Preview text:

lOMoAR cPSD| 23136115 I. Overview

The technological landscape stands as a pivotal force driving the wheels of modern

economic progress, heralding an era of innovation and transformation. In the quest

to navigate this dynamic terrain, this report embarks on a comprehensive evaluation

of an investment portfolio, anchored by two titans of the tech world: Apple (AAPL)

and Amazon (AMZN). Our analysis will cover the period from April 16 to May 15,

2024, the stage is set for strategic maneuvers and calculated decisions. Through

meticulous planning and rigorous analysis, our aim is to elucidate the thought

processes underpinning our portfolio strategy, providing insights into the rationale

guiding our investment decisions.

In this context, Apple, renowned for its cutting-edge products and robust ecosystem,

continues to innovate and expand its market presence. Meanwhile, Amazon, a leader

in e-commerce and cloud computing, persistently explores new frontiers,

maintaining its dominance in diverse sectors. By examining their performance and

potential during this specific timeframe, we seek to offer a nuanced understanding

of their contributions to the portfolio. II.

Analysis 1. Amazon (AMZN)

Investment highlights Full Year 2023

- Net sales increased 12% to $574.8 billion in 2023, compared with $514.0

billion in 2022. Excluding the $0.1 billion unfavorable impact from year-over-

year changes in foreign exchange rates throughout the year, net sales increased 12% compared with 2022.

- Operating income increased to $36.9 billion in 2023, compared with $12.2 billion in 2022.

- Net income was $30.4 billion in 2023, or $2.90 per diluted share, compared

with a net loss of $2.7 billion, or $0.27 per diluted share, in 2022.

- Operating cash flow increased 82% to $84.9 billion for the trailing twelve

months, compared with $46.8 billion for the trailing twelve months ended December 31, 2022.

- Free cash flow improved to an inflow of $36.8 billion for the trailing twelve

months, compared with an outflow of $11.6 billion for the trailing twelve

months ended December 31, 2022.

- Free cash flow less principal repayments of finance leases and financing

obligations improved to an inflow of $32.2 billion for the trailing twelve

months, compared with an outflow of $19.8 billion.

- Free cash flow less equipment finance leases and principal repayments of all

other finance leases and financing obligations improved to an inflow of $35.5 lOMoAR cPSD| 23136115

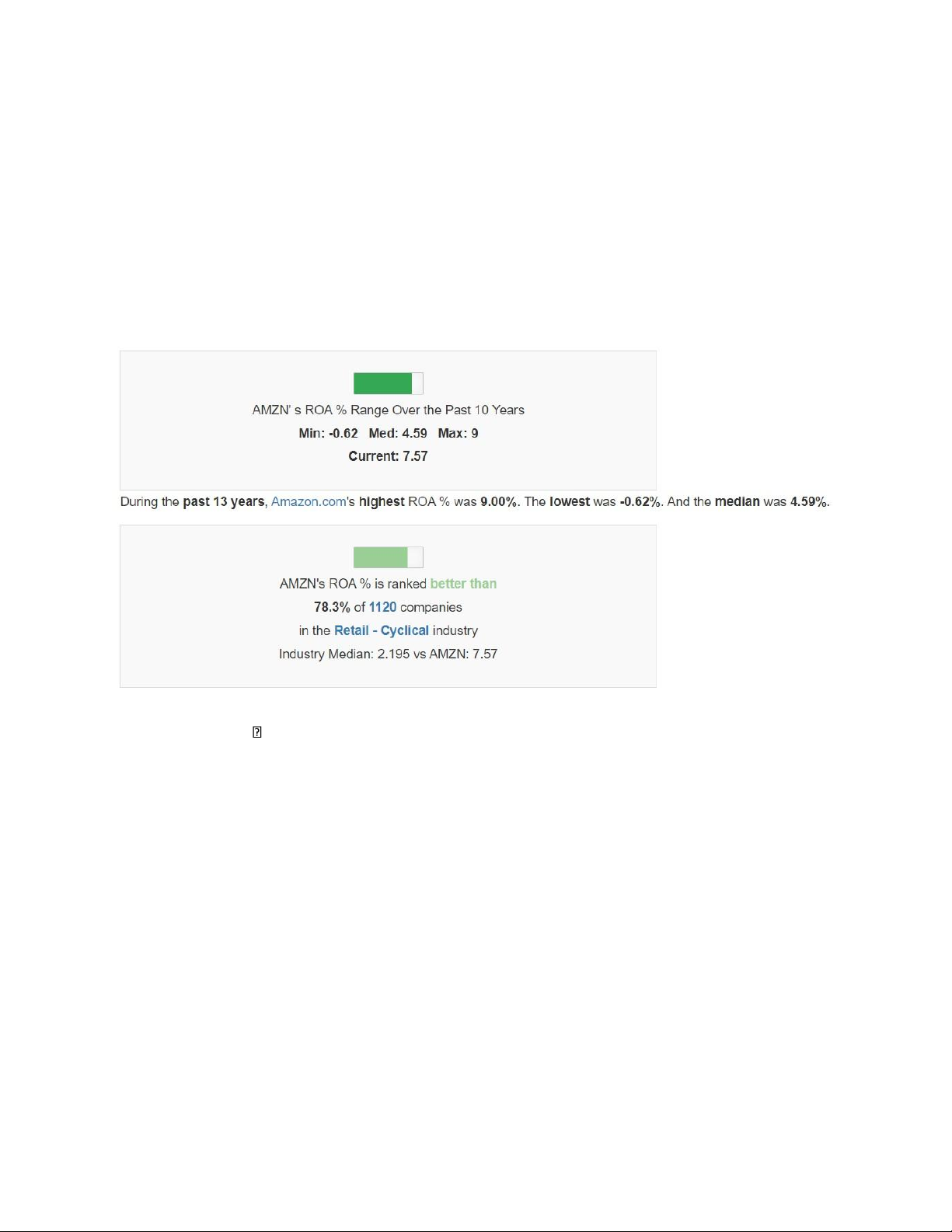

billion for the trailing twelve months, compared with an outflow of $12.8 billion. In Mar. 2024

- Amazon.com's annualized Net Income for the quarter that ended was $41,724 Mil.

- Amazon.com's average Total Assets over the quarter that ended was $529,412 Mil.

- Therefore, Amazon.com's annualized ROA % for the quarter that ended was 7.88%.

Analysis a. Performance of Amazon stock during the investing period

For Amazon stock, we chose the Protective Put strategy. We bought 100 shares of

AMZN at $185.32 on April 16th, 2024, with 100 Puts with a strike price of $225 and

an expiration date on May 15 at $40.50 per Put.

Amazon.com Inc (AMZN) saw options trading volume of 32,891,300 contracts on

April 16th, which is equivalent to 84.17% of the stock's average daily trading volume

of 39,073,798. This significant options activity suggests that investors are closely

watching and actively trading Amazon's stock.

The analysts at Argus Research and Barclays Capital have issued 12-month price targets for

Amazon (AMZN) stock over the past 3 months. The average target price they have

set is $220.93, with a high estimate of $246 and a low of $200. This indicates that lOMoAR cPSD| 23136115

the analysts are overall bullish on Amazon's stock and believe it is undervalued at its current price.

The fact that the average target price of $220.93 is significantly above Amazon's

current stock price, and the high estimate of $246 is even higher, suggests that the

analysts are confident in the company's future performance. They view Amazon's

shares as having the potential to appreciate by over 15% from the current stock price,

based on their analysis and projections.

Given this positive technical analysis and the analysts' price target projections, the

overall analyst recommendation on Amazon would be a "strong buy". The analysts

are strongly encouraging investors to purchase the stock based on their favorable

outlook and price target estimates.

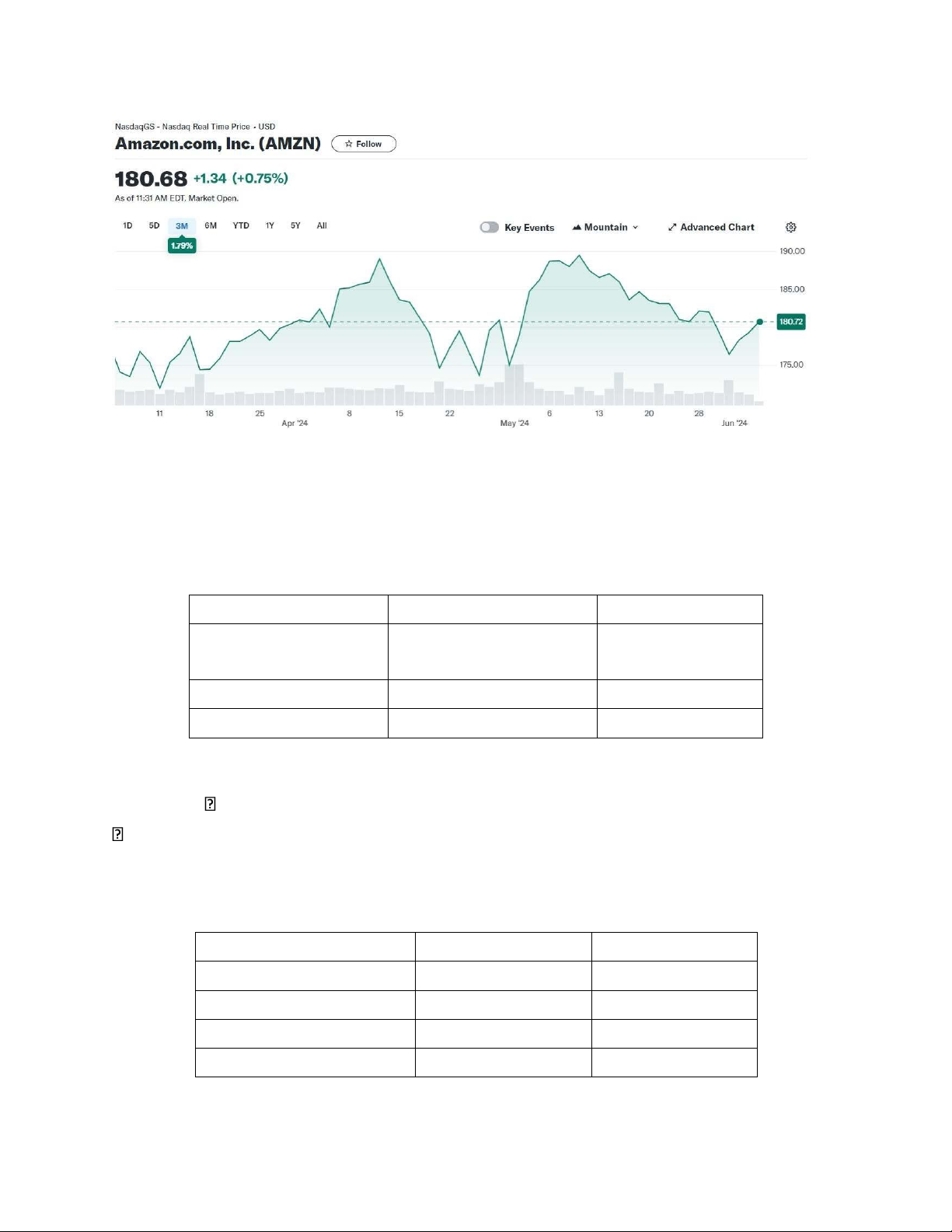

The performance of Amazon (AMZN) stock has largely aligned with our initial

expectations. The AMZN stock price has experienced significant fluctuations,

ranging between $171.47 and $191.70. From the day we entered the market with a

long position on April 16th, the AMZN stock price has decreased from $183.32 to

$180.80 but remains on an overall upward trend. This suggests that our decision to

implement the Protective Put strategy may have been a prudent one, as it helps to

mitigate the downside risk while still allowing us to potentially benefit from the stock's upside potential.

In general, the combination of positive analyst perspective, attractive price target

estimates, and the ongoing fluctuations in the AMZN stock price indicate that our

investment in Amazon using the Protective Put strategy may prove to be a sound

decision, offering a balance of risk and potential reward. lOMoAR cPSD| 23136115

Source: Investing.com, Nasquad

b. Evaluation of Protective Put Strategy + At time 0:

We bought 100 AMZN share at $185.32/share and 100 put at $40.50/put (K=225, T= May 15th )

Netdebit=100×(185.32+40.50)=$22,582 Protective Put Quoted price Total price Buy 100 AMZN $185.32 $18,532 share Buy 100 AMZN Put $40.50 $4,050 Net Debit $225.82 $22,582 *Excluding

commission + At time T:

ST=185.99 Exercise Put because ST<K

Put payoff=100×(225−185.99)=$3,901

AMZNshare=100×185.99=$18,599

So, our total value at time T = $22,500

Ournet loss=22,582 –22,500=$ 82 Value Per share Total AMZN price at time T $185.99 $18,599 Payoff of Put $40.50 $4,050 Total gain at time T $225 $22,500 Net debit at time 0 -$225.82 -$22,582 lOMoAR cPSD| 23136115 Net loss at time T -$0.82 -$82 Reference:

https://www.gurufocus.com/term/roa/AMZN

https://ir.aboutamazon.com/news-release/news-release-details/2024/Amazon.com-

AnnouncesFourth-Quarter-Results/default.aspx

https://www.statmuse.com/money/ask/amazon-stock-price-in-june-2024

https://www.barrons.com/market-data/stocks/amzn/research-ratings?

fbclid=IwZXh0bgNhZW0CMTAAAR1Y2QKD1gTaihvMbURoF4D9IznlDya9-

AB6alV1IZCjRdP_RF7UvY7_INc_aem_AVqym8kt8xHSwn9XBOCl9lIZc5ceXz2 uAJWvDTjH

Y6uEYjicmd6Y_5eCdngKC_SQWVe9rMJHaxEPJvF5Iao28qwF