Preview text:

lOMoAR cPSD| 23136115 [‘SOLUTION

Question 1: An investor buys 4 ABC June 60 put for $0.5, sells 4 ABC June 65 put for $2, sells 4 ABC

June 70 put for $5, and at the same time buys 4 ABC June 75 put for $9. Suppose that the investor

holds options until the expiration.

a. Calculate the profit/loss of the strategy if the stock price at expiration is $78 per share?

b. Calculate the profit/loss of the strategy if the stock price at expiration is $ 67 per share?

c. Calculate the profit/loss of the strategy if the stock price at expiration is $ 55 per share?

d. Determine the breakeven price, maximum loss, and maximum profit at expiration. Show all yourcalculations?

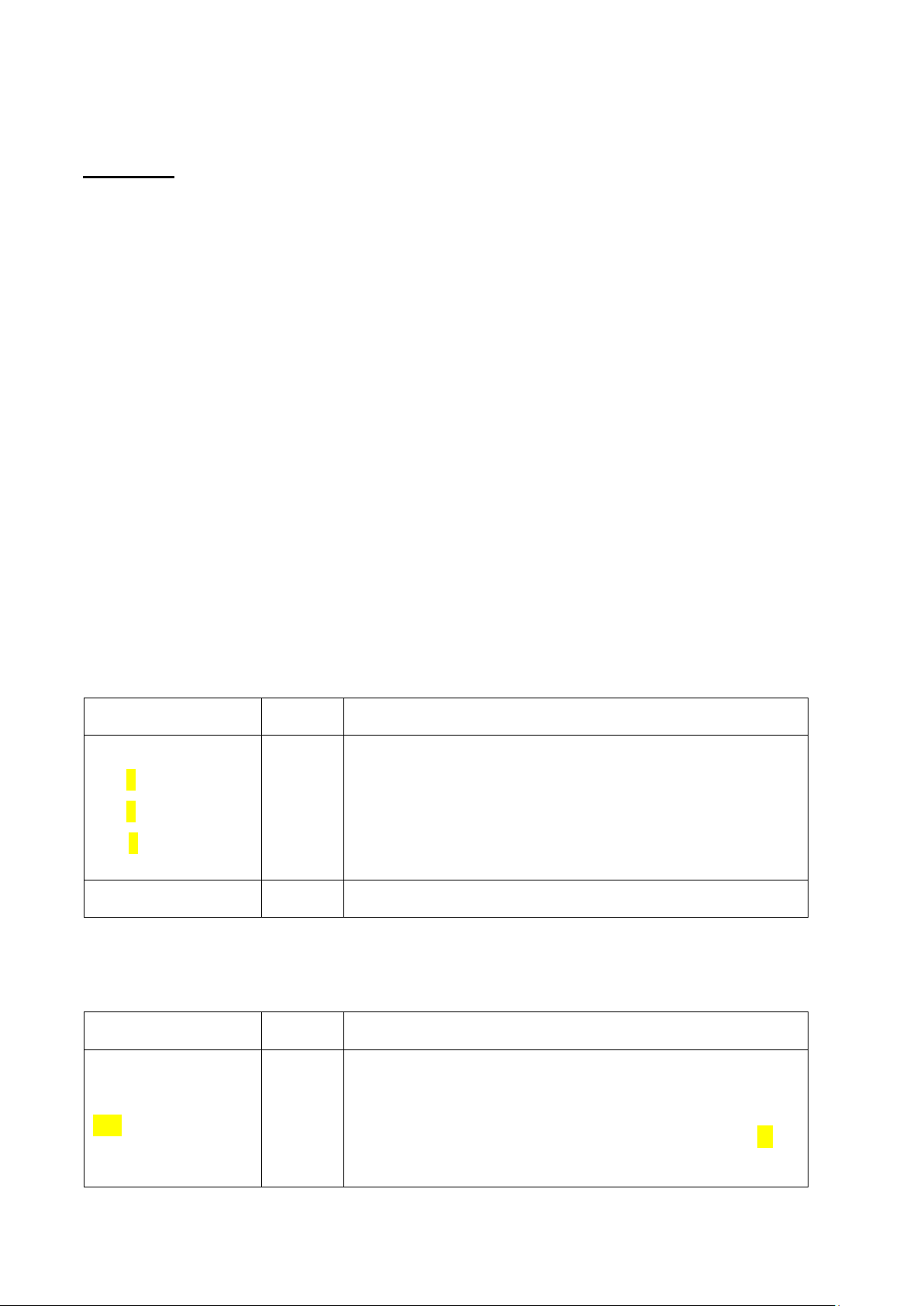

e. Draw the payoff graph for the above strategy at expiration? Buy 60 put $0.5 Sell 65 put $2.0 Sell 70 put $5.0 Buy 75 put $9.0

(X1 < X2 < X3 < X4) (P1 < P2 < P3 < P4) => Long put condor a) ST = 78 t = 0 t = T Buy 4 60 put $0.5 -0.5

ST > X (78 > 60) => No exercise => Profit = 0 Sell 4 65 put $2.0 2.0

ST > X (78 > 65) => No exercise => Profit = 0 Sell 4 70 put $5.0 5.0 S Buy 4 75 put $9.0 -9.0

T > X (78 > 70) => No exercise => Profit = 0

ST > X (78 > 75) => No exercise => Profit = 0 -2.5 0

=> Total profit = -2.5 * 4 * 100 = -$1,000 b) ST = 67 t = 0 t = T Buy 4 60 put $0.5 -0.5

ST > X (67 > 60) => No exercise => Profit = 0 Sell 4 65 put $2.0 2.0

ST > X (67 > 65) => No exercise => Profit = 0 Sell 4 70 put $5.0 5.0

ST < X (67 < 70) => Exercise => Profit = - (70 - 67) = -3 Buy 4 75 put $9.0 -9.0

ST < X (67 < 75) => Exercise => Profit = 75 - 67 = 8 lOMoAR cPSD| 23136115 -2.5 5

=> Sum = -2.5 + 5 = 2.5 => Total profit = 2.5 * 4 * 100 = $1,000 c) ST = 55 t = 0 t = T Buy 4 60 put $0.5 -0.5

ST < X (55 < 60) => Exercise => Profit = 60 - 55 = 5 Sell 4 65 put $2.0 2.0

ST < X (55 < ok 65) => Exercise => Profit = -(65 - 55) = - Sell 4 70 put $5.0 5.0 10 Buy 4 75 put $9.0 -9.0

ST < X (55 < 70) => Exercise => Profit = - (70 - 55) = -15

ST < X (55 < 75) => Exercise => Profit = 75 - 55 = 20 -2.5 0

=> Total profit = -2.5 * 4 * 100 = -$1,000 d)

Maximum profit = 5 - 2.5 = 2.5 => Total = 2.5 * 4 * 100 = $1,000

Maximum loss = 2.5 => Total = 2.5 * 4 * 100 = $1,000

Downside BEP = 60 + 2.5 = 62.5 Upside BEP = 75 - 2.5 = 72.5 e)

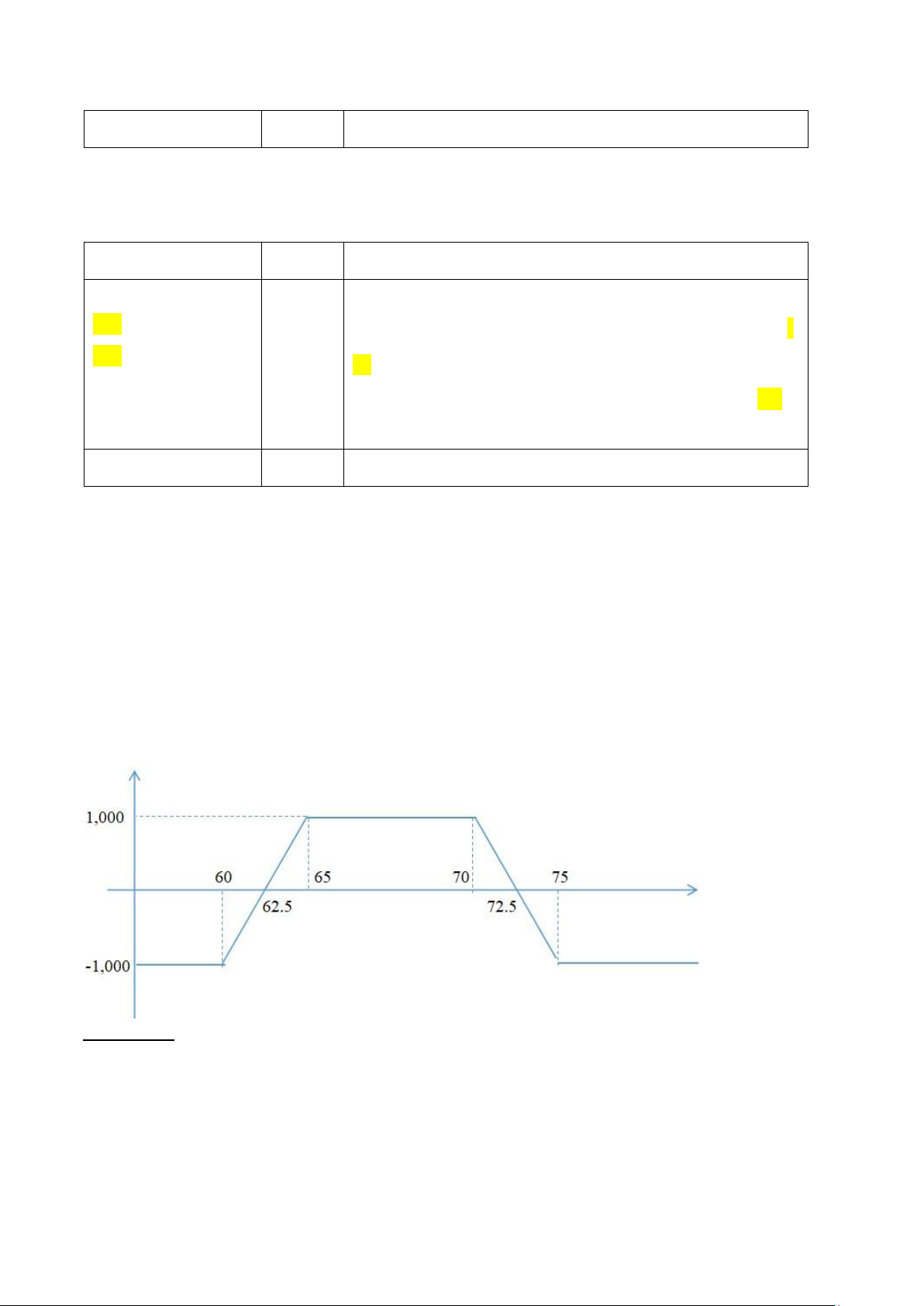

Question 2: An investor buys 3 XYZ August 50 put for $0.5, sells 3 XYZ August 55 put for $2.75.

Suppose that the investor holds the option until the expiration.

a. Calculate the profit/loss of the strategy if the stock price at expiration is $58 per share?

b. Calculate the profit/loss of the strategy if the stock price at expiration is $ 53 per share?

c. Calculate the profit/loss of the strategy if the stock price at expiration is $ 48 per share? lOMoAR cPSD| 23136115

d. Determine the breakeven price, maximum loss, and maximum profit at expiration. Show all yourcalculations?

e. Draw the payoff graph for the above strategy at expiration? Buy 50 put $0.5 Sell 55 put $2.75

(X1 < X2) (P1 < P2) => Bull put spread a) ST = 58 t = 0 t = T Buy 3 50 put $0.5 -0.5

ST > X (58 > 50) => No exercise => Profit = 0 Sell 3 55 put $2.75 2.75

ST > X (58 > 55) => No exercise => Profit = 0 2.25 0

=> Total profit = 2.25 * 3 * 100 = $625 b) ST = 53 t = 0 t = T Buy 3 50 put $0.5 -0.5

ST > X (53 > 50) => No exercise => Profit = 0 Sell 3 55 put $2.75 2.75

ST < X (53 < 55) => Exercise => Profit = - (55 - 53) = - 2 2.25 -2

=> Sum = 2.25 - 2 = 0.25 => Total profit = 0.25 * 3 * 100 = $75 c) ST = 48 t = 0 t = T Buy 3 50 put $0.5 -0.5

ST < X (48 < 50) => Exercise => Profit = 50 - 48 = 2 Sell 3 55 put $2.75 2.75

ST < X (48 < 55) => Exercise => Profit = - (55 - 48) = -7 2.25 -5

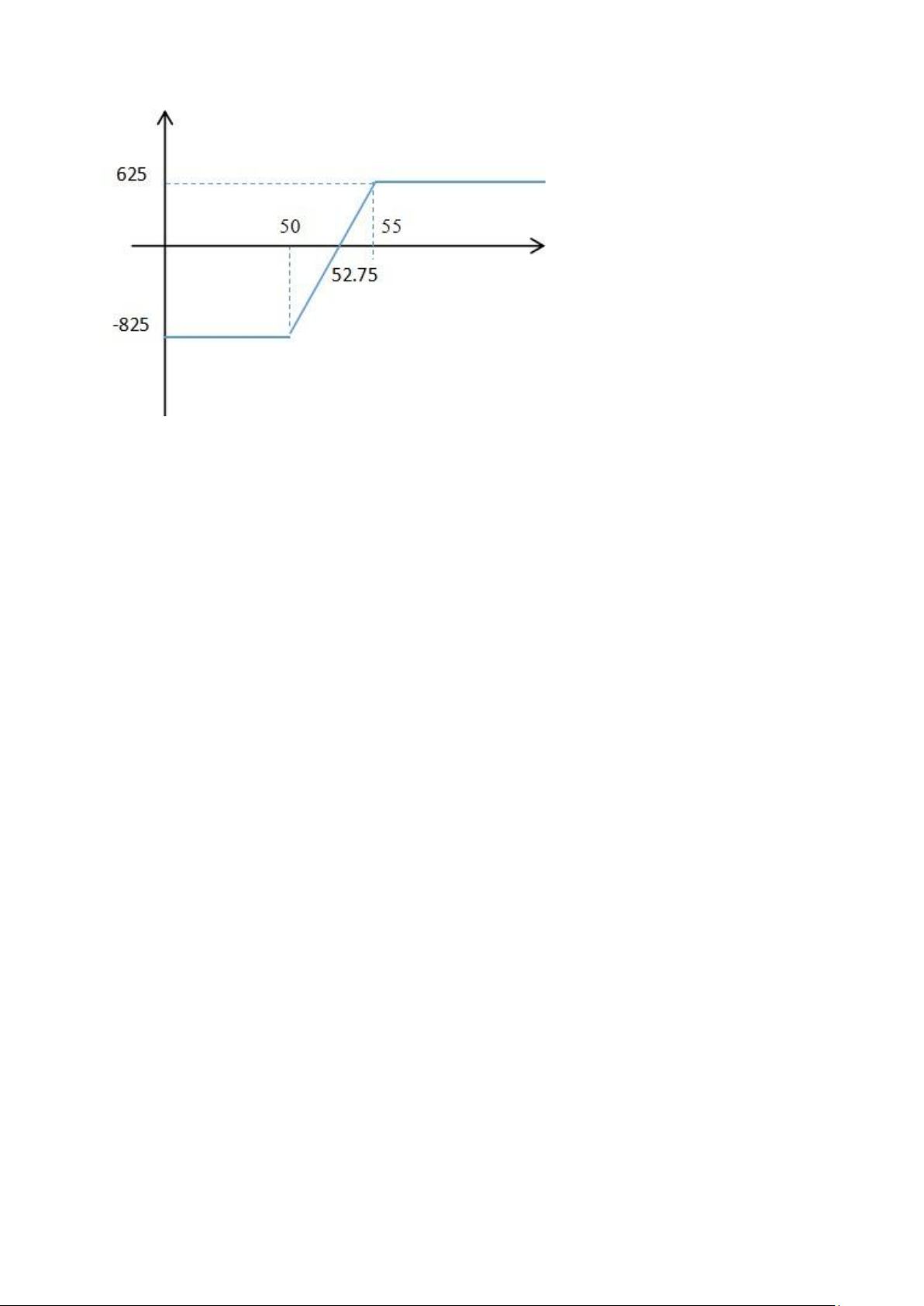

=> Sum = 2.25 - 5 = -2.75 => Total profit = -2.75 * 3 * 100 = -$825 d)

Maximum profit = 2.75 - 0.5 = 2.25 => Total = 2.25 * 3 * 100 = $625

Maximum loss = (55 - 50) - (2.75 - 0.5) = 2.75 => Total = 2.75 * 3 * 100 = $825 BEP

= X2 - (P2 - P1) = 55 - 2.25 = 52.75 e) lOMoAR cPSD| 23136115