Preview text:

lOMoAR cPSD| 58562220 Solutions Manual to

AN INTRODUCTION TO MATHEMATICAL

FINANCE: OPTIONS AND OTHER TOPICS Sheldon M. Ross 1 1.1 1.2 1.3 1.4 1.5

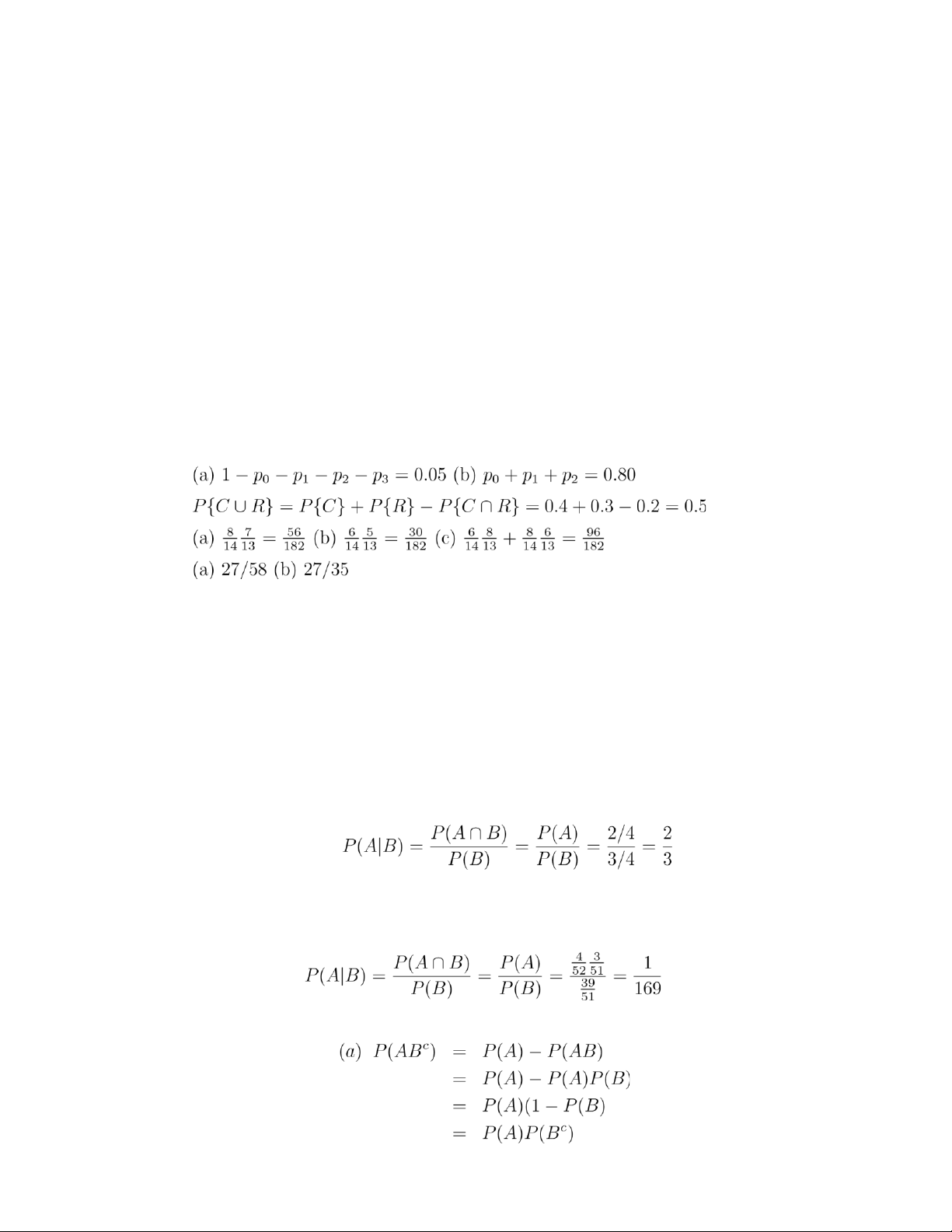

1. The probability that their child will develop cystic fibrosis is the probability thatthe

child receives a CF gene from each of his parents, which is 1/4.

2. Given that his sibling died of the disease, each of the parents much have exactlyone

CF gene. Let A denote the event that he possesses one CF gene and B that he does

not have the disease (since he is 30 years old). Then

1.6 Let A be the event that they are both aces and B the event they are of different suits. Then 1.7 lOMoAR cPSD| 58562220

Part (b) follows from part (a) since from (a) A and Bc are independent, implying from (a)

that so are Ac and Bc.

1.8 If the gambler loses both the bets, then X = −3. If he wins the first bet, or loses the

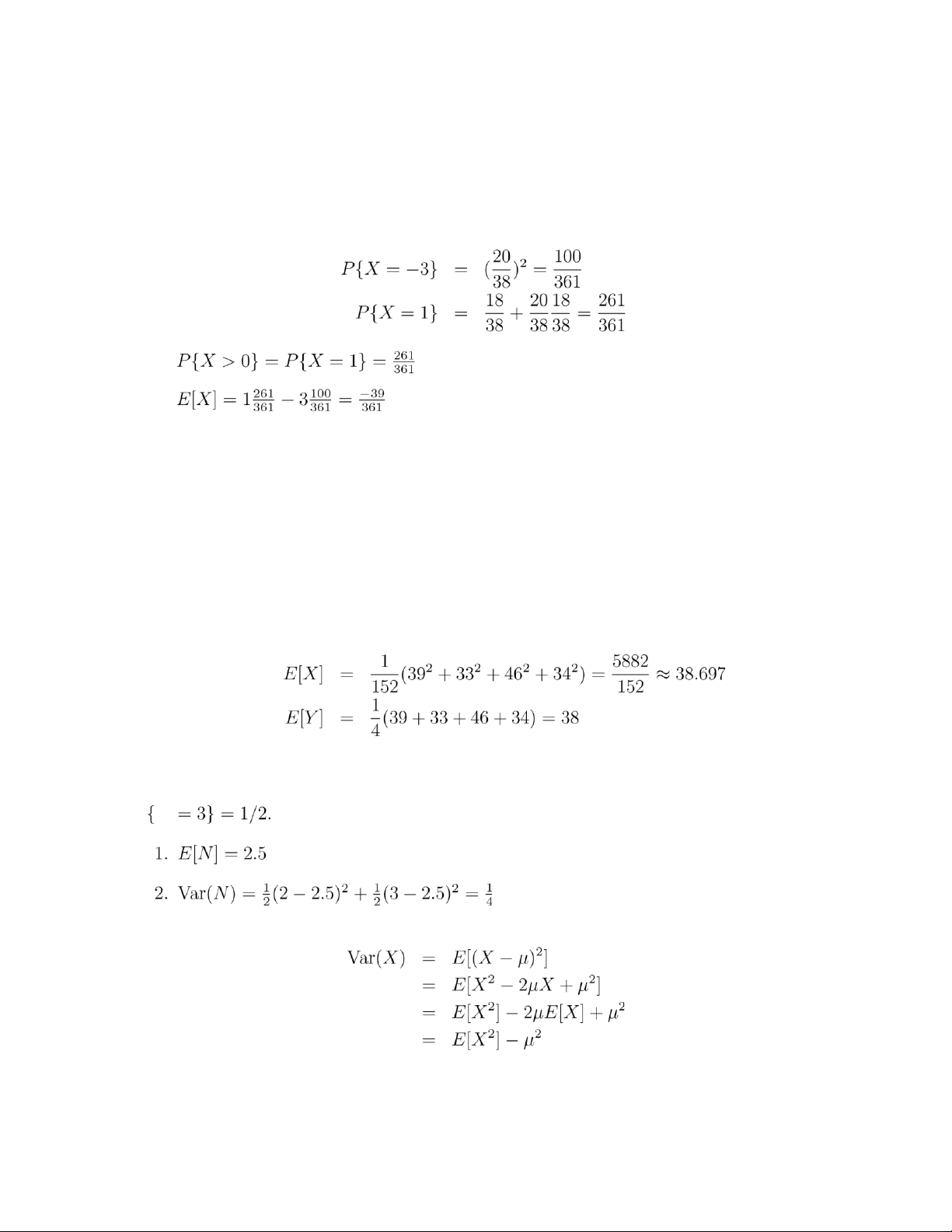

first bet and wins the second bet, X = 1. Therefore, 1. 2. 1.9 2

1. E[X] is larger since a bus with more students is more likely to be chosen than a bus with less students. 2.

1.10 Let N denote the number of sets played. Then it is clear that P{N = 2} = P N

1.11 Let µ = E[X].

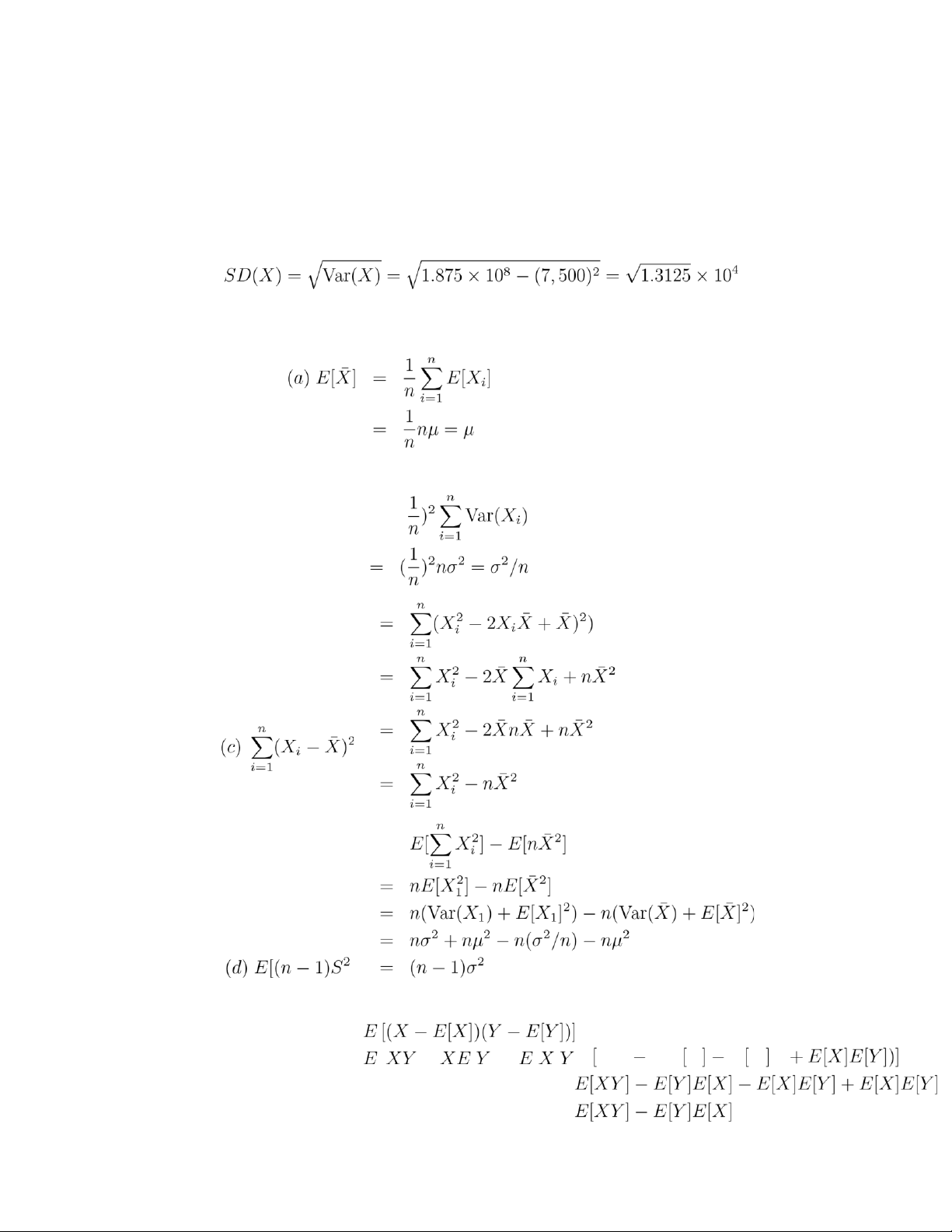

1.12 Let F be her fee if she takes the fixed amount and X when she takes the contingency amount. lOMoAR cPSD| 58562220

E[F] = 5,000, SD(F) = 0

E[X] = 25,000(.3) + 0(.7) = 7,500

E[X2] = (25,000)2(.3) + 0(.7) = 1.875 × 108 Therefore, 1.13 3 (b) Var(X¯) = ( ] = 1.14 Cov(X,Y ) = = = = lOMoAR cPSD| 58562220 1.15 (b) Cov(X,X) =

E[(X − E[X])2] = Var(X) − − = cCov(X,Y ) (d) Cov(c,Y ) =

E [(c − E[c])(Y − E[Y ])] = 0 4 1.16

Cov(aU + bV,cU + dV ) =

Cov(aU,cU + dV ) + Cov(bV,cU + dV ) =

Cov(aU,cU) + Cov(aU,dV ) + Cov(bV,cU) + Cov(bV,dV )

= ac(1) + ad(0) + bc(0) + bd(1) = ac + bd

1.17 With c(i,j) = Cov(Xi,Xj)

(a) c(1,3) + c(1,4) + c(2,3) + c(2,4) = 21

(b) 2 + 3 + 4 + 4 + 6 + 8 + 6 + 9 + 12 = 54 1.17

Let Xi be the amount it goes up in period i. Then and

Cov(X1,Y ) = Cov(X1,X1) = Var(X1) = 1/4 Therefore, Corr( 1.18

No, since for such a pair Corr(X,Y ) = 2, and correlations are always between −1 and 1.

1.18 Let Xi be the amount it goes up in period i. Then 3 Y = XXi i=1 lOMoAR cPSD| 58562220 and

Cov(X1,Y ) = Cov(X1,X1) = Var(X1) = 1/4 Therefore, Corr(

1.19 No, since for such a pair Corr(X,Y ) = 2 and correlations are always between −1 and 1. 1.20 X X X

h(y)P(Y = y) =

h(y)P(Y = y) y i

y:h(y)=hi

= X X hiP(Y = y) i

y:h(y)=hi = Xhi

X P(Y = y) i

y:h(y)=hi

= XhiP(h(Y ) = hi) i

1.21 P(X = i) = F(i) − F(i − 1) 2 5 2.1

1. P(Z < −.66) = P(Z > .66) = 1 − P(Z < .66) = 1 − Φ(.66) = 1 − .7454 = .2546 2.

P(|Z| < 1.64) =

P(Z < 1.64) − P(Z < −1.64) =

P(Z < 1.64) − [1 − P(Z < 1.64)]

= 2Φ(1.64) − 1 = 2 × .9495 − 1 = .8990

3. P(|Z| > 2.20) = 2P(Z > 2.20) = 2[1 − P(Z < 2.20)] = 2(1 − .9861) = .0278 2.2 x = 2 lOMoAR cPSD| 58562220 2.3

P(|Z| > x) = P(Z > x or Z < −x) = P(Z > x) + P(Z < −x) = 2P(Z > x)

where the last equality comes from the fact that Z is symmetric.

2.4 a = 2µ, b = −1.

Cov(X,Y ) = −Var(X) = −σ2 2.5

(a) 127.7 ± 19.2

(b) 127.7 ± (1.96)(19.2)

(c) 127.7 ± 57.6

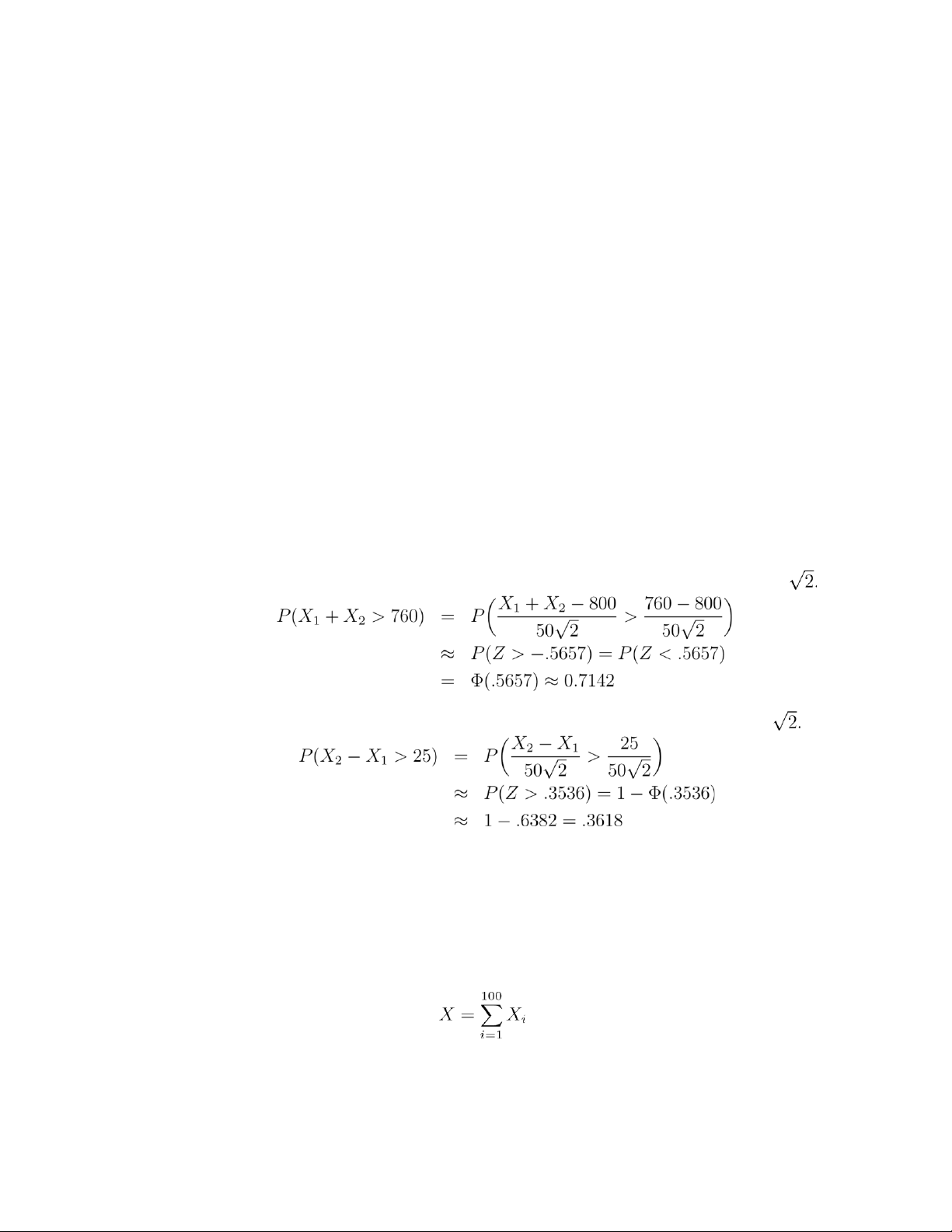

2.6 Let X1 and X2 denote the life of the first and the second battery respectively. It is

given that X1 and X2 are both normal random variables with mean 400 and standard

deviation 50. Let Z denote a standard normal random variable.

1. X1 +X2 is a normal random variable with mean 800 and standard deviation 50

2. X2 − X1 is a normal random variable with mean 0 and standard deviation 50 6

3. P(|X1 − X2| > 25) = 2P(X2 − X1 > 25) ≈ .7236

2.7 Let Xi be the time the that it takes to develop the ith print. Then, the time that

it takes to develop 100 prints, call it X, can be expressed as

It follows from the central limit theorem that X approximately has a normal distribution

with mean 1800 and standard deviation 10. Therefore, lOMoAR cPSD| 58562220

The probability for part (b) is 0

2.8 Let Xi be the mileage for person i, i = 1,...,30. From central limit theorem,

is approximately a normal random variable with mean 25000 × 30 and standard deviation 12000 1. 2.

2.9 Let Si be the price of stock in time period i. Then Si+1 = SiXi where the random

variable Xi is defined as

u ,with probability p d

,with probability 1 p Xi = ( − Then 7 lOMoAR cPSD| 58562220

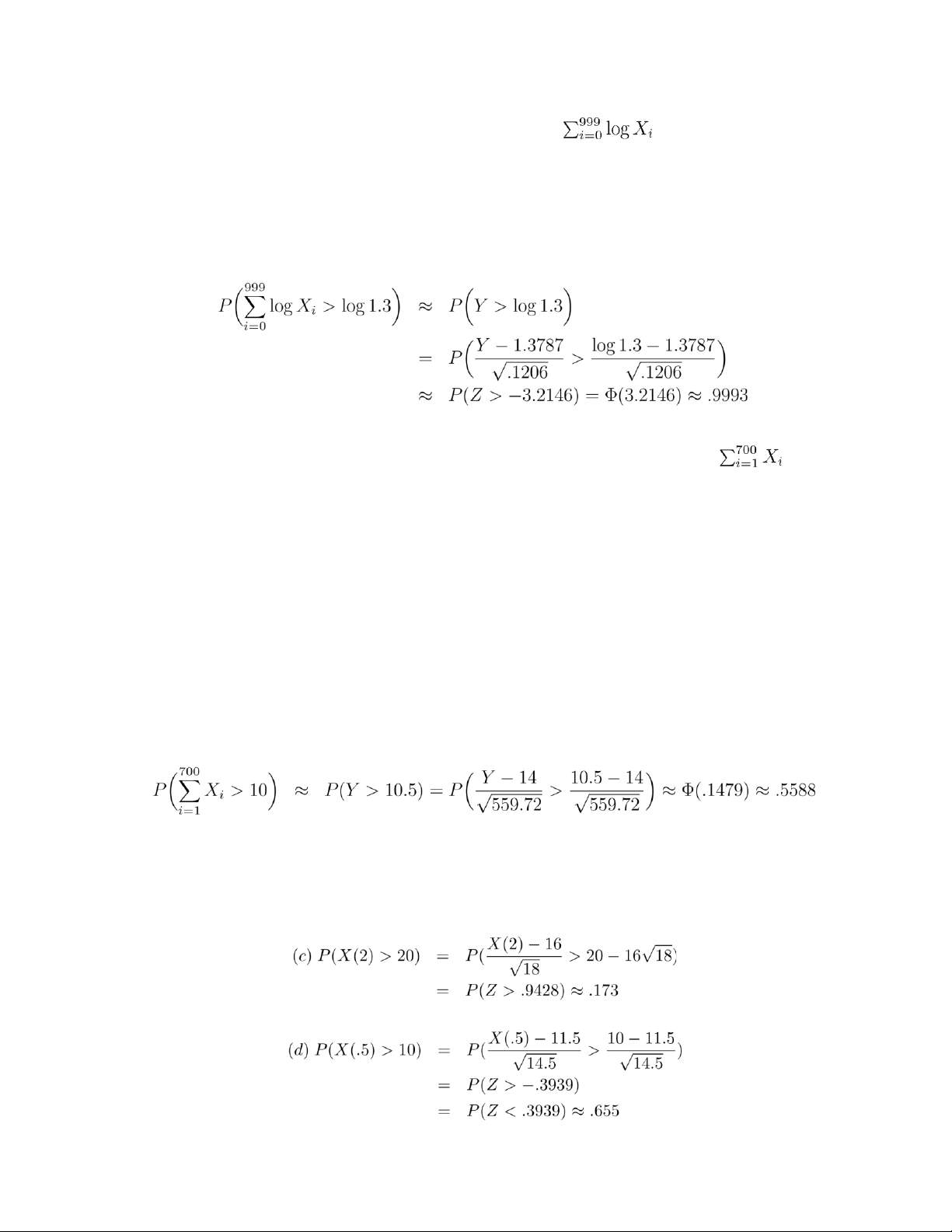

We can use the central limit theorem to approximate with a normal random

variable Y with the same mean and variance.

E[Y ] = 1000 E[logXi] = 1000 (plogu + (1 − p)logd) ≈ 1.3787

Var(Y ) = 1000 Var(logXi)

= 1000 (p(logu)2 + (1 − p)(logd)2 − .00137872) ≈ 0.1206 Therefore

where Z stands for a standard normal random variable.

2.10 Let Xi be the movement in period i. Then we can approximate with a

normal random variable Y with the same mean and variance 700 · E[Y ] =

EXXi¸ = 700(−.39 + .41) = 14 i=1 700 µ Var(Y ) =

VarXXi¶ = 700(.39 × 1.022

+ .20 × .022 + .41 × .982) = 559.72 i=1 Therefore,

3.1 This follows since −X(t + y) − (−X(y)) = −(X(t + y) − X(y)) is the negative of a normal

with mean µt and variance σ2t, and so has mean −µt and variance σ2t. 3.2 (a) 16; (b) 18 lOMoAR cPSD| 58562220

where Z is a standard normal.

3.3 (a) With 2p − 1 = .3162, E[X(1)] = 10 + 10(.9487)(.3168) = 13.005

(b) Var(X(1)) = 9[1 − .09998] ≈ 8.10018

(c) P(X(.5) > 10) = (.6581)5 + 5(.6581)4(.3419) + 10(.6581)3(.3419)2 = .7773

3.4 (a) With W being normal with mean .1 and variance .04,

P(S(1) > S(0)) = P(eW > 1) = P(W > 0) = P(Z > −.1/.2) = P(Z < .5) = .6915 (b) (.6915)2 (c)

3.6 S(t)/s is distributed as eW , where W is normal with mean µt and variance tσ2. Hence,

E[S(t)] = sE[eW ] = seµt+tσ2/2 and

E[S2(t)] = s2E[e2W ] = s2e2µt+2tσ2 3 Hence,

Var(S(t)) = s2e2µt+2tσ2 − s2e2µt+tσ2 = s2e2µt+tσ2(etσ2 − 1)

3.7 This follows directly from the formula for P(Ty ≤ t) given in the text, upon using that limx→∞ Φ(¯

x) = 0 and limx→∞ Φ(¯ −x) = 1. Hence, when µ < 0,

P(M > y) = P(Ty < ∞) = e2yµ/σ2, y > 0

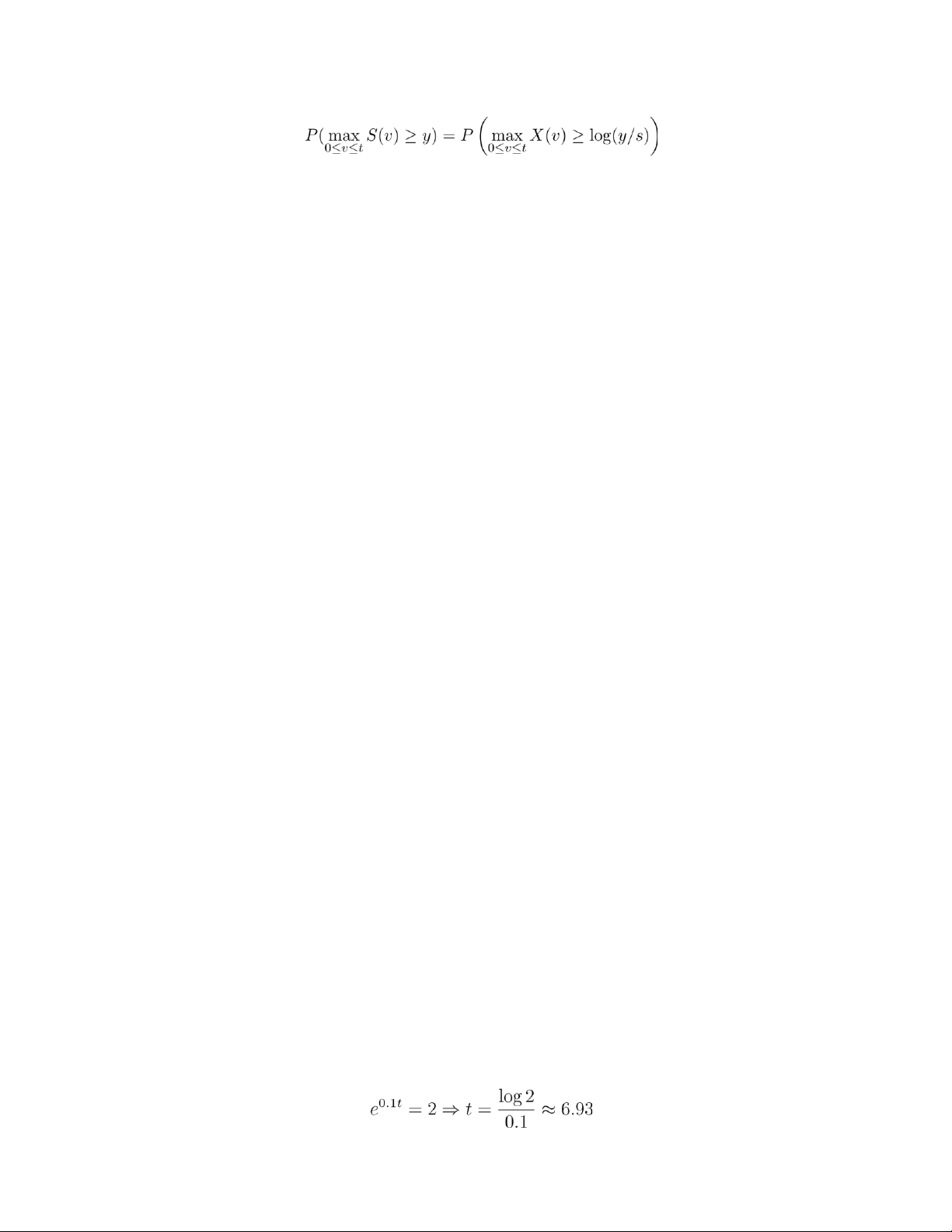

3.8 Using the representation that S(t) = seX(t), where X(t),t ≥ 0 is Brownian motion with X(0) = 0, gives lOMoAR cPSD| 58562220

Now use Corollary 1, setting t = log(y/s).

3.9 The desired probability is P (M(t) < log(1.2)) where M(t) is the maximum by time t of a

Brownian motion having µ = .1,σ = .3 and X(0) = 0. Now, apply Corollary 1. 4 9 4.1

(a) re = (1 + 0.1/2)2 − 1 = 0.1025

(b) re = (1 + 0.1/4)4 − 1 ≈ 0.1038

(c) re = e0.1 − 1 ≈ 0.1052

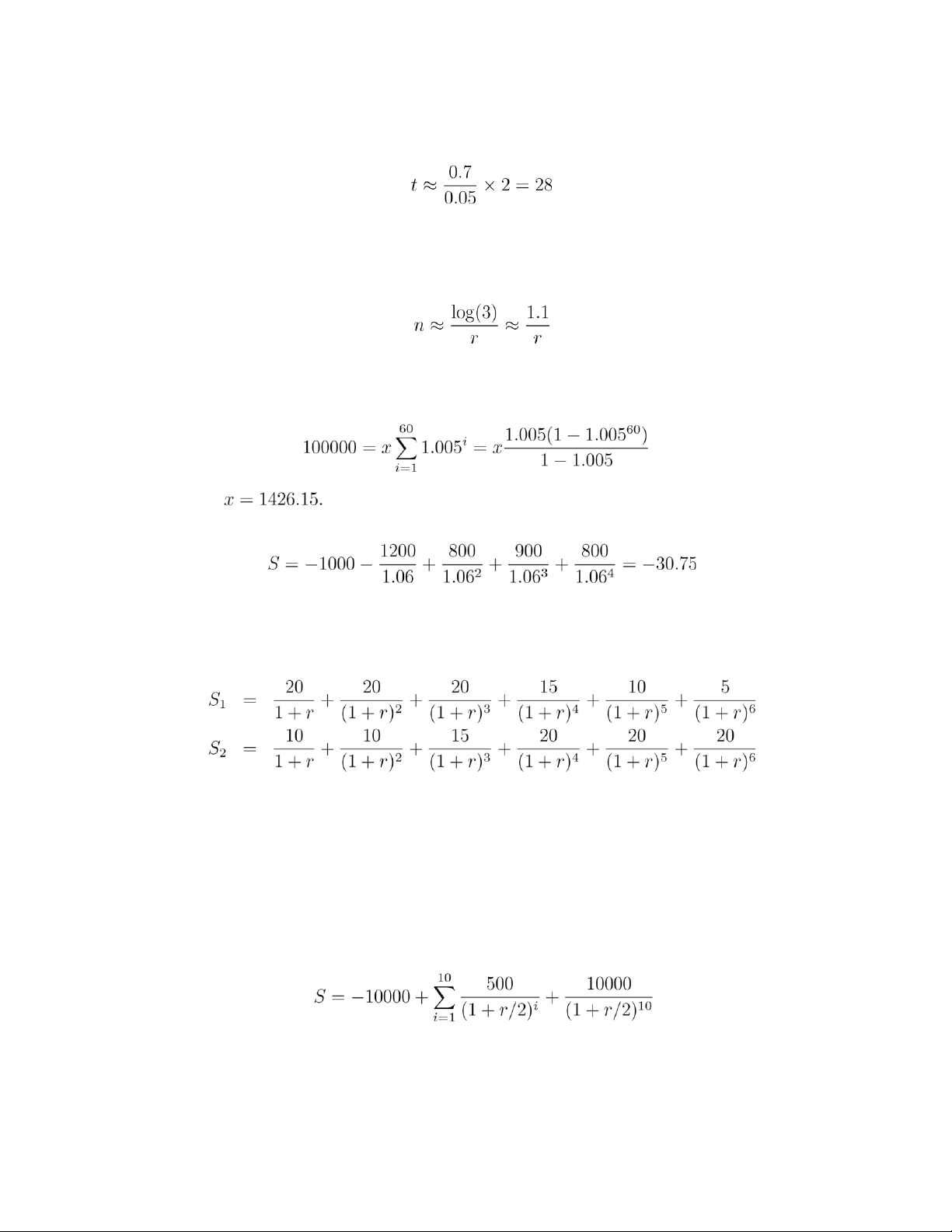

4.2 Suppose it takes t years to double, then lOMoAR cPSD| 58562220

4.3 Suppose it takes t years to quadruple, then we can solve t from 1.05t = 4. We

can also use the doulbing rule to approximate t, which gives

If the interest is 4%, then it is approximately 0.7/0.04 × 2 = 35 years.

4.4 Using that er ≈ 1+r, when r is small, we see that if (1+r)n = 3 then enr ≈ 3. Thus,

4.5 Suppose you need to invest x at the beginning of each of the next 60 months

to have a value of $100,000 at the end of 60 months, then Solve to get

4.6 Let’s compute the present value, denoted by S, of this cash flow.

Since it is negative, it is not worth investing.

4.7 (15 pts) Let the present value of the first cash flow sequence be S1 and that

of the second cash flow sequence be S2. Then 10

(a) r = 0.03, S1 = 82.71,S2 = 84.63. The second one is preferable. (b) r =

0.05, S1 = 78.37,S2 = 78.60. The second one is preferable.

(c) r = 0.1, S1 = 69.01,S2 = 65.99. The first one is preferable.

4.8 (15 pts) Let S denote the present value, then

(a) r = 0.06, S = 1706.04.

(b) r = 0.10, S = 0.

(c) r = 0.12, S = −736.01. lOMoAR cPSD| 58562220

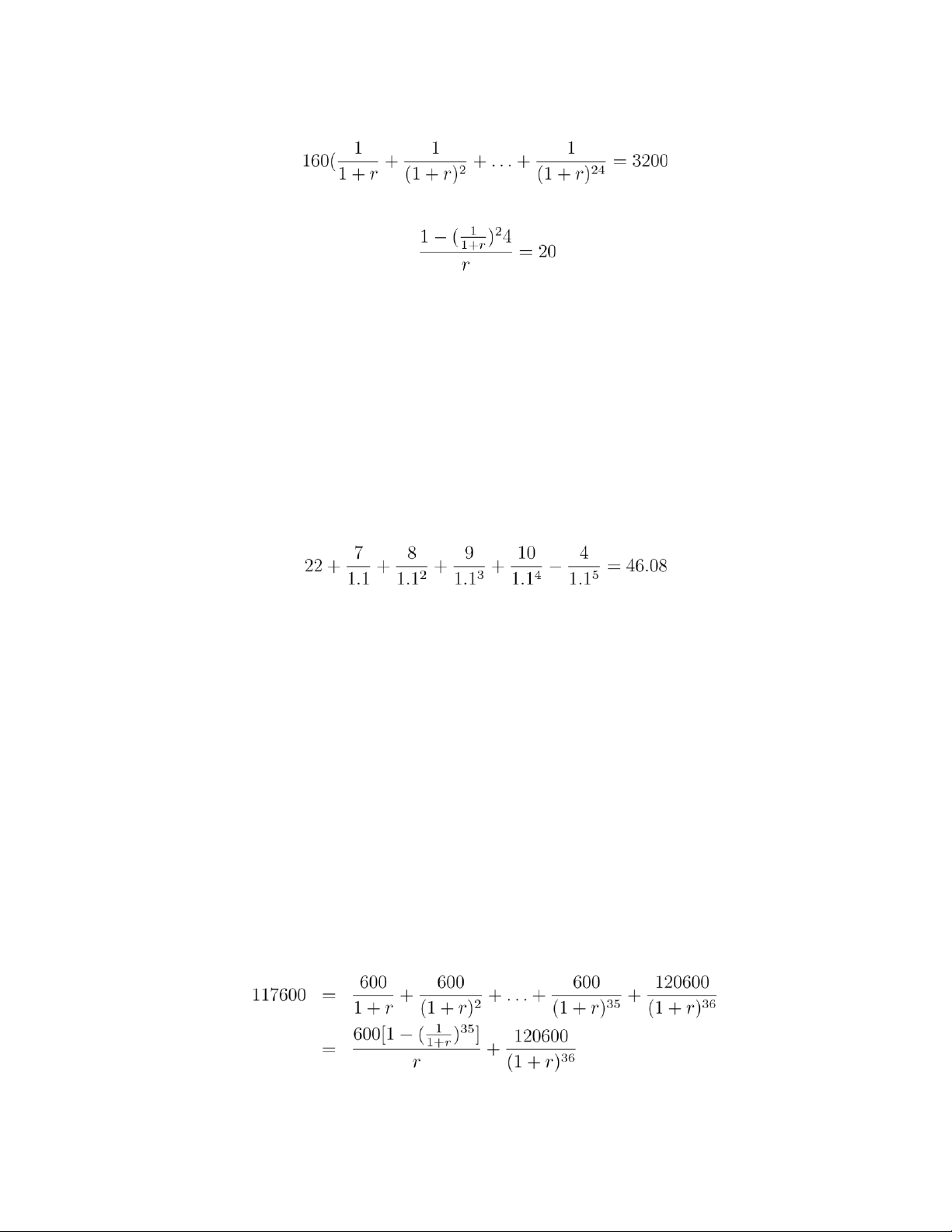

4.9 The effective interest rate, call it r, is that value for which which reduces to

Solution by trial and error shows that r ≈ .015. That is, the effective interest rate is 1.5 percent per month. 4.11

The cost-flow sequences are as follows

buy at beginning of year 1: 22 7 8 9 10 -4

buy at beginning of year 2: 9 25 7 8 9 -9

buy at beginning of year 3: 9 11 28 7 8 -14

buy at beginning of year 4: 9 11 13 31 7 -19

With the yearly interest rate 10%, the present value of the first cost-flow sequence is

Similarly, the prevent values of the other three cost-flow sequences can be determined,

and the four present values are

46.08, 44.08, 44.17, 46.02

Therefore, the company should purchase a new machine one year from now. 4.12

Since the bank charges 2 points, the amount of money we receive for

this loan is actually 120,000 × 0.98 = 117,600. The interest we need to pay per month is 120,000 ×

0.5% = 600. Therefore the cash flow sequence of this loan is 11 time (mths) 0 1 2 ... 35 36 cash flow

117600 -600 -600 ... -600 -120600

Let r be the effective interest rate per month for this loan, then

We can solve the above to get r ≈ 0.5615%. lOMoAR cPSD| 58562220 4.13

The present value of paying the entire amount of $16,000 now is

simply $16,000, while the present value of paying $10,000 now and another

$10,000 at the end of ten years is

S = 10,000 + 10,000(e−r)10 Therefore

(a) r = 0.02, S = 18,187.31, which is not preferable. (b) r

= 0.05, S = 16,065.31, which is not preferable.

(c) r = 0.10, S = 13,678.79, which is preferable.

4.14 The cash flow sequence is as follows, time (yrs) 0 0.5 1 ... 4.5 5

cash flow -1000 30 30 ... 30 1030

With a continuously compounded interest 5%, the present value of above is

4.15 The present value of a cash flow of 1,000 at the end of 10 years with a

continuously compounded interest rate 8% is

4.16 The rate of return is the effective interest rate which makes the present value of

the cash flow streams equal to the initial payment. Therefore lOMoAR cPSD| 58562220

4.15 (1 + 05/n)n would be the amount on deposit after one year if 1 is initially deposited, the

nominal interest rate is 5 percent, and interest is compounded n times in the year. The more times

it is compounded the higher this amount should be.

4.16 The amount of interest earned after n days is 100(e.06n/365 − 1).

4.17 1000e3r + 2000e2r + 3000er

4.18 You would pay the present value of the string of payments: 1 . 4.19 When 20 +

. That is, when r > .2. 4.20

104e−r = 110e−2r

giving that er = 110/104 or r = log(110/104) = .0561 4.21

4.22 (a) The interest earned by time t+h on the interest earned in (t,t+h) is of smaller order than h. (b) From (a), we have

Letting h → 0, the approximation becomes exact and we obtain that

D0(t) = rD(t) lOMoAR cPSD| 58562220 (c) Integrating both sides of , yields that

log(D(t)) = rt + C or

D(t) = Kert

for some constant K. Evaluating at t = 0 gives D = D(0) = K.

4.23 By Proposition 4.2.1, the cash flow 100,140,131 is preferable for any positive interest rate.

4.24 (a) 110/(1 + r)2 = 100 or r = .0488 √

(b) If R is the rate of return, then R is equally likely to be

1.2−1 or 0. Hence, E[R] = .0477.

4.25 1000e−.8 = 449.33

4.26 100 = 40(1 + r)−1 + 70(1 + r)−2 yielding that r = .0498

4.27 (a) No, it is greater than 10 percent if and only if Pi xi/(1.1)i is greater than 1. (b) yes because 1 .. 4.28 lOMoAR cPSD| 58562220

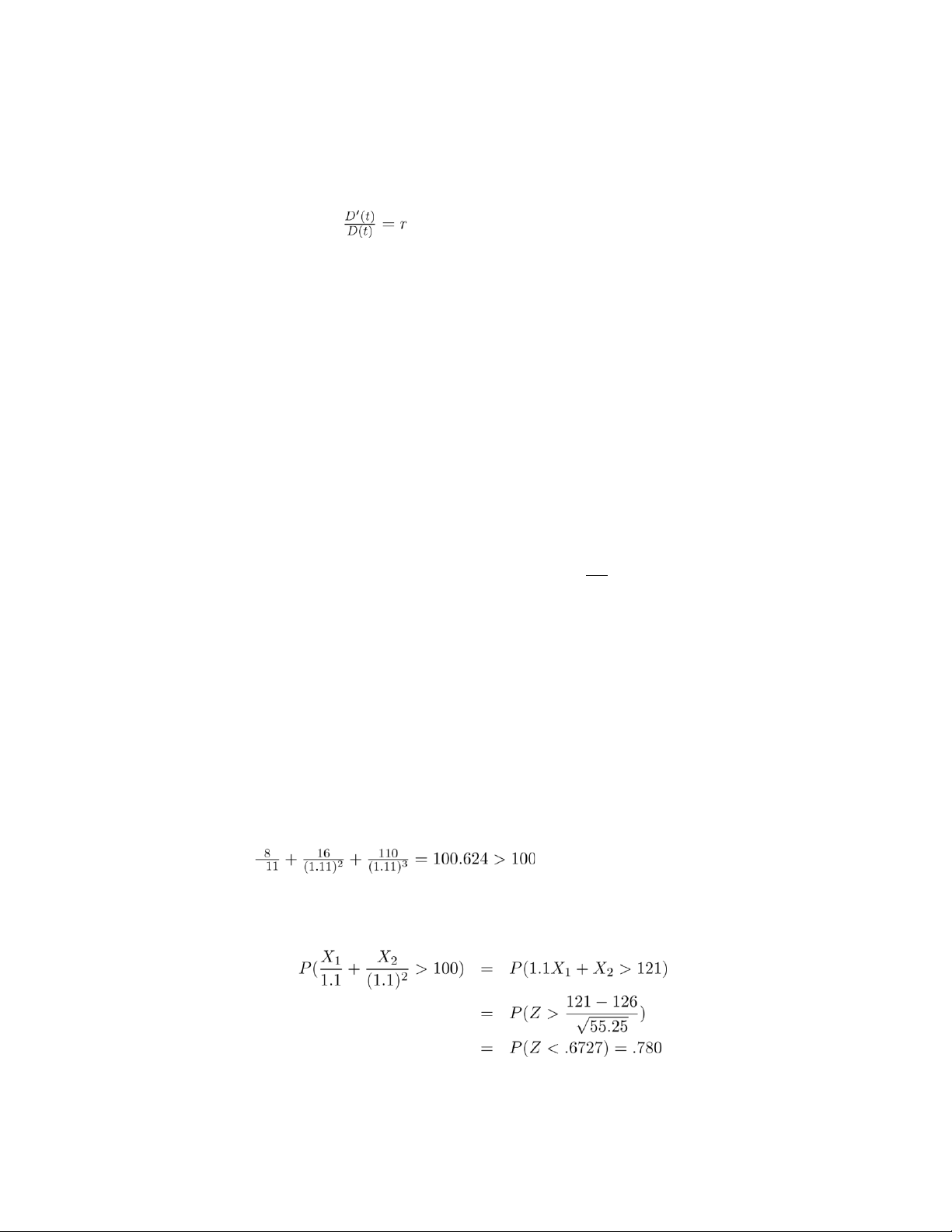

where the preceding used that 1.1X1 + X2 is normal with mean 126 and variance 55.25

5.1 (a) The present value of your net return is 10e−.12 − 10 = −1.1308 (b) −10

5.2 (a) -5;(b)2e−.03 − 5 = −3.059

5.3 Because the call option will be exercised, purchasing it costs C at time 0 and then costs K at

time 1 with the result being owning the security at time 1. Another investment that yields the

security at time 1 is to purchase it at time 0 for its initial price s. By the law of one price

s = C + Ke−r

giving that C = s − Ke−r.

5.4 If C > S an arbitrage is effected by simultaneously selling the call and buying the security.

5.5 Because P ≥ 0, the put call option parity implies that Ke−rt ≥ S − C

5.6 Use Exercise 5.5 to obtain C ≥ S − Ke−rt = 30 − 28e−.05/3

5.7 (a) is not necessarily true (to see this, let K be exceedingly large); (b) is true for if P > K an

arbitrage can be effected by selling the put.

5.8 This follows from the put call option parity formula.

5.10 Buying the security, buying the put, and selling the call has an initial cost of S + P − C and no

matter what the price at time t yields K at that time. (If S(t) ≤ K then the sold call is worthless and

we exercise the put to sell the security for K. If S(t) > K then the bought put is worthless but the lOMoAR cPSD| 58562220

purchaser of the call will exercise and we will receive K for the security.) A second investment that

yields K at time t is to ;put Ke−rt in the bank at time 0. The parity formula now follows from the law of one price.

5.11 (a) K; (b) If P is cost of put then law of one price yields s + P = Ke−rt, giving that P = Ke−rt −s.

(Note that if Ke−rt < s then sert > K > S(t), showing that selling the security with the intention to

purchase it at time t yields an arbitrage.)

5.12 Buying both yields 1 at time t, as would putting e−rt in the bank at time 0. Hence, the law of

one price gives C1 + C2 = e−rt

5.13 Because 25 = S+P −C > Ke−rt = 20e−.1/4, an arbitrage is effected by selling the security, selling

the put, and buying the call. This yields 25 and will cost you 20 at time t.

5.14 If C and P are the costs for the European versions, then Ca = C and Pa ≥ P. The put call parity formula yields

S + Pa − Ca ≥ Ke−rt

5.15 First note that P1 ≥ P2 for if P1 < P2 an arbitrage is effected by buying the P1 put and selling the

P2 put. So assume that P1 ≥ P2. If K1 − K2 < P1 − P2 then an arbitrage is effected by selling the K1,P1 put

and buying the K2,P2 put. This has an immediate return of P1 − P2. If the sold put is exercised at time

t then if you also exercise the bought put you will have to pay K1 − K2, which is less than your immediate return.

5.16 If it were less than could buy the exercise time t put and sell the exercise time s < t put. If the

sold put is ever exercised then you should exercise the bought put at that time. These latter

transactions cancel each other and you have the initial difference in prices as your arbitrage.

5.17 (a) True because it is clearly true for an American call option and the European is worth the same amount. lOMoAR cPSD| 58562220

(b) This is only true if the domestic interest rate is at least as large as the foreign rate. (c) This

need not be true since it is sometimes optimal to exercise early and so being forced to continue can be detrimential.

5.18 (a) If the security has a lot of volatility.

5.19 s − d

5.20 (a) (S(t) − K)+ + (K − S(t))+ = |S(t) − K|.

(b) (S(t) − K1)+ − (K2 − S(t))+

(c) 2(S(t) − K)+ − S(t)

(d) S(t) − (S(t) − K)+

5.21 If not then an arbitrage would result from buying the one with lower strike and

selling the one with higher strike. 5.22 (a) negative

5.23 Suppose you buy the K = 110 call and sell the K = 100 call. This would give you 20 −

C at time 0 and would cost at most (if the sold option is exercised then you should

exercise the other option) 10 at exercise time t. So there would be an arbitrage if 20

− C ≥ 10e−rt. Hence, C ≥ 20 − 10e−rt.

5.24 Convexity follows from the analogous result for call options upon using the put call option parity formula.

5.25 yes, to show that having λ put options with strike K1 and 1 − λ put options with strike

K2 is better than having one put option with strike K = λK1 +(1−λ)K2 exercise the put

pair at the same time that the single put is exercised, taking (K∗ −s)+ as the return

from exercising a K∗ strike put when the security price is s. lOMoAR cPSD| 58562220

5.26 If s is the price at time t1 than better than exercising is to sell the security at that time

and then exercise and give back the security at time t2. This follows because

exercising at time t1 gives a time t1 return of s−K1, whereas the latter policy gives a

time t1 return of s−K2e−r(t2−t1).

5.27 This follows because

S(t) − max(K,S(t) − A) = S(t) + min(−K,−S(t) + A) = min(S(t) − K,A) where we used

that −max(a,b) = min(−a,−b). Hence,

(S(t) − max(K,S(t) − A))+ = max{0,min(S(t) − K,A)} = min{(S(t) − K)+,A)}

5.28 A function is concave if the curve obtained when it is plotted is such that the straight

line connecting any two of its points lies below or on the curve.

5.29 An arbitrage is a sure win, so neither is necessarily true.