Preview text:

2020 Top 10 Public Sector ERP Systems Report lOMoAR cPSD| 58797173 ©Copyri ght 2019 ,

©Copyright 2019 , Panorama Consulting Grou p . Panorama Consulting Grou Do p . wn lAll Rights Reserved. o A ll Rights Reserved. lOMoAR cPSD| 58797173 Introduction

Panorama Consulting Group developed the 2020 Top 10 Public Sector ERP Systems Report to provide ERP

selection guidance to states, cities, agencies and tribal governments.

The analysis is based on past client experience, vendor RFI and RFP responses we’ve received, as well as

data from reliable industry sources. We’ve managed the demonstration process for numerous clients,

giving us direct exposure to the applications and development teams behind them.

States, cities and municipalities are facing many challenges, including an aging workforce, an increasing

demand for transparency, a growing population of citizens to serve and finally, employee (and citizen)

resistance to changing processes and technology: Aging Workforce

The mass retirement of the Baby Boomer generation will leave public sector organizations with the

challenge of retaining the knowledge of experienced employees. This knowledge loss can have a huge

impact on budget consumption when meeting the needs of a growing constituent base.

Demand for Transparency

Another major issue is the increasing pressure to be transparent and demonstrate the value of ERP

investments. This value may be intangible if the agency has not established the right performance measures. Growing Population

Overall, there has been exponential growth in the population that U.S. states, cities and municipalities

serve. If this applies to you, it’s important not to adhere to archaic processes as this will hinder your ability

to meet the demands of constituents.

Even if the population you serve has decreased, modernizing your systems is still essential despite financial limitations. lOMoAR cPSD| 58797173 Change Resistance

Economic globalization offers opportunities to improve living conditions for citizens across the globe. This

requires that the public sector substantially transform and restructure to meet social demands.

As such, the most urgent challenge for states, cities and municipalities is to help their citizens and

employees adopt processes that promote a sustainable economic and social environment.

If population and economic growth is dynamic with increasing demands both from population increases

and GDP growth, the pressure on government to satisfy unmet social needs will become burdensome

unless government adapts mentally and structurally.

Panorama has witnessed these issues as we help states, cities, agencies and tribal governments improve

business performance and customer service. Our clients have overcome these challenges by improving

internal communications, creating shared domain knowledge, improving business processes and redefining

the relationship between business and IT executives. With these improvements comes the ability to

successfully evaluate technology options and realize more value from ERP investments.

The vendors featured in this report were chosen based on the strength of their public sector functionality

as well as the amount of research and development invested in these products. The order is not based on ranking but on vendor size: • SAP Public Sector • Oracle Public Sector • Infor Public Sector • Tyler Technologies • Microsoft 365 Government • Deltek • Unit4 • Harris Computer Systems • BS&A Software

• Central Square Technologies lOMoAR cPSD| 58797173

What Digital Transformation Looks Like in the Public Sector

Improving the customer (citizen) experience is the primary aim of digital transformation initiatives in the

public sector. Once processes are designed for an optimal customer experience, public sector organizations

must focus on transitioning employees. This requires a strong focus on change management.

Change management not only enables organizations to adapt to new processes, but it enables them to

change their organizational culture to support the deployment of a digital strategy.

A key success factor of digital transformation for Case Study

the public sector is the ability to become a digital

A large capital city in the United States

government by selecting the right technology. To

engaged Panorama to determine the

prepare for technology selection, organizations

effectiveness of the change management

must focus on business process management and

component of their ERP project. Our

reengineering. This enables them to define the daily

consultants reviewed the city’s change

management strategy, plans, tools and

activities that deliver customer value. Only with the

related documentation. We then

clear definition of current and future state provided recommendations for

processes, can organizations select the right

improvement allowing the city to move technology. forward and regain momentum.

With the help of the right ERP systems, predictive analytic tools and business intelligence tools,

organizations can gain valuable insights into their data. They also find opportunities to leverage data to enable automation.

We have found that public sector organizations are increasingly relying on artificial intelligence to augment

their data insights. Our client engagements often focus on improving access to real - time data to enable

accurate predictions about future needs. Clients realize efficiency gains from the ability to predict customer

behavior and the ability to use their people, process and technology to quickly meet the needs of constituents. lOMoAR cPSD| 58797173

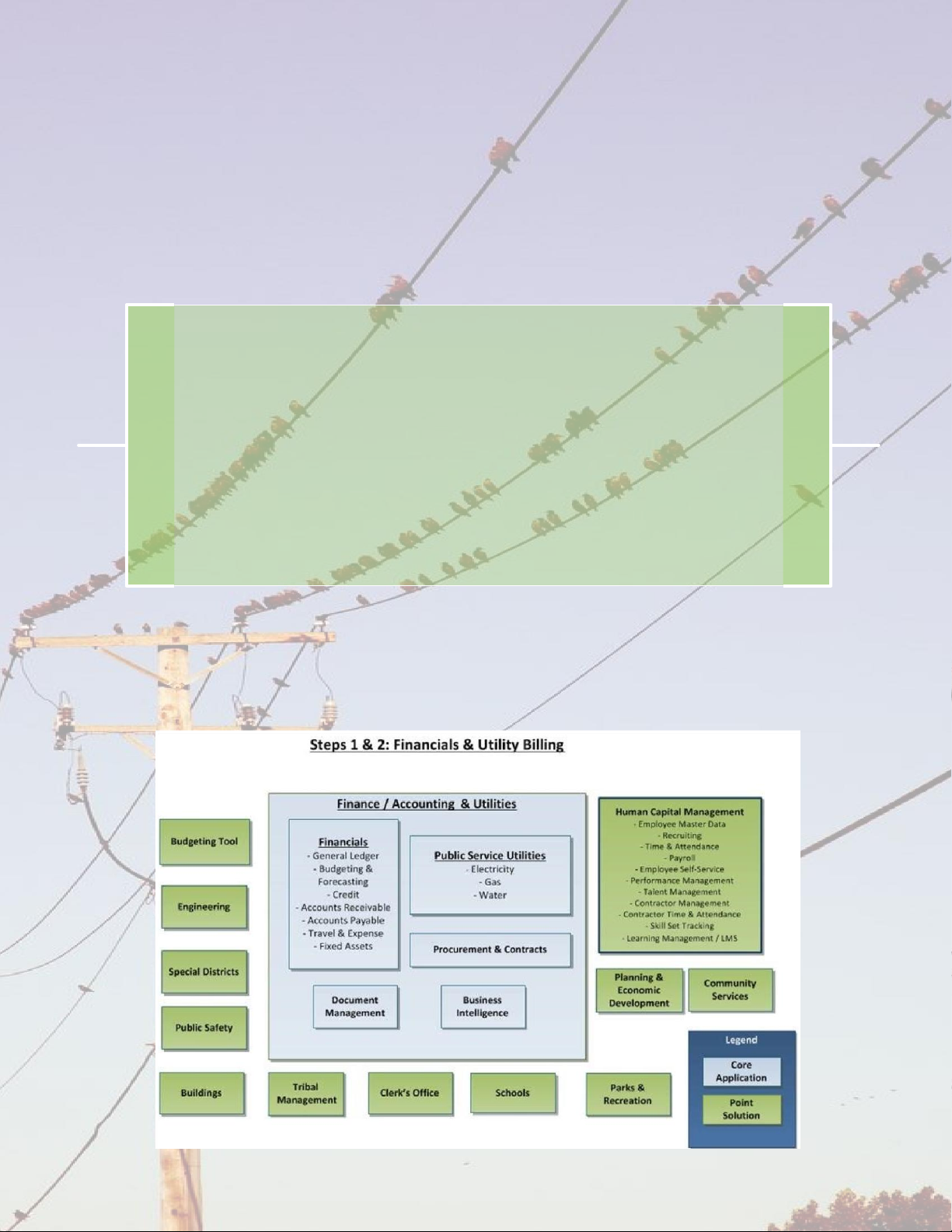

ERP Functionality for States, Cities & Municipalities

Following is a list of functional areas that states, cities and municipalities often look for within enterprise systems:

• Public Services (Utilities and • Schools Engineering) • Public Safety • Tribal Management • Buildings • Special Districts

• Planning & Economic Development

• Procurement & Contracts • Clerk's Office

• Financial & Accounting • Community Services • HR & Payroll • Parks & Recreation

In our experience, many organizations implement functionality in phases as opposed to all at once. This

makes the implementation more manageable and can reduce the risk of a significant operational disruption.

Below is an example of how an organization might integrate their systems in phases:

Continued on followin g page . . . lOMoAR cPSD| 58797173

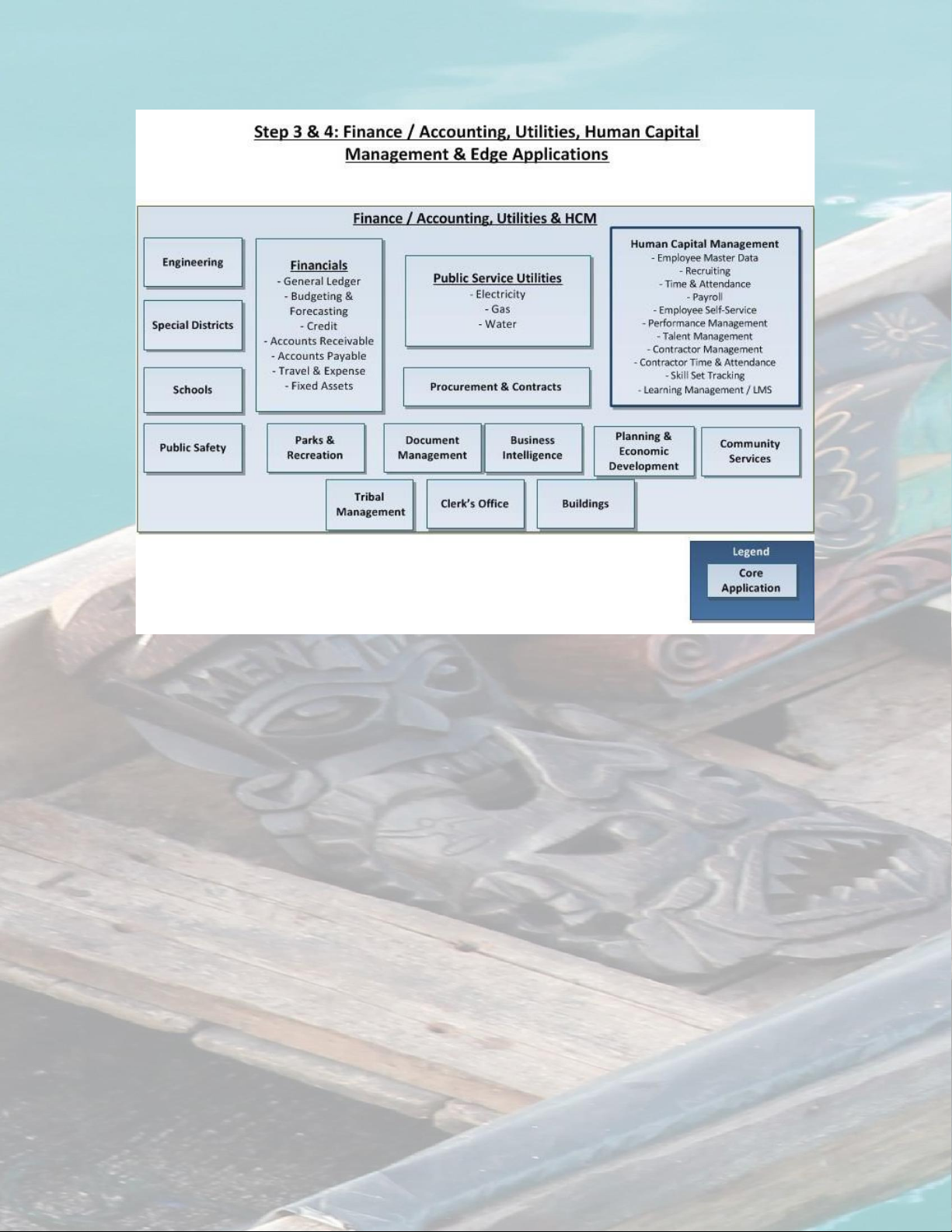

In phases three and four, all applications are integrated into one end - to - end solution.

Integrated systems result in many business benefits, including the elimination of

organizational silos and increased reliability of data. lOMoAR cPSD| 58797173

Top 10 Public Sector ERP Vendors & Niche Applications SAP Public Sector

SAP is designed for large, enterprise type organizations across the globe. While the solution

set can be the longest in duration to implement, it is often built specifically for the organization’s needs. Strengths:

• Strong focus on technology development and user experience • Machine learning

• Analytics and data modeling • End - to - end platform lOMoAR cPSD| 58797173 Oracle Public Sector

Oracle also has made its mark on a global scale. The platform is a complex set of applications

that can be leveraged in basic and advanced ways. Larger organizations are able to leverage

more out - of - the - box configurations. Strengths: • Technology and mobility • In - depth functionality

• Best practice implementation accelerators • Data analytics lOMoAR cPSD| 58797173 Infor Public Sector

Infor is still emerging as a global, enterprise solution. The platform is a set of applications that

can be configured to meet organizations’ needs. Many large enterprise type organizations are

matching up well with best practice implementation accelerators. Strengths:

• User experience and enhancement capabilities

• Business intelligence and data analytics

• Strong focus on industry verticals

• Workflow and repeatable process automation lOMoAR cPSD| 58797173 Tyler Technologies

As a leading mid - market offering, Tyler Technologies focuses only on public sector software

applications and has captured a good amount of the market share. Typically, most of its

applications are a good fit for mid - sized entities out - of - the - box with many easily adopted best practices. Strengths:

• Niche applications built for the public sector

• Numerous pre - defined, out - of - the - box processes • Rapid deployments

• Strong industry experience lOMoAR cPSD| 58797173

Microsoft 365 Government

This platform is a strong offering for small to mid - sized organizations. It is typically a good fit

for organizations that are already leveraging the Microsoft technology stack. Microsoft is

emerging and gaining market - share with many pre - configured processes. Strengths:

• User familiarity with Microsoft base applications

• Scalability from small to larger organizations

• Wide resource availability

• Configuration and enhancement capabilities lOMoAR cPSD| 58797173 Deltek

Deltek is a steady - paced vendor experiencing growth and cloud consolidation of their

products. This vendor offers a varied set of solutions for small to large organizations with

flexibility in their basic versus advanced functionality. Strengths:

• Functionality for simple and more complex organizations

• Merges best practices in all applications

• Focused industry expertise

• Experiencing organic growth by gaining market share via rich functionality lOMoAR cPSD| 58797173 Unit4

Unit4 is a quickly emerging North American vendor with a global footprint. This vendor has a

solid product offering for small to mid - sized organizations with many standard, out - of - the -

box processes that are pre - configured. Strengths: • Solid industry experience

• Best practice and standardized configurations • Focus on user experience

• Focus on strong client relationships lOMoAR cPSD| 58797173

Harris Computer Systems

Harris Computer Systems is an emerging vendor that has acquired a small handful of niche

applications in order to offer smaller to midsized organizations an end - to - end offering. Strengths: • Global footprint

• Industry experience with small - to mid - sized organizations

• Focus on a small handful of industry verticals

• Organic growth by acquisition lOMoAR cPSD| 58797173 BS&A Software

This is an emerging niche vendor that offers many edge products to extend their core

application and can also augment other core products. Strengths:

• Integration of solution sets • Microsoft technology

• Simple, standardized configurations

• Shorter implementation duration lOMoAR cPSD| 58797173

Central Square Technologies

This vendor is growing by acquisition and combining best practices of leading niche

applications to create an end - to - end solution. Strengths: • Broad industry experience

• Focus on small - to mid - sized organizations

• Workflow and automation capability

• Relatively simple configuration lOMoAR cPSD| 58797173

ERP Evaluation & Selection Advice

Many states, cities and municipalities are using old systems because their workforce doesn’t have the

skillset to use new technology. In some cases, organizations are using new technology but without integration.

For example, one client we worked with diagramed all of their systems and found they had about 200

systems, most of which did not integrate with each other. We found this was caused by organizational silos

and a failure to take a holistic view of how systems should operate.

When defining selection criteria, organizations should consider more than just their immediate needs. This

holistic view requires strong leadership from the top of the organization.

Unfortunately, the executive team doesn’t always have a clear, consistent vision. This is often due to the

high executive turnover rate, especially when it comes to elected officials.

While the lack of clear goals presents a challenge for public sector organizations beginning ERP selection, it

is not their only obstacle. Another obstacle they must overcome is a lack of funding.

Often, it is difficult for public sector organizations to get funding approval for an ERP project because the IT

budget is limited by competing requests across the municipality. Many government executives won’t

allocate money toward IT unless something is clearly broken.

Obtaining funding approval for an ERP project can be especially difficult because of the resource

requirements. ERP projects require extensive IT staffing and a variety of subject matter experts. Most public

sector organizations have limited internal resources to dedicate to an organization - wide project. lOMoAR cPSD| 58797173

The organizations that overcome these obstacles Case Study

face a new set of challenges during ERP selection.

One city we worked with had been on

One of the most daunting aspects of selection is

their existing ERP solution for several

determining which vendors offer what functionality.

decades, and it was not ideal for their

processes. It also had high maintenance

While large systems, like SAP and Oracle systems,

costs. We developed a strategic plan for

the city’s future state, created a

have public sector functionality, these systems are

business process map to pinpoint the

not specifically designed for the public sector. In

most critical functionalities and

contrast, niche systems, like Tyler Technologies, are

conducted a technical fit assessment to

specifically designed for the public sector and offer

find the best technology for their needs.

more robust functionality in many areas.

Another selection challenge is organizations’ lack of documented processes. This makes it difficult for

organizations to provide a complete list of business requirements to vendors.

In place of process documentation, public sector organizations tend to rely on “tribal knowledge” and

workarounds. If this sounds like your organization, it’s important to involve stakeholders in process mapping

sessions and mitigate resistance to change as early as possible.

One of the most prevalent problems we’ve seen in organizations’ selection process is a haphazard RFP

( request for proposal) process. Oftentimes, when public sector organizations issue their initial RFP, they ask

for vendors to respond instead of consultants. Essentially, they expect these RFP responses to define their

vendor shortlist, whether or not their RFP contains a complete list of business requirements.

However we’re seeing more organizations issue their initial RFPs for consultants instead of vendors. These

organizations are realizing the value of third

- party guidance when evaluating vendor RFP responses.

Consultant expertise not only helps organizations understand vendor functionality, but it minimizes the risk of vendor protests. lOMoAR cPSD| 58797173

Vendor protests occur when vendors that are not awarded your RFP protest the decision on the basis of

issues like favoritism. These protests can halt the RFP process as investigations ensue.

Organizations working with third - party consultants can avoid this headache. For example, independent ERP

consultants, like Panorama, advise clients to document as much as possible. This includes evaluation criteria,

RFP schedules, demo scripts, reference checks, committee meetings and more. Most of our clients don’t

have the experience or bandwidth to document everything necessary for discouraging vendors from protesting. lOMoAR cPSD| 58797173

The Importance of Strategic Alignment

While the implementation of new technology is a key way organizations improve their service to citizens,

we do not focus on technology at the beginning of our engagements.

Instead, we focus on strategic alignment. Once alignment is achieved, we can then gather ERP

requirements to help organizations understand what technology will enable them to meet their objectives.

Strategic management, planning and alignment are becoming much more important to the public sector.

By strategic alignment we mean the alignment of all stakeholders around project goals.

It is not always easy to think about strategic alignment in the public sector since the concepts of growth,

profit and competitive advantage tend to be foreign to public sector organizations. However, there is one

goal around which public sector organizations should align their operations: return on citizenship (ROC).

ROC can best be described as a measurement of success similar to return on investment. In essence, ROC is

the measurement of social value creation that provides citizens and their communities with the increased return.

Return on what? Return on income taxes, FICA, sales taxes and all sorts of local taxes that go to support all

public services. The return on this money is the benefits it provides citizens.