Preview text:

lOMoARcPSD|44744371 lOMoARcPSD|44744371 Chapter Ten Currency & Interest Rate Swaps INTERNATIONAL 10 FINANCIAL MANAGEMENT Chapter Objective:

This chapter discusses currency and interest rate

swaps, which are relatively new instruments for

hedging long-term interest rate risk and foreign exchange risk. EUN / RESNICK Second Edition lOMoARcPSD|44744371 Chapter Outline Types of Swaps

Size of the Swap Market The Swap Bank Interest Rate Swaps Currency Swaps lOMoARcPSD|44744371 Chapter Outline (continued)

Swap Market Quotations

Variations of Basic Currency and Interest Rate Swaps

Risks of Interest Rate and Currency Swaps

Swap Market Efficiency

Concluding Points About Swaps

McGraw-Hill/Irwin

.com)-Hill Companies, Inc. All rights lOMoARcPSD|44744371 Definitions

In a swap, two counterparties agree to a

contractual arrangement wherein they agree

to exchange cash flows at periodic intervals.

There are two types of interest rate swaps:

Single currency interest rate swap

“Plain vanilla” fixed-for-floating swaps are often just

called interest rate swaps.

Cross-Currency interest rate swap

This is often called a currency swap; fixed for fixed rate

debt service in two (or more) currencies. lOMoARcPSD|44744371 Size of the Swap Market

In 1995 the notational principal of:

interest rate swaps was $12,810,736,000,000.

Currency swaps $1,197,395,000,000

The most popular currencies are: U.S.$ (34%) ¥ (23%) DM (11%) FF (10%) £ (6%)

McGraw-Hill/Irwin

10-4.com)-Hill Companies, Inc. All rights lOMoARcPSD|44744371 The Swap Bank

A swap bank is a generic term to describe a

financial institution that facilitates swaps between counterparties.

The swap bank can serve as either a broker or a dealer.

As a broker, the swap bank matches counterparties

but does not assume any of the risks of the swap.

As a dealer, the swap bank stands ready to accept either

side of a currency swap, and then later lay off their

risk, or match it with a counterparty.

McGraw-Hill/Irwin

10- @gmailbyTheMcGraw.com)-Hill Companies, Inc. All rights lOMoARcPSD|44744371

An Example of an Interest Rate Swap

Consider this example of a “plain vanilla” interest rate swap.

Bank A is a AAA-rated international bank located

in the U.K. who wishes to raise $10,000,000 to

finance floating-rate Eurodollar loans.

Bank A is considering issuing 5-year fixed-

rate Eurodollar bonds at 10 percent.

It would make more sense to for the bank to issue

floating-rate notes at LIBOR to finance floating- rate Eurodollar loans.

McGraw-Hill/Irwin lOMoARcPSD|44744371

An Example of an Interest Rate Swap

Firm B is a BBB-rated U.S. company. It needs

$10,000,000 to finance an investment with a five- year economic life.

Firm B is considering issuing 5-year fixed-

rate Eurodollar bonds at 11.75 percent.

Alternatively, firm B can raise the money by issuing

5-year FRNs at LIBOR + ½ percent.

Firm B would prefer to borrow at a fixed rate.

McGraw-Hill/Irwin lOMoARcPSD|44744371

An Example of an Interest Rate Swap

The borrowing opportunities of the two firms are shown in the following table:

COMPANY B BANK A DIFFERENTIAL Fixed rate 11.75% 10% 1.75% Floating rate LIBOR + .5% LIBOR .5% QSD = 1.25%

McGraw-Hill/Irwin

10.com)-Hill Companies, Inc. All rights lOMoARcPSD|44744371

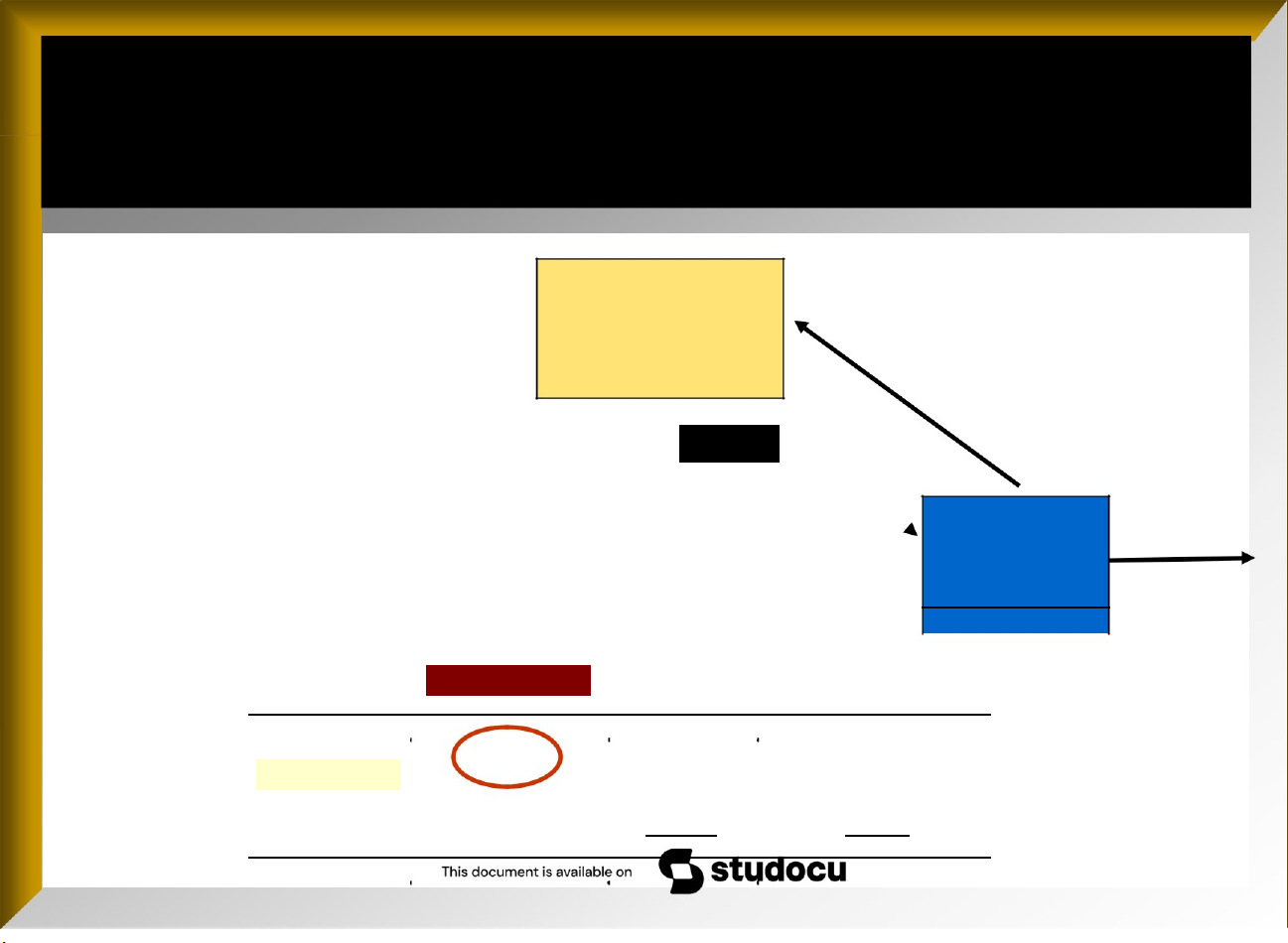

An Example of an Interest Rate Swap Swap The swap bank makes this offer to Bank A: Bank 10 3/8% You pay LIBOR – 1/8 % per year on $10 million LIBOR – 1/8% for 5 years and we will Bank pay you 10 3/8% on $10 A million for 5 years COMPANY B BANK DIFFERENTIAL A Fixed rate 11.75% 10% 1.75% Floating rate LIBOR + .5% LIBOR .5% QSD = 1.25%

McGraw-Hill/Irwin lOMoARcPSD|44744371

An Example of an Interest Rate Swap ½ % of $10,000,000 = Swap

Here’s what’s in it for Bank A: $50,000. That’s quite a They can borrow externally at cost savings per year for 5 Bank 10% fixed and have a net years. 10 3/8% borrowing position of LIBOR – 1/8%

-10 3/8 + 10 + (LIBOR – 1/8) = Bank 10% LIBOR – ½ % which is ½ % A better than they can borrow floating without a swap. COMPANY B BANK A DIFFERENTIAL Fixed rate 11.75% 10% 1.75% Floating rate LIBOR + .5% LIBOR .5% Q

SD = 1.25%

McGraw-Hill/Irwin . All rights lOMoARcPSD|44744371

An Example of an Interest Rate Swap The swap bank makes this Swap offer to company B: You Bank pay us 10 ½ % per year on 10 ½% $10 million for 5 years LIBOR – ¼% and we will pay you LIBOR – ¼ % per year on Company $10 million for 5 years. B COMPANY B BANK A DIFFERENTIAL Fixed rate 11.75% 10% 1.75% Floating rate LIBOR + .5% LIBOR .5% QSD = 1.25%

McGraw-Hill/Irwin

Companies, Inc. All rights lOMoARcPSD|44744371

An Example of an Interest Rate Swap ½ % of $10,000,000 =

Here’s what’s in it for B: Swap $50,000 that’s quite a cost Bank savings per year for 5 10 ½% years.

They can borrow externally at LIBOR + ½ % LIBOR – ¼% and have a net borrowing position of Company

10½ + (LIBOR + ½ ) - (LIBOR - ¼ ) = 11.25% LIBOR

which is ½ % better than they can borrow B + ½% floating without a swap. COMPANY B BANK A DIFFERENTIAL Fixed rate 11.75% 10% 1.75% Floating rate LIBOR + .5% LIBOR .5% Q

SD = 1.25%

McGraw-Hill/Irwin

)-Hill Companies, Inc. All rights lOMoARcPSD|44744371

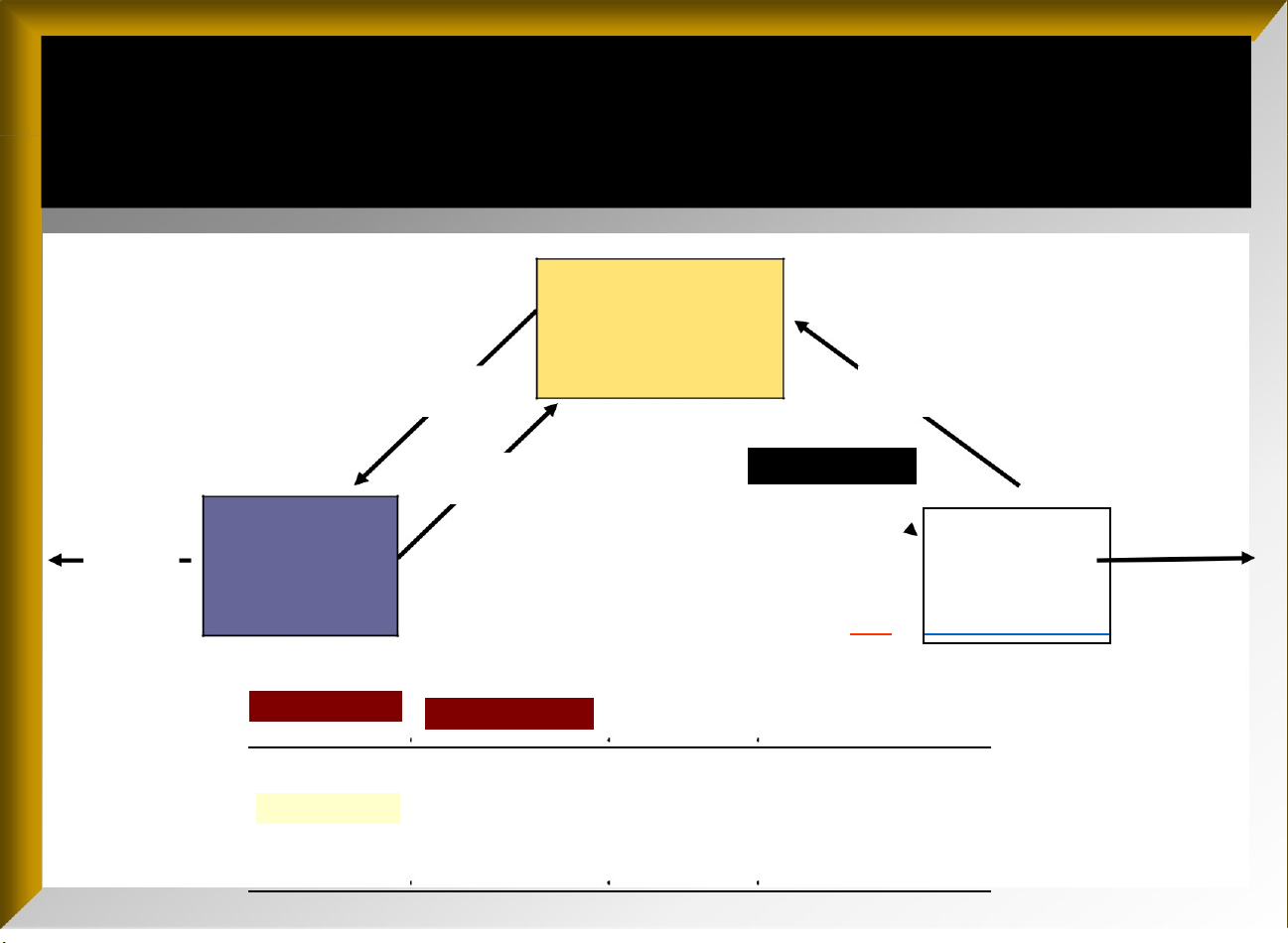

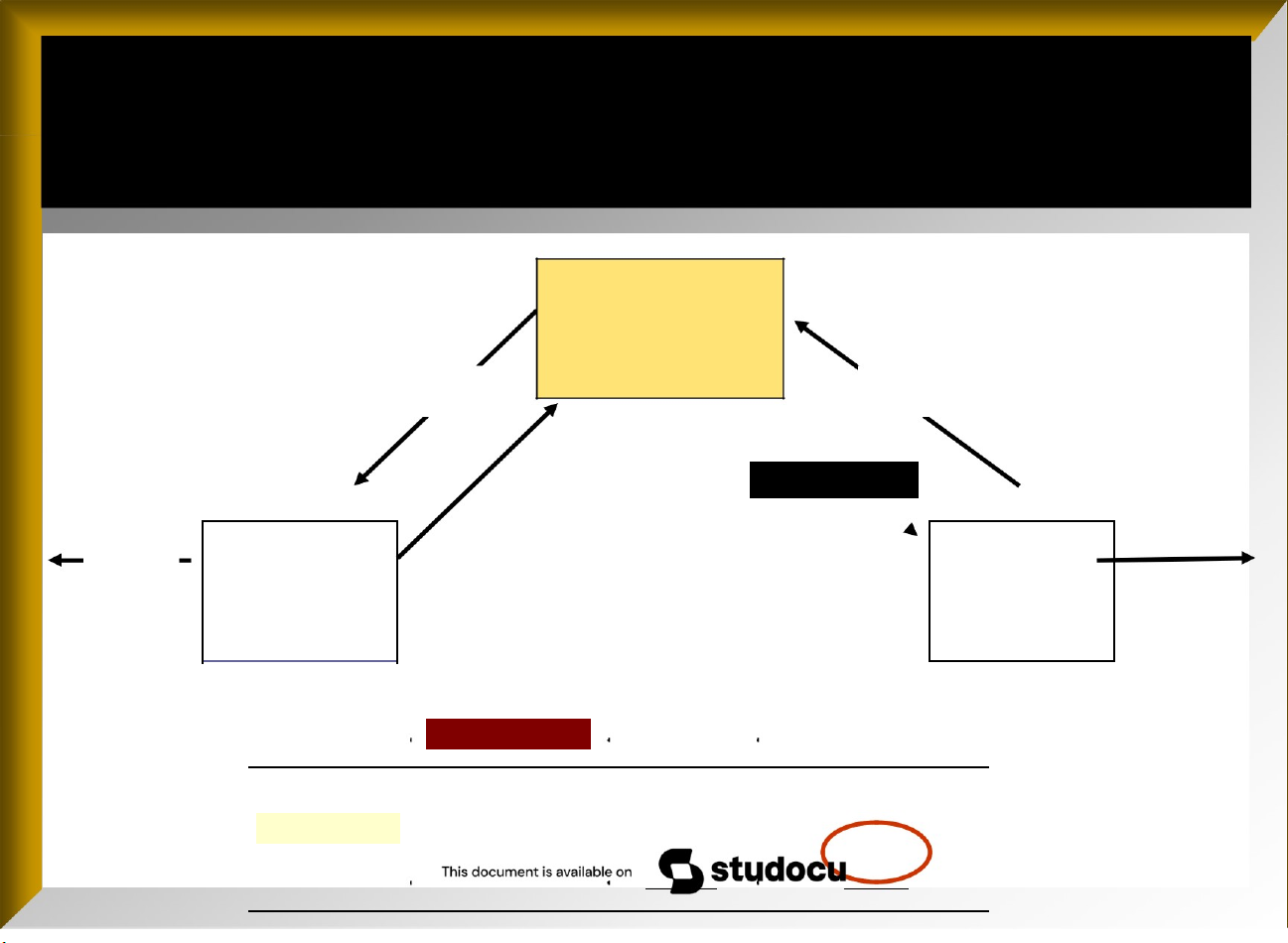

An Example of an Interest Rate Swap The swap bank Swap ¼ % of $10 million makes money too. = $25,000 per year Bank 10 3/8 % 10 ½% for 5 years. LIBOR – ¼% LIBOR – 1/8% Bank 10%

LIBOR – 1/8 – [LIBOR – ¼ ]= 1/8 Company LIBOR + ½% A 10½-103/8=1/8 B A saves ½ % ¼ B saves ½ % COMPANY B BANK A DIFFERENTIAL Fixed rate 11.75% 10% 1.75% Floating rate LIBOR + .5% LIBOR .5% QSD = 1.25%

McGraw-Hill/Irwin

.com)-Hill Companies, Inc. All rights lOMoARcPSD|44744371

An Example of an Interest Rate Swap The swap bank Swap makes ¼ % Bank 10 3/8 % 10 ½% LIBOR – ¼% LIBOR – 1/8% 10% Bank Company LIBOR

Note that the total savings + ½% A ½+½+¼=1.25%=QSD B A saves ½ % B saves ½ % COMPANY B BANK A DIFFERENTIAL Fixed rate 11.75% 10% 1.75% Floating rate LIBOR + .5% LIBOR .5% Q

SD = 1.25%

McGraw-Hill/Irwin

, Inc. All rights lOMoARcPSD|44744371 The QSD

The Quality Spread Differential represents the

potential gains from the swap that can be shared

between the counterparties and the swap bank.

There is no reason to presume that the gains will be shared equally.

In the above example, company B is less credit-

worthy than bank A, so they probably would have

gotten less of the QSD, in order to compensate

the swap bank for the default risk.

McGraw-Hill/Irwin

, Inc. All rights lOMoARcPSD|44744371 An Example of a Currency Swap

Suppose a U.S. MNC wants to finance a

£10,000,000 expansion of a British plant.

They could borrow dollars in the U.S. where

they are well known and exchange for dollars for pounds.

This will give them exchange rate risk: financing

a sterling project with dollars.

They could borrow pounds in the international

bond market, but pay a lot since they are not as well known abroad.

McGraw-Hill/Irwin All rights lOMoARcPSD|44744371 An Example of a Currency Swap

If they can find a British MNC with a mirror-

image financing need they may both benefit from a swap.

If the exchange rate is S0($/£) = $1.60/£, the

U.S. firm needs to find a British firm wanting to

finance dollar borrowing in the amount of $16,000,000.

McGraw-Hill/Irwin rights