Preview text:

lOMoAR cPSD| 58540065 ECONOMICS OF INVESTMENT 0988161658

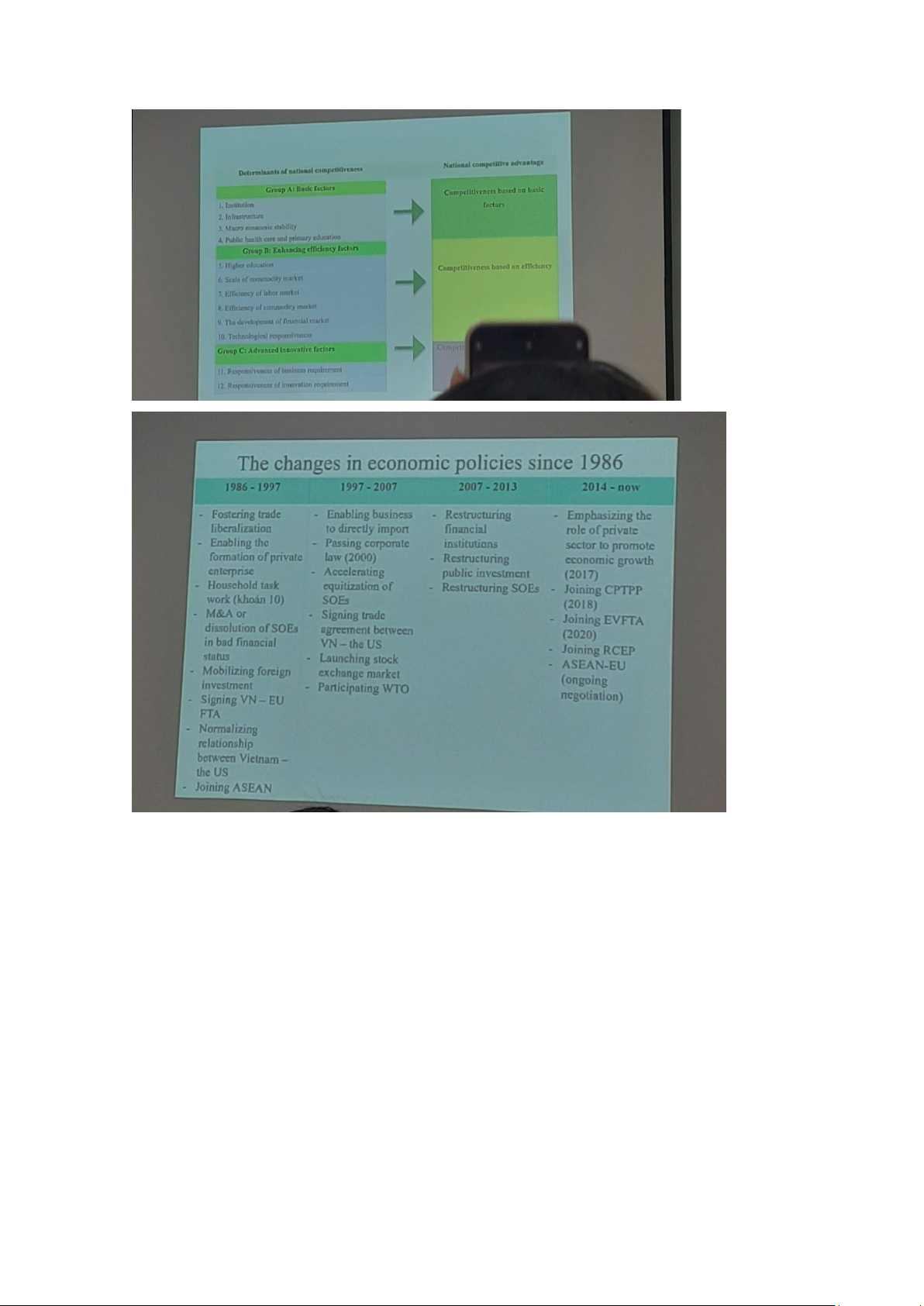

CHAPTER 1: OVERVIEW ON ECONOMICS OF INVESTMENT

CHAPTER 2: THEORETICAL FRAMEWORK

ON INVESTMENT AND ECONOMICS OF INVESTMENT

Liquidity trap ở vn ko nên tdong vào csach tien te, do cs tiền tệ ko có tdung đối với tỷ giá cố định

(tỷ giá VN dao động ở mức 1%)

1. Concept and classification of investment

Build a house for family to live in: not investment

Build a house for rent: investment Concepts:

- "The sacrifice of current consumption to increase future consumption" - Samuelson & Nordhaus Vietnam investment law 2014:

"Investment means the investor's spending in business activities through

establishing of (an) economic organization(s); investing through capital

contribution, purchasing shares or capital contributions of economic

organizations; Investing in the form of contracts or executing investment projects"

- Macro-approach: Capital formation accumulation

"Investment is the output accumulated to increase production capacity in the later

period of the economy" - Sachs and Larain (1993)

» Private investment (I): equipment, factory, new office, inventory

» Government investment (G): government spending, government expenditure

or periodic government payments to supply public goods

- Current expenditure for higher future benefit (expectation): lOMoAR cPSD| 58540065

Private investment: profit, sales, market share

Public investment: economic-social efficiency (employment, new asset,

tax or income distribution...)

Conclusion: Investment is the use of capital to gain profits and/or socioeconomic benefits

• Are buying lottery, personal savings deposits development investment? Please explain No Classification

• Based on the nature of object invested (for international)

- Fixed capital formation (new factories, machineries etc.)

- Financial assets: share, corporate and government bonds,

- Intangible assets: intellectual assets

• Based on the features of investment scale (Article 7-10 in Law of PublicInvestment 2014) (for Vietnam) - National important Projects - Projects in group A, B, C

• Based on sector of investment: Investment in business operation, investment inTech/R&D etc.

• Based on the feature of investment target:

- Basic investment to reproduce fixed assets - Operational investment to create current assets

• Based on investment for social reproduction process: - Investment for commerce - Investment for Production

• Based on the time of investment: short-term and long-term investment

• Based on the relationship among investors:

- Indirect investment: Investors do not supervise, manage the projects

- Direct investment: Investors supervise and manage the projects o M&A: not

new asset formation, only transferring ownership among investors

o Investment for development: new asset formation for the economy lOMoAR cPSD| 58540065

• The result of investment for development

- Increasing tangible assets: factories, equipments, etc.

- Increasing intellectual capital: expertise

- Increasing intangible assets; copyright, trademarks

• Based on the national scale -

Investment by domestic capital -

Investment by foreign capital Objectives of Investment • For investors: -

Private investor: Profit, market share, development etc. -

State agencies: profit and social-economic targets (collect tax, create jobs) • For the government: -

Economic targets: collect tax improve budget -

Social targets: improve hr quality, create added value to the society -

Environmental targets: gov don’t want to do this bc too costly Features

- Capital: Tangible and intangible

- Profitability: the main target

- Risk: investment may be implemented in long term - Time duration

- Being implemented via the formation of projects

Return of individual investment 1. Profit from business

2. Profit from hiring property 3. Income from copyright

4. Return from financial assets: put money in bank, get interest 5. Income from KOL

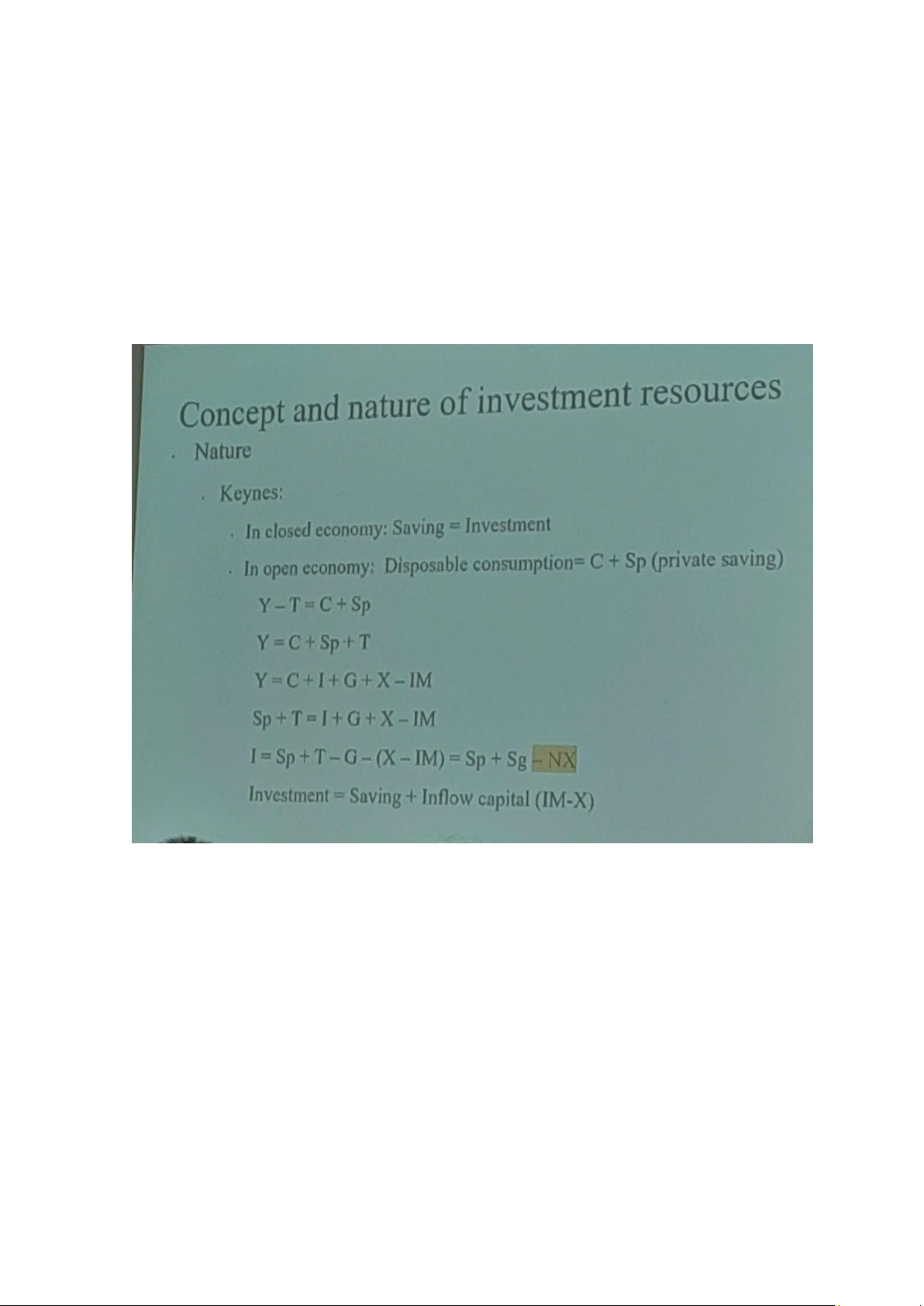

2. Impacts of investment for development on economics growth and development ΣIncome = ΣΕxpenditure lOMoAR cPSD| 58540065 Y=C+I+G+X-M

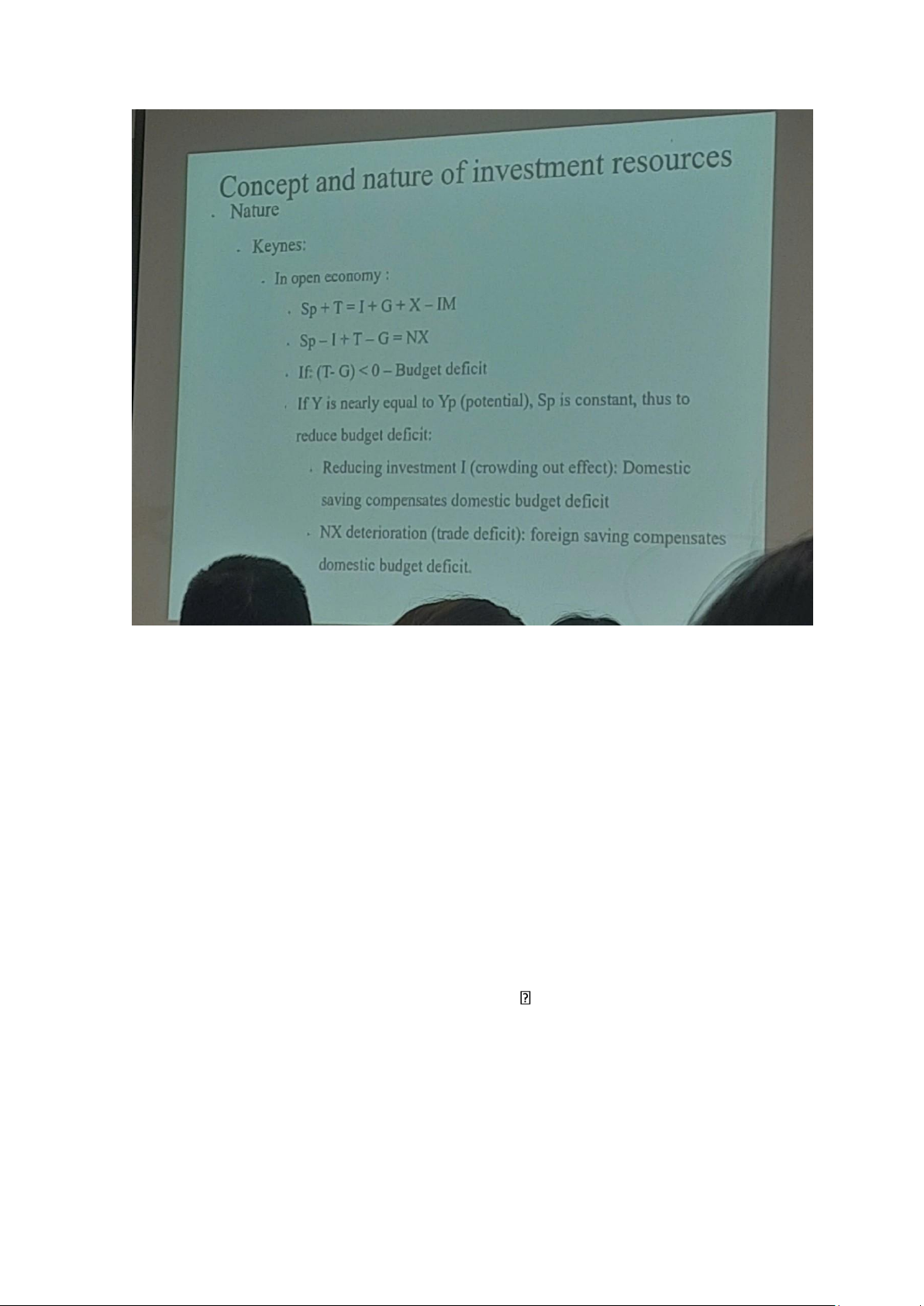

•Domestic expenditure: A = C+I+G • Trade balance: NX=X-M=Y-A • Y=C+SP+T=> I+G+X-M=S+T • NX-X-M=(SP-I) + (T-G) • I=SP+ (T-G)-NX • Implications???

• Investment depends on both private and public sectors

• The increase in government spending will reduce private investment

crowding out (thoái lùi đầu tư tư nhân)

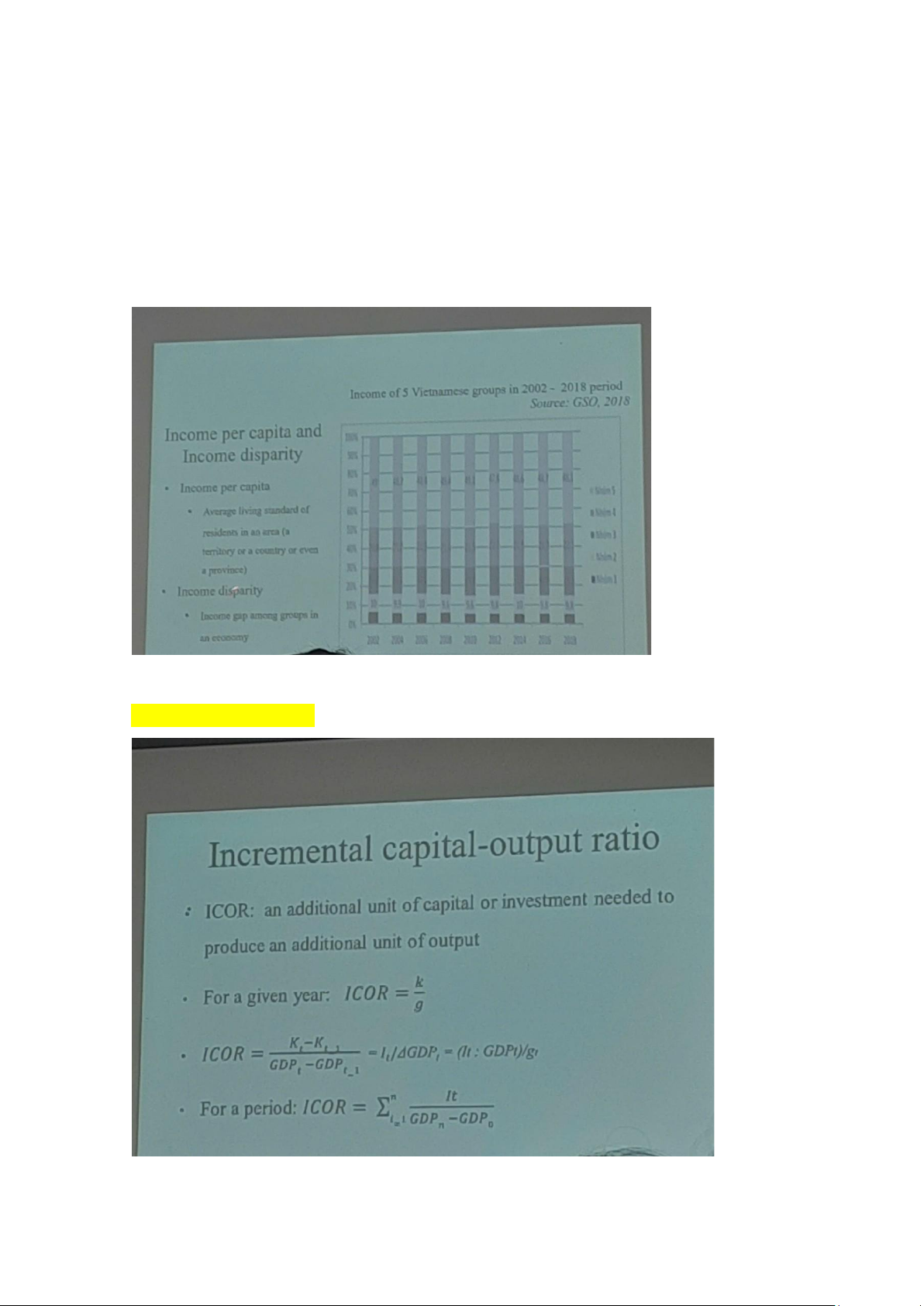

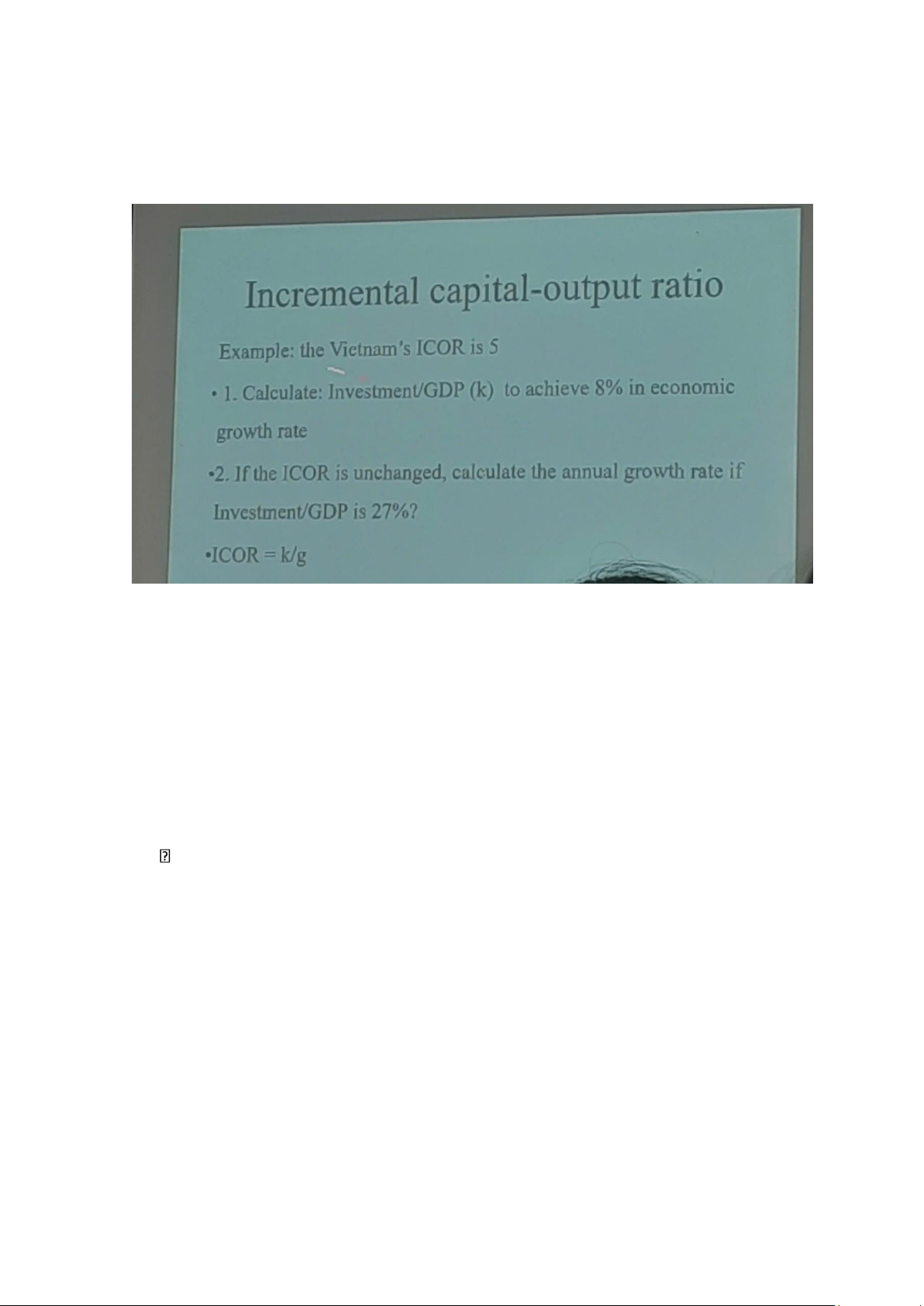

3. Incremental capital output ratio ICOR 4. Investment theories

TÌNH HÌNH VẬN DỤNG CÔNG CỤ QUẢN LÝ KINH TẾ

• Kinh tế Việt Nam giai đoạn 2000-2012: Bất ổn từ chính sách vĩ mô không phùhợp

• Bất ổn KT vĩ mô được đo bằng:

• Tăng trưởng, lạm phát, thâm hụt ngân sách, thâm hụt CA và dự trữ ngoạihối

• Chỉ số bất ổn kinh tế vĩ mô (MII) của Ismihan (2002) được tính bằng cáchlấy

bình quân gia quyền không trọng số của tỷ lệ lạm phát, tỷ lệ THNS/GNP, tỷ

lệ nợ nước ngoài/GNP và biến động của TGHĐ.

• Chỉ số bất ổn kinh tế vĩ mô (mi) của Jaramillo (2007) được dựa trên bốn

chỉsố kinh tế vĩ mô: biến động của lạm phát và tỷ giá hối đoái, tỷ lệ tích lũy

dự trữ so với tiền cơ sở và tỷ lệ THNS/GDP.

• CSTT và ảnh hưởng đến lạm phát CSTT

• Mở rộng được duy trì liên tục trong giai đoạn 2003 – 2007.

• Tăng trưởng cung tiền và tin dụng liên tục cao và cao nhất vào năm 2007;các

mức lãi suất khá ổn định ở mức dưới 8,25%

• Kích thích SX, tiêu dùng và tăng trưởng KT

• Đầu cơ vào chứng khoán và BĐS tăng cao

• Thu hút FDI vào BĐS, vốn chảy vào thị trường chứng khoán tăng mạnh lOMoAR cPSD| 58540065

• Hậu quả: bong bóng nhà đất, chứng khoán* Đầu năm 2008, thực hiện thắt chặt tiền tệ:

• Tăng tỷ lệ DTBB (dữ trữ bắt buộc) thêm 1%,; (ii) phát hành tín phiếu bắtbuộc

20,300 tỷ đồng cho các NHTM; (iii) khống chế tổng dư nợ cho vay, chiết

khấu giấy tờ có giả đề đầu tư kinh doanh chứng khoán không vượt 20% vốn

điều lệ của TCTD, nâng hệ số rủi ro đối với cho vay bất động sản và cho vay

đầu tư kinh doanh chứng khoán lên 250% -> cú sốc lớn đối với nhà đầu tư,

đẩy giá cả hai thị trường vào trạng thái rơi tự do; tại thị trường tiền tệ: thiếu

thanh khoản, lãi suất tăng mạnh

• Cuối năm: NHNN giảm nhẹ lãi suất điều hành, điều chỉnh giảm tỉ lệ DTBB • Năm 2009:

• Thực hiện gói kích cầu

• NHNN điều hành CSTT linh hoạt, hướng dẫn NHTM cho vay theo lãi suấtthỏa thuận

• Mục đích: giảm mặt bằng lãi suất, tạo điều kiện cho doanh nghiệp tiếp cậnvới

nguồn vốn với chi phí rẻ. • Năm 2010:

• Nửa năm đầu: theo đuổi mục tiêu chống lạm phát → hạn chế cung tiền,

lạmphát được kiểm soát tốt đến 8/2010 nhưng tăng trưởng chỉ đạt 5,57% < 6,5% theo mục tiêu

Áp lực tăng trưởng: NHNN tiến hành điều chỉnh chính sách nửa sau năm 2010

Kết hợp với Hiệp hội ngân hàng hạ một bằng lãi suất cho vay

* Tài cấp vốn 10.000 tỉ cho Vietin Bank và Agribank → cung tiền tăng, lạm phát tăng trở lại

• Chính sách tiền tệ lại thất chặt tăng thì suất cơ bản lên 9%/năm vào đầutháng

11 (10 tháng đầu năm là 8%) → các ngân hàng TM gặp khó khăn trong thanh khoản

• Năm 2011: kiên định chống lạm phát từ đầu năm

• Khống chế lãi suất huy động có kỳ hạn dưới 14% lOMoAR cPSD| 58540065

• liên tục tăng các lãi suất điều hành; tăng lãi suất tái cấp vốn từ 7%-12%•

Thực hiện các biện pháp kiểm soát hoạt động cho vay đối với lĩnh vực phi

sản xuất • tác động:

• Cả doanh ship gi khi khăn do thi xuất cho vay cao vượt quá khảnăng chịu

động của doanh nghiệp bằng thì khi ăn, chỉ số rằng ngay gần th

• TICK và thị trang bất động sản đồng bằng

• Tỷ lệ nợ xấu tăng trên toàn hệ thống (nhóm nợ phải điều chỉnh cơcấu tín

dụng theo ngành) – hệ quả của thời kỳ tăng trưởng tín dụng quá nóng gđ

2001 – 2007 và 2008 và điều chỉnh cơ cấu tín dụng năm 2011, • Năm 2012:

• Lãi suất điều hành giảm, cung tiền tăng nhưng trái ngược với những biểuhiện

mở rộng chính sách tiền tệ này là tốc độ tăng trưởng tín dụng giảm → Bẫy thanh khoản • Nhận xét:

- Tần suất xuất hiện các quyết định quá dày khiến các đối tượng bị điều chỉnh

bị động trong thực thi.

- CSTT chống lạm phát trong thời gian qua đã chưa tính toán được liều lượng vừa đủ,

- Thiếu nhất quán trong thực hiện mục tiêu chính sách; tăng trưởng hay ổn định giá cả?

- Mục tiêu không nhất quán, chỉ dừng ở mục tiêu hàng năm, không có mục tiêu dài hạn

- Các chính sách mang tính hành chính; qui định trần lãi suất... đối phó với lạm phát

- Áp dụng biện pháp hành chính làm méo thị trường: qui định trần lãi suất dẫn

tới một số thời điểm cuối năm 2008, 2011 người gửi tiền nhận lãi suất thực âm

(lãi danh nghĩa nhỏ hơn lạm phát),

- Chính sách đưa ra không đúng liều lượng, mang tính thử nghiệm. lOMoAR cPSD| 58540065

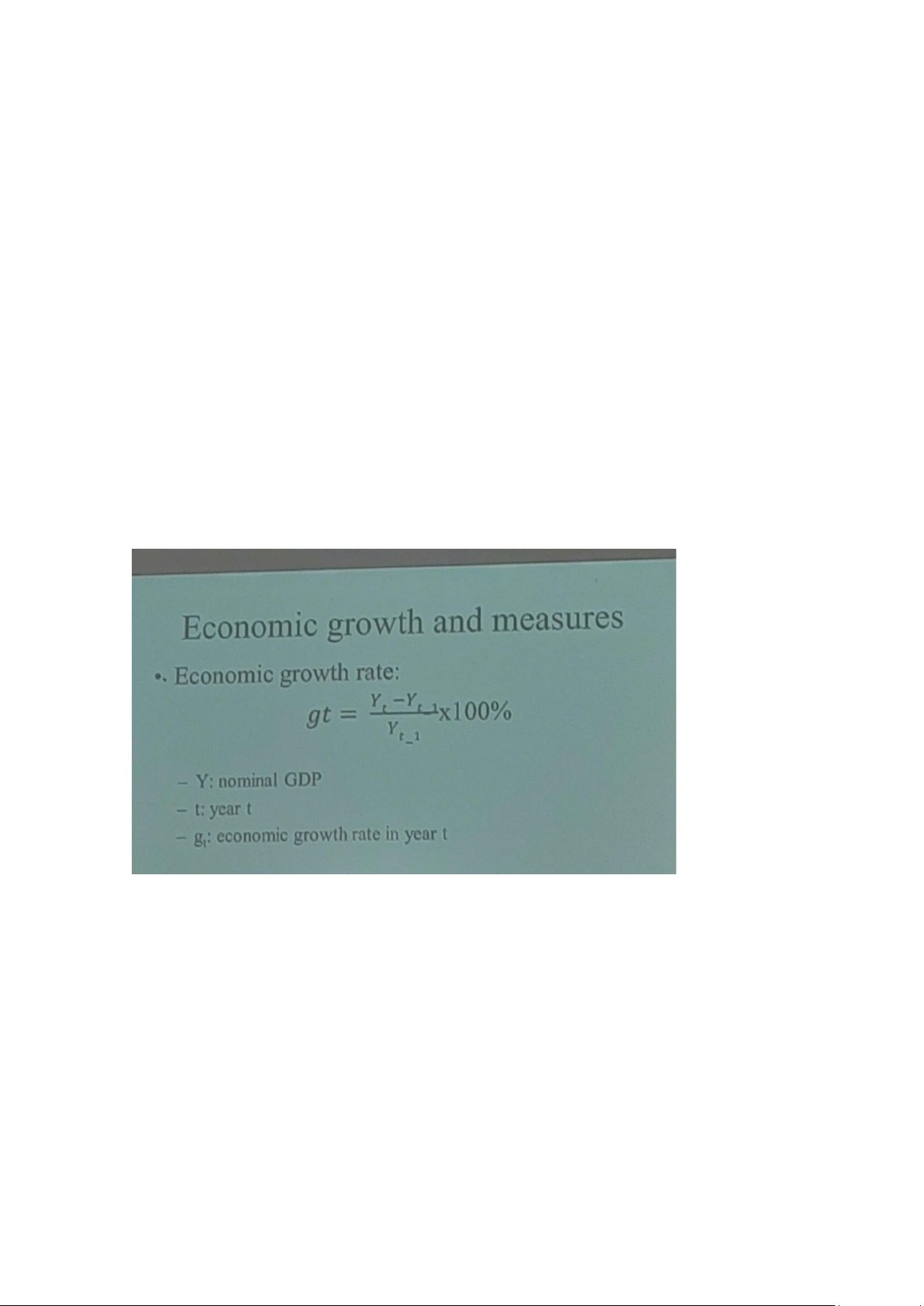

a. Economic growth and measures

• Economic growth is the increase in output produced by an economy in a givenperiod. Or

• Economic growth is the increase in the value of commodity and service producedby an economy in a given period

• GDP-Gross Domestic Product. is a monetary measure of the market value of allthe

final goods and services produced and sold in a specific time period by a country.

• GNI: is product produced by enterprises owned by a country's citizens

PPPs: the rates of currency conversion that equalize the purchasing power of different

currencies by eliminating the differences in price levels between countries. GDP or GNI per capita.

gp= gt - population growth rate in year t

• Nominal GDP: the value of output measured by current price

• Real GDP: the value of output measured by constant price • Economic development:

"A process of creating and utilizing physical, human, financial, and social

assets to generate improved and broadly shared economic well-being and

quality of life for a community or region"-Karl Seidman lOMoAR cPSD| 58540065

"Broadly based and sustainable increase in the overall standard of living for

individuals within a community" - Daphne Greenwood & Richard Holt -

Including both qualitative and quantitative indicators: - Economic growth

- HDI: healthcare, education (general education and higher education) - Environmental issues b. Invesment theories lOMoAR cPSD| 58540065 Capital: stock

Invesment: flow (dau tu vao tung nam)

(K= total I – Depreciation tung nam) 1. 0,4 2. 5,4%

Application to economic forecast - Economic growth rate

- Demand for investment capital (FDI, borrow from international market,

negotiate with inter org to borrow money)

Gov play imp role in balancing btw growth rate and D for investment

Classical, Neo-classical and New theories • Mercantilist • A.Smith ideas • Ricardo doctrine

• Solow growth model and exogenous theory • Endogenous theory • Investment multiplier • Investment accelerator lOMoAR cPSD| 58540065 Classical theories

*For the mercantilists:

• The national output was measured by the supply of money generated, in terms ofgold

• The government should encourage business people to increase export and

reduceimports. (establish colonies)

• The goal of these policies was, supposedly, to achieve a "favorable" balance oftrade

that would bring gold and silver into the country and also to maintain domestic employment.

• The relationship between the government and merchants was rather complicated.

- Governments levied tax for armies and battles among capitalist nations.

- Merchants needed the guarantee of government to protect them against competition

*A. Smith-The Wealth of Nation

• Free trade benefits both parties

• The collusive relationship between government and industry was harmful to thegeneral population

• Three aspects that correlate the division of labor with the increase in

productivity,finally improve economic growth:

• Capital accumulation contributes to the expansion of the market: labor isequipped

to perform specialized actions and wages can increase above the subsistence level

with more capital • The increase in the number of worker

• The increase in efficiency of the workers;

• Capital accumulation depends on the allocation between consumption

andinvestment: investment should be directed towards productive activities

• The manufacturing sector was a generator of surplus and played a major

role,although agriculture was still of vital importance

Salary: employers pay employees lOMoAR cPSD| 58540065

Living wages: employers consider a lot of aspects in daily life, sal support not ony

you but other mem in your familiy *Ricardo doctrine:

• Economic growth depends on capital accumulation which eventually relies

onreinvestment of profit. But profit earned by capitalist depends on the growth of agricultural output.

• Unluckily, agricultural output faced diminishing return: food price increasing ledto

grade up salary that harmed profit of entrepreneurs:

Income division: land rent + wages + profit

• Wages were determined by minimum subsistence level of the workers

• Industrial sector pursued constant return: stock of fixed capital plays an

importantrole in the growth of output and employment, which are constrained by

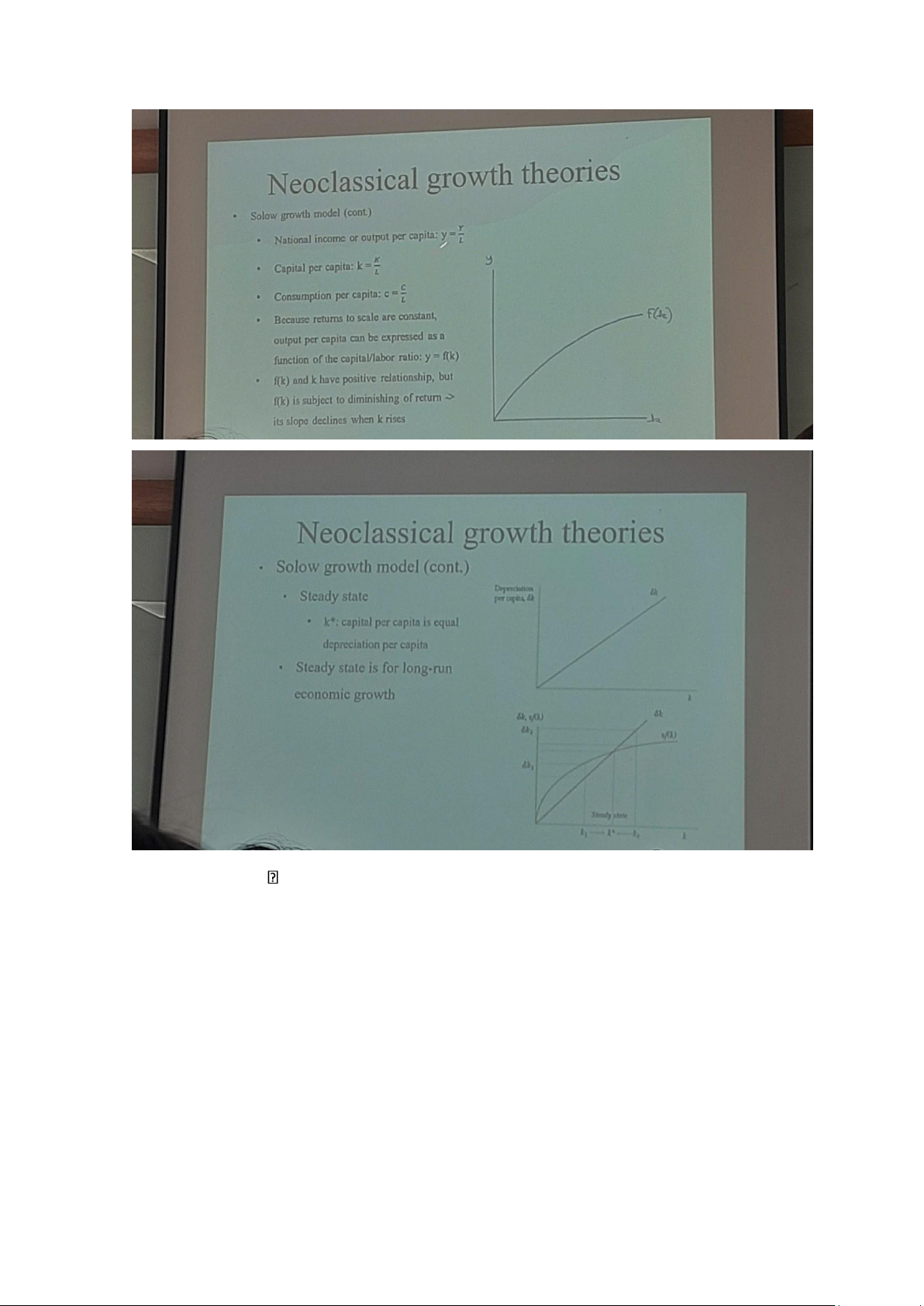

the operation of diminishing returns in agriculture. *Solow model: Assumptions: • There is full employment.

• Two production factors: labor and capital

• All capital and labor are utilized in production

• Capital is subject to diminishing returns in a closed economy(no cap and laborexport)

• (Net) Capital accumulation = saving accumulation - depreciation

• The economy is in a position of minimal capital stock

• Consumption increase in association with capital increase until steady state(saturated consumption) lOMoAR cPSD| 58540065

Khấu hao nhanh tái đầu tư nhanh

Sau điêm giao: investment ko bù đắp dc cho depreciation, inflowtrưởng kte (steady state: điểm dừng) lOMoAR cPSD| 58540065 Y=f(K,L,T,R)

Don’t depend on Resources (not good for longterm, dẫn đến tham nhũng)

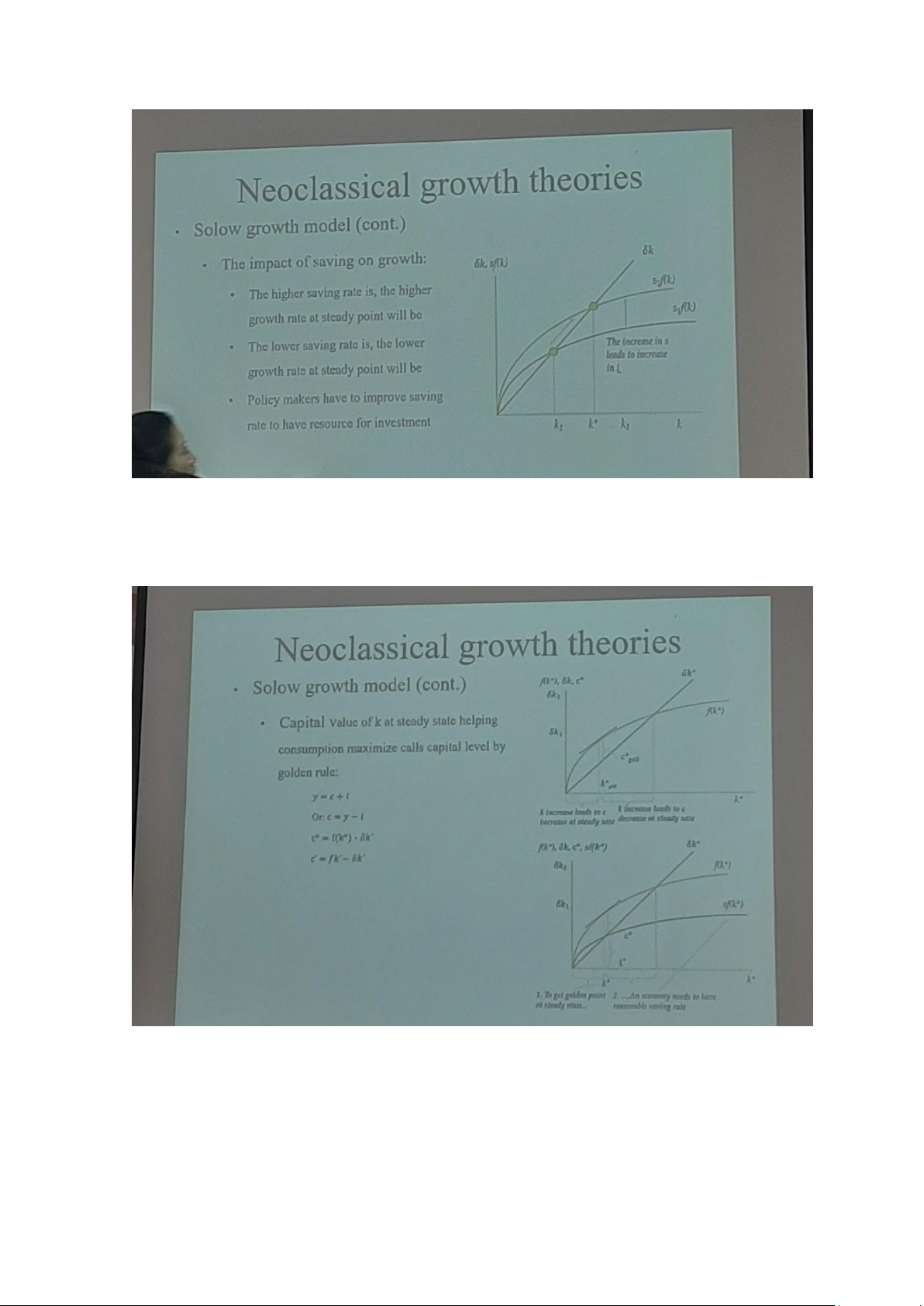

Use technology to break down steady state point, for longterm growth Contributions: •

The role of saving on economic growth •

Investment does foster growth in long run (steady state) Limitations: • Only 2 production factors lOMoAR cPSD| 58540065 •

Only supply side Implications: •

Capital is the constraint of growth •

Investment in Tech is to avoid the diminishing return of capital •

Tech can foster growth in long run and facilitate to accumulate more capital *New growth theories Endogenous growth theories • Tech is endogenous

• Intellectual capital is public goods (neither competition nor exclusion)

• Intellectual capital creates spillover effect o Romer (1990), "Endogenous

Technological Change": output has correlation with capital, labor and knowledge.

o Investment into education and training can improve knowledge.

• Increasing marginal product of capital:

o Lucas (1988), "On the Mechanics of Economic Development": human

capital is subject to increasing marginal product of capital, and growth

depends on each type of investment.

o Capital accumulation depends on income and income growth rate o

Various growth rates among countries thanks to policy and institution differentiations

CHAPTER 3: INVESTMENT RESOURCES

1. Concepts and nature of investment resources Concepts

• Capital is the accumulation in terms of value for investment to adapt the

requirements of social development

• Investment resources are capital mobilization and distribution for investment

to adapt the requirements of social development lOMoAR cPSD| 58540065 Nature

• Smith: savings is direct source for capital acceleration. Labor creates products

for saving acceleration to improve investment

• Marx: new value created must be higher than products made in the sector

producing consumer products → promoting production materials and saving in both sectors. lOMoAR cPSD| 58540065

2. Classification of investment resources At national scale

• Domestic investment capital

• Foreign investment capital At corporate level

• Internal investment capital

• External investment capital *Domestics invenstment capital

Government investment capital: • State budget capital;

• State credit for development investment; Investment capital of SOEs.

Private investment capital resources: • Personal savings;

• Accumulation of businesses: cooperatives, private companies, etc. lOMoAR cPSD| 58540065

FDI (Foreign Direct Investment)

• FDI: an incorporated or unincorporated enterprise in which a foreign

investorowns 10 per cent or more of the ordinary shares or voting power of

an incorporated enterprise or the equivalent of an unincorporated enterprise - IMF • Characteristics:

• Mainly implemented by private sector for profit-seeking purpose

• Minimum requirement of capital contribution for foreign investors

• Self-decision making by foreign investors

•Technology transfer (a part)

Foreign portfolio investment Concept:

- FPI: involves an investor purchasing foreign financial assets without direct

ownership of organization's assets. Nature:

• No direct control on the project

• Profit-seeking target and risk diversification

• High liquidity of financial assets

• Enhancement of financial market through rewarding superior performance,

prospects, and corporate governance

Intrenational private loan

Is an importantly internatinal investment Characteristics: • Currency • Credit period • Interest rate

• Collateral or security for the credit to guarantee the interests of lenders

• The income of lenders: agreed interest lOMoAR cPSD| 58540065

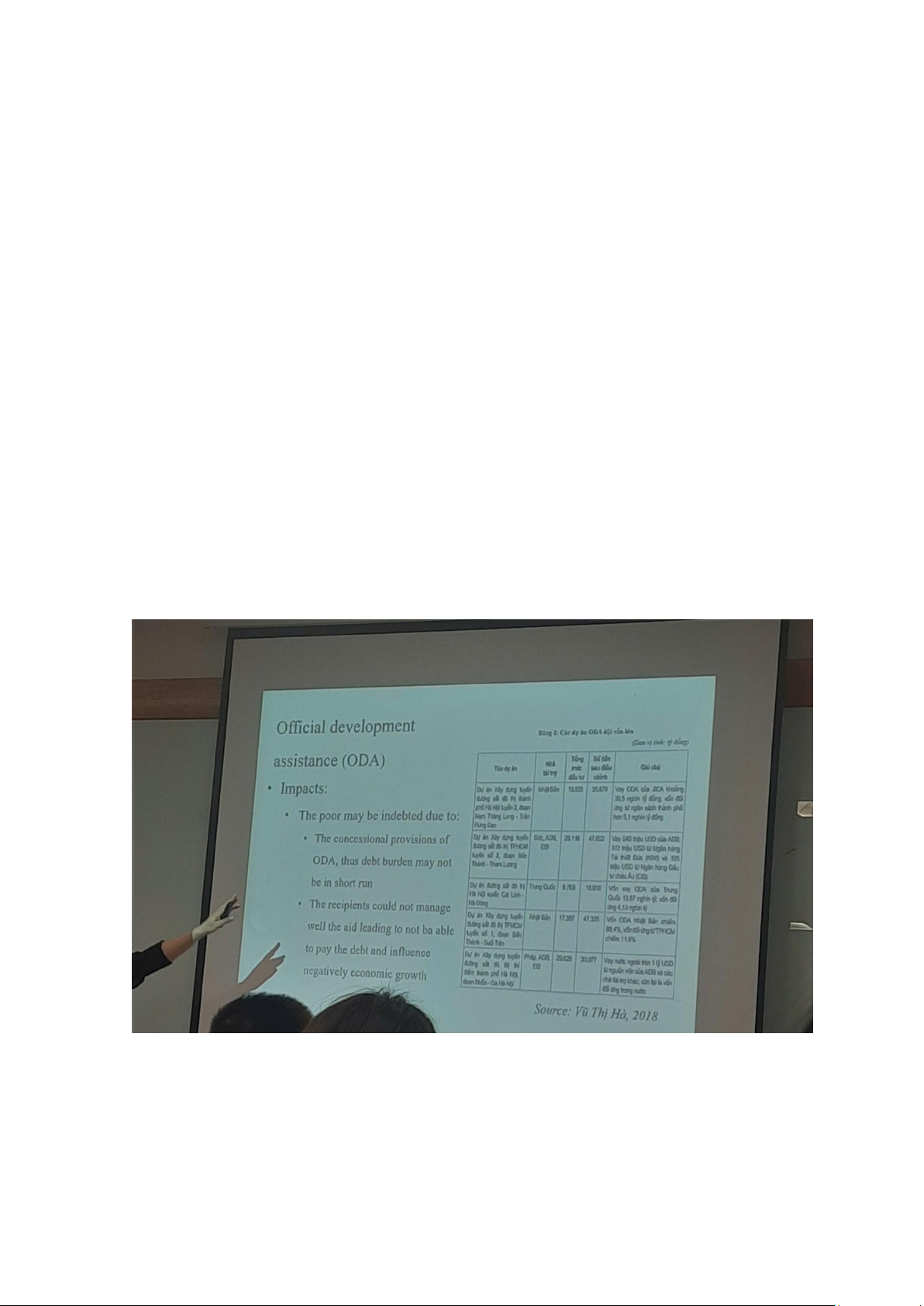

Official development assistance (ODA) • Concept

Official development assistance (ODA) flows to countries and territories on the DAC

List of ODA Recipients and to multilateral development institutions are:

i. Provided by official agencies, including state and local governments, or by their

executive agencies; and ii. Concessional (i.e. grants and soft loans) and administered

with the promotion of the economic development and welfare of developing countries as the main objective.

The DAC list of countries eligible to receive ODA is updated every three years and

is based on per capita income Millitary aid and promotion of donors' security interests are not ODA, • Characteristics

• Donated by governmental offices (central and local) or their governing bodies;

• Enhancing economic growth and improving welfare for developing countries;

• Concessional provisions and non-refundable level up to over 25% Opinions on ODA:

• Optimistic approach: the positive aspects of ODA for social-economic

development in the poor - Jeffey Sachs (2005): the developed countries should lOMoAR cPSD| 58540065

double ODA support for the poor in the next decades to promote economic growth in these countries

• Practical approach: the rich only grants ODA for the poor with sound macro

economic policies (appropriate monetary, commercial and fiscal policies)

Bunside & Dollar (2000): emphasize on the aid efficiency to build an efficient aid market

• Pessimistic approach: aid may not be for the poor and create corruption; the

instable and uncertain donation affect seriously on the recipients - Easterly

(2006): undemocratic management and corruption in the recipient countries At corporate level Internal capital resource

• Corporate accumulation (initial investment, retained income) and yearly depreciation

• Advantages: reduction of credit risk, autonomy in business

• Disadvantages: constraint of investment scale External capital resource

• Credit: provided by financial intermediate or direct financing (stock market)

• Advantages: diversified financial resources for investment

• Disadvantages: Risk, constraint in business

Conditions for effective mobilization of investment capital resources

• Sustainable economic growth

• Macro-economic stability or sound macro-economic policy

• Building Effective capital mobilization policies

Nature: forming sound business environment to mobilize resources for investment lOMoAR cPSD| 58540065