Preview text:

Pablo Fernandez

The most common error in valuations using WACC

PhD Bus. Ec. (Finance), Harvard U.

The most common error in valuations using WACC

Pablo Fernandez. PhD Bus. Ec. (Finance) Harvard U.

Professor of Finance. IESE Business School, University of Navarra

e-mail: fernandezpa@iese.edu xLmhsac January 15, 2020

To value shares there are two usual methods that, if properly applied, provide the same value:

a) Present value of expected free cash flows (FCF) discounted with the WACC rate and then, subtract the value of debt; or

b) Present value of expected equity cash flows (ECF) discounted with the Ke rate (required return to equity).

Both valuations must provide the same result because both methods analyze the same reality under the

same hypotheses; they differ only in the cash flows taken as the starting point for the valuation.

But in many valuations performed by investment banks, analysts, consultants, finance professors… both

methods do not provide the same value.

This paper presents a real valuation performed by a well-known investment bank, with two very

different values: €6,9 million using method a), and €4,2 million using method b).

This error (perhaps the most common error performed in discounted cash flows valuations) is due to

“not remembering the definition of WACC”. In other words, it is due to “follow a recipe without thinking”.

1. A valuation performed by an investment bank in November 2019 2. Valuation using ECF and Ke 3. Definition of WACC 4. Conclusion

Exhibit 1. Calculating the WACC

Exhibit 2. Wrong calculations of WACC and wrong valuations

Exhibit 3. 210 answers and 49 comments from readers References and bibliography

Section 1 contains the assumptions and results of a valuation report produced by an investment bank for

the transaction of 22% of the shares of the company. The cost of the report was €115 thousands. Using the

WACC, the report ends with “our best estimation of the value of the shares is €6,9 million.”

Section 2 uses the same assumptions of the valuation report but calculates the Present value of expected

equity cash flows (ECF) discounted with the Ke rate (required return to equity). The value obtained is €4,2 million. Now, we have two questions:

a) Is the valuation of the investment bank valid, consistent, solid… or is it worthless?

b) Which value, if any, is more consistent: €6,9 or €4,2 million?

To help the reader to answer the two questions, we include section 3: definition of WACC. Errors using WACC. 1 - 1

Electronic copy available at: https://ssrn.com/abstract=3512739 Pablo Fernandez

The most common error in valuations using WACC

PhD Bus. Ec. (Finance), Harvard U.

1. A valuation performed by an investment bank in November 2019

The company BadValue Inc. The forecast of the balance sheets and income statements are shown in

Table 1. We assume that the balance sheet and the income statement items will grow at an annual rate of

2% after 2023. Using the balance sheet and income statement forecasts in Table 1, we can readily obtain

the free cash flow given in Table 2. Obviously, the free cash flow will grow at a rate of 2% after year 2023.

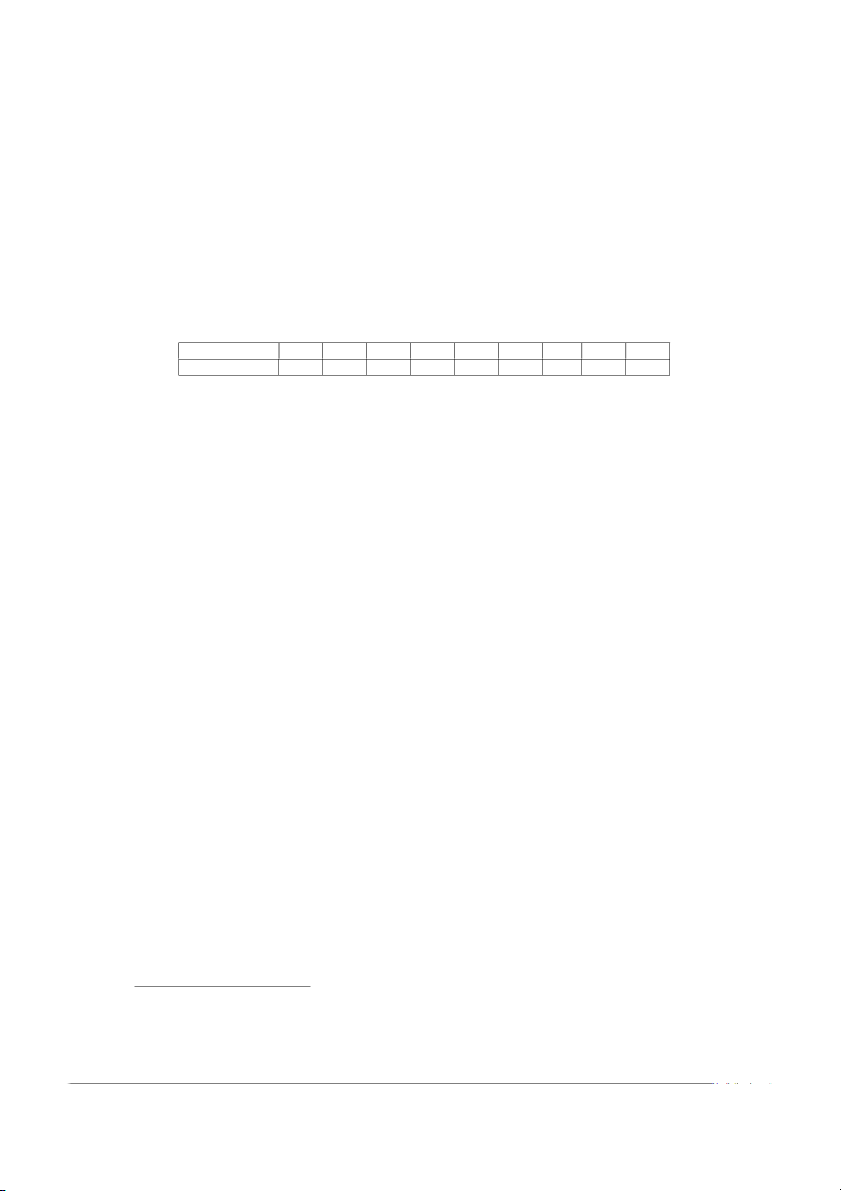

Table 1. Balance sheet and income statement forecasts for BadValue Inc. Source: XInvBank (€ thousands) 2019 2020 2021 2022 2023 2024…

WCR (working capital requirements) 500 500 550 600 612 + 2% Gross fixed assets 1500 1800 2000 2250 2516,8 - accumulated depreciation 200 410 640 874,6 Net fixed assets 1500 1600 1590 1610 1642,2 + 2% TOTAL ASSETS 2000 2100 2140 2210 2254,2 + 2% Debt 1000 1050 1150 1200 1224 + 2% Equity 1000 1050 990 1010 1030,2 + 2% TOTAL LIABILITIES 2000 2100 2140 2210 2254,2 + 2%

Income statement Margin 210 250 570 581,4 + 2% Interest payments 40 42 46 48 + 2% PBT (profit before tax) 170 208 524 533,4 + 2% Taxes 42,5 52 131 133,35 + 2%

PAT (profit after tax = net income) 127,5 156 393 400,05 + 2%

Table 2. Free Cash Flow forecasts for BadValue Inc. Source: XInvBank (€ thousa nds) 2020 2021 2022 2023 2024…

PBIT (profit before interest and tax) 210 250 570 581,4 + 2% - taxes on PBIT - 52,5 -62,5 -142,5 -145,35 + 2% + depreciation 200 210 230 234,6 + 2% - investment in fixed assets -300 -200 -250 -266,8 + 2%

- in crease of working capital requirements 0 - 50 -50 - 12 + 2% FCF (Free Cash Flow) 57,5 147,5 357,5 391,85 + 2%

Table 3 contains the valuation of the shares. Using a reasonable cost of equity of 9,75% and the

financial leverage of the company, we arrive at a WACC of 6,375% which is very reasonable for the

company. The present value of the expected FCFs discounted using the WACC (6,375%) results in an

enterprise value of €7,9 million. Thus, our best estimation of the value of the shares is €6,9 million.

Table 3. Valuation of the shares of BadValue Inc. Source: XInvBank

Risk-free rate (RF) = 1%. Market risk premium (MRP) = 5%. Levered beta (L) = 1,75.

Ke = RF + L PM = 1% + 1,75 x 5% = 9,75% = cost of equity

Cost of debt (Kd) = 4%. Corporate tax rate (T) = 25%. Leverage D / (D+E) = 50%

WACC = [E / (D+E)] Ke + [D / (D+E)] Kd (1-T) = 50% x 9,75% + 50% x 4% x 75% = 6,375%

Enterprise value (D + E) = PV (FCF; WACC) = €7922,26 thousands

E = (D + E) – D =7922,26 - 1000 = €6922,26 thousands = Value of the shares of BadValue Inc. Errors using WACC. 1 - 2

Electronic copy available at: https://ssrn.com/abstract=3512739 Pablo Fernandez

The most common error in valuations using WACC

PhD Bus. Ec. (Finance), Harvard U.

2. Valuation using ECF and Ke

With the forecasts of table 1, it is very easy to calculate the expected Equity Cash Flows (see table 4)

Table 4. Equity Cash Flow forecasts for BadValue Inc. Source: Table 1 (€ thousands) 2020 2021 2022 2023 2024… PAT (profit after tax) 127,5 156 393 400,05 + 2% + increase of debt 50 100 50 24 + 2% + depreciation 200 210 230 234,6 + 2% - investment in fixed assets - 300 -200 -250 -266,8 + 2%

- increase of working capital requirements 0 -50 -50 -12 + 2% ECF (Equity Cash Flow) 77,5 216,0 373,0 379,85 + 2%

With the forecasts of table 2, and the relationship between ECF and FCF, it is also very easy to

calculate the expected Equity Cash Flows (see table 5). The free cash flow is the hypothetical equity cash

flow when the company has no debt. The expression that relates the FCF (Free Cash Flow) with the ECF is:

ECFt = FCFt + Dt - It (1 - T). Dt is the increase in debt, and It is the interest paid by the company.

Table 5. Equity Cash Flow forecasts for BadValue Inc. Source: Tables 1 and 2 (€ thousands) 2020 2021 2022 2023 2024… FCF (Free Cash Flow) 57,5 147,5 357,5 391,85 + 2% + increase of debt 50 100 50 24 + 2% - interest (1 – T) -30 -31,5 -34,5 -36 + 2% ECF (Equity Cash Flow) 77,5 216,0 373,0 379,85 + 2%

The present value of the expected ECFs discounted using the Ke (9,75%) calculated by the investment

bank in table 3 results in a value of the shares of €4,2 million:

Equity value (E) = PV (ECF) = €4239,74 thousand

How is it possible? The investment bank valued the shares (table 3) in €6,9 million. Now, we have two questions: 1.

Is the valuation of the investment bank valid, consistent, solid… or is it worthless? 2.

Which value, if any, is more consistent: €6,9 or €4,2 million?

To help the reader to answer the two questions, we include section 3: definition of WACC Errors using WACC. 1 - 3

Electronic copy available at: https://ssrn.com/abstract=3512739 Pablo Fernandez

The most common error in valuations using WACC

PhD Bus. Ec. (Finance), Harvard U. 3. Definition of WACC

There are two basic methods for valuing companies by discounted cash flows:

Method 1. Using the expected equity cash flow (ECF) and the required return to equity (Ke).

Equation [1] indicates that the value of the equity (E) is the present value of the expected equity cash

flows (ECF) discounted at the required return to equity (Ke).

[1] E0 = PV0 [Ket; ECFt]

Equation [2] indicates that the value of the debt (D) is the present value of the expected debt cash flows

(CFd) discounted at the required return to debt (Kd).

[2] D0 = PV0 [Kdt; CFdt]

The free cash flow is the hypothetical equity cash flow when the company has no debt. The

expression that relates the FCF (Free Cash Flow) with the ECF is:

[3] ECFt = FCFt + Dt - It (1 - T)

Dt is the increase in debt, and It is the interest paid by the company. CFdt = It - Dt

Method 2. Using the free cash flow and the WACC (weighted average cost of capital).

Equation [4] indicates that the value of the debt (D) plus that of the shareholders’ equity (E) is the

present value of the expected free cash flows (FCF) that the company will generate, discounted at the

weighted average cost of capital (WACC):

[4] E0 + D0 = PV0 [WACCt ; FCFt]

The WACC is the rate at which the FCF must be discounted so that equation [4] gives the same

result as that given by the sum of [1] and [2]. By doing so, the expression of the WACC (Weighted

Average Cost of Capital) is given by [5]:

[5] WACCt = [Et-1 Ket + Dt-1 Kdt (1-T)] / [Et-1 + Dt-1]

T is the effective tax rate applied to interest in equation [3].

Et-1 + Dt-1 are not market values nor book values: in actual fact, Et-1 and Dt-1 are the values obtained

when the valuation is performed using formulae [1], [2] or [4].1 D = Value of debt I = Interest paid

WACC = Weighted average cost of capital E = Value of equity PV = Present value

Ke = Required return to levered equity ECF = Equity cash flow r = Cost of debt Kd = Required return to debt FCF = Free cash flow RF = Risk-free rate N = Book value of the debt g = Growth rate

1 Consequently, the valuation is an iterative process: the free cash flows are discounted at the WACC to calculate the

company’s value (D+E) but, in order to obtain the WACC, we need to know the company’s value (D+E). Errors using WACC. 1 - 4

Electronic copy available at: https://ssrn.com/abstract=3512739 Pablo Fernandez

The most common error in valuations using WACC

PhD Bus. Ec. (Finance), Harvard U. 4. Conclusion

Understanding section 3, the reader should be able to answer the two questions:

1. Is the valuation of the investment bank valid, consistent, solid… or is it worthless?

2. Which value, if any, is more consistent: €6,9 or €4,2 million?

The WACC is just the rate at which the Free Cash Flows (FCF) must be discounted to obtain the

same result as the valuation using Equity Cash Flows.

To value shares there are two usual methods that, if properly applied, provide the same value:

a) Present value of expected free cash flows (FCF) discounted with the WACC rate and then, subtract the value of debt; or

b) Present value of expected equity cash flows (ECF) discounted with the Ke rate (required return to equity).

Both valuations must provide the same result because both methods analyze the same reality under the

same hypotheses; they differ only in the cash flows taken as the starting point for the valuation.

But in many valuations performed by investment banks, analysts, consultants, finance professors… both

methods do not provide the same value.

This paper presents a real valuation performed by a well-known investment bank with two very

different values: €6,9 million using method a), and €4,2 million using method b).

This error (perhaps the most common error performed in discounted cash flows valuations) is due to

“not remembering the definition of WACC”. In other words, it is due to “follow a recipe without thinking”.

For a further understanding about WACC, we recommend reading:

“WACC: definition, misconceptions and errors” (https://ssrn.com/abstract=1620871)2

Section 1 of “119 common errors in company valuations” (https://ssrn.com/abstract=1025424)3 “Cash flow discounting: fundamental relationships and unnecessary complications”

(https://ssrn.com/abstract=2117765) “Valuing companies by cash flow discounting: ten methods and nine theories”

(https://ssrn.com/abstract=256987)4

For a collection of errors and examples of “follow a recipe without thinking”, we recommend reading:

“WACC and CAPM according to Utilities Regulators: Confusions, Errors and Inconsistencies”

(https://ssrn.com/abstract=3327206). We show how a European Regulator arrives to a “WACC before taxes of

the electricity regulated activities” of 5,58%, but he could justify any figure in the interval 2,4% - 7,4%.

2 A previous version may be found in Business Valuation Review, 2010, Vol. 29, Number 4, pp. 138-144.

3 A previous version may be found in Investment Management and Financial Innovations Journal, 2005, Vol. 2, issue 2, pp. 128-141.

4 A previous version may be found in Managerial Finance, 2007, Vol. 33 No 11, pp. 853-876. Another previous

version in International Journal of Finance Education, 2005, Volume 1 Issue 1, pp. 141-168. Errors using WACC. 1 - 5

Electronic copy available at: https://ssrn.com/abstract=3512739 Pablo Fernandez

The most common error in valuations using WACC

PhD Bus. Ec. (Finance), Harvard U.

Exhibit 1. Calculating the WACC

The intertemporal form of equations [1], [2] and [4] is:

[1i] Et+1 = Et (1+Ket+1) - ECFt+1

[2i] Dt+1 = Dt (1+Kdt+1) - CFdt+1

[4i] [Et+1 + Dt+1] = [Et + Dt] (1+WACCt+1) - FCFt+1

The sum of [1i] and [2i] must be equal to [4i]:

[Et + Dt] + Et Ket+1 + Dt Kdt+1 - [ECFt+1 + CFdt+1] = [Et + Dt] (1+WACCt+1) - FCFt+1

As CFdt+1 = Dt Kdt+1 - [Dt+1 - Dt] and ECFt+1 = FCFt+1 + [Dt+1 - Dt] - Dt Kdt+1 (1-T)

[ECFt+1 + CFdt+1] = FCFt+1 + Dt Kdt+1 -- Dt Kdt+1 (1-T) and

[Et + Dt] + Et Ket+1 + Dt Kdt+1 (1-T)] - FCFt+1 = [Et + Dt] (1+WACCt+1) - FCFt+1

[Et + Dt] WACCt+1 = Et Ket+1 + Dt Kdt+1 (1-T) E Ke D Kd (1 T) The WACC is: t t 1 t t 1 WACCt 1 E D t t

T is the effective tax rate applied to interest in equation [3].

Et + Dt are not market values nor book values: in actual fact, Et and Dt are the values obtained when the

valuation is performed using formulae [1], [2] or [4]. . Errors using WACC. 1 - 6

Electronic copy available at: https://ssrn.com/abstract=3512739 Pablo Fernandez

The most common error in valuations using WACC

PhD Bus. Ec. (Finance), Harvard U.

Exhibit 2. Wrong calculations of WACC and wrong valuations

1. Wrong definition of WACC. An example:

Valuation, dated April 2001, of an edible oil company in Ukraine, provided by a leading European

investment bank. “The weighted average cost of capital (WACC) is defined as: WACC = Rf + ßu (Rm – Rf), (1)

where: Rf = risk-free rate; ßu = unlevered beta; Rm = market risk rate.”

The WACC calculated for the Ukrainian company was 14.6% and the expected free cash flows were: (Million euros)

2001 2002 2003 2004 2005 2006 2007 2008 2009 FCF 3.7 14.7 11.9 -3.0 12.9 12.9 12.6 12.6 12.6

The reported enterprise value in December 2000 was 71 million euros. This result comes from adding the

present value of the 2001-2009 FCFs (45.6) discounted at the 14.6% plus the present value of the residual

value calculated with the FCF of 2009 assuming no growth.

In fact, (1) is not the definition of the WACC. It is the definition of the required return to assets, also

known as the cost of unlevered equity (Ku). We also must interpret the term (Rm – Rf) as the required market risk premium.

The correct formula for the WACC is: WACC = [D / (D+E)] Kd (1– T) + [E / (D+E)] Ke (2)

where: Ke = Ku + (D / E) (1-T) (Ku - Kd) (3)

Kd = Cost of debt. D = Value of debt. E = Value of equity. T = effective corporate tax rate

The valuation of the Ukrainian company used a (wrongly defined) “WACC” of 14.6%. But 14.6% was

the Ku, not the WACC. The 71 million euros was the value of the unlevered equity, not the enterprise value.

On December 2000, the Ukrainian company’s debt was 33.7 million euros and the nominal cost of debt

was 6.49%. The correct WACC for the Ukrainian company should have been5:

Ke = Ku + (D / E) (1-T) (Ku - Kd)= 14.6 + (33.7/48.63) (1-0.3)(14.6-6.49) = 18.53%

WACC = [D / (D+E)] Kd (1– T) + [E / (D+E)] Ke = 0.409 x 6.49 (1-0.30) + 0.591 x 18.53 = 12.81%

Enterprise value = E+D = PV(FCF;12.81%) = 82.33 million euros.

2. The debt to equity ratio used to calculate the WACC is different than the debt to equity ratio

resulting from the valuation.

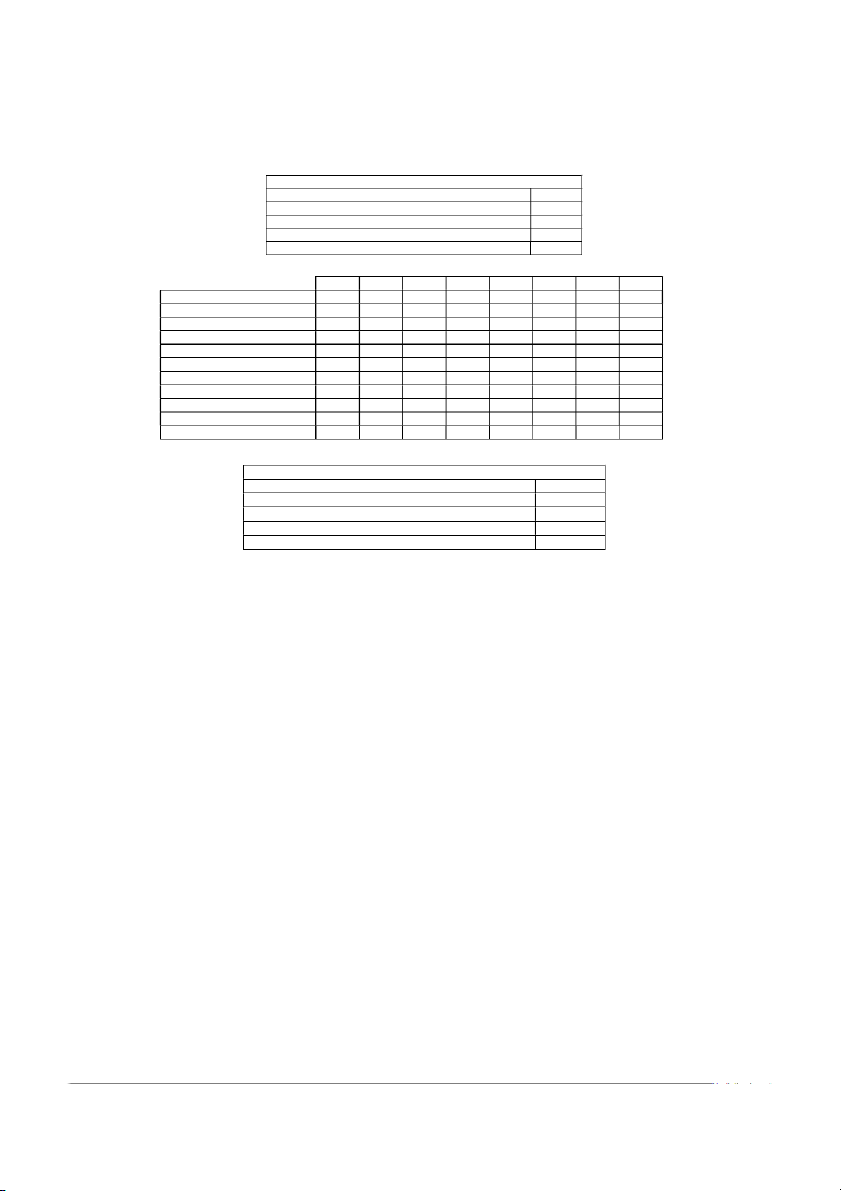

An example is the valuation of a broadcasting company performed by an investment bank (see Table 5),

which discounted the expected FCFs at the WACC (10%) and assumed a constant growth of 2% after 2008.

5 The (D/E) ratios must be calculated using the values obtained in the valuation. Errors using WACC. 1 - 7

Electronic copy available at: https://ssrn.com/abstract=3512739 Pablo Fernandez

The most common error in valuations using WACC

PhD Bus. Ec. (Finance), Harvard U.

The valuation provided lines 1 to 7, and stated that the WACC was calculated assuming a constant Ke of

13.3% (line 5) and a constant Kd of 9% (line 6). The WACC was calculated using market values (the

equity market value on the valuation date was 1,490 million and the debt value 1,184 million) and the

statutory corporate tax rate of 35%.

Table 5. Valuation of a broadcasting company performed by an investment bank

Data provided by the investment bank in italics 2002 2003 2004 2005 2006 2007 2008 1 FCF -290 -102 250 354 459 496 2 ECF 0 0 0 0 34 35 3 Intere st expenses 107 142 164 157 139 112 4 Effective tax rate 0.0% 0.0% 0.0% 0.0% 12.0% 35.0% 5 Ke 13.3% 13.3% 13.3% 13.3% 13.3% 13.3% 6 Kd 9.0% 9.0% 9.0% 9.0% 9.0% 9.0% 7 WACC used in the valuation 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% 8 Equity value (E) 3,033 3,436 3,893 4,410 4,997 5,627 6,341

9 ∆D = ECF - FCF + Int (1-T) 397 244 -86 -197 -303 -389 10 Debt value (D) 1,184 1,581 1,825 1,739 1,542 1,239 850 11 D/(D+E) 28.1% 31.5% 31.9% 28.3% 23.6% 18.0% 11.8%

12 WACC using lines 4,5,6,8,10

12.0 9% 11.95% 11.93% 12.08% 12.03% 11.96%

13 Implicit Ke in a WACC of 10%

10.39% 10.46% 10.47% 10.39% 10.64% 10.91%

The valuation also included the equity value at the end of 2002 (3,033; line 8) and the debt value at the

end of 2002 (1,184; line 10). Table 6 provides the main results of the valuation according to the investment bank. Errors

a. Wrong calculation of the WACC. To calculate the WACC, we need to know the evolution of the equity

value and the debt value. We calculate the equity value based on the equity value provided for 2002. The

formula that relates the equity value in one year to the equity value in the previous year is Et = Et-1 (1+Ket) - ECFt.

To calculate the debt value, we may use the formula for the increase of debt, shown in line 9. The

increase of debt may be calculated if we know the ECF, the FCF, the interest and the effective tax rate.

Given line 9, it is easy to fill line 10.

Line 11 shows the debt ratio according to the valuation, which decreases with time.

If we calculate the WACC using lines 4, 5, 6, 8 and 10, we get line 12. The calculated WACC is higher

than the WACC assumed and used by the valuer.

Another way of showing the inconsistency of the WACC is to calculate the implicit Ke in a WACC of

10% using lines 4, 6, 8 and 10. This is shown in line 13. If we are using a WACC of 10%, Ke should be much lower than 13.3%.

b. The capital structure of 2008 is not valid for calculating the residual value because in order to calculate

the present value of the FCF growing at 2% using a single rate, a constant debt to equity ratio is needed. Errors using WACC. 1 - 8

Electronic copy available at: https://ssrn.com/abstract=3512739 Pablo Fernandez

The most common error in valuations using WACC

PhD Bus. Ec. (Finance), Harvard U.

Table 6. Valuation using the wrong WACC of 10%

Present value in 2002 using a WACC of 10%

Present value in 2002 of the free cash flows 2003-2008 647

Present value in 2002 of the residual value (g=2%) 3,570 Sum 4,217 Minus debt -1,184 Equity value 3,033

Table 7. Valuation calculating the WACC correctly 2002 2003 2004 2005 2006 2007 2008 2009 1 FCF -290 - 102 250 354 459 496 505.9 2 ECF 0 0 0 0 34 35 473.2 3 Interest expenses 107 142 164 157 139 112 76.5 4 Effective tax rate 0.0% 0.0% 0.0% 0.0% 12.0% 35.0% 35.0% 5 Ke 13.3% 13.3% 13.3% 13.3% 13.3% 13.3% 13.3% 6 Kd 9.0% 9.0% 9.0% 9.0% 9.0% 9.0% 9.0% 8 Equity value (E) 2,014 2,282 2,586 2,930 3,320 3,727 4,187 4,271

9 ∆D = ECF - FCF + Int (1-T) 397 244 -86 -197 -303 -389 17 10 Debt value (D) 1,184 1,581 1,825 1,739 1,542 1,239 850 867 11 D/(D+E) 37.0% 40.9% 41.4% 37.2% 31.7% 25.0% 16.9% 16.9%

12 WACC calculated with 4,5,6,8,10

11.71% 11.54% 11.52% 11.70% 11.59% 11.44% 12.04%

Table 8. Valuation using the corrected WACC from Table 6

Present value in 2002 using the WACC calculated in Table 6

Present value in 2002 of the free cash flows 2003-2008 588

Present value in 2002 of the residual value (g=2%) 2,610 Sum 3,198 Minus debt -1,184 Equity value 2,014

To perform a correct valuation, assuming a constant WACC from 2009 on, we must recalculate Table 5.

Tables 7 and 8 contain the valuation correcting the WACC. To assume a constant WACC from 2009 on,

the debt must also increase by 2% per year (see line 9, 2009). This implies that the ECF (line 2) in 2009 is

much higher than the ECF in 2008.

Simply by correcting the error in the WACC, the equity value is reduced from 3,033 to 2,014 (a 33.6% reduction).

3. Using the statutory tax rate, instead of the effective tax rate of the levered company. There are

many valuations in which the tax rate used to calculate the WACC is the statutory tax rate (normally

arguing that the correct tax rate is the marginal tax rate). However this is wrong. The correct tax rate that

should be used in order to calculate the WACC, when valuing a company, is the effective tax rate of the levered company every year.

4. Valuing all the different businesses of a diversified company using the same WACC (same leverage and same Ke).

5. Using the wrong formula for the WACC when the value of debt (D) is not equal to its book value (N).

Chapter 4 shows that the expression for the WACC when the value of debt (D) is not equal to its book Errors using WACC. 1 - 9

Electronic copy available at: https://ssrn.com/abstract=3512739 Pablo Fernandez

The most common error in valuations using WACC

PhD Bus. Ec. (Finance), Harvard U.

value (N) is WACC = (E Ke + D Kd – N r T) / (E + D). Kd is the required return to debt and r is the cost of debt.

6. Calculating the WACC assuming a capital structure and deducting the current debt from the enterprise

value. This error appears in a valuation by an investment bank. Current debt was 125, the enterprise value

was 2180, and the debt to equity ratio used to calculate the WACC was 50%.

This is wrong because the outstanding and forecasted debt should be used to calculate the WACC. The

equity value of a firm is given by the difference between the firm value and the outstanding debt, where the

firm value is calculated using the WACC, and the WACC is calculated using the outstanding (market value

of) debt. Alternatively, if the firm starts with its current debt and moves towards another round of

financing, then a variable WACC (different for each year) should be used, and the current debt should be

deducted from the enterprise value.

7. Calculating the WACC using book values of debt and equity. This is quite a common error. The

appropriate values of debt and equity are the ones resulting from the valuation.

8. Valuing shares calculating the Present Value of expected free cash flows (FCF) discounted with

the Ke rate!!!6 They got a value of the shares of €3,2 billion. Correcting the error, the value went down to €1,8 billion.

6 Authors: prestigious economists, members of a well-known Consulting Firm. Errors using WACC. 1 - 10

Electronic copy available at: https://ssrn.com/abstract=3512739