Preview text:

I/ Discount rate of a bond (yield to maturity: lợi suất tới ngày áo hạn trái phiếu, tỷ suất sinh lợi

của nhà ầu tư trái phiếu)) – Cost of debt 1.

The bonds issued by Stainless Tubs bear a 6 percent coupon, payable semiannually. The

bonds mature in 11 years and have a $1,000 face value. Currently, the bonds sell for $989. What is the yield to maturity? 2.

Greenbrier Industrial Products' bonds have a 7.60 percent coupon and pay interest annually.

The face value is $1,000 and the current market price is $1,062.50 per bond. The bonds mature in

16 years. What is the yield to maturity? 3.

Collingwood Homes has a bond issue outstanding that pays an 8.5 percent coupon and

matures in 18.5 years. The bonds have a par value of $1,000 and a market price of $964.20. Interest

is paid semiannually. What is the yield to maturity? 4.

Oil Well Supply offers 7.5 percent coupon bonds with semiannual payments and a yield to

maturity of 7.68 percent. The bonds mature in 6 years. What is the market price per bond if the face value is $1,000? 5.

Roadside Markets has a 6.75 percent coupon bond outstanding that matures in 10.5 years.

The bond pays interest semiannually. What is the market price per bond if the face value is $1,000

and the yield to maturity is 6.69 percent?

II/ Discount rate of a stock (tỷ suất sinh lợi yêu cầu của nhà ầu tư cổ phiếu) – Cost of equity 1.

The common stock of Auto Deliveries sells for $28.16 a share. The stock is expected to

pay $1.35 per share next year when the annual dividend is distributed. The firm has established a

pattern of increasing its dividends by 3 percent annually and expects to continue doing so. What

is the market rate of return on this stock? 2.

The current dividend yield on Clayton's Metals common stock is 3.2 percent. The company

just paid a $1.48 annual dividend and announced plans to pay $1.54 next year. The dividend growth

rate is expected to remain constant at the current level. What is the required rate of return on this stock? 3.

Northern Gas recently paid a $2.80 annual dividend on its common stock. This dividend

increases at an average rate of 3.8 percent per year. The stock is currently selling for $26.91 a

share. What is the market rate of return? 4.

Denver Shoppes will pay an annual dividend of $1.46 a share next year with future

dividends increasing by 4.2 percent annually. What is the market rate of return if the stock is

currently selling for $42.10 a share? 5.

The preferred stock of Rail Lines, Inc., pays an annual dividend of $12.25 and sells for

$59.70 a share. What is the rate of return on this security?

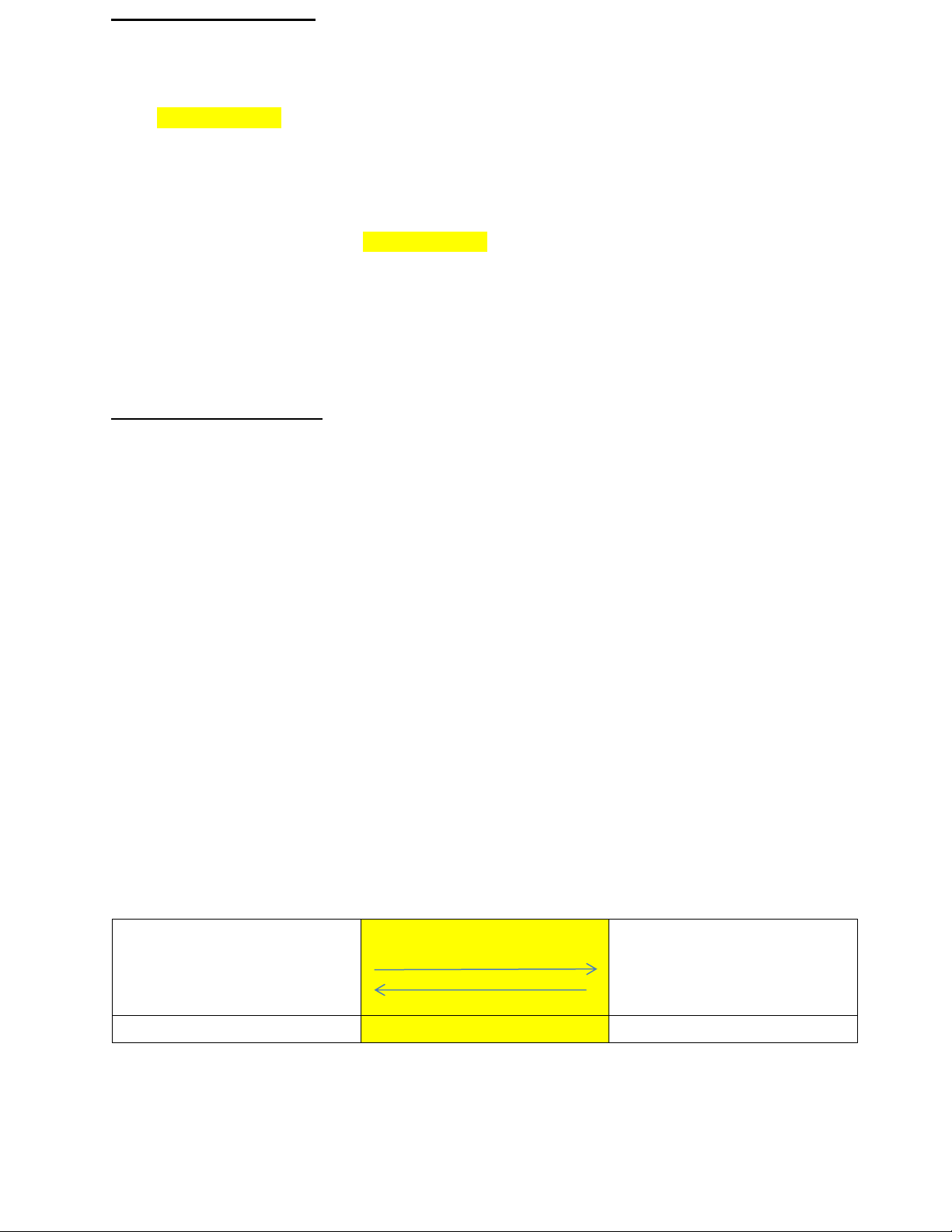

Investment (tài sản của nhà ầu Financial markets, financial

Fund (nguồn tài trợ của doanh tư) intermediaries nghiệp)

(list the financial instruments, (list the type of financing financial asset) resources in your business) Bank deposit Banks. Bank market Bank loan

III/ Read: definition of cost of debt, cost of equity, cost of capital, formula.