Preview text:

lOMoAR cPSD| 23136115

CHAP 5 - DERIVATIVE STRATEGY A. BASIC STRATEGY I. Asset strategy - Long position •

Contract: 100 shares, $100/per share •

Profit/ loss diagram: a “per share” basic

Maximum loss: $100 at stock price ST = 0

Break even point (BEP) = ST = 100 (point no loss and no profit) - Risk profile: •

Substantial risk (when stock price can ↓ 0) •

Unlimited profit potential (when stock price can ↑ definitely) II. Option strategy Call option Put option

Long position ST < X ⇒ do not exercise (No)

ST < X ⇒ exercise (Yes) → Profit = 0 – C0 = - C0 → Profit = X – ST – P0

ST > X ⇒ exercise (Yes)

ST > X ⇒ do not exercise (No) → Profit = ST – X – C0

→ Profit = 0 – P0 = – P0

Short position ST < X ⇒ do not exercise (No)

ST < X ⇒ exercise (Yes)

(lưu ý short phải → Profit = 0 + C0 = C0 → Profit = (X – ST) + P0 đổi dấu công thức thành ct

ST > X ⇒ exercise (Yes)

ST > X ⇒ do not exercise (No)

như bên) → Profit = – (ST – X) + C0 → Profit = 0 + P0 = P0 1. Long call

Ex 1: Buy a 100 call option at 5. Calculate profit at stock price be $105 and $95? → X = 100, C0 = 5

→ ST = 105 > X = 100 ⇒ exercise → Profit = 105 – 100 − 5 = 0

→ ST = 95 < X = 100 ⇒ do not exercise → Profit = 0 – 5 = −5

Ex 2: Buy a 70 call option at 3. Calculate profit at stock price be $79 → X = 70, C0 = 3

→ ST =79 > X = 70 ⇒ exercise → Profit = 79 – 70 − 3 = 6 Risk

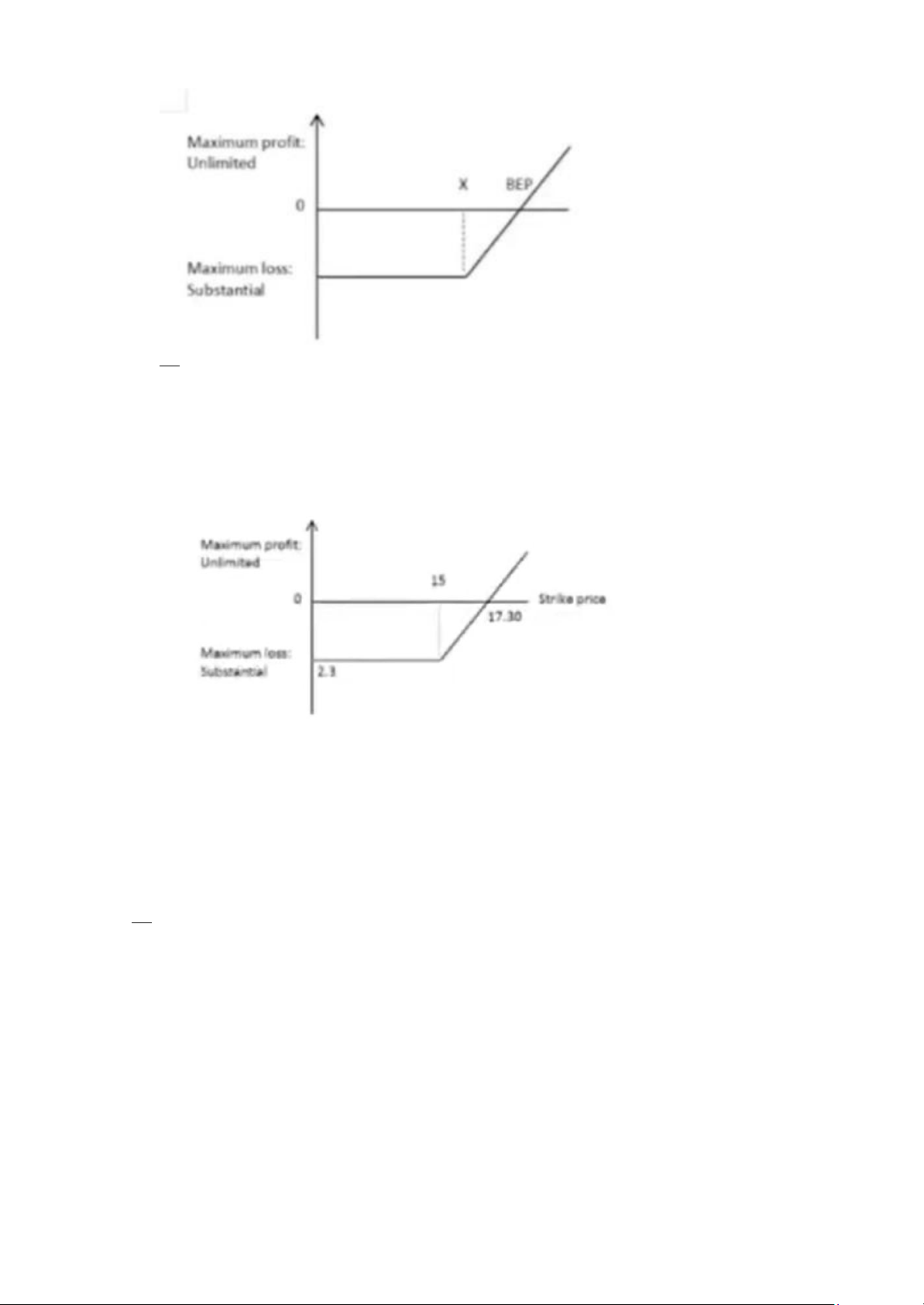

profile: limited risk + unlimited profit potential 2. Long put

Ex 1: Buy a 100 put option at 4. Calculate profit at stock price be $95? → X = 100, C0 = 4

→ ST = 95 < X = 100 ⇒ exercise → Profit = 100 – 95 – 4 =1

Ex 2: Buy a 90 put option at 4.25. Calculate profit at stock price be $81? lOMoAR cPSD| 23136115 → X = 90, C0 = 4.25

→ ST = 81 < X = 90 ⇒ exercise → Profit = 90 – 81 − 4.25 = 4.75 Risk profile: •

Limited risk → Maximum risk = Premium/Fee •

Substantial profit potential → Stock can only ↓ 0 3. Short call

Ex: Short position a 100 call at 5. Calculate profit at stock price be $105 → X=100, C0 = 5

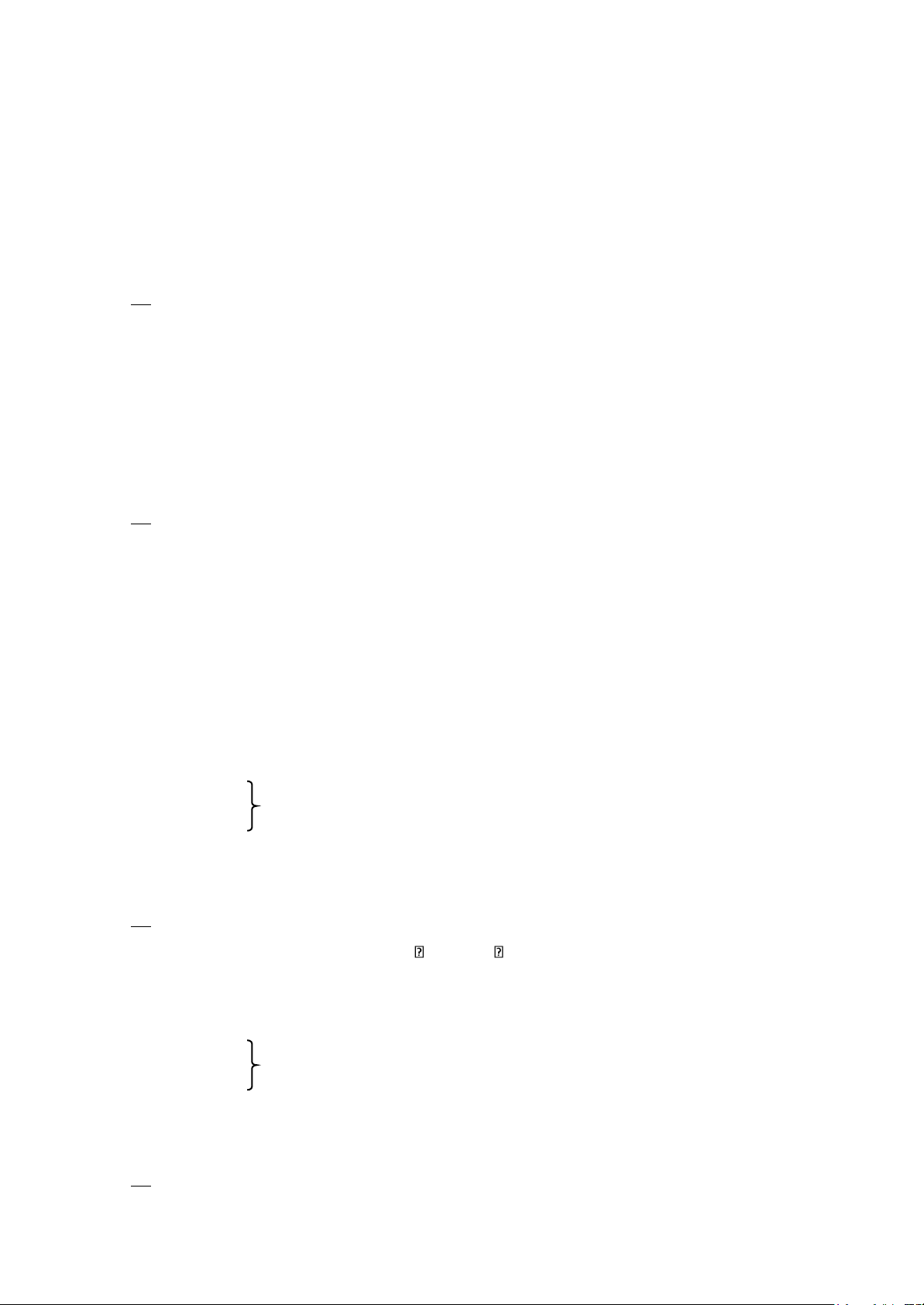

→ ST = 105 > X = 100 ⇒ exercise → Profit = − (105 − 100) + 5 = 0 Risk profile: •

Unlimited risk → Stock price can ↑ definitely •

Limited profit potential → Maximum potential profit = Premium/ Fee received 4. Short put

Ex: Short position a 100 put option at 4. Calculate profit at stock price be $95 → X = 100, P0 = 4

→ ST = 95 < X = 100 ⇒ exercise → Profit = − (100 − 95) + 4 = −1 Risk profile: •

Substantial risk → Stock price ↓ < BEP •

Limited profit potential → Maximum profit earned (ST > X) + Profit potential limited to premium received III. G

1. Synthetic long asset: Long call Same X and T Short put Long asset Ex: ST = 80, X = 50

Strategy 1: Long call: ST = 80 > X = 50 Exercise Profit = 80 – 50 = 30

Strategy 2: Long asset: -50 + 80 = 30

2. Synthetic short asset Long put Same X and T Short call Short asset Ex: ST = 80, X = 50 lOMoAR cPSD| 23136115

Strategy 1: Short call: ST = 80 > X = 50 Exercise Profit = -(80 – 50) = -30

Strategy 2: Short asset: 50 – 80 = -30 3. Synthetic call Long asset Same X and T Short put Long call Ex: ST = 20, X = 50

Strategy 1: Long call: ST = 20 < X = 50 Do not exercise Profit = 0

Strategy 2: Long asset: -50 + 20 = -30

Long put: ST = 20 < X = 50 Exercise Profit = 50 – 20 = 30 4. Synthetic put Short asset Same X and T Long call Long put Ex: ST = 80, X = 50

Strategy 1: Long call: ST = 80 < X = 50 Exercise Profit = 80 – 50

Strategy 2: Short asset: -50 + 20 = -30

Long put: ST = 80 > X = 50 Do not exercise Profit = 0 IV.

Covered calls & Protective puts 1. Covered calls ST < X ST > X Long stock - S0 + ST - S0 + ST Short call No: 0 + C0 = C0 Yes: -(ST – X) + C0 Total -S0 + ST + C0 X – S0 + C0

Maximum gain = (X – S0) + C0 Maximum loss = S0 – C0 BEP = S0 – C0

Expiration value = ST – Max [(ST – X); 0]

Profit at expiration = ST – Max [(ST – X); 0] lOMoAR cPSD| 23136115

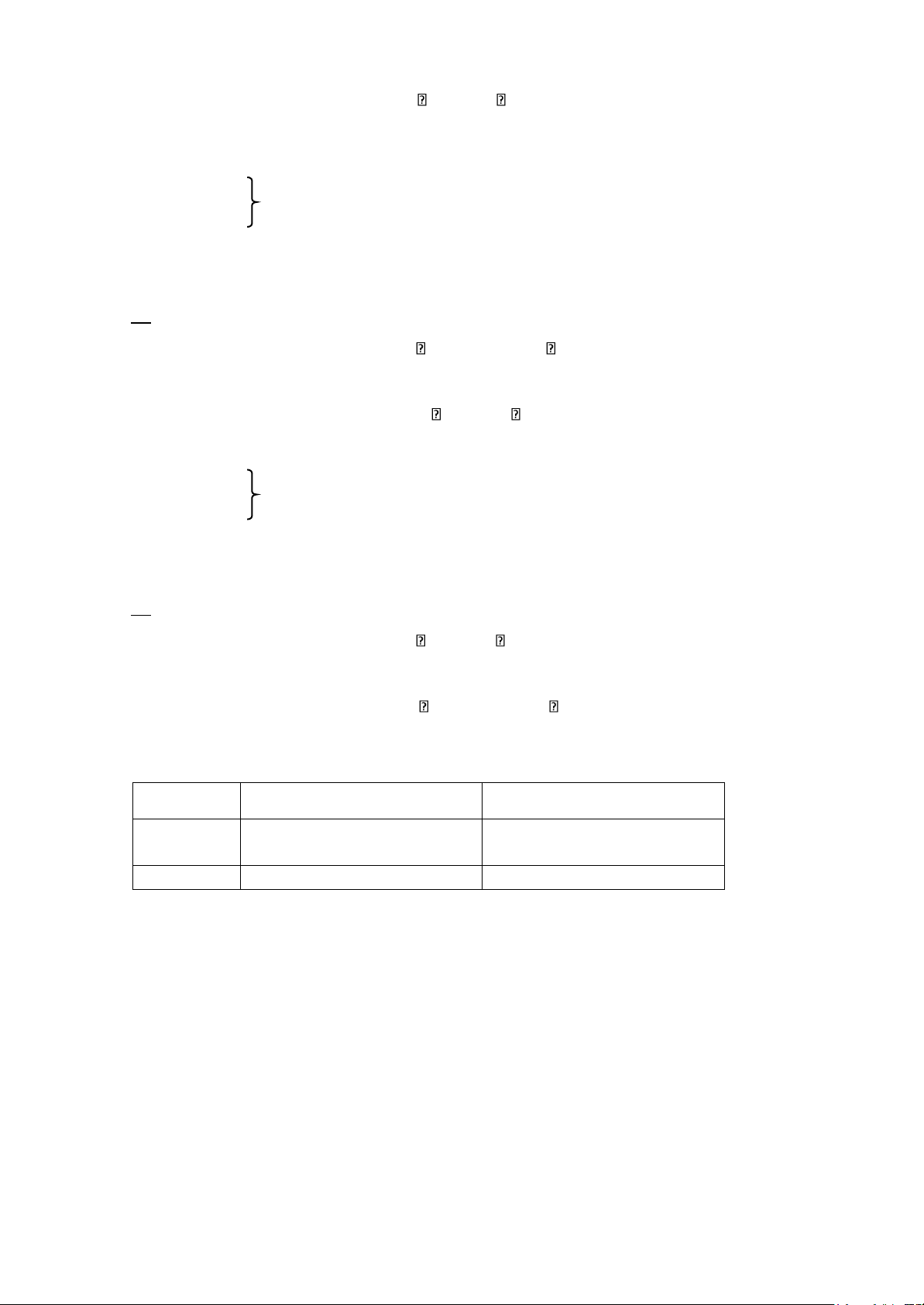

Ex: An investor buy an underlying asset at price $15.84 and short call option at $1.44 at the

same time. Strike price of call option is $17. Calculate maximum profit, maximum loss,

and break even point. Then draw the paragraph? → S0 = 15.84; X = 17; C0 = 1.44

→ Maximum gain = (17 – 15.84) + 1.44 = 2.6

→ Maximum loss = 15.84 – 1.44 = 14.4 → BEP = 14.4 2. Protective puts -

The stock-owning inestors don’t want to sell share (↑ value)

want protect unrealized profit ST < X ST > X Long stock - S0 + ST - S0 + ST Long put (X – ST) – P0 - P0 X – S S Total 0 – P0 T – S0 – P0 (Max loss) (Max gain)

Maximum profit = ST – S0 – P0 (Unlimited profit potential) •

Maximum loss = S0 – X + P0 (Limited loss) • BEP = S0 + P0 • Expiration value = Max(ST; X) •

Profit at expiration = Max(ST; X) – S0 −P0 lOMoAR cPSD| 23136115

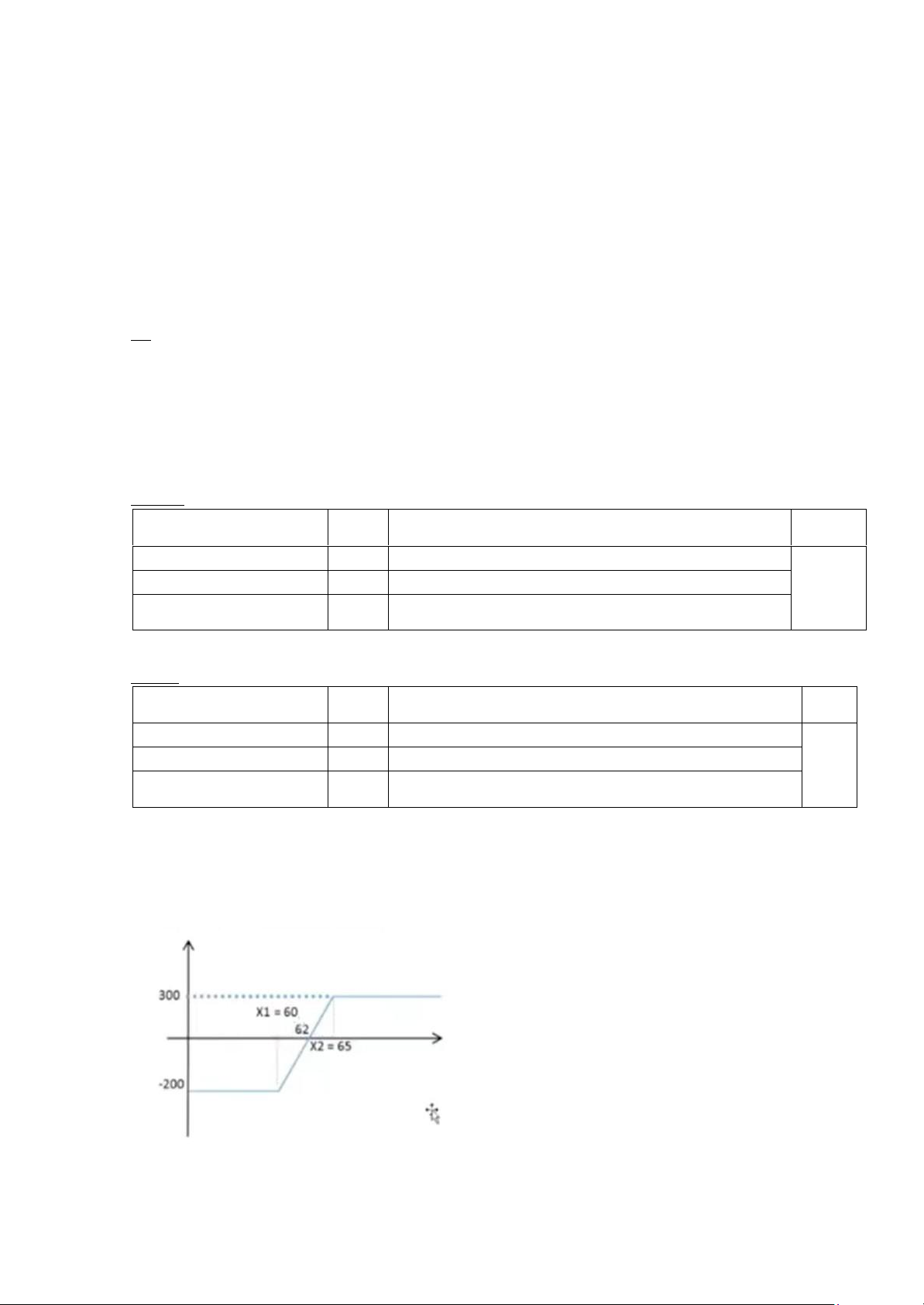

Ex: An investor buy an underlying asset at price $15.84 and long put option at $1.46 at the

same time. Strike price of put option is $15. Calculate maximum profit, maximum loss, and

break even point. Then draw the paragraph?

→ S = 15.84, X = 15, P = 1.46₀ ₀ → Maximum gain = Unlimited

→ Maximum loss = 15.84 - 15 + 1.46 = 2.3

→ BEP = 15.84 + 1.46 = 17.30 3. Collars Long asset Long a put (X < S )ₚ ₀

Short a call (X𝚌 > S )₀

Profit/loss = (S - X )+ or (Xₜ ₚ 𝚌 - S )+ₜ

Ex: An investor buy an underlying asset at price $12 and long put option at $1.46, short call option at

price $1.44 at the same time. Strike price of put and call option are $15 and $17. Calculate profit and loss?

→ S = $12, P = 1.46, C = $1.44, X = $15, X₀ ₀ ₀ ₚ

𝚌 = $17, ST = 16 → (16 - 15)+ or (17 - 16)+ B. OPTION STRATEGY I. OPTION SPREAD

Spread: purchase 1 option + sale 1 option

1. Bull call spread (Debit spread): Reduce risk for long call lOMoAR cPSD| 23136115

Buy ↓ X call option (C > C )₁ ₁

₂ Sell ↑ X call option (X < X )₂ ₁ ₂ (Net debit)

Maximum profit = (X - X ) - (C - C )₂₁ ₁ ₂ Maximum loss = C - C₁ ₂ BEP = X + (C - C )₁₁ ₂

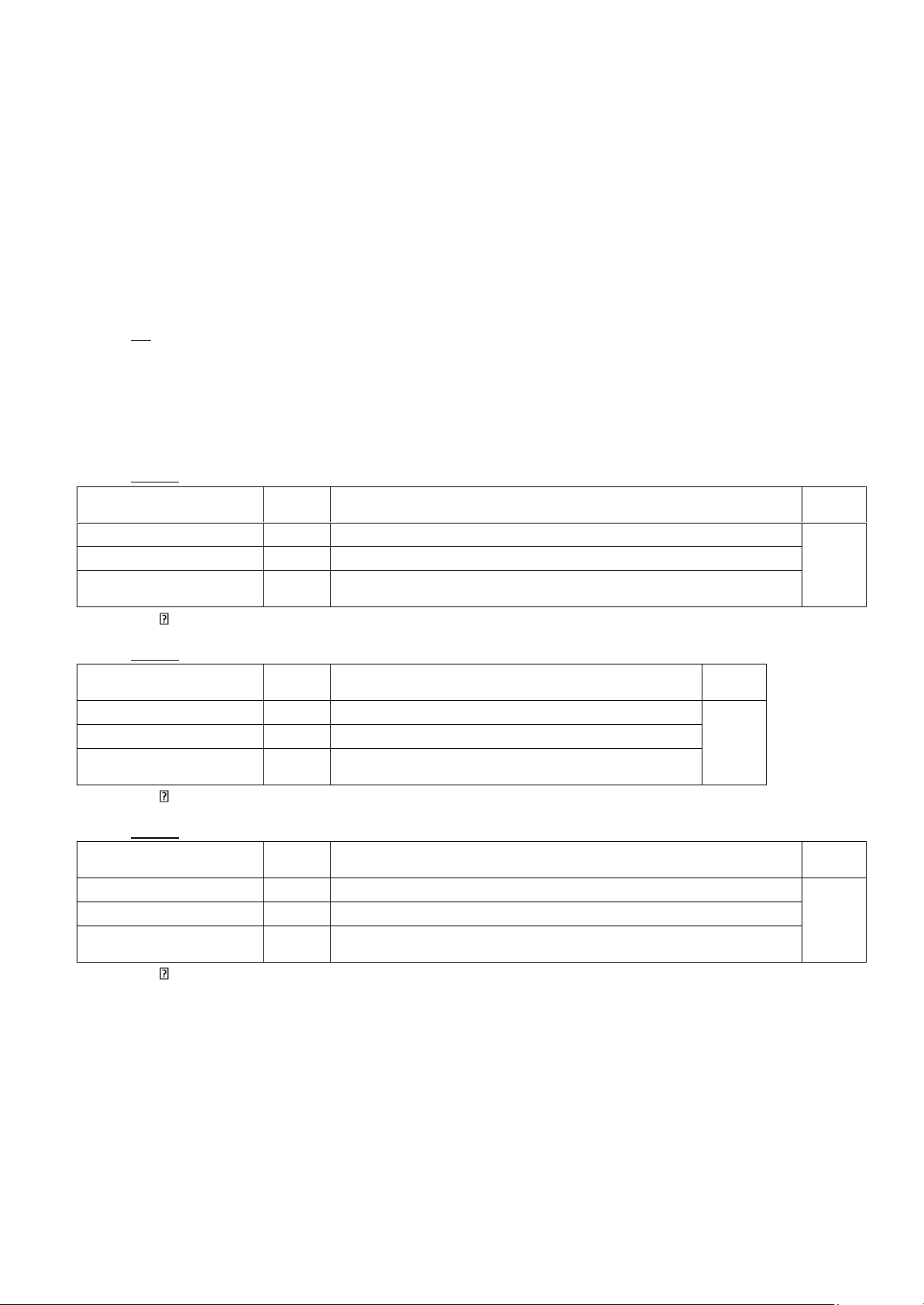

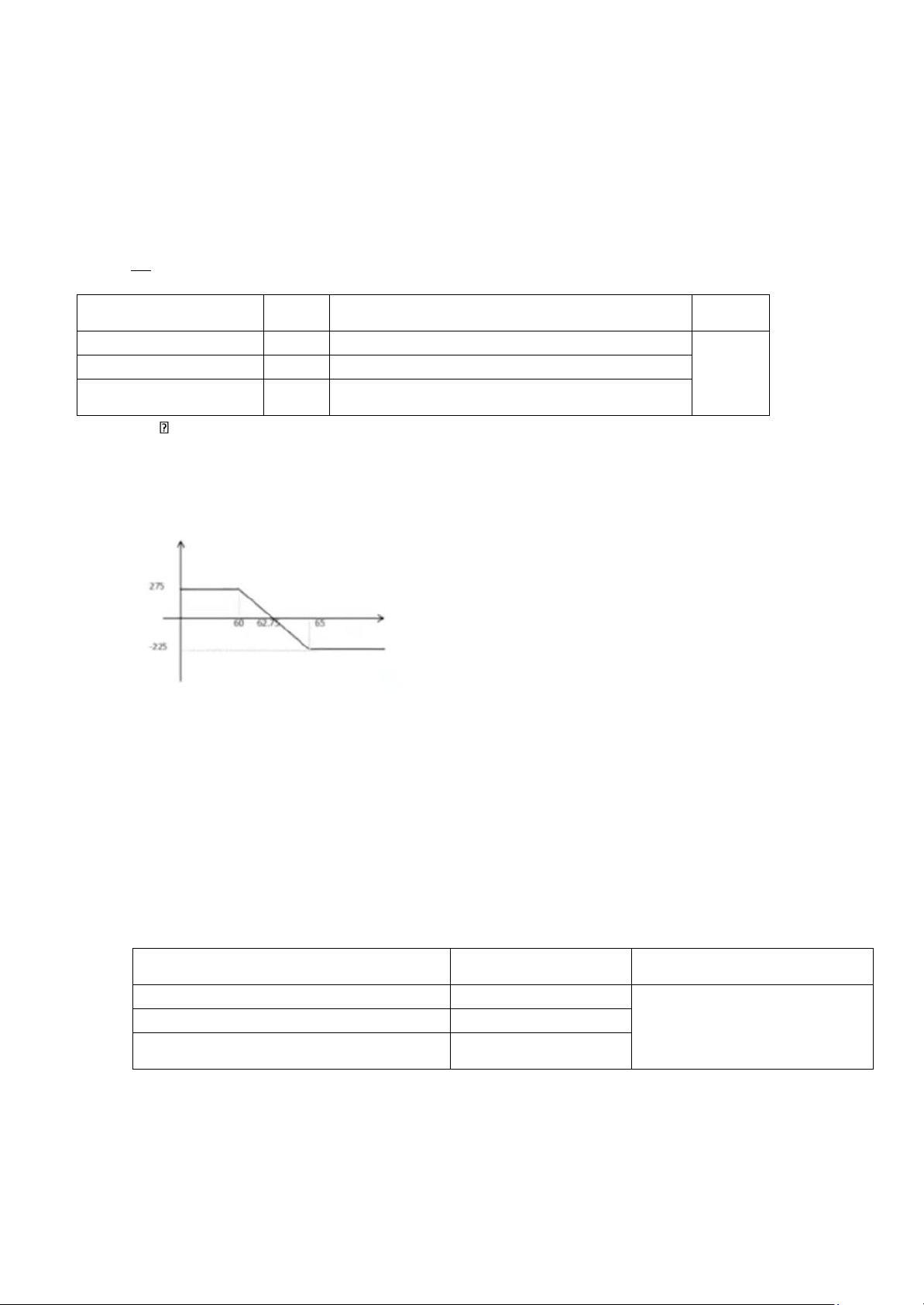

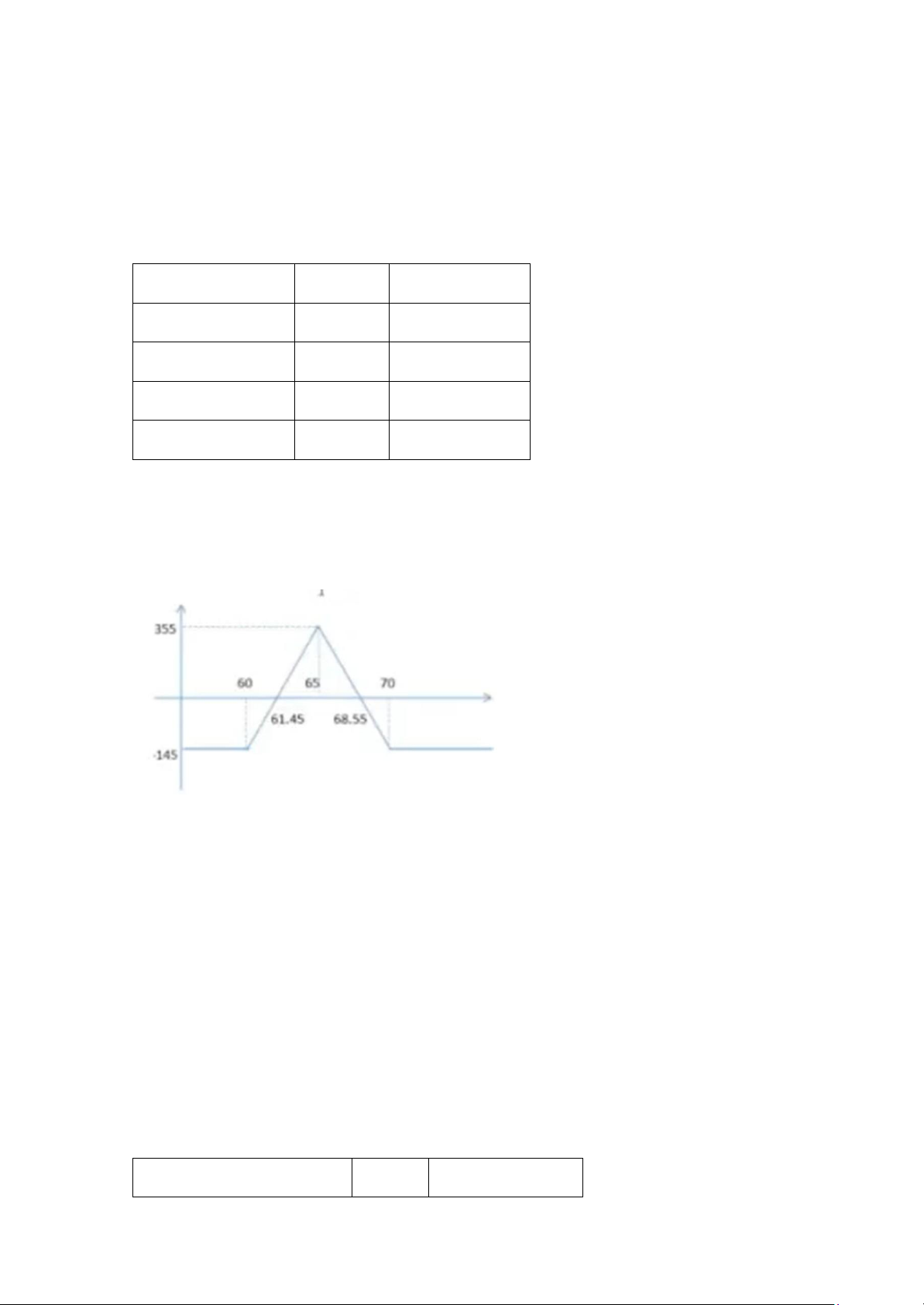

Ex: An investor uses bull call spread strategy to earn profit through buying a $60 call option at

$2.5 and selling a $65 call option at $0.5. Calculate profit or loss when stock price at $63 and $66. Buy $60 call option at $2.5 Sell $65 call option at $0.5 => Solution: Case 1: S = $63ₜ t = 0 T Total Long a $60 call option -2.5

ST > X (63 > 60) -> Exercise -> Profit = 63 - 60 = 3 Short a $65 call option

+0.5 ST < X (63 < 65) -> No exercise -> Profit = 0 3 -2 (Net debit)

=> Sum = $1 per share * 100 shares = $100 Case 2: ST = $66 t = 0 T Total Long a $60 call option -2.5

ST > X (66 > 60) -> Exercise -> Profit = 66 - 60 = 6 Short a $65 call option

+0.5 ST < X (66 > 65) -> Exercise -> Profit = -(66 – 65) = -1 5 -2 (Net debit)

=> Sum = $3 per share * 100 shares = $300

Maximum profit = (65 – 60) – (2.5 – 0.5) = 5 – 2 = 3 => 3*100 = $300

Maximum loss = 2.5 – 0.5 = 2 => 2*100 = 200

BEP = 60 + (2.5 – 0.5) = 60 + 2 = 62

2. Bear call spread (Credit spread) lOMoAR cPSD| 23136115

Buy ↑ X call option (C < C )₁ ₁

₂ Sell ↓ X call option (X > X )₂ ₁ ₂ (Net credit) Maximum profit = C - C₂ ₁

Maximum loss = (X - X ) - (C - C )₁ ₂ ₂ ₁ BEP = X + (C - C )₂₂ ₁

Ex: An investor uses bear call spread strategy to earn profit through buying a $65 call option at

$0.5 and selling a $60 call option at $2.5. Calculate profit or loss when stock price at $62.5, $58.5 and $68.5. Buy 65 call option $0.5 Sell 60 call option $2.5 Case 1: S = $ₜ 62.5 t = 0 T Total Long a $65 call option -0.5

ST < X (62.5 < 65) -> No exercise -> Profit = 0 Short a $60 call option +2.5

ST > X (62.5 > 60) -> Exercise -> Profit = -(62.5 - 60) = -2.5 -2.5 2 (Net credit)

Sum = -$0.5 per share * 100 shares = -$50 Case 2: ST = $58.5 t = 0 T Total Long a $65 call option -0.5

ST < X (58.5 < 65) -> No exercise -> Profit = 0 Short a $60 call option +2.5

ST < X (58.5 > 60) -> No exercise -> Profit = 0 0 2 (Net credit)

Sum = $2 per share * 100 shares = $200 Case 3: ST = $68.5 t = 0 T Total Long a $65 call option -0.5

ST > X (68.5 > 65) -> Exercise -> Profit = 3 Short a $60 call option +2.5

ST > X (68.5 > 60) -> Exercise -> Profit = -8.5 -5 2 (Net credit)

Sum = -$3 per share * 100 shares = -$300

Maximum profit = 2.5 - 0.5 = 2 => 2 * 100 = $200

Maximum loss = (65 - 60) - (2.5 - 0.5) = 3 => 3 * 100 = $300

BEP = 60 + (2.5 - 0.5) = 60 + 2 = 62 lOMoAR cPSD| 23136115

3. Bull put spread (credit spread)

Buy ↓ X1 put option (P1 < P2)

Sell ↑ X2 put option (X1 < X2) (Net credit) Maximum profit = P2 - P1

Maximum loss = (X2 - X1) - (P2 - P1) BEP = X2 - (P2 - P1)

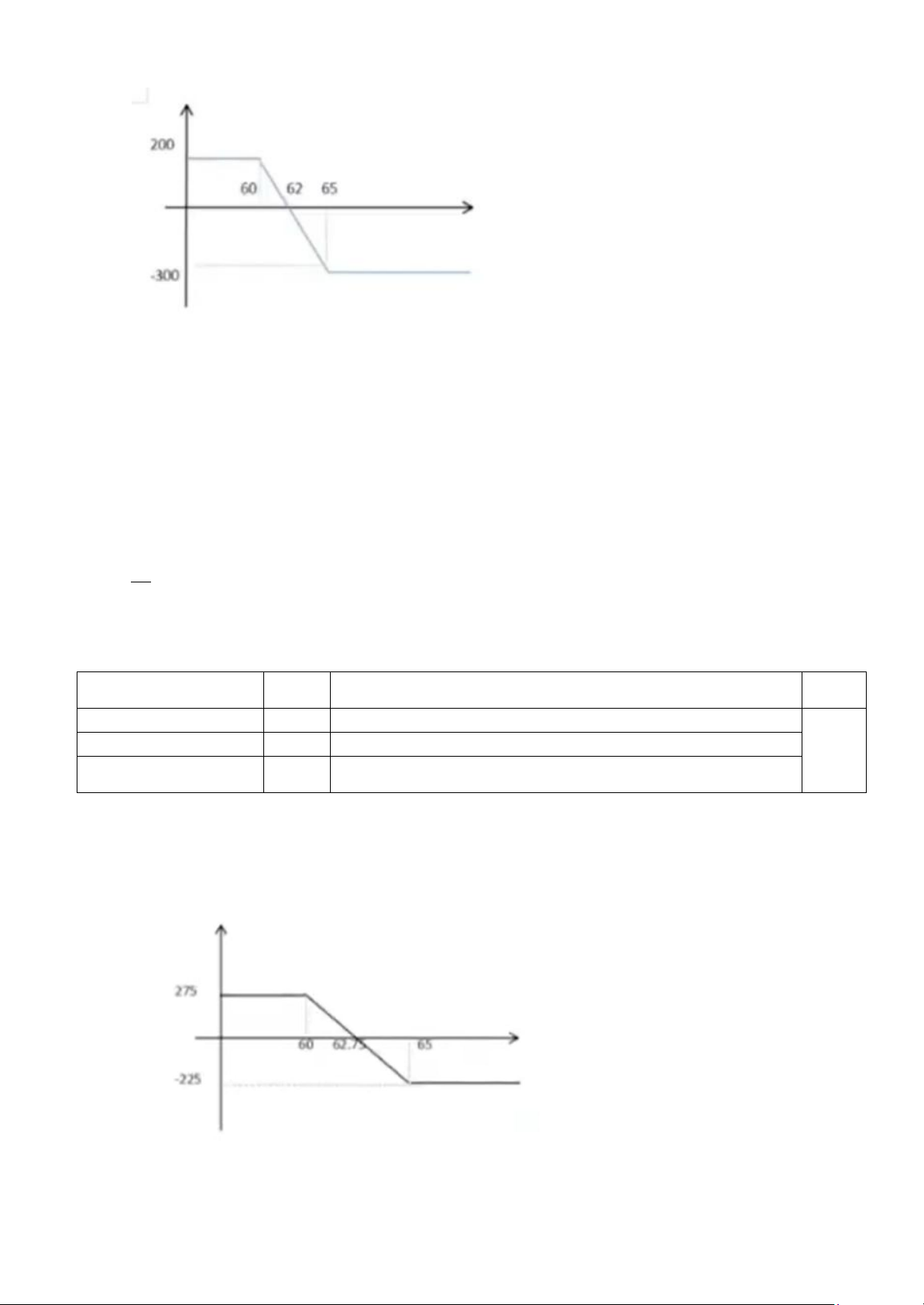

Ex: An investor uses bull put spread strategy to earn profit through buying a $60 put option at

0.5 and selling a $65 put option at 2.75. Calculate profit or loss when stock price at $55.5. Buy 60 put option $0.5 Sell 65 put option $2.75 t = 0 T Total Long a $60 call option -0.5

ST < X (55.5 < 60) -> Exercise -> Profit = 4.5 Short a $65 call option

+2.75 ST < X (55.5 < 65) -> Exercise -> Profit = -9.5 -5 2.25 (Net credit)

=> Sum = -2.75 => Total = -$275

Maximum profit = 2.75 - 0.5 = 2.25 => 2.25 * 100 = $225

Maximum loss = (65 - 60) - (2.75 - 0.5) = 2.75 => 2.75 * 100 = $275 BEP = 65 - 2.25 = 62.75

4. Bear put spread (Debit spread)

Buy ↑ X1 put option (P1 > P2) lOMoAR cPSD| 23136115

Sell ↓ X2 put option (X1 > X2) (Net debit)

Maximum profit = (X1 - X2) - (P1 - P2) Maximum loss = (P1 - P2) BEP = X1 - (P1 - P2)

Ex: An investor uses bear put spread strategy to earn profit through buying a $65 put option at

$2.75 and selling a $60 put option at $0.5. Calculate profit or loss when stock price at $67. t = 0 T Total Long a $65 call option

-2.75 ST > X (67 > 65) -> No exercise -> Profit = 0 Short a $60 call option +0.5

ST > X (67 > 60) -> No exercise -> Profit = 0 0 -2.25 (Net credit) Sum = -2.25

Maximum profit = (65 - 60) - 2.25 = 2.75 ⇒ $275

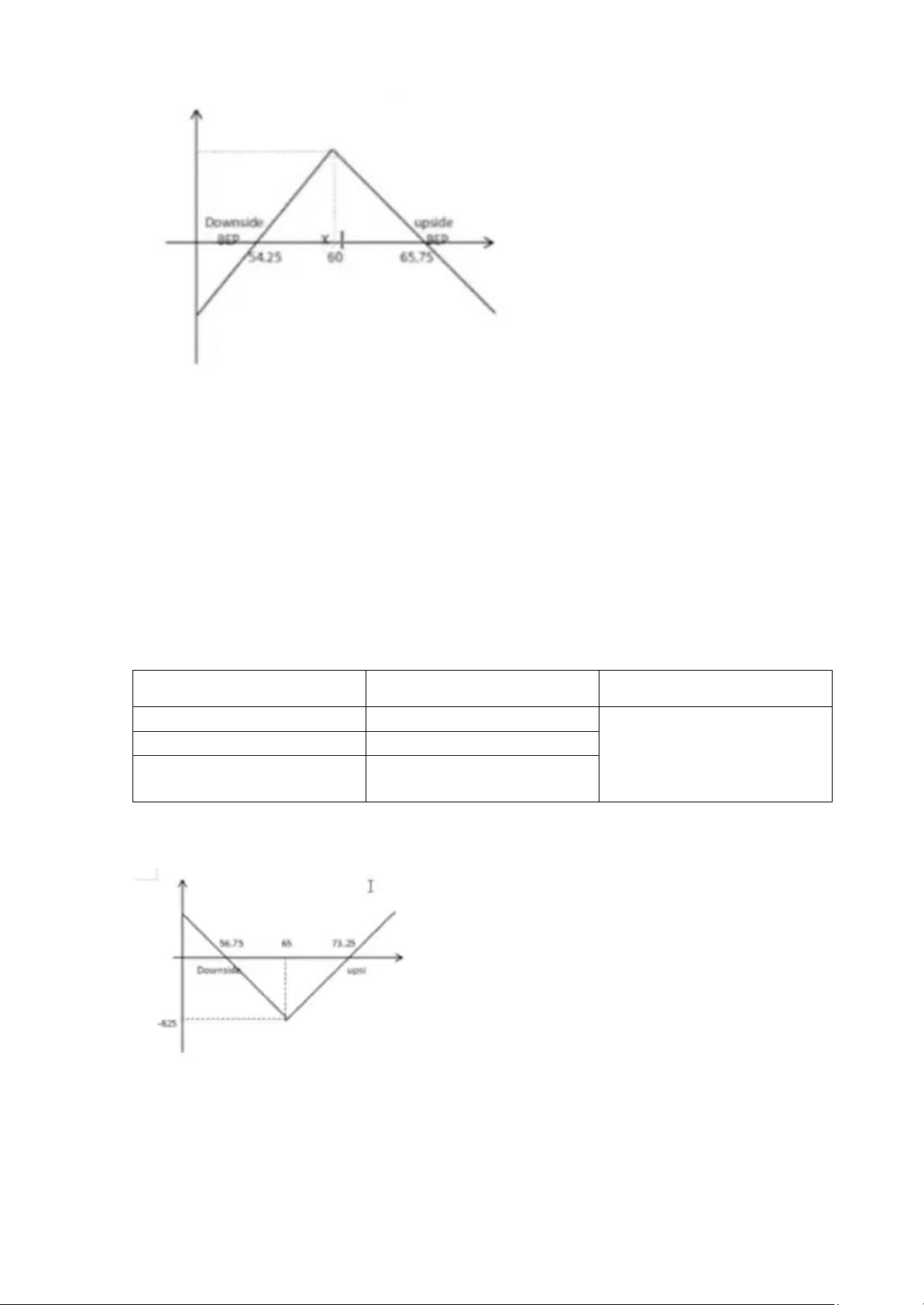

Maximum loss = 2.75 - 0.5 = 2.25 ⇒ 2.25 * 100 = $225 BEP = 65 - 2.25 = 62.75 II. STRADDLES 1. Short straddles Sell call option (X1 = X2) Sell put option (Credit spread) Maximum profit = c + p

Maximum loss = loss on upside, unlimited loss

Maximum loss = loss on downside, substantial loss BEP (Upside) = X + (c + p) BEP (Downside) = X - (c + p) t = 0 Total Short a $60 call option at $3 3

Short a $60 put option at $2.75 2.75 5.75*100 = $575 5.75

BEP (Upside) = 60 + (3 + 2.75) = 65.75

BEP (Downside) = 60 – (3 + 2.75) = 54.25 lOMoAR cPSD| 23136115 2. Long straddles Buy call option (X1 = X2) Buy put option (debit spread) Maximum profit: - Upside: unlimited

- Downside: substantial profit Maximum loss = p + c BEP (upside) = X + (p + c) BEP (downside) = X - (p + c) t = 0 Total Buy a $65 call option at $4.3 -4.3 Buy a $65 put option at $3.95 -3.95 -8.25 * 100 = -$825 -8.25

Maximum loss = 4.3 + 3.95 = 8.25 => 8.25 * 100 = -$825

BEP (upside) = X + (p + c) = 65 + 8.25 = 73.25

BEP (downside) = X - (p + c) = 65 - 8.25 = 56.75 III. STRANGLE 1. Short strangle

Sell call option ↑ X1 (X1 > X2) Sell put option ↓ X2 (Credit) lOMoAR cPSD| 23136115 Maximum gain = c + p Maximum loss: •

Downside BEP = Substantial loss • Upside BEP = Unlimited Downside BEP = X2 - (c + p) Upside BEP = X1 + (c + p)

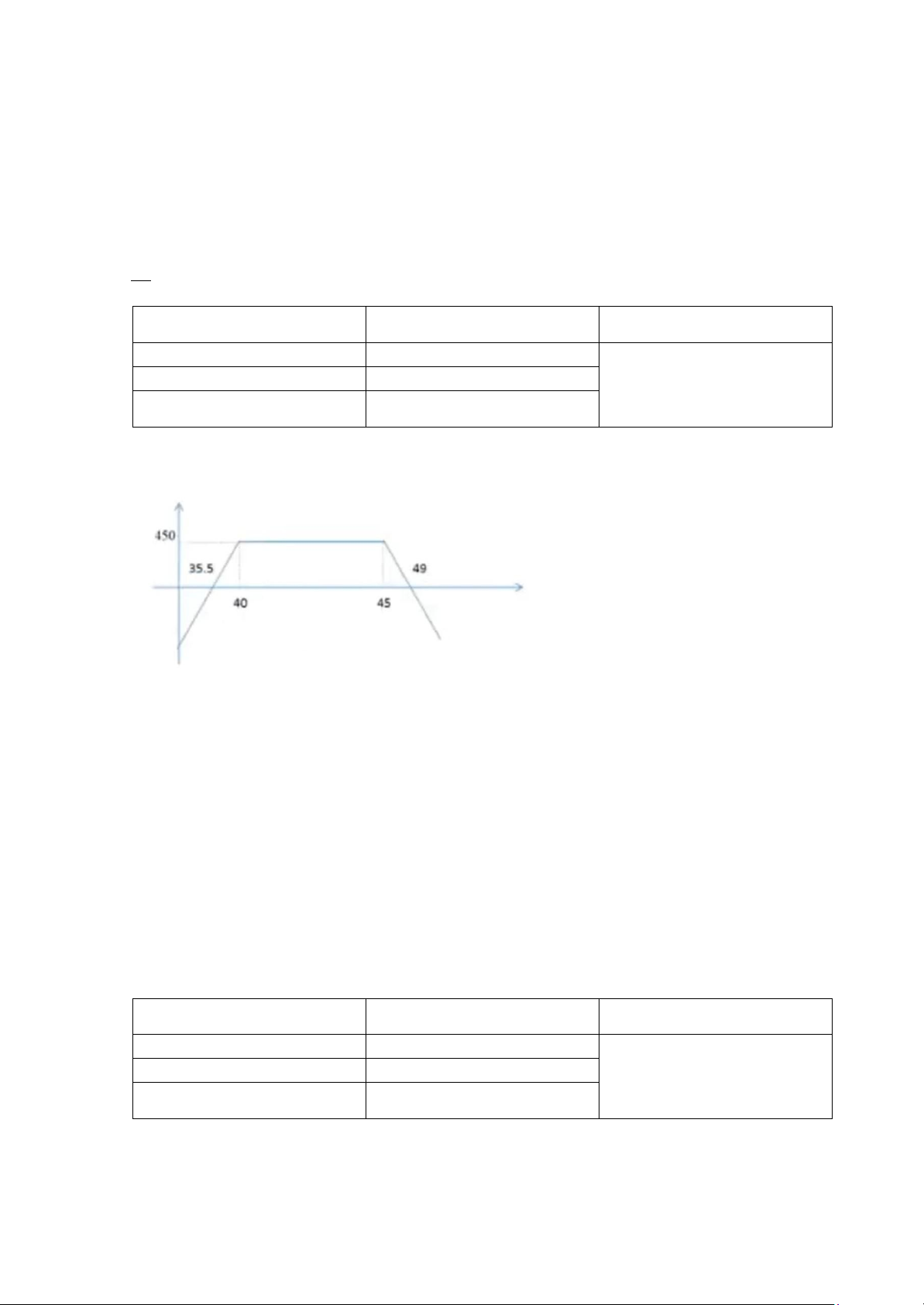

Ex: An investor uses short strangle strategy to earn profit through selling a $45 call option at

$3.75 and selling a $40 put option at $0.75. Calculate profit or loss, t = 0 Total

Sell a $45 call option at $3.75 3.75

Sell a $40 put option at $0.75 0.75 4.5 * 100 = $450 4.5 (credit)

Maximum gain = 4.5 ⇒ Total = 4.5 * 100 = $450

Downside BEP = 40 - 4.5 = 35.5 Upside BEP = 45 + 4.5 = 49 2. Long strangle

Buy call option ↑ X1 (X1 > X2) Buy put option ↓ X2 (Debit) Max gain: - Downside = Substantial gain - Upside = Unlimited gain Max loss = c + p Downside BEP = X2 - (c + p) Upside BEP = X1 + (c + p) t = 0 Total Buy a $75 call option at $4.5 -4.5 Buy a $70 put option at $3.25 -3.25 -7.75 * 100 = -$775 -7.75 (debit)

Max loss: 7.75 ⇒ Total = $775

Downside BEP = 70 - 7.75 = 62.25

Upside BEP = 75 + 7.75 = 82.75 lOMoAR cPSD| 23136115 IV. Butterfly

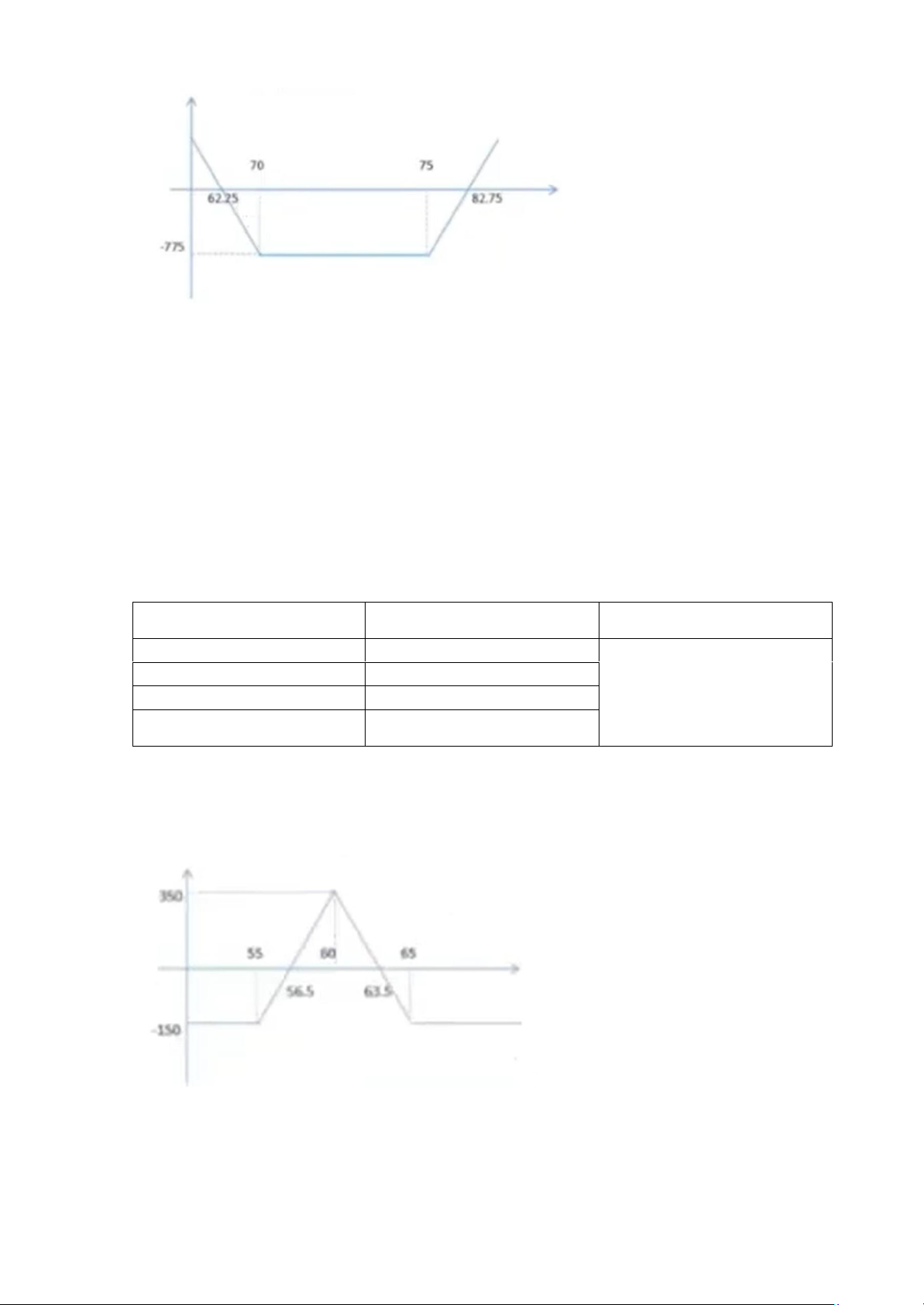

1. Long call butterfly spread Buy ⤓ call Sell 2 middle calls Buy ⤒ call (Neutral) Max gain = Strike # – debit Max loss = Debit

Downside BEP = Strike ⤓ + Debit

Upside BEP = Strike ⤒ – Debit t = 0 Total Buy 1 55 call at $6 -6 Sell 2 60 calls at $2.75 2.75*2 -1.5 * 100 = -$150 Buy 1 65 call at $1 -1 -1.5

Max gain = 5 – 1.5 = 3.5 ⇒ Total = $350

Max loss = 1.5 ⇒ Total = $150

Downside BEP = 55 + 1.5 = 56.5

Upside BEP = 65 – 1.5 = 63.5

2. Long put butterfly spread Buy ⤓ put Sell 2 middle puts lOMoAR cPSD| 23136115 Buy ⤒ put (Neutral) Max gain = Strike # – Debit Max loss = Debit

Downside BEP = Strike ↓ + Debit

Upside BEP = Strike ↑ – Debit t = 0 Total Buy 1 70 put at $4.5 -4.5 Sell 2 75 puts at $2.5 2.5 * 2 Buy 1 80 put at $0.75 -0.75 -0.25 * 100 = -$25 -0.25 (debit)

Max gain = 5 – 0.25 = 4.75 ⇒ Total = $475

Max loss = 0.25 ⇒ Total = $25

Downside BEP = 70 + 0.25 = 70.25

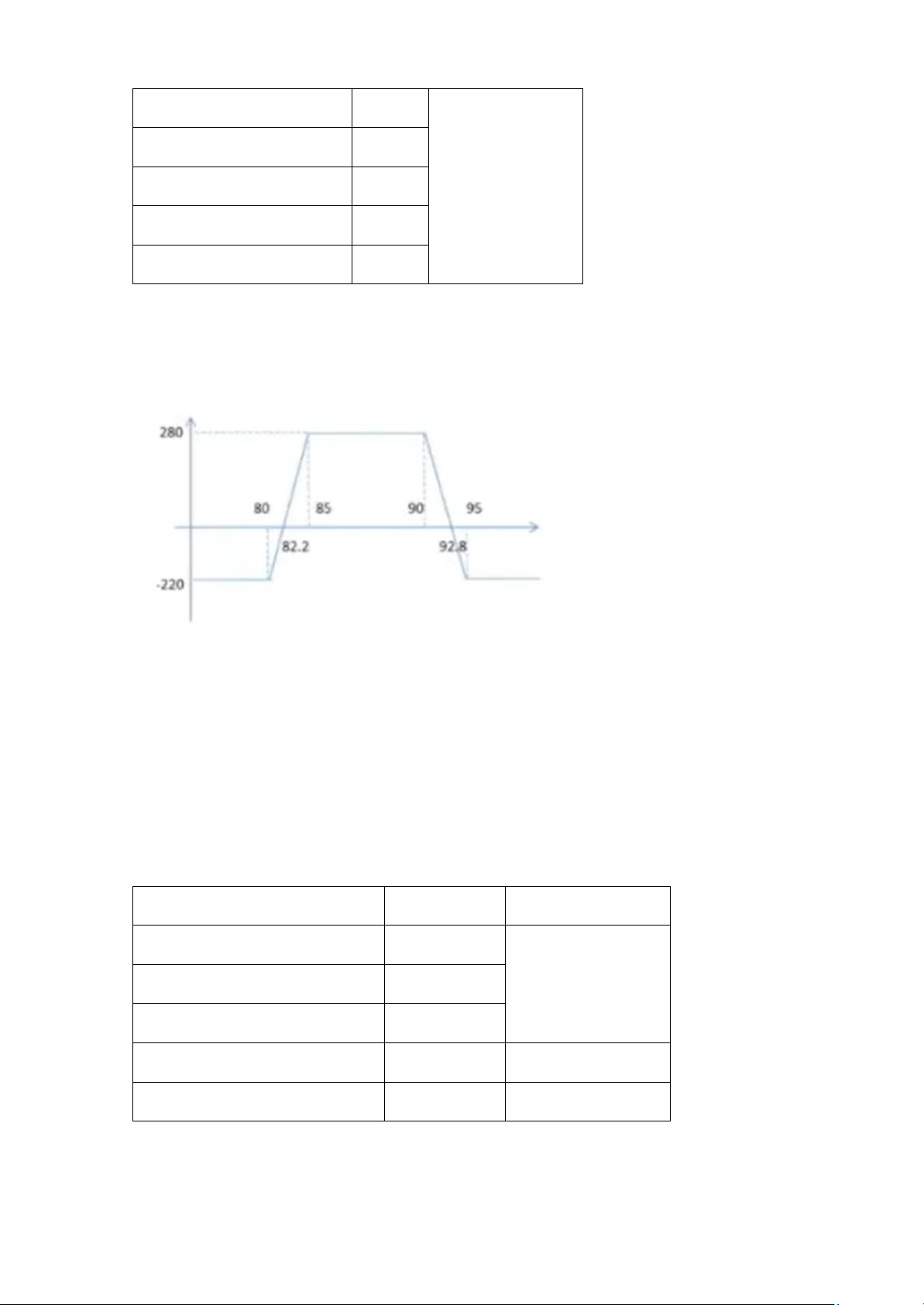

Upside BEP = 80 – 0.25 = 79.75 V. CONDOR 1. Long Call Condor Buy ↓ call Sell ↑ call Sell ↑ call Buy ↑ call (neutral)

Max gain = Strike middle # – Debit Max loss = Debit

Downside BEP = Strike ↓ + Debit

Upside BEP = Strike ↑ – Debit t = 0 Total lOMoAR cPSD| 23136115 Buy 1 80 call at $7.9 -7.9 -2.2 * 100 = -$220 Sell 1 85 call at $4.35 4.35 Sell 1 90 call at $1.85 1.85 Buy 1 95 call at $0.5 -0.5 -2.2

Max gain = 5 - 2.2 = 2.8 => Total = $280

Max loss = 2.2 => Total = $220

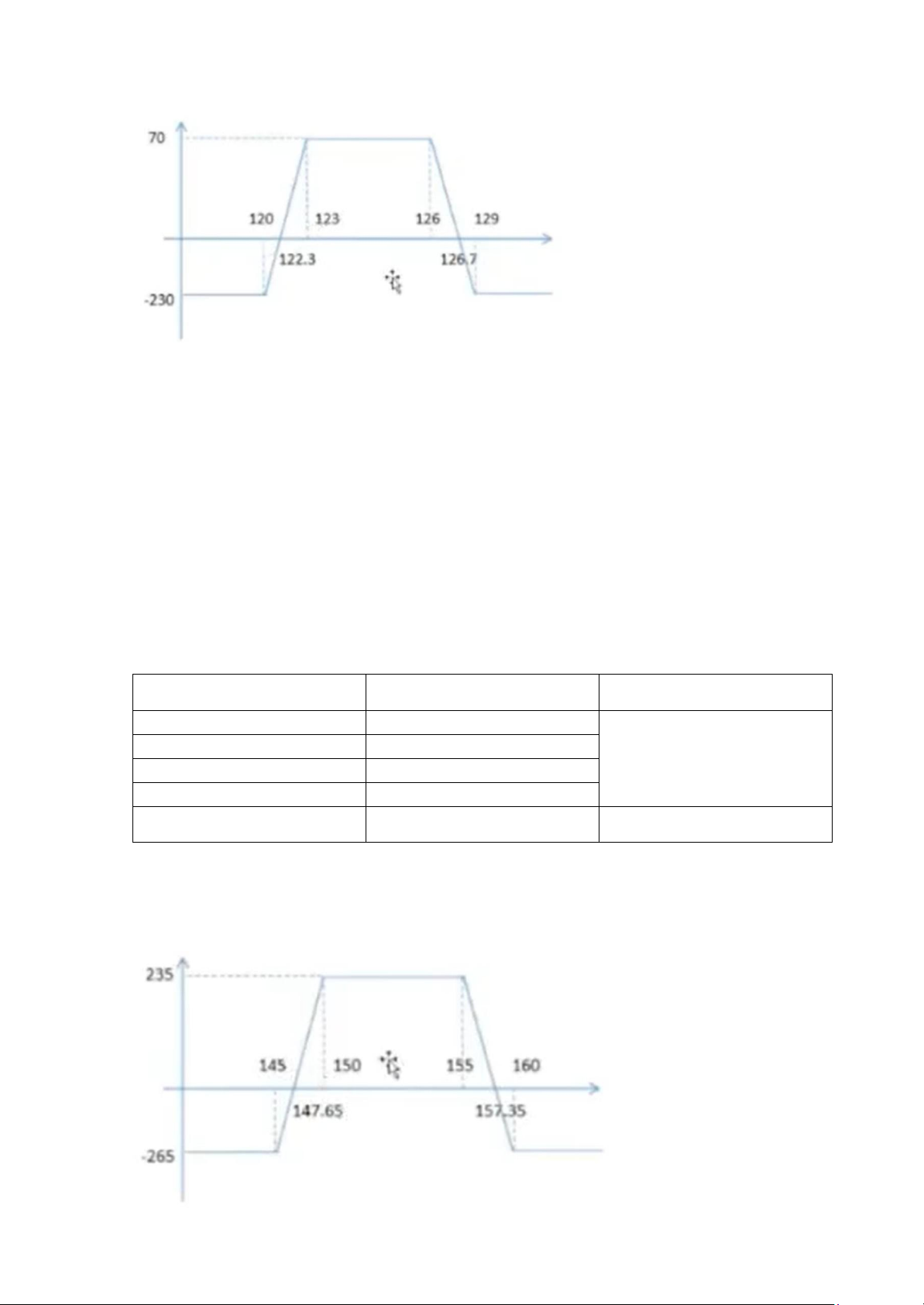

Downside BEP = 80 + 2.2 = 82.2 Upside BEP = 95 - 2.2 = 92.8 2. Long put condor Buy ↓ put Sell ↑ put Sell ↑ put Buy ↑ put (Neutral)

Max gain = Strike middle # – debit Max loss = Debit

Downside BEP = Strike ↓ + Debit

Upside BEP = Strike ↑ – Debit t = 0 Total Buy 1 120 put at $0.35 -0.35 -2.3 * 100 = -$230 Sell 1 123 put at $1.75 1.75 Sell 1 126 put at $4.3 4.3 Buy 1 129 put at $8 -8 -2.3

Max gain = 3 – 2.3 = 0.7 → Total = $70

Max loss = 2.3 ⇒ Total = $230

Downside BEP = 120 + 2.3 = 122.3 lOMoAR cPSD| 23136115

Upside BEP = 129 – 2.3 = 126.7 3. Iron condor Buy ↓ put Sell ↑ put Sell ↑ call Buy ↑ call (Neutral) Max gain = Credit Max loss = Strike # - Credit

Downside BEP = Sell put strike - Credit

Upside BEP = Sell call strike + Credit t = 0 Total Buy 1 145 put at $0.45 -0.45 Sell 1 150 put at $1.5 1.5 2.35 * 100 = $235 Sell 1 155 call at $1.8 1.8 Buy 1 160 call at $0.5 -0.5 2.35

Max gain = 2.35 ⇒ Total = $235

Max loss = 5 – 2.35 = 2.65 ⇒ Total = $265

Downside BEP = 150 – 2.35 = 147.65

Upside BEP = 155 + 2.35 = 157.35 lOMoAR cPSD| 23136115 EXAMPLE EXAM

QUESTION 1: An investor buys 4 ABC June 60 put for $0.5, sells 4 ABC June 65 put for $2, sells

4 ABC June 70 put for $5, and at the same time buys 4 ABC June 75 put for $9. Suppose that the

investor holds options until the expiration.

a. Calculate the profit/loss of the strategy if the stock price at expiration is $78 per share?

b. Calculate the profit/loss of the strategy if the stock price at expiration is $67 per share?

c. Calculate the profit/loss of the strategy if the stock price at expiration is $55 per share?

d. Determine the breakeven price, maximum loss, and maximum profit at expiration. Show all your calculations.

e. Draw the payoff graph for the above strategy at expiration.

QUESTION 2: Analyze the Vietnamese derivatives market during the Covid-19 period and then

provide possible trading strategies.

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________ lOMoAR cPSD| 23136115

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _ lOMoAR cPSD| 23136115

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _ lOMoAR cPSD| 23136115

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _ lOMoAR cPSD| 23136115

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _

________________________________________________________________________________ _