Preview text:

RMIT International University Vietnam ASSIGNMENT COVER PAGE Course Code ACCT2105 Course Name

Accounting in Organisations & Society Campus Saigon South School Campus Semester Sem 1 - 2021

Understanding Financial Reports and Title of Assignment

Notes to the Financial Statements - Group Report Part A Lecturer Vinh Tran Phuc Nguyen Hoai Thu- S3817883 Student Name & sID Vu Tien Hung – s3878640 (SG-012-06) Pham Quoc Trung - s3878796 Nguyen Trong Khoi - s3864237 Assignment Due Date

Week 11, Wednesday 19th May, 9:00

1422 words (excluding headings, Word Count reference and appendices) 1

IMPORTANT NOTICE: All students listed on this page declare that they have read and agree to the statement of authorship on the next page.

Declaration and Statement of Authorship

1. I/we hold a soft copy of this assignment which can be produced if the original is lost/damaged.

2. This assignment is my/our original work and no part of it has been copied from any other student’s

work or from any other source except where due acknowledgement is made.

3. No part of this assignment has been written for me/us by any other person except where such

collaboration has been authorised by the academic/teacher concerned and as detailed in the assignment.

4. I/we have not previously submitted this work for any other course/unit.

5. I give permission for my assignment to be scanned for electronic checking of plagiarism.

6. I give permission for a copy of my/our marked work to be retained by the Department for review by external examiners. I/we understand that:

Plagiarism is the presentation of the work, idea or creation of another person as though it is one’s own. It

is a form of cheating and is a very serious academic offence which may lead to expulsion from the University.

Plagiarised material can be drawn from, and presented in, written, graphic and visual form, including

electronic data, and oral presentations. Plagiarism occurs when the origin of the material used is not appropriately cited.

Enabling Plagiarism is the act of assisting or allowing another person to plagiarise or to copy one’s work;

this is not acceptable and is also subject to penalty.

Further information relating to the penalties for plagiarism, which range from a notation on your student

file to expulsion from the University, is contained in RMIT Statute 6.1 Student Discipline (see Appendix

in Student Guide or consult Turing.) 2 Table of Contents

ASSIGNMENT COVER PAGE ....................................................................................1

Declaration and Statement of Authorship.............................................................................................................2

Table of Contents.....................................................................................................................................................3

Task I: Understanding financial statements in detail..............................................................4

1) What are the principal activities of the company?...................................................................................4

2) What is the purpose of the auditor's report?.......................................................................................4

3) What opinion did the auditor give the financial statements? What does the above opinion mean?...4

4) Explain one additional type of opinion the auditor could have given the financial statements.........4

Task II: Understanding financial statements’ items.....................................................................5

BALANCE SHEET (BS)................................................................................................................................5

INCOME STATEMENT (IS)..................................................................................................................6

STATEMENT OF CASH FLOW (SCF)........................................................................................................8

STATEMENT OF CHANGES IN SHAREHOLDER EQUITY (SCE)...................................................10

REFERENCE ........................................................................................................................................................11

APPENDIX ...........................................................................................................................................................14 3

Task I: Understanding financial statements in detail.

1) What are the principal activities of the company?

Kroger is a leading retailer in the USA. Its business varies from operating nearly 3000 retail stores, more than 2000

pharmacies, more than 1500 supermarkets to fine jewelry stores and high-quality food production facilities (Kroger

n.d). Albeit abundant offer provisions, Kroger still steadily uplifts their retail predomination and optimizes manufacturing powers.

2) What is the purpose of the auditor's report?

Kroger’s independent registered public accounting firm - PwC - with PCAOB exposes responsibilities for auditing

their opinions on Company’s joint financial statements, in addition to the Internal control over the financial

statements. The report expresses the evaluation of risks of material misstatements on the scope of fraud-free scale,

magnifies existence of material weaknesses incurred upon the internal control and validates the company’s overall

performance stated in the consolidated financial statement through necessary medians of evaluating procedures,

examination and determination (Kroger Co 2020, p.45).

3) What opinion did the auditor give the financial statements? What does the above opinion mean?

According to Sinra (n.d), the prominence of auditor’s opinions provides the company's shareholders with sufficient,

trustworthy information evaluation. The auditing party has given the Unmodified Opinion, situated in the Report

of Independent Registered Public Accounting Firm section (Kroger Co 2020, p.45). Under the nature of an

unmodified opinion, the report is presented fairly and contains adequate information that complies with GAAP

(Tuovila 2020), concluding a material misstatement free assumption in the report (Fahad zar n.d).

4) Explain one additional type of opinion the auditor could have given the financial statements.

The Qualified Opinion, underpinning the emphasis of any possible material misstatements, could be proposed

whenever the auditor is incapable of outreaching limitations (AccountingTools 2021). Said opinion could have

been used, as Kroger’s auditor has met limitations in issuing the Internal Control, disabling misstatement

identification and immobilizing necessary prevention (Kroger Co 2020, p.46). 4 5

Task II: Understanding financial statements’ items BALANCE SHEET (BS)

The BS shows changes in assets, liabilities and shareholders' equity, reflecting what a company owns and owes, as

well as the amount invested by shareholders (CFI n.d). The Kroger BS depicts their financial performance for

various stakeholders’ requirements.

Assets are investments that generates economic value in future time (AccountingTools 2021). The most notable

change in asset lies in cash and temporary cash investment as an increase of around 1.3 billion dollars of cash.

This is likely a direct the exponential online sale growth during the COVID19.

Shareholder Equity is value paid to shareholders when the company liquidates all assets and pays all debts

(Kennon 2020). The BS shows increase in shareholders’ equity as reflected in accumulated earnings. The earnings

rose from $20,978M to $23,018M in 2020, which is likely an outcome of Kroger growing stock price as also shown in the CSE.

Liabilities are financial obligations borne by the company (Hayes 2021). The pandemic raised Kroger liabilities

significantly in the other current liabilities as an increase of $1.5B in 2020 since the company had to bear

incurred costs following closures of underperformed stores and investment in safeguard equipment for associates.

This makes the company hold more current liabilities than current assets ($15,366M >$12,503M) implying negative working capital.

To conclude, we infer that although the sudden cost increase in the pandemic puts Kroger at risk of debt paying

failure, the company still managed to keep its financial performance positive with increased earnings. INCOME STATEMENT (IS)

IS discloses the business’s financial health via the total revenue, incurred expenditure and net income (Dybvig

2015). It assists the investors and lenders decide preferable investability and determine credit limits via evaluating

the firm's stock value and forecasting the possible future profitability (Arya & Nagar 2020). Operating revenue (OR) 6

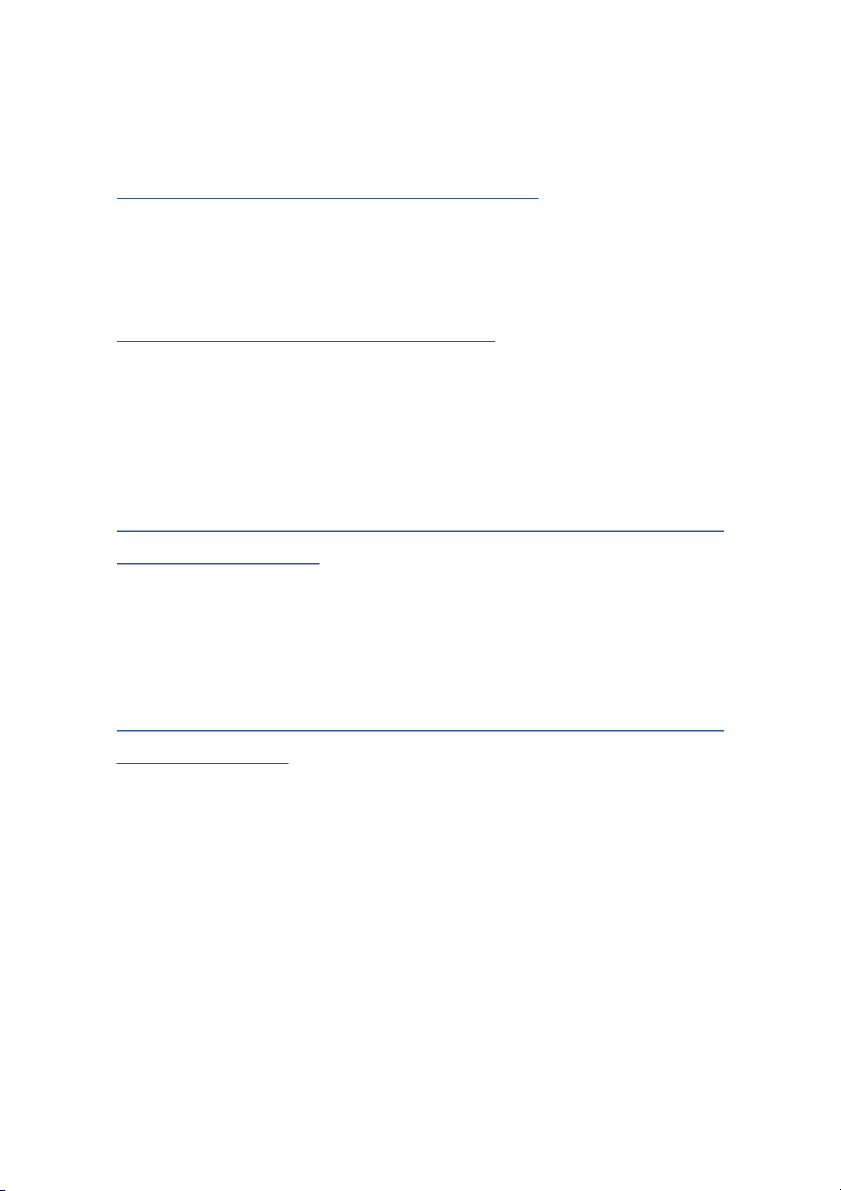

OR is the total sales from core businesses of a company (AccountingTools 2021). Kroger’s OR change in year 2020

is higher than 2019 (8.4 %) and 2018 (7.94%) (Appendix 1). Due to Covid-19, online shopping demand burst into

Kroger digital sales which led to a remarkable increment of Kroger's 2020 OR. The higher OR represents the

increase in selling activity but it is not enough to conclude whether Kroger operated effectively in 2020. Operation expense (OE)

OE is expenditure related to selling goods to create revenues (CFI n.d). Total OE increases 8.79% and 8.07%

compared to 2018 and 2019 respectively primarily resulted from the increase of Merchandise costs (MC) . The

online sale growth during the pandemic leads to the higher MC. Generally, as the higher expense decreases net 7

profit, it could impact negatively in the business’s financial performance. However, the Kroger’s expense in 2020

increase less than revenue implying an effective control of expense.

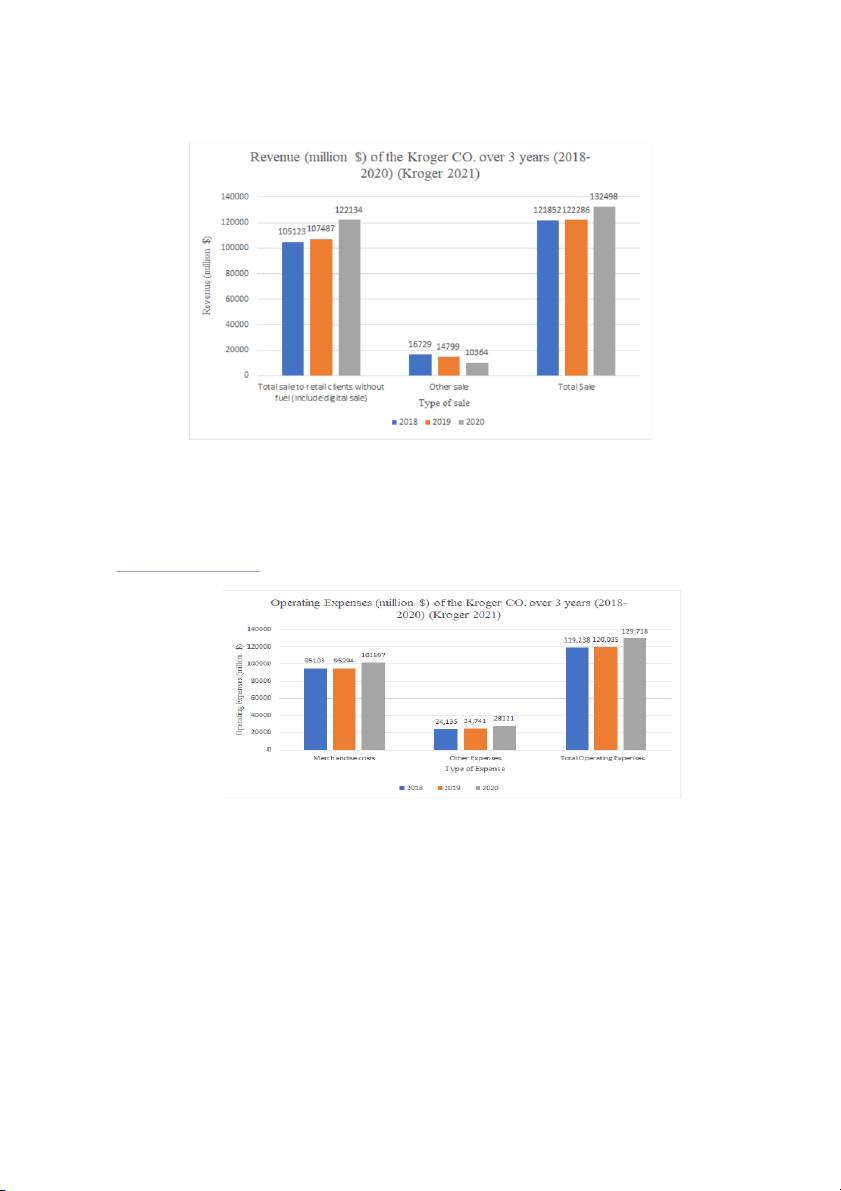

Net profit margin before tax and expense (NPM)

NPM measures how much net profit is created as %revenue (CFI,b n.d). Kroger’s NPM in 2020 is smaller than

2018 but higher than 2019. The higher NPM in 2020 compared to 2019 resulted from higher revenue and profit

(Appndix 1). Although Revenue and net income in 2020 were both greater than in 2018, the higher increase of

revenue than Profit (8.74% > 6.35%) leads to the smaller NPM in 2020 compared to 2018. The higher NPM means

higher profitability and the lower expense which showed Kroger's effective expense management and efficient operation performance.

Overall, despite the pandemic, the positive changes the IS indicated Kroger’s increased efficiency in 2020. The

efficient operation is based on Kroger strengths of understanding customers’ demands, quickly adapting the

incredible change of demands and managing expenditures effectively to take advantages from covid 19 outbreak.

STATEMENT OF CASH FLOWS (SCF)

SCF allows stakeholders to assess the following information. The ability to generate positive net cash flows in the

future following with its obligations' acquirement. Moreover, the statement reveals reasons for differences between

net income, cash receipts and payments, accommodating with the effects on the financial position of investing and

financing transactions during a time period (Epstein & Pava 1992). 8

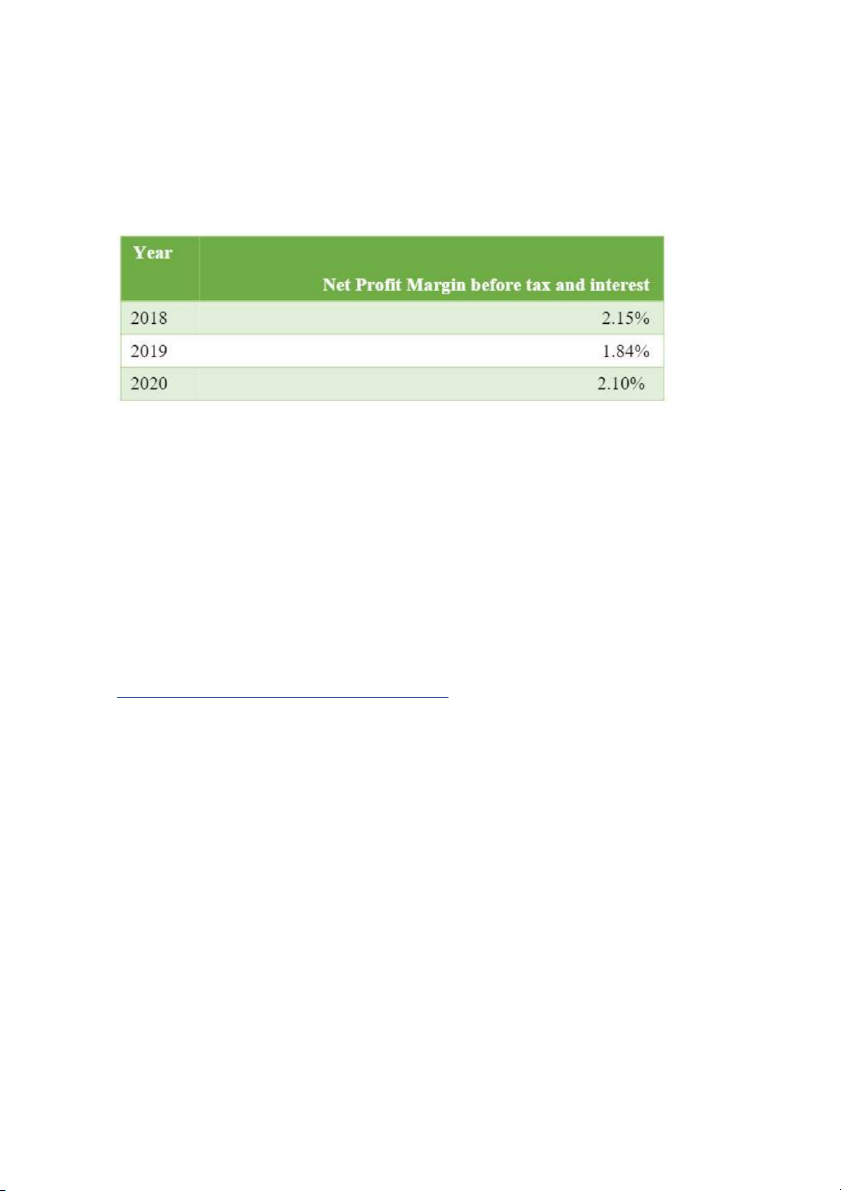

Figure: Cash flows from Operating activities (in Million) by Kroger, 2021

Cash flow from operating activities indicates the money generated during the firm's business operation (Murphy

2021). In Kroger’s SCF, positive net cash generated from operating activities in 2020 was much higher than that

of 2018 and 2019. This phenomenon mainly comes from the difference in accrued expenses. In 2020, they covered

all the cost of operating lease liabilities, prepaid and current assets. The great increase in net cash inflow from

operating activities implies that in 2020, Kroger generated a lot of profit. Figu

re: Cash flows from Financing Activities (in million) (Kroger 2021)

Cash flow from financing activities implies the net flow of cash used to keep the business running such as debts

(from banks), shareholders' profit, etc. (Murphy 2021)

. In 2020, the amount of net outflow from financing activities

is slightly indistinguishable with the 2018 net cash outflow ($2,713M & $2,896M). This happens mainly because

of the higher treasury stocks .

purchased As mentioned above, the stock’s suppressed levels in 2020 was a buying 9

opportunity, thus Kroger spent tons of money on buying treasury stock. Additionally, as reflected in the BS,

Kroger’s payment of long-term debt in 2020 has a great reduction compared to 2018 and 2019 debts. Therefore, in

2020, dividends paid to owners of the company increased by nearly 10% and 22% compared to 2019, 2018

respectively, which assures the profitability of Kroger for shareholders.

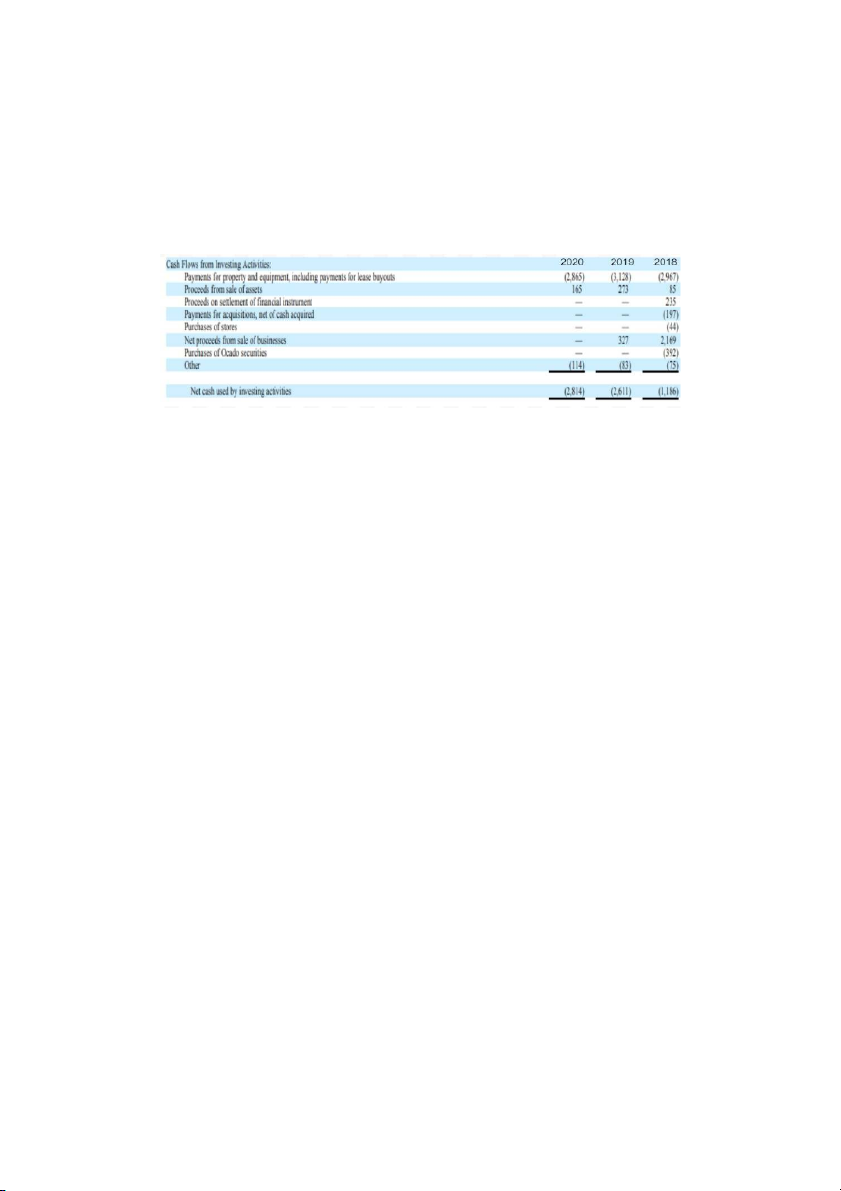

Figure: Cash Flows from Investing Activities (in million) (Kroger 2021)

Cash flow from investing activities summarizes the amount of cash spent on investing activities (Murphy 2021).

In this section, the net cash used for investing has increased slightly because in 2020, there was no profit from sale

of business like the previous years. The cost mainly comes from the money spent on property and equipment.

This shows that Kroger has the financial power to maintain their business property.

To sum up, the positive changes of CF on Operating, Investing and Financing activities implying Kroger’s stable growth in 2020. 10