Preview text:

Analysis of the beer market in Vietnam

Supply in the Vietnamese beer market

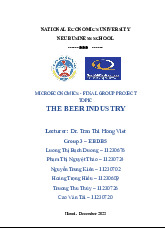

The key players dominating the market include both domestic and international

brands such as Heineken, Carlsberg, Sapporo Breweries, Hanoi Beer Alcohol

Beverage Corporation (Habeco), and Saigon Beer Alcohol Beverage Corporation (Sabeco).

For example, by the end of 2022, Saigon Beer Alcohol Beverage Corporation (Sabeco

- SAB) reported a revenue of nearly 35,000 billion VND, a 33% increase compared to

2021, and a post-tax profit of nearly 5,500 billion VND, a 40% increase from 2021.

This marked a record profit in Sabeco's operational history. The company attributed

this success to various sales and marketing support programs implemented in the past

year, boosting sales for their brands. Additionally, the company enhanced production

efficiency, implemented cost-saving measures, and minimized the impact of higher input costs.

Similarly, Hanoi Beer Alcohol Beverage Corporation (Habeco - BHN) experienced

strong revenue and profit growth in 2022 after being affected by the Covid-19

pandemic. Specifically, in 2022, Habeco's net revenue reached 8,398 billion VND, a

21% increase, and post-tax profit reached 527 billion VND, a 63% increase compared

to 2021. The company also mentioned that production activities continued to recover

in parallel with cost-saving measures, minimizing the impact of input costs and

contributing to robust profit growth... [Source: Thanh Niên:

https://thanhnien.vn/nguoi-viet-tieu-thu-bia-hang-dau-asean-giup-bia-sai-gon-lai-ki- luc-185230201085007138.htm]

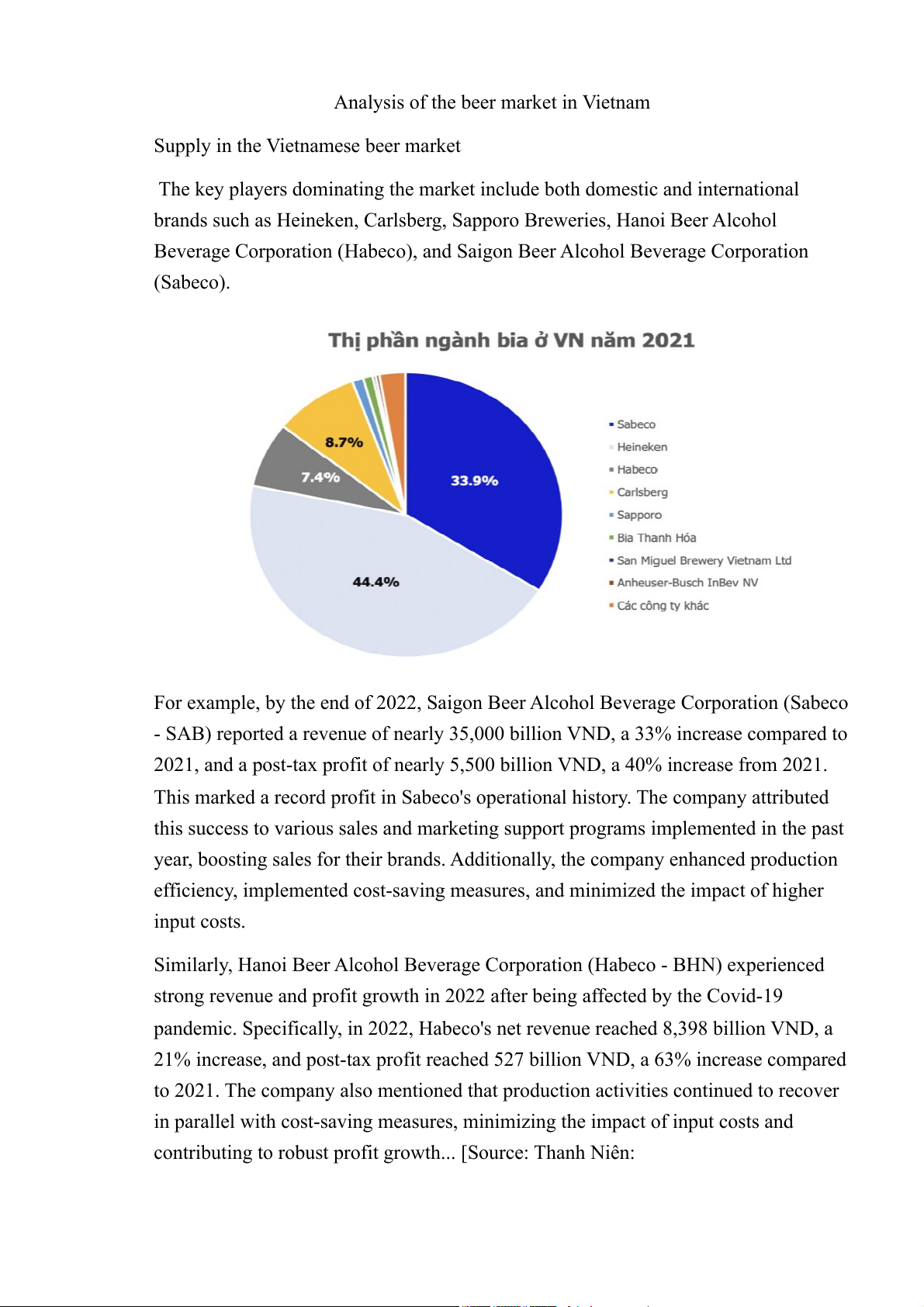

According to the VIRAC report, the beer industry's production volume in Q1/2023

increased by approximately 27% compared to the same period last year, despite a 15%

decrease from the previous quarter. However, VIRAC also pointed out that the lower

beer production in Q1 is partly due to the usual seasonal dip during this time, as

production activities tend to pause during the extended Tet holiday period.

[ VIRAC: https://viracresearch.com/tong-quan-co-hoi-cua-nganh-bia-viet-nam-nam- 2023/?

fbclid=IwAR3pU2NdHpdCyB2kJcGwQThUBO5VAoSOcREe604bIV8HC4vaCMzgg AfWq-w ]

From the information above, we can see that the Vietnamese market is a lucrative

opportunity for beer brands. Alongside this, the continuous growth in the beer supply

is evident from the strong sales figures of brands, despite the challenges faced.

2. Demand in the Vietnamese Beer Market

According to a report from Vietnam-Briefing, Vietnam's beer consumption

accounted for 2.2% of the global market by 2022, equivalent to 3.8 million liters of

beer annually. This positions Vietnam as a leader in the ASEAN region in terms of beer consumption.

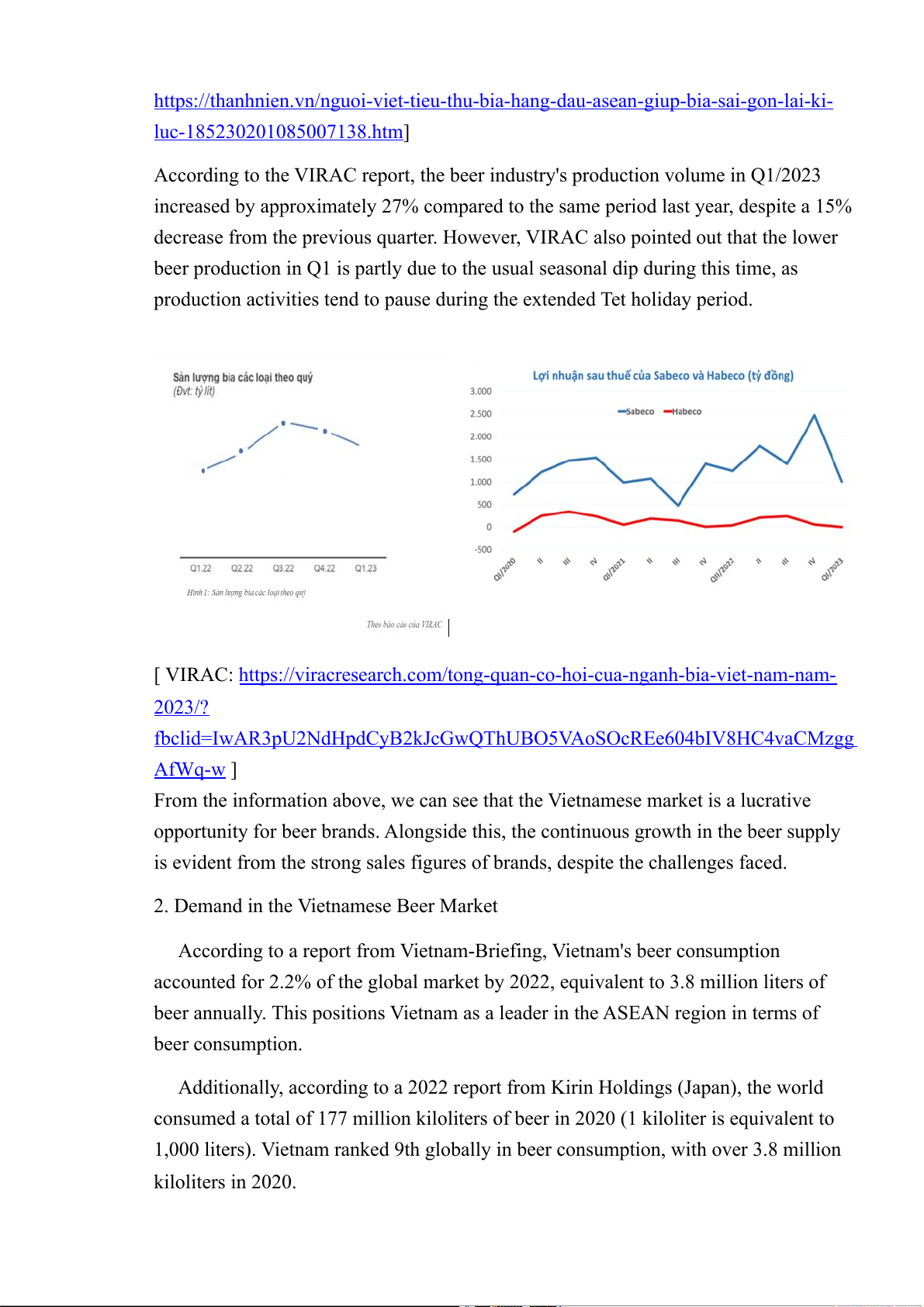

Additionally, according to a 2022 report from Kirin Holdings (Japan), the world

consumed a total of 177 million kiloliters of beer in 2020 (1 kiloliter is equivalent to

1,000 liters). Vietnam ranked 9th globally in beer consumption, with over 3.8 million kiloliters in 2020.

The infographic below illustrates the top 25 countries in the world with the highest

beer consumption based on data tracked by Kirin Holdings, a Japanese company that

has been monitoring these figures since 1975.

[ VnEconomy: https://vneconomy.vn/viet-nam-nam-trong-top-quoc-gia-tieu-thu-

nhieu-bia-nhat-the-gioi.htm?fbclid=IwAR3AGxqTi-Gz0XL-

XDgxXuCLxBgjs2jwjQaxiWDia964ht8qSe0zj1OvSmo ]

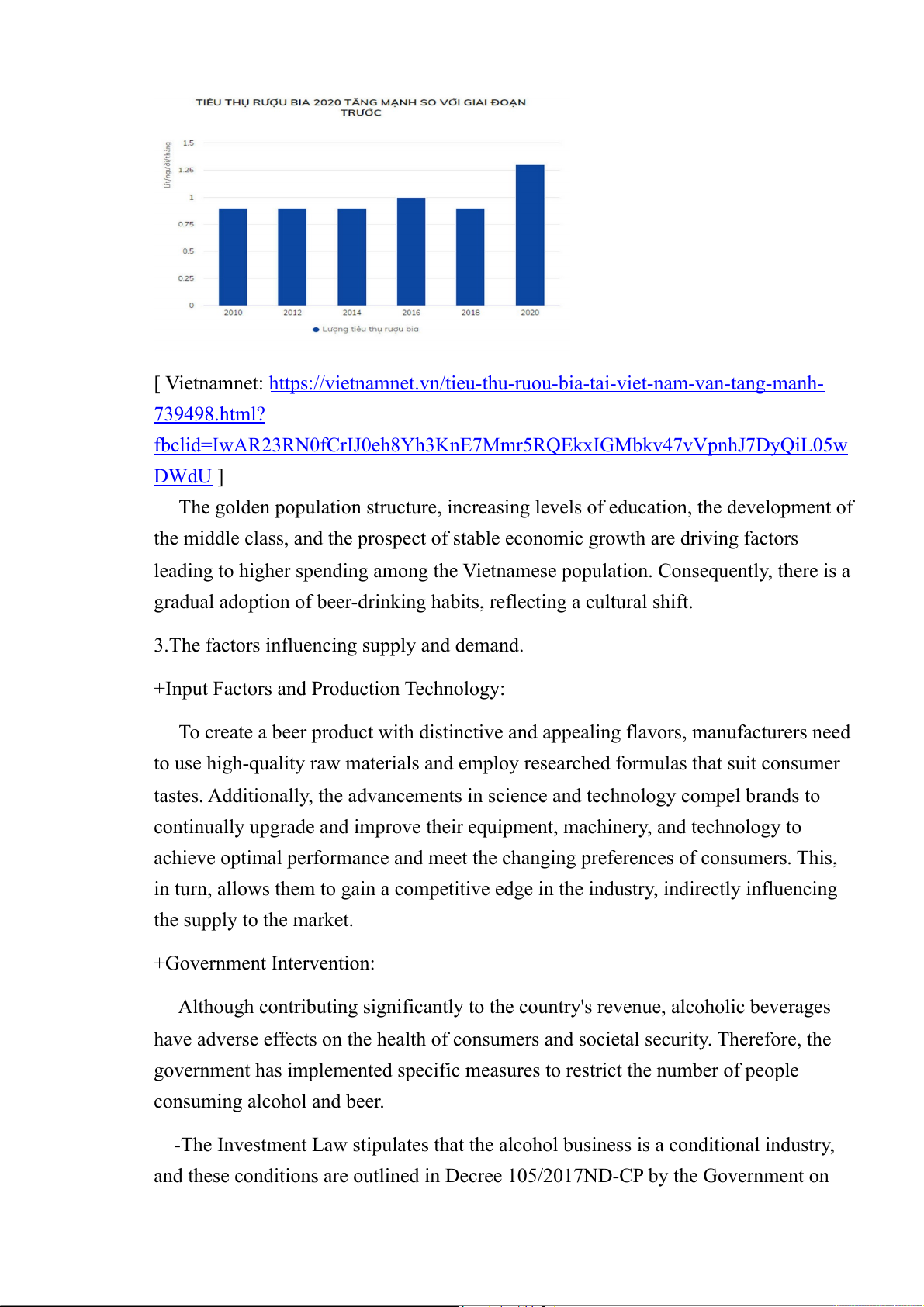

The per capita consumption of beer and alcohol increased from 0.9 liters per person

per month in 2018 to 1.3 liters per person per month in 2020, according to the 2020

survey on living standards conducted by the General Statistics Office. In urban areas,

the average consumption was 1.2 liters per month, while in rural areas, it was slightly

higher at 1.4 liters per month.

Notably, the General Statistics Office observed that the wealthiest households

consumed an average of up to 2.4 liters of beer and alcohol per person per month,

nearly double the consumption of the poorest households, which was 1.3 liters per person per month.

[ Vietnamnet: https://vietnamnet.vn/tieu-thu-ruou-bia-tai-viet-nam-van-tang-manh- 739498.html?

fbclid=IwAR23RN0fCrIJ0eh8Yh3KnE7Mmr5RQEkxIGMbkv47vVpnhJ7DyQiL05w DWdU ]

The golden population structure, increasing levels of education, the development of

the middle class, and the prospect of stable economic growth are driving factors

leading to higher spending among the Vietnamese population. Consequently, there is a

gradual adoption of beer-drinking habits, reflecting a cultural shift.

3.The factors influencing supply and demand.

+Input Factors and Production Technology:

To create a beer product with distinctive and appealing flavors, manufacturers need

to use high-quality raw materials and employ researched formulas that suit consumer

tastes. Additionally, the advancements in science and technology compel brands to

continually upgrade and improve their equipment, machinery, and technology to

achieve optimal performance and meet the changing preferences of consumers. This,

in turn, allows them to gain a competitive edge in the industry, indirectly influencing the supply to the market. +Government Intervention:

Although contributing significantly to the country's revenue, alcoholic beverages

have adverse effects on the health of consumers and societal security. Therefore, the

government has implemented specific measures to restrict the number of people consuming alcohol and beer.

-The Investment Law stipulates that the alcohol business is a conditional industry,

and these conditions are outlined in Decree 105/2017ND-CP by the Government on

alcohol business. This includes regulations prohibiting the sale of alcohol to

individuals under 18 years old, licensing requirements for activities related to alcohol

production for individuals under 18 years old, and regulations on licensing for

activities related to alcohol production, distribution, wholesale, retail, and on-premises consumption.

-Advertising laws include restrictions on advertising for alcoholic beverages with

alcohol content above 15 degrees.

-The Special Consumption Tax Law specifies that alcohol and beer are subject to

special consumption tax with the current tax rate being 65%. According to statistics

from early 2020, customer rates at restaurants decreased by 30-50% compared to the

annual average. The enforcement of penalties is considered effective in deterring

individuals from drinking alcohol while driving. Many establishments experienced a

decline in customer traffic, and people tended to reduce their consumption of alcoholic

beverages outside. This had a considerable impact on businesses in the alcohol and beer industry.

-For example, Hanoi Beer Alcohol Beverage Corporation (Habeco) lost nearly half

of its revenue in the first quarter of 2020 compared to the same period in 2019,

resulting in a 55% decline in profits, equivalent to 148 billion VND. Similarly, Saigon

Beer Alcohol Beverage Corporation (Sabeco) concluded the first three months of 2020

with a 47% decrease in revenue, recording the lowest profit since the first quarter of 2016.

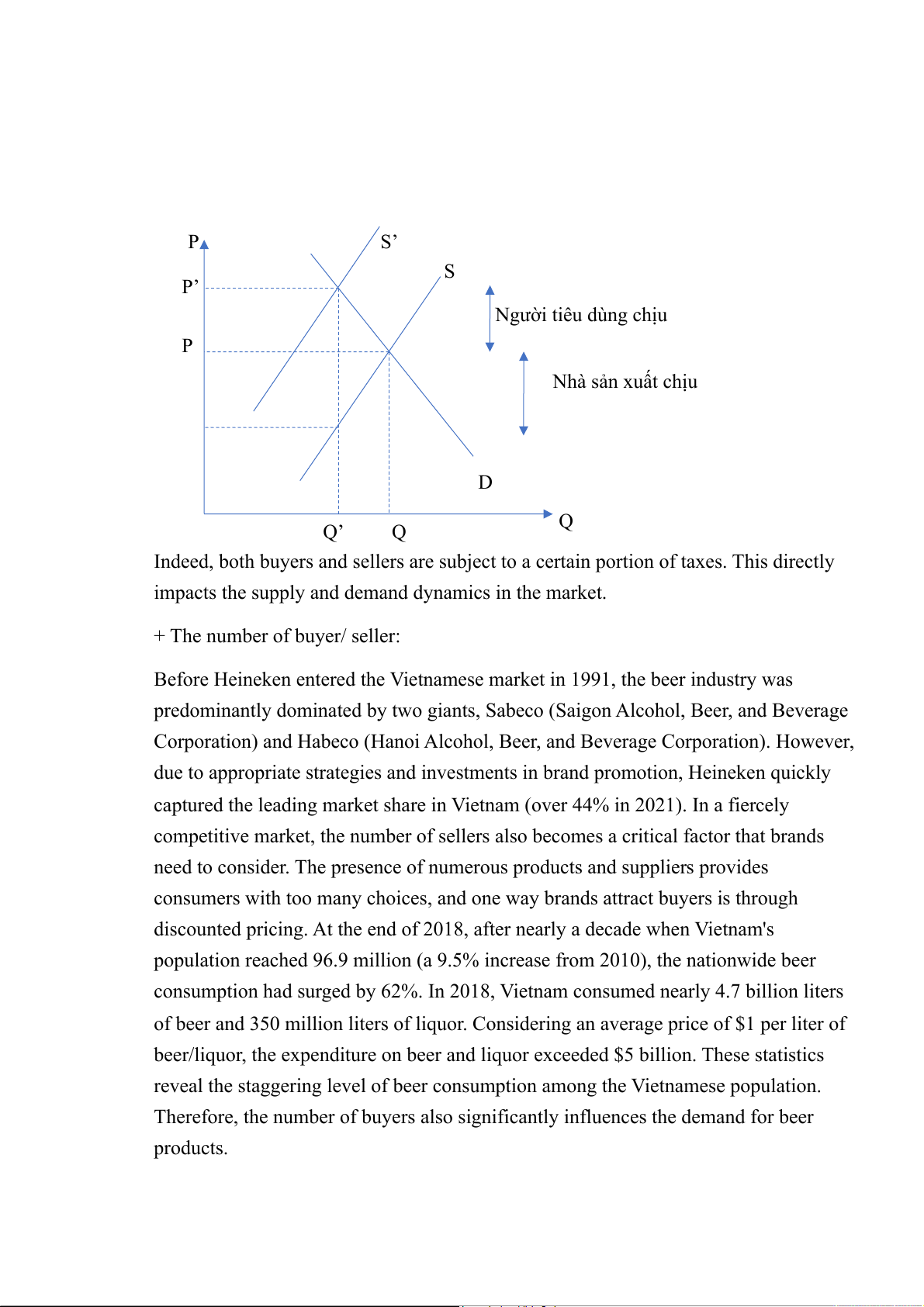

*Direct Government Measures for Beer and Alcohol Products:

In Resolution No. 115/NQ-CP dated July 28, 2023, regarding the Specialized

Session on Law Building in July 2023, the government has proposed amendments to

the Law on Special Consumption Tax. The revision aims to adopt a mixed tax

calculation method (tax rates based on percentage and absolute tax amounts) for

alcoholic beverages, including beer, replacing the current proportional method. For the

beer industry, the proposed special consumption tax is expected to increase by at least

10% on the product's selling price, following the recommendations of the World

Health Organization (WHO). This measure aims to limit consumption, protect public

health, and regulate the increase in state budget revenue.

[ VnEconomy: https://vneconomy.vn/lo-thue-tieu-thu-dac-biet-day-doanh-nghiep-bia- vao-nguy-kho.htm ] P S’ S P’ Người tiêu dùng chịu P Nhà sản xuất chịu D Q Q’ Q

Indeed, both buyers and sellers are subject to a certain portion of taxes. This directly

impacts the supply and demand dynamics in the market. + The number of buyer/ seller:

Before Heineken entered the Vietnamese market in 1991, the beer industry was

predominantly dominated by two giants, Sabeco (Saigon Alcohol, Beer, and Beverage

Corporation) and Habeco (Hanoi Alcohol, Beer, and Beverage Corporation). However,

due to appropriate strategies and investments in brand promotion, Heineken quickly

captured the leading market share in Vietnam (over 44% in 2021). In a fiercely

competitive market, the number of sellers also becomes a critical factor that brands

need to consider. The presence of numerous products and suppliers provides

consumers with too many choices, and one way brands attract buyers is through

discounted pricing. At the end of 2018, after nearly a decade when Vietnam's

population reached 96.9 million (a 9.5% increase from 2010), the nationwide beer

consumption had surged by 62%. In 2018, Vietnam consumed nearly 4.7 billion liters

of beer and 350 million liters of liquor. Considering an average price of $1 per liter of

beer/liquor, the expenditure on beer and liquor exceeded $5 billion. These statistics

reveal the staggering level of beer consumption among the Vietnamese population.

Therefore, the number of buyers also significantly influences the demand for beer products. +Income:

Vietnam's development over the past 30 years is commendable. The economic and

political reforms since 1986 have driven rapid economic growth, transforming

Vietnam from one of the world's poorest countries into a nation with average income.

From 2002 to 2018, GDP per capita increased 2.7 times, reaching over $2,700 in 2019,

with over 45 million people lifted out of poverty. The poverty rate dramatically

decreased from over 70% to below 6%. In 2022, the International Monetary Fund

(IMF) estimated the average GDP per capita for countries worldwide. Vietnam's GDP

per capita in 2022 is approximately $4,162.94, ranking 117th globally. With this

figure, Vietnam's GDP per capita in 2022 is expected to jump seven places compared

to 2021 and 56 places compared to 2000 on a global scale. From these statistics, it is

evident that the quality of life for the Vietnamese people is increasing, and the demand

for beer is likely to rise ( I (increase, decrease) -> D (increase, decrease) ).

[ kinhtetrunguong: https://kinhtetrunguong.vn/kinh-te/kinh-tet-vi-mo/gdp-binh-quan-

viet-nam-nam-2000-xep-thu-173-200-the-gioi-nam-2022-thay-doi-the-

nao-.html#:~:text=N%C4%83m%202022%2C%20IMF%20t%C3%ADnh%20GDP,tr

%C3%AAn%20quy%20m%C3%B4%20th%E1%BA%BF%20gi%E1%BB%9Bi. ] +Prices of substitute goods:

Many world-renowned beer brands such as Heineken, Tiger, and others have

entered the Vietnamese beer market. Alongside them are well-established Vietnamese

brands like Sabeco and Habeco. Consequently, beer has various substitute goods, and

when the price of one beer brand increases, it can lead to an increase in demand for

alternative brands as consumers may choose based on price. Example: When the price

of Saigon beer rises, consumers may shift to purchasing Heineken.

+Prices of complementary goods:

As known, producing a distinctive beer product requires various input materials.

Any change in the prices of these inputs can result in changes in the price of beer,

thereby reducing consumer demand. Nearly all beer drinkers require "snacks," and the

prices of these snack products also influence the preferences of those who want to

drink beer. Example: The impact of the Russia-Ukraine conflict in May 2022 led to

difficulties in importing, causing input material prices to increase by 20%-30%. This

increase affected the price of a batch of Tiger beer, which rose from 343,200-343,500

VND per crate to 366,000-376,000 VND per crate

[ Báo Pháp Luật: https://plo.vn/gia-bia-tang-cao-chay-hang-do-anh-huong-xung-dot- nga-ukraine-post678452.html ]