Preview text:

lOMoAR cPSD| 23136115

II. INDUSTRY AND COMPANY OVERVIEW 1. Apple Inc. (AAPL)

The advancement of technology in the industry 4.0 era is greatly influencing consumer

behavior and expectations. Beginning with the introduction of the "First touchscreen phone",

advancements in sophisticated software and applications at each phase have played a role in

encouraging consumer behavior regarding the purchase of such electronic devices. This is

likewise the driving force for major global technology companies like Apple, Samsung,

Microsoft, Sony, etc., to persistently compete against one another, innovating new products for

market sale to achieve greater revenue than the prior year. Focusing on the subject of "Operating

Systems," iOS is preferred over Android, which contributed to Apple ranking as the world's

third-largest technology company in 2023, with sales reaching $385.1 billion, according to a report by Forbes.

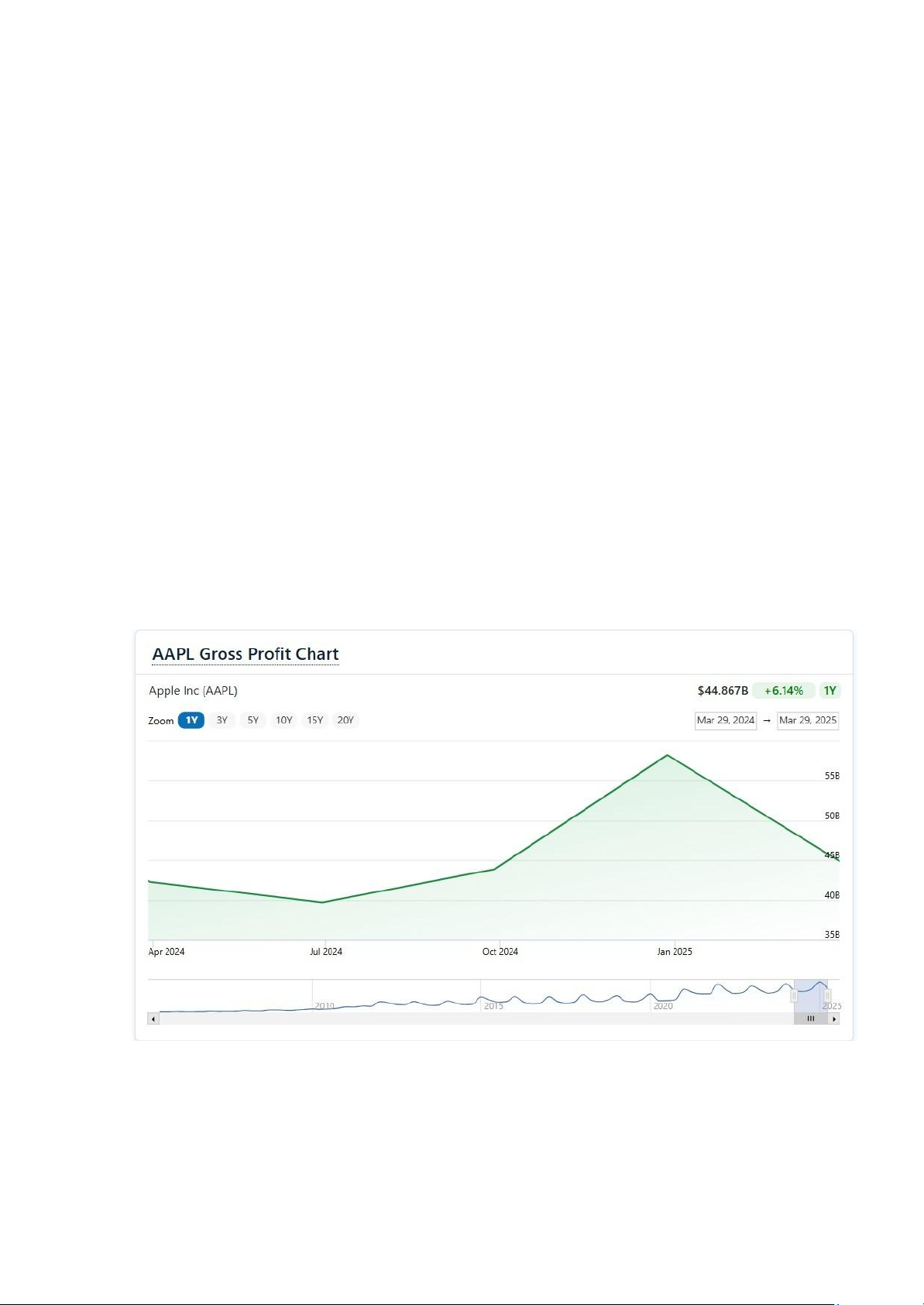

AAPL Gross Profit Margin Chart 2024 (Source: Finance Charts, 2025)

In the fiscal year ending March 29, 2025, Apple (AAPL) records a gross profit of $44.87

billion, up 6.14% year-over-year. The chart shows a slight decline in gross profit in mid-2024 but lOMoAR cPSD| 23136115

a sharp rebound in the first quarter of 2025, driven by strong holiday sales and the launch of

products like the iPhone 16 and MacBook M4. Services continue to be a major contributor to

profit margins, helping Apple maintain steady growth despite supply chain and manufacturing cost fluctuations.

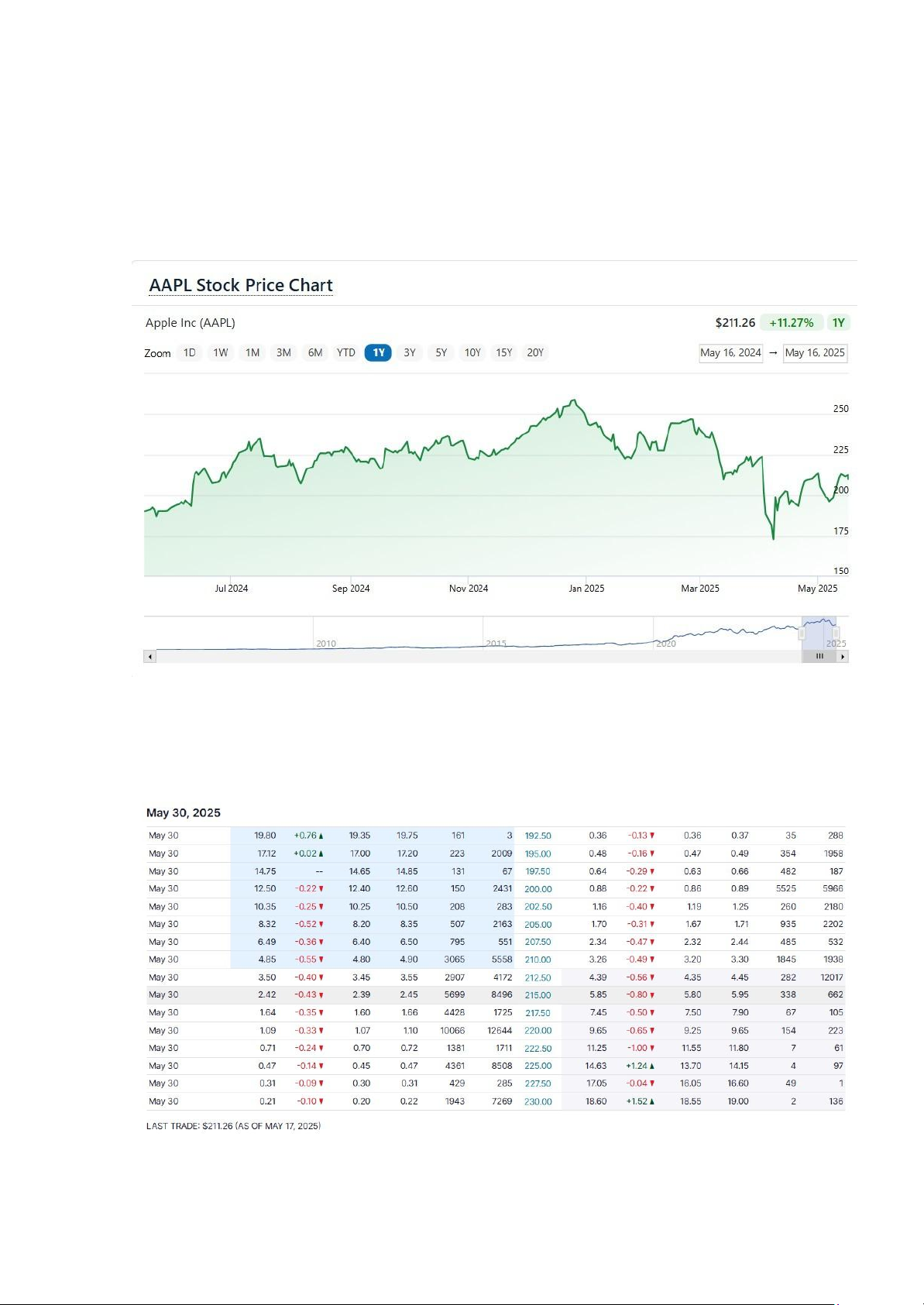

AAPL Stock Sprice Chart 2024 (Source: Finance Charts, 2024)

III. PORTFOLIO CONSTRUCTION: lOMoAR cPSD| 23136115

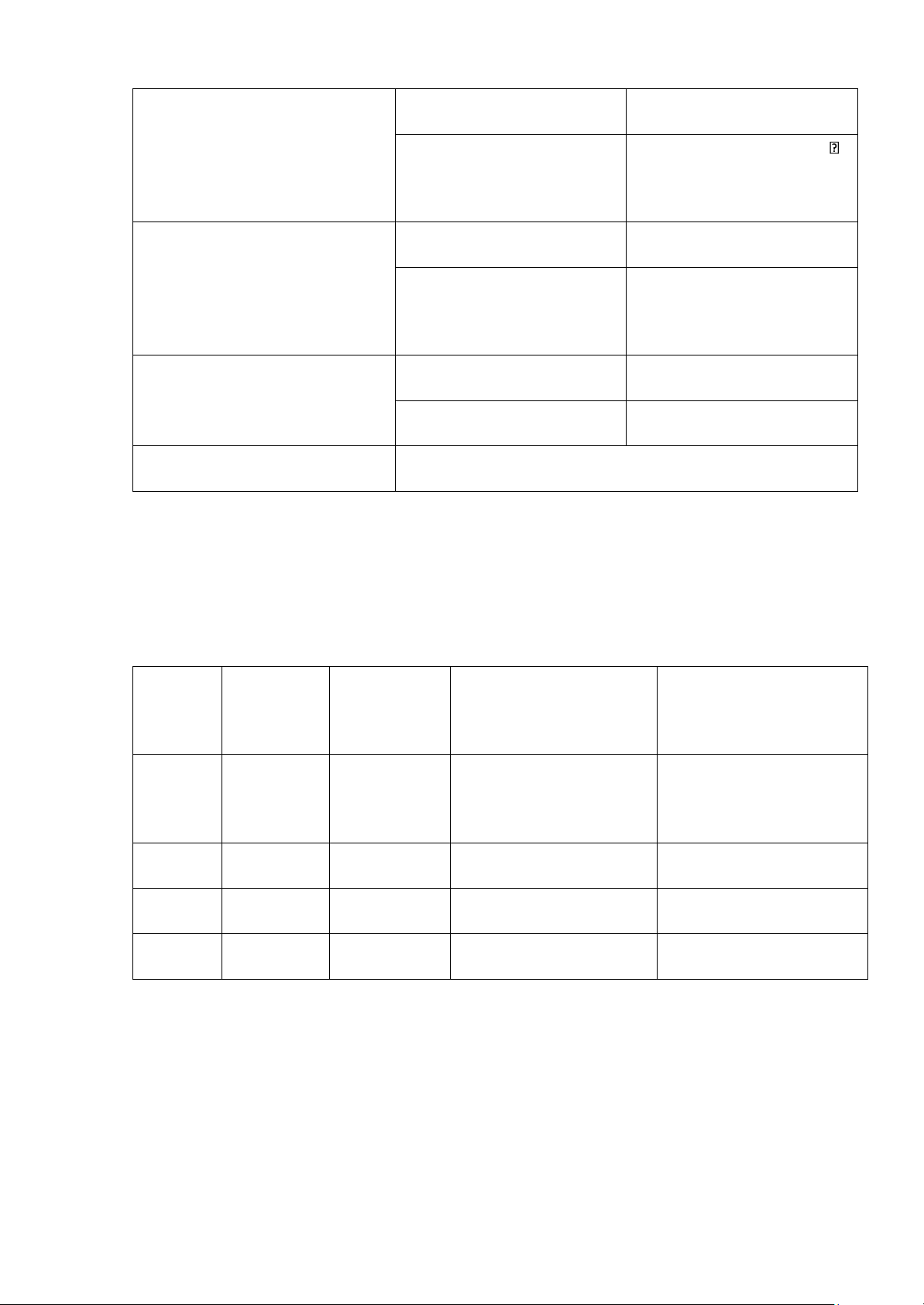

AAPL Option Chain Table Price on 04/04/2025 Price on 08/05/2025

On 4th of April, the AAPL’s close price was $188.38. With the expectation that AAPL’s stock

price would be increase by 8th of May, we decided to exercise by following the “Covered Call

Strategy”. We purchased 100 shares at $188.38 and sold 1 AAPL $210 Call option expiring on 8th of May at the price of $0.04 lOMoAR cPSD| 23136115 Transaction 04/04 08/05 ST < X (197.49 < 210) Do not Excercise

Long 1 AAPL Stock at $188.38 -188.38 197.49

Short 1 AAPL Call $210 at +0.04 0 $0.04 Net Cashflow -188.34 197.49 -188.34 x 1 x 100 = -18,834 197.49 x 1 x 100 = 19,749 Total profit $19,749 – $18,834 = $915

On May 8th, AAPL’s closee price was at $197.49, which is lower than the strike price of

$210. Therefore, we did not exercise anything more. After calculating for the initial cost of the

shares and saving for the call option, this strategy generated a profit of $915

IV. PORTFOLIO EVALUATION: Stock Stock Stock Price

Profit/ Loss from Stock Profit/ Loss from Price on on 13/12 Option Strategies 18/11 AAPL $188.38 $197.49 ($197.49 - $188.38) x 19,749 - 18,834 = $915 100 = $911 TOTAL