Preview text:

1. Activities of entrepreneurs in the rice industry:

Since the beginning of the year, Vietnam's rice exports have continuously received

good news with record numbers from output to selling price. But paradoxically,

many listed rice enterprises recorded high revenue, but thin profits or reduced

profits, even heavy losses. The third quarter earnings of rice firms were not what

was anticipated, notwithstanding the overall happiness.

VietstockFinance's statistics from 10 rice enterprises on the stock exchange have

announced their business results in the third quarter of 2023, 4 enterprises

increased profits, 2 enterprises reduced profits, 3 enterprises switched from loss to

profit and 1 business lost. Total revenue of enterprises reached nearly 20,000

billion VND, up 52% over the same period. However, the net profit was negative

at more than 156 billion VND, while the same period profit was 118 billion VND.

a. Business results in the third quarter of 2023:

Business results in the third quarter of 2023 of listed rice enterprises - Unit: Billions Dong Source: VietstockFinance

Loc Troi Group (UPCoM: LTG), the "giant" of the Western rice business, had a

record loss of 327 billion VND in the third quarter, compared to a profit of 64

billion Dong. It is noteworthy to add that the company just turned a 426 billion

VND profit, the greatest profit in company history. Although revenue increased

sharply, gross profit decreased and gross profit margin decreased. Accumulated for

9 months, total revenue reached more than 10,440 billion VND, an increase of

18%, thanks to the rice segment generating revenue of nearly 7,900 billion VND

(accounting for 76% of the proportion), an increase of 57%. Fortunately, there is

no loss, but Ho Chi Minh City Food (Foodcosa, UPCoM:FCS)'s profit is ''thin

like rice leaves'', less than 300 million VND, corresponding to a decrease of 94%.

Foodcosa said that in the third quarter, the Company's financial situation was still

difficult, working capital was always negative and had not received capital support

from any organization. Regarding the results of 9 months, FCS changed from a

loss of VND 3 billion in the same period to a profit of nearly VND 800 million, the

highest level since the enterprise equitized so far (in 2016). Import and export of

An Giang Agricultural and Food Products (Afiex, UPCoM: AFX) is the same

when profits plummeted by more than 70% over the same period, to nearly 3

billion VND, although this period, revenue increased by 67% and gross interest

increased by 90%. In terms of growth, Trung An High-Tech Agriculture (HNX:

TAR) made a profit of nearly 12 billion VND, an increase of 1.330% compared to

more than 800 million VND in the third quarter of 2022 and the highest level since

the beginning of the year. Behind the profit growth momentum is a strong net

revenue increase of 93%, to more than VND 966 billion. In terms of absolute

numbers, the third quarter profit champion belongs to The Pan Group (HOSE:

PAN), reaching nearly VND 99 billion in net profit, up 78%. There is also Kien

Giang Trade (UPCoM: KTC) with a net profit of more than 14 billion VND,

improving compared to the loss of 11 billion VND in the third quarter of 2022.

Behind that is the improvement of the gross profit margin from 3% of the same

period to 4% and the profit from the affiliate, other profits. Due to the export

market's benefits, which include rising selling prices and demand, Southern Food

Corporation - Joint Stock Company (Vinafood II, UPCoM: VSF) has reversed

the continuous loss chain and achieved its highest quarterly revenue ever,

exceeding VND 7,328 billion. The net profit of the company increased to

approximately 10 billion VND, surpassing the loss of 4 billion VND over the same

period. Despite being profitable, the company's losses during the 10 consecutive

quarters in 2019–2021 resulted in a cumulative loss of nearly 2,800 billion VND as

of September 30, 2023. Large rice enterprises in An Giang - Angimex (HOSE:

AGM) achieved nearly 3 billion VND in net profit, while losing 29 billion VND in

the same period. Accumulated in 9 months, AGM has a net loss of nearly 52

billion VND, bringing the total accumulated loss to more than 122 billion VND. In

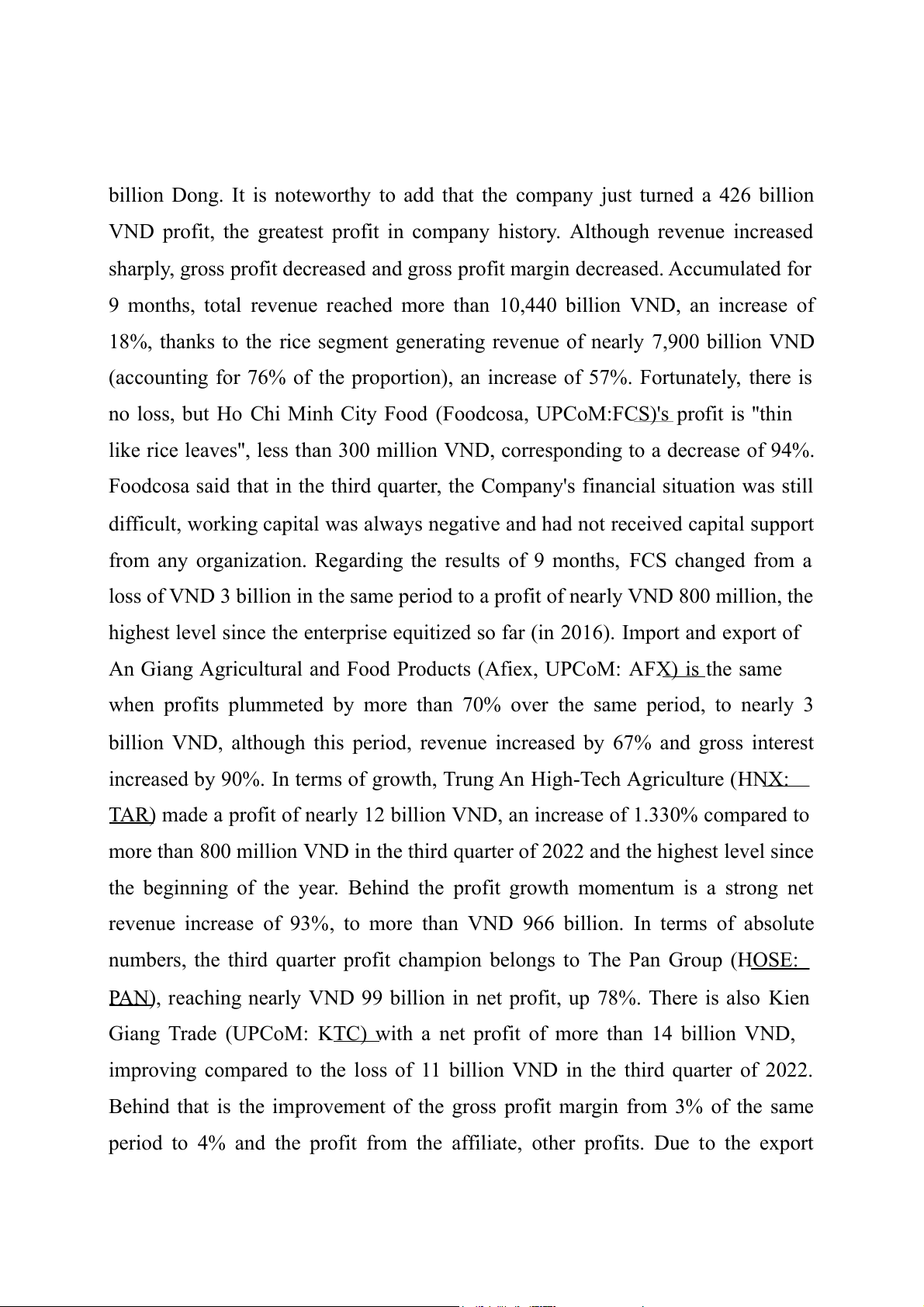

the third quarter, the group of rice enterprises continued to bear the burden of high

interest rates and eroding profits. At the same time, the fact that the VND is

relatively stable while the currencies of other countries have devalued a lot,

causing export enterprises to suffer large exchange rate losses. Almost all

businesses increase interest costs, except for Foodcosa, which does not incur this.

Interest expense of rice enterprises at the end of the third quarter – Unit: Billions Dong Source: VietstockFinance

In the third quarter, Loc Troi had financial expenses increased from 111 billion VND to

268 billion VND and this number was at 647 billion VND in the first 9 months of the

year, double the same period. In which, interest costs with 438 billion VND (accounting

for 68%), along with an exchange rate difference of nearly 156 billion VND. Similarly,

Vinafood II also sharply increased interest costs from VND 33 billion to VND 59

billion; exchange rate difference loss increased from VND 14 billion to VND 92 billion

and incurred a loss in foreign currency sales of nearly VND 14 billion in the third

quarter. Or like AFX, the interest cost was 2.3 times higher than the same period, up to nearly 13 billion VND. T

AR has more than 29 billion VND in interest expenses, up 36%. b. Inventory:

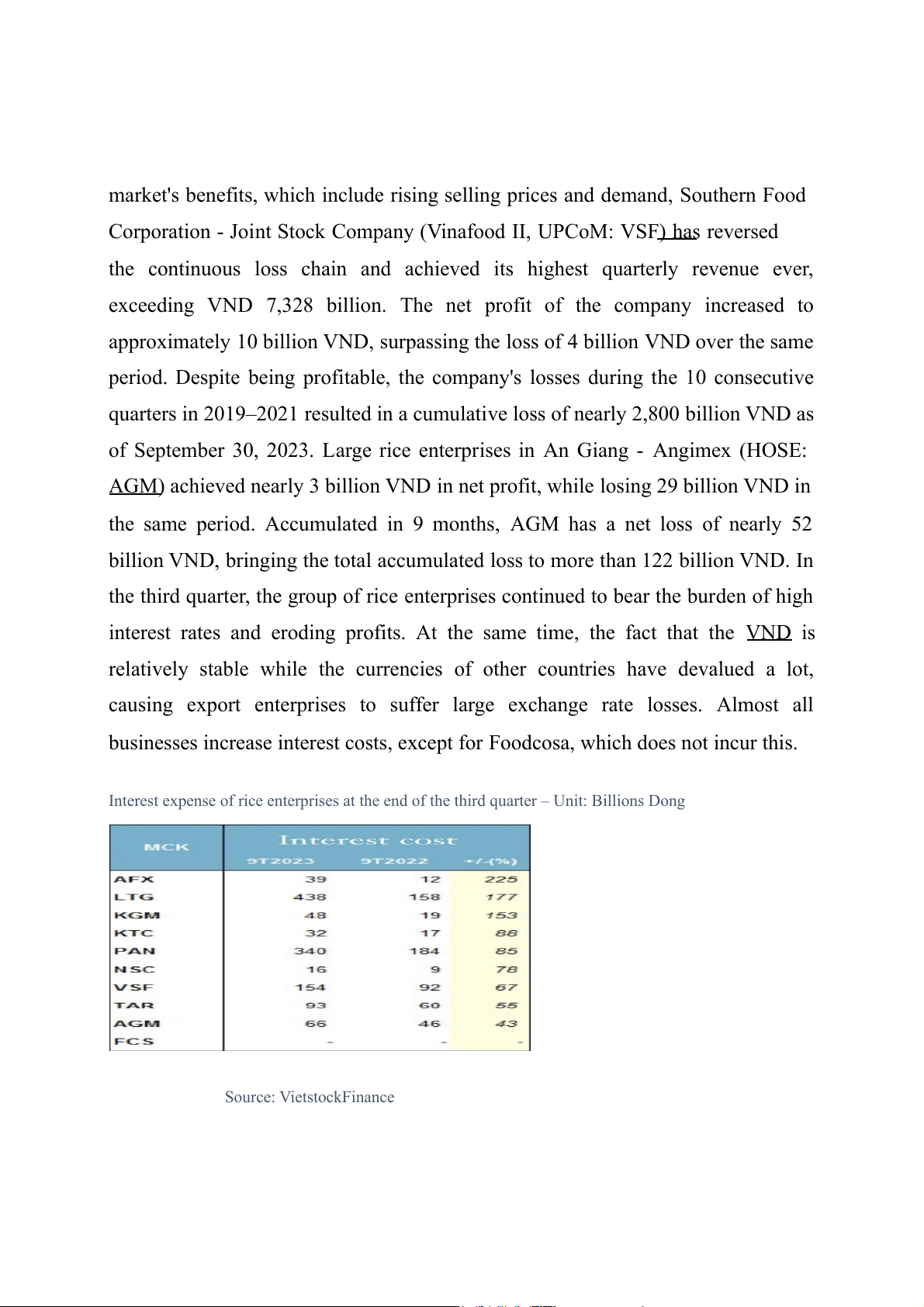

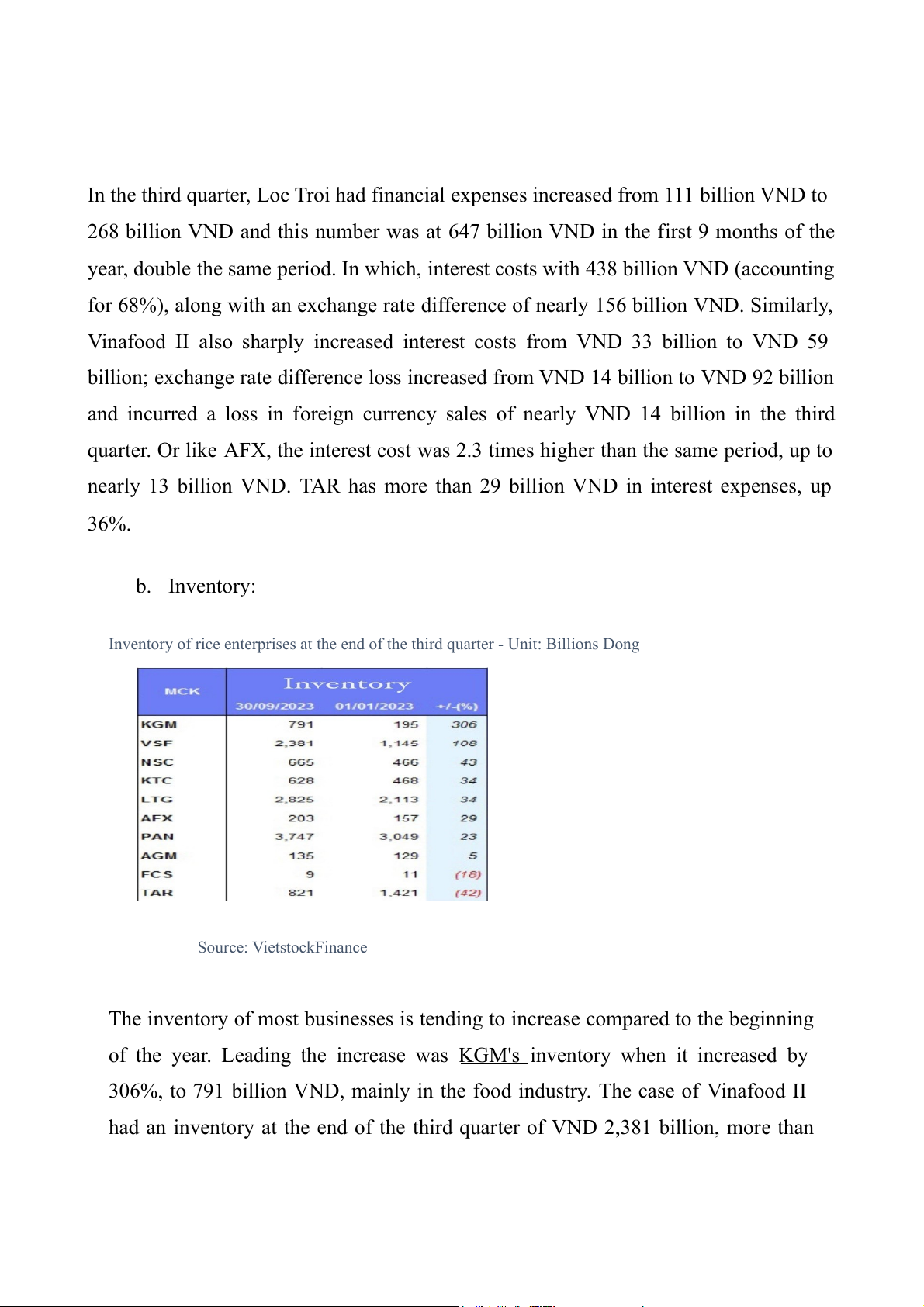

Inventory of rice enterprises at the end of the third quarter - Unit: Billions Dong Source: VietstockFinance

The inventory of most businesses is tending to increase compared to the beginning

of the year. Leading the increase was KGM's inventory when it increased by

306%, to 791 billion VND, mainly in the food industry. The case of Vinafood II

had an inventory at the end of the third quarter of VND 2,381 billion, more than

double at the beginning of the year. Or like Loc Troi, inventory increased by 34%,

to VND 2,825 billion. In contrast, Foodcosa and TAR are 2 units with inventories

decreased by 11% and 42% respectively compared to the beginning of the year, at

9 billion VND and 821 billion VND respectively.

2. The impact of the COVID-19 pandemic on Vietnam's rice industry:

The COVID-19 pandemic has caused economic decline and a lot of losses for the

state. Although the rice market is a vital source of goods for people's daily needs,

epidemics have a detrimental effect on society by slowing down the flow of goods

and reducing consumption. Near the end of March 2020, the government decided

to announce the temporary suspension of rice exports to other countries because of

the complicated situation of the Covid-19 epidemic. Due to the abrupt halt of rice

exports, businesses and farmers suffered as a result of the companies' quick

bankruptcy. According to statistics, a total of 90 businesses have signed rice export

contracts and the total amount of rice to be exported is about 1.5 million tons of

rice. Over 204,000 tons of rice are under contract with businesses in Long An

province through the end of 2020, but they are unable to transport the rice. About

832,500 tons of sticky and unpeeled rice are needed to be delivered in An Giang.

Although it has been approved to deliver the rice that has completed the

transportation process and is still at the port, signed until the end of 2020, the

amount of rice exported in April is the amount of exported rice that cannot be

successfully transported according to the contract, lost nearly 48,500 tons of rice,

worth 23.6 million USD from 16/18 businesses. Regarding the domestic rice

market, it has experienced a slight decline but remains stable and not a significant

issue. Vietnam harvested 43.5 million tons of rice in total in 2020; of that, the

Winter-Spring crop harvested the most, accounting for about 20.2 million tons; Ha

Thu harvested 11 million tons; and 8.2 million tons in rice crop. After accounting

for food needs, processing, storage, and breeding, about 30 million tons are left

over for export. In 2020, rice prices tended to increase because of increased

demand and increased freight prices, so the export market at that time, although the

export quantity was small, the turnover increased. Same for the first months of

2021 but from mid-August, rice prices gradually decreased, went downhill and had

the lowest price since November. Along with that, in the Mekong Delta region, the

price also decreased a lot, the lowest is OM 9582 rice with a fluctuating price of

4,600 VND/kg and the highest is ST24 rice priced at 6,200 VND/kg. In the last

months of 2020, the rice industry increased export turnover to 3.07 billion USD,

but from the beginning of 2021 to the middle of the year, it increased and then

tended to decrease leading to the middle of the year because of the extremely

stressful nature of the epidemic particularly in the acute outbreak in Ho Chi Minh

City, factories' workers were forced to abide by Directive No. 16, which resulted in

a significant fall in production volume because there were no rice mills or workers.

Nevertheless, Vietnam's rice exports to the EU eventually reached 60,000 tons in

2021, valued at 41 million USD, despite being severely impacted by the Covid-19

pandemic. This represented an increase of more than 20% in value and close to 1%

in volume over 2020 levels (by the newspaper The People).