. no; because the IRR exceeds the required return by about 3.9%.

E. no; because the IRR is 9.89%. B. RISK AND RETURN.

1. The excess return required from a risky asset over that required from a risk-free asset is called the: A. risk premium. B. geometric premium. C. excess return. D. average return. E. variance.

2. Which one of the following is a correct statement concerning risk premium?

A. The greater the volatility of returns, the greater the risk premium.

B. The lower the volatility of returns, the greater the risk premium.

C. The lower the average rate of return, the greater the risk premium.

D. The risk premium is not correlated to the average rate of return.

E. The risk premium is not affected by the volatility of returns.

3. Which of the following statements are correct concerning the variance of the annual returns on an investment?

I. The larger the variance, the more the actual returns tend to differ from the average return.

II. The larger the variance, the larger the standard deviation.

III. The larger the variance, the greater the risk of the investment.

IV. The larger the variance, the higher the expected return. A. I and III only B. II, III, and IV only C. I, III, and IV only D. I, II, and III only E.I, II, III, and IV

4. You purchased 200 shares of stock at a price of $36.72 per share. Over the last year, you have received total

dividend income of $322. What is the dividend yield? lOMoAR cPSD| 58562220 A. 3.2 % B.4.4 % C. 6.8 % D. 9.2 % E. 11.4 %

5. One year ago, you purchased a stock at a price of $32 a share. Today, you sold the stock and realized a total

return of 25%. Your capital gain was $6 a share. What was your dividend yield on this stock? A. 1.25 % B. 3.75 % C.6.25 % D. 18.75 % E. 21.25 % 6. A portfolio is:

A. a group of assets, such as stocks and bonds, held as a collective unit byan investor.

B. the expected return on a risky asset.

C. the expected return on a collection of risky assets.

D. the variance of returns for a risky asset.

E. the standard deviation of returns for a collection of risky assets.

7. Risk that affects at most a small number of assets is called _____ risk. /rủi ro phi hệ thống/ A. portfolio B. nondiversifiable C. market D.unsystematic E. total

8. If investors possess homogeneous expectations over all assets in the market portfolio, when riskless lending

and borrowing is allowed, the market portfolio is defined to:

A. be the same portfolio of risky assets chosen by all investors.

B. have the securities weighted by their market value proportions.

C. be a diversified portfolio. D. All of these. E. None of these.

9. You have a portfolio consisting solely of stock A and stock B. The portfolio has an expected return of 10.2%.

Stock A has an expected return of 12% while stock B is expected to return 7%. What is the portfolio weight of stock A? A. 46 % B. 54 % C. 58 % D.64 % E. 70 %

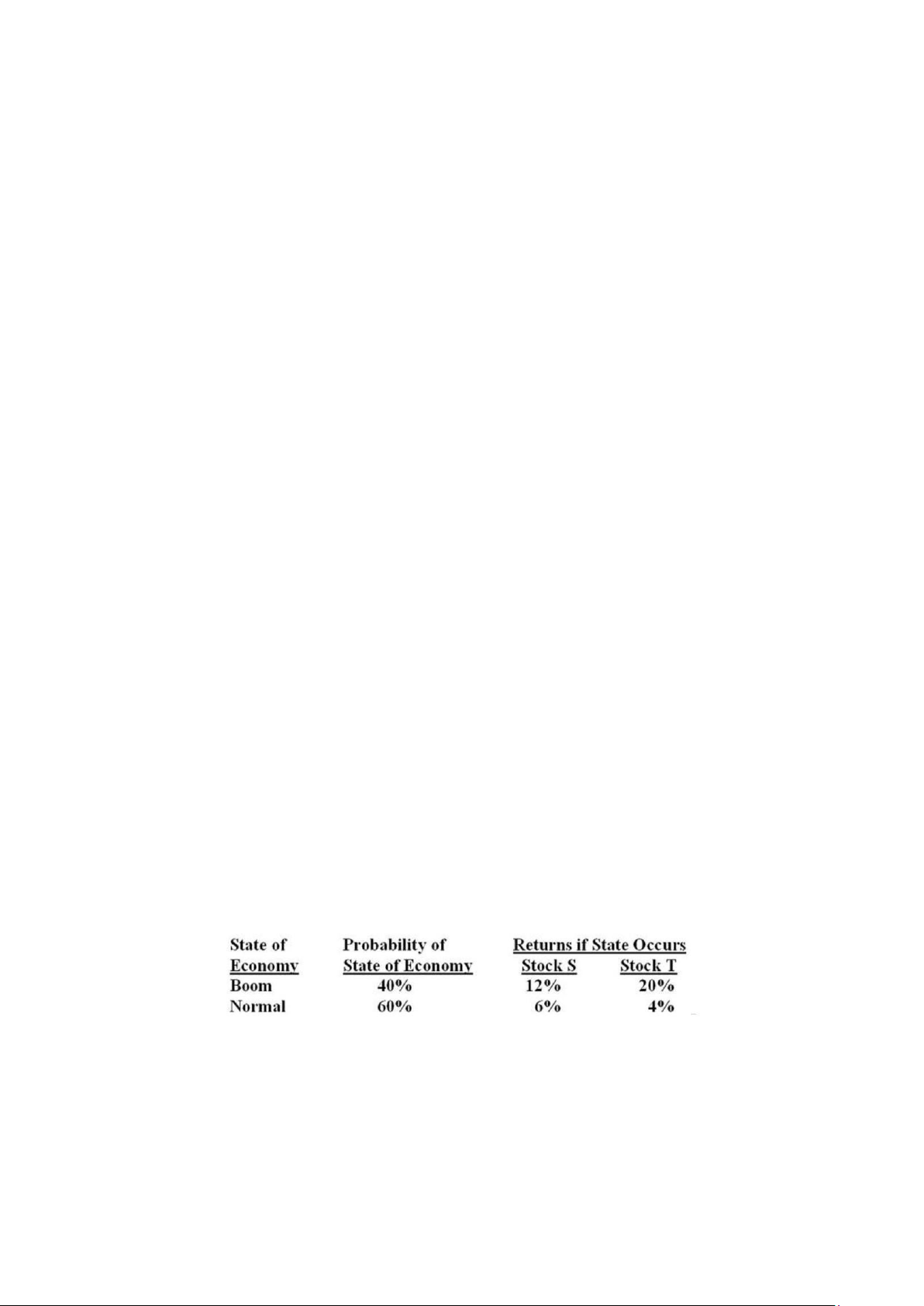

10. What is the portfolio variance if 30% is invested in stock S and 70% is invested in stock T? A. 0.002220 B. 0.004056 C. 0.006224 D. 0.008080 E. 0.098000 lOMoAR cPSD| 58562220

11. Stock A has an expected return of 20%, and stock B has an expected return of 4%. However, the risk of

stock A as measured by its variance is 3 times that of stock B. If the two stocks are combined equally in a

portfolio, what would be the portfolio's expected return? A. 4 % B.12 % C. 20 % D. Greater than 20%

E. Need more information to Answer C. COST OF CAPITAL.

1. A group of individuals got together and purchased all the outstanding shares of common stock of Mr. Thien,

Inc. What is the return that these individuals require on this investment called? A. dividend yield B. cost of equity C. capital gains yield D. cost of capital E. income return

2. The weighted average cost of capital for a wholesaler:

A. is equivalent to the after-tax cost of the firm's liabilities.

B. should be used as the required return when analyzing a potential acquisition of a retail outlet.

C. is the return investors require on the total assets of the firm.

D. remains constant when the debt-equity ratio changes.

E. is unaffected by changes in corporate tax rates.

3. All else constant, which one of the following will increase a firm's cost of equity if the firm computes that

cost using the security market line approach. Assume the firm currently pays an annual dividend of $1 a share and has a beta of 1.2.

A. a reduction in the dividend amount

B. an increase in the dividend amount

C. a reduction in the market rate of return

D. a reduction in the firm's beta

E. a reduction in the risk-free rate

4. The cost of preferred stock:

A. is equal to the dividend yield.

B. is equal to the yield to maturity.

C. is highly dependent on the dividend growth rate.

D. is independent of the stock's price.

E. decreases when tax rates increase.

5. International University is expected to pay an annual dividend of $0.80 a share next year. The market price

of the stock is $22.40, and the growth rate is 5 percent. What is the firm's cost of equity? A. 7.58 percent B. 7.91 percent C. 8.24 percent D. 8.57 percent E. 9.00 percent

6. The HD Food court has paid annual dividends of $0.65, $0.70, $0.72, and $0.75 per share over the last four

years, respectively. The stock is currently selling for $26 a share. What is this firm's cost of equity? A. 7.56 percent B. 7.93 percent C. 10.38 percent D. 10.53 percent E. 11.79 percent lOMoAR cPSD| 58562220

7. The common stock of Coffee story has a negative growth rate of 1.5 percent and a required return of 18

percent. The current stock price is $11.40. What was the amount of the last dividend paid? A. $2.07 B. $2.11 C. $2.19 D. $2.22E. $2.26

8. Foresta just paid its annual dividend of $0.65 a share. The stock has a market price of $13 and a beta of 1.12.

The return on the U.S. Treasury bill is 2.5 percent and the market risk premium is 6.8 percent. What is the cost of equity? A. 9.98 percent B. 10.04 percent C. 10.12 percent D. 10.37 percent E. 10.45 percent

9. International University has 1,200 bonds outstanding that are selling for $990 each. The company also has

2,500 shares of preferred stock at a market price of $28 a share. The common stock is priced at $37 a share

and there are 28,000 shares outstanding. What is the weight of the common stock as it relates to the firm's

weighted average cost of capital? A. 43.08 percent B. 45.16 percent C. 47.11 percent D. 54.00 percent E. 55.45 percent

10. Mr. Thien maintains a debt-equity ratio of 0.65 and has a tax rate of 32 percent. The firm does not issue

preferred stock. The pre-tax cost of debt is 9.8 percent. There are 25,000 shares of stock outstanding with a

beta of 1.2 and a market price of $19 a share. The current market risk premium is 8.5 percent, and the current

risk-free rate is 3.6 percent. This year, the firm paid an annual dividend of $1.10 a share and expects to

increase that amount by 2 percent each year. Using an average expected cost of equity, what is the weighted average cost of capital? A. 8.44 percent B. 8.78 percent C. 8.96 percent

D. 9.13 percentE. 9.20 percent

11. Kelso's has a debt-equity ratio of 0.55 and a tax rate of 35 percent. The firm does not issue preferred stock.

The cost of equity is 14.5 percent and the after-tax cost of debt is 4.8 percent. What is the weighted average

cost of capital? A. 10.46 percent B. 10.67 percent C. 11.06 percent D. 11.38 percent E. 11.57 percent 4.

Which one of the following statements is correct concerning the payback period? A.

An investment is acceptable if its calculated payback period is less than some pre-specified period of time. B.

An investment should be accepted if the payback is positive and rejected if it is negative. lOMoAR cPSD| 58562220 C.

An investment should be rejected if the payback is positive and accepted if it is negative. D.

An investment is acceptable if its calculated payback period is greater than some pre-specified period of time. E.

An investment should be accepted any time the payback period is less than the discounted payback

period, given a positive discount rate.